Professional Documents

Culture Documents

NSEIT Declaration For Sec 206AB

Uploaded by

sam franklinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NSEIT Declaration For Sec 206AB

Uploaded by

sam franklinCopyright:

Available Formats

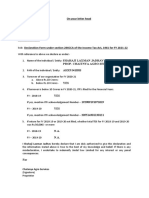

26th June 2021

Declaration

Dear Sir / Madam

Subject : Section 206AB of the Income Tax Act, 1961.

We hereby confirm that NSEIT Limited having PAN AABCN0159P have filed our Income Tax Return for

the preceding two Financial Years and the details of the same are as given below :

Financial Year Date of filing the IT Return ITR Acknowledgement No.

2019-20 11-02-2021 251197621110221

2018-19 28-11-2020 757227091281120

We further confirm that the aggregate of the TDS and TCS exceeded Rs 50,000/- per annum in each of

the above two financial years.

Accordingly we request you to continue Tax Deduction at Source (TDS) as per the applicable rates only

and not at the higher rates as prescribed under section 206AB of the Income Tax Act.

We further declare that all the information furnished above is true and correct.

For NSEIT Limited

M N Hariharan

Chief Financial Officer

NSEIT Limited

Regd Office : Trade Globe, Ground Floor, Sir M.V.Road, Andheri-Kurla Road, Andheri (East), Mumbai 400 059 INDIA

Tel : +91 22 4254 7600 www.nseit.com, CIN : U72200MH1999PLC122456

You might also like

- Declaration To Hafele Customers 194QDocument2 pagesDeclaration To Hafele Customers 194QBhavesh PatelNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Nov 2021-97th EditionDocument13 pagesNov 2021-97th EditionSwathi JainNo ratings yet

- Karuna No YeeDocument6 pagesKaruna No YeeDebashis MitraNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Tax Collector Correspondence3740587933521Document1 pageTax Collector Correspondence3740587933521shahid kamalNo ratings yet

- Reply For Hashim KhanDocument2 pagesReply For Hashim Khanhamza awan0% (1)

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Information Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Document3 pagesInformation Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Mangesh JoshiNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Professional Programme (New Syllabus) Supplement FOR Advanced Tax LawDocument5 pagesProfessional Programme (New Syllabus) Supplement FOR Advanced Tax Lawmanjunath rNo ratings yet

- Calling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFDocument1 pageCalling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFnsreddy3613No ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Tax Accounting Set ADocument4 pagesTax Accounting Set AGopti EmmanuelNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- (2021 Tax Memo) Year-End Tax Compliance RemindersDocument2 pages(2021 Tax Memo) Year-End Tax Compliance RemindersMary Joy BautistaNo ratings yet

- Trade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Document6 pagesTrade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Gautam jainNo ratings yet

- Union GST Audit ReplyDocument2 pagesUnion GST Audit ReplybirmaniNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Assignment 3 - Vat ReturnDocument1 pageAssignment 3 - Vat ReturnRomaica Ella AmbidaNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Home Loan ReceiptDocument1 pageHome Loan ReceiptJoshua Dcunha100% (1)

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Vishal Income Tax NoticeDocument4 pagesVishal Income Tax NoticePriyank SisodiaNo ratings yet

- Ingredient Solutions: That Make Life BetterDocument19 pagesIngredient Solutions: That Make Life BetternawazNo ratings yet

- Computation 23-24 Buta Singh.Document2 pagesComputation 23-24 Buta Singh.Sharn RamgarhiaNo ratings yet

- Do You Know GST - August 2021Document11 pagesDo You Know GST - August 2021CA Ranjan MehtaNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Document4 pagesRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- Guideline Answers: Professional ProgrammeDocument115 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Due Date For Payment of TDS Deducted On Amount: Paid or CreditedDocument3 pagesDue Date For Payment of TDS Deducted On Amount: Paid or CreditedAbhishek GuptaNo ratings yet

- Notice of Assessment 2021 03 22 16 13 15 065002Document4 pagesNotice of Assessment 2021 03 22 16 13 15 065002kulbirsinghxxxxNo ratings yet

- 97 Practice Question On SALARY by Sir Tariq TunioDocument56 pages97 Practice Question On SALARY by Sir Tariq TunioGhulam Mohyudin KharalNo ratings yet

- Goods and Services TaxDocument5 pagesGoods and Services TaxphukerakeshraoNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- GST Amendment For June 2023 Part 3Document3 pagesGST Amendment For June 2023 Part 3rajbhanushali3981No ratings yet

- ALPHA 91KP Solutions Brief Facts of The CaseDocument2 pagesALPHA 91KP Solutions Brief Facts of The CaseAdv Shyam KGNo ratings yet

- Cheeliza Trading - Director Report - 2013Document2 pagesCheeliza Trading - Director Report - 2013CA Pallavi KNo ratings yet

- Delayed Payment of Tax - Taxguru - inDocument2 pagesDelayed Payment of Tax - Taxguru - insukantabera215No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Web Aggregator SyllabusDocument5 pagesWeb Aggregator Syllabussam franklinNo ratings yet

- Gps Galileo Glonass Beidou: L1 BandDocument4 pagesGps Galileo Glonass Beidou: L1 Bandsam franklinNo ratings yet

- CPSP AllIndiaDocument2 pagesCPSP AllIndiasam franklinNo ratings yet

- Virtual ID Generation-InstructionsDocument2 pagesVirtual ID Generation-Instructionssam franklinNo ratings yet

- Permission Letter - Offroll, DPDocument1 pagePermission Letter - Offroll, DPsam franklinNo ratings yet

- Vaccination Certificate 56431750509770Document1 pageVaccination Certificate 56431750509770sam franklinNo ratings yet

- Now Hiring - HR Admin (Gormley, Ontario)Document1 pageNow Hiring - HR Admin (Gormley, Ontario)sam franklinNo ratings yet