Professional Documents

Culture Documents

Republic of The Philippines: Quezon City

Uploaded by

Charina Marie CaduaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic of The Philippines: Quezon City

Uploaded by

Charina Marie CaduaCopyright:

Available Formats

Republic of the Philippines

QUEZON CITY

SWORN STATEMENT OF GROSS RECEIPTS / SALES & EVALUATION FORM

Pursuant to Ordinance No. SP-91, S- 1993 as amended, otherwise known as the Quezon City Revenue Code

and Ordinance No. SP-2981 S-2020,on the collection / payment of business taxes, charges and fees for purposes of renewal

of Business /Mayor's permits, it is hereby declared under oath, thus:

Name of Taxpayer / Company / Establishment:

Trade / Business Name:

Exact Business Address:

Category: Partnership Corporation Single Proprietorship Cooperative SEC/DTI/Bus. Reg. No.____________

KIND / NATURE AREA MAYOR'S / BUSINESS GROSS SALES / RECEIPTS ( In Pesos )

OF BUSINESS ( In Sq. Meters ) PERMIT NO. 2019 2020

SUMMARY OF SALES PER VAT/PERCENTAGE TAX CHECKLIST OF ORIGINAL DOCUMENTS TO BE PRESENTED

RETURN/ QUARTERLY INCOME TAX RETURNS TO DOCUMENTS VERIFIER IN THE FOLLOWING ORDER

2020 AMOUNT PRIOR TO EVALUATION: Please mark ( )

1st Quarter 2020 Business / Mayor's Permit accompanied with

2nd Quarter Tax Bill and OR from the Treasurer's Office;

3rd Quarter 2020 Certified Breakdown of Sales, if more than

4th Quarter one line of business and/or more than one Branch.

October 2020 VAT Returns / ITR / Percentage Tax Returns,

November whichever is applicable;

December 2020 Audited Financial Statement with proof of

TOTAL receipt of SEC/BIR/DTI, whichever is applicable;

( pursuant to Ordinance No. SP-2981 S-2020 );

I attest, under pain of perjury, to the truthfulness and correctness 2019 Annual Income Tax Returns ( ITR ) with

of the foregoing to the best of my personal knowledge and based complete set of Audited Financial Statement,

on authentic documents and records ( i.e. Books of Accounts ). with proof of payment;

Proof of Authority (Secretary's Certificate or SPA)

____________________________________________________ of the company / establishment's representative.

( Signature Over Printed Name )

SUBSCRIBED AND SWORN TO before me at Quezon City,

Date: ________________ Contact No. ___________________ Metro Manila on the date as herein indicated.

( Administering Officer )

Note: DO NOT WRITE BELOW THIS PORTION *************************************** RESERVED FOR THE EVALUATOR.

TAX YEAR NATURE OF BUSINESS GROSS SALES / RECEIPTS ( pesos ) REMARKS / FINDINGS

Evaluated by: __________________________________

( Signature Over Printed Name )

Date of Evaluation: ______________________________

QCG-CTO(BT)F1-V2

You might also like

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- 70534BIR Form 1921 - Annex B PDFDocument1 page70534BIR Form 1921 - Annex B PDFJunar MadaliNo ratings yet

- Audited Financial Statements Cover SheetDocument1 pageAudited Financial Statements Cover SheetLorenz Samuel GomezNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- Annex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Document5 pagesAnnex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Donna Amanda Victorino100% (1)

- Joint affidavit land transfer PhilippinesDocument1 pageJoint affidavit land transfer PhilippinesMer Cy100% (1)

- Tax Practitioner Accreditation ApplicationDocument2 pagesTax Practitioner Accreditation Applicationcristian reyesNo ratings yet

- Sample - Amended SEC Articles, Change AddressDocument10 pagesSample - Amended SEC Articles, Change AddressJimmelyn CalejesanNo ratings yet

- WWHBQB Tawakkal 20191004162232Document1 pageWWHBQB Tawakkal 20191004162232Sherly ManoharaNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Final Notice Before Legal Action D1030Document1 pageFinal Notice Before Legal Action D1030azade azamiNo ratings yet

- Lesses Information Statement For Subsequent FillingDocument2 pagesLesses Information Statement For Subsequent Fillingchristopher ighotNo ratings yet

- Tax Practitioner'S Application For Accreditation: (Individual)Document2 pagesTax Practitioner'S Application For Accreditation: (Individual)vivian deocampoNo ratings yet

- Bulk Sales Law SummaryDocument12 pagesBulk Sales Law SummaryManuel VillanuevaNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleHenna CapaoNo ratings yet

- Tax Estate TaxDocument13 pagesTax Estate TaxAlbert Baclea-an100% (1)

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- 43735rmc No 5-2009 Annex CDocument1 page43735rmc No 5-2009 Annex CJM GapisaNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Invoice Receipt For Property Form GF 30 A 2Document1 pageInvoice Receipt For Property Form GF 30 A 2Rexis ReginanNo ratings yet

- Random Drug Testing Acknowledgment FormDocument2 pagesRandom Drug Testing Acknowledgment FormBudong BernalNo ratings yet

- Section 2.57.4 of RR No. 2-98Document2 pagesSection 2.57.4 of RR No. 2-98fatmaaleahNo ratings yet

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocument9 pagesSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraNo ratings yet

- TFS - Affidavit of UndertakingDocument1 pageTFS - Affidavit of UndertakingMary Rose LealNo ratings yet

- HLF065 ChecklistRequirementsWindow1Accounts V05Document2 pagesHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboNo ratings yet

- Petition For Dropping LTFRBDocument3 pagesPetition For Dropping LTFRBMegan Camille SanchezNo ratings yet

- Procedure For Land AcquisitionDocument25 pagesProcedure For Land AcquisitionRob ClosasNo ratings yet

- Esrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeDocument1 pageEsrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeGina Garcia100% (1)

- Affidavit Consolidates Ownership After Expired Right to RepurchaseDocument1 pageAffidavit Consolidates Ownership After Expired Right to RepurchaseAlexandrius Van VailocesNo ratings yet

- FINAL FOI Request Form - Annex BDocument1 pageFINAL FOI Request Form - Annex BAnnie Bag-ao100% (1)

- OMB registration licensing feesDocument2 pagesOMB registration licensing feested canadaNo ratings yet

- Verification of Cash Payment To SubscriptionDocument2 pagesVerification of Cash Payment To SubscriptionAlexNo ratings yet

- How To Enroll EfpsDocument18 pagesHow To Enroll EfpsAdyNo ratings yet

- Esteban Pos PPRDocument18 pagesEsteban Pos PPRMarisseAnne CoquillaNo ratings yet

- NEW OMNIBUS SWORN STATEMENT UpdatedDocument2 pagesNEW OMNIBUS SWORN STATEMENT Updatedchedita obiasNo ratings yet

- HDMF Contributions and Loan PaymentDocument29 pagesHDMF Contributions and Loan PaymentRocelle IndicoNo ratings yet

- One Time Taxpayers Capital Gains Tax SharesDocument1 pageOne Time Taxpayers Capital Gains Tax SharesJaypee OrtizNo ratings yet

- AUTHORIZATION TO QUERY BSP RECORDSDocument1 pageAUTHORIZATION TO QUERY BSP RECORDSApril NNo ratings yet

- LRA Circular No 12-2020 - Guidelines For Conversion On DemandDocument2 pagesLRA Circular No 12-2020 - Guidelines For Conversion On DemandjosephNo ratings yet

- Notice of Non-Renewal of Lease With Notice To VacateDocument1 pageNotice of Non-Renewal of Lease With Notice To VacateJimbo HotdogNo ratings yet

- Confidentiality AgreementDocument4 pagesConfidentiality AgreementVinnetCaluyaNo ratings yet

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceDocument74 pagesCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveNo ratings yet

- AIA Philam Life Policy Fund Withdrawal FormDocument2 pagesAIA Philam Life Policy Fund Withdrawal Formippon_osotoNo ratings yet

- Demand Letter GlorianiDocument1 pageDemand Letter GlorianiNorman CalambaNo ratings yet

- Sec Memo Circular No.6 Series of 2008 Section 3Document2 pagesSec Memo Circular No.6 Series of 2008 Section 3orlyNo ratings yet

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- TREASURER'S AFFIDAVIT - IncreaseDocument2 pagesTREASURER'S AFFIDAVIT - IncreaseFernando GapuzNo ratings yet

- Cover Sheet: Month Day Month DayDocument1 pageCover Sheet: Month Day Month DayWilliam S. FeridaNo ratings yet

- Affidavit of CancellationDocument2 pagesAffidavit of CancellationAeris Sycamine Garces AquinoNo ratings yet

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingYani DaquisNo ratings yet

- MANILA TRAFFIC PARKING CITIZEN'S CHARTER SERVICESDocument12 pagesMANILA TRAFFIC PARKING CITIZEN'S CHARTER SERVICESRobin de VegaNo ratings yet

- Annex C.1 - BITCDocument1 pageAnnex C.1 - BITCMoro oil SalimbaoNo ratings yet

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachNo ratings yet

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- RDO No. 15 - Naguilian, IsabelaDocument982 pagesRDO No. 15 - Naguilian, IsabelaJames ReyesNo ratings yet

- Contract to Sell LandDocument7 pagesContract to Sell LandRejane MarasiganNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- Tax Declaration Form 2021Document1 pageTax Declaration Form 2021Jessica SantosNo ratings yet

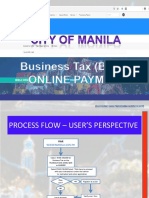

- Manila Btax Online Payment 2019Document33 pagesManila Btax Online Payment 2019Charina Marie CaduaNo ratings yet

- Authorization Letter - QC FormDocument2 pagesAuthorization Letter - QC FormCharina Marie Cadua78% (9)

- Revenue Region No. 07 - BIR Regional Office BuildingDocument2 pagesRevenue Region No. 07 - BIR Regional Office BuildingCharina Marie CaduaNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Revenue District Office No. 38 - North Quezon CityDocument5 pagesRevenue District Office No. 38 - North Quezon CityCharina Marie CaduaNo ratings yet

- Authorization Letter - QC FormDocument2 pagesAuthorization Letter - QC FormCharina Marie Cadua78% (9)

- TESDA OP CO 05 Competency Assessment FormsDocument15 pagesTESDA OP CO 05 Competency Assessment FormsDarwin Vargas100% (2)

- Forms Program Registration 2018Document25 pagesForms Program Registration 2018Tahani Awar GurarNo ratings yet

- Revenue District Office No. 27 - Caloocan: NO. RR No. Rdo No. Bank Code Bank Name Bank Branch Bank AddressDocument2 pagesRevenue District Office No. 27 - Caloocan: NO. RR No. Rdo No. Bank Code Bank Name Bank Branch Bank AddressCharina Marie CaduaNo ratings yet

- Get your Liquor License in Quezon CityDocument1 pageGet your Liquor License in Quezon CityCharina Marie CaduaNo ratings yet

- Procedures Manual On UtprasDocument42 pagesProcedures Manual On UtprasAttorney Ma. Leny Ignalaga100% (1)

- Program Registration Forms Sea-BasedDocument28 pagesProgram Registration Forms Sea-BasedCharina Marie CaduaNo ratings yet

- Manila Btax Online Payment 2019Document33 pagesManila Btax Online Payment 2019Charina Marie CaduaNo ratings yet

- TESDA compliance audit checklistDocument15 pagesTESDA compliance audit checklistJonalyndie ChuaNo ratings yet

- Philippine NGO Certification ProcessDocument3 pagesPhilippine NGO Certification ProcessJoseph Jumao-asNo ratings yet

- Requirements in Renewing Business PermitDocument1 pageRequirements in Renewing Business PermitCharina Marie CaduaNo ratings yet

- Get your Liquor License in Quezon CityDocument1 pageGet your Liquor License in Quezon CityCharina Marie CaduaNo ratings yet

- Real Estate Affidavit of Ownership Template ExampleDocument1 pageReal Estate Affidavit of Ownership Template ExampleCharina Marie CaduaNo ratings yet

- Business Profile 3Document30 pagesBusiness Profile 3Charina Marie CaduaNo ratings yet

- Sample Company ProfileDocument3 pagesSample Company ProfileAparna Rizal100% (1)

- TCTDocument2 pagesTCTRene Jane RosendoNo ratings yet

- Revenue District Office No. 38 - North Quezon CityDocument5 pagesRevenue District Office No. 38 - North Quezon CityCharina Marie CaduaNo ratings yet

- JP Group Quality and Value enDocument7 pagesJP Group Quality and Value enCharina Marie CaduaNo ratings yet

- 6-30 Gitman School ReportDocument6 pages6-30 Gitman School ReportCharina Marie CaduaNo ratings yet

- Marketing GuideDocument1 pageMarketing GuideCharina Marie CaduaNo ratings yet

- Affidavit of Loss of Cash DividendDocument1 pageAffidavit of Loss of Cash DividendCharina Marie CaduaNo ratings yet

- Phase 1 - The World Wide Web (Web 1.0)Document5 pagesPhase 1 - The World Wide Web (Web 1.0)Charina Marie CaduaNo ratings yet

- TITLE IX - Section 232 To 235 of The National Internal Revenue CodeDocument2 pagesTITLE IX - Section 232 To 235 of The National Internal Revenue CodeCharina Marie CaduaNo ratings yet

- FOI - Routing Slip PDFDocument2 pagesFOI - Routing Slip PDFCharina Marie CaduaNo ratings yet

- NPV Calculation of Euro DisneylandDocument5 pagesNPV Calculation of Euro DisneylandRama SubramanianNo ratings yet

- Canara HSBC Life Insurance Premium ReceiptDocument1 pageCanara HSBC Life Insurance Premium Receiptyogesh bafnaNo ratings yet

- Invoice Name Vender Code Address Contact +91-Gst No PAN: 7977860361 AALFH8917JDocument2 pagesInvoice Name Vender Code Address Contact +91-Gst No PAN: 7977860361 AALFH8917JchindendrasinghNo ratings yet

- RMC No. 51-2018Document1 pageRMC No. 51-2018Atty. Jackelyn Joy Pernitez0% (1)

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- System Input For FoxPro 2.6Document29 pagesSystem Input For FoxPro 2.6Jet Mark IgnacioNo ratings yet

- 1575 Tania Sultana (Taxation I)Document28 pages1575 Tania Sultana (Taxation I)Tania SultanaNo ratings yet

- Commission On Audit: Republic of The PhilippinesDocument3 pagesCommission On Audit: Republic of The Philippinesjaymark camachoNo ratings yet

- Calculate Self-Employment IncomeDocument6 pagesCalculate Self-Employment IncomejoanaNo ratings yet

- Anderson, Elle 2019 Federal Tax ReturnDocument13 pagesAnderson, Elle 2019 Federal Tax ReturnElle Anderson100% (2)

- Philippine Income Tax Multiple Choice Practice TestDocument4 pagesPhilippine Income Tax Multiple Choice Practice TestKathlyn PostreNo ratings yet

- Kalol Indian Farmers Fertiliser Co-Operative Limited Pay SlipDocument1 pageKalol Indian Farmers Fertiliser Co-Operative Limited Pay SlipSHAILESH PATELNo ratings yet

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- Sales Tax ComputationDocument5 pagesSales Tax ComputationAnkur SinghNo ratings yet

- Meesho Payments A4lfl 1627030049858Document5 pagesMeesho Payments A4lfl 1627030049858Ramakrishna SriNo ratings yet

- Realize Your Tax PotentialDocument4 pagesRealize Your Tax PotentialHiwa Khan SalamNo ratings yet

- Naparam Zacharry Kyll 2 2 Bacr5 Mo8Document3 pagesNaparam Zacharry Kyll 2 2 Bacr5 Mo8Melvin ZafraNo ratings yet

- Tabag Pp354 364 PDF FreeDocument16 pagesTabag Pp354 364 PDF FreeJonalyn Marasigan RapezaNo ratings yet

- Asian Paints PLDocument2 pagesAsian Paints PLPriyalNo ratings yet

- Charge Assumption ReportDocument2 pagesCharge Assumption ReportALi MAlikNo ratings yet

- Income Tax Certificate SuccessuptechDocument2 pagesIncome Tax Certificate Successuptecheandc.bdNo ratings yet

- PT. Alfa Laval Indonesia salary slipsDocument4 pagesPT. Alfa Laval Indonesia salary slipsputri endah rahmawatiNo ratings yet

- GST 101 ADocument1 pageGST 101 AchriswoonNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Shashank Sasane 02Document1 pageShashank Sasane 02Pratik BajiNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- Affidavit To Obtain Refund of New Mexico Tax Due A Deceased TaxpayerDocument2 pagesAffidavit To Obtain Refund of New Mexico Tax Due A Deceased Taxpayerhypnotix-2000No ratings yet

- 2019 CorporationsDocument21 pages2019 CorporationsKathleen Joi MontezaNo ratings yet

- FormDocument1 pageFormDeepakNo ratings yet