Professional Documents

Culture Documents

Declaration Confirmation-Section-194Q - Format

Uploaded by

Rupamata Group OsmanabadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration Confirmation-Section-194Q - Format

Uploaded by

Rupamata Group OsmanabadCopyright:

Available Formats

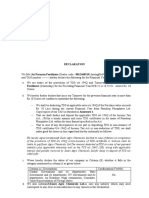

(On letterhead of buyer party)

Dated: _____________

To

Triveni Turbine Limited

No.12A, Peenya Industrial Area

Peenya, Bengaluru-560058

Karnataka, India.

Subject: Declaration for compliance of Section 194Q of the Income Tax Act, 1961 in respect of TDS

on purchase of goods from Triveni Turbine Limited for the financial year 2021-22.

Dear Sir,

This is with reference to Section 194Q: Deduction of tax at source on payment of certain sum for

purchase of goods and Section 206C(1H): Collection of tax at source on consideration for sale of any

goods, we furnish our required particulars as under: -

(please tick as applicable)

Sl. No. Particulars YES NO

1. Our Turnover from business during the FY 2020-

21 exceeds Rs. 10 Crores.

2. Value of goods to be purchased from Triveni

Turbine Limited during FY 2021-22 is likely to

exceed Rs. 50 lakhs.

We further confirm and declare as under: -

1) That we shall be liable/ not liable to deduct tax at source on the goods purchased by us from

you in accordance with the provisions of Section 194Q of the Income Tax Act, 1961 in

financial year 2021-22.

2) If we are liable to deduct TDS u/s 194Q as per above table, we shall comply with the

provisions of Section 194Q and relevant Rules with regard to same. In such a case, we

request Triveni Turbine Limited, not to comply with TCS provisions on sale of goods u/s

206C(1H).

3) In case we are not liable to deduct TDS u/s 194Q as per table above, we authorize Triveni

Turbine Limited to deposit TCS u/s 206C(1H) on our behalf which we shall reimburse to

Triveni Turbine Limited.

Thanking you,

For (Buyer’s Name)

Authorised Signatory

You might also like

- AnnuxureabDocument2 pagesAnnuxureabDeepak MaliNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Letter To CustomerDocument3 pagesLetter To CustomerAgri MosaramNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declaration Turnover Below 10crDocument2 pagesDeclaration Turnover Below 10crAbhimanyuNo ratings yet

- Declaration For Applicability of Deduction of Tax at Source (TDS) On Purchase of Goods U/s 194QDocument1 pageDeclaration For Applicability of Deduction of Tax at Source (TDS) On Purchase of Goods U/s 194QYugant SonawaneNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- Annexure - Format For DeclarationDocument1 pageAnnexure - Format For DeclarationAhmed SaadNo ratings yet

- TDS & TCSDocument19 pagesTDS & TCSpawan dhokaNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- TCS On Sale of GoodsDocument16 pagesTCS On Sale of GoodsAshish ModiNo ratings yet

- Form P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramDocument1 pageForm P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramZubair AkramNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- Taxguru - in-TCS On Sales of Goods Wef 1st October 2020Document12 pagesTaxguru - in-TCS On Sales of Goods Wef 1st October 2020javed aliNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- Declaration/Undertaking To Be Taken From Supplier (On His Letter Head)Document1 pageDeclaration/Undertaking To Be Taken From Supplier (On His Letter Head)Mehul SinghNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- Wa0008.Document7 pagesWa0008.amyashu22No ratings yet

- PPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Document37 pagesPPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Kartik AgrawalNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Format of Inward Remittance For Export AdvanceDocument2 pagesFormat of Inward Remittance For Export AdvanceKamlesh SonareNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- GST Amendment For June 2023 Part 3Document3 pagesGST Amendment For June 2023 Part 3rajbhanushali3981No ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Inward Advance FormatDocument2 pagesInward Advance FormatskydigisolutionsNo ratings yet

- 21c835 5Document3 pages21c835 5shubhamkumar.arch12No ratings yet

- GST Part 2Document14 pagesGST Part 22022 YearNo ratings yet

- CH.12 Tax AuditDocument19 pagesCH.12 Tax AuditSita BhuraNo ratings yet

- Tax Deduction at Source On Purchase of Goods (Section 194 Q)Document7 pagesTax Deduction at Source On Purchase of Goods (Section 194 Q)Pallavi SharmaNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- CORRIGENDUM2Document4 pagesCORRIGENDUM2Shalini BorkerNo ratings yet

- Declaration For E-Invoice - Apr'2022Document2 pagesDeclaration For E-Invoice - Apr'2022pinak powerNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Note On Applicability of TDS Under Section 194Q and TCS Under Section 206CDocument15 pagesNote On Applicability of TDS Under Section 194Q and TCS Under Section 206CvamshiNo ratings yet

- New Income Tax Provisions On TDS and TCS On GoodsDocument31 pagesNew Income Tax Provisions On TDS and TCS On Goodsऋषिपाल सिंहNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Disposal Instruction - 13012021 - Final Revised Ultimate CountryDocument3 pagesDisposal Instruction - 13012021 - Final Revised Ultimate CountryNishedhNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- New Section 194Q Applicable From 1.7.2021Document14 pagesNew Section 194Q Applicable From 1.7.2021ramanmaharishiNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- 30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021Document6 pages30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021ashok babuNo ratings yet

- Question TAX GMDocument7 pagesQuestion TAX GMAshutosh Kr. Sahuwala 7bNo ratings yet

- Article On Section 194Q and Common Queries TheretoDocument5 pagesArticle On Section 194Q and Common Queries TheretonamanojhaNo ratings yet

- What Is Input Tax Credit - GST IndiaDocument4 pagesWhat Is Input Tax Credit - GST Indiaaslam_bechemNo ratings yet

- Tender No: Issued OnDocument53 pagesTender No: Issued Onrafikul123No ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- F.Y. Turnover 21-22 (01.04.2021 To 31.03.2022) 22-23 (01.04.2022 To 31.03.2023)Document1 pageF.Y. Turnover 21-22 (01.04.2021 To 31.03.2022) 22-23 (01.04.2022 To 31.03.2023)Sagar AmbatNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)