Professional Documents

Culture Documents

Cash Flow STMT

Uploaded by

Santhosh ShettyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow STMT

Uploaded by

Santhosh ShettyCopyright:

Available Formats

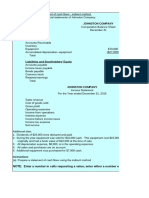

CASH FLOW STATEMENT OF S.L.FLOWCONTROLS PVT LTD.

, Step Change in Cash: Dec 31, 2011 Balance minus Dec 31,2010 balance ($54,000-$37,000)=$17,000 1: Step 2: Net Cash flow from Operating Activities Direct Method: Cash collected from Revenues Cash payments for Expenses Interest Expense Income before Income Taxes Income Taxes Net cash flow from Operating Activities Comments: The $848,000 was derived by subtracting the change in Accts Receivable from Revenues for the period. The cash payments for expenses was derived by adding the actual cash expended on inventory ($465,000 + 54,000) plus operating expenses adjusted for the change in accounts payable (+7,000), prepaid expenses (-2,000), and reduced by the included depreciation expense ($33,000). Indirect Method: Net Income Adjustments to reconcile net income to net cash Accts Receivable decrease ($42,000) Prepaid Expense decrease $2,000 Inventory increase ($54,000) Accts Payable decrease ($7,000) Loss on Equipment Sale $2,000 Depreciation $33,000 Net cash flow from Operating Activities

$848,000 $712,000 $12,000 $136,000 $65,000 $59,000

$125,000

($66,000) $59,000

Step 3: Investing Activities Land Sale Equipment Sale Equipment Purchase Financing Activities Issuance of Common Stock Redemption of Bonds Payable Dividend payment to shareholders

$25,000 $34,000 ($166,000) $160,000 ($40,000) ($55,000)

Statement of Cash Flows Cash Flow from Operating Activities Net Income Adjustments to reconcile net income to net cash Accts Receivable decrease ($42,000) Prepaid Expense decrease $2,000 Inventory increase ($54,000) Accts Payable decrease ($7,000) Loss on Equipment Sale $2,000 Depreciation $33,000 Net cash provided from Operating Activities Investing Activities Land Sale Equipment Sale Equipment Purchase Financing Activities Issuance of Common Stock Redemption of Bonds Payable Dividend payment to shareholders Net Decrease in Cash Cash Jan 1, 2011 Cash Dec 31, 2011

$125,000

($66,000) $59,000 $25,000 $34,000 ($166,000) ($107,000) $160,000 ($40,000) ($55,000)

$65,000 $17,000 $37,000 $54,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A 201 Chapter 12Document14 pagesA 201 Chapter 12blackprNo ratings yet

- Chaechapter 7 SolutionsDocument16 pagesChaechapter 7 Solutionsmadddy_hydNo ratings yet

- Chapter 3 ProFormaDocument15 pagesChapter 3 ProFormaNancy LuciaNo ratings yet

- Financial Reporting & Analysis Solutions Statement of Cash Flows ExercisesDocument72 pagesFinancial Reporting & Analysis Solutions Statement of Cash Flows ExerciseskazimkorogluNo ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Statement of Cash Flows 3Document7 pagesStatement of Cash Flows 3Rashid W QureshiNo ratings yet

- Exercises On Cash Flow StatementsDocument3 pagesExercises On Cash Flow StatementsSam ChinthaNo ratings yet

- ContabilidadDocument38 pagesContabilidadEshianneNo ratings yet

- Chapter 5Document8 pagesChapter 5AriaNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Cash Flow Statement ReviewDocument3 pagesCash Flow Statement ReviewSarah WinzenriedNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- ABC Company comparative balance sheet and income statement analysisDocument6 pagesABC Company comparative balance sheet and income statement analysisruruNo ratings yet

- Practice Problems, CH 5 SolutionDocument6 pagesPractice Problems, CH 5 SolutionscridNo ratings yet

- ACC1002 Team 8Document11 pagesACC1002 Team 8Yvonne Ng Ming HuiNo ratings yet

- Financial Statements ExplainedDocument36 pagesFinancial Statements ExplainedTakouhiNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Managerial Accounting1Document33 pagesManagerial Accounting1MM-Tansiongco, Keino R.No ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- Ch1-Homework Solutions (A Problems)Document11 pagesCh1-Homework Solutions (A Problems)jmdd555100% (1)

- Accounting-8264829Document6 pagesAccounting-8264829nathardeen2000100% (3)

- Assignment EMB660Document11 pagesAssignment EMB660Ashekin MahadiNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Cash Flow Activities of 5 CompaniesDocument6 pagesCash Flow Activities of 5 CompaniesFariha tamannaNo ratings yet

- Chap 007Document16 pagesChap 007dbjn100% (1)

- Solutions Chapter 23Document11 pagesSolutions Chapter 23Avi SeligNo ratings yet

- Latihan Soal Sebelum UAS 29 April 2023Document14 pagesLatihan Soal Sebelum UAS 29 April 2023Ritsu SenkaNo ratings yet

- ACC101 Chapter1newDocument16 pagesACC101 Chapter1newtazebachew birkuNo ratings yet

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresNo ratings yet

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- Acct 2301 FinaDocument42 pagesAcct 2301 FinaFabian NonesNo ratings yet

- Reporting and Interpreting Cash Flows AnswersDocument6 pagesReporting and Interpreting Cash Flows AnswersMostakNo ratings yet

- Answer Key: Sample Exam 1 Dr. Goh Beng WeeDocument8 pagesAnswer Key: Sample Exam 1 Dr. Goh Beng Weeqwerty1991srNo ratings yet

- Student Ch03 FOF8eDocument131 pagesStudent Ch03 FOF8eRainey KamNo ratings yet

- Review of Chapter 8/9Document36 pagesReview of Chapter 8/9BookAddict721100% (1)

- Examination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Garing, Aireen - Sa No.13 Statement of CashflowsDocument3 pagesGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNo ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (40)

- Practice Questions - Cash FlowDocument13 pagesPractice Questions - Cash FlowMariamNo ratings yet

- Chapter 13Document9 pagesChapter 13RBNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- FinanceDocument53 pagesFinanceSheethal RamachandraNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Book Solutions Ch2 To Ch11Document45 pagesBook Solutions Ch2 To Ch11FayzanAhmedKhanNo ratings yet

- Cash and Accrual BasisDocument36 pagesCash and Accrual BasisHoney LimNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDocument39 pagesConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNo ratings yet

- Chapter 23 HomeworkDocument10 pagesChapter 23 HomeworkTracy LeeNo ratings yet

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Document3 pagesQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923No ratings yet

- ACCT557 Week 7 Quiz SolutionsDocument7 pagesACCT557 Week 7 Quiz SolutionsDominickdad100% (2)

- "How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/IrwinDocument23 pages"How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/Irwinrayjoshua12No ratings yet

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet