Professional Documents

Culture Documents

BIR Tax Deadlines: Home About Us Services Clientele Contact Us

Uploaded by

NICKOL NAMOCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Tax Deadlines: Home About Us Services Clientele Contact Us

Uploaded by

NICKOL NAMOCCopyright:

Available Formats

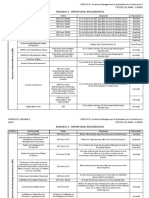

BIR Tax Deadlines

Home About Us Services Clientele Contact Us

BIR Tax Deadlines

WAIVER: Please note that this is just a basic listing and should not be taken as complete or accurate. Deadlines may change

without prior notice. For a more complete and updated listing, please visit the website of the respective agency concerned.

(Filing and Remittance)

Form Requirement Deadline for manual filers

No.

1601-C Monthly Remittance Return of W/Tax on Compensation Every 10th day after the end of each month

1601-E Monthly Remittance Return of Expanded Withholding Tax Every 10th day after the end of each month

(together with Monthly Summary Alpha List)

1601-F Monthly Remittance Return of Final Income Tax Withheld Every 10th day after the end of each month

2550-M Monthly Value Added Tax Declaration Every 20th day after the end of each month

2551-M Monthly Percentage Tax Return Every 20th day after the end of each month

2550-Q Quarterly Value Added Tax Return Every 25th day after the end of each qtr.

(together with Quarterly List of Sales and Purchases)

1701-Q Quarterly Income Tax Return (for self-employed individuals)

- 1st Quarter April 15 or 15 days after end of qtr.

- 2nd Quarter August 15 or 45 days after end of qtr.

- 3rd Quarter Nov. 15 or 45 days after end of qtr.

1702-Q Quarterly Income Tax Return (for corporations and

partnerships)

- 1st Quarter May 29 or 60 days after end of each qtr.

- 2nd Quarter August 29 or 60 days after end of each qtr.

- 3rd Quarter Nov. 29 or 60 days after end of each qtr.

1701 Annual Income Tax Return (for self-employed individuals) Ápril 15

1702 Annual Income Tax Return (for corporations and April 15 or 105 days after the end of the fiscal

partnerships) year

2000 Documentary Stamp Tax Declaration 5th day after the end of each month

0605 Payment Form - Annual Registration Fee January 31

1604-CF Annual Information Return of Income Taxes withheld on January 31

Compensation and Final Withholding Tax

1604-E Annual Information Return of Creditable Income Taxes March 1

withheld (Expanded)

1905 Registration renewal of manual books of accounts December 29

1900 Registration of computerized books of accounts and other January 30 or 30 days after the end of the fiscal

accounting records (together with affidavit attesting the year

completeness of the computerized accounting books/records)

1900 Registration of permanently bound computer-generated/loose January 15 or 15 days after the end of the fiscal

leaf books of accounts and other accounting records year

no form Submission of Inventory List January 30 or 30 days after the end of the fiscal

year

*NOTE:

1. For Large and Selected Non-Large Taxpayers who are enrolled in the eFPS( Electronic Filing and Payment System) , the

remittance and filing of the basic tax returns is staggered based on the industry classification of the company.

2. All other tax forms or tax deadlines not enumerated in the above schedule, please feel free to consult with us.

Accreditations Our Affiliations Current Visitors

We are accredited with the following We are a proud member of the We have 14 guests online

institutions: following organizations:

• BOA Accred. #05020

file:///C|/Users/Leah/Desktop/BIR%20Tax%20Deadlines.html[10/13/2016 9:36:58 AM]

BIR Tax Deadlines

Valid until 12/31/2017

• SEC Accred. #0253-R-1

Valid until 01/31/2019

• BIR Accred. #08-002123-1

Valid until 2017

file:///C|/Users/Leah/Desktop/BIR%20Tax%20Deadlines.html[10/13/2016 9:36:58 AM]

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Philippine Tax Form Requirements and DeadlinesDocument1 pagePhilippine Tax Form Requirements and DeadlinesLhyraNo ratings yet

- Form No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesDocument7 pagesForm No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesromarcambriNo ratings yet

- Bir Tax DeadlinesDocument1 pageBir Tax DeadlinesJomar VillenaNo ratings yet

- BIR FormsDocument3 pagesBIR FormsLuis JoseNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- BIR Registration RequirementsDocument27 pagesBIR Registration RequirementsCrizziaNo ratings yet

- Bir FilingsDocument2 pagesBir FilingsJehiel ImbocNo ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- Bir Filings When To FileDocument1 pageBir Filings When To FileJehiel ImbocNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- BIR Registration & Due Dates-1Document6 pagesBIR Registration & Due Dates-1jessicamarieogbinar37No ratings yet

- BIR FormsDocument1 pageBIR FormsBSA MaterialsNo ratings yet

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocument2 pagesFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoNo ratings yet

- Bir FormDocument3 pagesBir FormChelsea Anne VidalloNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- Guidelines On Compliances and DocumentationDocument4 pagesGuidelines On Compliances and DocumentationJfm A Dazlac100% (1)

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- BIR Filing Deadlines GuideDocument4 pagesBIR Filing Deadlines GuideI Am Not DeterredNo ratings yet

- W11-Module Tax Return Preparation and Tax Payments - PPTDocument14 pagesW11-Module Tax Return Preparation and Tax Payments - PPTVirgilio Jay CervantesNo ratings yet

- Briefing MADE EASY-LUCILLEDocument51 pagesBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNo ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- RA No. 10963 Compliance Requirements and DeadlinesDocument3 pagesRA No. 10963 Compliance Requirements and Deadlinesmenche galuraNo ratings yet

- Deadline For Govt Reports & FormsDocument6 pagesDeadline For Govt Reports & FormsKrisha AlcozerNo ratings yet

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanNo ratings yet

- Reportorial RequirementsDocument3 pagesReportorial RequirementsMark Anthony P. TarroquinNo ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- VAT Guide: Rates, Returns, Filing ProceduresDocument33 pagesVAT Guide: Rates, Returns, Filing ProceduresvicsNo ratings yet

- SSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineDocument1 pageSSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineIvy ValcarcelNo ratings yet

- W11-Module Tax Return Preparation and Tax PaymentsDocument20 pagesW11-Module Tax Return Preparation and Tax PaymentsVirgilio Jay CervantesNo ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- New Tax Campaign 2024 DumagueteDocument14 pagesNew Tax Campaign 2024 DumaguetebugsparNo ratings yet

- Tax Remedies of The GovernmentDocument16 pagesTax Remedies of The GovernmentrmsenyoritaNo ratings yet

- About The VAT (PDocument11 pagesAbout The VAT (PAmie Jane MirandaNo ratings yet

- Tax 304 - Vat Compliance RequirementsDocument5 pagesTax 304 - Vat Compliance RequirementsiBEAYNo ratings yet

- Corporate CalenderDocument12 pagesCorporate CalenderNikhil DaroliaNo ratings yet

- WITHHOLDING TAX OBLIGATIONSDocument152 pagesWITHHOLDING TAX OBLIGATIONSemytherese100% (2)

- Summary of Filing Deadlines of Internal Revenue TaxesDocument1 pageSummary of Filing Deadlines of Internal Revenue TaxesColleen GuimbalNo ratings yet

- Tax Requirements for Govt Job OrdersDocument14 pagesTax Requirements for Govt Job OrdersghNo ratings yet

- txtn502 Part2Document21 pagestxtn502 Part2Sandra Mae Cabuenas100% (1)

- Pananaw 2020 PDFDocument93 pagesPananaw 2020 PDFKobi SaibenNo ratings yet

- VAT Compliance RequirementsDocument4 pagesVAT Compliance RequirementsRyan AllanicNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDocument107 pagesBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- Deductions From Gross Income: Basis Ceiling RuleDocument8 pagesDeductions From Gross Income: Basis Ceiling RuleFabiano JoeyNo ratings yet

- Proposal To Lalaine GandaDocument1 pageProposal To Lalaine GandaJM Valonda Villena, CPA, MBANo ratings yet

- Presentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Document44 pagesPresentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Franco DurantNo ratings yet

- List of Bir FormsDocument49 pagesList of Bir Formsblessaraynes50% (4)

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Tax Compliance and Dispute RelationshipDocument37 pagesTax Compliance and Dispute Relationshipryu255No ratings yet

- How Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanDocument13 pagesHow Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanRheneir MoraNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- 2016 Filing Schedule for AFS and GISDocument6 pages2016 Filing Schedule for AFS and GISGummy BearNo ratings yet

- Reportorial RequirementsDocument5 pagesReportorial RequirementsMelaine A. FranciscoNo ratings yet

- Understanding Pakistan's Taxation LawsDocument89 pagesUnderstanding Pakistan's Taxation LawsHAMZA TAHIRNo ratings yet

- Form # Form Title: Annual Income Tax Return For Individuals Earning Income PURELY From Business/ProfessionDocument2 pagesForm # Form Title: Annual Income Tax Return For Individuals Earning Income PURELY From Business/ProfessionErika Jane Recto FanoNo ratings yet

- 5 Instances of Input VAT Expense in The Philippines - Tax and Accounting Center Inc. - Tax and Accounting Center, Inc PDFDocument5 pages5 Instances of Input VAT Expense in The Philippines - Tax and Accounting Center Inc. - Tax and Accounting Center, Inc PDFNICKOL NAMOCNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Value Added Tax On Sales To Government in PhilippinesDocument5 pagesValue Added Tax On Sales To Government in PhilippinesNICKOL NAMOCNo ratings yet

- 8 Pointers For Expanded Withholding Taxes in The Philippines - GPP & CO. CPASDocument4 pages8 Pointers For Expanded Withholding Taxes in The Philippines - GPP & CO. CPASNICKOL NAMOCNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- Michael Easley 1040 2017Document2 pagesMichael Easley 1040 2017MichaelNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- US Internal Revenue Service: I1040gi - 2006Document87 pagesUS Internal Revenue Service: I1040gi - 2006IRS100% (1)

- Payroll Accounting 2014 24Th Edition Bieg Test Bank Full Chapter PDFDocument22 pagesPayroll Accounting 2014 24Th Edition Bieg Test Bank Full Chapter PDFcaninerawboned.2rfl40100% (8)

- Application Tenant Rent&UtilityAssistance 199056Document34 pagesApplication Tenant Rent&UtilityAssistance 199056Veronica LopezNo ratings yet

- Solutions To Self-Study Problems: Chapter 1 The Individual Income Tax ReturnDocument84 pagesSolutions To Self-Study Problems: Chapter 1 The Individual Income Tax ReturnTiffy LouiseNo ratings yet

- IRS Pub 2194 - Disaster Relief Tax AddendumDocument136 pagesIRS Pub 2194 - Disaster Relief Tax AddendumdonlucekNo ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- Sample Manufacturing Business Chart of Accounts PDFDocument3 pagesSample Manufacturing Business Chart of Accounts PDFMamun Kabir73% (15)

- FAFSA Summary ReportDocument5 pagesFAFSA Summary ReportJason LinkNo ratings yet

- Irs 2285 ManualDocument15 pagesIrs 2285 ManualMichael BarnesNo ratings yet

- Foreign Status Certificate Individual Tax FormDocument1 pageForeign Status Certificate Individual Tax FormAndrew Christopher CaseNo ratings yet

- Battelle Form 990-Fy10Document74 pagesBattelle Form 990-Fy1011CV00233100% (1)

- Indiana FRSDocument84 pagesIndiana FRSMatt BrownNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusboayoung.0820No ratings yet

- W-2, W-4, Refunds, Oh My!Document11 pagesW-2, W-4, Refunds, Oh My!Linda Escobar100% (13)

- Ucla Fra Report Fy 20Document84 pagesUcla Fra Report Fy 20Matt BrownNo ratings yet

- f8822 PDFDocument2 pagesf8822 PDFmina catNo ratings yet

- 2020 - PmaDocument2 pages2020 - Pmalaniya rossNo ratings yet

- Instructions For Form 941: (Rev. March 2021)Document20 pagesInstructions For Form 941: (Rev. March 2021)Btakeshi1No ratings yet

- US Embassy Manila IV Interview RequirementsDocument26 pagesUS Embassy Manila IV Interview Requirementsleesangyoo14No ratings yet

- 1099 Form Year 2021Document8 pages1099 Form Year 2021Candy Valentine100% (1)

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- Multiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeDocument1 pageMultiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeTaimour HassanNo ratings yet

- Instructions For Form 2848 (02 - 2020) - Internal Revenue ServiceDocument30 pagesInstructions For Form 2848 (02 - 2020) - Internal Revenue ServiceBIGBOY80% (5)

- 2018 Federal Income Tax Return PDFDocument8 pages2018 Federal Income Tax Return PDFBrandon BachNo ratings yet

- US Internal Revenue Service: Iw2 - 1999Document12 pagesUS Internal Revenue Service: Iw2 - 1999IRSNo ratings yet

- 6209 ManualDocument724 pages6209 ManualthenjhomebuyerNo ratings yet

- Confirmation - Letter - Stacy Newsome LNCC LLCDocument2 pagesConfirmation - Letter - Stacy Newsome LNCC LLCOPL OJJJNo ratings yet