Professional Documents

Culture Documents

Declaration For Customers For Sale of Goods

Uploaded by

pramod bathijaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration For Customers For Sale of Goods

Uploaded by

pramod bathijaCopyright:

Available Formats

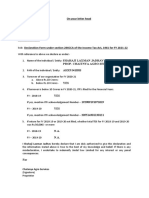

Date: 01st July, 2021

Dharampal Satyapal Limited

Survey no. 107,Lasudia Mori Dewas Naka,

Indore (M.P.)

Re: Declaration for FY 2021-22 for purchase of goods wef 01.07.2021 for the purpose of section 194Q read

with section 206AB and Provisions of section 206C(1H) of Income Tax Act, 1961 (“of the Act”)

Dear Sir / Madam,

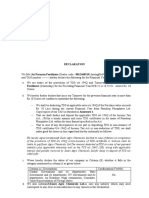

We, M/s. ____________________, having Permanent Account Number ________________, is resident in India

and hereby declare as under:

1. Turnover of our firm / company during Financial Year 2020-21 was more than Rs. 10 Crores.

Therefore, our firm / company is liable to deduct tax u/s 194Q of the Act @ 0.1 % of sale

consideration to be paid / credited to your company on or after 01.07.2021 by us on the amount

exceeding Rs.50 lacs during the current financial year. Hence, we request you not to take any action

to collect tax under provisions of section 206C(1H) of the Act.

Or

Turnover of our firm / company during Financial Year 2020-21 was not more than Rs. 10 Crores.

Therefore, our firm / company is not liable to deduct tax u/s 194Q of the Act. You may, therefore,

continue to comply with provisions of Section 206C(1H) of the Act to collect tax on the amount of sale

consideration exceeding Rs. 50 lacs.

As confirmed by you that you have duly filed your returns of income for Assessment Years 2019-20

and 2020-21 with income tax authorities and hence provisions of section 206AB is not applicable and

TDS will be deducted under normal provisions of the Act.

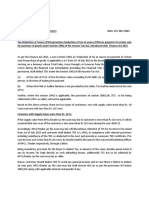

I, __________ s/o _____________hereby declare that I am duly authorized to give this declaration and the

information stated above is true to the best of my knowledge and belief. If there is any mis-declaration, our

firm / company undertake to indemnify your company for any interest or any penal consequences thereon.

For_______________

(Signature)

Name:

Designation:

Date:

Place:

You might also like

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- F.Y. Turnover 21-22 (01.04.2021 To 31.03.2022) 22-23 (01.04.2022 To 31.03.2023)Document1 pageF.Y. Turnover 21-22 (01.04.2021 To 31.03.2022) 22-23 (01.04.2022 To 31.03.2023)Sagar AmbatNo ratings yet

- Note On TDSDocument3 pagesNote On TDSRadha KrishnaNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- Letter To CustomerDocument3 pagesLetter To CustomerAgri MosaramNo ratings yet

- Refund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14Document3 pagesRefund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14JianSadakoNo ratings yet

- FoodPanda LetterForSalesDocument1 pageFoodPanda LetterForSalesEphraim LopezNo ratings yet

- VAT RegistrationDocument23 pagesVAT RegistrationMT RANo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Declaration Confirmation-Section-194Q - FormatDocument1 pageDeclaration Confirmation-Section-194Q - FormatRupamata Group OsmanabadNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Pre-Season Tax Letter 2 PDFDocument3 pagesPre-Season Tax Letter 2 PDFMark SilbermanNo ratings yet

- Annexure - Format For DeclarationDocument1 pageAnnexure - Format For DeclarationAhmed SaadNo ratings yet

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaNo ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- Income-Tax Circular 2021-22Document1 pageIncome-Tax Circular 2021-22Aishwarya TripathiNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Declaration For Applicability of Deduction of Tax at Source (TDS) On Purchase of Goods U/s 194QDocument1 pageDeclaration For Applicability of Deduction of Tax at Source (TDS) On Purchase of Goods U/s 194QYugant SonawaneNo ratings yet

- E Invoice Exemption DeclarationDocument1 pageE Invoice Exemption DeclarationHiring CrescentNo ratings yet

- Dividend Received From A Domestic CompanyDocument9 pagesDividend Received From A Domestic Companyshiraz shabbirNo ratings yet

- Tax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Document17 pagesTax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Tariqul IslamNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- 32 - Exemption From Pymt of Adv. TaxDocument7 pages32 - Exemption From Pymt of Adv. TaxFurqan Shariff -AFCNo ratings yet

- Terms & Conditions - India: Legal Conditions of My SubscriptionDocument4 pagesTerms & Conditions - India: Legal Conditions of My SubscriptionVikasNo ratings yet

- FAQ's Income TaxDocument8 pagesFAQ's Income TaxRobin SharmaNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- Byju's - Offer Letter - TNL71850255Document1 pageByju's - Offer Letter - TNL71850255study addaNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- AnnuxureabDocument2 pagesAnnuxureabDeepak MaliNo ratings yet

- Corporate Tax ConceptsDocument20 pagesCorporate Tax ConceptsVandana ChambyalNo ratings yet

- Declaration/Undertaking To Be Taken From Supplier (On His Letter Head)Document1 pageDeclaration/Undertaking To Be Taken From Supplier (On His Letter Head)Mehul SinghNo ratings yet

- Finance Bill 2012-13Document21 pagesFinance Bill 2012-13shahbhavya2811No ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- TDS Under Sec 194A EtcDocument26 pagesTDS Under Sec 194A EtcDivyaNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- New TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inDocument7 pagesNew TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inCA Ranjan MehtaNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Return of IncomeDocument13 pagesReturn of IncomeParth UpadhyayNo ratings yet

- Sebi Dire CT S Ai Fs / Rtas F or Collecti On of ST AmpDocument2 pagesSebi Dire CT S Ai Fs / Rtas F or Collecti On of ST AmpPrabhas ChandraNo ratings yet

- Declaration From Vendor On Letter Head - Under Section 206AB of IT ActDocument1 pageDeclaration From Vendor On Letter Head - Under Section 206AB of IT ActSiddharth shuklaNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Resource Material On TCS Us 206C (1H) SSADocument14 pagesResource Material On TCS Us 206C (1H) SSASankaran SwaminathanNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- LLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.From EverandLLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.No ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)