Professional Documents

Culture Documents

Energy and Resources Projects Are The Main Focus of Our Investment Strategy

Energy and Resources Projects Are The Main Focus of Our Investment Strategy

Uploaded by

Karthik Krishna Rupesh VanamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Energy and Resources Projects Are The Main Focus of Our Investment Strategy

Energy and Resources Projects Are The Main Focus of Our Investment Strategy

Uploaded by

Karthik Krishna Rupesh VanamaCopyright:

Available Formats

Energy and Resources projects are the main focus of our investment strategy.

This web site offers you the chance to invest in the developments. AP Energy Invest Ltd does not own the actual projects, we simply are investing in various aspects of them. Below are some examples of the giant projects underway that we have interests in.

Australia - Pilbara - FMG Chichester - Iron Ore Mine, Rail and Port Development Fortescue Metals Group Ltd FMG Chichester operates iron ore mines at Cloudbreak and Christmas Creek in the Chichester Ranges of the eastern Pilbara, serviced by a multiuser railway and port facilities at Port Hedland. FMG Chichester is currently ramping production up to 120Mtpa from the Chichester Ranges. Employment: Construction: 2500; Operation: 3200 Australia - Great Southern Region - Mount Cattlin Lithium Project, Ravensthorpe Galaxy Resources Limited Galaxy Resources Limited commenced commissioning of the Mt Cattlin lithium concentrate processing plant in September 2010. The mine and the mineral plant will produce approx. 137,000tpa of spodumene concentrate. Galaxy commenced exporting its product to China in the first quarter of 2011. In China, Galaxy will produce 17,000tpa of battery grade lithium carbonate. A large proportion of this will make its way into the growing markets of China and Japan. Expenditure: $75m. Employment: Construction: 100; Operation: 75

Australia - Mid West Region - Extension Hill Hematite Mine Mount Gibson Iron Limited Mount Gibson Iron has environmental approval for a 3Mtpa hematite mining operation at Extension Hill, 260km south east of Geraldton. The ore will be trucked to a rail head near Perenjori then railed to the port of Geraldton for export. Construction has commenced with first shipments expected to be in Q3 2011. Expenditure: $73m. Employment: Construction: 150; Operation: 100 Australia - Mid West Region - Karara Iron Ore Karara Mining Ltd (Gindalbie Metals Ltd / Ansteel Joint Venture) The Karara Iron Ore Project is Karara Mining's cornerstone production project in the Mid West region. Construction commenced in November 2009. Karara will deliver some 10Mtpa of iron products by Q2 2012 comprising 8Mtpa of high grade magnetite concentrate and blast furnace quality pellets and 2Mtpa of Direct Shipping Ore hematite. The Project is underpinned by a world-class JORC-Code compliant resource base comprising a 977 million tonne magnetite reserve, a 2.518 billion tonne magnetite resource, a 10.9Mt hematite reserve and a 16.2Mt hematite resource. Expenditure: $1.975b. Employment: Construction: 1500; Operation: 500 Australia - Pilbara - BHPB - Inner Harbour Expansion Port Hedland BHP Billiton Iron Ore Pty Ltd In March 2011, BHP Billiton announced approval of $6.71 billion (BHP Billiton's share $5.98 billion) of capital investment to continue production growth in the

company's Western Australian iron ore operations. It will deliver an integrated operation with capacity in excess of 220Mtpa. The investment includes $1.72 billion (BHP Billiton's share) to increase total inner harbour installed capacity to 220Mtpa with debottlenecking opportunities to 240Mtpa. The project is currently on schedule (overall project is 30 per cent complete) and on budget. Expenditure: $1.722b Employment: Figures not currently available. Australia - Yilgarn - Koolyanobbing Iron Ore Upgrade Cliffs Asia Pa cific Iron Ore Pty Ltd In September 2010, Cliffs approved an upgrade of its Koolyanobbing iron ore operations from 8.5Mtpa to around 11Mtpa. Koolyanobbing is located 50km north east of Southern Cross and also includes the Mt Jackson and Windarling mines. The upgrade is expected to consist of enhancements to the existing Kalgoorlie-Esperance rail infrastructure, an increase in rolling stock and decreasing constraints at various other existing operational areas. Cliffs anticipates these improvements to be fully implemented in the second half of 2012. The development of the Mt Jackson J1 deposit, which contains 30Mt of iron ore reserves, is currently underway and is expected to contribute to the increased production. Expenditure: $320m. Australia - Ravensthorpe - Ravensthorpe Nickel Operation First Quantum Minerals Australia Nickel Pty Ltd FQM Australia Nickel (FQMAN) acquired the Ravensthorpe Nickel Operation (RNO) from BHP Billiton in February 2010. FQMAN plans to return RNO to

sustainable production by late 2011. RNO is an open cut mine and hydrometallurgical process plant that produces a mixed nickel cobalt hydroxide intermediate product. The modifications are within the plant's existing footprint in the materials handling area, including crushing, conveying and stockpiles. FQMAN aims to produce 39,000tpa nickel metal for the first five years after recommencement and 28,000tpa nickel metal over the current anticipated mine life of 32 years. Expenditure: $190m. Employment: Construction: 200; Operation: 500 Australia - Carnarvon Basin - Pluto LNG Project Woodside Energy Approved for development in July 2007, the project will process gas from the Pluto and Xena gas fields, located about 190km north-west of Karratha in Western Australia, into LNG and condensate. The Pluto and Xena gas fields are estimated to contain 4.8 trillion cubic feet (Tcf) of dry gas reserves and an additional 0.25Tcf of contingent resources. The initial phase of the Pluto LNG Project comprises five subsea wells on the Pluto gas field connected to an offshore processing platform in 85m of water. Gas will be piped about 180km to the onshore plant in a 36-inch pipeline. Onshore facilities at the Pluto LNG Park include a single LNG processing train with forecast production capacity of 4.3 million tonnes a year, in addition to storage facilities and an export jetty. First LNG cargo is estimated for March 2012. Expenditure: $14.9b. Employment: Construction: 5000; Operation: 300 Australia - Carnarvon Offshore Basin - Barrow Island Gorgon Project Gorgon Joint Venture

The Gorgon Joint Venture (GJV) made a final investment decision on the $43 billion Gorgon Project on 14 September 2009. The GJV's foundation project on Barrow Island includes a three train LNG development capable of exporting 15Mtpa and a domestic gas project capable of delivering at least 300 terajoules per day of gas to the mainland. The development on Barrow Island also includes potentially the largest commercial geosequestration project in the world. The project obtained State and Commonwealth environmental approval in August 2009. The project is based on gas from both the offshore Gorgon and Jansz/Io gas fields. On-island activity commenced in late 2009 and the major construction work for the processing plant is scheduled to commence in 2011. Expenditure: $43b. Employment: Construction: 5500; Operation: 300 Australia - Carnarvon Offshore Basin - North Rankin North Rankin Redevelopment Woodside Energy In March 2008, the North West Shelf Project participants approved funding of the A$5 billion North Rankin Redevelopment which will recover remaining low pressure gas from the North Rankin and Perseus gas fields, and extend the field life to around 2040. The project involves the installation of a new second platform - North Rankin B - with gas compression facilities, low pressure separators, utilities and accommodation. North Rankin B will be connected by two 100 metre bridges to the existing North Rankin A platform and on completion both platforms will be operated as a single integrated facility known as the North Rankin hub. The North Rankin Redevelopment project also includes the necessary connections to North Rankin A and some

refurbishment of the North Rankin A platform. North Rankin B is scheduled for start-up in 2013 and will support the North West Shelf Project's onshore gas requirements to supply future customer commitments. Expenditure: $5b. Papua New Guinea - Solwara 1 Project Nautilus Minerals Nautilus Minerals current focus remains on delivering a cost effective and efficient system for their first commercial development, the Solwara 1 Project, which is located at 1600 metres water depth in the Bismarck Sea, Papua New Guinea. The Company released an independent Definition and Cost Study ("Study") for the Solwara 1 Project in the second quarter of 2010. The Study provides in depth details on resources, production planning and equipment to be used in the proposed operations. The key conclusions for the Solwara 1 Offshore Production System are: Capital costs, including those associated with barging to the Port of Rabaul, estimated to be US$383 million (including a 17.5% contingency). Average operating costs to the Port of Rabaul estimated at US$70 per tonne (including a 10% contingency) based on a 1.35 million tonnes per year production rate. Production rate commencing at 1.2 million tonnes per year (dry equivalent) with capacity to ramp up to 1.8 million tonnes per year. Once approved by the Board of Nautilus, the build program is 30 months to commence commercial production. Through strategic partnerships and collaboration with industry leaders from around the globe, the Company is refining existing technologies for the Solwara 1 project. Technologies from surface mining (rock cutting), dredging (slurry pumping/hard rock cutting/gathering) and offshore oil

and gas (trenching/Remotely Operated Vehicles ("ROVs")/risers) sectors are being combined and adapted for the Solwara 1 Production System. Papua New Guinea Gulf of Papua BAM Clough Joint Venture In August 2010 the Chiyoda JGC Joint Venture (CJJV) awarded the contract to design and construct the LNG and condensate offloading jetty for the PNG LNG project to the BAM Clough Joint Venture. The total value of the award is approximately US$261 million and represents a third contract for Clough on the PNG LNG project. The LNG and condensate jetty will be constructed adjacent to the planned LNG facility twenty kilometres northwest of Port Moresby on the coast of the Gulf of Papua, utilising an anticipated workforce of 500 people. The scope includes the design and construction of a 2.4 kilometre long trestle with substation platform, loading platform and single berth. In October 2010, BAM Clough received an additional Letter of Intent for the fabrication and construction of the topsides for the PNG LNG condensate offloading jetty. The second contract is valued at approximately US$53 million, bringing the total value of contracts awarded to BAM Clough for the PNG LNG jetty project to US$314 million. An integrated design team within the Project Organisation ensures short communication lines and frequent constructability reviews integrated throughout the development of the design.

You might also like

- Atrum Coal Investment Fact Sheet February 2012Document2 pagesAtrum Coal Investment Fact Sheet February 2012Game_BellNo ratings yet

- Offshore Production FacilitiesDocument8 pagesOffshore Production FacilitiesPercival Wulfric Brian100% (1)

- Kanmantoo Construction and Commissioning UpdateDocument4 pagesKanmantoo Construction and Commissioning UpdatehabilyigitNo ratings yet

- 2011 Annual Report FinalDocument88 pages2011 Annual Report FinalrusoexpressNo ratings yet

- NWS Corporate Brochure v17Document2 pagesNWS Corporate Brochure v17jbloggs2007No ratings yet

- Australia Is Poised For A New Era of Mining GrowthDocument4 pagesAustralia Is Poised For A New Era of Mining GrowthKhor Tze MingNo ratings yet

- Market Announcement: Completion of $5 Million Capital RaisingDocument6 pagesMarket Announcement: Completion of $5 Million Capital RaisingRodolfo Carrillo ArenasNo ratings yet

- Coalfax.23 August 2012Document1 pageCoalfax.23 August 2012vvvarunn6530No ratings yet

- KararaDocument9 pagesKararaAnatoliy D LigayNo ratings yet

- West Pilbara Iron Ore Project Definitive Feasibility StudyDocument7 pagesWest Pilbara Iron Ore Project Definitive Feasibility StudyFitra Dwi100% (1)

- LNC - August 1 2013 - Quarterly Activities ReportDocument38 pagesLNC - August 1 2013 - Quarterly Activities ReportdigifiNo ratings yet

- N Territory Petroleum Leases PDFDocument4 pagesN Territory Petroleum Leases PDFnik_ramli7391No ratings yet

- Brief History of Acquiring CompanyDocument13 pagesBrief History of Acquiring CompanyVarun SharmaNo ratings yet

- 07pa TM 3 5 PDFDocument10 pages07pa TM 3 5 PDFMarcelo Varejão CasarinNo ratings yet

- Atrum Coal Investment Fact Sheet February 2012Document3 pagesAtrum Coal Investment Fact Sheet February 2012mekarsari retnoNo ratings yet

- Top Ten Biggest Lithium Mines in The World Based On ReservesDocument12 pagesTop Ten Biggest Lithium Mines in The World Based On Reservesjeetjain02No ratings yet

- Calcatreu 7Document237 pagesCalcatreu 7ricar20100% (1)

- Kendal Coal Mine, Witbank, South AfricaDocument3 pagesKendal Coal Mine, Witbank, South Africamnazzal17No ratings yet

- PM607 Assessment 2 PIB Scenario Sem2 2016Document4 pagesPM607 Assessment 2 PIB Scenario Sem2 2016Radhianie DjanNo ratings yet

- Kidstone Mines Start UpDocument5 pagesKidstone Mines Start UpCraftychemistNo ratings yet

- Nalco Rti-Cicdireunders19 8 RevDocument64 pagesNalco Rti-Cicdireunders19 8 RevSuneli SuhaniNo ratings yet

- Env Impact Assessment KelticPetroDocument249 pagesEnv Impact Assessment KelticPetrorome_n21No ratings yet

- ALTA 2020 NCC - Queensland Pacific MetalsDocument19 pagesALTA 2020 NCC - Queensland Pacific MetalssirbrianmiloNo ratings yet

- Nickel and Cobalt Mining in PhilippinesDocument2 pagesNickel and Cobalt Mining in PhilippinesJunel AlapaNo ratings yet

- Construction Plan of 400MW TPPDocument16 pagesConstruction Plan of 400MW TPPdupe2010No ratings yet

- Power PlantsDocument9 pagesPower PlantsGabriel SuguitanNo ratings yet

- Kangaroo Pakar AcquisitionDocument7 pagesKangaroo Pakar Acquisitionjmport00No ratings yet

- Tarong Project Fact SheetDocument2 pagesTarong Project Fact SheetDennis BowtellNo ratings yet

- ALTA 2022 NCC - Queensland Pacific Metals (6 May)Document24 pagesALTA 2022 NCC - Queensland Pacific Metals (6 May)sirbrianmiloNo ratings yet

- Commissioning of BFPLDocument11 pagesCommissioning of BFPLsaravananknpcNo ratings yet

- Info MineDocument10 pagesInfo MineUpdatest newsNo ratings yet

- Informe - 468 - 18-11-2022bDocument44 pagesInforme - 468 - 18-11-2022bMadahi Katherine Garcia MedranoNo ratings yet

- Galaxy Resources ReportDocument28 pagesGalaxy Resources Reportokeydokey01No ratings yet

- Ndonesia: by Chin S. KuoDocument8 pagesNdonesia: by Chin S. KuoAldo BagusNo ratings yet

- Business Report On Pilbara Port AuthoritiesDocument14 pagesBusiness Report On Pilbara Port AuthoritiesNishant kumarNo ratings yet

- Completion of Alacer Gold Corp.'S Australian Business Unit AcquisitionDocument3 pagesCompletion of Alacer Gold Corp.'S Australian Business Unit AcquisitionihopethisworksNo ratings yet

- Trevali Mining On The Path To ProductionDocument16 pagesTrevali Mining On The Path To ProductionOld School ValueNo ratings yet

- Moving Dirt LatestDocument76 pagesMoving Dirt LatestFrederick Martinez TrujilloNo ratings yet

- Malagasy Aquires Karlawinda Gold Project: HighlightsDocument7 pagesMalagasy Aquires Karlawinda Gold Project: HighlightsOwm Close CorporationNo ratings yet

- 02-07-02 (Lalala1)Document9 pages02-07-02 (Lalala1)Precious BalgunaNo ratings yet

- ASX Carrapateena Release and PresentationDocument33 pagesASX Carrapateena Release and PresentationStephen DNo ratings yet

- Productora Pre-Feasibility Gets Go-Ahead After Scoping Study Finds Project Is On-Track To Be A Major Low-Cost Copper ProducerDocument6 pagesProductora Pre-Feasibility Gets Go-Ahead After Scoping Study Finds Project Is On-Track To Be A Major Low-Cost Copper ProducerEzequiel Guillermo Trejo NavasNo ratings yet

- Kayelekera Mine Malawi, Southern Africa: in Production Ramp-UpDocument4 pagesKayelekera Mine Malawi, Southern Africa: in Production Ramp-UpRanken KumwendaNo ratings yet

- Northern Australia Portfolio: Project OverviewDocument2 pagesNorthern Australia Portfolio: Project Overviewgraceenggint8799No ratings yet

- 337TO 003 World's Largest FLNG PreludeDocument9 pages337TO 003 World's Largest FLNG PreludeRamNo ratings yet

- Positive Pre-Feasibility Outcome For Cloncurry Copper ProjectDocument13 pagesPositive Pre-Feasibility Outcome For Cloncurry Copper Projectsbirol5409No ratings yet

- This Is Hatch 2011Document56 pagesThis Is Hatch 2011alibaba011No ratings yet

- Independent Expert Review Uncovers 623,000 Ounces of Gold Resources at CNMC's Sokor Flagship Project Despite DepletionDocument3 pagesIndependent Expert Review Uncovers 623,000 Ounces of Gold Resources at CNMC's Sokor Flagship Project Despite DepletionWeR1 Consultants Pte LtdNo ratings yet

- Asian Oil and Gas-January-February 2013Document24 pagesAsian Oil and Gas-January-February 2013jedi_pandaNo ratings yet

- Energy: P Oje CTP Rof Ile RDocument18 pagesEnergy: P Oje CTP Rof Ile RAli RazaNo ratings yet

- GLNG Investor Tour PresentationDocument39 pagesGLNG Investor Tour PresentationchasstyNo ratings yet

- Cygnus Energy LNG News Weekly 07th May 2021Document14 pagesCygnus Energy LNG News Weekly 07th May 2021Sandesh Tukaram GhandatNo ratings yet

- Oilshale Country NotesDocument16 pagesOilshale Country NotesminurkashNo ratings yet

- Victory West Moly To Acquire A Majority Interest in Highly Prospective DSO Nickel Project in South Sulawesi, IndonesiaDocument6 pagesVictory West Moly To Acquire A Majority Interest in Highly Prospective DSO Nickel Project in South Sulawesi, IndonesiaWahyu Hidayat BaderuNo ratings yet

- WA Ports HandbookDocument28 pagesWA Ports HandbookMark-SimonNo ratings yet

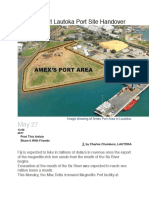

- Amex To Get Lautoka Port Site HandoverDocument3 pagesAmex To Get Lautoka Port Site Handovercoupfourpointfive100% (1)

- Thar CoalDocument33 pagesThar CoalBilal Ahmed TunioNo ratings yet

- National Aluminium Company Limited (NALCO)Document5 pagesNational Aluminium Company Limited (NALCO)Smita DasNo ratings yet

- Clean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeFrom EverandClean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeRating: 4 out of 5 stars4/5 (1)

- Will Cheap Asian HPAL Save The EV Industry From Its Looming SuccessDocument10 pagesWill Cheap Asian HPAL Save The EV Industry From Its Looming SuccessDartwin ShuNo ratings yet

- Pengolahan NikellDocument31 pagesPengolahan NikellBahta WijayaNo ratings yet

- 2008 Oct Ravensthorpe PresentationDocument21 pages2008 Oct Ravensthorpe PresentationTimBarrowsNo ratings yet

- 2008 Oct Stainless Steel PresentationDocument62 pages2008 Oct Stainless Steel PresentationTimBarrowsNo ratings yet