Professional Documents

Culture Documents

GST - Ch. 6, 8 - 13 - NS - Dec. 23

Uploaded by

Madhav Tailor0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

GST - Ch. 6, 8 -13 - NS - Dec. 23

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23

Uploaded by

Madhav TailorCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

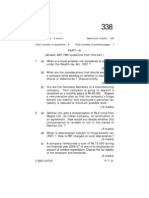

“IGNITE ACADEMY”

CS Executive – GST – Test – Ch. 6, 8 To 13 – NS – 2023

Time – 50 min Marks - 30

SECTION A – MCQS’ – ANSWER WITH REASONS – 2 MARKS EACH

1. Which one of the following is not a condition as per section 16(2) of CGST Act,

2017, to avail Input Tax Credit (ITC) :

(a) Recipient has possession of tax invoice issued by supplier

(b) Goods or Services is actually consumed by Recipient

(c) Filing of valid return by supplier

(d) Supplier pays the tax to the government

2. A banking company has 52,000 by way of input tax credit for the month of

January, 2021. How much of input tax credit it can avail and how much would

lapse?

(a) 26,000 and balance 50% of ITC would lapse

(b) 13,000 and balance 75% of ITC would lapse

(c) 39,000 and balance 25% of ITC would lapse

(d) 52,000 and nothing would lapse

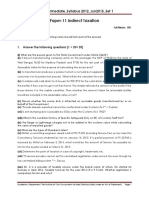

3. ABC Ltd. is engaged in manufacture of electrical appliances supply following

details relating to GST paid on various items by them:

Item GST Paid

Electrical Transformers utilized in the manufacturing process 1,20,000

Trucks used for transporting materials 80,000

Cakes and Pastries for consumption within factory 12,500

The amount of Input Tax Credit (ITC) available to ABC Ltd. shall be

(a) 2,00,000 (b) 2,12,500 (c) 52,500 (d) 1,00,000

4. Find from the following which inward supplies are not eligible under section

17(5) of the CGST Act for Input Tax Credit (ITC) in case of a company who is

engaged in manufacturing of Paints and Chemicals:

(a) Trucks used in supply of finished goods

(b) Food and beverages consumed by workers in factory

(c) Life and health insurance paid for staff as per Government policy

(d) Motor vehicle of sitting capacity of 12 (excluding driver)

5. Section 56 of the CGST Act, 2017 states that claim of refund arising from an order

passed by an adjudicating authority or Appellate Authority or an Appellate

Tribunal or Court which is not being refund within days from the date of receipt

of application filed consequent to such order, interest at such rate not exceeding

per annum, shall be payable in respect of such refund.

(a) 30 days, 6% (b) 30 days, 9% (c) 60 days, 9% (d) 60 days, 6%

SECTION B – Descriptive Questions

1. Bharat Ltd., a registered supplier under the regular scheme, is engaged in manufacture

of electronic items. The following details for the month of March, 2021 are available:

Item GST Paid

Machines acquired for manufacture (capital goods) 10,00,000

Electronic items utilized in manufacture 25,00,000

Trucks used for transporting materials 1,00,000

Food and beverages consumed within the factory 25,000

Advise the ITC eligibility for the company. [5]

2. Goyal Manufacturers, a registered person, instructs it's one of the suppliers to send the

input directly to Sumit Enterprises, who is a job worker, outside its factory premises for

carrying out certain operations on the goods. The goods were sent by the supplier on

15th July, 2020 and were received by the job worker on 17th July, 2020.

Whether Goyal Manufacturers are eligible to take Input Tax Credit (ITC) on the input

goods directly received by the job worker from the supplier. Discuss, what action under

the GST law is required to be taken by Goyal Manufacturers. [4]

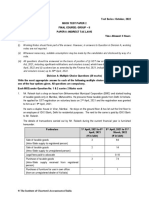

3. Balaram, a registered supplier, furnishes the following details pertain in to the month of

October, 2017 (First month of starting of business):

Particulars Amount

Purchase of goods within state 8,00,000

Purchase of goods from outside the state 10,00,000

Inter-state sales 6,00,000

Intra-state sales 12,50,000

The rates of taxes for the goods supplied are as under:

Particulars Rate

CGST 6%

SGST 6%

IGST 12%

Compute the GST payable by the supplier Balaram for the month of October, 2017 [5]

4. Write a note on refund of tax under section 54 of CGST Act. Discuss the provisions

relating to refund of balance of electronic cash ledger as per the GST law. [2]

5. Explain the procedure of furnishing details of outward supplies and of revision for

rectification of errors and omissions as per CGST Act, 2017. [4]

You might also like

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- CA FINAL INDIRECT TAX LAWS MCQ PRACTICEDocument4 pagesCA FINAL INDIRECT TAX LAWS MCQ PRACTICEJignesh NagarNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- GST MCQDocument22 pagesGST MCQG Prasana KumarNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Itctp 2022Document4 pagesItctp 2022Muskaan ShawNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- 76923bos61942 4Document13 pages76923bos61942 4nerises364No ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- SKANS School of Accountancy Midterm Exam ReviewDocument4 pagesSKANS School of Accountancy Midterm Exam ReviewMuhammad ArslanNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaDocument13 pagesGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686No ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- Test Paper-2 Master Question PGBPDocument3 pagesTest Paper-2 Master Question PGBPyeidaindschemeNo ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- Mock Test Cma June 19Document6 pagesMock Test Cma June 19amit jangraNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7india1965No ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- CAF-2-TAX-Spring-2021Document6 pagesCAF-2-TAX-Spring-2021duocarecoNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Paper18_Set1-Rev-AnsDocument15 pagesPaper18_Set1-Rev-AnsSanya GoelNo ratings yet

- GST Exam Paper Suggested AnswersDocument15 pagesGST Exam Paper Suggested Answersamit jangraNo ratings yet

- Indirect Taxation Paper for MBA Exam with Questions on Composition SchemeDocument3 pagesIndirect Taxation Paper for MBA Exam with Questions on Composition SchemeShubham NamdevNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- 4 GSTDocument4 pages4 GSTafsiya.mjNo ratings yet

- Paper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1Document7 pagesPaper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1RAj BardHanNo ratings yet

- Suggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate Examinationseenu pNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2022 - QuestionsajedulNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- Indirect Taxes-May 2011: FIRST OF ALL Read CarefullyDocument8 pagesIndirect Taxes-May 2011: FIRST OF ALL Read Carefully9811702789No ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- CA Final DT Super 30 QuestionsDocument65 pagesCA Final DT Super 30 Questionsambica mahabhashyamNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- ICMAP Business Law Past PapersDocument2 pagesICMAP Business Law Past Papersmuhzahid786No ratings yet

- taxation-test-6-ch-4-unit-3-unscheduled-nov-2023-Test-Paper-1689754347 (1)Document11 pagestaxation-test-6-ch-4-unit-3-unscheduled-nov-2023-Test-Paper-1689754347 (1)ashishchafle007No ratings yet

- Ca Final May 2011 Qustion Paper 8Document8 pagesCa Final May 2011 Qustion Paper 8Asim DasNo ratings yet

- Indirect Tax Laws Detail Test 1 May 2024 Solution 1702459521Document13 pagesIndirect Tax Laws Detail Test 1 May 2024 Solution 1702459521SAKSHI SINGHNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- Chapter 4Document26 pagesChapter 4Kritika JainNo ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- GSTDocument13 pagesGSTpriyababu4701No ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Conversion or Sale of Partnership Firm Into Limited CompanyDocument24 pagesConversion or Sale of Partnership Firm Into Limited CompanyMadhav TailorNo ratings yet

- 74742bos60488 m3 cp3Document46 pages74742bos60488 m3 cp3Madhav TailorNo ratings yet

- JLL 0808 22Document1 pageJLL 0808 22Madhav TailorNo ratings yet

- Unit 2 - Planning, Strategic Planning and Decsion MakingDocument40 pagesUnit 2 - Planning, Strategic Planning and Decsion MakingMadhav TailorNo ratings yet

- JD LafargeHolcim Global Hub Business ServicesDocument1 pageJD LafargeHolcim Global Hub Business ServicesMadhav TailorNo ratings yet

- XjisJD PhilipsDocument1 pageXjisJD PhilipsMadhav TailorNo ratings yet

- How The MOU OperatesDocument2 pagesHow The MOU OperatesMadhav TailorNo ratings yet

- ICSI signs MoUs with 64 universities for academic collaborationsDocument10 pagesICSI signs MoUs with 64 universities for academic collaborationsMadhav TailorNo ratings yet

- Strategic Exam Blueprints 2022 2023 Version3Document56 pagesStrategic Exam Blueprints 2022 2023 Version3KAH MENG KAMNo ratings yet

- EC Bajaj AutoDocument2 pagesEC Bajaj AutoMadhav TailorNo ratings yet

- Chapter 9 - HW SolutionsDocument7 pagesChapter 9 - HW Solutionsa8829060% (1)

- ENTRP Week 11 20Document46 pagesENTRP Week 11 20Jr ReforbaNo ratings yet

- RBI Internship Report.Document30 pagesRBI Internship Report.Prerna MathurNo ratings yet

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- Account Statement for ASHISH KUMAR SARANGI from 21 Apr 2021 to 21 May 2021Document5 pagesAccount Statement for ASHISH KUMAR SARANGI from 21 Apr 2021 to 21 May 2021Ashish Kumar SarangiNo ratings yet

- Tax GuidesDocument25 pagesTax Guidesjr7mondo7edoNo ratings yet

- Reviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover RegulationsDocument32 pagesReviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover Regulationsyarramsetty geethanjaliNo ratings yet

- Fixed DepositsDocument2 pagesFixed DepositsNarendrapratap1No ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- Gam Chap 3Document9 pagesGam Chap 3Johanna VidadNo ratings yet

- Raghee Horner Daily Trading EdgeDocument53 pagesRaghee Horner Daily Trading Edgepsoonek100% (8)

- How To Start A Trucking Business PDFDocument2 pagesHow To Start A Trucking Business PDFMagoo MarjonNo ratings yet

- Register Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaDocument16 pagesRegister Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaKavita SinghNo ratings yet

- Investment in Equity Securities - IA1Document17 pagesInvestment in Equity Securities - IA1dumpyforhimNo ratings yet

- Annual Report 2009Document338 pagesAnnual Report 2009ferrovialNo ratings yet

- Bitcoin Investment Options - Indian Family OfficesDocument5 pagesBitcoin Investment Options - Indian Family OfficesPranav UdaniNo ratings yet

- 1 - Gaite Vs FonacierDocument2 pages1 - Gaite Vs FonacierPauPau Abut100% (1)

- Annualreport2020 21Document362 pagesAnnualreport2020 21Kaushal pateriyaNo ratings yet

- Fr. Emmanuel Lemelson Letter To Congress Regarding LigandDocument9 pagesFr. Emmanuel Lemelson Letter To Congress Regarding LigandamvonaNo ratings yet

- Mortgage Lab pg1Document3 pagesMortgage Lab pg1api-457616660No ratings yet

- ICAI Nagapoor Branch - Relevent Case LawDocument1 pageICAI Nagapoor Branch - Relevent Case LawkrishnaNo ratings yet

- APC Individual Assignment - CIC160097Document10 pagesAPC Individual Assignment - CIC160097Siti Nor Azliza AliNo ratings yet

- Optional Riders Provide Critical Illness and Disability CoverageDocument2 pagesOptional Riders Provide Critical Illness and Disability Coverageemaraty khNo ratings yet

- Rights of Homebuyers Under IBCDocument4 pagesRights of Homebuyers Under IBCsana khanNo ratings yet

- Dwnload Full Auditing An International Approach 8th Edition Smieliauskas Solutions Manual PDFDocument35 pagesDwnload Full Auditing An International Approach 8th Edition Smieliauskas Solutions Manual PDFconstanceholmesz7jjy100% (9)

- Monetary Policy and The Federal Reserve: Current Policy and ConditionsDocument25 pagesMonetary Policy and The Federal Reserve: Current Policy and ConditionsJithinNo ratings yet

- Dax PDFDocument64 pagesDax PDFpiyushNo ratings yet

- Stipulated Order Appointing ReceiverDocument27 pagesStipulated Order Appointing ReceiverDaily TimesNo ratings yet

- SPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSUDocument8 pagesSPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSURafina Aziz 1331264630No ratings yet

- Unit 6Document9 pagesUnit 6sheetal gudseNo ratings yet