Professional Documents

Culture Documents

BIR Forms

Uploaded by

Luis Jose0 ratings0% found this document useful (0 votes)

7 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesBIR Forms

Uploaded by

Luis JoseCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

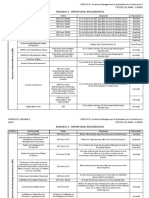

Form No.

Requirement Deadline for manual filers

Payment Form Annual

0605 January 31

Registration

Monthly Remittance Return

Every 10th day of after the

1601-C of Income Taxes Withheld

end of each month

on Compensation

Monthly Remittance Form

Every 10th day of after the

0619-E for Creditable Income

end of each month

Taxes Withheld (Expanded)

Monthly Remittance Form

Every 10th day of after the

0619-F for Final Income Taxes

end of each month

Withheld

Quarterly Remittance

Return of Creditable

Every Last Day of the

Income Taxes Withheld

1601-EQ month after the end of each

(Expanded) (together with

quarter

the Quarterly Alphabetical

List of Payees)

Quarterly Remittance Every Last Day of the

1601-FQ Return of Final Income month after the end of each

Taxes Withheld quarter

Annual Information Return

of Income Taxes Withheld

1604-CF January 31

on Compensation of Final

Withholding Taxes

Annual Information Return

1604-E of Creditable Income Taxes March 1

Withheld (Expanded)

Monthly Value Added Tax Every 20th day after the

2550-M

Declaration end of each month

2551-M Monthly Percentage Tax Every 20th day after the

Return end of each month

Quarterly Value Added Tax Every 25th day after the

2550-Q

Return end of each month

Quarterly Percentage Tax Every 25th day after the

2551-Q

Return end of each month

Annual Income Tax Return

1701 (for self-employed April 15

individuals)

Quarterly Income Tax

1701-Q Return (for self-employed

individuals)

May 15 or 45 days after

- 1st Quarter

end of each quarter

August 15 or 45 days after

- 2nd Quarter

end of each quarter

November 15 or 45 days

- 3rd Quarter

after end of each quarter

Annual Income Tax Return

1702 (for corporations and April 15

partnerships)

Quarterly Income Tax

1702-Q Return (for corporations

and partnerships)

May 29 or 60 days after

- 1st Quarter

end of each quarter

August 29 or 60 days after

- 2nd Quarter

end of each quarter

November 29 or 60 days

- 3rd Quarter

after end of each quarter

2000 Documentary Stamp Tax 5th day after the end of

Declaration transaction month

Registration renewal of

1905 December 29

manual books of accounts

Registration for New

1905

Corporation

Registration for Single

1902

Proprietor

Registration of

computerized books of

accounts and other

accounting records January 30 or 30 days after

1900

(together with affidavit the end of the fiscal year

attesting the completeness

of the computerized

accounting books/records)

Registration of permanently

bound computer-

January 15 or 15 days after

1900 generated/loose leaf books

the end of the fiscal year

of accounts and other

accounting records

Submission of Inventory January 30 or 30 days after

no form

List the end of the fiscal year

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Philippine Tax Form Requirements and DeadlinesDocument1 pagePhilippine Tax Form Requirements and DeadlinesLhyraNo ratings yet

- Bir FilingsDocument2 pagesBir FilingsJehiel ImbocNo ratings yet

- Form No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesDocument7 pagesForm No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesromarcambriNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- Bir Tax DeadlinesDocument1 pageBir Tax DeadlinesJomar VillenaNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- Bir Filings When To FileDocument1 pageBir Filings When To FileJehiel ImbocNo ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocument2 pagesFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoNo ratings yet

- BIR FormsDocument1 pageBIR FormsBSA MaterialsNo ratings yet

- BIR Registration RequirementsDocument27 pagesBIR Registration RequirementsCrizziaNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- Bir FormDocument3 pagesBir FormChelsea Anne VidalloNo ratings yet

- SSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineDocument1 pageSSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineIvy ValcarcelNo ratings yet

- BIR Filing Deadlines GuideDocument4 pagesBIR Filing Deadlines GuideI Am Not DeterredNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- BIR Registration & Due Dates-1Document6 pagesBIR Registration & Due Dates-1jessicamarieogbinar37No ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet

- How To Become Tax CompliantDocument1 pageHow To Become Tax CompliantNGANJANI WALTERNo ratings yet

- New Tax Campaign 2024 DumagueteDocument14 pagesNew Tax Campaign 2024 DumaguetebugsparNo ratings yet

- Reportorial RequirementsDocument3 pagesReportorial RequirementsMark Anthony P. TarroquinNo ratings yet

- W11-Module Tax Return Preparation and Tax PaymentsDocument20 pagesW11-Module Tax Return Preparation and Tax PaymentsVirgilio Jay CervantesNo ratings yet

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanNo ratings yet

- W11-Module Tax Return Preparation and Tax Payments - PPTDocument14 pagesW11-Module Tax Return Preparation and Tax Payments - PPTVirgilio Jay CervantesNo ratings yet

- RA No. 10963 Compliance Requirements and DeadlinesDocument3 pagesRA No. 10963 Compliance Requirements and Deadlinesmenche galuraNo ratings yet

- Bright Sun Production Corporation Bir Forms - Train Law (For Corporations)Document1 pageBright Sun Production Corporation Bir Forms - Train Law (For Corporations)Joyce Hidalgo PreciaNo ratings yet

- Briefing MADE EASY-LUCILLEDocument51 pagesBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNo ratings yet

- Deadline For Govt Reports & FormsDocument6 pagesDeadline For Govt Reports & FormsKrisha AlcozerNo ratings yet

- Reportorial RequirementsDocument5 pagesReportorial RequirementsMelaine A. FranciscoNo ratings yet

- Guidelines On Compliances and DocumentationDocument4 pagesGuidelines On Compliances and DocumentationJfm A Dazlac100% (1)

- Pananaw 2020 PDFDocument93 pagesPananaw 2020 PDFKobi SaibenNo ratings yet

- Statutory - Compliance IIDocument2 pagesStatutory - Compliance IIKapil BhardwajNo ratings yet

- Final Withholding Taxation and Capital Gains TaxationDocument10 pagesFinal Withholding Taxation and Capital Gains TaxationKatrina MaglaquiNo ratings yet

- Lesson 9Document17 pagesLesson 9Win OziracNo ratings yet

- VAT Compliance RequirementsDocument4 pagesVAT Compliance RequirementsRyan AllanicNo ratings yet

- Recurring Dates For Statutory CompliancesDocument2 pagesRecurring Dates For Statutory CompliancesDeepika BathinaNo ratings yet

- Tax Remedies of The GovernmentDocument16 pagesTax Remedies of The GovernmentrmsenyoritaNo ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Tax 304 - Vat Compliance RequirementsDocument5 pagesTax 304 - Vat Compliance RequirementsiBEAYNo ratings yet

- Corporate CalenderDocument12 pagesCorporate CalenderNikhil DaroliaNo ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- BIR Form Filing RequirementsDocument3 pagesBIR Form Filing RequirementsApril Lynn Ursal-BelciñaNo ratings yet

- Summary of Filing Deadlines of Internal Revenue TaxesDocument1 pageSummary of Filing Deadlines of Internal Revenue TaxesColleen GuimbalNo ratings yet

- Acca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsDocument2 pagesAcca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsSumiya YousefNo ratings yet

- Tax FormsDocument4 pagesTax FormsJennie KimNo ratings yet

- Compliance Calendar 2020-21Document10 pagesCompliance Calendar 2020-21Suraj SinghNo ratings yet

- About The VAT (PDocument11 pagesAbout The VAT (PAmie Jane MirandaNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- Tax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesDocument2 pagesTax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesArvin GarciaNo ratings yet

- Taxation: 27. Court of Tax Appeals and Compliance RequirementsDocument4 pagesTaxation: 27. Court of Tax Appeals and Compliance RequirementsLele CaparasNo ratings yet

- Understanding Pakistan's Taxation LawsDocument89 pagesUnderstanding Pakistan's Taxation LawsHAMZA TAHIRNo ratings yet

- Forms KvatDocument63 pagesForms KvatShashi KanthNo ratings yet

- PPE - Basic Taxes For The Sale of RE PDFDocument1 pagePPE - Basic Taxes For The Sale of RE PDFrobina56No ratings yet

- PPE - Basic Taxes For The Sale of REDocument1 pagePPE - Basic Taxes For The Sale of RElowell madrilenoNo ratings yet

- Tax Requirements for Govt Job OrdersDocument14 pagesTax Requirements for Govt Job OrdersghNo ratings yet

- PEZA REPORTORIAL REQUIREMENTS As of Feb 2023Document2 pagesPEZA REPORTORIAL REQUIREMENTS As of Feb 2023MarkNo ratings yet

- SEC Reporting Requirements for Lending CompaniesDocument1 pageSEC Reporting Requirements for Lending CompaniesbrainNo ratings yet

- Assignment Number 1Document2 pagesAssignment Number 1Luis JoseNo ratings yet

- Jose Rizal ChinaDocument3 pagesJose Rizal ChinaLuis JoseNo ratings yet

- BE - Stockholders' Equity QADocument4 pagesBE - Stockholders' Equity QALuis JoseNo ratings yet

- 11111NOLIIIIIIIIIIDocument1 page11111NOLIIIIIIIIIILuis JoseNo ratings yet

- Conversion TopicDocument1 pageConversion TopicLuis JoseNo ratings yet

- Brief Exercises 3A (Q)Document4 pagesBrief Exercises 3A (Q)Luis JoseNo ratings yet

- BE - Stockholders' Equity ADocument5 pagesBE - Stockholders' Equity ALuis JoseNo ratings yet

- Assignment #3 QDocument1 pageAssignment #3 QLuis JoseNo ratings yet

- Pe Ta#1Document1 pagePe Ta#1Luis JoseNo ratings yet

- PromotionDocument5 pagesPromotionLuis JoseNo ratings yet

- Brazil PESTLE Analysis Reveals Political & Economic StrengthsDocument2 pagesBrazil PESTLE Analysis Reveals Political & Economic StrengthsLuis JoseNo ratings yet

- Peta#2Document3 pagesPeta#2Luis JoseNo ratings yet

- Written Works 1Document1 pageWritten Works 1Luis JoseNo ratings yet

- PT-4 Social Agents and How They Impact UsDocument1 pagePT-4 Social Agents and How They Impact UsLuis JoseNo ratings yet

- Activity 3Document1 pageActivity 3Luis JoseNo ratings yet

- Single Step Income StatementDocument2 pagesSingle Step Income StatementLuis JoseNo ratings yet

- CLEDDocument2 pagesCLEDLuis JoseNo ratings yet

- Activity 2Document1 pageActivity 2Luis JoseNo ratings yet

- The Chicken and The EagleDocument1 pageThe Chicken and The EagleLuis JoseNo ratings yet

- Intro To PhiloDocument1 pageIntro To PhiloLuis JoseNo ratings yet

- View of Myself Through The East and WestDocument1 pageView of Myself Through The East and WestLuis JoseNo ratings yet

- Prelim Term PaperDocument9 pagesPrelim Term PaperLuis JoseNo ratings yet

- Prelim Performance Task 1Document1 pagePrelim Performance Task 1Luis JoseNo ratings yet

- MMW Activity NO. 1Document1 pageMMW Activity NO. 1Luis JoseNo ratings yet

- My Online Learning ExperienceDocument1 pageMy Online Learning ExperienceLuis JoseNo ratings yet

- Knowing Thy SelfDocument1 pageKnowing Thy SelfLuis JoseNo ratings yet

- Self and Social BehaviorDocument1 pageSelf and Social BehaviorLuis JoseNo ratings yet

- Discussion QuestionsDocument8 pagesDiscussion QuestionsLuis JoseNo ratings yet

- Decoding The Secrets Patterns in NatureDocument1 pageDecoding The Secrets Patterns in NatureLuis JoseNo ratings yet

- SBI PO Final Results 2018Document2 pagesSBI PO Final Results 2018KshitijaNo ratings yet

- Gestopa Vs CaDocument12 pagesGestopa Vs CaLDNo ratings yet

- 2008-Wilkie v. LimosDocument7 pages2008-Wilkie v. LimosKathleen MartinNo ratings yet

- PCJS Module 6Document8 pagesPCJS Module 6Almarez RazielNo ratings yet

- San Jose, AntiqueDocument2 pagesSan Jose, AntiqueSunStar Philippine NewsNo ratings yet

- Uniform Civil Code 7Document7 pagesUniform Civil Code 7Ajay KandhariNo ratings yet

- 01.19.2018 Ezor Order Granting MTDDocument17 pages01.19.2018 Ezor Order Granting MTDKrista MarshallNo ratings yet

- India - Wikipedia, The Free EncyclopediaDocument41 pagesIndia - Wikipedia, The Free EncyclopediaAbhishek ThakurNo ratings yet

- Safety and Health Committee Regulation 1996Document11 pagesSafety and Health Committee Regulation 1996Reza100% (1)

- Hizon Notes - Evidence (Francisco) (Erika Pineda's Conflicted Copy 2014-10-10)Document112 pagesHizon Notes - Evidence (Francisco) (Erika Pineda's Conflicted Copy 2014-10-10)JImlan Sahipa IsmaelNo ratings yet

- PDRM Kontinjen Kuala Lumpur Dalam Pelaksanaannya Mohd Shahrizal Bin Azhari, Asmadi Bin Hassan & Alias Bin AbdullahDocument15 pagesPDRM Kontinjen Kuala Lumpur Dalam Pelaksanaannya Mohd Shahrizal Bin Azhari, Asmadi Bin Hassan & Alias Bin Abdullahthaity.classicNo ratings yet

- Project On HUman RightDocument24 pagesProject On HUman Rightram rajaNo ratings yet

- ABM-BUSINESS ETHICS - SOCIAL RESPONSIBILITY 12 - Q1 - W1 - Mod1 PDFDocument18 pagesABM-BUSINESS ETHICS - SOCIAL RESPONSIBILITY 12 - Q1 - W1 - Mod1 PDFHannah Joy Lontayao84% (19)

- Accept Warranty DeedDocument2 pagesAccept Warranty DeedOxigyne93% (14)

- The Philippine Penal ColoniesDocument17 pagesThe Philippine Penal Coloniesϑαναη Υμε Ορεαμ85% (13)

- Purchase Order ChecklistDocument1 pagePurchase Order Checklistatripathi2009No ratings yet

- Cecilio S. de Villa Vs CADocument1 pageCecilio S. de Villa Vs CAKling King100% (1)

- Gorospe vs. SantosDocument6 pagesGorospe vs. Santosvanessa_3No ratings yet

- NHRC - 18132002Document8 pagesNHRC - 18132002Watch ManNo ratings yet

- Insular Life V YoungDocument7 pagesInsular Life V YoungAngela Louise SabaoanNo ratings yet

- Contractual Liability of The Government: Tusharika Singh Roll Number-411Document32 pagesContractual Liability of The Government: Tusharika Singh Roll Number-411Ar SoniNo ratings yet

- LTD ReviewerDocument15 pagesLTD ReviewerGracelyn Enriquez BellinganNo ratings yet

- Filipinas Port Services, Inc. V. Go DoctrineDocument2 pagesFilipinas Port Services, Inc. V. Go DoctrineNicolo GarciaNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Littlefield v. Fresno Superior Court Clerk&apos S Office Et Al - Document No. 6Document4 pagesLittlefield v. Fresno Superior Court Clerk&apos S Office Et Al - Document No. 6Justia.comNo ratings yet

- A D Black Moors and The USA Constitution TreatyDocument9 pagesA D Black Moors and The USA Constitution TreatyCdw Town100% (3)

- Complaint For Collection of MoneyDocument4 pagesComplaint For Collection of MoneyAngel UrbanoNo ratings yet

- Response of State Canvassing Board & SD SOS BarnettDocument8 pagesResponse of State Canvassing Board & SD SOS BarnettSally Jo SorensenNo ratings yet

- SPECIAL CIVIL ACTIONS Syllabus AY 2020 2021Document40 pagesSPECIAL CIVIL ACTIONS Syllabus AY 2020 2021Emman FernandezNo ratings yet

- 6 Frabelle Vs Phil AmericanDocument4 pages6 Frabelle Vs Phil AmericanIvan Montealegre ConchasNo ratings yet