Professional Documents

Culture Documents

Jayanata Kumar Hota TDS DECLARATION

Uploaded by

Amit Ranjan SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jayanata Kumar Hota TDS DECLARATION

Uploaded by

Amit Ranjan SharmaCopyright:

Available Formats

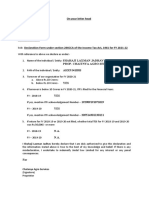

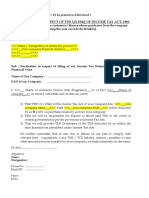

Customer Declaration on Turnover for FY 2022-23

(Pursuant to Section 194Q & 206C of Income Tax Act, 1961)

Amendment to the Income Tax Act w.e.f. 1st July 2021 requires the buyer having turnover above Rs.10 crores to

deduct TDS @ 0.10% on payments made above Rs.50 lacs every financial year. For other customers (i.e. less than

Rs.10 crores) and those who will not apply TDS we will apply TCS @ 0.10% on invoice.

If we do not receive the below correct declaration and/or if the customer is found not to have filed the return for

FY 2020-21 within due date then will apply 5% TCS on all such customers

Once TCS collected and TCS return is filed we will not amend the return any more as the customer will be entitled

to set-off of TCS appearing in their Form 26AS.

We have filed our IT return for FY 2020-21 within due date and acknowledgement number of the same is

324542430110322, so TDS if applicable, has to be deducted @ 0.10 %.

NUVOCO VISTAS CORP LTD

DECLARATION

Name of the Customer JAYANTA KUMAR HOTA

Name and Designation of the Authorised JAYANTA KUMAR HOTA

Signatory providing the declaration

PAN of customer AAEHJ2407A

SAP Customer Number (For Existing Customers

available on invoice)

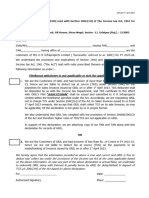

1. We hereby declare that turnover of the business carried on by us for Financial Year 2022-23 is likely to

be above Rs.10 crores and we would deduct TDS u/s 194Q if applicable

NO YES

2. Our TAN (mandatory for turnover above Rs.10 crores) Click here to enter text.

3. We declare that we have filed our IT return for FY 2020-21 within due date

NO YES

4. TDS / TCS status

Total TDS / TCS for FY 2020-21 exceeds ₹ 50,000/-

Total TDS / TCS for FY 2020-21 does not exceeds ₹ 50,000/-

`I / we further declare that information furnished above is correct. In case any part of the above

declaration is untrue / false, we undertake to indemnify the Company and the Company shall recover

the amount from us.

Name: Jayanta Kumar Hota

Contact Number: 8658095476

Email ID: hota.jayant91@gmail.com

You might also like

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- FY 2021-22 declaration for TDS 194QDocument1 pageFY 2021-22 declaration for TDS 194Qpramod bathijaNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declaration by SAMIRAHMEDDocument1 pageDeclaration by SAMIRAHMEDsamirahmed atashbajiwalaNo ratings yet

- Declaration of TDS/TCS Credit and ITR FilingDocument2 pagesDeclaration of TDS/TCS Credit and ITR FilingCA Deepak JainNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- Amitsinh Nababha Rana Versus ITO, Ward-1 Morbi - 2022 (8) TMI 188 - ITAT RAJKOTDocument6 pagesAmitsinh Nababha Rana Versus ITO, Ward-1 Morbi - 2022 (8) TMI 188 - ITAT RAJKOTSrichNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Declaration-FormatsDocument4 pagesDeclaration-FormatsG N Harish Kumar YadavNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Ca. Pathik B. Shah: Value Added Tax Act 2003Document36 pagesCa. Pathik B. Shah: Value Added Tax Act 2003SanjayThakkarNo ratings yet

- CENTURION UNIVERSITY GSTDocument32 pagesCENTURION UNIVERSITY GSTBANANI DASNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- SRS GST DeclarationDocument1 pageSRS GST DeclarationShashank SinghNo ratings yet

- Declaration-formatDocument2 pagesDeclaration-formatshyam gildaNo ratings yet

- Invoicing Under GSTDocument5 pagesInvoicing Under GSTpuru1292No ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Request Bank GuaranteeDocument2 pagesRequest Bank GuaranteeladmohanNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- Note On TDSDocument3 pagesNote On TDSRadha KrishnaNo ratings yet

- GST_DeclarationksjdhwjnnDocument1 pageGST_Declarationksjdhwjnnphoenix.hb.krNo ratings yet

- VAT Booklet for FY 2012-13 by Dhirubhai Shah & CoDocument20 pagesVAT Booklet for FY 2012-13 by Dhirubhai Shah & Coankur2706No ratings yet

- Declaration For Rekyc Non IndividualsDocument2 pagesDeclaration For Rekyc Non IndividualsPartha SundarNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Afcan Reply 133Document1 pageAfcan Reply 133rajorajisunnyNo ratings yet

- Dipankar BarmanDocument2 pagesDipankar Barmanmanishasurywanshi91No ratings yet

- Analysis of Section 43B(h)Document21 pagesAnalysis of Section 43B(h)gavandarpita02No ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Declaration for TDS u/s 194QDocument2 pagesDeclaration for TDS u/s 194QCma Saurabh AroraNo ratings yet

- E Invoice Exemption DeclarationDocument1 pageE Invoice Exemption DeclarationHiring CrescentNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Revisiting The Rules On Claiming Withholding Tax CreditsDocument3 pagesRevisiting The Rules On Claiming Withholding Tax Creditsarnelo sarmientoNo ratings yet

- Mohammed Khan (SR Accountant) KSA Wup CCDocument21 pagesMohammed Khan (SR Accountant) KSA Wup CCftimum1No ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- BPCL TDS declaration titleDocument1 pageBPCL TDS declaration titleAhmed SaadNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- Vendor Accreditation FormDocument2 pagesVendor Accreditation Formrowena balaguerNo ratings yet

- State Bank of Patiala: Rtgs/Neft/Application FormDocument2 pagesState Bank of Patiala: Rtgs/Neft/Application FormAnonymous wfgcPmJYNo ratings yet

- Request Letter for Direct Import Bill RemittanceDocument4 pagesRequest Letter for Direct Import Bill RemittanceAnonymous rjf5q5zNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Form 15Cb: U. Mohanan & Co Chartered AccountantDocument4 pagesForm 15Cb: U. Mohanan & Co Chartered AccountantKrishna S MohanNo ratings yet

- Audit Report Fy 2020 21Document15 pagesAudit Report Fy 2020 21Ankrut VaghasiyaNo ratings yet

- Declaration Confirmation-Section-194Q - FormatDocument1 pageDeclaration Confirmation-Section-194Q - FormatRupamata Group OsmanabadNo ratings yet

- Declaration Turnover Below 10crDocument2 pagesDeclaration Turnover Below 10crAbhimanyuNo ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Payu Payments Private Limited: Page - 1Document2 pagesPayu Payments Private Limited: Page - 1Goyal AbhijeetNo ratings yet

- Sample Wale Ka LetterDocument3 pagesSample Wale Ka LetterPreeti mittalNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Nuvoco Standard QuoteDocument12 pagesNuvoco Standard QuoteAmit Ranjan SharmaNo ratings yet

- Nuvoco Standard QuoteDocument11 pagesNuvoco Standard QuoteAmit Ranjan SharmaNo ratings yet

- Subh Engineer 20.01.22Document1 pageSubh Engineer 20.01.22Amit Ranjan SharmaNo ratings yet

- Nuvoco Standard QuoteDocument12 pagesNuvoco Standard QuoteAmit Ranjan SharmaNo ratings yet

- R C Copy Milina AgencyDocument3 pagesR C Copy Milina AgencyAmit Ranjan SharmaNo ratings yet

- Tc-External DetailsDocument1 pageTc-External DetailsAmit Ranjan SharmaNo ratings yet

- RMC Quotation for Chalah InfraDocument12 pagesRMC Quotation for Chalah InfraAmit Ranjan SharmaNo ratings yet

- PO For Readymix ConcreteDocument1 pagePO For Readymix ConcreteAmit Ranjan SharmaNo ratings yet

- Railway - M30 PSC Design MixDocument2 pagesRailway - M30 PSC Design MixAmit Ranjan SharmaNo ratings yet

- PO For Readymix ConcreteDocument1 pagePO For Readymix ConcreteAmit Ranjan SharmaNo ratings yet

- Nuvoco Instamix QuoteDocument4 pagesNuvoco Instamix QuoteAmit Ranjan SharmaNo ratings yet

- Po 164 RMC Nuvoco SVGLLPDocument1 pagePo 164 RMC Nuvoco SVGLLPAmit Ranjan SharmaNo ratings yet

- PO For Readymix ConcreteDocument1 pagePO For Readymix ConcreteAmit Ranjan SharmaNo ratings yet