Professional Documents

Culture Documents

NCFM Capital Market Dealer's Module

NCFM Capital Market Dealer's Module

Uploaded by

Intelivisto Consulting India Private LimitedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NCFM Capital Market Dealer's Module

NCFM Capital Market Dealer's Module

Uploaded by

Intelivisto Consulting India Private LimitedCopyright:

Available Formats

The NSE s certification in financial markets is widely accepted course and numbers o f candidates are earning excellent salary

after completing this course. NCFM is an online testing and certification program. It tests the practical knowledge an d skills required to operate in the financial markets. The entire process of tes ting, assessing and scores reporting in the NCFM is fully automated. The capital market is a profitable field for youngsters because of the high compensation ty pically involved with this market. So, if you want to make career in this sector you must clear the NCFM capital market certification. The validity of the CMDM certification is 5 years after registration. Capital market certification is especially designed for students, graduates, equ ity traders, professionals in equity market, as well as those who want to build a career in capital market trading and related services. If you are preparing fo r this exam, take the online test of capital market module for practices. Inteli visto provides the capital market test paper having tricky questions and brief o verview of every section. The main objective to developing these module test pap ers of NCFM capital markets to enable candidate clear the exam with full prepara tion in minimum possible time. The capital market dealer s module question paper is designed with the chapters of I ndian security markets, trading membership, trading, clearing & settlement, lega l framework and fundamental valuation concept. We also proffer the capital marke t dealers module mock test for complete preparation. The main purpose of the onl ine capital market mock test is to give candidate clear & brief knowledge of rel ated questions asked in the exam. Actually, our capital market dealer s module test papers are designed for practice of exam pattern. Overview of Capital Market Chapters Indian Security Market, The Bombay Stock Exchange and the National Stock Exchang e (NSE) are the two national stock exchanges of India. Both are with fully elect ronic platforms and have approximately 9400 broking outfits participating. Trading, Clearing & settlement accelerate their reinvention and adaptation proce ss. Clearing & settlement define the risk framework for equities and derivatives . Legal Framework consists of Provisions of the Treaty on the Functioning of the E uropean Union and protocol and declaration. The regulatory framework for securit ies market is consistent with the best international benchmarks, such as, standa rds prescribed by International Organization of Securities Commissions. Fundamental Valuation of equity securities relies on financial analysis of histo rical financial data and an assessment of the business prospects of an issuer. T he financial analysis of the company examines trends in it s profitably, efficiency in employing capital, financial capability and other factors that the analyst co nsiders important. If any candidate is interested to take the online test for capital market dealer s m odule, he/she have to free registration on our website that is intelivisto.com. Our capital market question papers tests are similar to actual exam of NCFM whic h are helpful in preparation for this exam. This course is highly job oriented.

You might also like

- LBO ModellingDocument22 pagesLBO ModellingRoshan PriyadarshiNo ratings yet

- ARMY TM 9-2320-280-20-2 Technical Manual Unit MaintenanceDocument953 pagesARMY TM 9-2320-280-20-2 Technical Manual Unit Maintenanceabduallah muhammadNo ratings yet

- NISM VII - SORM Short NotesDocument25 pagesNISM VII - SORM Short Notescomplaints.tradeNo ratings yet

- Hand Book For NSDL Depository Operations Module 3Document108 pagesHand Book For NSDL Depository Operations Module 3mhussainNo ratings yet

- The Trade Lifecycle: Behind the Scenes of the Trading ProcessFrom EverandThe Trade Lifecycle: Behind the Scenes of the Trading ProcessNo ratings yet

- CIR Vs La Tondena Full TextDocument3 pagesCIR Vs La Tondena Full TextKatherine Jane UnayNo ratings yet

- 1 Important of Financial Advisor For Mutual Fund Investors Karvy FinalDocument113 pages1 Important of Financial Advisor For Mutual Fund Investors Karvy Finalranjeetmttl4No ratings yet

- Floodgate WorkshopDocument89 pagesFloodgate WorkshopCyrus R. FloresNo ratings yet

- SecuritiesDocument196 pagesSecuritiesAdarsh KumarNo ratings yet

- Nism - 6Document29 pagesNism - 6vjeshnani100% (1)

- Mutual Funds - NCFMDocument123 pagesMutual Funds - NCFMUDAYAN SHAHNo ratings yet

- Practical Sap Us Payroll Sample 72701Document72 pagesPractical Sap Us Payroll Sample 72701prdeshpandeNo ratings yet

- Mutual Fund: Prof. Shriram NerlekarDocument167 pagesMutual Fund: Prof. Shriram Nerlekarhimanshu sikarwarNo ratings yet

- NISM QuestionsDocument6 pagesNISM QuestionsAvibhav KumarNo ratings yet

- SM Fin Bigin EnnewDocument88 pagesSM Fin Bigin EnnewRajan GoyalNo ratings yet

- SM CMM RevDocument168 pagesSM CMM Revprafulvg100% (2)

- Foundation Modules: + Expand All - Collapse AllDocument1 pageFoundation Modules: + Expand All - Collapse AllManoj SharmaNo ratings yet

- The Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsFrom EverandThe Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsRating: 5 out of 5 stars5/5 (1)

- Capital Market and NSDL Book 2Document55 pagesCapital Market and NSDL Book 2mhussainNo ratings yet

- NCFM BsmeDocument96 pagesNCFM BsmeAstha Shiv100% (1)

- CAIIB 3 DerivativesDocument5 pagesCAIIB 3 Derivativestamil8919No ratings yet

- Quantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingFrom EverandQuantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- API 510 Study GuideDocument3 pagesAPI 510 Study GuidedanikakaNo ratings yet

- Roller ConveyorDocument6 pagesRoller ConveyorzainonayraNo ratings yet

- What Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.Document15 pagesWhat Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.SRINIVASAN100% (4)

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Fimmda-Nse Debt Market (Basic) Module CurriculumDocument12 pagesFimmda-Nse Debt Market (Basic) Module Curriculumsinghabhishek3No ratings yet

- Security Analysis and Portfolio Management, Bond Market in India.Document26 pagesSecurity Analysis and Portfolio Management, Bond Market in India.Gagandeep Singh BangarNo ratings yet

- Chapter-1: Issue Issue / Stock SplitDocument21 pagesChapter-1: Issue Issue / Stock SplitNidheesh BabuNo ratings yet

- International Finance, HedgeDocument7 pagesInternational Finance, HedgeJasmin HallNo ratings yet

- NCFM Nse Wealth Management Module BasicsDocument49 pagesNCFM Nse Wealth Management Module BasicssunnyNo ratings yet

- NCFM Irdbm SMDocument66 pagesNCFM Irdbm SMNeha Bhatia100% (1)

- Mutual Funds: A Beginner's ModuleDocument2 pagesMutual Funds: A Beginner's Moduledavidd121No ratings yet

- Fimmda SumsDocument33 pagesFimmda SumsNamrata RoyNo ratings yet

- Kotak Securities - Fundamental Analysis Book 1 - IntroductionDocument8 pagesKotak Securities - Fundamental Analysis Book 1 - IntroductionRajesh Bellamkonda0% (1)

- NISM VA Short NotesDocument86 pagesNISM VA Short NotesPiyush SehlotSSIMNo ratings yet

- Derivatives As A Hedging Tool For Instrumental PlanDocument88 pagesDerivatives As A Hedging Tool For Instrumental Planjitendra jaushikNo ratings yet

- Ipm-Balaji Mba College - KadapaDocument113 pagesIpm-Balaji Mba College - KadapaSaniaNo ratings yet

- NismDocument51 pagesNismMayur WalunjNo ratings yet

- Nism Book Summary: Nismtop500 - Series Iiia-Securities Intr ComplianceDocument44 pagesNism Book Summary: Nismtop500 - Series Iiia-Securities Intr Compliancebhavani sankar areNo ratings yet

- Financial DerivativesDocument2 pagesFinancial DerivativesDreamtech PressNo ratings yet

- NCFM Fees Details PDFDocument2 pagesNCFM Fees Details PDFkadambari naikNo ratings yet

- Series-V-A: Mutual Fund Distributors Certification ExaminationDocument218 pagesSeries-V-A: Mutual Fund Distributors Certification ExaminationAjithreddy BasireddyNo ratings yet

- Securities Market (Basic) Module - RevDocument284 pagesSecurities Market (Basic) Module - RevnnjndjnNo ratings yet

- Indian Debt Market DetailedDocument75 pagesIndian Debt Market DetailedShubham BansalNo ratings yet

- Risk Management in Bse and NseDocument52 pagesRisk Management in Bse and NseAvtaar SinghNo ratings yet

- Financial Modelling 2016 PDFDocument25 pagesFinancial Modelling 2016 PDFĐỗ Đen Đổ Đỏ0% (1)

- Course DMDM PDFDocument2 pagesCourse DMDM PDFriteshsoniNo ratings yet

- Clearing and Settlement: Financial DerivativesDocument28 pagesClearing and Settlement: Financial DerivativesnarunsankarNo ratings yet

- Nism Xiii Common Derivatives Short NotesDocument64 pagesNism Xiii Common Derivatives Short NotesAnsh DoshiNo ratings yet

- Fixed Income MarketsDocument15 pagesFixed Income MarketstoabhishekpalNo ratings yet

- Chapter 3 Securities MarketDocument50 pagesChapter 3 Securities Marketsharktale2828100% (1)

- Top 10 Best Stock Market Courses in India - 62f105f8Document20 pagesTop 10 Best Stock Market Courses in India - 62f105f8Tina RathoreNo ratings yet

- Alternative Investment Strategies A Complete Guide - 2020 EditionFrom EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNo ratings yet

- Investment Portfolio Management A Complete Guide - 2020 EditionFrom EverandInvestment Portfolio Management A Complete Guide - 2020 EditionNo ratings yet

- Quantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesFrom EverandQuantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesRating: 4 out of 5 stars4/5 (1)

- NISM Series-VIII Equity Derivatives Certification ExaminationDocument2 pagesNISM Series-VIII Equity Derivatives Certification ExaminationIntelivisto Consulting India Private Limited50% (2)

- Practice Test Paper & Mock Test For NISM SeriesDocument2 pagesPractice Test Paper & Mock Test For NISM SeriesIntelivisto Consulting India Private LimitedNo ratings yet

- Surveillance in Securites MarketsDocument9 pagesSurveillance in Securites MarketsIntelivisto Consulting India Private LimitedNo ratings yet

- Commodity Derivatives in IndiaDocument3 pagesCommodity Derivatives in IndiaIntelivisto Consulting India Private LimitedNo ratings yet

- Get The CISI Certificate With IntelivistoDocument1 pageGet The CISI Certificate With IntelivistoIntelivisto Consulting India Private LimitedNo ratings yet

- NCFM Modules Study MaterialDocument1 pageNCFM Modules Study MaterialIntelivisto Consulting India Private Limited50% (2)

- NISM Test and Certification ProgramDocument1 pageNISM Test and Certification ProgramIntelivisto Consulting India Private LimitedNo ratings yet

- Uson v. Diosomito, 61 Phil. 535 (1935)Document3 pagesUson v. Diosomito, 61 Phil. 535 (1935)Danica GodornesNo ratings yet

- Controlled CorrespondenceDocument20 pagesControlled CorrespondenceSreekanth ChNo ratings yet

- 2011 FORD E-250 5.4L V8 Fuel Pump & Housing Assembly RockAutoDocument1 page2011 FORD E-250 5.4L V8 Fuel Pump & Housing Assembly RockAutoJoe RomeroNo ratings yet

- JusMundi PDF Claimant S V Respondent S Icc Case No 14431 Initial Interim AwardDocument14 pagesJusMundi PDF Claimant S V Respondent S Icc Case No 14431 Initial Interim AwardthhekmpsryvlfvwuvtNo ratings yet

- Alarm Audio and VideoDocument81 pagesAlarm Audio and VideompicaNo ratings yet

- A Comparative Study On He Performance of Multiphase FlowDocument12 pagesA Comparative Study On He Performance of Multiphase Flowfranciani goedertNo ratings yet

- QM - Master Inspection Characteristic (MIC) GP02Document45 pagesQM - Master Inspection Characteristic (MIC) GP02sapppqmmanloNo ratings yet

- SM32x USB Flash Disk Utility - EnglishDocument19 pagesSM32x USB Flash Disk Utility - EnglishnjfqNo ratings yet

- Gross Domestic Product-An Analysis: ContentsDocument4 pagesGross Domestic Product-An Analysis: ContentsSumeet ChoudharyNo ratings yet

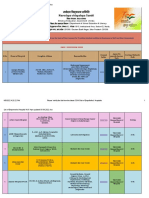

- Navodaya Vidayalaya SamitiDocument100 pagesNavodaya Vidayalaya SamitiAnoopNo ratings yet

- GMP QomDocument75 pagesGMP QomSandy PiccoloNo ratings yet

- Hci Task 01 PDFDocument2 pagesHci Task 01 PDFVS ShirleyNo ratings yet

- DIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeDocument23 pagesDIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeanupthattaNo ratings yet

- Cisco 2960 OpenflowDocument18 pagesCisco 2960 OpenflowLoop AvoidanceNo ratings yet

- Motorola Moto E4 Plus Manual PDFDocument59 pagesMotorola Moto E4 Plus Manual PDFVule VuleNo ratings yet

- FFT ApplicationDocument22 pagesFFT ApplicationShahrukh MushtaqNo ratings yet

- Solutions Manual To Accompany An Introduction To Modern Astrophysics 2nd 9780805304022Document13 pagesSolutions Manual To Accompany An Introduction To Modern Astrophysics 2nd 9780805304022plaudittaborine.pqowz100% (49)

- Remoteness of Damages in Light of TortDocument6 pagesRemoteness of Damages in Light of TortAST TROLLINGNo ratings yet

- CPLA-20-QG06 AVI50219 Schedule 9 Nov 20 - V1.5 - Aug 20 PDFDocument1 pageCPLA-20-QG06 AVI50219 Schedule 9 Nov 20 - V1.5 - Aug 20 PDFkevinNo ratings yet

- A Journal On-Design and Analysis of Industrial Warehouse Using STAAD - Pro .Document8 pagesA Journal On-Design and Analysis of Industrial Warehouse Using STAAD - Pro .Nusrath HuzeifaNo ratings yet

- Child Friendly School S High School 1Document17 pagesChild Friendly School S High School 1Roy C. EstenzoNo ratings yet

- BLOOMBERG Quick Start GuideDocument138 pagesBLOOMBERG Quick Start Guidejean_gourdonNo ratings yet

- Intellectual Property Law: JM - Personal NotesDocument5 pagesIntellectual Property Law: JM - Personal NotesJovita Andelescia MagasoNo ratings yet