Professional Documents

Culture Documents

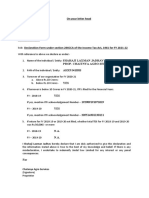

Declaration From Vendor On Letter Head - Under Section 206AB of IT Act

Uploaded by

Siddharth shukla0 ratings0% found this document useful (0 votes)

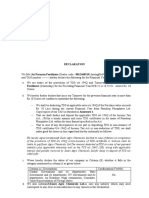

30 views1 pageThe letter provides details of an organization in relation to Section 206AB of the Income Tax Act of 1961. It includes the organization's PAN number, name, whether TDS or TCS of Rs. 50,000 or more was claimed in the financial years of 2018-19 and 2019-20, if income tax returns were filed as per section 139(1) for those years, and if filed the acknowledgment number and date. The letter also includes an indemnity clause stating that the information provided is true and if found false, the organization will be liable for resultant tax, interest, penalty, and associated costs for non-compliance with section 206AB.

Original Description:

Original Title

Declaration From Vendor on Letter Head - Under Section 206AB of IT Act (1) (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe letter provides details of an organization in relation to Section 206AB of the Income Tax Act of 1961. It includes the organization's PAN number, name, whether TDS or TCS of Rs. 50,000 or more was claimed in the financial years of 2018-19 and 2019-20, if income tax returns were filed as per section 139(1) for those years, and if filed the acknowledgment number and date. The letter also includes an indemnity clause stating that the information provided is true and if found false, the organization will be liable for resultant tax, interest, penalty, and associated costs for non-compliance with section 206AB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views1 pageDeclaration From Vendor On Letter Head - Under Section 206AB of IT Act

Uploaded by

Siddharth shuklaThe letter provides details of an organization in relation to Section 206AB of the Income Tax Act of 1961. It includes the organization's PAN number, name, whether TDS or TCS of Rs. 50,000 or more was claimed in the financial years of 2018-19 and 2019-20, if income tax returns were filed as per section 139(1) for those years, and if filed the acknowledgment number and date. The letter also includes an indemnity clause stating that the information provided is true and if found false, the organization will be liable for resultant tax, interest, penalty, and associated costs for non-compliance with section 206AB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

≪ Letter head≫

To,

ASENCE PHARMA PVT LTD,

VADODARA.

In relation to Section.206AB of Income tax act 1961, please see below details of our

organisation

Permanent Account Number

(PAN):

Name as Per PAN:

Information required under FY 2018-19 FY 2019-20

Sec.206AB

Whether TDS, TCS Claimed in

Income tax return of Rs. 50,000 or

more in each of the Financial year

(Yes/No/NA)

Whether Income Tax return has

been filed as per sec.139(1)

(Yes/No/NA)

If filed then provide

Acknowledgement No. & Date of

Filing

Indemnity

I, hereby declare that afore mentioned information is True and Correct and in case, same

is found to be false, we would be liable for payment of resultant tax, Interest, penalty,

and associated cost to your organisation in relation to non-compliance of section 206AB

of the IT Act.

Name of Organisation ________________________________________

Signature

Name of Person ________________________________________

Designation/Authorised Person _________________________________________

General

You might also like

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- WW SS-4Document3 pagesWW SS-4cstocksg1100% (7)

- VENDOR - ID - DECLARATION - FORM ShahiDocument1 pageVENDOR - ID - DECLARATION - FORM ShahiRajnand singhNo ratings yet

- Guide 90Document39 pagesGuide 90Gilbert CourtotNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Bona Fide Farmer ApplicationDocument3 pagesBona Fide Farmer ApplicationVíctor M GonzálezNo ratings yet

- Draft Self DeclarationDocument1 pageDraft Self DeclarationNagarajan100% (1)

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Change To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonesDocument3 pagesChange To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonespeteycostaNo ratings yet

- Declaration: Details of Investment (FINANCIAL YEAR 2017-2018)Document1 pageDeclaration: Details of Investment (FINANCIAL YEAR 2017-2018)Dinesh SanodiyaNo ratings yet

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011No ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- BusinesslicenseappDocument2 pagesBusinesslicenseappapi-253134164No ratings yet

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- FACTA-CRS Non Individual Declaration FormDocument1 pageFACTA-CRS Non Individual Declaration FormGSTMS ANSARINo ratings yet

- Declaration For Rekyc Non IndividualsDocument2 pagesDeclaration For Rekyc Non IndividualsPartha SundarNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Taxmitr-What Is ITRDocument3 pagesTaxmitr-What Is ITRTaxmitr ITR OnlineNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Instructions ITR5 AY2020 21 V1Document158 pagesInstructions ITR5 AY2020 21 V1Ravindra PoojaryNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Bir 2316 Submission Waiver 2022Document1 pageBir 2316 Submission Waiver 2022John Jason Narsico AlbrechtNo ratings yet

- CBDT Instructions For Filing New Form Itr 5 Fy 2018 19 Ay 2019 20Document62 pagesCBDT Instructions For Filing New Form Itr 5 Fy 2018 19 Ay 2019 20Anonymous SFy3Uv6No ratings yet

- Honda Cars, Rizal: Credit Application For Auto FinancingDocument13 pagesHonda Cars, Rizal: Credit Application For Auto FinancingalbertfrancoNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- Income Tax RetrnDocument21 pagesIncome Tax RetrnHema joshiNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- Undertaking From Non Resident IndividualsDocument1 pageUndertaking From Non Resident IndividualstajmussaratNo ratings yet

- MCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailDocument2 pagesMCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailIliana RamosNo ratings yet

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- 10 1041sbDocument9 pages10 1041sbTham DangNo ratings yet

- 2012 Instructions For Schedule C: Profit or Loss From BusinessDocument13 pages2012 Instructions For Schedule C: Profit or Loss From BusinessDunk7No ratings yet

- Life Cancellation FormDocument2 pagesLife Cancellation FormSavka SavkaNo ratings yet

- Attention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business DayDocument3 pagesAttention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business Daypreston_40200350% (2)

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- FATCA Declaration Individual HUFDocument8 pagesFATCA Declaration Individual HUFMOHAN SNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- Publication 583 by My StyleDocument39 pagesPublication 583 by My StyleNassif El DadaNo ratings yet

- Declaration of GST Non-EnrollmentDocument2 pagesDeclaration of GST Non-EnrollmentftasindiaNo ratings yet

- SelfDeclarationform Sec 80CDocument1 pageSelfDeclarationform Sec 80CPrudhvi ReddyNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Annex B-2Document1 pageAnnex B-2Von Virchel VallesNo ratings yet

- Draft CIS For MonetizerDocument8 pagesDraft CIS For MonetizerElwin arifin100% (1)

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Customs PoaDocument5 pagesCustoms PoaAtlas SNo ratings yet

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- PSDTDocument32 pagesPSDTmedivision diagnosticsNo ratings yet

- Supplier ContarctarDocument7 pagesSupplier ContarctarAbdiaziz M. YusoufNo ratings yet

- Helper Form UploadDocument1 pageHelper Form UploadDhaval PotaNo ratings yet

- VAT - Getting Started GuideDocument6 pagesVAT - Getting Started GuideBlueLake InvestmentNo ratings yet

- Application For Registration: (For Certain Excise Tax Activities)Document6 pagesApplication For Registration: (For Certain Excise Tax Activities)douglas jonesNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- How To Complete A Tax Return If You Received SEISS Grants: TH THDocument3 pagesHow To Complete A Tax Return If You Received SEISS Grants: TH THTony WhNo ratings yet

- Blue White Modern Professional ResumeDocument1 pageBlue White Modern Professional ResumeSiddharth shuklaNo ratings yet

- PDF 212675930280722Document1 pagePDF 212675930280722Siddharth shuklaNo ratings yet

- FUTURE MAN POWER SOLUTION PDF SiddDocument1 pageFUTURE MAN POWER SOLUTION PDF SiddSiddharth shuklaNo ratings yet

- EVENT S TYLERS PDF SiddDocument1 pageEVENT S TYLERS PDF SiddSiddharth shuklaNo ratings yet

- MCA111CDocument2 pagesMCA111CSiddharth shuklaNo ratings yet

- Black Gold Diamonds Luxury Business CardDocument2 pagesBlack Gold Diamonds Luxury Business CardSiddharth shuklaNo ratings yet

- Subscriber Details Modification and Change of APY-SP FormDocument3 pagesSubscriber Details Modification and Change of APY-SP FormSiddharth shuklaNo ratings yet