Professional Documents

Culture Documents

Incometax 29 09 2022

Uploaded by

nitishbhaskaran4Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Incometax 29 09 2022

Uploaded by

nitishbhaskaran4Copyright:

Available Formats

u•ci

1i 11 - rgt

fl cJT fflcfl 9t11c1 I

,

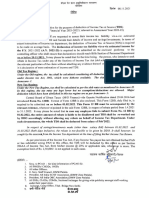

GOVERNMENT OF INDiA

:

DEtJ E 4CCX,4i MNtTR.Y OF DEFEiNC

\)P1RTME1. THE MAHATMA

I1

CQtirRcLLER OF• •D:EEE!NCE ACCOUNTS. QjV4.A:7

Udayan Vihar, Narangi, Guwahati- 781171

Tel. 0361-2640394/2641142 Mail: cda-guw@nic.in Fax. 0361-2640204/2640810/2641143

CIRCULAR NO. iO5

THROUGH OFFICIAL WEBSITE

Subject: Submission of Income Tax Savings Documents for the Financial Year

2022-2023: DAD

For the purpose of assessment and regularization of Income Tax for the Financial Year

2022-2023 (Assessment Year 2023-2024) all the officers and staffs are requested to submit the

following documents:-

I. Proof of savings documents viz. insurance premium receipt, NSC, Infrastructure Bond, PPF Bank

statement, Housing Loan Certificate from Bank, rent receipt, copy of House owner's PAN card

etc should be produce as per Annexure I and II (enclosed).

Any Officers and staffs claiming exenwtion of Income Tax under IT Act 1961 under section 197

who have not forwarded the Exemption Certificate for Fy. 2022-23 from Income Tax

Department are advised to do so at the earliest; failing which total Tax payable will be

deducted at source and Tax refund if any should be claimed only from IT Deoartment. In this

connection it is also stated that exemption allowed will be limited to the amount of salary and

period of exemption mentioned in the Income Tax Department. Any amount exceeding the

amount mentioned in the Certificate and any salary drawn prior or after the period mentioned

will be liable for tax deduction. Moreover, the said certificate must pertain to TAN of CDA

Guwahati, i.e. SHLC00100C.

Ill. Those employees who had produced "Self Declaration" earlier, should also submit proof of

savings/documents along with Annexure I and Annexure II failing which the "Self Declaration"

submitted earlier shall be considered null and void and Tax Deduction at source shall be done

accordingly.

It is therefore requested to submit the above documents (whichever applicable) duly

completed in all respect such a way that should reached at this office on or before 31.10.2022 to

enable the DDO to regulate the Income Tax deduction at source during the current financial

year. In absence of receipt of the aforementioned documents from the official, the Income Tax

will be deducted based on the available information at this end and any refund, if admissible

may be claimed only from the Income Tax Department.

Shri, N,K. Biswas

I

(GO Admin)

No. AN/Il I/019/OlT/2022-23/VoI-XI I

Dated: 29/09/2022

Distribution

EDP centre: For uploading of the same on CDA

Guwahati Website please.

,

Smt. Ruby Bose

(Accounts Officer- AN-Ill)

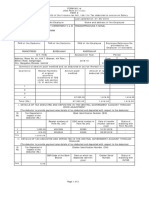

Annexure-I

PROFORMALSUMMARY OF PROOF OF SAVINGS FOR THE PURPOSE OF CALCULATION OF

TAXABLE INCOME/INCOME TAX (FY 20222023 AY 2023-2024)

EMPLOYEE NAME DESGN

EMPLOYEE ACCOUNT NO PAN NO

OFFICE

PREFERRED TAX MODULE OLD MODULE/NEW TAX MODULE (Strike out whichever is not applicable)

EXEMPTIONS CLAIMED FOR OLD TAX MODULE

SL Type of Savings Section Policy Amount for Whether proof

NO No/Folio the Full Year submitted

No/Bank A/C (yes/No)

No /Reference

No

1 INTEREST ON HOME 24 (b)

LOAN

2 PRINCIPAL OF HOME 80C

LOAN

3 PUBLIC PROVIDENT 80C

FUND

4 NSC 80C

S BOND 80C

6 MEDICAL PREMIUM 80C

7 LIC/PLI 80C

8 LIC/PLI 80C

9 LIC/PLI 80C

10 LIC/PLI 80C

11 ELSS 80C

12 BANK DEPOSIT UNDER 80C

TAX SAVINGS

13 SUKANYA SAMRIDDHI 80C

14 DONATION 80G

15 RENT PAID 10(13A)

16 OTHERS

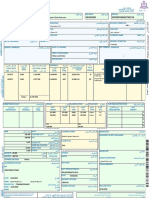

ANNEXURE U

HOUSE RENT RECEIPT (SAMPIE)

Relief (under section 10 (13A) of Income Tax Act)

Received a sum of Rs. (Rupees in words

towards rent for the

Financial year 2022-23 from Mr /Mrs

@ Rs per month

from to residing at the address

Date

Signa ture of House Owner

NAME

ADDRESS

PAN NO. ________________

(IF APPLICABLE)

You might also like

- Taxation of rental income and partnerships under Philippine lawDocument13 pagesTaxation of rental income and partnerships under Philippine lawAnne Marieline BuenaventuraNo ratings yet

- Income Tax 2021-22Document3 pagesIncome Tax 2021-22nawazz1No ratings yet

- 49 Insights June 2022V2Document24 pages49 Insights June 2022V2Rheneir MoraNo ratings yet

- Government Accounting ManualDocument10 pagesGovernment Accounting ManualRyan DberkyNo ratings yet

- City Foundry, St. Louis - TIF ApplicationDocument154 pagesCity Foundry, St. Louis - TIF ApplicationnextSTL.comNo ratings yet

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111No ratings yet

- Multi Task Questions.Document8 pagesMulti Task Questions.wilbertNo ratings yet

- Bishop of Nueva Segovia V Provincial Board PDFDocument2 pagesBishop of Nueva Segovia V Provincial Board PDFMarianneNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Computation of Income Tax For The Financial Year 2021-2022 Corresponding To The Assessment Year 2022-2023Document3 pagesComputation of Income Tax For The Financial Year 2021-2022 Corresponding To The Assessment Year 2022-2023maityutsabNo ratings yet

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Aino Communique 108th EditionDocument12 pagesAino Communique 108th EditionSwathi JainNo ratings yet

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- Income Tax Notice for Construction Expenses DetailsDocument3 pagesIncome Tax Notice for Construction Expenses DetailsD R B INFRASTRUCTURE PRIVATE LIMITED D.Ramesh NaiduNo ratings yet

- Chapter-XVIII 9.3.15Document86 pagesChapter-XVIII 9.3.15Whats Going On ??No ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Aino Communique 110th Dec EditionDocument12 pagesAino Communique 110th Dec EditionSwathi JainNo ratings yet

- DHBVN Tax Statement DeadlineDocument13 pagesDHBVN Tax Statement DeadlineResearch AccountNo ratings yet

- FVCreport - 2023-02-06T114342.040Document1 pageFVCreport - 2023-02-06T114342.040ओमप्रकाश चौरसियाNo ratings yet

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- Highlights For August 2020: Supreme Court DecisionDocument6 pagesHighlights For August 2020: Supreme Court DecisionshakiraNo ratings yet

- Pol 129298Document2 pagesPol 129298summu paulNo ratings yet

- TDS on Virtual Digital Asset TransfersDocument3 pagesTDS on Virtual Digital Asset TransfersshantXNo ratings yet

- TDS AND TCS PROVISIONSDocument55 pagesTDS AND TCS PROVISIONSBeing HumaneNo ratings yet

- GOI CIRCULARS & ENC MEMOS ON PMGSY PENDING ISSUES 070324Document109 pagesGOI CIRCULARS & ENC MEMOS ON PMGSY PENDING ISSUES 070324sdeepika_bNo ratings yet

- SEC Form 17-Q Cover SheetDocument118 pagesSEC Form 17-Q Cover SheetSeifuku ShaNo ratings yet

- Pend InvDocument4 pagesPend Invcetl.mantNo ratings yet

- TDS Certificate Form 16 SummaryDocument3 pagesTDS Certificate Form 16 SummarySvsSridharNo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- General Guideline Claims10142022 Optimized 17oct2022Document64 pagesGeneral Guideline Claims10142022 Optimized 17oct2022Just Ask UsNo ratings yet

- GST Circular PDFDocument11 pagesGST Circular PDFNavnera divisionNo ratings yet

- Babu Form 16Document4 pagesBabu Form 16sundar1111No ratings yet

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- Accounting Handbook For Regional Controllers PDFDocument66 pagesAccounting Handbook For Regional Controllers PDFAntara DeyNo ratings yet

- Acc 305 Assessment 1 June 2020Document5 pagesAcc 305 Assessment 1 June 2020SharonNo ratings yet

- AINO Management InsightsDocument12 pagesAINO Management InsightsSwathi JainNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111No ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Due Date Calendar Oct 22Document1 pageDue Date Calendar Oct 22Kushal DabhadkarNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- AUDIT REPORT-GB RevenuesDocument27 pagesAUDIT REPORT-GB RevenuesAbid KhawajaNo ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- Annual Report - 2020.finalDocument58 pagesAnnual Report - 2020.finalAMR ABDULHAKIM ALASABAHINo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- ST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesDocument9 pagesST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesTaruna BajajNo ratings yet

- Executive Summary: in Thousands of PesosDocument6 pagesExecutive Summary: in Thousands of PesosDAS MAGNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111No ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- Suggested Answer On Tax Planning and Compliance Nov-Dec, 2023Document18 pagesSuggested Answer On Tax Planning and Compliance Nov-Dec, 2023Erfan KhanNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- 1 Section 80CDocument2 pages1 Section 80CcssumanNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Urbanization and The Development of Informal Activities in The City of Bamenda and Environs, 1988-2010Document8 pagesUrbanization and The Development of Informal Activities in The City of Bamenda and Environs, 1988-2010Mamta AgarwalNo ratings yet

- LHDNM notification new employee under Income Tax Act 1967Document1 pageLHDNM notification new employee under Income Tax Act 1967BETTY BALANNo ratings yet

- Working Capital Tulasi SeedsDocument22 pagesWorking Capital Tulasi SeedsVamsi SakhamuriNo ratings yet

- Edifact Invoic D96aDocument41 pagesEdifact Invoic D96aIps IpsNo ratings yet

- Finweek - September 10, 2015Document48 pagesFinweek - September 10, 2015mariusNo ratings yet

- Dallas Council Budget WorkshopDocument159 pagesDallas Council Budget WorkshopRobert WilonskyNo ratings yet

- Ratios Report Ambuja CementDocument11 pagesRatios Report Ambuja CementSajal GoyalNo ratings yet

- University of ZimbabweDocument16 pagesUniversity of ZimbabwePhebieon MukwenhaNo ratings yet

- DepreciationDocument30 pagesDepreciationjosua siregarNo ratings yet

- ELP-Exclusive Analysis Budget 2017Document66 pagesELP-Exclusive Analysis Budget 2017Panache ZNo ratings yet

- Notes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Document21 pagesNotes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Aayushi AroraNo ratings yet

- DST & OPT overviewDocument37 pagesDST & OPT overviewEder EpiNo ratings yet

- rc685 Fill 22eDocument4 pagesrc685 Fill 22ePreetpaul ThiaraNo ratings yet

- Hatta Land Border 05/06/2022 DECIDF0506227306719: Oman Dry Dock Company LLCDocument2 pagesHatta Land Border 05/06/2022 DECIDF0506227306719: Oman Dry Dock Company LLCMaan JuttNo ratings yet

- Property Return Form 2014Document4 pagesProperty Return Form 2014rajat304shrivastavaNo ratings yet

- Sector FMCGDocument45 pagesSector FMCGBijoy SahaNo ratings yet

- Capital GainDocument32 pagesCapital GainswajanNo ratings yet

- Chapter - 1 GST - IntroductionDocument24 pagesChapter - 1 GST - IntroductionhanumanthaiahgowdaNo ratings yet

- Gul AhmedDocument4 pagesGul AhmedDanialRizviNo ratings yet

- Estate Tax Gross EstateDocument13 pagesEstate Tax Gross Estatefernan opeliñaNo ratings yet

- Digital Advantage Insurance Company 6-30-22Document115 pagesDigital Advantage Insurance Company 6-30-22georgi.korovskiNo ratings yet

- Strat CostDocument39 pagesStrat Costyen c aNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- DAV Question BankDocument79 pagesDAV Question BankSantosh SrivastavaNo ratings yet

- Quote Template 35Document1 pageQuote Template 35Shivraj BankarNo ratings yet