Professional Documents

Culture Documents

Coba Ralat

Coba Ralat

Uploaded by

Niar IriantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coba Ralat

Coba Ralat

Uploaded by

Niar IriantiCopyright:

Available Formats

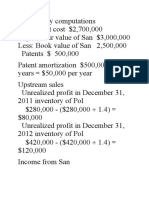

Cost of Investment: 700.000 x 100/70 Book value Excess Alokasi Inventory Plant 80.000 Allocation Goodwill Excess a.

: :

1.000.000 800.000 200.000 20.000 80.000 100.000 100.000 200.000

Capital Stock Retained Earnings, beginning Unamortized excess Investment in S (nilai perolehan) NCI beginning * yang dihapus itu nilai awal. Saldo investasi awal tahun. Retained earning awal, NCI awal dan amortisasi awal Kalo yang ini nilai ending (31 Dec) Parent Invest at 1 Jan 700.000 Net Income 49.000 Dividend (7.000) Allocation Inventory 70% x 20.000 (14.000) Plant 70% x 80.000/8 (7.000) Investment 31 Dec 721.000 NCI invest at 1 Jan 30% x 1.000.000 Net income 30% x 70.000 Allocation: Inventory: 30% x 20.000 Plant: 30% x 80.000/8 Dividend 30% x 10.000 NCI ending

500.000 300.000 200.000 700.000 300.000

: 300.000 : 21.000 (6.000) (3.000) (3.000) 309.000

* pake nilai amortisasi awal (200.000) Kalo pakai nilai Unamortized ending 170.000 berarti masih ada sisa nilai unamortized 30.000. b. Inventory Buildings Goodwill Unamortized exess c. Account Payable Account Receivable Dividend Payable 10.000 10.000 7.000 20.000 80.000 100.000 200.000

d.

Dividend Receivable Investment in S Dividend Jurnal resiprokal dari dividend : P mencatat : Dividend receivable 7.000 Investment in S 7.000 S mencatat : Dividend 7.000 Dividend payable 7.000 e. Income from S Investment in S Eliminasi Income from S Saldo Income from S : NI (70% x 70.000) (-) amortisasi Inventory (70% x 20.000) Plant (70% x 10.000) Income from S 7.000

7.000 7000

28.000 28.000

49.000 14.000 7.000 28.000

f. g.

COGS Inventory Operating expense Plant

20.000 20.000 10.000 10.000

You might also like

- Group 3 - Master Budget-Earrings UnlimitedDocument8 pagesGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNo ratings yet

- Project Case 9-30 Master BudgetDocument6 pagesProject Case 9-30 Master Budgetleizalm29% (7)

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelDocument3 pagesChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- Exercise 1Document5 pagesExercise 1Jade Y80% (5)

- OREN - AC 102 (Quiz 2F)Document4 pagesOREN - AC 102 (Quiz 2F)Leslie Joy OrenNo ratings yet

- Cost Accounting Digos CompanyDocument2 pagesCost Accounting Digos Companyannewilson100% (1)

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- A031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Document2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Rezky ApriliantiNo ratings yet

- Pertemuan 7Document8 pagesPertemuan 7Sagita RajagukgukNo ratings yet

- 8 Cash Budget Example Solution PDFDocument3 pages8 Cash Budget Example Solution PDFmoss roffattNo ratings yet

- Course Project ADocument9 pagesCourse Project AJay PatelNo ratings yet

- Sazkiya Aldina - Lat Soal AKL 1 Chapter 2Document3 pagesSazkiya Aldina - Lat Soal AKL 1 Chapter 2sazkiyaNo ratings yet

- Multinational Finance Eiteman CH 19 No 5Document4 pagesMultinational Finance Eiteman CH 19 No 5Anugrah Juwita SariNo ratings yet

- Activity OperationsDocument9 pagesActivity OperationsJethro GutlayNo ratings yet

- Raihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsDocument4 pagesRaihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsRaihan Rohadatul 'AisyNo ratings yet

- BVPS ReviewerDocument4 pagesBVPS ReviewerDegracia Mia AbegailNo ratings yet

- "Fete N Fiesta" Management Team: Names ShareholdingDocument9 pages"Fete N Fiesta" Management Team: Names ShareholdingMuskan AliNo ratings yet

- December 31 Capital Balance P 180,000 P 120,000: Chi ChuDocument3 pagesDecember 31 Capital Balance P 180,000 P 120,000: Chi ChuBerna LagradaNo ratings yet

- Advanced Accounting CH 14, 15Document16 pagesAdvanced Accounting CH 14, 15jessicaNo ratings yet

- Chapter 8Document3 pagesChapter 8Yasmeen YoussefNo ratings yet

- Book 1Document8 pagesBook 1Alejandra LamasNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- Partnership AccountingDocument46 pagesPartnership AccountingAether SkywardNo ratings yet

- Cost Method Vs Equity MethodDocument5 pagesCost Method Vs Equity MethodRahman Ari MulyajiNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- 2021 CH 7 AnswersDocument8 pages2021 CH 7 AnswersMiquel VillamarinNo ratings yet

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- Tugas 2 - AKL 1Document2 pagesTugas 2 - AKL 1Geroro D'PhoenixNo ratings yet

- Group 3 - Compensation Budget Report - Midterm PT GenMathDocument2 pagesGroup 3 - Compensation Budget Report - Midterm PT GenMathShaff LeighNo ratings yet

- Advance Accounting P14-3Document2 pagesAdvance Accounting P14-3Jeremy BastantaNo ratings yet

- Zenaida Solutions To Exercises Chap 14 15 IncompleteDocument8 pagesZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanNo ratings yet

- Answers 8-1: Surname 1Document6 pagesAnswers 8-1: Surname 1Alkadir del AzizNo ratings yet

- Maria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)Document14 pagesMaria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)maria evangelistaNo ratings yet

- Chapter 14Document5 pagesChapter 14Kiminosunoo LelNo ratings yet

- Santos - Solution FinalsDocument3 pagesSantos - Solution FinalsIan SantosNo ratings yet

- Cost Accounting Assignment #2Document5 pagesCost Accounting Assignment #2BRIANNIE ASRI VIVASNo ratings yet

- CFAS2Document7 pagesCFAS2kaji cruzNo ratings yet

- Cap Table Modeling TemplateDocument11 pagesCap Table Modeling Templatericky_stwnNo ratings yet

- Cap Table Modeling TemplateDocument11 pagesCap Table Modeling TemplateAde Hk100% (1)

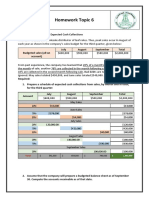

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Partnership QuizzerDocument18 pagesPartnership QuizzerJehannahBarat100% (1)

- Pre-Test 10Document2 pagesPre-Test 10BLACKPINKLisaRoseJisooJennieNo ratings yet

- Piecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsDocument13 pagesPiecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsMario KaunangNo ratings yet

- Piecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsDocument13 pagesPiecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsMario KaunangNo ratings yet

- Engineering Economy 8th Edition Blank Solutions Manual 1Document36 pagesEngineering Economy 8th Edition Blank Solutions Manual 1michellejoneskjdeacngzs100% (29)

- A. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareDocument109 pagesA. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareChris Jay LatibanNo ratings yet

- Acctg Solution Prelim ExamDocument3 pagesAcctg Solution Prelim ExamAbigail ConstantinoNo ratings yet

- Presentasi Kelompok 12 BAB 9Document10 pagesPresentasi Kelompok 12 BAB 9simsonNo ratings yet

- AdvAcct Chapter04 Solutions 07.13Document35 pagesAdvAcct Chapter04 Solutions 07.13Andrew Gladue100% (1)

- Materi 13Document32 pagesMateri 13Elsa RosalindaNo ratings yet

- Proforma of Dale Ct.Document3 pagesProforma of Dale Ct.Wilson4049663818No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet