Professional Documents

Culture Documents

NI LAW Handbook Eng

NI LAW Handbook Eng

Uploaded by

Mikee MendiolaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NI LAW Handbook Eng

NI LAW Handbook Eng

Uploaded by

Mikee MendiolaCopyright:

Available Formats

Specialized Workshop Delivered to AICC

Negotiable Instruments Law

from

International Business & Trade Law

(Toronto: Carswell, 2005. ISBN 0-459-24279-2)

Authored By:

Prof. William E. Kosar, B.A. (Hons.), LL.B., LL.M.

Legal Advisor Emerging Markets / Bearing Point Economic Governance & Private Sector Strengthening

The Law of Negotiable Instruments

LEARNING OBJECTIVES By the end of this chapter, you will have a basic understanding of: o Negotiable Instruments including o Promissory Notes o Bills of Exchange o Cheques

1. INTRODUCTION Most business transactions involve the exchange of goods and services for money Payment usually either by a bank transfer or by negotiable instrument The most common negotiable instruments include cheques, bills of exchange and promissory notes

2. THE NEGOTIABLE INSTRUMENTS LAW The Negotiable Instruments Law sets out the general rules that relate to bills of exchange, cheques and promissory notes The rules are very similar to the United Kingdoms, Canadas, Americas, Indias & Pakistans Negotiable Instruments have their origin in centuries past where they were developed as an alternative to the risk of carrying gold or money from market town to market town They represent moneys worth and are considered almost good as gold A major advantage of a Negotiable Instrument is its transferability A NEGOTIABLE INSTRUMENT is a document that meets the requirements for circulation without reference to other sources. The amount must be clearly specified or capable of being calculated The Law sets forth detailed rules with 3 general types of negotiable instruments: 1. Cheques 2. Bills of exchange 3. Promissory Notes A cheque is a special type of a bill of exchange Much of what can be said about cheques also applies to bills of exchange A promissory note is distinct in both purpose and use from the other two

Each has characteristics that make them important for the specific commercial purpose the person who prepares the Bill is the Drawer the Drawee is the person to whom it is addressed Once the bill is drawn, it is sent to the Drawee for acceptance who would write accepted across the face of the bill, sign and date it and return it to the Drawer. the Drawee is under no obligation to accept the bill If it is accepted, the Drawee at this point becomes the Acceptor The acceptor promises at that point to pay the bill in accordance with its terms If the Drawee refuses to accept, the bill is said to be dishonoured Demand = immediate Sight = within 2 business days Term = on a fixed or determined or determinable (i.e. 60 days sight) future date If it is a demand bill, payment must be immediate If it is a sight bill it is payable at sight or within a specified number of days Sight means acceptance Every bill is entitled to three days grace The drawer then would deposit the accepted bill just as he would a cheque At any time prior to negotiation, the drawer may transfer the bill by endorsement. This is the act of signing the bill and delivering it to the new holder the person ion possession of a bill is called a holder A holder who has paid for the bill (other than receiving it as a gift) is called a holder for value An important type of holder is a holder in due course A holder in due course is one who receives an instrument that is 1. complete and regular on its face 2. before the bill is overdue 3. without any knowledge that the bill had previously been dishonoured 4. took the bill in good faith and for value, and 5. had no notice of any defect in the title of the person who negotiated it

3. BILL OF EXCHANGE The Negotiable Instruments Law, defines a Bill of Exchange as: o unconditional order in writing o addressed by one person to another o signed by the person giving it o requiring the person to whom it is addressed to pay o on demand or at a fixed or determinable future time o sum certain in money o to or to the order of a specified person or to bearer the person who prepares the bill is called the drawer

the person to whom the bill is addressed is the drawee the drawer then sends the bill to the drawee for acceptance the bill will name a payee, who may or may not be the drawer the drawee then accepts the bill, endorses (signs) it and returns it to the drawer the drawee (who becomes the acceptor) is under no obligation to accept a bill however, if accepted, the drawee promises to pay the bill when it comes due (it may be at a future date, say 30 or 45 days) if the acceptor/drawee does not pay when the bill is due, he may be sued for payment if the drawee does not accept the bill, the bill is said to be dishonoured a bill of exchange may be negotiated before its due date to other persons known as holders a holder usually negotiates a bill by endorsement, that is placing his signature on it the bill may be endorsement several times over as the bill changes hands Jack may the drawer/payee, but he owes money to Peter. Jack endorses the bill and gives it to Peter. Peter owes money to Paul, so he in turn endorses the bill, and so and so on If the bill is payable on demand or presentation or if the bill does not state a due date, it is said to be a demand bill A demand bill does not require acceptance unless it is stated to be payable at other than the drawees place of residence or business Except for demand bills, 3 days grace is added to the payment date A sight bill state that it is payable at sight or at a specified time sight means acceptance so 3 days grace would be added Under the Bills of Exchange Act, it is not fatal that the Bill is not dated nor has no fixed time for acceptance or if there is no mention of the amount If not dated, the bill must at least have the due date. A date may be added at a later time

a. LIABILITY OF THE PARTIES TO A BILL OF EXCHANGE Acceptance of a bill of exchange by a drawee makes the drawee liable to pay the bill at the place and date fixed for payment, or in the case of a demand bill, at a reasonable time thereafter The bill MUST be presented by the holder or his authorized representative at a reasonable hour on a business day at the place specified in the bill Once payment is made, the holder must turn the bill over to the acceptor for cancellation or destruction If a bill is dishonoured by non-payment, the holder may hold the drawer, acceptor and any endorsers liable on the bill

However, in order to confirm this liability, the holder must give an opportunity to each them to pay the bill by giving each of them (except the acceptor) notice of dishonour To be valid, notice has to be given no later than the next business day after the date of dishonour The notice may be either in writing or by telephone but must 1. identify the bill 2. indicate that the bill has been dishonoured notice of dishonour may be dispensed withthis is sometimes indicated right on the bill if the bill is a foreign bill of exchange, a formal procedure known as protest, which is done before a notary public, must be used

4. CHEQUES A cheque is a bill drawn on a bank, payable on demand. Where a cheque is delivered to a bank for deposit to the credit of a person and the bank credits him with the amount of the cheque, the bank acquires all the rights and powers of a holder in due course of the cheque. The bank is always the drawee Accepting a cheque is equivalent to extending credit since there are usually several days between handing over goods and receiving payment by cheque Often, there are another few days from the date the cheque is deposited in the bank until the time that the drawers bank takes the money out of his account Certification is the process whereby a bank guarantees payment of a cheque. In this case, the Bank has transferred funds out of drawers account Certification is not described in the Bills of Exchange Act. It is an American practice which has been adopted here in Canada An uncertified cheque is not legal tender when given as payment to a creditor It is a condtional payment only that entitles the creditor to take action for payment either on the debt or the cheque should the cheque be dishonoured Although not obliged to accept payment by cheque, once it has been done and the cheque has not been dishonoured, it serves to extinguish the debt and is evidence of payment by the creditors endorsement on the back A debtor paying by cheque will often indicate the reason for payment on the cheque A cheque, being a demand payment, must be presented for payment within a reasonable period of time. Most banks will not accept a cheque that is dated more than 6 months ago. Such cheques are said to be stale-dated Stop Payment is the process whereby the person who writes the cheque orders the bank not to pay the holder who presents it for payment Endorsement in blank is when one signs a cheque without any special instructions

Restrictive Endorsement is where one signs a cheque for deposit only to a particular bank account Special Endorsement is where one signs a cheque and makes it payable to a specific person Endorsement without recourse permits only the named endorsee to negotiate the cheque. If however the cheque is dishonoured, the endorsee cannot proceed against the endorserhe can only proceed to collect from the drawer

5. PROMISSORY NOTES The Bills of Exchange Act, defines a Promissory Note as o unconditional promise in writing o made by one person to another person o signed by the maker o engaging to pay o on demand or at a fixed or determinable future time o sum certain in money o To or to the order of o a specified person or to bearer. A promissory note is signed by a maker and must contain a promise to pay a sum certain in money A promissory note may be made by two or more makers, and they may be liable thereon jointly, or jointly and severally, according to its tenor Where a note bears the words I promise to pay and is signed by two or more persons, it is deemed to be their joint and several note Place of payment is normally specified in the promissory note Payment must take place there if the holder of the note wishes to hold any endorser liable Endorsers of promissory notes are in much the same position as endorsers of bills of exchange The maker of a promissory note, promises, by signing it, that he will make the payment according to the terms of the note A maker is not allowed to deny to a holder in due course the existence of the payee and the payees capacity to endorse If there has been default, a holder is obliged to give notice of dishonour to all endorsers if the holder wishes to hold them liable Not all promissory notes are on demand or for one lump sum Many promissory notes are payable over time in monthly or other periodic installments Installment notes are frequently used for consumer purchasers of goods such as automobiles or boats The seller may also take a collateral security interest in the property sold The note may provide that the seller reserves title in the goods until such time as the note is paid for

The cost for paying for the goods is spread out over a period of time with a blended payment of interest and principal The advantage to the seller is that a promissory note is a negotiable instrument which he may endorse over to or in favour of the bank which will pay the seller The bank will then collect from the maker of the note An installment note will usually provide that each installment is a separate note for payment purposes If default should occur, the whole balance owing under the note becomes due and payable This is known as an acceleration clause Sometimes several copies of a note will be made. If the duplicates are intended to be copies, the word copy should be stamped or written on it. Otherwise, each note is a negotiable instrument that may be sued upon

Learning Goals Review The Negotiable Instruments Law is a law that governs cheques, bills of exchange and promissory notes Negotiable instruments are promises to pay and are not legal tender A bill of exchange facilitates commercial transactions by allowing the holder to negotiate the bill to a bank for immediate payment. A cheque is a special type of bill of exchange where the drawee is always a bank A promissory note is a promise to pay, in writing. It may provide for payments over time Endorsement of a cheque (or a bill) renders the endorser liable to pay of the bill or cheque is dishonoured On dishonour, the holder of the bill of exchange must immediately notify all endorser of the bill (and the drawer)

6. DEFENCES TO CLAIMS FOR PAYMENT OF BILLS OF EXCHANGE The holder of a negotiable instrument, whether it is a bill of exchange, cheque or promissory note is entitled to present the instrument for payment on its due date If an instrument has two or more endorsers, each endorsement is deemed to have been made in the order in which it appears on the instrument Liability to some extent follows the order of endorsement Not every holder receives payment A holder has greater rights than as assignee of a contract In the case of an assignment, the assigned takes subject to any defects that there may be

A holder, without notice of any prior defect of title, may enforce the negotiable instrument against all prior parties in spite of any fraud, undue influence or set off that may have existed between the original parties The only exception may be where one of the prior endorsers or the payee can establish that the instrument was unenforceable due to a serious defect such as a forgery or the minority status of the maker There are 3 classes of defence that can raised to a payment of a bill of exchange: 1. real defences 2. defect of title defences 3. personal defences

Real Defences The most effective defences are called real defences Real defences go to the root of the instrument and are valid against all holders, including a holder in due course

Forgery Where the signature of any party to a bill of exchange is forged, the holder may not enforce payment against any party whose signature was forged unless prevented from doing so either by conduct or negligence

Incapacity of a Minor A minor cannot incur liability on a negotiable instrument

Lack of Delivery of a Complete Instrument An incomplete negotiable instrument, such as a cheque, but that is not delivered; this lack of delivery may be a real defence if someone else should complete the instrument and negotiate it or present it for payment

Material Alteration of the Instrument This defence limited to changes made to the negotiable instrument and does not affect the enforcement of the instrument in accordance with its terms Where the instrument such as a cheque is altered, the holder may only be entitle to enforce it against the maker/drawer for the original amount

Fraud as to the Nature of the Instrument Fraud as to the Nature of the Instrument is a rare defence

It is only limited to those case where non est factum may be raised as a defence The person signing has a duty of care to all others who may receive the negotiable instrument It is only available as a defence to someone who signed an instrument and did not understand the nature of it due to infirmity, advance age or illiteracy

Cancellation of the Instrument The cancellation of the instrument, such as marking Paid in Full would be a defence for claim for a claim for payment made by a holder If paid before the due date, the careless handling of the note that allows it to fall into the wrong hands, would not afford the maker or drawer of the instrument the opportunity to avail themselves of this defence Sometimes several copies of a note or a bill will be made. If the duplicates are intended to be copies, the word copy should be stamped or written on it. Otherwise, each note or bill is a negotiable instrument that may be sued upon

Defect of Title Defences Defect of Title defences are good against all parties except a holder in due course A Defect of Title defence may arise where a negotiable instrument is obtained by fraud, duress or undue influence or by a promise not to negotiate the instrument until after maturity Fraud may be a serious enough defence to constitute non est factum Where a person has been induced to sign a cheque on the basis of false representations made by the payee, the defence of fraud may be raised The defence may also arise where there has a total failure of consideration or where the instrument is illegal A Defect of Title defence may also be raised where a person is given the responsibility to fill in the blanks on a negotiable instrument and that person fills in the blanks incorrectly or releases the instrument when instructed not to do so The defence also arises where a properly completed note or bill is stolen in completed form the absence of delivery would constitute a good defect of title defence against a holder, but not a holder in due course

Personal Defences A personal defence is a defence that is only effective as against an immediate party. Set-off is the most common defence raised. That is the party claiming the setoff is alleging that the plaintiff owes the defendant money as well

Learning Goals Review There are 3 defences that can raised to a payment of a bill of exchange: 1. real defences 2. defect of title defences 3. personal defences Real defences are good against all parties including a holder in due course Defect of Title defences are good against all parties except a holder in due course Personal defences are good only against the immediate parties when the bill is presented

SUMMARY Negotiable instruments in the form of bills of exchange, promissory notes and cheques are governed by the Negotiable Instruments Law Each of these instruments was developed to meet the particular needs of merchants To be negotiable, an instrument must possess certain essential elements for negotiability The instrument must be an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay, on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer or to a specific person If it meets these requirements, it may be negotiated by the holder to any other by way of delivery The endorsement renders the person making the endorsement liable to the holder in the event that the instrument is subsequently dishonoured A holder acquires greater rights under a negotiable instrument than an ordinary assignee of a contractual right A holder in due course is generally entitled to claim payment even if there is a defect in title in the instrument The only defence against a holder in due course are what are called real defences such as forgery, incapacity of a minor and others that may render the instrument a nullity

KEY WORDS ACCELERATION CLAUSE a clause in an installment note that requires payment of the entire balance if default occurs in the payment of an installment ACCEPTANCE-- once the bill is drawn, it is sent to the Drawee for acceptance who would write accepted across the face of the bill, sign and date it and return it to the drawer (the person it is paying) ACCEPTOR --If a bill of exchange is accepted, the Drawee at this point becomes the acceptor. The acceptor promises at that point to pay the bill in accordance with its terms BEARER CHEQUEcheque made out to whomever is in procession of it (made out to cash/ bearer) BILL OF EXCHANGE is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay, on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer or to a specific person CERTIFICATION (on a cheque)--is understanding by a bank to pay the amount upon presentation CHEQUE a bill of exchange, drawn on a banking institution which is payable on demand. DISHONOUR, the holder of the bill of exchange must immediately notify all endorser of the bill (and the drawer) DRAWEE is the person to whom a bill of exchange is addressed DRAWER --the person who prepares the Bill of Exchange DEMAND BILL a bill of exchange payable on demand ENDORSEErecipient of a negotiable instrument who becomes the holder ENDORSEMENTthe act of making your mark on the back of a cheque for the purpose of negotiation ENDORSEMENT WITHOUT RECOURSEan endorsement that may limit the liability of the endorser

ENDORSER-- holder of a cheque who transfers ownership to another by signing the back of the cheque ENDORSEMENT OF A CHEQUE (or a bill) renders the endorser liable to pay of the bill or cheque is dishonoured HOLDERperson in possession of a negotiable instrument HOLDER IN DUE COURSEa person who acquires a negotiable instrument before its due date that is complete and regular on its face, who gave value for the instrument without any knowledge of default or defect in the title of prior holders HOLDER FOR VALUEa holder who was given value for a negotiable instrument INSTALLMENT NOTEa promissory note repayable by a number of payments MAKERa person who signs a promissory note NEGOTIABLE INSTRUMENTS are promises to pay and are not legal tender NOTICE OF DISHONOUR notice to all parties that a bill of exchange has been dishonoured by non-payment PAYEE-- the person entitled to payment of a negotiable instrument (person, corporation) PROMISSORY NOTE is a promise to pay, in writing. payments over time It may provide for

RESTRICTIVE ENDORSEMENT is where one signs a cheque for deposit only to a particular bank account SET-OFF is the most common defence raised. That is the party claiming the setoff is alleging that the plaintiff owes the defendant money as well SIGHT BILL a bill of exchange payable three days after acceptance SPECIAL ENDORSEMENT is where one signs a cheque and makes it payable

QUESTIONS 1. What is a promissory note? 2. What does sight mean? 3. How many days grace is one entitled to when presenting a bill of exchange? 4. Who is the payee? 5. What is a maker? 6. Can 16 year old Jacques be a maker of a promissory note? 7. What are 3 classes of defences to a claim for payment on a negotiable instrument? 8. What is the difference between a real defence and a defect of title defence? 9. Old Mrs. Pyl was 79 years old and living in a retirement home. She received a notice in the mail that she had won a prize. She called the number stated in the letter. A nice young man named Christopher made an appointment to see her to deliver the prize to her personally the very next day. While he was there, he demonstrated the wonderful new vacuums that he happened to sell. Boy, could that thing suck! Mrs. Pyl was very impressed. However, the young man told Mrs. Pyl that in order to receive her prize (which were a few tea towels and an ashtray), she had to buy the vacuum for $1,800. She willingly wrote out a cheque. When her daughter came to visit her later that afternoon, Mrs. Pyl proudly displayed her new acquisitions. Her daughter became very upset. What can be done now? 10. Describe the document, sometimes referred to as a bill of exchange that is the instrument normally used in international commerce for payment. a. Bill of lading is a document in which one party, the Drawer directs another party, the Drawee to make a payment. b. Bill of exchange which is a document in which one party, the Drawer directs another party, the Drawee to make a payment. c. Stamp of credit worthiness is a document in which one party, the Drawer directs another party, the Drawee to make a payment. d. Open note issued by the Importers Bank.

11. Define a bill of exchange? a. A bill of exchange is an unconditional order in writing, signed by the exporter and drawn on the importer demanding payment of the indicated sum of money on a specified date. b. A bill of exchange is a conditional order in writing, signed by the exporter and drawn on the importer demanding payment of the indicated sum of money on a specified date. c. A bill of exchange is an unconditional sales contract in writing, signed by the exporter and addresses to the importer demanding payment against delivery of the goods. d. A bill of exchange is a conditional order in writing, signed by the exporter and drawn on the importer demanding payment of the indicated sum of money on a date to be specified later. 12. Jane Harris signs a cheque on her account at the Bank of Nova Scotia to Michael King. Which of the following is true? a. The Bank of Nova Scotia is the drawer. b. Jane Harris is the drawer. c. The Bank of Nova Scotia is the Drawee. d. both A and B e. both B and C 13. Which of the following is an example of a negotiable instrument? a. Promissory note b. cheque c. a mortgage d. a and b e. all of the above 14. Lou Gaudette writes a cheque to Judy Atkinson for services rendered. What is Lou called in relation to the cheque? a. Payee b. endorser c. holder in due course d. drawer e. payor

TRUE/FALSE

15. Few business transactions involve the exchange of good and services for money. 16. Negotiable instrument is not a viable method of payment in Canada. 17. A cheque is a special type of bill of exchange. 18. The drawee is obligated to accept a bill.

19. A minor cannot incur liability on a negotiable instrument. 20. The most effective defenses are real defenses. 21. Absence of consideration may be a personal defense.

FILL IN THE BLANKS

22. A ________________ is a defense that is only effective against an immediate party. 23. A major advantage of a bill of exchange is ___________________. 24. A___________________ is a document that meets the requirements for circulation without reference to other sources. 25. The person who prepares a bill of exchange is the ______________. 26. ___________________ is the process whereby the person who writes a cheque orders the bank not to pay the holder who presents it. 27. An advantage of a bill of exchange is its ________________. 28. A person in possession of a negotiable instrument is sometimes called a (the) _____________. 29. A(n) _______________ is a bill of exchange that is payable on demand

ANSWERS 1. A Promissory Note is a promise to pay, in writing. It may provide for payments over time. 2. Sight means payable within 3 days 3. 3 4. A Payee is the person to whom a bill of exchange must be paid to. 5. A maker is a person who prepares and signs a promissory note. 6. No. Jacques is incapacitated by his minority. 7. Real defences, Personal Defences and Defect of Title Defences. 8. Real defences are good against all parties including a holder in due course. Defect of title defences are good against all parties except a holder in due course. 9. Mrs. Pyl may be able to claim fraud as to the nature of the instrument, a real defence which is valid as against a holder in due course. However, it is more likely that she will claim that she was induced to sign the cheque on the basis of false representations by Christopher. This is a Defect of Title defence. This defence will not apply if Christopher negotiated the cheque to a holder in due course. Mrs. Pyl should also consider putting a stop payment on the cheque immediately. 10. b 11. a 12. c The bank is always the drawee on a cheque. 13. d 14. d

TRUE/FALSE

15. F 16. F 17. T 18. T But if he does not accept, he is said to have dishonoured the bill. 19. T A minor does not have the legal capacity. 20. T Real defences are available against all holders including a holder in due course. 21. T FILL IN THE BLANKS 22. personal defense 23. It is transferable 24. Negotiable instrument

25. Drawer 26. Stop payment 27. Promissory 28. Holder 29. cheque

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Test Card CreditDocument32 pagesTest Card CreditHerard Gravi100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Soa PDFDocument1 pageSoa PDFLiezel TapiaNo ratings yet

- TBChap 012Document237 pagesTBChap 012omar altamimiNo ratings yet

- SBLCDocument2 pagesSBLCwillian cortez100% (1)

- The Impact of Financial Technology On Banking Sector - Evidence From EgyptDocument19 pagesThe Impact of Financial Technology On Banking Sector - Evidence From EgyptGoldy MaleraNo ratings yet

- Principles of Accounting 12th Edition Needles Solutions ManualDocument26 pagesPrinciples of Accounting 12th Edition Needles Solutions Manualmodelerdativelygb7100% (33)

- Tax Deduction ChecklistDocument2 pagesTax Deduction ChecklistlunwenNo ratings yet

- An Introduction To Financial System, Its Components: Unit 1Document16 pagesAn Introduction To Financial System, Its Components: Unit 1bhavyaNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- © All Rights Reserved, Indian Institute of Management BangaloreDocument2 pages© All Rights Reserved, Indian Institute of Management Bangaloresanchay3090No ratings yet

- Super Endowment BrochureDocument13 pagesSuper Endowment BrochuremiteshtakeNo ratings yet

- Notes - Indian Financial System & Regulators - 19.12.2023Document172 pagesNotes - Indian Financial System & Regulators - 19.12.2023cr7milamkbNo ratings yet

- Arul SPF 2000Document13 pagesArul SPF 2000ADLFVNRNo ratings yet

- Week 10 - Case Study 9.2Document2 pagesWeek 10 - Case Study 9.2Nishita LinNo ratings yet

- Meaning of E-Banking: 3.2 Automated Teller MachineDocument16 pagesMeaning of E-Banking: 3.2 Automated Teller Machinehuneet SinghNo ratings yet

- Business Combination.: Pfrs 3Document33 pagesBusiness Combination.: Pfrs 3Reginald Valencia100% (1)

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- 2018 ZB PaperDocument9 pages2018 ZB Papermandy YiuNo ratings yet

- Auditing Theory - 3Document6 pagesAuditing Theory - 3Kageyama HinataNo ratings yet

- FABM - L-10Document16 pagesFABM - L-10Seve HanesNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- Fair Market Value - Calculating Capital Gain For Property Purchased Before 2001Document12 pagesFair Market Value - Calculating Capital Gain For Property Purchased Before 2001CA Amit RajaNo ratings yet

- Lyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20Document9 pagesLyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20leniNo ratings yet

- Tai Tran ResumeDocument1 pageTai Tran Resumeapi-574243817No ratings yet

- Account Transactions: Rey Fernan RefozarDocument13 pagesAccount Transactions: Rey Fernan RefozarPaula Bautista75% (4)

- Ibps Po Mains GK Capsule 2019 21Document170 pagesIbps Po Mains GK Capsule 2019 21AssNo ratings yet

- Bank Recon and Petty CashDocument3 pagesBank Recon and Petty CashCyrus MulopeNo ratings yet

- Chapter 13Document67 pagesChapter 13HugooNo ratings yet

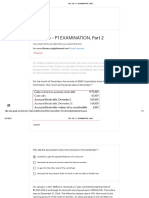

- Acc 106 - P1 Examination, Pa 2: Your Email Will Be Recorded When You Submit This FormDocument17 pagesAcc 106 - P1 Examination, Pa 2: Your Email Will Be Recorded When You Submit This FormATHALIAH LUNA MERCADEJASNo ratings yet