Professional Documents

Culture Documents

Freight Forward & Air Cargo

Freight Forward & Air Cargo

Uploaded by

ankitjaipurCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Freight Forward & Air Cargo

Freight Forward & Air Cargo

Uploaded by

ankitjaipurCopyright:

Available Formats

Freight Forwarding and Air Cargo

Freight Forwarding

A freight forwarder, forwarder, or forwarding agent is a person or company that organizes shipments for individuals or corporations to get large orders from the manufacturer or producer to market or final point of distribution. Forwarders will contract with a carrier to facilitate the movement of goods. A forwarder is not typically a carrier, but is an expert in supply chain management. In other words, a freight forwarder is a "travel agent," for the cargo industry, or a third-party (non-asset-based) logistics provider.

Air Cargo

The air cargo industry incorporates an industrial supply chain, which includes airlines, customs, ground services, air cargo forwarders, brokers, domestic transportation, air cargo terminals, distribution centers and integrated international express services. Of these, air cargo terminals are critical in the air cargo supply chain. A typical air cargo terminal has three main users airlines, air cargo terminal operators and forwarders/cargo-agents who are the principal contributors to the revenue of air cargo terminals. Air cargo can be categorized into international and domestic cargo. Within Domestic cargo that is transported by passenger flights through the belly space of aircraft is one and by dedicated freighter aircraft is another variant. Along with normal cargo express delivery cargo which includes Speed of Service, Door-to-door Delivery including completion of all cross border regulatory requirements, Tracking Systems, Proof of Delivery also included in cargo services. Also freight forwarders and other allied services along with carriers play critical role in air cargo services. Domestic Cargo: There are in all, 500 plus Air Cargo Players in the Domestic Sector with 75 at National and regional level providing direct and indirect employment of about a million on pan India basis.10 The industry was valued at Rs. 2015 crores in 2007 2008. 82% of cargo transported as belly cargo in Domestic Airlines. Interline Cargo from International Line haul for Domestic Carriage grew from a share of 4.78% in 2007 2008 to 6.55% in 2009 2010 of the total Domestic Air Cargo business. Following tables displays the growth rate trend for GDP vis a vis domestic and international cargo:

Trends in inbound and outbound Air Cargo Traffic In India outbound traffic is higher compare to inbound traffic in Air cargo . following figure displays the trend in air cargo traffic :

Source : AAI, Ministry of civil Aviation Also though the volume share of Air cargo is much lower compare to sea cargo the value is higher for air cargo. In 2008-09 while volume share counted for only 1.5% , it was around 29% for value based share. In 2010-11 total cargo was around 2.39 MMT with domestic cargo was 0.89 and international cargo was 1.50 MMT. Following figure displays growth in sea cargo and air cargo .

Figure: International trade by Air and Sea Cargo: Value and Volume growth

In 1986 air taxi operators were allowed to provide on-demand services primarily to boost tourism on major routes. Subsequently, based onAir Cargo Open Sky Policy ,any airline whether Domestic or Foreign carriers which met specified operational and safety requirements, were allowed to operate scheduled and non-scheduled cargo services to/from any airports in India wherever customs facilities are available. In addition, regulatory regime over cargo rates for major export commodities was abolished so that carriers are free to set their own rates. Total Cargo Handled at Indian Airports has grown 3.5 times in the last 15 years from 0.68 Million Metric Tonnes (MMT) in 1995-96 to 2.39 MMT in 2010-11 i.e. a CAGR of 8.7%. Domestic Cargo Handled has grown 4 times from 0.22 MMT in 1995-96 to 0.89 MMT in 2010-11 i.e. at a CAGR of 9.7%. Similarly, International Cargo Handled at Indian Airports has grown 3.2 times in the same period from 0.46 MMT to 1.5 MMT i.e. at a CAGR of 8.2%. However, in the last 3 years, Domestic Cargo throughput is the fastest growing segment (CAGR of 13.6%) as compared to International Cargo throughput at a CAGR of 9.2%.

Figure: Freight through across 6 metro citires ( 2010-11 ) Thousand Metric Tonnes

The proportion of belly cargo to the total cargo carried has been declining and stood at 82.8% in 2009-10 from a level of 88.7% in 2000-01; and that of freighter cargo operations has been increasing.The cargo capacity in Passenger aircrafts as part of belly capacity is around 13 to 15 MT; baggage space does not exceed 2 to 3 MT whereas small jet freighter aircrafts have a capacity of 10 to 30 tons, mid-size freighter aircrafts have a capacity of 30 to 80 tons and large freighter aircrafts have a capacity of greater than 80 tons. Figure : Proportion of Scheduled belly cargo and freight cargo

Forecast of Aircraft Traffic MoCA forecasts that the Total Cargo throughput at Indian airports is expected to grow 7.6 times in the next 20 years (CAGR of 11.2). Domestic Cargo throughput is expected to grow 7.8 times in the next 20 years (CAGR of 10.4%). International Cargo throughput is expected to grow 7.5 times in the next 20 years (CAGR of 11.7%). Transshipment segment has significant market potential. It is assumed to be 5% by 2015-16, 10% by 2020-21, 15% by 2025-26 and 20% of International cargo by 2030-31.

Drivers of Air cargo traffic in India Just-in-time manufacturing coupled with global outsourcing business model will continue to push demand for Air cargo business in India. Growth of passenger fleets would provide ample belly capacity for cargo movement both in the domestic and international segment Express industry is certain to grow many folds as provider of fast door to door integrated solutions. At an average of 7-9% over the next 5 years,China and India could be at the epicenter of supply / redistribution in the region. Government of Indias goal is to double exports from $225 Billion to $450 Billion by 2014 and also , GoI aims to enhance share of manufacturing in GDP to 25% by 2020 from current level of 15%. Transshipment throughput at Indian airports is assumed to grow at a much higher rate than what it is now based on a number of factors. Transshipment cargo constitutes as high as 6070% of total volumes handled by some of leading airports tends to be negligible for Indian airports. Also the relaxation for FDI in aviation sector will have positive impact on aviation industry. following figure displays the FDI regulations for aviation sector :

Performance measurement indicators

Dwell time as a performance indicator for air cargo is much higher for Indian airports as shown below:Figure : Dwell time for imports and exports at major airports

MIAL in a written submission has quantified the time taken for clearance of various types of cargo imports for the period from October 2011 to February 2012 which is reproduced below: General Cargo: - Out of the total time of 153.12 hours taken for delivery, 12.27 hours are attributable to custodian and airlines and rest 141.25 hours are attributable to importers, break-bulk agents, CHAs and regulatory agencies. Perishable Cargo: - Out of the total time of 138.09 hours taken for delivery, 11.03 hours are attributable to custodian and airlines and rest 127.06 hours are attributable to importers, break-bulk agents, CHAs and regulatory agencies. DGR Cargo: - Out of the total time of 212.34 hours taken for delivery, 12.36 hours are attributable to custodian and airlines and rest 200.38 hours are attributable to importers, break-bulk agents, CHAs and regulatory agencies.

You might also like

- Baggage Delivery Business ProposalDocument6 pagesBaggage Delivery Business ProposalMamun ChowdhuryNo ratings yet

- IFRS 15 For AirlinesDocument40 pagesIFRS 15 For AirlinesDimakatsoNo ratings yet

- Air Traffic Management: Economics, Regulation and GovernanceFrom EverandAir Traffic Management: Economics, Regulation and GovernanceNo ratings yet

- Training tcgp51 Live Animal Regulations PDFDocument2 pagesTraining tcgp51 Live Animal Regulations PDFsocheata67% (3)

- Global Megatrends and Aviation: The Path to Future-Wise OrganizationsFrom EverandGlobal Megatrends and Aviation: The Path to Future-Wise OrganizationsNo ratings yet

- IATA Loss PreventionDocument112 pagesIATA Loss PreventionShaivik Sharma100% (1)

- Quick Referral - SSIM CHAPTER 6Document12 pagesQuick Referral - SSIM CHAPTER 6ArdhenduNo ratings yet

- AHM39 Changes 20181029Document3 pagesAHM39 Changes 20181029jakchan0% (1)

- FlightsLogic Flight APIDocument10 pagesFlightsLogic Flight APIYaroslav Albert100% (1)

- Jar-Fcl 1 - Flight Crew Licensing (Aeroplane)Document221 pagesJar-Fcl 1 - Flight Crew Licensing (Aeroplane)Enmanuel Perez100% (1)

- Airport Organization and ReorganizationDocument86 pagesAirport Organization and ReorganizationPaula De Medeiros Andrade100% (1)

- 1 Air Transport .TDocument160 pages1 Air Transport .TWondwosen TirunehNo ratings yet

- Design and Implementation of RFID Based Air-Cargo Monitoring SystemDocument12 pagesDesign and Implementation of RFID Based Air-Cargo Monitoring SystemNavi gNo ratings yet

- SWOT Ryanair Air-ScoopDocument6 pagesSWOT Ryanair Air-Scooptushar_02No ratings yet

- Interline Agreements vs. Codeshare Agreements vs. Alliances vs. Joint VenturesDocument5 pagesInterline Agreements vs. Codeshare Agreements vs. Alliances vs. Joint VenturesPranav choudharyNo ratings yet

- Seminar: Air Cargo Supply Chain Management and ChallengesDocument64 pagesSeminar: Air Cargo Supply Chain Management and ChallengesAimms AimmsNo ratings yet

- Introduction To Air Transport Economics From Theory To Applications 201 372Document172 pagesIntroduction To Air Transport Economics From Theory To Applications 201 372Alessio TinerviaNo ratings yet

- CWBPO Shared Service Location Index 2016 PDFDocument32 pagesCWBPO Shared Service Location Index 2016 PDFTrần KiệtNo ratings yet

- Cargo Management White PaperDocument10 pagesCargo Management White PaperFarhan AnjumNo ratings yet

- Baggage TraceDocument2 pagesBaggage TraceRahimi YahyaNo ratings yet

- Airline Traffic, Financial Forecasts and RequirementsDocument19 pagesAirline Traffic, Financial Forecasts and RequirementsJai Sagar100% (1)

- Cargo SecurityDocument2 pagesCargo SecurityPro TectorNo ratings yet

- Code ShareDocument21 pagesCode ShareBipul RaiNo ratings yet

- Preliminary Version of Doc 9562 Airport Economics Manual Fourth Edition 2019 enDocument149 pagesPreliminary Version of Doc 9562 Airport Economics Manual Fourth Edition 2019 enEngr Muhammad KamranNo ratings yet

- Airline IndustryDocument176 pagesAirline Industrykutty3031100% (2)

- Afsma Oct2013 f1 Complete PDFDocument36 pagesAfsma Oct2013 f1 Complete PDF4HakunaMatata4No ratings yet

- Air India Cargo ServiceDocument19 pagesAir India Cargo ServiceHimanshi RathiNo ratings yet

- Guidelines For Removal of The Inadmisable PassengerDocument8 pagesGuidelines For Removal of The Inadmisable PassengerPoltak PujiantoNo ratings yet

- STB White Paper 2017Document36 pagesSTB White Paper 2017Alex SoNo ratings yet

- Air Transport SystemsDocument7 pagesAir Transport SystemsadibaigNo ratings yet

- Low Cost Airlines PROJECT: RYANAIR V/S AIRBERLINDocument13 pagesLow Cost Airlines PROJECT: RYANAIR V/S AIRBERLINROHIT SETHINo ratings yet

- Air Cargo ManagerDocument28 pagesAir Cargo ManagerAdil IbrahimNo ratings yet

- RFP FormatDocument4 pagesRFP FormatSayed A. IqbalNo ratings yet

- CPCSDocument12 pagesCPCSRajeev KumarNo ratings yet

- 29oct NDC TrackDocument89 pages29oct NDC TracksakinaNo ratings yet

- Pom Project PcaaDocument24 pagesPom Project PcaaRana Haris100% (1)

- The Impact of Low-Cost Carriers PDFDocument16 pagesThe Impact of Low-Cost Carriers PDFSohaib EjazNo ratings yet

- FOSI Handbook Vol 2 AOCDocument116 pagesFOSI Handbook Vol 2 AOCMondo BijaineNo ratings yet

- World Air Cargo Forecast 2014 2015Document68 pagesWorld Air Cargo Forecast 2014 2015Ankit Varshney100% (1)

- Dubai International AirportDocument19 pagesDubai International AirportelcivilengNo ratings yet

- The Future of AirportsDocument7 pagesThe Future of AirportsBrazil offshore jobsNo ratings yet

- The Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Document51 pagesThe Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Suyog Funde100% (2)

- Airline Cargo OperationsDocument29 pagesAirline Cargo OperationsRudro Mukherjee75% (4)

- Common Airline Business ModelsDocument12 pagesCommon Airline Business ModelsGianne Sebastian-LoNo ratings yet

- Day01 04 IATA AcostaDocument58 pagesDay01 04 IATA AcostaManuel ReyesNo ratings yet

- All Bags Aboard: Delivering A Baggage Service For The Digital AgeDocument12 pagesAll Bags Aboard: Delivering A Baggage Service For The Digital AgecalvfooNo ratings yet

- Project On Airlines SECTORDocument29 pagesProject On Airlines SECTORaayushilodha100% (1)

- Interline Considerations On Baggage Standards: Guidance Document For AirlinesDocument24 pagesInterline Considerations On Baggage Standards: Guidance Document For AirlinesGutha Giribabu NaiduNo ratings yet

- Ssim Impguide 03 1 Oct03Document147 pagesSsim Impguide 03 1 Oct03api-3845390No ratings yet

- Airline and Cargo ManagementDocument107 pagesAirline and Cargo ManagementMohamed Abdi100% (1)

- 9626 Manul Air Transport RegDocument218 pages9626 Manul Air Transport RegDražen Pečnik100% (1)

- Prepared By, Arslan ShaukatDocument8 pagesPrepared By, Arslan ShaukatArslan ShaukatNo ratings yet

- WorldTracer - Product Sheet Bag Management - S9.2 - AcpDocument5 pagesWorldTracer - Product Sheet Bag Management - S9.2 - AcpezeprooneNo ratings yet

- Passenger Services Conference Resolutions Manual: Resolution 780Document34 pagesPassenger Services Conference Resolutions Manual: Resolution 780Marishi0% (1)

- Summary Air Transport Economics For The Mid Term ExamDocument30 pagesSummary Air Transport Economics For The Mid Term ExamJohn100% (1)

- Subba ReddyDocument47 pagesSubba Reddyankitjaipur0% (1)

- Taco BellDocument18 pagesTaco BellankitjaipurNo ratings yet

- 0438 Supply ChainDocument6 pages0438 Supply ChainFaizan RashidNo ratings yet

- Level-1 Diagram - Online Music StoreDocument1 pageLevel-1 Diagram - Online Music StoreankitjaipurNo ratings yet

- Drugs For Bone MetabolismDocument15 pagesDrugs For Bone MetabolismkwennybiangNo ratings yet

- S04 BoomDocument66 pagesS04 BoomRaul Adrián Quiñonez MadrigalNo ratings yet

- CSN-103: Fundamentals of Object Oriented Programming: Indian Institute of Technology RoorkeeDocument11 pagesCSN-103: Fundamentals of Object Oriented Programming: Indian Institute of Technology RoorkeeParth SinghNo ratings yet

- Phytochemical AnalysisDocument2 pagesPhytochemical AnalysisJaveria SalahNo ratings yet

- 13-Wire MeshDocument2 pages13-Wire MeshthowchinNo ratings yet

- Latitudes and LongitudesDocument31 pagesLatitudes and LongitudesHarsh Vardhan BaranwalNo ratings yet

- DeforestationDocument27 pagesDeforestationRabi'atul Adawiyah Ismail100% (1)

- 1 s2.0 S1364032116305366 MainDocument15 pages1 s2.0 S1364032116305366 MainMeita PratiwiNo ratings yet

- DX GX System Guide ISS 5Document22 pagesDX GX System Guide ISS 5Rafael JazzNo ratings yet

- Verification Manual: WR Written By: The Soilvision Systems Ltd. Team Last Updated: Tuesday, February 20, 2018Document49 pagesVerification Manual: WR Written By: The Soilvision Systems Ltd. Team Last Updated: Tuesday, February 20, 2018Nilthson Noreña ValverdeNo ratings yet

- Roofing Solution - EcoclipDocument7 pagesRoofing Solution - EcoclipWindi Puji WaskitoNo ratings yet

- POLS235 Exam 1Document6 pagesPOLS235 Exam 1defran 262No ratings yet

- BW-700 Manual English 2010-1Document14 pagesBW-700 Manual English 2010-1Βαγγέλης ΓκαρετNo ratings yet

- Thyssenkrupp Industrial Solutions (India) Job Safety Analysis 1 6Document6 pagesThyssenkrupp Industrial Solutions (India) Job Safety Analysis 1 6Nitesh kumar yadavNo ratings yet

- Lecture18-RTL Combinational Components - A-EDocument82 pagesLecture18-RTL Combinational Components - A-EattarshahriarNo ratings yet

- Congruence of TrianglesDocument33 pagesCongruence of Trianglesptv7105No ratings yet

- Gallus and The CulexDocument20 pagesGallus and The CulexkatzbandNo ratings yet

- Anemia 9Document7 pagesAnemia 9Rina FebriantiNo ratings yet

- BOSCH DS9370 Manual de Usuario InglésDocument8 pagesBOSCH DS9370 Manual de Usuario Inglésjulian vargasNo ratings yet

- Importance of ExcitationDocument26 pagesImportance of Excitationtokamaka100% (4)

- Boiler Question and AnswerDocument22 pagesBoiler Question and AnswerKaruppuswamy PalanisamyNo ratings yet

- Nagin Doshi Guidance From Sri Aurobindo Vol IDocument215 pagesNagin Doshi Guidance From Sri Aurobindo Vol IRajbala SinghNo ratings yet

- CV - Nirmal Shanker-CompressedDocument6 pagesCV - Nirmal Shanker-Compressednirmal_elex7863No ratings yet

- Lewis StructureDocument3 pagesLewis StructurerennylowNo ratings yet

- Chapter One: Stress in A Soil From Surface LoadDocument27 pagesChapter One: Stress in A Soil From Surface LoadDAGMAWI ASNAKENo ratings yet

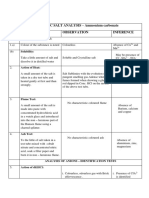

- INORGANIC SALT ANALYSIS - Ammonium Carbonate S.No Experiment Observation InferenceDocument24 pagesINORGANIC SALT ANALYSIS - Ammonium Carbonate S.No Experiment Observation InferenceRyoshiNo ratings yet

- Cement Treatment GIT 1Document12 pagesCement Treatment GIT 1Sparsh ShukalNo ratings yet

- 6.application of Derivatives 2ndPUC PYQsDocument2 pages6.application of Derivatives 2ndPUC PYQstrial userNo ratings yet

- Research Paper On Minor Project123 FINALDocument7 pagesResearch Paper On Minor Project123 FINALSiddharth kumar ChoudharyNo ratings yet

- Rothe Erde Calculation For Slewing BearingDocument2 pagesRothe Erde Calculation For Slewing Bearingankesh_ghoghariNo ratings yet