Professional Documents

Culture Documents

Group 3 - Master Budget-Earrings Unlimited

Uploaded by

Lorena Mae LasquiteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group 3 - Master Budget-Earrings Unlimited

Uploaded by

Lorena Mae LasquiteCopyright:

Available Formats

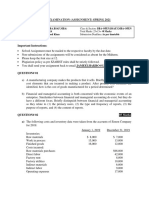

Required: Prepare a master budget for the three-month period ending June 30.

Include the following detailed budgets:

1.a- A sales budget, by month and in total

Earrings Unlimited

Sales Budget

April May June Quarter

Budgeted unit sales 65,000 100,000 50,000 215,000

Selling price per unit x $10 x $10 x $10 x $10

Total Sales $650,000 $1,000,000 $500,000 $2,150,000

1b. A schedule of expected cash collections from sales, by month and in total.

Schedule of expected cash collections:

April May June Quarter

February sales $26,000 $26,000

March Sales (70%,10%) 280,000 $40,000 320,000

April Sales (20%,70%,10%) 130,000 455,000 65,000 650,000

May Sales (20%, 70%) 200,000 700,000 900,000

June sales (20%) 100,000 100,000

Total cash collections $436,000 $695,000 $865,000 $1,996,000

1c. A merchandise purchases budget in units and in dollars.

Show the budget by month and in total.

Merchandise purhases budget:

April May June Quarter

Budgeted unit sales 65,000 100,000 50,000 215,000

Add desired ending inventory

(40% of the next month's unit sales) 40,000 20,000 12,000 12,000

Total needs 105,000 120,000 62,000 227,000

Less beginning inventory 26,000 40,000 20,000 26,000

Required purchases 79,000 80,000 42,000 201,000

Cost of purchases at

$4 per unit $316,000 $320,000 $168,000 $804,000

1d. A schedule of expected cash disbursements for merchandise purchases,

by month and in total.

Budgeted cash disbursements for merchandise purchases:

Accounts payable $100,000 $100,000

April purchases 158,000 $158,000 316,000

May purchases 160,000 $160,000 320,000

June purchases 84,000 84,000

Total cash payments $258,000 $318,000 $244,000 $820,000

2. A cash budget. Show the budget by month and in total.

Determine any borrowing that would be needed to maintain the

minimum cash balance of $50,000.

Earrings Unlimited

Cash Budget

For the Three Months Ending June 30

April May June Quarter

Cash balance $74,000 $50,000 $50,000 $74,000

Add collections from customers 436,000 695,000 865,000 1,996,000

Total cash available $510,000 $745,000 $915,000 $2,070,000

Less disbursements

Merchandise purchases 258,000 318,000 244,000 820,000

Advertising 200,000 200,000 200,000 600,000

Rent 18,000 18,000 18,000 54,000

Salaries 106,000 106,000 106,000 318,000

Commission (4% of sales) 26,000 40,000 20,000 86,000

Utilities 7,000 7,000 7,000 21,000

Equipment purchases - 16,000 40,000 56,000

Dividends paid 15,000 - - 15,000

Total disbursements 630,000 705,000 635,000 1,970,000

Excess (deficiency) of

receipts over disbursments (120,000) 40,000 280,000 100,000

Financing

Borrowings 170,000 10,000 0 180,000

Repayments - - (180,000) (180,000)

Interest

($170,000 x 1% x 3 +

$10,000 x 1% x 2) - - (5,300) (5,300)

Total Financing 170,000 10,000 (185,300) (5,300)

Cash balance, ending $50,000 $50,000 $94,700 $94,700

3. A budgeted income statement for the three-month period ending June 30.

Use the contribution approach.

Earrings Unlimited

Budgeted Income Statement

For the Three Months Ending June 30

Sales (Part 1a) $2,150,000

Variable expenses:

Cost of goods sold @ $4 per unit 860,000

Commission @4% of sales 86,000 946,000

Contribution margin 1,204,000

Fixed expenses

Advertising ($200,000 x 3) 600,000

Rent ($18,000 x 3) 54,000

Salaries (106,000 x 3) 318,000

Utilities ($7,000 x 3) 21,000

Insurance ($3,000 x 3) 9,000

Depreciation ($14,000 x 3) 42,000 1,044,000

Net operating income 160,000

Interest expense (part 2) (5,300)

Net Income $154,700

4. A budgeted balance sheet as of June 30.

Earrings Unlimited

Budgeted Balance Sheet

As of June 30

Assets

Currents Assets

Cash $ 94,700

Accounts Receivable 500,000

Inventory (12,000 units @ $4 per unit) 48,000

Prepaid insurance ($21,000 - $9,000) 12,000

Total Current Assets 654,700

Non Current Asset

Property and equipment, net

($950,000 + $56,000 - $42,000) 964,000

Total non-current asset 964,000

Total Assets 1,618,700

Liabilities and Stockholder's Equity

Liabilities

Accounts payable, purchases (50% x $168,000) 84,000

Dividends payable 15,000

Total liabilities 99,000

Stockholder's equity

Capital stock 800,000

Retained Earnings 719,700

Total Stockholders equity 1,519,700

Total liabilities and stockholder's equity 1,618,700

Notes:

Accounts receivable at June 30:

10% x May sales of $1,000,000 $100,000

80% x June sales of $500,000 400,000

Total $500,000

Retained earnings at June 30:

Balance, March 31 $580,000

Add net income (part 3) 154,700

Total 734,700

Less Dividends declared 15,000

Balance, June 30 $719,700

You might also like

- Bill FrenchDocument5 pagesBill Frenchabigail franciscoNo ratings yet

- GROUP 4 Music Teachers IncDocument4 pagesGROUP 4 Music Teachers IncLorena Mae LasquiteNo ratings yet

- Group 1-Java SourceDocument5 pagesGroup 1-Java SourceLorena Mae LasquiteNo ratings yet

- CVP AnalysisDocument17 pagesCVP AnalysisDave AguilaNo ratings yet

- VANDERBECKCh7 - Multiple Choice (Theory and Problem)Document8 pagesVANDERBECKCh7 - Multiple Choice (Theory and Problem)Saeym SegoviaNo ratings yet

- Piedmont Fasteners Break Even AnalysisDocument9 pagesPiedmont Fasteners Break Even AnalysisAi Lyn100% (1)

- Whitney CompanyDocument4 pagesWhitney CompanyRIZA JOY CAÑETE DELARAGANo ratings yet

- Single Company QuizDocument3 pagesSingle Company QuizShanthan AkkeraNo ratings yet

- Service Organization Segment ReportingDocument6 pagesService Organization Segment ReportingAudrey LouelleNo ratings yet

- Case 16 3 Bill French Case Analysis KoDocument5 pagesCase 16 3 Bill French Case Analysis KoPankit Kedia100% (1)

- CVP Formulas for Analysis of Contribution Margin, Break Even Point & Margin of SafetyDocument4 pagesCVP Formulas for Analysis of Contribution Margin, Break Even Point & Margin of SafetybilalchatthambaNo ratings yet

- EARRINGS UNLIMITED BUDGETDocument3 pagesEARRINGS UNLIMITED BUDGETsinbad9772% (18)

- Case 5 Ans - Charmingly YoursDocument4 pagesCase 5 Ans - Charmingly YoursVaness Grace Aniban100% (4)

- Cost Accounting - Final Exam QuestionsDocument6 pagesCost Accounting - Final Exam QuestionsBo RaeNo ratings yet

- CSU-Andrews Cost Management Quiz 1Document4 pagesCSU-Andrews Cost Management Quiz 1Wynie AreolaNo ratings yet

- Chapter 2-Multi-Product CVP AnalysisDocument53 pagesChapter 2-Multi-Product CVP AnalysisAyeNo ratings yet

- Procurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Document7 pagesProcurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Aqba ImtiazNo ratings yet

- Finals Quiz No 2Document2 pagesFinals Quiz No 2Hello PMNo ratings yet

- Spoilage, Rework, and Scrap: Learning ObjectivesDocument12 pagesSpoilage, Rework, and Scrap: Learning ObjectivesKelvin John RamosNo ratings yet

- Revenues and costs allocation by divisionDocument7 pagesRevenues and costs allocation by divisionlaale dijaan100% (1)

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- ExercisesDocument19 pagesExercisesbajujuNo ratings yet

- OjoylanJenny - Charmingly (Case#5)Document5 pagesOjoylanJenny - Charmingly (Case#5)Jenny Ojoylan100% (1)

- Landau CompanyDocument4 pagesLandau Companyrond_2728No ratings yet

- Management AccountingDocument6 pagesManagement AccountingJohn Allen Cruz Caballa100% (2)

- Cost Accounting Chapter 11Document6 pagesCost Accounting Chapter 11Random100% (1)

- Ch18 Spoilage Reword and Scrap TestDocument36 pagesCh18 Spoilage Reword and Scrap TestSweet Emme50% (2)

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- MASDocument10 pagesMASMelvin TalaveraNo ratings yet

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- Chapter 16 SolutionDocument3 pagesChapter 16 Solutionamitkrhpcic100% (1)

- MS02 Relevant Costs Special Order and Sell or Process FurtherDocument5 pagesMS02 Relevant Costs Special Order and Sell or Process FurtherIohc NedmiNo ratings yet

- Chapter 7 Materials Controlling and CostingDocument43 pagesChapter 7 Materials Controlling and CostingNabiha Awan100% (1)

- Cost Volume Profit Analysis - With KEYDocument8 pagesCost Volume Profit Analysis - With KEYPatricia AtienzaNo ratings yet

- Segmented Income Statement - L01-7Document5 pagesSegmented Income Statement - L01-7Yza Belle Soldevilla Vego100% (1)

- Actg 10 - MAS Midterm ExamDocument24 pagesActg 10 - MAS Midterm Examjoemel091190100% (1)

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- Zappos AnalysisDocument3 pagesZappos AnalysisShiela Marie PintorNo ratings yet

- HW 6-19Document9 pagesHW 6-19tgawri100% (2)

- Chap7vanderbeck ReviewerDocument8 pagesChap7vanderbeck ReviewerSaeym SegoviaNo ratings yet

- Assignment On Segment Reporting, Jonas Albert AtasDocument2 pagesAssignment On Segment Reporting, Jonas Albert AtasJonasAlbertAtasNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Delaney Motors CaseDocument15 pagesDelaney Motors CaseVan DyNo ratings yet

- 4a Standard Costs and Analysis of VariancesDocument3 pages4a Standard Costs and Analysis of VariancesGina TingdayNo ratings yet

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- Guslits Grunwald CaseDocument2 pagesGuslits Grunwald CaseArmin Joel Dimalibot100% (1)

- LPP - Problem Number 2Document9 pagesLPP - Problem Number 2CT SunilkumarNo ratings yet

- Bus Trans Taxes Key Solution PTVAT 2013 2014Document17 pagesBus Trans Taxes Key Solution PTVAT 2013 2014Jandave ApinoNo ratings yet

- Quick Lunch CaseDocument4 pagesQuick Lunch CaseChleo EsperaNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Delaney Motors Case SolutionDocument13 pagesDelaney Motors Case SolutionParambrahma Panda100% (2)

- Incremental Analysis E7-11Document2 pagesIncremental Analysis E7-11Rehairah Munirah100% (1)

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Project Case 9-30 Master BudgetDocument6 pagesProject Case 9-30 Master Budgetleizalm29% (7)

- Earrings Unlimited Sales and Cash Budget AnalysisDocument6 pagesEarrings Unlimited Sales and Cash Budget AnalysisLandon GalenskiNo ratings yet

- Case StudiesDocument6 pagesCase StudiesFrancesnova B. Dela PeñaNo ratings yet

- MAS ExerciseDocument9 pagesMAS ExerciseAlaine Milka GosycoNo ratings yet

- Proj 2Document15 pagesProj 2Shahan AsifNo ratings yet

- Financial PlanningDocument6 pagesFinancial Planningakimasa raizeNo ratings yet

- Midterm ExamDocument7 pagesMidterm ExamLorena Mae LasquiteNo ratings yet

- Case No. 1Document2 pagesCase No. 1Lorena Mae LasquiteNo ratings yet

- GROUP 6-Case-Wesco-Inc.Document4 pagesGROUP 6-Case-Wesco-Inc.Lorena Mae LasquiteNo ratings yet

- Chapter 4-Case StudyDocument2 pagesChapter 4-Case StudyLorena Mae LasquiteNo ratings yet

- "Tufstuff, Inc" Requirement 1: Group CaseDocument10 pages"Tufstuff, Inc" Requirement 1: Group CaseLorena Mae LasquiteNo ratings yet

- "Tufstuff, Inc" Requirement 1: Group CaseDocument10 pages"Tufstuff, Inc" Requirement 1: Group CaseLorena Mae LasquiteNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Group 3 - Master Budget-Earrings UnlimitedDocument8 pagesGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Resolution Amendingthe Applicable SOLRRateDocument3 pagesResolution Amendingthe Applicable SOLRRateAbbi PerezNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- Pala Postivabrik as-1, Mait Kalmus, Mike CalamusDocument11 pagesPala Postivabrik as-1, Mait Kalmus, Mike CalamusTeabeamet Teabe Amet LuureAmetNo ratings yet

- Employee Cost AnalysisDocument9 pagesEmployee Cost AnalysisGokarakonda SandeepNo ratings yet

- Cost of DebtDocument6 pagesCost of DebtrajisumaNo ratings yet

- Event Tree Analysis ExplainedDocument13 pagesEvent Tree Analysis Explainedananthu.u100% (1)

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- Demand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Document3 pagesDemand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Muchangi KamitaNo ratings yet

- Collection Development PDFDocument3 pagesCollection Development PDFolalekan jimohNo ratings yet

- Bussiness Model Canvas Dian Paramita 2Document2 pagesBussiness Model Canvas Dian Paramita 2Muhammad RusyadiNo ratings yet

- Consumer Behavior 12th Edition Schiffman Test BankDocument31 pagesConsumer Behavior 12th Edition Schiffman Test Bankrowanbridgetuls3100% (24)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceProficient CyberNo ratings yet

- IMC Plan - Nhóm 5 - PowerpointDocument25 pagesIMC Plan - Nhóm 5 - PowerpointQuỳnh Lai PhươngNo ratings yet

- Business Organizations: Dennis Guardado Bmhs-3A January 5, 2021 POADocument9 pagesBusiness Organizations: Dennis Guardado Bmhs-3A January 5, 2021 POADennis GuardadoNo ratings yet

- Merchandising - Journal EntriesDocument3 pagesMerchandising - Journal EntriesBhea Ballesteros CabasanNo ratings yet

- Slots, Tables, and All That Jazz: Managing Customer Profitability at MGM Grand Hotel (Do All The Questions)Document3 pagesSlots, Tables, and All That Jazz: Managing Customer Profitability at MGM Grand Hotel (Do All The Questions)Ankita jainNo ratings yet

- Solved A Monopolist Operates With The Following Data On Cost andDocument1 pageSolved A Monopolist Operates With The Following Data On Cost andM Bilal SaleemNo ratings yet

- Dwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFduongnujl33q100% (11)

- Food Quality FactorsDocument19 pagesFood Quality FactorsBubacarr Fatty100% (9)

- 12 Acc c3 Prelim Exam p2 2023 QP AbDocument23 pages12 Acc c3 Prelim Exam p2 2023 QP AbPax AminiNo ratings yet

- Laboratory Activity - HIS Lab - Material Management SystemDocument2 pagesLaboratory Activity - HIS Lab - Material Management SystemKat OrcinoNo ratings yet

- Reflection on Experiences and Organizational Behavior Concepts Learned this SemesterDocument6 pagesReflection on Experiences and Organizational Behavior Concepts Learned this SemesterVaneet SinglaNo ratings yet

- Transactions: The Barclays Bank A/C 20-77-85 43223280Document2 pagesTransactions: The Barclays Bank A/C 20-77-85 43223280Doris Zhao100% (2)

- Walmart - Market Leader StrategiesDocument4 pagesWalmart - Market Leader Strategiesmurtaza mannanNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- The Gold Mine - Field Book For Lean TrainersDocument12 pagesThe Gold Mine - Field Book For Lean TrainersC P ChandrasekaranNo ratings yet

- Nil 20210313Document32 pagesNil 20210313Ambrosia NeldonNo ratings yet

- Top Agrochemical Suppliers in Tamil NaduDocument6 pagesTop Agrochemical Suppliers in Tamil NadumjmariaantonyrajNo ratings yet

- A Complete Guide To Credit Risk Modelling PDFDocument30 pagesA Complete Guide To Credit Risk Modelling PDFAvanish KumarNo ratings yet