Professional Documents

Culture Documents

(2021 Tax Memo) Year-End Tax Compliance Reminders

Uploaded by

Mary Joy BautistaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(2021 Tax Memo) Year-End Tax Compliance Reminders

Uploaded by

Mary Joy BautistaCopyright:

Available Formats

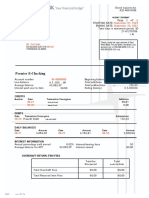

Philippine Seven Corporation

MO-TAX-2021-012

DECEMBER 2021

TAX MEMORANDUM

DATE DECEMBER 01,2021

TO ALL FRANCHISEES

YEAR-END TAX COMPLIANCE REMINDERS

SUBJECT

This memorandum outlines the year-end tax compliance requirements under the rules and regulations set by Bureau of Internal

Revenue (BIR) and Local Government Units (LGU), as follows:

YEAR-END REQUIREMENT

1 DESCRIPTION

1 DEADLINE

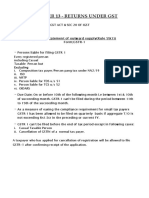

I. Renewal of Registrations

This includes, but is not limited to, the payment of local

business tax, mayor's permit fee (include MONEY Local Business Tax (LBT) is due on or

REMITTANCE), sanitary inspection fee, garbage fee, building before January 20 of each year. However,

a. LGU Registration inspection fee, electrical inspection fee, mechanical taxpayers may opt to pay this on an

inspection fee, plumbing inspection fee, fire inspection fee, installment basis within the first 20 days of

personnel fee, business plate registration fee, and other fees each taxable quarter.

which may be required by the city or municipality.

Annual registration fee amounting to Php 500.00 per

b. BIR Annual On or before January 31 of each year (i.e.,

business establishment is filed and paid using BIR Form No.

Registration Fee (ARF) for 2021 ARF - January 31, 2022).

0605. (Sec.8 ofRR No. 7-2012)

II. Registration of Books of Accounts

BIR requires BIR-approved loose-leaf books of accounts and

a. Loose-leaf Books of

other accounting records to be printed, permanently bound, On or before January 15,2022.

accounts

and properly labeled.

BIR requires registration of Computerized books of accounts

b. Computerized Books of

and other accounting records in CD-R, DVD-R or other On or before January 30,2022.

accounts optical media properly labeled as required.

III. Monthly eSales Reporting

All taxpayers using POS machines, with or without sales Every 8th of the following month - if last

eSales for POS Machines transactions, are required to submit monthly sales report digit of TIN is even

through eSales system. (RMCNo. 45-2014) Every 10th of the following month - if last

digit of TIN is odd

IV. Submission of Annual Information Returns and Summary of Alphabetical Lists (Alphalists)

The Annual Information Return of Income Taxes Withheld on

Compensation and Final Withholding Taxes (BIR Form Nos.

a. BIR Form No. 1604-C and 1604-C and 1604-F) contain the summary of withholding tax On or before February 28 of each year

1604-F on compensation and final paid during the year. Also (i.e., For 20211604CF - February 28,2022).

required are the alphabetical list of employees and payees

from whom taxes were withheld for the year.

The Annual Information Return of Creditable Income Taxes

Withheld - Expanded (BIR Form No. 1604-E) contains the

On or before March 1 of each year

b. BIR Form No. 1604-E summary of EWT paid during the year. Also required is the

(i.e., For 20211604E - March 1, 2022).

alphabetical list of income payees from whom taxes were

withheld for the year.

V. Submission of Monthly, Quarterly and Yearly Tax Returns

Deadline of e-Filing/e-Payment of

Regular monthly filing and payment of withholding taxes

December 2021 remittance:

a. Monthly Tax Returns (i.e., WTC and Withholding VAT) together with the Alphalists

a. WTC (January 11-15, 2022

for the month of December 2021.

depending on the Group and

Philippine Seven Corporation

MO-TAX-2021-012

DECEMBER 2021

TAX MEMORANDUM

Type of Taxpayer)

(RMC No. 26-2002)

b. Withholding VAT

(January 10,2022)

Quarterly filing of VAT (BIR Form No. 2550-Q), FBT (BIR Form Deadline of e-filing/e-payment of 4th

No. 1603), EWT (BIR Form No. 1601-EQ) and FWT (BIR Form quarter 2021:

No. 1601-FQ) together with the required attachment for 4th a. FBT, EWT & FWT and submission

quarter of 2021. Required attachments are as follows: of QAP: January 31,2022

b. Quarterly Tax Returns

1. VAT - Summary List of Sales (SLS) and Summary b. VAT: January 25,2022

List of Purchases (SLP); SLSP: eFPS- January 30,2022

2. EWT and FWT - Quarterly Alphalist of Payees Non-eFPS - January 25,2022

(QAP).

Annual filing of Income Tax Return for 2021 together with

the applicable attachments (e.g., Audited Financial On or before April 15,2022

c. Annual Income Tax Return Statements, SAWT, Copies of BIR Form No. 2307, BIR Form

No. 1709 - Information Return on Related Party

Transactions, if applicable).

VI. Other Year-End Requirements

This is the 'Certificate of Compensation Payments and Taxes The 2021 withholding statement must be

Withheld' issued to the employees for the year 2021 which provided to employees on or before

may be submitted in soft copies in lieu of the hard copies. January 31,2022.

(Sec. 2 of RR No. 2-2015)

a. BIR Form No. 2316 Duplicate signed copies of these

Certificates must be provided to BIR (in

hard or soft copies) on or before February

28, 2022.

Submission of list of warehouse and store inventories as of

b. Annual Inventory List year-end in compliance with the prescribed format by the On or before January 30,2022.

BIR. (Sec. 2 ofRMC No. 57-2015)

For taxpayers engaged in leasing of property for commercial For 2nd semester 202|, BIR submission is

activities, submission of layout of the property, lease on or before January 31,2022.

c. Lessee Information Sheet

contracts and lessee information sheet are required.

(Sec. 2 of RR No. 12-2011)

We hope the above summary of year-end requirements will help and guide you in your annual tax compliance preparations and

submissions to avoid incurring penalties and unnecessary costs.

Should you have any questions on the foregoing, please contact Ms. Gelleen Anne Arcillas at taxcompliance@7-eleven.com.ph

or gqarcillas@7-eleven.com.ph or call (02) 8705-5228 / (02) 8705-5351.

Please be guided accordingly.

Thank you.

Preared b: Reviewed by: Approved by:

Ariann^Dbminic|ue T. I Lawrence M. De Leon

Tax Specialist Ta^Section Manager Finance Division Head

You might also like

- Greendot StatementDocument1 pageGreendot StatementSiobhan76No ratings yet

- East West Bank StatementDocument1 pageEast West Bank StatementHalon GlenNo ratings yet

- Financial Rehabilitation Act SummaryDocument25 pagesFinancial Rehabilitation Act SummaryNaiza Mae R. Binayao100% (2)

- Aom 2022 RecommendationDocument15 pagesAom 2022 RecommendationEnerita AllegoNo ratings yet

- Globalization and EducationDocument7 pagesGlobalization and Educationbambi rose espanola50% (2)

- Employee payroll data with filters and calculationsDocument178 pagesEmployee payroll data with filters and calculationsVinayak ShegarNo ratings yet

- EmilDocument6 pagesEmilABDO Moh.No ratings yet

- Income Tax Quiz AnswerDocument4 pagesIncome Tax Quiz AnswerMarco Alejandro Ibay100% (1)

- Hku Compfee 0000598476Document3 pagesHku Compfee 0000598476Hong_Kong_Bin_LadenNo ratings yet

- Nov 2021-97th EditionDocument13 pagesNov 2021-97th EditionSwathi JainNo ratings yet

- Jan 2022 Bir Tax CalendarDocument1 pageJan 2022 Bir Tax Calendarmypinoy taxNo ratings yet

- RMC No. 23-2022Document3 pagesRMC No. 23-2022Shiela Marie MaraonNo ratings yet

- Feb 2022-Bir-Tax-CalendarDocument1 pageFeb 2022-Bir-Tax-Calendarmypinoy taxNo ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Taxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditDocument5 pagesTaxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditJessica NulphNo ratings yet

- Mar 2022 Bir Tax CalendarDocument1 pageMar 2022 Bir Tax Calendarmypinoy taxNo ratings yet

- Aurora Executive Summary 2021Document8 pagesAurora Executive Summary 2021J JaNo ratings yet

- Do You Know GST - August 2021Document11 pagesDo You Know GST - August 2021CA Ranjan MehtaNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- RMO No. 42-2020Document2 pagesRMO No. 42-2020Miming BudoyNo ratings yet

- Compliance Calendar NovDocument23 pagesCompliance Calendar NovDsp VarmaNo ratings yet

- Withholding On Other TaxesDocument22 pagesWithholding On Other Taxesdea34.drNo ratings yet

- Legal Updates on Tax, Customs and FEMA CircularsDocument6 pagesLegal Updates on Tax, Customs and FEMA CircularsAnupam BaliNo ratings yet

- GST Returns and ComplianceDocument11 pagesGST Returns and ComplianceJay PawarNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- Ey Hk Tax Alert 31 Mar 2022 Issue 02 EnDocument4 pagesEy Hk Tax Alert 31 Mar 2022 Issue 02 En6zt6f6tkxxNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Communication To The Shareholders TDS On Dividend Email Bank Details UpdationDocument21 pagesCommunication To The Shareholders TDS On Dividend Email Bank Details UpdationJagdish RajpurohitNo ratings yet

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNo ratings yet

- E InvoiceDocument23 pagesE Invoicenallarahul86No ratings yet

- Matrix of Deadlines Extended Due To COVID-19 Situation: Revenue Memorandum Circular (RMC) No. 27-2020Document14 pagesMatrix of Deadlines Extended Due To COVID-19 Situation: Revenue Memorandum Circular (RMC) No. 27-2020Brevin PerezNo ratings yet

- Executive Programme (New Syllabus) Supplement FOR Tax LawsDocument14 pagesExecutive Programme (New Syllabus) Supplement FOR Tax Lawsgopika mundraNo ratings yet

- Bank Bulletin No. 2022-06 - Reiteration of Relevant Policies in The Acceptance of 2021 Annual Income Tax Return and PaymentDocument3 pagesBank Bulletin No. 2022-06 - Reiteration of Relevant Policies in The Acceptance of 2021 Annual Income Tax Return and PaymentRen Mar CruzNo ratings yet

- Tax compliance deadline extensionsDocument3 pagesTax compliance deadline extensionsCamp Asst. to ADGP AdministrationNo ratings yet

- Dividend, Interest & Rent IncomeDocument5 pagesDividend, Interest & Rent IncomeUrvashi RNo ratings yet

- Itr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesDocument1 pageItr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesVittal TalwarNo ratings yet

- Balabac Executive Summary 2022Document5 pagesBalabac Executive Summary 2022Gray XoxoNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- ReceivingDocument1 pageReceivingAlfonso CaviteNo ratings yet

- Tax Laws - Direct TaxDocument45 pagesTax Laws - Direct TaxAnubha PriyaNo ratings yet

- Streamlined BIR Transfer Pricing GuidelinesDocument3 pagesStreamlined BIR Transfer Pricing GuidelinesJejomarNo ratings yet

- FTU Case Study 13nov2022 ENGDocument19 pagesFTU Case Study 13nov2022 ENGTHANH HẰNG NGUYỄNNo ratings yet

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewNo ratings yet

- IMPORTANT CIRCULAR - 23.03.2024Document2 pagesIMPORTANT CIRCULAR - 23.03.2024pratikNo ratings yet

- MSME Return Delay ReasonDocument1 pageMSME Return Delay ReasonMAYUR SHARMANo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- Irl MsmeDocument1 pageIrl MsmeMAYUR SHARMANo ratings yet

- AINO Management InsightsDocument12 pagesAINO Management InsightsSwathi JainNo ratings yet

- Bureau of Internal RevenueDocument8 pagesBureau of Internal RevenueDianne EvardoneNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- Withholding Tax (WHT) Advanced Income Tax (AIT) : On or Before January 15, 2023Document1 pageWithholding Tax (WHT) Advanced Income Tax (AIT) : On or Before January 15, 2023ThiruNo ratings yet

- Due Date Calendar June 22Document1 pageDue Date Calendar June 22HAKIMI MZNNo ratings yet

- DHBVN Tax Statement DeadlineDocument13 pagesDHBVN Tax Statement DeadlineResearch AccountNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- Emperador Inc Quarterly Report For The Period June 30 2021Document45 pagesEmperador Inc Quarterly Report For The Period June 30 2021backup cmbmpNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Annual financial details and tax informationDocument2 pagesAnnual financial details and tax informationravikumarNo ratings yet

- E-TDS Return Preparation GuideDocument29 pagesE-TDS Return Preparation GuideSuhag PatelNo ratings yet

- Incometax 29 09 2022Document3 pagesIncometax 29 09 2022nitishbhaskaran4No ratings yet

- Receipts Budget 2021-22 SummaryDocument78 pagesReceipts Budget 2021-22 SummarySashankNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- CV NadeeraDocument1 pageCV NadeeraLahiru Supun SamaraweeraNo ratings yet

- Country selection factorsDocument26 pagesCountry selection factorsShirley Low40% (5)

- P&G Case StudyDocument5 pagesP&G Case Studystrada_squalo100% (1)

- Jan PayslipDocument1 pageJan PayslipSidvik InfotechNo ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEAshirbad SahuNo ratings yet

- Final Endoded PA 104Document102 pagesFinal Endoded PA 104Abdul Hakim MambuayNo ratings yet

- Unit 10 EthicsDocument9 pagesUnit 10 EthicsTrúc ĐoànNo ratings yet

- Variants On CPECDocument15 pagesVariants On CPEClajbar khanNo ratings yet

- Impact of E-commerce in Indian Economy[1]Document11 pagesImpact of E-commerce in Indian Economy[1]kgourab1184No ratings yet

- Cambridge IGCSE: 0455/12 EconomicsDocument12 pagesCambridge IGCSE: 0455/12 Economicst.dyakivNo ratings yet

- Oracle Financials Cloud: Expenses Fundamentals: Codice Durata Prezzo Lingua ModalitàDocument4 pagesOracle Financials Cloud: Expenses Fundamentals: Codice Durata Prezzo Lingua ModalitàRocky SaltNo ratings yet

- Tata Motors' Acquisition of Jaguar Land RoverDocument17 pagesTata Motors' Acquisition of Jaguar Land Roverashish singhNo ratings yet

- 2023 EwtDocument4 pages2023 Ewtdivine mercyNo ratings yet

- Strategic Management-Ii: Topic Presented byDocument16 pagesStrategic Management-Ii: Topic Presented bydeepika singhNo ratings yet

- Mba Dissertation Topics in Accounting and FinanceDocument7 pagesMba Dissertation Topics in Accounting and FinanceSomeoneToWriteMyPaperUKNo ratings yet

- DCSL SBD 04-2024 Tender Invitation - Supply, Install and Deliver of 14 High Mask Lighting For KZNDocument2 pagesDCSL SBD 04-2024 Tender Invitation - Supply, Install and Deliver of 14 High Mask Lighting For KZNdavid selekaNo ratings yet

- Merck Innovation Centre Case StudyDocument11 pagesMerck Innovation Centre Case StudyGokul ThilakNo ratings yet

- Beautiful You!: Reusable ScrunchiesDocument11 pagesBeautiful You!: Reusable ScrunchiesNicole Faye EyanaNo ratings yet

- Accounting For MaterialsDocument31 pagesAccounting For Materialsmuriithialex2030No ratings yet

- Methodology SP Cse Sector and Industry Group IndicesDocument18 pagesMethodology SP Cse Sector and Industry Group Indicescrappy blue angelNo ratings yet

- BT Bank AnswersDocument5 pagesBT Bank AnswersKereen Ruie LingcoNo ratings yet

- Loss of Resources and Reputation from Poor Environmental PracticesDocument2 pagesLoss of Resources and Reputation from Poor Environmental PracticesRockNo ratings yet

![Impact of E-commerce in Indian Economy[1]](https://imgv2-2-f.scribdassets.com/img/document/720874275/149x198/b0ee1ccfe4/1712504211?v=1)