Professional Documents

Culture Documents

Idt Q

Uploaded by

riyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Idt Q

Uploaded by

riyaCopyright:

Available Formats

Test Series: October, 2022

MOCK TEST PAPER 2

FINAL COURSE: GROUP – II

PAPER 8: INDIRECT TAX LAWS

Maximum Marks: 100 Marks Time Allowed: 3 Hours

Notes:

(i) Working Notes should form part of the answer. However, in answers to Question in Division A, working

notes are not required.

(ii) Wherever necessary, suitable assumptions may be made by the candidates and disclosed by way of a

note.

(iii) All questions should be answered on the basis of position of (i) GST law as amended by the Finance

Act, 2021, including significant notifications and circulars issued, which have become effective up to 30 th

April, 2022 and (ii) customs law as amended by the Finance Act, 2021, including significant notifications

and circulars issued, up to 30 th April, 2022.

Division A: Multiple Choice Questions (30 marks)

Write the most appropriate answer to each of the following multiple choice questions by choosing

one of the four options given. All questions are compulsory.

Each MCQ under Question No. 1 & 2 carries 2 Marks each

1. Mr. Rakesh took a shop on lease from Brihanmumbai Municipal Corporation (BMC) and started trading

of taxable goods only in Mumbai, Maharashtra. He procures these taxable goods from Delhi & Kolkata.

He applied for GST registration on voluntary basis on 2 nd April, 2021 and the registration was granted

to him w.e.f. 9 th April, 2021.

He owns a duplex house in Virar, Mumbai. He stays on the ground floor & has let out the first floor to

an employee of IDICI Bank, Delhi for residential purposes. The rent for the same is paid by IDICI Bank

to Mr. Rakesh.

The details of transactions carried out by Mr. Rakesh during the current financial year is furnished

hereunder:

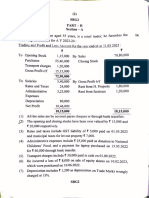

Particulars 1st April, 2021 to 8 th 9th April, 2021 to 31 st

April, 2021 March, 2022

(` in lakh) (` in lakh)

Sale of taxable goods 3 84

(Intra-State supply to registered person)

Sale of taxable goods 2 14

(Intra-State supply to unregistered person)

Legal fees paid to advocate - 0.10

Purchase of taxable goods 3 74

(Intra-State supply received from registered

person)

Purchase of furniture for use in own office - 1

(from an unregistered dealer of Kolkata)

© The Institute of Chartered Accountants of India

Purchase of taxable goods from a registered 1 18

dealer of Delhi

Lease rent of the shop paid to Brihanmumbai - 1.20

Municipal Corporation (BMC)

Transportation charges paid to M/s Gati 0.10 1.50

Transporters, a GTA

(Tax is not payable @ 12%)

Interest paid on borrowings from First Bank 0.20 1.80

Accrued interest on Fixed deposit with First Bank - 0.16

Rent received from IDICI Bank for its employee - 2.40

Mr. Rakesh went to Kolkata, West Bengal for a business meeting in February 2022 and stayed in Hotel

Ace Bird for a week. Hotel charged ` 1,00,000 (taxable value) for the stay.

All the amounts given above are exclusive of GST, wherever applicable, unless otherwise provided.

Assume that there is no other outward or inward supply transaction apart from aforesaid transactions in

the current financial year. GST is applicable on all inward and outward supplies, except on services of

transportation of goods, at the following rates:

I. Intra-State supply – 6% CGST and 6% SGST

II. Inter-State supply – 12% IGST

Based on the facts of the case scenario given above, choose the most appropriate answer to Q. Nos.

1.1 to 1.5 below:-

1.1 The value of outward supply which shall be subject to GST for the current financial year is _______.

(a) ` 98 lakh

(b) ` 100 lakh

(c) ` 102.40 lakh

(d) ` 108 lakh

1.2 Which of the following statements is correct in terms of the facts of the case scenario given above?

(a) Mr. Rakesh cannot opt to pay tax in the FY - 2022-23 under composition scheme under section

10(1) and 10(2) of the CGST Act, 2017.

(b) Mr. Rakesh is entitled to take the ITC of inputs held in stock on 1 st April, 2021.

(c) Mr. Rakesh shall be liable to pay GST under reverse charge under section 9(4) of the CGST

Act during the current financial year in respect of purchases made from unregistered persons.

(d) Mr. Rakesh is entitled to take the ITC of inputs held in stock on 8 th April, 2021.

1.3 The value of supply on which Mr. Rakesh is liable to pay GST under reverse charge for the current

financial year is _______________.

(a) ` 1,60,000

(b) ` 2,80,000

(c) ` 1,30,000

(d) ` 2,70,000

© The Institute of Chartered Accountants of India

1.4 Which of the following inward supply is not subject to payment of tax under reverse charge

mechanism?

(i) Shop rent paid to BMC

(ii) Legal fee paid to advocate

(iii) Purchase of stationery items from unregistered person

(iv) Transportation charges paid to M/s Gati Enterprises

Choose the most appropriate option.

(a) (i) and (ii)

(b) (iii)

(c) (ii) and (iii)

(d) (i) and (iii)

1.5 Whether input tax credit is available on the GST paid by Mr. Rakesh on the taxable value of

` 1,00,000 charged by Hotel Ace Bird located in Kolkata, West Bengal, for his stay? If yes, please

specify the amount of input tax credit available.

(a) Yes, ` 3,000 - CGST and ` 3,000 - SGST

(b) Yes, ` 12,000 - IGST

(c) Yes, ` 6,000 - CGST and ` 6,000 - SGST

(d) No input tax credit is available.

2. DP Ltd. is a supplier of air conditioners (ACs). It also undertakes installation of ACs at the premises of

the client. The company has provided the following details for the month of February:

Date Transaction

2nd February Supply and installation of 10 ACs at the newly established office of M/s Dhairya &

Co., a CA firm, registered under GST in New Delhi under the cover of an invoice.

The company charged ` 21,000 per AC from the CA firm. Payment for the same

was received on 28 th February.

15th February Service of installation of 15 ACs at Mr. Dheeraj’s Mansion in Chandigarh.

Mr. Dheeraj is an individual and is unregistered. The company has charged

` 2,000 per installation. The company forgot to issue the invoice for the service in

the February month. However, payment was received in advance on 13 th February.

20th February Received advance of ` 2,00,000 from Baskin Ltd. for service of installation of AC

at its factory in Bawana, Delhi. AC is installed on 28 th February and the invoice is

also issued on the date of provision of service, i.e., on

28th February. The client is registered under GST in New Delhi.

Other relevant information:

1. Standard price charged:

Air Conditioner: ` 20,000 per piece

Service of installation of air conditioner: ` 2,000 per installation

AC + Installation: ` 21,000 per piece

© The Institute of Chartered Accountants of India

2. Applicable rate of taxes:

Date of transaction Applicable rate of GST Applicable rate of GST on

on supply of air supply of service of

conditioner installation of air conditioner

Before 22 nd February 18% 5%

On or after 22 nd February 12% 12%

3. DP Ltd. is registered under GST in Delhi.

4. One order for supply of 100 ACs in Hongkong has been received by the company. The company

is unable to determine the time and value for this supply.

Based on the facts of the case scenario given above, choose the most appropriate answer to Q. Nos.

2.1 to 2.4 below:-

2.1 What rate of tax should the company charge on supply made to M/s Dhairya & Co.?

(a) 18%

(b) 5%

(c) 18% on AC value and 5% on installation value

(d) 12%

2.2 What is the time of supply of service provided to Mr. Dheeraj?

(a) 15th February

(b) 16th February

(c) 13th February

(d) 14th February

2.3 Baskin Ltd. contended that GST should be charged @ 12% since supply is made after change in

rate of tax. Advise whether the contention of Baskin Ltd. is valid as per GST law.

(a) No. Since payment has been received before the change in rate of tax, old rate shall b e

applicable.

(b) Yes. Since provision of service and issue of invoice is after the change in rate of tax, new

rate shall be applicable.

(c) No. Since time of supply shall be earlier of date of receipt of payment and date of issue of

invoice, old rate shall be applicable.

(d) Yes. Since provision of service is after change in rate of tax, new rate shall be applicable.

Date of invoice is not relevant.

2.4 Since DP Ltd. is unable to determine the time and value of supply of air conditioners to be supplied

in Hongkong, it decides to seek the advance ruling in the given case. Which of the following

statements are true in this regard?

(a) DP Ltd. can seek advance ruling to determine the time and value of supply of air conditioners.

After seeking advance ruling, if it is aggrieved with the finding of the Authority for Advance

Ruling (AAR), it can also file an appeal with Appellate Authority for Advance Ruling (AAAR).

(b) DP Ltd. can seek advance ruling to determine the time of supply of air conditioners, bu t

advance ruling cannot be sought for determining the value of supply of air conditioners. Order

of AAR is final and cannot be appealed against.

(c) DP Ltd. cannot seek advance ruling to determine the time and value of supply of air

conditioners.

© The Institute of Chartered Accountants of India

(d) DP Ltd. can seek advance ruling to determine the time and value of supply of air conditioners.

Order of AAR is final and cannot be appealed against.

3. State which of the following statements is incorrect:

(i) An agent, supplying taxable goods on behalf of principal, where invoice is issued in the name of

principal, is required to get compulsorily registered under GST.

(ii) Persons who are required to deduct tax under section 51 of the CGST Act, 2017, whether or not

separately registered under CGST Act, are compulsory required to get registered under GST

without any threshold limit.

(iii) Every person supplying online information and database access or retrieval services from a place

outside India to a registered person in India is compulsory required to get registered under GST

without any threshold limit.

(iv) Persons who supply services, other than supplies specified under sub-section (5) of section 9 of

the CGST Act, 2017, through such electronic commerce operator who is required to collect tax at

source under section 52 of the CGST Act, 2017, are compulsory required to get registered under

GST without any threshold limit.

Choose the most appropriate option.

(a) (i), (ii)

(b) (iii), (iv)

(c) (i), (iii), (iv)

(d) (i), (ii), (iii) and (iv) (2 Marks)

4. George Ltd., India, has received an order for supply of services amounting to $ 5,00,000 from a US

based client. George Ltd., India is unable to supply the entire services from India and asks Harry Inc.,

Mexico (who is not an establishment of George Ltd.) to supply a part of the services, i.e. 40% of the

total contract value to the US client. George Ltd. raised the invoice for entire value of $ 5,00,000, but

the US client paid $ 3,00,000 to George Ltd. and $ 2,00,000 directly to Harry Inc., Mexico which is

approved by a special order of RBI. George Ltd. also paid IGST@ 18% on the services imported from

Harry Inc. Mexico. Assuming all the conditions of section 2(6) of the IGST Act, 2017 are fulfilled,

determine the value of export of services assuming that the amounts given above are exclusive of GST.

(a) $ 3,00,000

(b) $ 5,00,000

(c) $ 3,90,000

(d) $ 5,90,000 (2 Marks)

5. During access to any business premises under section 71 of the CGST Act, 2017, which of the following

records can be inspected by the officers:

(i) Trial balance

(ii) Statements of annual financial accounts, duly audited, wherever required;

(iii) Cost audit report

(iv) Income-tax audit report

Choose the most appropriate option.

(a) (i) and (ii)

(b) (i), (ii) and (iv)

(c) (ii), (iii) and (iv)

© The Institute of Chartered Accountants of India

(d) (i), (ii), (iii) and (iv) (2 Marks)

6. Tobacco is:

(a) exempt from GST.

(b) subject to both GST and central excise duty.

(c) outside the realm of GST.

(d) subject to GST only. (1 Mark)

7. Alpha Ltd. makes two sales to unrelated buyers. In the first sale, 500 units are sold at a price of ` 95.

In the second sale, 400 units are sold at a price of ` 100. For the purposes of rule 7 (Deductive Value)

of the Customs (Determination of Value of Imported Goods) Rules, 2007, determine the unit price in

greatest aggregate quantity.

(a) ` 95

(b) ` 100

(c) Average of ` 95 and ` 100 i.e. (` 95 + ` 100)/2 = ` 97.5

(d) Data is insufficient to determine the unit price in greatest aggregate quantity (2 Marks)

8. Advaita Ltd. sent certain goods abroad for repairs. Advaita Ltd. has been advised by their consultants

that they will have to pay customs duty (i.e. basic customs duty, IGST & GST compensation cess) only

on fair cost of repairs, cost of materials used in repairs (whether such costs are actually incurred or not),

freight and insurance charges, both ways, on re-import of exported goods under Notification No. 45/2017

Cus dated 30.06.2017 provided they fulfill following conditions:

(i) The re-importation is done within 3 years from date of export or, if time is extended, within 5 years.

(ii) The exported and re-imported goods are same.

(iii) The ownership of goods should not have changed.

Which one of the above-mentioned conditions is/are correct? Choose the most appropriate option.

(a) (i), (ii) and (iii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) Only (ii) (2 Marks)

9. The relevant date for determining the rate of exchange in case of imported goods is:

(a) date when the vessel leaves the exporter’s port for India.

(b) date of presentation of bill of entry.

(c) date of examination of goods by proper officer.

(d) date of deposit of duty. (1 Mark)

Division B: Descriptive Questions (70 marks)

Question paper comprises of 6 questions. Answer Question No. 1 which is compulsory and any 4 out of the

remaining 5 questions.

1. Zingle Pvt. Ltd. is a manufacturing company registered under GST in the State of Uttar Pradesh. It

manufactures two taxable products ‘Alpha’ and ‘Beta’ and one exempt product ‘Gama’. On 1 st October,

while product ‘Beta’ got exempted through an exemption notification, exemption available on ‘Gama’ got

withdrawn on the same date. The turnover (exclusive of taxes) of ‘Alpha’, ‘Beta’ and ‘Gama’ in the

month of October was ` 9,00,000, ` 10,00,000 and ` 6,00,000.

Zingle Pvt. Ltd. has furnished the following details:

© The Institute of Chartered Accountants of India

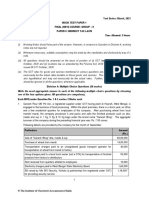

S. No. Particulars Price (`) GST (`)

(a) Machinery ‘U’ purchased on October for being used in

1 st 2,00,000 36,000

manufacturing all the three products

(b) Machinery ‘V’ purchased on 1 st October for being used in 1,00,000 18,000

manufacturing product ‘Alpha’ and ‘Gama’

(c) Machinery ‘W’ purchased on 1 st October for being 3,00,000 54,000

exclusively used in manufacturing product ‘Beta’

(d) Machinery ‘Y’ purchased on 1 st October four years ago for 4,00,000 72,000

being exclusively used in manufacturing product ‘Beta’.

From 1st October, such machinery will also be used for

manufacturing product ‘Gama’.

(e) Machinery ‘Z’ purchased on 1 st October two years ago for 3,00,000 54,000

being used in manufacturing all the three products

(f) Raw Material used for manufacturing ‘Alpha’ purchased on 1,50,000 27,000

5th October

(g) Raw Material used for manufacturing ‘Beta’ purchased on 2,00,000 36,000

10th October

(h) Raw Material used for manufacturing ‘Gama’ purchased 1,00,000 18,000

on 15 th October

Compute the following:

(i) Amount of ITC to be credited to Electronic Credit Ledger, for the month of October

(ii) Amount of aggregate value of common credit (T c)

(iii) Common credit attributable to exempt supplies, for the month of October

(iv) GST liability of the company payable through Electronic Cash Ledger, for the month of October if

opening balance of ITC is nil.

Note: Assume that all the procurements made by the company are from States other than Uttar Pradesh.

Similarly, the company sells all its products in States other than Uttar Pradesh. Rate of IGST is 18%.

Subject to the information given above, assume that all the other conditions necessary for availing ITC

have been fulfilled. Ignore interest, if any and make suitable assumptions wherever required.

(14 Marks)

2. (a) Singla Manufacturers Ltd., registered in Mumbai (Maharashtra), is a manufacturer of footwear. It

imports a footwear making machine from USA. Singla Manufacturers Ltd. enters into a contract

with Bhaskar Logistics, a licensed customs broker with its office at Ahmedabad (Gujarat), to meet

all the legal formalities in getting the said machine cleared from the customs station.

Apart from this, Singla Manufacturers Ltd. authorises Bhaskar Logistics to incur, on its behalf, the

expenses in relation to clearance of the imported machine from the customs station and bringing

the same to the warehouse of Singla Manufacturers Ltd. which shall be reimbursed by Singla

Manufacturers Ltd. to Bhaskar Logistics on the actual basis in addition to agency charges.

Bhaskar Logistics provided following details in the invoice issued by it to Singla Manufacturers Ltd.:

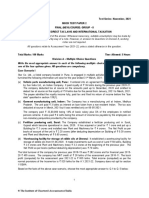

S. No. Particulars Amount (`)

(i) Agency charges 5,00,000

(ii) Unloading of machine at Kandla port, Gujarat 50,000

(iii) Charges for transportation of machine from Kandla port, Gujarat to its 25,000

Bhaskar Logistics’ godown in Ahmedabad, Gujarat

© The Institute of Chartered Accountants of India

(iv) Charges for transportation of machine from Bhaskar Logistics’ 28,000

Ahmedabad godown to the warehouse of Singla Export Import House

in Mumbai, Maharashtra

(v) Prepared and submitted Bill of Entry and paid customs duty 5,00,000

(vi) Dock dues paid 50,000

(vii) Port charges paid 50,000

(viii) Hotel expenses 45,000

(ix) Travelling expenses 50,000

(x) Telephone expenses 2,000

Compute the value of supply made by Bhaskar Logistics with the help of given information.

Would your answer be different if Bhaskar Logistics has charged ` 13,00,000 as a lump sum

consideration for getting the imported machine cleared from the customs station and bringing the

same to the warehouse of Singla Manufacturers Ltd.? (9 Marks)

(b) Product ‘Alpha’ was imported by Mr. Adhik by air. The details of the import transaction are as

follows:

Particulars US $

Price of ‘Alpha’ at exporter’s factory 8,500

Freight from factory of the exporter to load airport (airport in the country of 250

exporter)

Loading and handling charges at the load airport 250

Freight from load airport to the airport of importation in India 4,500

Insurance charges 2,000

Though the aircraft arrived on 22 nd August, the bill of entry for home consumption was presented

by Mr. Adhik on 20 th August.

The other details furnished by Mr. Adhik are:

20th August 22nd August

Rate of basic customs duty 20% 10%

Exchange rate notified by CBIC ` 70 per US$ ` 72 per US$

Exchange rate prescribed by RBI ` 71 per US$ ` 72 per US$

Integrated tax leviable under section 3(7) of the 18% 12%

Customs Tariff Act, 1975

Compute-

(i) value of product ‘Alpha’ for the purpose of levying customs duty

(ii) customs duty and tax payable (5 Marks)

3. (a) John Inc., a corn chips manufacturing company based in USA, intends to launch its products in

India. However, the company wishes to know the taste and sensibilities of Indians before launching

its products in India. For this purpose, John Inc. has approached Saubhagya Consultants, Mumbai,

(Maharashtra) to carry out a survey in India to enable it to make changes, if any, in its products to

suit Indian taste.

The survey is to be solely based on the oral replies of the surveyees; they will not be provided any

sample by John Inc. to taste. Saubhagya Consultants will be paid in convertible foreign exchange

for the assignment.

© The Institute of Chartered Accountants of India

With reference to the provisions of GST law, determine the place of supply of the service. Also,

explain whether the said supply will amount to export of service? (5 Marks)

(b) Determine whether GST is payable in respect of each of the following independent services

provided by the registered persons:

(i) Housekeeping service provided by M/s. Dhruv Services Ltd. to Yash Public School, a play

school, for cleaning its playground and classrooms - ` 25,000 per month.

(ii) Dhara Link supplied ‘Tracing Alphabets’, an online educational journal, to students of UKG

class of Addhyan Public School - ` 2,000. (2 X 2=4 Marks)

(c) Rock & Rock India Ltd. imported a consignment from U.S.A (by sea). The value of consignment

was ` 7,50,000 and total duty payable was ` 1,50,000.

Company filed bill of entry for home consumption but before inspection and clearance for home

consumption it found that the goods were damaged.

On filing a representation to the Customs Department, proper officer refused the claim for

abatement because goods were already unloaded. The proper officer is in agreement with the claim

that the value of goods has come down to only ` 1,50,000.

Examine the issue with reference to the relevant statutory provisions and calcul ate the amount of

total duty payable:

Would your answer be different in the above case if the goods get deteriorated after unloading and

examination but before clearance for home consumption, and value comes down to ` 7,00,000?

(5 Marks)

4. (a) Super Electricals Ltd., a registered supplier of air-conditioners, is required to send from Mumbai

(Maharashtra), a consignment of parts of air-conditioner to be replaced under warranty at various

client locations in Gujarat. The value of consignment declared in delivery challan accompanying

the goods is ` 70,000. Super Electricals Ltd. claims that since movement of goods to Gujarat is

caused due to reasons other than supply, e-way bill is not mandatorily required to be generated in

this case.

You are required to examine the technical veracity of the claim made by Super Electricals Ltd.

(5 Marks)

(b) Parekh Enterprises, registered in Delhi, is engaged in supply of various goods and services

exclusively to Government departments, agencies etc. and persons notified under section 51. It

has provided the information relating to the supplies made, their contract values and the payment

due against each of them in the month of October, respectively as under:

S. Particulars Total contract value Payment due in

No. (inclusive of GST) October

(`) (`)

(i) Supply of stationery to Fisheries 2,60,000 15,000

Department, Kolkata

(ii) Supply of car rental services to Municipal 2,95,000 20,000

Corporation of Delhi

(iii) Supply of a heavy machinery to Public 5,90,000 25,000

Sector Undertaking located & registered

in Uttarakhand

You are required to determine amount of tax, if any, to be deducted from each of the receivable

given above assuming the rate of CGST, SGST and IGST as 9%, 9% and 18% respectively.

(4 Marks)

9

© The Institute of Chartered Accountants of India

(c) Determine the total duties payable under Customs Act if Mr. Bhairav imported rubber from Malaysia

at landed price (exclusive of duties) of `25 lakh. It has been notified by the Central Government

that share of imports of rubber from the developing country against total imports to India exceeds

5%. Safeguard duty notified on this product is 30%, IGST u/s 3(7) is 12% and BCD is 10%. Ignore

agriculture infrastructure and development cess. (5 Marks)

5. (a) Bharat & Co. self-assessed its tax liability as ` 90,000 for the month of April, but failed to make the

payment.

Subsequently the Department initiated penal proceedings against Bharat & Co. for recovery of

penalty under section 73 of the CGST Act, 2017 for failure to pay GST and issued show cause

notice on 10 th August which was received by Bharat & Co. on 14th August.

Bharat & Co. deposited the tax along with interest on 25 th August and informed the department on

the same day.

Department is contending that he is liable to pay a penalty of ` 45,000 (i.e. 50% of ` 90000).

Examine the correctness of the stand taken by the Department with reference to the provisions of

the CGST Act. Explain the relevant provisions in brief. (5 Marks)

(b) Mr. Arjun had filed an appeal before the Appellate Tribunal against an order of the Appellate

Authority where the issue involved relates to place of supply. The order of Appellate Tribunal is

also in favour of the Department. Mr. Arjun now wants to file an appeal against the decision of the

Appellate Authority as he feels the stand taken by him is correct.

You are required to advise him suitably with regard to filing of an appeal before the appellate forum

higher than the Appellate Tribunal. (4 Marks)

(c) After visiting USA for a month, Mrs. and Mr. X (Indian residents aged 40 and 45 years respectively)

brought to India a laptop computer valued at ` 80,000, used personal effects valued at ` 90,000

and as personal computer for ` 52,000. What is the customs duty payable? Ignore Agriculture

infrastructure and development cess. (5 Marks)

6. (a) Explain the situation in which access to business premises is allowed under section 71 of the CGST

Act, 2017. Also, list the records which are to be produced during access to business premises.

(5 Marks)

(b) With reference to the provisions of section 121 of the CGST Act, 2017, specify the orders against

which no appeals can be filed. (4 Marks)

(c) Write a short note on “prohibition and regulation of drawback” with reference to the provisions of

section 76 of the Customs Act, 1962 (5 Marks)

10

© The Institute of Chartered Accountants of India

You might also like

- Leather Product CompanyDocument256 pagesLeather Product Companyhappy_birthday_to_kwanNo ratings yet

- FMCGDocument96 pagesFMCGAnkita Sadani0% (1)

- Solution 8Document10 pagesSolution 8Pua Suan Jin Robin100% (3)

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- 66107bos53355fold p8Document19 pages66107bos53355fold p8sam kapoorNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- Costing G10 QuestionDocument6 pagesCosting G10 QuestionVishal Kumar 5504No ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- 73253bos59102 Final p8Document18 pages73253bos59102 Final p8Vishal AgarwalNo ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Itctp 2022Document4 pagesItctp 2022Muskaan ShawNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- Ca Final Idt RtpsDocument31 pagesCa Final Idt Rtpschandrakantchainani606No ratings yet

- Worksheet Ques of GST 1 QuesDocument9 pagesWorksheet Ques of GST 1 Queslipika goelNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- 58794bos47893finalnew p8 PDFDocument21 pages58794bos47893finalnew p8 PDFANIL JARWALNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocument6 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNo ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- CAF 2 TAX Autumn 2022Document6 pagesCAF 2 TAX Autumn 2022QasimNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- 1idt PDFDocument10 pages1idt PDFShantanuNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Notice Inviting Tender For Works (Online Tender) : DGMBP - Contracts@nlcindia - in Crmchennai@nlcindia - in WWW - Nlcindia.inDocument48 pagesNotice Inviting Tender For Works (Online Tender) : DGMBP - Contracts@nlcindia - in Crmchennai@nlcindia - in WWW - Nlcindia.inRama Rao MNo ratings yet

- 76923bos61942 4Document13 pages76923bos61942 4nerises364No ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- PGBP - PaperDocument6 pagesPGBP - PapermuskaanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- 221120221702-Interior Works Tender For EddumailaramDocument77 pages221120221702-Interior Works Tender For Eddumailaramshubham kumarNo ratings yet

- Sy Tax P.set - 2022-23 New Section - IIDocument4 pagesSy Tax P.set - 2022-23 New Section - IICupid FriendNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- GST Year End Checklist FY 2022-23-NynDocument4 pagesGST Year End Checklist FY 2022-23-NynCA Rajendra Prasad ANo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Question IDT GM 2Document12 pagesQuestion IDT GM 2Prajwal AradhyaNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- CA Inter Taxation Suggested Answer May 2022Document30 pagesCA Inter Taxation Suggested Answer May 2022ileshrathod0No ratings yet

- CA - FINAL NOV 22 Suggested AnswerDocument17 pagesCA - FINAL NOV 22 Suggested AnswerVeena reddyNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- P11 QpmaDocument7 pagesP11 QpmaRehan RahmanNo ratings yet

- Paper11 Set1Document8 pagesPaper11 Set1mvsvvksNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- GST Model Paper - 1Document3 pagesGST Model Paper - 1Joshua StarkNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- 63925bos51393finalnew p8Document23 pages63925bos51393finalnew p8Salman ghaswalaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- International TaxDocument18 pagesInternational TaxriyaNo ratings yet

- ECONIMICSDocument22 pagesECONIMICSriyaNo ratings yet

- QUESTIONSDocument13 pagesQUESTIONSriyaNo ratings yet

- SFM Answer 2Document13 pagesSFM Answer 2riyaNo ratings yet

- SFM Answers 1Document10 pagesSFM Answers 1riyaNo ratings yet

- SFM QDocument4 pagesSFM QriyaNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- Question 8 Which of The Following Did Chiquita Ceo FernandoDocument4 pagesQuestion 8 Which of The Following Did Chiquita Ceo FernandoDoreenNo ratings yet

- PESTEL Analysis On China and FinlandDocument26 pagesPESTEL Analysis On China and FinlandAmeer Shafiq89% (18)

- Hotel Industry Project ReportDocument29 pagesHotel Industry Project ReportRAHUL MEHERNo ratings yet

- Week 3 - China Moves Up The Value Chains Foxconn's DilemmaDocument17 pagesWeek 3 - China Moves Up The Value Chains Foxconn's DilemmanurilNo ratings yet

- Term Paper: Dr. Tamgid Ahmed ChowdhuryDocument9 pagesTerm Paper: Dr. Tamgid Ahmed ChowdhuryYasir AlamNo ratings yet

- Trade Theories and Economic DevelopementDocument48 pagesTrade Theories and Economic DevelopementAhmed LoveNo ratings yet

- CH 1Document19 pagesCH 1Ak AgarwalNo ratings yet

- ChapFour PPT TradeDocument32 pagesChapFour PPT Tradebashatigabu100% (1)

- Tax AssDocument11 pagesTax AssGabrielle Marie RiveraNo ratings yet

- Ormoc Sugar Vs Ormoc City 1968Document2 pagesOrmoc Sugar Vs Ormoc City 1968ulticonNo ratings yet

- What Are Tariffs and Non TariffsDocument4 pagesWhat Are Tariffs and Non TariffsRonalie SustuedoNo ratings yet

- Group 3 - Topic 3Document21 pagesGroup 3 - Topic 3Khánh Huyền PhạmNo ratings yet

- Globalisation and The Indian Economy Class 10 Economics Chapter 4 Extra QuestionsDocument18 pagesGlobalisation and The Indian Economy Class 10 Economics Chapter 4 Extra QuestionsGurinder SinghNo ratings yet

- JCB in IndiaDocument2 pagesJCB in IndiaAnnie100% (2)

- 22BEDocument491 pages22BESanjay AgnihotriNo ratings yet

- Circular DebtDocument14 pagesCircular DebtNaina MukhtarNo ratings yet

- Problem Set III For International TradeDocument11 pagesProblem Set III For International TradeShahbaz SarwarNo ratings yet

- Wacker Neuson Track Excavators 1404 Service Manual 1000166693Document23 pagesWacker Neuson Track Excavators 1404 Service Manual 1000166693ericwilson060590yjk100% (122)

- Win22 Pill4AB Agro MFG Services HDT MrunalDocument29 pagesWin22 Pill4AB Agro MFG Services HDT MrunalAkhilesh YadavNo ratings yet

- Emerging Global World: X Class (History)Document3 pagesEmerging Global World: X Class (History)suryachandra27No ratings yet

- 3 11 3 PDFDocument12 pages3 11 3 PDFEndashu TekalignNo ratings yet

- Mandanas vs. Ochoa, JR., 869 SCRA 440, July 03, 2018Document185 pagesMandanas vs. Ochoa, JR., 869 SCRA 440, July 03, 2018Xate KimNo ratings yet

- Trac Nghiem Market Leader 3 IntermediateDocument24 pagesTrac Nghiem Market Leader 3 IntermediateNhi LêNo ratings yet

- The Indian Forest Under British RajDocument26 pagesThe Indian Forest Under British RajKovid VermaNo ratings yet

- AssignmentDocument8 pagesAssignmentJan Uriel GelacioNo ratings yet

- Opportunities For Sri Lankan Tea in PakistanDocument21 pagesOpportunities For Sri Lankan Tea in PakistanV Lotus HbkNo ratings yet

- Pakistan Light Engineering SectorDocument50 pagesPakistan Light Engineering Sectortest12341No ratings yet