Professional Documents

Culture Documents

Trade Licence

Uploaded by

Sk Imran IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Licence

Uploaded by

Sk Imran IslamCopyright:

Available Formats

West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979

Profession Tax Payment Certificate

[See Rule 13A]

A. Particulars of the Person/Employer :

(a) Enrolment Certificate No. : 192146397125

(b) Registration Certificate No.: N.A.

(c) Income Tax Pemanent Account Number (PAN) : CGOPB7885L

(d) Applicant Name: SUNNY BANIK

(e)Trade Name: GLOBAL INDIASECURITY

(f) Address: 505B THAKURPUKUR ROD,MAIL- 171/1A AVOY PADA

SCHOOL ROAD,KOLKATA,700063

(g)Mobile Number: 7003049930

(h) E-mail ld: nepalsaha@hotmail.com

B. Nature of Profession / Trade / Calling / Employment:

Serial 3(e) of the Schedule - Contractors of all descriptions engaged in any work

Tax paid for 2022-23 indicates turnover for 2021-22 to be:- Not more than Rs. 7,50,000

C. Payment Status:

Information regarding payment of profession tax on Enrollment

Financial Year Amount (Rs.)

2022-2023 327

2021-2022 300

2020-2021 300

2019-2020 300

Note: Challans covering multiple financial years are apportioned hearin using average method, in absence of

specific yearwise tax being mentioned.

THE APPLICANT IS ANENROLLED PERSON AND HAS PAID

TAX UP-TO-DATE.

THIS CERTIFICATE IS VALIDTILL - 31/07/2023

This System generated certificate is based on departmental database as on date and requires no signature.

https:/legov.wbcomtax.gov.in/PT PaymentCertificate 17/02/2023 12:58:14

You might also like

- PTaxPaymentCertificate '192093028113'-1Document1 pagePTaxPaymentCertificate '192093028113'-1DIVYA PANDEYNo ratings yet

- PTaxPaymentCertificate '192156969058'Document1 pagePTaxPaymentCertificate '192156969058'skmasudali041No ratings yet

- Contract GEMC 511687765261892 Thu - 09 Sep 2021 16 22 41Document9 pagesContract GEMC 511687765261892 Thu - 09 Sep 2021 16 22 41Sandeep KumarNo ratings yet

- Gemc 511687746073257 29092022Document7 pagesGemc 511687746073257 29092022Sandeep KumarNo ratings yet

- Observer Bill AllDocument1 pageObserver Bill Allseetar550No ratings yet

- Contract GEMC 511687704751759 Mon - 27 Sep 2021 16 06 30Document9 pagesContract GEMC 511687704751759 Mon - 27 Sep 2021 16 06 30Sandeep KumarNo ratings yet

- Observer Bill AllDocument1 pageObserver Bill Allseetar550No ratings yet

- Home LoanDocument2 pagesHome LoanRoshan LewisNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- Gemc 511687798146693 10062022Document9 pagesGemc 511687798146693 10062022Sandeep KumarNo ratings yet

- Contract GEMC 511687741005842 Tue - 30 Nov 2021 13 49 43Document9 pagesContract GEMC 511687741005842 Tue - 30 Nov 2021 13 49 43Sandeep KumarNo ratings yet

- Gujarat Petrosynthese LimitedDocument58 pagesGujarat Petrosynthese LimitedContra Value BetsNo ratings yet

- IT Declaration Form 2022-23Document3 pagesIT Declaration Form 2022-23Chetan NarasannavarNo ratings yet

- 1 CertificatesDocument9 pages1 CertificatesBhhasskar BoddupallyyNo ratings yet

- It 2023102601012116505Document1 pageIt 2023102601012116505Afzal GillaniNo ratings yet

- Robiul Hoque PDFDocument2 pagesRobiul Hoque PDFAMIRUL HAQUENo ratings yet

- With Tax Jul 22 To June 23Document2 pagesWith Tax Jul 22 To June 23Mirza Naseer AbbasNo ratings yet

- BCC BR 107 127Document182 pagesBCC BR 107 127DasthagiriBhashaNo ratings yet

- Statement of Total Income For The Asst. Year 2012-13Document5 pagesStatement of Total Income For The Asst. Year 2012-13mohan11pavanNo ratings yet

- Sail/Bokaro Steel Plant VT Intimation SlipDocument1 pageSail/Bokaro Steel Plant VT Intimation SlipAditya RajNo ratings yet

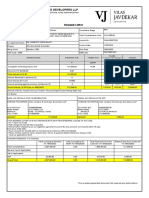

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Provisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernVenkateshNo ratings yet

- ST 000145830208 2023 10Document2 pagesST 000145830208 2023 10Sultan Bin QasimNo ratings yet

- PDN953Document1 pagePDN953naysagupta2014No ratings yet

- Ca Audit Report 2324Document6 pagesCa Audit Report 2324UmasankarNo ratings yet

- MVSR Engineering College-Fee Account: Nadergul, Saroornagar Mandal, RR Dist,, Hyderabad-501510Document1 pageMVSR Engineering College-Fee Account: Nadergul, Saroornagar Mandal, RR Dist,, Hyderabad-501510Ravi LochanNo ratings yet

- Contract GEMC 511687789160932 Fri - 30 Jul 2021 18 18 41Document12 pagesContract GEMC 511687789160932 Fri - 30 Jul 2021 18 18 41Sandeep KumarNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- Jaypee Business School: Page 1 of 1Document1 pageJaypee Business School: Page 1 of 1NAVYA BANSAL BBG220461No ratings yet

- Updates (Company Update)Document2 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Proposed ReplyDocument1 pageProposed ReplytanvirNo ratings yet

- View SoaDocument4 pagesView SoaChristian Vincent Tampus AliñoNo ratings yet

- Press Release On The Unaudited Financial Results Q2 2024Document2 pagesPress Release On The Unaudited Financial Results Q2 2024Akash DuttaNo ratings yet

- Payslip For The Month August 2020: Quess Corp LimitedDocument1 pagePayslip For The Month August 2020: Quess Corp LimitedasdNo ratings yet

- CIB Form - BlankDocument2 pagesCIB Form - BlankKausikNo ratings yet

- 6ff48fd4-1069-41ce-91aa-c56092e305adDocument1 page6ff48fd4-1069-41ce-91aa-c56092e305adayushNo ratings yet

- B4 VerifyDocument1 pageB4 VerifyJasmin NirmalNo ratings yet

- PHR051401998301-Final IT CertificateDocument2 pagesPHR051401998301-Final IT Certificateamjad.shaik0128No ratings yet

- Calcutta Telephones: Bhabesh Mukherjee Swami Sivananda RD, Kolkata WB 700124 P O StampDocument3 pagesCalcutta Telephones: Bhabesh Mukherjee Swami Sivananda RD, Kolkata WB 700124 P O StampSulagna DharNo ratings yet

- Tax Invoice: IRNDocument1 pageTax Invoice: IRNCA Shrikant VaranasiNo ratings yet

- He Accounting Year 01-2022Document3 pagesHe Accounting Year 01-2022Balayya PattapuNo ratings yet

- VCB Po SecrDocument3 pagesVCB Po Secrshivshanker tiwariNo ratings yet

- EL - MR DuggalDocument5 pagesEL - MR DuggalSayak MitraNo ratings yet

- Annex C2103527927 14072023Document3 pagesAnnex C2103527927 14072023hari prasadNo ratings yet

- Gemc 511687770363541 01092022Document7 pagesGemc 511687770363541 01092022Sandeep KumarNo ratings yet

- FVCreport - 2023-02-06T114342.040Document1 pageFVCreport - 2023-02-06T114342.040ओमप्रकाश चौरसियाNo ratings yet

- Tally-Access-eFiling AssignmentDocument10 pagesTally-Access-eFiling AssignmentAman NayakNo ratings yet

- Seminar Registration Form v.16Document1 pageSeminar Registration Form v.16Grace Mecate VillanuevaNo ratings yet

- AOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Document3 pagesAOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Basavaraj KorishettarNo ratings yet

- Bts 44445Document1 pageBts 44445msNo ratings yet

- TK Elevator India Private Limited: Tax InvoiceDocument3 pagesTK Elevator India Private Limited: Tax InvoiceNarayan Kumar GoaNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- Search FileDocument3 pagesSearch FileArunava BanerjeeNo ratings yet

- Registration FormDocument1 pageRegistration FormNidhi RanaNo ratings yet

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111No ratings yet

- Compost 58000002480Document13 pagesCompost 58000002480prasadNo ratings yet

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- ViewDocument2 pagesViewVenkat JvsraoNo ratings yet

- Invoice / Demand Note: " 255555556748, INDUSIND BANK"Document1 pageInvoice / Demand Note: " 255555556748, INDUSIND BANK"Sumit KumarNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- OfferletterDocument8 pagesOfferletterSk Imran IslamNo ratings yet

- Kli - KolDocument14 pagesKli - KolSk Imran IslamNo ratings yet

- Offer LetterDocument2 pagesOffer LetterSk Imran IslamNo ratings yet

- Offer Letter Future GeneraliDocument2 pagesOffer Letter Future GeneraliSk Imran IslamNo ratings yet

- GST Certificate - Panama SyndicateDocument1 pageGST Certificate - Panama SyndicateSk Imran IslamNo ratings yet