Professional Documents

Culture Documents

Value Added Tax On Sales To Government in Philippines

Uploaded by

NICKOL NAMOCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Added Tax On Sales To Government in Philippines

Uploaded by

NICKOL NAMOCCopyright:

Available Formats

Value Added Tax on Sales to Government in Philippines > Tax and Accounting Center Inc.

- Tax and Accounting Center, Inc.

Tweet

58

Like

Share

7 Home About Us Services Clients Articles Featured Blog Contact Us

SMEs

Share

Value Added Tax on Sales to Government in Philippines

Government, any of its political subdivision, instrumentality or agencies, including government-owned or

controlled corporations (GOCCs) is also subject to value added tax in the Philippines, unless otherwise

exempted. Sales to government of goods, properties, or services are subject to 12% value added tax.

However, there are some special rules that one must be aware of in dealing with the government sales –

final withholding VAT on sales to government in the Philippines, accounting and fill-out of value added tax

returns in the Philippines.

Final withholding VAT on sales to government

As a rule, government or any of its political subdivision, instrumentalities, or agencies, including

government-owned or controlled corporations are mandated to withhold 5% (out of the 12% VAT) on

VATable sales upon payment to value added tax sellers of goods or services. Such 5% withholding tax shall

represent the net VAT payable by the seller to government. This would mean that the seller will not be

made to pay more than 5% out of the 12% value added tax on government sales in the Philippines. In the

VAT returns however, the 12% value added tax on sale to government has to be declared for transparency

purposes.

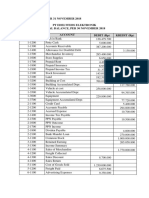

Sample computation on final VAT on sales to government:

A Corp. sold P1,000,000 worth of goods plus 12% VAT or P120,000 to Government Agency

(GA). Upon payment of GA to A Corp., GA will withhold the 5% or P50,000 (P1,000,000

multiplied by 5%), so it will only pay P1,070,000.00 (P1,120,000 less P50,000) to A Corp. A

Corp. will no longer pay or remit the Bureau of Internal Revenue (BIR) the P70,000 (P120,000

less P50,000) because the P50,000 withheld by GA constitute final VAT on sales to government

in the Philippines.

Standard input VAT on sales to government

Since the seller will effectively pay the 5% out of the 12% value added tax on sales to government, the 7%

(12% less 5%) effectively accounts for the standard input VAT in lieu of actual input VAT. The question

now is – How about the actual input tax on purchases of the seller for goods or services used in sales to

government? Such actual input tax attributable or ratable (for those with mixed transactions) to sales to

government will no longer be deducted against the output VAT on other regular sales because the standard

input VAT will take their place. Said actual input VAT attributable or ratable to government sales shall not

also be carried over to succeeding months or quarters, not an outright input VAT expense, and not allowed

to be claimed for refund and tax credit certificates. Instead, such actual input VAT are closed to the

standard input VAT in the books of account of the VAT-registered taxpayer in the Philippines and any

difference treated as follows:

file:///C|/Users/Leah/Desktop/g.html[9/9/2016 5:36:43 PM]

Value Added Tax on Sales to Government in Philippines > Tax and Accounting Center Inc. - Tax and Accounting Center, Inc.

If actual input VAT exceeds standard input VAT, input VAT expenses; or

If actual input VAT is less than the standard input VAT, closed to expense or cost.

Sample computation on sales to government

A Corp. sold P1,000,000 worth of goods plus 12% VAT or P120,000 to Government Agency

(GA). In making such sales to government, A Corporation’s purchases totaled P625,000 plus

12% VAT of P75,000.00.

As a sale to government, A Corp. will not compute VAT due and payable at P45,000 (P120,000

less P75,000). With the 5% or P50,000.00 final VAT withheld by GA, the P75,000.00 input VAT

will not be deducted from the P120,000 output VAT on sales to GA or on other VATable sales of

A Corp. Instead, it will be closed in the books of accounts of A Corp. as input VAT expense of

P5,000 (P75,000 actual less P70,000 standard). On the other hand, assuming the actual input

VAT is only P60,000, then closing the actual input VAT in the books will result to a reduction of

expense or cost, or simply other income of P10,000 (P60,000 actual less P70,000 standard).

Related Seminars

Join our VAT seminars to learn more about Value Added Tax in the Philippines

Value Added Tax, In and Out – One Day Seminar

Basic Business Accounting and BIR Compliance for VAT Registered – Two Day Seminar

Workshop

Disclaimer: This article is for general conceptual guidance only and is not a substitute for an

expert opinion. Please consult your preferred tax and/or legal consultant for the specific

details applicable to your circumstances. For comments, you may please send mail at

info@taxacctgcenter.org.)

See how we can help you with our professional services…

See our quality seminars, workshops, and trainings…

Read More Articles…(Post viewed 26615 times)

file:///C|/Users/Leah/Desktop/g.html[9/9/2016 5:36:43 PM]

Value Added Tax on Sales to Government in Philippines > Tax and Accounting Center Inc. - Tax and Accounting Center, Inc.

Seminar Schedules

September 2016

September 8-9, 2016 Thursday & Friday - Basic Business Accounting and BIR VAT Compliance

Seminar Workshop

September 10, 2016 Saturday- BIR Returns & Reports Preparations under eBIR and Online Submissions

Seminar

September 15, 2016 Thursday- How to Register Philippine Business Entity, Seminar

September 16-17, 2016 Friday & Saturday - Basic Business Taxation Simplified

September 24, 2016 Saturday - Compensation: Computations and Must Know Exemptions

September 29, 2016 Thursday - BIR Examination: Their Procedures and related Defenses

October 2016

October 1, 2016 Saturday- BIR Returns & Reports Preparations under eBIR and Online Submissions

Seminar

October 6-7, 2016 Thursday & Friday - Basic Business Accounting and BIR Non-VAT Compliance

Seminar Workshop

October 8, 2016 Saturday - Value Added Tax In and Out

October 15, 2016 Saturday - Compensation: Computations and Must Know Exemptions

October 21, 2016 Friday - How to analyze audited financial statements & Accounting for Management

October 21, 2016 Friday- PEZA Registered Entities: Tax Compliance – Seminar

October 21, 2016 Friday - How to analyze audited financial statements & Accounting for Management

October 22, 2016 Saturday - BIR Examination: Their Procedures and related Defenses

October 27-28, 2016 Thursday & Friday - Basic Business Accounting and BIR VAT Compliance Seminar

Workshop

Blog & Updates

September 2015 Tax and Accounting Seminar Workshop Schedules Philippines

How to Register a Subsidiary of a Foreign Company in Philippines

July 2015 Tax and Accounting Seminar Workshop Schedules Philippines

June 2015 Tax and Accounting Seminar Workshop Schedules Philippines

May 2015 Tax and Accounting Seminar Workshop Schedules Philippines

10 Tax mistakes on financial statements and income tax returns Philippines

file:///C|/Users/Leah/Desktop/g.html[9/9/2016 5:36:43 PM]

Value Added Tax on Sales to Government in Philippines > Tax and Accounting Center Inc. - Tax and Accounting Center, Inc.

Join our Forum References

Contact Us

Tax and Accounting Center,. Inc.

U2309 Cityland 10 - Tower I, 6815 H.V. dela Costa St. cor. Ayala Avenue, 1200 Makati City,

Metro Manila

Phone :

(02) 894-2608

(02) 348-2193

Mobile :

(+63)922-856-2358

Email : info@taxacctgcenter.org

Government Links

Bureau of Internal Revenue (BIR)

Securities and Exchange Commission(SEC)

Philippine Economic Zone Authority(PEZA)

Bases Conv. & Dev't. Authority (BCDA)

Cagayan Economic Zone Authority (CEZA)

Subic Bay Metropolitan Authority (SBMA)

Board of Investments (BOI)

Bureau of Customs (BoC)

Department of Finance (DOF)

Department of Trade and Industry(DTI)

Food and Drugs Administration Phils. (FDA)

Bureau of Immigration(BI)

Affiliates

file:///C|/Users/Leah/Desktop/g.html[9/9/2016 5:36:43 PM]

Value Added Tax on Sales to Government in Philippines > Tax and Accounting Center Inc. - Tax and Accounting Center, Inc.

G. Pagaspas Partners & Co. CPAs

Newsletter Sign Up

Get the latest updates and news direct to your mailbox!

Subscribe

© Tax and Accounting Center 2011

file:///C|/Users/Leah/Desktop/g.html[9/9/2016 5:36:43 PM]

You might also like

- Your Dual Fuel Account: MR R Salimath 24B Norway Street Aro Valley Wellington 6012Document3 pagesYour Dual Fuel Account: MR R Salimath 24B Norway Street Aro Valley Wellington 6012Ravi Salimath100% (1)

- JPMCStatementDocument4 pagesJPMCStatementJoe Whitelaw50% (2)

- Process Financial Transactions and Extract ReportsDocument49 pagesProcess Financial Transactions and Extract Reportsnigus93% (14)

- Australian Tax ObligationsDocument17 pagesAustralian Tax Obligationshemant100% (2)

- Inventory Management Chapter OverviewDocument11 pagesInventory Management Chapter OverviewAnirudh Prabhu100% (1)

- VAT Rules for Philippine Government SalesDocument5 pagesVAT Rules for Philippine Government SalesVan BalaresNo ratings yet

- Accounting For VAT in The Philippines - Tax and Accounting Center, IncDocument8 pagesAccounting For VAT in The Philippines - Tax and Accounting Center, IncJames SusukiNo ratings yet

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaNo ratings yet

- Tax AccountingDocument4 pagesTax Accountinguymaxx3No ratings yet

- KRN BIR ReqDocument2 pagesKRN BIR ReqNitz GallevoNo ratings yet

- What Is VAT in NepalDocument4 pagesWhat Is VAT in NepalAjayNo ratings yet

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingDocument3 pagesTips To Legally Avoid Paying BIR Penalties During Tax MappingMark Anthony CasupangNo ratings yet

- Avoid BIR Penalties with Tax ComplianceDocument2 pagesAvoid BIR Penalties with Tax ComplianceLevi Lazareno EugenioNo ratings yet

- Gambia Tax Guide 2016 17Document11 pagesGambia Tax Guide 2016 17joebeqNo ratings yet

- VatDocument5 pagesVatninaryzaNo ratings yet

- Taxation For Professional Services: TopicDocument35 pagesTaxation For Professional Services: TopicLANCENo ratings yet

- Request for a Business NumberDocument5 pagesRequest for a Business Numberrouzbeh1797No ratings yet

- Analysis Group 4Document5 pagesAnalysis Group 4Clarise DatayloNo ratings yet

- Percentage Taxes: Use BIR Form 2550MDocument17 pagesPercentage Taxes: Use BIR Form 2550Mcha11No ratings yet

- How To Compute For VATDocument29 pagesHow To Compute For VATNardsdel RiveraNo ratings yet

- 5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncDocument7 pages5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncMartin MartelNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- Business Tax ClassificationsDocument2 pagesBusiness Tax ClassificationsAlberto NicholsNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichNo ratings yet

- Vat On Importation of GoodsDocument6 pagesVat On Importation of GoodsLica Dapitilla PerinNo ratings yet

- Week 16 and 17 Tax Incentives and BMBEDocument28 pagesWeek 16 and 17 Tax Incentives and BMBEwatanabe200412No ratings yet

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Presumptive Taxation For Business and ProfessionDocument17 pagesPresumptive Taxation For Business and ProfessionRupeshNo ratings yet

- Exercises 15-1 discussion questions simplified business tax system VAT scopeDocument1 pageExercises 15-1 discussion questions simplified business tax system VAT scopesamsungacerNo ratings yet

- Implication of VAT On Individuals: Value Added Tax (VAT)Document4 pagesImplication of VAT On Individuals: Value Added Tax (VAT)Jabir U V KaladiNo ratings yet

- ULO-A Let's Analyze Answers: Activity 1Document1 pageULO-A Let's Analyze Answers: Activity 1Lealyn CuestaNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- VAT Presentation To The General PublicDocument27 pagesVAT Presentation To The General PublicJoette PennNo ratings yet

- BUSTAX SepDocument4 pagesBUSTAX SepReniva KhingNo ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- Common Tax Issues of PEZADocument25 pagesCommon Tax Issues of PEZALielet MatutinoNo ratings yet

- CIR Vs ShinkoDocument3 pagesCIR Vs ShinkoEllaine BernardinoNo ratings yet

- Peza ReportDocument2 pagesPeza ReportDiana FernandezNo ratings yet

- Accounting For Withholding Taxes in The PhilippinesDocument3 pagesAccounting For Withholding Taxes in The PhilippinesRollie ConteNo ratings yet

- Fabm 2 Module 10 Vat OptDocument5 pagesFabm 2 Module 10 Vat OptJOHN PAUL LAGAONo ratings yet

- SUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Document2 pagesSUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Bryce BihagNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- Tax Reform For Acceleration and Inclusion LawDocument28 pagesTax Reform For Acceleration and Inclusion LawGloriosa SzeNo ratings yet

- 9 - Intro To Business TaxesDocument16 pages9 - Intro To Business TaxesEULALIA QuiniquiniNo ratings yet

- Business Tax GuideDocument30 pagesBusiness Tax GuideKristelle Mae BautistaNo ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahNo ratings yet

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- MEMODocument6 pagesMEMOLudmila DorojanNo ratings yet

- Pakistan Tax Structure Explained: Income, Sales, Corporate and MoreDocument23 pagesPakistan Tax Structure Explained: Income, Sales, Corporate and MoreAsif Rasool ChannaNo ratings yet

- VAT RegistrationDocument23 pagesVAT RegistrationMT RANo ratings yet

- VAT To Remedies of A Taxpayer (95%)Document61 pagesVAT To Remedies of A Taxpayer (95%)Yrjell ObsiomaNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- Introduction to Value Added Tax in MaharashtraDocument38 pagesIntroduction to Value Added Tax in MaharashtraKavita NadarNo ratings yet

- Percentage TaxDocument4 pagesPercentage TaxPATRICK JAMES BALOGBOG ROSARIONo ratings yet

- Legal and Tax Aspects of Business OrganizationsDocument4 pagesLegal and Tax Aspects of Business OrganizationsMaureenNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- VAT vs Percentage Tax for CompaniesDocument1 pageVAT vs Percentage Tax for CompaniesalejandroctayNo ratings yet

- How To Compute Income TaxDocument36 pagesHow To Compute Income TaxbrownboomerangNo ratings yet

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overDocument46 pagesDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionNo ratings yet

- Philippines 2018 PDFDocument28 pagesPhilippines 2018 PDFJohnryan Anthony CabatacNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- 5 Instances of Input VAT Expense in The Philippines - Tax and Accounting Center Inc. - Tax and Accounting Center, Inc PDFDocument5 pages5 Instances of Input VAT Expense in The Philippines - Tax and Accounting Center Inc. - Tax and Accounting Center, Inc PDFNICKOL NAMOCNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- 8 Pointers For Expanded Withholding Taxes in The Philippines - GPP & CO. CPASDocument4 pages8 Pointers For Expanded Withholding Taxes in The Philippines - GPP & CO. CPASNICKOL NAMOCNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- 1 TAXF372-TaxinActionCASESTUDYandREQUIREDDocument3 pages1 TAXF372-TaxinActionCASESTUDYandREQUIREDrenette1010No ratings yet

- Terminal Handling Charges: London Heathrow AirportDocument2 pagesTerminal Handling Charges: London Heathrow AirportMuhammad SiddiuqiNo ratings yet

- Intro To Business Taxation: Group 2Document32 pagesIntro To Business Taxation: Group 2Hardly Dare GonzalesNo ratings yet

- Car Rental ReceiptDocument1 pageCar Rental ReceiptabrshNo ratings yet

- GCWUF Bank Credit VoucherDocument1 pageGCWUF Bank Credit VoucherHamna tahir Hamna tahirNo ratings yet

- Carriage by AirDocument7 pagesCarriage by AirHaroonĦammadiNo ratings yet

- Daftar Saldo Dan Kartu Pembantu PT EdelweissDocument3 pagesDaftar Saldo Dan Kartu Pembantu PT EdelweissalifaNo ratings yet

- POS Class Diagram PDFDocument1 pagePOS Class Diagram PDFSaad HassanNo ratings yet

- DepEd Northern Samar requests athlete insuranceDocument2 pagesDepEd Northern Samar requests athlete insuranceMarv MarvNo ratings yet

- Quick Guide To Reissue ManuallyDocument14 pagesQuick Guide To Reissue ManuallyMaha OtaifyNo ratings yet

- Letter of Credit Process - Recherche GoogleDocument1 pageLetter of Credit Process - Recherche GoogleKONE MEHANVAIS KARIMNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- Account Statement From 1 Jan 2018 To 31 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jan 2018 To 31 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceATULNo ratings yet

- MakeMyTrip ICICI Bank Platinum Card TermsDocument11 pagesMakeMyTrip ICICI Bank Platinum Card TermsnaveenNo ratings yet

- SEA FREIGHT DOCUMENTS - Sea-Docf-170810080659Document98 pagesSEA FREIGHT DOCUMENTS - Sea-Docf-170810080659Thien Nguyen100% (1)

- Appendix 52 - Instructions - ADADJDocument1 pageAppendix 52 - Instructions - ADADJpdmu regionixNo ratings yet

- PMC MDCAT 2021 Registration Fee ChallanDocument1 pagePMC MDCAT 2021 Registration Fee ChallanAkif SadiqNo ratings yet

- Bank Reconciliation - SolvedDocument2 pagesBank Reconciliation - SolvedMUHAMMAD NADEEMNo ratings yet

- StatementDocument10 pagesStatementdoninsgusts016No ratings yet

- Operating Bank AccountsDocument2 pagesOperating Bank AccountsWira KafryawanNo ratings yet

- JUNE Prepaid Info Card 2021Document2 pagesJUNE Prepaid Info Card 2021Prasanth K PNo ratings yet

- Chapter 17, Modern Advanced Accounting-Review Q & ExrDocument23 pagesChapter 17, Modern Advanced Accounting-Review Q & Exrrlg481475% (4)

- Logistics Consulting Companies and Flexitank Companies in MexicoDocument3 pagesLogistics Consulting Companies and Flexitank Companies in MexicoDiego AntonioNo ratings yet

- Government of Telangana Commercial Taxes DepartmentDocument8 pagesGovernment of Telangana Commercial Taxes DepartmentAbhishek SinghNo ratings yet

- Bank Reconsiliasi - Model Soal 7.5Document4 pagesBank Reconsiliasi - Model Soal 7.5William SugiartoNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet