Professional Documents

Culture Documents

PTaxPaymentCertificate '192156969058'

Uploaded by

skmasudali0410 ratings0% found this document useful (0 votes)

8 views1 pageJaba

Original Title

PTaxPaymentCertificate_'192156969058' (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJaba

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pagePTaxPaymentCertificate '192156969058'

Uploaded by

skmasudali041Jaba

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

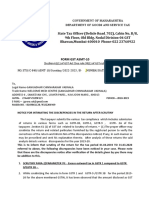

West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979

Profession Tax Payment Certificate

[See Rule 13A]

A. Particulars of the Person/Employer :

(a) Enrolment Certificate No. : 192156969058

(b) Registration Certificate No.: N.A.

(c) Income Tax Permanent Account Number (PAN) : AGLPW0440P

(d) Applicant Name: KAZI WASIM

(e) Trade Name: KRISHI BHANDER

(f) Address: DEULIA,713147

(g) Mobile Number: 7872923563

(h) E-mail Id: kaziw60@gmail.com

B. Nature of Profession / Trade / Calling / Employment:

Serial 3(b) of the Schedule - Employers and/or Shopkeepers as defined in the West Bengal Shops and

Establishments Act, 1963, whether or not their establishments or shops are situated within an area to which the

aforesaid Act applies and also whether registered or not registered under that Act

Tax paid for 2023-24 indicates turnover for 2022-23 to be:- Not more than Rs. 7,50,000

C. Payment Status:

Information regarding payment of profession tax on Enrollment

Financial Year Amount (Rs.)

2023-2024 300

2022-2023 300

2021-2022 300

Note: Challans covering multiple financial years are apportioned hearin using average method, in absence of

specific yearwise tax being mentioned.

THE APPLICANT IS AN ENROLLED PERSON AND HAS PAID

TAX UP-TO-DATE.

THIS CERTIFICATE IS VALID TILL - 31/07/2024

This System generated certificate is based on departmental database as on date and requires no signature.

https://egov.wbcomtax.gov.in/PT_PaymentCertificate 28/12/2023 21:27:19

You might also like

- Vat Registration CertificateDocument1 pageVat Registration Certificateudiptya_papai2007No ratings yet

- Housing Laon (0726675100007849) Provisional Certificate PDFDocument1 pageHousing Laon (0726675100007849) Provisional Certificate PDFanon_1747268810% (1)

- PTaxPaymentCertificate '192093028113'-1Document1 pagePTaxPaymentCertificate '192093028113'-1DIVYA PANDEYNo ratings yet

- Trade LicenceDocument1 pageTrade LicenceSk Imran IslamNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- 1 CertificatesDocument9 pages1 CertificatesBhhasskar BoddupallyyNo ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- Subject: Request For Revocation of Cancellation of Registration-RegDocument1 pageSubject: Request For Revocation of Cancellation of Registration-Regraj sahilNo ratings yet

- PDF - 28-09-23 07-02-29Document18 pagesPDF - 28-09-23 07-02-29jalodarahardik786No ratings yet

- PTaxEnrollmentCertificate 192156136604Document1 pagePTaxEnrollmentCertificate 192156136604Ashutosh ThakurNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- DRC 03Document2 pagesDRC 03MANISHA SINGHNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Annual ReportDocument38 pagesAnnual ReportNeha DenglaNo ratings yet

- Form 24Q - ARN - 770000177869683Document1 pageForm 24Q - ARN - 770000177869683ASHADULLAH KHANNo ratings yet

- 21 21 0593825 01 PDFDocument2 pages21 21 0593825 01 PDFtamil2oooNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Document Checklist - Sole-ProprietorDocument4 pagesDocument Checklist - Sole-ProprietorKarthik DeshapremiNo ratings yet

- Tax Audit ReportDocument28 pagesTax Audit Reportsmith sethisNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Audit Report Fy 2020 21Document15 pagesAudit Report Fy 2020 21Ankrut VaghasiyaNo ratings yet

- ProfessionhaltaxenrolmentDocument1 pageProfessionhaltaxenrolmentSaurav SharmaNo ratings yet

- PTaxEnrollmentCertificate 192167581440Document1 pagePTaxEnrollmentCertificate 192167581440mondal.bikash31No ratings yet

- PHR051401998301-Final IT CertificateDocument2 pagesPHR051401998301-Final IT Certificateamjad.shaik0128No ratings yet

- R P JayaswalDocument26 pagesR P JayaswalVIKASH KUMARNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- HDB InfoWEB Printer Friendly Page 20231127T163335ZDocument2 pagesHDB InfoWEB Printer Friendly Page 20231127T163335ZfebyrichieNo ratings yet

- Form 3CB-3CD - ARNDocument1 pageForm 3CB-3CD - ARNVipasha SanghaviNo ratings yet

- Demand 103279656Document2 pagesDemand 103279656Tarun kumarNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Know Your JurisdictionDocument10 pagesKnow Your JurisdictionsamaadhuNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Form 3CD - Meenakshi SoniDocument15 pagesForm 3CD - Meenakshi SoniAditya AroraNo ratings yet

- Pdf24 MergedDocument8 pagesPdf24 MergedBeatriz do Nascimento VicenteNo ratings yet

- Documentservice PDFDocument29 pagesDocumentservice PDFMayank KumarNo ratings yet

- QIPL FY 2020-21 Form 3CA-3CDDocument26 pagesQIPL FY 2020-21 Form 3CA-3CDvasanth.sNo ratings yet

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999No ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNo ratings yet

- Action Points For All India Drive For Fake RegistrationsDocument3 pagesAction Points For All India Drive For Fake RegistrationsThamil RajendranNo ratings yet

- ProvisionalInterestCertificate IL10026977 202205111824Document1 pageProvisionalInterestCertificate IL10026977 202205111824Diksha PrasadNo ratings yet

- 80c-House Princ Phrxxxxxx8636Document1 page80c-House Princ Phrxxxxxx8636Sama UmateNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- CHISMIS - Return LetterDocument2 pagesCHISMIS - Return LetterVenus DuranNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- 2019 07 24 13 29 47 240 - Aexpl9707n - 2019Document12 pages2019 07 24 13 29 47 240 - Aexpl9707n - 2019KhuNo ratings yet

- Form 15CADocument4 pagesForm 15CAManoj MahimkarNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- Form16 1103Document12 pagesForm16 1103NaveenchdrNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet