Professional Documents

Culture Documents

Microsoft Corporation Annual Report 2011

Uploaded by

rajesh_dawat1991Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microsoft Corporation Annual Report 2011

Uploaded by

rajesh_dawat1991Copyright:

Available Formats

NAME: ROLL NO: CLASS:

RAJESH DAWAT 88 TYBBI

PROJECT:

MICROSOFT CORPORATION

MICROSOFT CORPORATION 2011 AUDITORS REPORT

INCOME STATEMENTS

(In millions, except per share amounts)

Year Ended June 30,

2011

2010

2009

Revenue

69,943

62,484

58,437

Operating expenses:

Cost of revenue

15,577

12,395

12,155

Research and development

9,043

8,714

9,010

Sales and marketing

13,940

13,214

12,879

General and administrative

4,222

4,063

4,030

Total operating expenses

42,782

38,386

38,074

Operating income

27,161

24,098

20,363

Other income (expense)

910

915

(542 )

Income before income taxes

28,071

25,013

19,821

Provision for income taxes

4,921

6,253

5,252

Net income

23,150

18,760

14,569

Earnings per share:

Basic

2.73

2.13

1.63

Diluted

2.69

2.10

1.62

Weighted average shares outstanding:

Basic

8,490

8,813

8,945

Diluted

8,593

8,927

8,996

Cash dividends declared per common share

0.64

0.52

0.52

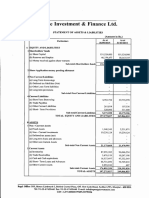

BALANCE SHEETS

(In millions)

June 30,

2011

2010

Assets

Current assets:

Cash and cash equivalents

9,610

5,505

Short-term investments (including securities loaned of $1,181 and $62)

43,162

31,283

Total cash, cash equivalents, and short-term investments

52,772

36,788

Accounts receivable, net of allowance for doubtful accounts of $333 and $375

14,987

13,014

Inventories

1,372

740

Deferred income taxes

2,467

2,184

Other

3,320

2,950

Total current assets

74,918

55,676

Property and equipment, net of accumulated depreciation of $9,829 and

8,162

7,630

$8,629

Equity and other investments

10,865

7,754

Goodwill

12,581

12,394

Intangible assets, net

744

1,158

Other long-term assets

1,434

1,501

Total assets

$ 108,704

86,113

Liabilities and stockholders equity

Current liabilities:

Accounts payable

4,197

4,025

Short-term debt

1,000

Accrued compensation

3,575

3,283

Income taxes

580

1,074

Short-term unearned revenue

15,722

13,652

Securities lending payable

1,208

182

Other

3,492

2,931

Total current liabilities

28,774

26,147

Long-term debt

11,921

4,939

Long-term unearned revenue

1,398

1,178

Deferred income taxes

1,456

229

Other long-term liabilities

8,072

7,445

Total liabilities

51,621

39,938

Commitments and contingencies

Stockholders equity:

Common stock and paid-in capital shares authorized 24,000; outstanding 8,376 and 8,668

63,415

62,856

Retained deficit, including accumulated other comprehensive income of $1,863 and $1,055

(6,332 )

(16,681 )

Total stockholders equity

57,083

46,175

Total liabilities and stockholders equity

$ 108,704

86,113

CASH FLOWS

(In millions)

Year Ended June 30,

2011

2010

2009

Operations

Net income

23,150

18,760

14,569

Adjustments to reconcile net income to net cash from operations:

Depreciation, amortization, and other

2,766

2,673

2,562

Stock-based compensation expense

2,166

1,891

1,708

Net recognized losses (gains) on investments and derivatives

(362 )

(208 )

683

Excess tax benefits from stock-based compensation

(17

(45

(52

Deferred income taxes

(220 )

762

Deferral of unearned revenue

31,227

29,374

24,409

Recognition of unearned revenue

(28,935 )

(28,813 )

(25,426 )

Changes in operating assets and liabilities:

Accounts receivable

(1,451 )

(2,238 )

2,215

Inventories

(561 )

(44 )

255

Other current assets

(1,259 )

464

(677 )

Other long-term assets

62

(223 )

(273 )

Accounts payable

58

844

(671 )

Other current liabilities

(1,146 )

451

(2,700 )

Other long-term liabilities

1,294

1,407

1,673

Net cash from operations

26,994

24,073

19,037

Financing

Short-term debt borrowings (repayments), maturities of 90 days or less, net

(186 )

(991 )

1,178

Proceeds from issuance of debt, maturities longer than 90 days

6,960

4,167

4,796

Repayments of debt, maturities longer than 90 days

(814 )

(2,986 )

(228 )

Common stock repurchased

(11,555 )

(11,269 )

(9,353 )

Common stock cash dividends paid

(5,180 )

(4,578 )

(4,468 )

Excess tax benefits from stock-based compensation

17

45

52

Other

(40 )

10

(19 )

Net cash used in financing

(8,376 )

(13,291 )

(7,463 )

Investing

Additions to property and equipment

(2,355 )

(1,977 )

(3,119 )

Acquisition of companies, net of cash acquired

(71 )

(245 )

(868 )

Purchases of investments

(35,993 )

(30,168 )

(36,850 )

Maturities of investments

6,897

7,453

6,191

Sales of investments

15,880

15,125

19,806

Securities lending payable

1,026

(1,502 )

(930 )

Net cash used in investing

(14,616 )

(11,314 )

(15,770 )

Effect of exchange rates on cash and cash equivalents

103

(39 )

(67 )

Net change in cash and cash equivalents

4,105

(571 )

(4,263 )

Cash and cash equivalents, beginning of period

5,505

6,076

10,339

Cash and cash equivalents, end of period

9,610

5,505

6,076

AUDITORS REPORT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Microsoft Corporation: We have audited the accompanying consolidated balance sheets of Microsoft Corporation and subsidiaries (the "Company") as of June 30, 2011 and 2010, and the related consolidated statements of income, cash flows, and stockholders' equity for each of the three years in the period ended June 30, 2011. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Microsoft Corporation and subsidiaries as of June 30, 2011 and 2010, and the results of their operations and their cash flows for each of the three years in the period ended June 30, 2011, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of June 30, 2011, based on the criteria established in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated July 28, 2011, expressed an unqualified opinion on the Company's internal control over financial reporting. /s/ DELOITTE & TOUCHE LLP Seattle, Washington July 28, 2011

DIRECTORS REPORT REPORT OF MANAGEMENT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal control over financial reporting for the company. Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of our financial reporting for external purposes in accordance with accounting principles generally accepted in the United States of America. Internal control over financial reporting includes maintaining records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected on a timely basis. Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that a misstatement of our financial statements would be prevented or detected. Management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the company's internal control over financial reporting was effective as of June 30, 2011. There were no changes in our internal control over financial reporting during the quarter ended June 30, 2011 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. Deloitte & Touche LLP has audited our internal control over financial reporting as of June 30, 2011; their report follows.

You might also like

- Chap 2 Financial Analysis & PlanningDocument108 pagesChap 2 Financial Analysis & PlanningmedrekNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Analyze Dell's FinancialsDocument18 pagesAnalyze Dell's FinancialsSaema JessyNo ratings yet

- Final Grace CorpDocument14 pagesFinal Grace CorpAnonymous 0M5Kw0YBXNo ratings yet

- Chap-6 Financial AnalysisDocument15 pagesChap-6 Financial Analysis✬ SHANZA MALIK ✬No ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Auditors Report Financial StatementsDocument57 pagesAuditors Report Financial StatementsSaif Muhammad FahadNo ratings yet

- Final Grace CorpDocument14 pagesFinal Grace CorpKarl Chua100% (1)

- Grace Corporation: Statement of Management's Responsibility For Financial StatementsDocument14 pagesGrace Corporation: Statement of Management's Responsibility For Financial StatementsLaiza Joyce Sales100% (2)

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- IRRI AR 2011 - Audited Financial StatementsDocument45 pagesIRRI AR 2011 - Audited Financial StatementsIRRI_resourcesNo ratings yet

- Altek Corporation Consolidated Financial Statements and Report of Independent Accountants DECEMBER 31, 2012 AND 2011Document50 pagesAltek Corporation Consolidated Financial Statements and Report of Independent Accountants DECEMBER 31, 2012 AND 2011JimmyNo ratings yet

- Company Financial StatementsDocument49 pagesCompany Financial StatementsStar ShinnerNo ratings yet

- Panoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements September 30, 2010 and 2009Document18 pagesPanoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements September 30, 2010 and 2009LuisMendiolaNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Report For The Second Quarter Ended September 30, 2011: Letter To The ShareholderDocument4 pagesReport For The Second Quarter Ended September 30, 2011: Letter To The ShareholderNiranjan PrasadNo ratings yet

- GT Kendisinin 49 Sfinancial Statements Ri13 enDocument39 pagesGT Kendisinin 49 Sfinancial Statements Ri13 enkazimkorogluNo ratings yet

- Jollibee Foods Corporation 2011 Audited Financial StatementsDocument82 pagesJollibee Foods Corporation 2011 Audited Financial StatementsRegla MarieNo ratings yet

- Course Code: Fn-550Document25 pagesCourse Code: Fn-550shoaibraza110No ratings yet

- Bloomage 2010 Annual ReportDocument25 pagesBloomage 2010 Annual ReportHenry ThurmanNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- Infosys LimitedDocument3 pagesInfosys Limitedjyoti_jazzzNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Hyundai Motor Company Financial Statements and Auditors' Report 2011-2010Document65 pagesHyundai Motor Company Financial Statements and Auditors' Report 2011-2010ৰিতুপর্ণ HazarikaNo ratings yet

- Pyrogenesis Canada Inc.: Financial StatementsDocument43 pagesPyrogenesis Canada Inc.: Financial StatementsJing SunNo ratings yet

- Financial Statements 2015 ReportDocument64 pagesFinancial Statements 2015 ReportAftab SaadNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Unaudited Financials H1 2014Document2 pagesUnaudited Financials H1 2014Kristi DuranNo ratings yet

- Infosys Balance SheetDocument28 pagesInfosys Balance SheetMM_AKSINo ratings yet

- 2011 Interaction Audited Financial StatementsDocument16 pages2011 Interaction Audited Financial StatementsInterActionNo ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Annual Report PPT FinalDocument23 pagesAnnual Report PPT FinalManish Jaiswal100% (1)

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinNo ratings yet

- Audited FS 2010 2012 Philex Mining Corporation and SubsidiariesDocument96 pagesAudited FS 2010 2012 Philex Mining Corporation and SubsidiariesDerick John PalapagNo ratings yet

- Balance Sheet: As at June 30, 2011Document45 pagesBalance Sheet: As at June 30, 2011Rana HaiderNo ratings yet

- Factset Research Systems Inc: FORM 10-QDocument53 pagesFactset Research Systems Inc: FORM 10-QKaren AlmenarNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document72 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNo ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Financials and Projects: International Finance CorporationDocument118 pagesFinancials and Projects: International Finance CorporationMonishaNo ratings yet

- Grace Corp Audited FSDocument17 pagesGrace Corp Audited FSArchie Guevarra90% (10)

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Negros Navigation Co., Inc. and SubsidiariesDocument48 pagesNegros Navigation Co., Inc. and SubsidiarieskgaviolaNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Infosys Consolidated Financial Statements ReviewDocument13 pagesInfosys Consolidated Financial Statements ReviewLalith RajuNo ratings yet

- Cash Flow Statement: Segregation of Cash FlowsDocument7 pagesCash Flow Statement: Segregation of Cash FlowsawedawedNo ratings yet

- Proactive CPA and Consulting FirmDocument23 pagesProactive CPA and Consulting FirmPando DailyNo ratings yet

- ConsolidatedReport08 (BAHL)Document87 pagesConsolidatedReport08 (BAHL)Muhammad UsmanNo ratings yet

- Katzie First Nation - Financial Statements 2013Document32 pagesKatzie First Nation - Financial Statements 2013Monisha Caroline MartinsNo ratings yet

- Report For The Third Quarter Ended December 31, 2011: Letter To The ShareholderDocument4 pagesReport For The Third Quarter Ended December 31, 2011: Letter To The ShareholderfunaltymNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Chapter 3 Short ProlemsDocument9 pagesChapter 3 Short ProlemsRhedeline LugodNo ratings yet

- Consolidated Annual Report 2011Document84 pagesConsolidated Annual Report 2011Adnan NaeemNo ratings yet