Professional Documents

Culture Documents

From Hybrids To Self Driving Vehicles: The Future of The Car

Uploaded by

Alexander KotlyarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

From Hybrids To Self Driving Vehicles: The Future of The Car

Uploaded by

Alexander KotlyarCopyright:

Available Formats

THE FUTURE OF THE CAR

FINANCIAL TIMES SPECIAL REPORT | Monday October 4 2010

www.ft.com/car2010 | twitter.com/ftreports

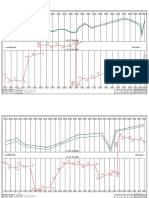

From hybrids to 2005 selfdriving 2010 vehicles

Europe N America

Global light vehicle sales (m)

Asia S America Other

20.2m 18.9m 16.8m 2.6m . 5.6m 17.7m 14.0m 28.8m 4.6m 5.4m 23.2m 19.4m 40.7m 6.6m 7.0m 26.9m 20.7m 48.6m 7.2m 7.4m 28.9m 22.0m

Figures below are Asias contribution to global growth over past ve years

1 188%

A sector hit hard by the downturn is hoping to exploit changing urban landscapes, writes John Reed

eneral Motors with the memory of the worst crisis in its history still fresh indulged in a futuristic flight of fancy at the Shanghai Expo. The US carmaker and its Chinese partner SAIC unveiled in March their vision of a car for 2030: a self-driving, networked bubble-car run on electric power, and small enough to park in your living room. It was called EN-V (for Electric Networked Vehicle) and came in three variants with Chinese names: Xiao (laugh), Jiao (pride) and Miao (magic) Miao will transport you magically and seamlessly through the urban landscape, GM and SAIC promised. You can play your favourite video games or hold a videoconference with your colleagues around the world. In Europe, Audi, the German luxury carmaker owned by Volkswagen, this year staged a competition for architects to imagine what urban landscapes and driving would be like two decades hence. Like GM and SAIC, the winner of the 100,000 prize offered a vision of automated driving in

cars wired up to the surrounding environment. The car will transform from being a viewing machine for manoeuvring in traffic towards a sensorial experience machine, the architectural firm J. Mayer H. said. Cars would interact with the urban context in completely new ways. The year 2030 is a long way off, even by the standards of automaking, with its long product cycles. However, both projects indicate how automakers see the future of driving: electric-powered, networked to the surrounding environment, and decidedly urban. The crisis that sent GM into bankruptcy court and even dented sales at Germanys moreresilient luxury carmakers such as Audi accelerated big, longterm changes already afoot in the car industry, and suddenly brought the future closer. The industrys centre of gravity tipped decisively to Asia, where China replaced the US as the worlds largest vehicle market in 2009. Before the crisis, analysts had predicted this would take up to a decade. By 2050, more than 2bn people in emerging markets will become first-time buyers, demanding low-cost cars, according to PA Consulting. Many of them live in large cities, where policymakers contending with smog and packed streets are realising that automobiles can no longer be large, costly hunks of metal that pol-

2015 2020 2025

lute for a few hours of the day then sit idle for the rest of the time, occupying valuable space. Electrification of cars, already a growing trend among automakers, accelerated during the crisis. Governments in the US, the UK, France and elsewhere earmarked stimulus grants or soft loans for producers of electric and plug-in hybrid cars and their batteries, and made subsidies available to early buyers. Electrification will fundamentally change the way cars are manufactured and sold, and transform carmakers relationships with their customers.

45%

56%

52.0m 46% 7.7m 7.8m

Source: JD Power Automotive Forecasting

FT montage Photos: company; AP

BMWs family of electric vehicles due out in 2013, code-named Megacity, will feature a lightweight carbon-fibre and plastic shell on an aluminium chassis. It will mark an industry first in terms of both materials and architecture, a radical departure from mass-produced cars usual unibody form. Electric motors are mechanically simpler than internal combustion engines, and so will reduce some of the money automakers earn on service in the years after they sell a car. On the other hand, carmakers will have to offer warranties on the batteries through the life of

a car an obligation, but one that holds the promise of longer relationships with their customers. But to keep new customers interested, carmakers will have to raise their game and make cars more like those most coveted devices of the digital age: smart phones, with their portals to social networks and endless upgradeability. While millions of people in China, India and Brazil buy their first cars, something else is happening in the developed world. Younger people in

Continued on Page 2

Inside this issue

Safety The oncepopular vision

of fully automated cars is being resisted by drivers, says Daniel Schaefer Page 3

On FT.com

Lowcost production

Sharing platforms across different models offers manufacturers big savings, reports John Reed

Interiors Buyers are

demanding a home from home, writes Bernard Simon Page 4

Batteries An infant industry

bears the hallmarks of a gold rush, says Bernard Simon

Technology

Twowheelers can show the way, says Rohit Jaggi Page 4

Connectivity The car that can compose and send its own tweets is just the start, writes John Reed

FINANCIAL TIMES MONDAY OCTOBER 4 2010

The Future of the Car From hybrids to higher tech

Continued from Page 1

Sales feed off hype and subsidy

Electric and hybrid Limits to range will prove crucial for these vehicles, say John Reed and Jonathan Soble

Europe have been telling pollsters that the one device without which they cannot live is not a car, but a phone. Enter the smart car: an automobile wired to the internet and increasingly other cars and roadside infrastructure. Drivers increasingly demand a seamless transition from the social networking, entertainment, and communications networks they use at home to their cars. If you look back over the past 10 years, everything within the car got connected to everything else, with computers steering everything, says Peter Schwarzenbauer, Audis head of marketing and sales. The change over the next 10 years will be that the car gets connected to its environment. The car of the future, rather than just losing value in the driveway, might do a better job of earning its keep, too. Utility companies are studying schemes that would see electric cars recharging during the night when rates are low, then either using the power during peak hours or selling it back to the grid. If cars are inexorably converging with phones, automakers are also realising that they need to make their products just as adaptable. Customisation is already a lucrative business line for carmakers notably for urban minicars such as Fiats 500. For its forthcoming A2, Audi is studying the possibility of selling mobile phone-like apps allowing customers to download and activate features already engineered to the car, such as stiffer suspension or heated seats. Carmakers are also reaching out to the sceptical hard core of young drivers unsure whether they want to own a car at all. PSA Peugot Citron recently launched a scheme that allows drivers to pay for mobility units used to rent a car, scooter, or even a bicycle. Most big automakers now are studying mobility a new industrywide buzzword. Amid all this blue-sky thinking, profound doubts remain around customers acceptance of new products such as plug-in cars. While decisionmakers clamber to subsidise silver bullet technologies, for example electric powertrains and lithium-ion batteries, some of the industrys biggest technological strides are coming in relatively prosaic areas such as downsized and turbocharged engines. There is also the perennial question of what carbuyers will value enough to buy. The big question today is not the technology, says Patrick Pelata, chief operating officer of Renault. The big question is what customers need, and how much they will pay for it all our strategy is driven by that. Renault and its partner Nissan announced in April a partnership with Daimler allowing the three companies to pool costs in small and electric cars, vans, and other technologies. Automakers, while offering customers endless variants in the showroom, are radically simplifying their manufacturing, building more cars on fewer platforms with a greater commonality of parts. Fords new Focus midsized car, for example, will have 80 per cent of parts in common in its different versions around the world. And amid all the doubts about the future, there are reasons for optimism too: while the politically correct term these days is mobility, it looks like driving has a future. All the entrants to Audis urban design competition included cars.

fter years of development and substantial amounts of hype a new wave of batterypowered cars will begin arriving in Japan and the US by December, led by Nissans Leaf and General Motors Chevrolet Volt. All the big carmaking groups plan to produce battery-powered cars over the coming three years, from Chinas SAIC to Germanys BMW which plans an entire new sub-brand for electric cars from 2013. Electric and plug-in hybrid cars have captured policymakers imaginations, prompting governments around the world even in the fiscally stretched US, Spain, Portugal, and the UK to pledge big subsidies to early buyers. Electric cars have also galvanised private investors, allowing Tesla Motors and Better Place, Silicon Valley startups in electric cars and charging infrastructure, respectively, to raise hundreds of millions of dollars for untested businesses during the depths of the credit crunch. The technological bandwagon forming around plug-in cars is remarkable, given the serious doubts about whether consumers will accept the cars high prices and short range. Even with subsidies worth $7,500 in the US and 5,000 ($7,900) in the UK, the Leaf and the Volt will

be priced more like small luxury cars than mass-market vehicles. In a poll carried out for the Financial Times by Nielsen in September, three-quarters of respondents in the US and the UK said they would consider buying an electric car. However, more than half in each country said they were unwilling to pay any more for them. The oil price and the rate at which lithium-ion batteries performance will improve are two other variables affecting the adoption rate for electric cars. Japans car industry might seem a good place to look for clues about what is to come. However, even there, opinions about what customers will want are sharply divided. On the one hand Carlos Ghosn, chief executive of

There will be a lot of battery electric vehicles in the future for urban usage

Nissan, plans to launch four electric cars for Japans third largest carmaker by 2014, and another four at its French ally Renault. A long-time sceptic about hybrid cars which he sees as an interim technology he has predicted that one in 10 cars globally will run on battery power alone by 2020. Toyota, for its part, agreed in May to invest $50m in Tesla, and plans to introduce a battery-only city car in 2012. However, Takeshi Uchiyamada, who heads the carmakers product development, says it will produce only a few thousand of the small commuter vehicles to start, and bets that more consumers will want the hybrid

cars, whose global sales Toyota dominates and in which it has invested billions of dollars. Both companies can point to recent achievements in their home market to support their favoured technology. The Leaf, due to arrive in dealerships in December, exceeded Nissans first-year Japanese sales target of 6,000 vehicles in just two months. The Prius was Japans best-selling car of any kind for the 16 months ending in August. But the numbers say little about real consumer demand and highlight the extent to which plug-in cars will remain creatures of subsidies for years to come. The Prius took Japans top sales spot only after the government introduced subsidies last year worth more than Y400,000 ($4,770) for low-emission vehicles. The incentive expired in September and Toyota executives are braced for a sharp fall in sales. JD Power, the consultancy, recently revised upward its forecast for electric vehicles, which it now predicts will overtake hybrids by 2015, mostly because of government incentives. Even so, it says both pure electric and plug-in hybrid cars will account for a scant 3 per cent the overall world market by 2020. Price aside, driving range remains a formidable barrier to pure electric cars. For this reason GM is including a petrol range extender on the Volt for longer trips. Even so, GM is keeping expectations for electric cars modest. Battery limitations will hold back the electric revolution says Frank Weber, head of corporate and product planning at GMs Opel unit, who played a central role in the Volts

Live wire: General Motors is hedging its bets with a range extender on the Chevrolet Volt

Mark Blinch/Reuters

development. It is a partial answer for a particular use: there will be a lot of battery electric vehicles in the future for urban usage. He adds: When we ask people what they are expecting from an electric vehicle, they say 500km of range, absolutely quiet, doesnt emit anything, and Im willing to spend 1,000 more for that vehicle than my conventional one. Yet the technology could

surprise. Analysts say a fresh spike in petrol prices as the world economy recovers could lower the break-even point for electric cars. Early drivers of electric cars have also raved about their high torque and lack of engine noise. Some have found their limited ranges easier to accept than they had thought. BMW recently tested 600 electric versions of its Mini small car in Germany, the UK and

the US in one of the industrys biggest tests of battery-powered cars to date. It found that most drivers charged the car only two or three times a week and mostly used charging points at home or at work. Before they drove the car, they wanted us to install a charging pole every mile, says Ulrich Kranz, the BMW executive heading its Project i electric cars programme. After a week this [desire] was gone.

Utilities hope vehicles will open electric avenues

Power companies Electricity providers are gearing up for very uncertain levels of demand, reports John Reed

Cars have a lot of attention and money lavished on them but they spend much of their time idle expensive, depreciating deadweight taking up precious urban and household space. But with time, say power companies, electric cars will be able to store electricity overnight, when it is cheaper, then during the day when rates are higher sell it back to the grid or feed it into your home. Cars could thus help utilities smooth out the daily spikes in power demand and allow owners to benefit from lower rates. While such vehicle-to-grid schemes are still only being studied, utility companies are already teaming up with carmakers to explore the opportunities and future demands on their power supply posed by cars that run on electricity rather than petrol. Its a business not only for new electricity, but to develop infrastructure and provide services to our customers, says Andrea Valcalde, head of innovation and environmental activities for Italys Enel. The notion of cars storing power as part of a smart grid scheme could work, he thinks, in about 10 years time. For now, the utility is working with Daimler, Renault and Piaggio on projects to develop charging infrastructure for electric vehicles and to study how drivers use them Enel is joining Daimler in a pilot of 100 Smart-brand electric cars in Milan, Rome, and Pisa, for which it is developing 400 public and private charging points. Unlike some early electric vehicle schemes in Europe, where power was offered free at charging points, Enel will charge for what it supplies. We want to send a clear message that this is a real business, says Mr Valcalde. In Britain, EDF is also investing in on-street infrastructure. In partnership with Elektromotive, a Brighton-based private company, it has installed about 85 charge points in the UK and plans another 550 in London as part of the citys Plugged-in Places initiative that will link to EDFs sponsorship of the 2012 Olympic games. EDF also has a partnership with Toyota, which in July began testing 20 of its Prius plug-in hybrid cars with fleet customers, including Londons Metropolitan Police Service, Transport for London, broadcaster Sky, and the Government Car and Despatch Agency. Were looking to understand how the vehicles are used, and how we can left to their own devices, says Ms Carver. Most of Europes big utility companies, from Germanys RWE to Swedens Vattenfall, have similar partnerships with automakers on electric cars. They are also working together to study the impact on Europes power grids of the coming wave of electric and plug-in hybrid cars under a project called G4V (Grid for Vehicles). Given most analysts forecasts of a modest adoption curve for electric cars, power companies do not have to worry about an early surge in power needs. However, as more plug-in cars arrive, utilities will have to meet the demand and be prepared to answer tough questions about where the power comes from. Sceptics about EVs question the net environmental benefit of running cars on electricity produced by dirty sources such as coal and oil. While electric cars true carbon footprint is smallest in countries such as France, which derives most of its power from nuclear plants, it is larger in Britain, the US and China, with their higher share of power generated from nonrenewable sources. Most automakers and utility companies and independent studies such as the UKs King Review on lowcarbon cars have concluded that electric cars have a lower carbon footprint than conventional ones, whatever the source of their power. Even based on the current-generation mix, EVs are around 30 per cent lower-carbon than an internal combustion engine equivalent, says EDFs Ms Carver. Renault, which is launching four electric models by 2014, is not ducking the fact that its cars well-to-wheel impact is not zero. In the UK, when the French carmaker recently showed a plug-in version of its Kangoo van to potential fleet customers, it offered estimated carbon dioxide counts for the cars. We put in a fair disclaimer: Zero emission when used, says Thierry Koskas, Renaults head of vehicle electrification. In France, he says, electric cars will emit about 12 grams of CO2 per km but the European average will be more like 60-70 g/km. This will change as more countries decarbonise their grids to help meet international commitments to reduce greenhouse gases. We need to see things in a dynamic way, says Mr Koskas. The picture will be very different in 10 or 20 years.

EVs are around 30 per cent lowercarbon than an equivalent internal combustion engine

incentivise users to recharge at specific times, says Bethan Carver, an EDF executive. As the company brings more nuclear power online in coming years, it wants to flatten the spiky demand profile for power to match supply from nuclear plants, which is flat throughout the day. EDF is also working with Daimler to install charge points to serve a pilot of 60 electric Smarts in Britain. Were studying how customers charge when

Hydrogen car plans go off the boil

Fuel cells Jonathan Soble and Daniel Schaefer note a shift in sentiment with some exceptions

In 2008, a battle for the future of automotive propulsion seemed to be shaping up in Japan. On one side were Toyota and Nissan, which were promoting electric motors powered by rechargeable batteries as the best alternative to internal-combustion engines: Toyota with its Prius petrol-electric hybrid, and Nissan with the Leaf, a forthcoming all-electric car that was then still on the drawing-board. On the other side was Honda, whose president, Takeo Fukui, dismissed electric vehicles as underpowered golf carts. Although Honda was developing a new version of its hybrid the Insight, launched last year Mr Fukui insisted the technology would be limited to smaller models and said Honda had no plans for a battery-only vehicle. Instead, Honda was backing an even more futuristic technology: hydrogen fuel cells, which harness the chemical energy produced when hydrogen, stored on-board, is mixed with oxygen from the air. Powerful as well as superclean a hydrogen cars only tailpipe emission is water fuel cells stood the best chance of replacing todays petrol engines, Mr Fukui believed. In June 2008, Honda started leasing its first hydrogen fuelcell vehicle, the FCX Clarity, to a few hundred drivers in California, becoming the first carmaker to put the technology in the marketplace Two years later, however, and Honda executives rarely mention hydrogen. During the recession, the company slashed funding for the Clarity, which costs more than $1m each to build. Takanobu Ito, who succeeded Mr Fukui as president in 2009, says the infrastructure needed to process and distribute hydrogen isnt moving forward. Instead, he has steered Honda into the battery camp, expanding the companys line-up of hybrids, and plans to launch an all-electric vehicle in 2012. Hondas move is symbolic of a broader shift in the fortunes of hydrogen fuel-cell cars. In the US, the Obama administration cancelled $100m in annual research funding last year, reducing overall public spending on the technology by 60 per cent. Californias hydrogen highway, was meant to have 150 filling stations serving cars such the Clarity by this year, but only 30 have been built. Hydrogen cars look even further off than they did a couple of years ago, says Koji Endo, an analyst at Advanced Research Japan. Not everyone is giving up on the fuel. Hyundai, the fast-rising South Korean carmaker, has announced plans to sell a fuelcell car in 2012, while General Motors hopes to have a production-ready version by 2015. Perhaps the deepest well of enthusiasm is in Germany. Last year, a consortium including Daimler, the energy group EnBW and the industrial gas maker Linde agreed plans to build 1,000 hydrogen stations in the next five years, at a cost of up to 2bn. The first 25 will pushed hard by Daimler, which has spent billions of euros developing fuel-cell technology. This year the premium carmaker started production of a hydrogen drive module that fits into a B-class compact car and its Citaro city bus. In 10 years, the company will be selling a few hundred city buses with fuel cells a year, says Christian Mohrdieck, head of fuel-cell development, adding that several dozen have been ordered. Daimler plans to begin mass production of hydrogen-powered passenger cars once the refuelling network is completed, Mr Mohrdieck says. He is adamant that the company can sell the vehicles at a profit something many industry experts doubt. Annual output of 80,000 to 100,000 units would be needed to make production economically viable, he estimates. According to Mr Opfermann, We will have to bring 500,000 to 1m cars on to the roads before 2020 to utilise fully the planned hydrogen station capacity. In Japan, meanwhile, the technology is being kept alive in the housing sector, where a group of natural-gas utilities has joined hardware makers to sell fuel-cell units for residential heating and power generation. Manufacturers include Panasonic and Toshiba, and Toyota which for all its current focus on hybrids, may yet see a future use for hydrogen infrastructure.

Contributors

John Reed Motor Industry Correspondent Bernard Simon North America Motor Industry Correspondent Rohit Jaggi Aircraft and Motorcycle Columnist Daniel Schaefer Frankfurt Correspondent Jonathan Soble Tokyo Correspondent Rohit Jaggi Commissioning Editor Steven Bird Designer Andy Mears Picture Editor For advertising details, contact: Stuart Wakling +44 020 7873 4129 stuart.wakling@ft.com

We will have to bring 500,000 to 1m cars on to the roads before 2020 to fully utilise the planned capacity

appear in large cities such as Berlin and Hamburg next year. Andreas Opfermann, head of innovation at Linde, says the hype around hydrogens main rival, lithium-ion batteries, has outgrown their capabilities. Todays combustion-engine cars are all-round-vehicles. There will be a fragmentation of drive technologies, just as we have seen a fragmentation of car segments. The German initiative is being

Tough cell: Honda has cooled to its fuelcell Clarity

Bloomberg News

FINANCIAL TIMES MONDAY OCTOBER 4 2010

The Future of the Car

Mass reduction techniques cross into the mainstream

Weight saving Exotic, lighter materials ease the load on motors and batteries, writes John Reed

hen BMW recently fielded a fleet of about 600 electric cars to study their viability in real-life driving conditions, it packed a 260kg battery pack into the back of its small Mini. Test drivers liked the car, but complained about the bulky batteries, which took up most of the boot space and all of the back seat. The Mini E is a test mule, BMW says, and as such not destined for series production; nor is the Active E, a forthcoming battery-powered test version of its 1 Series small car. But the Munich carmakers Megacity mass-produced electric vehicle, when it goes on sale in 2013, will mark a radical

departure from its current line-up of cars. Indeed, the car will be built using a different manufacturing process and using different materials from most other cars on the road. The car will have a flat battery pack smaller than the Mini Es inside a lightweight aluminium chassis called a Drive module. Atop it will sit a Life module a passenger cabin made mostly out of carbon-fibrereinforced plastic. BMWs decision to build the car out of expensive aluminium and plastic composites turned heads in the industry as did the Megacitys departure from the classic unibody method of designing and building cars. But BMW says the weight savings will allow it to spend less on the Megacitys battery pack. Battery cells are quite expensive, so we said, Lets reduce the weight of the vehicle we can achieve the same mileage with less battery, says Ulrich Kranz, the head of BMWs Project i electric-car unit. Carbon fibre has long been prized in the industry. BMW

says it is as strong as steel, but about 50 per cent lighter, whereas aluminium, is only 30 per cent lighter than steel. BMW says that the car will seat four and have a range of 160km to 180km between charges. The carmaker will source the carbon fibre through a 49-51 per cent joint venture announced last year with SGL

Because of carbon fibres high price, it has until now mostly been used in aircraft and racing cars, or on luxury vehicles

Group, a leading German-headquartered carbon producer. Because of carbon fibres high price, it has until now mostly been used in aircraft and racing cars or in small quantities on luxury vehicles, such as some of the bumper reinforcements and roofs in BMWs own M highperformance models.

While curing carbon components for a Formula One racing car takes hours in an oven, says Mr Kranz, our manufacturing process is different. BMW is keeping close wraps on the details. Automakers have long been working with new materials and manufacturing processes in a bid to take weight out of cars. The pressures to do so have changed over the years. In past decades, a leading factor pushing for weight reduction was the growing number of safety and comfort features automakers were building into cars, which made them heavier for example electric seats and stronger steel bodies. Over the past decade, regulators demands for loweremission, more fuel-efficient cars have become the factors pushing carmakers to find lighter materials. The industrys new push into electric cars has intensified the quest. Tesla Motors, the recently floated US electric carmaker, chose Lotus, a British niche pro-

Light touch: the Megacitys construction allows for cheaper batteries and better handling, BMW says

ducer, to make the bodies for its pioneering roadster based on its Elise, largely because of their light weight. Among BMWs luxury competitors, Audi has also been a leader in lightweight design, most notably the aluminium bodies based on its trademark Space Frame. The carmaker has made more than half a million cars with aluminium bodies since 1994. While high-tech materials used to be solely the province of luxury automakers, their use is filtering down to volume producers as the value of weight

savings in their cars goes up. PSA Peugeot Citron, in partnership with its supplier Rhodia, is studying ways of using high-tech materials including composites in its cars. For a lot of parts, it is difficult to be cost-competitive versus steel, says Marc DuvalDestin, the companys head of research and development. But the value of lightweight solutions is really increasing now. Automakers are also using new alloys, metal foams, and enhanced manufacturing methods to save on weight. By using more integrated electronics in

their cars, automakers are also saving on weight and costs by reducing their use of chips and the cable needed to connect them about 35kg in the typical car, according to Engelbert Wimmer of PA Consulting. While traditional safety features added weight to cars, new active safety features that reduce the speed of any crash, or avoid collisions entirely, will allow the industry to take even more weight out of its cars. We have just begun to exploit the potential of lightweight construction, says Mr Wimmer.

Buyers seek assistance not loss of control

Safety Drivers limit the effectiveness of electronics, says Daniel Schaefer

If one technological feature of a car ranks high on customers shopping list, it is safety. Carmakers and their suppliers around the world have been investing heavily in safety features over the past decade, and a slew of new products will soon start to trickle down from high-end cars. After a first wave of electronic systems such as antilock braking systems (ABS) and electronic stability programmes (ESP), customers are starting to adapt to safety systems that become even more actively involved in a drivers reactions. The new buzzword in the car industry is driver assistance. This decade will see the roll-out to the mass market of a number of these active and highly advanced safety features such as emergency braking systems or lane departure warnings. Downsizing might be a they sell. Similar laws will take effect in Europe, Australia and South Korea in the next few years, and some emerging markets are expected to follow. Werner Struth, head of the chassis systems control business unit at Bosch, the worlds largest car parts supplier, says: It will only take another one or two years and this will be standard everywhere. Even low-price cars such as the Dacia Logan will soon be equipped with ESP. Carmakers are also rolling out a number of features that will take some decisions out of drivers hands. Emergency braking systems are one. They monitor the area in front of a car with radar and/or video sensors. If they compute that there is a danger of a collision, they give an acoustic warning. And if the driver fails to react they brake automatically. Mr Struth at Bosch, which has sold the first such predictive emergency braking systems for Audis premium A8 car, says that this feature will soon be sold in the middle ranks of cars as well. We expect a doubling or even tripling of driver assistance sales within the next two to three years, he says. This will lead to a rapid cost reduction. Mr Cramer at Continental says: It will take five to 10 years until driver assistance systems will be as common as ABS and ESP are today. Other systems, such as a lane departure warning, and a hold control that prevents the car from rolling backwards at traffic lights, will spread to the mass market in this decade. But there is a limit to how much control drivers are prepared to give away, says Mr Steffan. Automatic cruise control, which adapts the driving speed to traffic and speed limits, has not been widely accepted yet, as customers feel restricted in their driving freedom, he says. This is why most carmakers forecasts about the future of vehicle safety look different from the automatic, driverless visions commonplace in the past. Manufacturers now see a future in which cars bristle with sensors and communicate with each other to warn and help the drivers, but not to take over control from them. But the obstacles for introducing such a system are many. Unlike with ESP or driver assistance systems, the customer who pays for such features will not reap any benefit until most cars are equipped with the relevant sensors and communication devices. What we will need is a business model that will help to entice customers to buy such a system, says Mr Struth. This does no exist yet.

It will take five to 10 years until driver assistance systems will be as common as ABS and ESP

trend for engines but it is definitely not one for safety features, says Ralf Cramer, head of the chassis and safety division at Continental, the German car parts supplier. The trend has been spurred by customer demand, tighter regulation and carmakers realisation of its relevance to image. Today, a carmaker spends 15 to 20 per cent of the development costs for a new model on safety features, says Hermann Steffan, head of the institute for vehicle safety at the Technical University of Graz in Austria. Twenty years ago, it was almost zero. The issue is more pressing than ever. The number of fatal car accidents has been falling in Europe in the past two decades (from 70,000 to about 39,000 this year). But worldwide the figure is still on the rise, driven by the rapid trend towards individual mobility in emerging markets. The UN estimates that 1.3m people die each year in road accidents. It has called the period to 2019 the decade of action for road safety, aimed at halving the number of road deaths. One way to get there will be to make sure that every car sold has ABS and ESP. Carmakers in the US will be forced by law from 2011 to install ESP on every car

FINANCIAL TIMES MONDAY OCTOBER 4 2010

The Future of the Car

Mobile phone generation cools on cars

Alternatives Sharing or rental could replace ownership for many drivers, says John Reed

Marketing and strategy executives at automakers who poll young people about cars are meeting a chilly indifference toward the notion of owning one at all. While buying an automobile remains a leading aspiration for consumers in emerging markets, a growing proportion of younger people in Europe and, to a smaller extent, the US say the one device they cannot live without is a mobile phone, not a car. A cooling of younger peoples enthusiasm toward cars has been noted for several years in Japan. A new frugality after the credit crunch has fed the trend, as has the rise of social networking sites. Physical mobility is not as necessary as it was in the past, says Beatrice Fourcher, Renaults head of production. Its not necessary to get in a car to get connected. Ms Fourcher says the number of customers aged 35 or less in France who want to buy a car has fallen from 30 per cent 10 years ago to only 20 per cent now. Its too expensive, she says. They want to put money into other things. Carmakers, ever resourceful, are searching for new ways to give these sceptical younger consumers products that fall short of full car ownership, but attach them to their brands. Many leading manufacturers, including Renault, have appointed executives or working groups responsible for mobility one of the biggest buzzwords in the industry these days. Some are now studying car-sharing or rental schemes, including ones that meld cars with public or other forms of transport. PSA Peugeot Citron recently launched an internet-based scheme offering subscribers the ability to rent a mobility solution. Users of Mu by Peugeot pay a fixed fee for mobility units not unlike a mobile phone subscription package which they can redeem to rent a large car or cabriolet for the weekend, a scooter for an urban jaunt, or even a bicycle. The buzz around mobility has coincided with the growing popularity of carsharing schemes such as Zipcar. Frost & Sullivan, the consultancy, says membership of such schemes in Europe will rise from about 500,000 today to 5m by 2016. It also dovetails with the launch of the first of several electric cars. Renault and BMW are among carmakers that think plug-in cars will appeal to a generation sceptical of automobiles not just because of their smaller carbon footprint, but because of the connectivity possibilities they will offer via recharging infrastructure. The electric vehicle is a solution: its new, its fresh, its different from what your parents had, says Ms Fourcher. Also, its a connected car. Daimlers Smart car brand is piloting a car clublike scheme in Ulm, Germany and Austin, Texas, under which users can pick up a car on the street and drive or drop it off as company, says Frank Weber, head of corporate and product planning for General Motors European Opel unit. They might take the car away from the personal ownership we have today. GM is studying possible shared mobility solutions involving electric cars and recharging stations able to identify drivers. However, adds Mr Weber: Theres too much uncertainty we need products first to understand peoples electric mobility needs. BMW says it is looking at new sales models or rental schemes based on the needs of customers who live in big cities and do not have enough space for more than one car. An urban driver who uses his electric car 350 days a year to get to work, for example, might need a larger car once a year to take on holiday. We are studying this, and looking at whether there are ways of making money on this, says Ulrich Kranz, head of the carmakers Project i team devising its Megacity line of electric cars. Rival luxury brand Audi is also, according to a senior marketing executive, studying a pool leasing scheme akin to a car club, where participants pay a monthly fee for a vehicle based on their needs for a week, a weekend, or a day. Are young people still interested in cars? asks Peter Schwarzenbauer, Audis head of marketing and sales. If you have the right product, the answer is yes. The iPhone generation is, he says, used to getting hardware free with the right mobile-phone contract. So Audi, he says, is studying the possibility of allowing customers to pay for usage say, 10,000km of driving a year rather than the actual car. We have to add to not replace the normal way of selling cars, says Mr Schwarzenbauer. We are trying to figure out which format would attract which focus group. We think the possibilities are unlimited.

Old tech still has plenty of mileage left

Powertrains It is too early to bury internal combustion, says Bernard Simon

When Oliver Kuttner, a Virginia real-estate developer, brought together a group of investors to enter a $10m competition for a highly fuel efficient but commercially viable vehicle, he expected they would produce an electric or hybrid car. He was so confident that electric power held the key to success that the venture was named Edison 2. Yet Mr Kuttner and his colleagues realised early on that the weight of batteries currently on the market made them unsuitable for the project. Instead, they chose an internal combustion engine powered by ethanol, complemented by lightweight materials and an aerodynamic design. The final product weighs just 826lbs. Edison 2s experience is evidence that for all the headlines garnered by electric cars, many of the most meaningful advances in low-emission, fuel-efficient powertrains will come from improvements in traditional petrol and diesel technology. We were surprised at how clear it was that we were better off concentrating on an internal combustion engine, says Ron Mathis, Edison 2s chief designer. Ian Penny, global engines director at Ricardo, a consultancy, told the Financial Times earlier this year: There is more scope to improve the internal combustion engine now than there has ever been. Mike Omotoso, a powertrain specialist at JD Power, another consultancy, adds that improvements in gasoline technology can be accomplished at relatively low cost, both for carmakers and their customers. JD Power estimates that global sales of pure electric and hybrid vehicles will reach about 2.8m units in 2015, or less than 5 per cent of total light-vehicle sales. Even after that probably for at least another 20 or 30 years the vast majority of vehicles on the roads, especially in emerging economies, will continue to be powered by petrol, diesel and, to a lesser extent, biofuels such as ethanol. There are an awful lot of things we can do that werent possible or economic in the past, says Mr Penny, citing advances such as more aerodynamic turbochargers, engine covers that retain more heat, and lighter materials. He notes that the typical sedan now achieves a thermal efficiency the ratio of heat energy in its fuel converted into power of only about 25 per cent. Turbocharging can raise the percentage to the mid-30s. Mr Penny estimates that technological advances could raise diesel engines thermal efficiency from the current 40 per cent to more than 50 per cent. Ironically, much of the improvement is likely to come from advanced electrical systems. Improved technology has enabled carmakers to replace eight- and six-cylinder engines with smaller models that offer greater fuel efficiency but little or no drop in performance. According to Wards Automotive Reports, fourcylinder cars made up 61.9 per cent of US production last year, up from 46.6 per cent in 2000. The proportion of four-cylinder light trucks pick-ups and sport-utility vehicles almost doubled to 14.8 per cent. Direct petrol injection and turbochargers enable Ford Motors new EcoBoost engine to achieve as much power in a six-cylinder configuration as a traditional V8. The number-two Detroit carmaker aims to turn out 1.5m EcoBoost engines a year by 2013, fitting them in 80 per cent of its models worldwide. Others are working on engines that, they claim, will go even further than the EcoBoost in combining fuel efficiency, low emissions, compact size and performance. Ricardo has developed a technology known as ethanol boost direct injection which it expects to demonstrate by early next year. Another potentially ground-breaking technology being developed by General Motors and Volkswagen, among others, combines the

Physical mobility is not as necessary as it was. Its not necessary to get in a car to get connected

needed, and pay for the service with a smart card. Paris plans on expanding its Vlib public bicycle hire scheme to include cars. You can imagine a future where most vehicles that provide battery electric propulsion for urban usage can be owned by a carsharing company, a leasing company, a city, or a utility

Fords EcoBoost engine achieves as much power from six cylinders as a traditional V8

efficiency of diesel with the low emissions of the most advanced petrol engines. Known as homogenouscharged compression ignition (HCCI), the process could improve fuel economy by 25-30 per cent. Mr Omotoso predicts that HCCI engines will be commercially available within the next few years. On another front, Microsoft founder Bill Gates teamed up earlier this year with Khosla Ventures, a California venture capital fund, to invest $23.5m in EcoMotors, a two-year-old company in suburban Detroit staking its future on a opposed-piston opposedcylinder (Opoc) internal combustion engine. If all goes to plan, commercial production of the two-stroke engine will start in two to three years. EcoMotors claims its engine will be half the weight, half the size and have half the number of components of existing powertrains, giving it 50 per cent more fuel efficiency. Its other backers include Zhongding Holding, a Chinese car parts supplier. Meanwhile, Mr Kuttners decision to opt for a conventional engine turned out to be wise one. The results of the contest, organised by the Californiabased X Prize Foundation, were announced on September 16. The Edison 2 team walked away with the first prize of $5m.

Backseat driving: the rear of the Buick LaCrosse was designed with chauffeurdriven Chinese buyers in mind

Everything but the kitchen sync

Interiors Constantly connected consumers are asking more of their vehicles, writes Bernard Simon

ven as car buyers especially Americans seek out smaller, more fuelefficient vehicles, they are demanding more space with more amenities inside the cabin. The growing emphasis on interiors reflects the evolution of cars into much more than a means of transportation. They increasingly double as offices, entertainment venues and communication hubs. People eat and drink while driving. Who has not used a car for sleeping or sex? According to the JD Power consultancy, Americans typically spend almost three hours a day in their vehicle during the week, and more than two hours over weekends, making a total of 18.5 hours a week. Larry Erickson, head of the transportation department at Detroits College for Creative

Studies, says: The consumer is going to want [carmakers] to deliver everything theyve got in the rest of their lives, whether its a good idea or not. The list of everything theyve got keeps growing. A JD Power survey found that 47 per cent of drivers owned cars with heated seats last year, up from 35 per cent in 2006. The proportion of cars with controls on the steering wheel has climbed from 53 per cent to 73 per cent, while more than two-thirds now offer compatibility with MP3 devices, up from slightly more than a quarter in 2006. The evolution of car interiors is especially noticeable in minivans, which are designed to appeal to both adults and children, and to be used for a wide range of activities. The 2011 Honda Odyssey has a cool-box under the instrument panel that can store six soft-drink cans. The second and third rows of seats can be removed, providing enough space for three mountain bikes or a 4ft x 8ft sheet of plywood. The Odysseys entertainment system includes a 16-inch screen that can be split in two to keep

quarrelling children out of each others hair. Chryslers minivans feature swivel seats and a small, removable table that turn the area behind the driver into what the Detroit carmaker calls a family room on wheels. They boast no fewer than 13 cup and bottle holders. J Mays, Ford Motors chief designer, ticks off three priority

Voice and graphical interface technology is paving the way for the elimination of buttons, knobs and switches

areas for car interiors in the years ahead: Improved packaging of components to create more space. Seats are becoming thinner. Mechanical transmissions and parking brakes are making way for drive-by-wire technology. Outdated technology is being ditched. If youre under 30, who needs a CD player? Mr Mays observes.

Selection of materials. Increasingly, [consumers] want natural materials, as long as they are affordable, Mr Mays says. Plastics are giving way to natural fibres. The seat fabric in some Ford models is made from recycled yarn, and reclaimed wood is used for accents on some premium models. Most important are advances in the interface between man and machine. As Mr Mays puts it, the demand for seamless sociability and total connectivity is helping blur the lines between home, office and car. Improvements in voice and graphical interface technology are paving the way for the elimination of the buttons, knobs and switches that have been part of instrument panels and consoles since the car was invented. The goal is to replace them with voice recognition systems and the swiping movements used to operate an iPhone or iPad. Fords Sync system, developed with Microsoft and introduced in 2007, uses voice commands to control mobile phones and music players. A version with improved voice recognition capability made its debut this year.

However, the need for a car to withstand extreme weather and driving conditions has hampered progress towards sensitive iPadtype controls. Even so, Mr Mays predicts, its just around the corner. Cultural differences present another challenge, even as carmakers move towards global platforms. General Motors designed the interior of its latest Buick LaCrosse sedan with an eye mainly on China, where the Detroit carmaker sells four times as many Buicks as in North America. While a cars rear passenger compartment is typically designed for children in North America, the LaCrosse is marketed as a chauffeur-driven vehicle in China. As a result, the LaCrosse has an unusual amount of backseat legroom for a North American car. The back window is equipped with an anti-glare screen operated at the touch of a button, making it easier for Chinese businessmen to use their laptops and for American children to watch DVDs. We both benefited, a GM spokeswoman says.

Twowheelers show fourwheelers the way in innovation

Technology Rohit Jaggi looks at the latest developments

My dining room in London contains a couple of bikes that should have changed motorcycling for ever. One is the only production two-wheel-drive motorcycle from a big manufacturer, Yamaha. The same Japanese company was also responsible for the other bike, an attempt to improve on the failings of conventional front forks. Neither achieved big sales success. But in spite of such setbacks a number of the trends only now emerging among car manufacturers have long been seen among two-wheelers. One that is also reflected in aviation is the pursuit of light weight, with aluminium and more recently carbon-fibre construction being employed to make the most of power outputs and fuel loads. But two-wheelers have also led on powertrains. Piaggio, the Italian manufacturer, beat the carmakers into series production of a plug-in hybrid with the launch last year of the first hybrid scooter, based on its innovative MP3 tilting three-wheel scooter. An electric-only mode running on its lithium-ion batteries, with a range of about 20km, gave it a big advantage over the fourwheel competition. And the extra wheel at the front gave nearer car-levels of stability on greasy roads. However, low sales were attributed to a high price of about 9,000 ($12,250) and the small petrol engine being inadequate to cope with its extra weight. So Piaggios answer this year is a bigger engine of 300cc and a price cut of 1,000. Even conventionally engined scooters have many advantages for urban transport, by minimising traffic congestion and the space needed for parking. However, safety-paranoid planners in the west tend to fight shy of promoting machines that some groups are vocal in insisting expose users to more risk than in cars. BMW of Germany, with its history of making both four-wheelers and twowheelers, has addressed this in a number of ways. One was with its C1 safety-cell scooter of early this decade. However that failed to achieve hoped-for sales volumes. In the UK, where buyers should have warmed to its weather protection, sales also suffered because of the obduracy of officials, who refused an exemption from the requirement to wear a helmet despite the twin seat belts. The Munich manufacturer has revisited the concept, though, with a similar all-electric version, the C1-E unveiled last year. And it has taken another approach with the newly unveiled Mini Scooter E allelectric two-wheeler, which aims to complement its Mini car brand. Features aimed at the mobile generation include a docking station to integrate a smart phone into the electronics. Smart, part of DaimlerBenz, is also unveiling an electric scooter in Paris that it claims will have a 60-plus mile range. Safety fears, however, may be better addressed by the cabin motorcycle design that last month won one of the two subsidiary classes in the $10m X Prizes for fuel efficiency (see also separate story on Powertrains). The E-Tracer from Swiss company Peraves uses a 150kW electric drive system made by AC Propulsion, based in San Dimas, California, and a 19.4 kWh lithium polymer battery system from NeuEnergy of San Diego. With a claimed top speed of well over 120mph and the equivalent of more than 200 mpg much b e t t e r than the other two X Prize winners it

Winner: the ETracer has speed, range and, in effect, 200mpg

shows that performance and economy can co-exist. The E-Tracer is a development of the Monotracer and its predecessor the Ecomobile cabin motorcycles powered by BMW bike engines that have been in small-scale production for more than 25 years. With the safety and weather protection of a tough composite shell, and rider-controlled retracting outrigger wheels to keep upright when standing still, they answer many of the criticisms of conventional two-wheelers at a price. The Monotracer, which is available now, costs about 53,000. The E-Tracer, once Peraves and fellow Swiss company Designwerk have made it ready for production next year, will sell for 60-80,000, It promises

0-60mph in less than 4.5 seconds and a real-life range of 220 miles. And, from my own experience of driving the Ecomobile, unique fun. The Yamaha off-road bike in my dining room is lowertech, but was revolutionary in using hydraulics to drive the front wheel. Later 2WD designs from Austrian manufacturer KTM use a simpler electric motor in the front hub instead. With no need for cumbersome and heavy hydraulic hoses. Car designers say they are just starting to exploit the freedom that new technologies give them to relocate components and provide better aerodynamics or more space for occupants. This is a direction that is likely to provide exciting results for some time.

You might also like

- Existing Site LayoutDocument1 pageExisting Site LayoutNana BarimaNo ratings yet

- ASO-KE Cable Route PlanDocument18 pagesASO-KE Cable Route Planlaxmikant JanpageNo ratings yet

- Annual World Airport Traffic ReportDocument1 pageAnnual World Airport Traffic ReportBravo NovemberNo ratings yet

- 2015 07 17 Meeting Saginaw v2Document31 pages2015 07 17 Meeting Saginaw v2monutilisation0No ratings yet

- Infographic ACI World Airport Traffic Forecasts 2017-2040Document1 pageInfographic ACI World Airport Traffic Forecasts 2017-2040Robith Basyarul AlamNo ratings yet

- Front Elevation Side Elavation: Architectural Design 4Document1 pageFront Elevation Side Elavation: Architectural Design 4052 Deepak NaralaNo ratings yet

- Seeking Stable MarketsDocument74 pagesSeeking Stable MarketszhangxyNo ratings yet

- CBRE - Vietnam - Major Report - Vietnam Industrial Real Estate Market - Dec - 2018 - EN PDFDocument24 pagesCBRE - Vietnam - Major Report - Vietnam Industrial Real Estate Market - Dec - 2018 - EN PDFLinh MaiNo ratings yet

- Auto Sector ReportDocument18 pagesAuto Sector ReportAnurag KhandelwalNo ratings yet

- Sdre14-6 Vig 1-8-May 2019Document9 pagesSdre14-6 Vig 1-8-May 2019danielsu87No ratings yet

- Parking CirculationDocument1 pageParking CirculationDimpleNo ratings yet

- Auto and Auto ComponentsDocument21 pagesAuto and Auto Componentszoheb jafriNo ratings yet

- Top 225 Design Firms ENRDocument18 pagesTop 225 Design Firms ENRIon PreascaNo ratings yet

- 3 392875 2019 Indian Agriculture BrochureDocument5 pages3 392875 2019 Indian Agriculture BrochureashutoshNo ratings yet

- Study - Id18105 - Tire Market in The Us Statista DossierDocument57 pagesStudy - Id18105 - Tire Market in The Us Statista DossierMitraNo ratings yet

- Auto Components Infographic November 2021Document1 pageAuto Components Infographic November 2021ROOHI SHARMA 19111037No ratings yet

- Romeo S1Document1 pageRomeo S1glenn villacruzNo ratings yet

- ml1812r Variable Reach TruckDocument3 pagesml1812r Variable Reach TruckLeandro GomesNo ratings yet

- Ground Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSDocument5 pagesGround Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSBon HarperNo ratings yet

- Ground Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSDocument1 pageGround Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSBon HarperNo ratings yet

- GROUP-6 PPT BMW Vs MercedesDocument20 pagesGROUP-6 PPT BMW Vs MercedesDilip K PillaiNo ratings yet

- CEO Investor Day: February 27, 2019Document31 pagesCEO Investor Day: February 27, 2019Katherine GavrilovaNo ratings yet

- Yemen Atlas A3LC 10-01-2010Document1 pageYemen Atlas A3LC 10-01-2010Ghallab AlsadehNo ratings yet

- Typical Mercedes-Benz Electric Truck PowertrainDocument8 pagesTypical Mercedes-Benz Electric Truck Powertrainmujahid0 irfanNo ratings yet

- Cotas 1Document1 pageCotas 1Alicia Apreciado RiveraNo ratings yet

- 2019 Intl DesignDocument73 pages2019 Intl DesigniabhiuceNo ratings yet

- Legends: Ground Floor Second FloorDocument1 pageLegends: Ground Floor Second FloorCharle TsaiNo ratings yet

- Site Plan ZoningDocument1 pageSite Plan ZoningPangestu SantosoNo ratings yet

- Hastinapuram Residential Cellar PlanDocument1 pageHastinapuram Residential Cellar PlanNagi ReddyNo ratings yet

- (A) Background (D) Target Setting: Phase-Wise Growth AnalysisDocument4 pages(A) Background (D) Target Setting: Phase-Wise Growth AnalysisHafsa MarufNo ratings yet

- Sales Analysis ReportDocument1 pageSales Analysis ReportVishal DevlekarNo ratings yet

- Wilwood Brake Pads - 2010 CatalogDocument56 pagesWilwood Brake Pads - 2010 CatalogJenner Volnney Quispe ChataNo ratings yet

- 07 - 5. ITB-2023-45343 GSU Phase 1 Part 1 ICTDocument6 pages07 - 5. ITB-2023-45343 GSU Phase 1 Part 1 ICTxuseen maxamedNo ratings yet

- Area y Per Imetro de Formas Varias (A)Document20 pagesArea y Per Imetro de Formas Varias (A)Ana Pazmiño de TorresNo ratings yet

- AdMob Mobile Metrics Dec 09Document26 pagesAdMob Mobile Metrics Dec 09TechCrunchNo ratings yet

- Siemens Rotating Machinery GuideDocument191 pagesSiemens Rotating Machinery GuideSathish KumarNo ratings yet

- PSARenaultDocument53 pagesPSARenaultmcaraiacNo ratings yet

- MidjetDocument1 pageMidjetNiraj JoshiNo ratings yet

- Navi Mumbai Airport PlanningDocument82 pagesNavi Mumbai Airport PlanningLasantha SameeraNo ratings yet

- Airline Sector - Monthly Snapshot Oct 09Document2 pagesAirline Sector - Monthly Snapshot Oct 09indianaviationNo ratings yet

- BOI-brochure 2015-Automotive-20150325 - 70298Document11 pagesBOI-brochure 2015-Automotive-20150325 - 70298Nunnun NaezNo ratings yet

- Ground Floor Plan and Site Calculation: 6.8M DrivewayDocument1 pageGround Floor Plan and Site Calculation: 6.8M Drivewaysarthak patelNo ratings yet

- Floor Plan: Service Area A B C D E F 1Document1 pageFloor Plan: Service Area A B C D E F 1Sygee BotantanNo ratings yet

- LRDI - 08: Pie-Chart & Bar GraphsDocument9 pagesLRDI - 08: Pie-Chart & Bar GraphsxyzNo ratings yet

- (19 02 26) HMC Ceo Investor Day Final enDocument31 pages(19 02 26) HMC Ceo Investor Day Final enSanjay Kumar GuptaNo ratings yet

- Final 2018: Name:Kumar Swapnil Roy Roll No: DM18B25Document16 pagesFinal 2018: Name:Kumar Swapnil Roy Roll No: DM18B25trisanka banikNo ratings yet

- Setting The Standard: Two Generations of Wireless Telecom: de Jure vs. de Facto: Europe and The USDocument7 pagesSetting The Standard: Two Generations of Wireless Telecom: de Jure vs. de Facto: Europe and The USJaadNo ratings yet

- TTIW018-DC Power Train Architecture For EVs-EN-FINALDocument8 pagesTTIW018-DC Power Train Architecture For EVs-EN-FINALPawin seesamleeNo ratings yet

- Paris Air Show Boeing 2019Document26 pagesParis Air Show Boeing 2019Sani SanjayaNo ratings yet

- Hastinapuram Residential Podium - 2 PlanDocument1 pageHastinapuram Residential Podium - 2 PlanNagi ReddyNo ratings yet

- Appendix B5 (Rumble Strip)Document1 pageAppendix B5 (Rumble Strip)vivekNo ratings yet

- Analytical Report q4 2019Document6 pagesAnalytical Report q4 2019Moksha ShahNo ratings yet

- Propuesta MDI 2014 SQDCDocument1 pagePropuesta MDI 2014 SQDCarelyta8123No ratings yet

- CR-1010 2ND Basement PlanDocument1 pageCR-1010 2ND Basement PlanAnonymNo ratings yet

- Water Harvesting SystemDocument1 pageWater Harvesting SystemMegha PatidarNo ratings yet

- 4 Dilip ChenoyDocument24 pages4 Dilip ChenoyJinisha HiraniNo ratings yet

- Architectural PlansDocument5 pagesArchitectural PlansBenson Mwathi MungaiNo ratings yet

- MERCADO TRAZADO LOTIZACION CENTRO CUYANI-Layout2Document1 pageMERCADO TRAZADO LOTIZACION CENTRO CUYANI-Layout2Elias Samuel Lizana GuerraNo ratings yet

- Vandana Shiva - How Economic Growth Has Become Anti-LifeDocument4 pagesVandana Shiva - How Economic Growth Has Become Anti-LifeAngel MartorellNo ratings yet

- Wainwright, M Et Al - Isolation of Biological Entities From The StratosphereDocument8 pagesWainwright, M Et Al - Isolation of Biological Entities From The StratosphereAngel MartorellNo ratings yet

- Hameroff - The Brain Is Both Neurocomputer and Quantum Computer (2007) PDFDocument11 pagesHameroff - The Brain Is Both Neurocomputer and Quantum Computer (2007) PDFNoor L AmsirNo ratings yet

- Noel Sharkey - 2084: Big Robot Is Watching You (Future Robot Policing Report Final)Document13 pagesNoel Sharkey - 2084: Big Robot Is Watching You (Future Robot Policing Report Final)Angel MartorellNo ratings yet

- Baron-Cohen, S - Autism: The Empathizing-Systemizing (E-S) TheoryDocument13 pagesBaron-Cohen, S - Autism: The Empathizing-Systemizing (E-S) TheoryAngel MartorellNo ratings yet

- Nicolelis, M Et Al - Perceiving Invisible Light Through A NeuroprosthesisDocument7 pagesNicolelis, M Et Al - Perceiving Invisible Light Through A NeuroprosthesisAngel MartorellNo ratings yet

- Rosenberg, RS Et Al - Virtual Superheroes: Using Superpowers in Virtual Reality To Encourage Prosocial BehaviorDocument9 pagesRosenberg, RS Et Al - Virtual Superheroes: Using Superpowers in Virtual Reality To Encourage Prosocial BehaviorAngel MartorellNo ratings yet

- Gigerenzer, G & Brighton, H - Homo HeuristicusDocument37 pagesGigerenzer, G & Brighton, H - Homo HeuristicusAngel MartorellNo ratings yet

- Gray, K & Wegner, DM - Uncanny ValleyDocument6 pagesGray, K & Wegner, DM - Uncanny ValleyAngel MartorellNo ratings yet

- A Brain-to-Brain Interface For Real-Time Sharing of Sensorimotor InformationDocument10 pagesA Brain-to-Brain Interface For Real-Time Sharing of Sensorimotor Informationgiulio141091No ratings yet

- Smith, LS - Neuromorphic Systems-Past, Present and FutureDocument16 pagesSmith, LS - Neuromorphic Systems-Past, Present and FutureAngel MartorellNo ratings yet

- Diagnosis by DefaultDocument3 pagesDiagnosis by DefaultAngel MartorellNo ratings yet

- Reiss, D & Marino, L - Mirror Self-Recognition in The Bottlenose DolphinDocument6 pagesReiss, D & Marino, L - Mirror Self-Recognition in The Bottlenose DolphinAngel MartorellNo ratings yet

- The Economics of Brain NetworkDocument24 pagesThe Economics of Brain NetworkAngel MartorellNo ratings yet

- Power To The People - FTDocument4 pagesPower To The People - FTAngel MartorellNo ratings yet

- Power Generation From Coal PDFDocument114 pagesPower Generation From Coal PDFMardi RahardjoNo ratings yet

- MEK Marine MAN Engine Spare PartsDocument6 pagesMEK Marine MAN Engine Spare PartsMEK MarineNo ratings yet

- Question Bank - AEDDocument3 pagesQuestion Bank - AEDbhuvan raju t kNo ratings yet

- Solar Water Pump - Project ReportDocument32 pagesSolar Water Pump - Project ReportTanvi33% (3)

- Fuel Oil Handling SystemDocument3 pagesFuel Oil Handling SystemPaulrajNo ratings yet

- Section I1: Boiler Selection ConsiderationsDocument28 pagesSection I1: Boiler Selection Considerationsfructora100% (1)

- Engine Detroit S-60 PDFDocument76 pagesEngine Detroit S-60 PDFcarlosorizaba100% (1)

- KRAL Screw VolumeterDocument2 pagesKRAL Screw VolumeterGaurav SrivastavaNo ratings yet

- Org. Chem. (Chapter 1D) - IsomerismDocument8 pagesOrg. Chem. (Chapter 1D) - IsomerismJia LinNo ratings yet

- Jac Hfc1131kr1 g15d0Document269 pagesJac Hfc1131kr1 g15d0oleg796283% (6)

- Research Proposal For Axial Compressor BladeDocument18 pagesResearch Proposal For Axial Compressor BladeHein Thiha SanNo ratings yet

- 008 CharlieDocument3 pages008 Charlietallervaleras2020No ratings yet

- Engine - Gtdi 2.0L PetrolDocument5 pagesEngine - Gtdi 2.0L PetrolroryNo ratings yet

- Rebuild StanadyneDocument4 pagesRebuild StanadyneKevin TtitoNo ratings yet

- Site Maintenance ProcedureDocument13 pagesSite Maintenance ProcedureMuhammad KashifNo ratings yet

- SNO E DB 54 001 Electrical Desain Basis Rev.0Document19 pagesSNO E DB 54 001 Electrical Desain Basis Rev.0Jan Richardo GultomNo ratings yet

- 2206F-E13TA Industrial Engine Operation and Maintenance ManualDocument118 pages2206F-E13TA Industrial Engine Operation and Maintenance ManualWeifang PowerNo ratings yet

- PSX2 Jump Pack2Document32 pagesPSX2 Jump Pack2Brenda AndersonNo ratings yet

- Hino 258Lp Serie S: Truck Chassis SpecificationsDocument2 pagesHino 258Lp Serie S: Truck Chassis Specificationsagussulaksana100% (3)

- Spesifikasi HCR1200-DSIIIDocument8 pagesSpesifikasi HCR1200-DSIIIYudi YusufNo ratings yet

- Buderus Logano G201 Wood and Coal Boiler BrochureDocument2 pagesBuderus Logano G201 Wood and Coal Boiler Brochuree-ComfortUSANo ratings yet

- 10436-PWT6.8 L - 6068afm75Document328 pages10436-PWT6.8 L - 6068afm75adrienspinozzi100% (2)

- ASCO Catalogue EnglishDocument172 pagesASCO Catalogue EnglisharygtNo ratings yet

- Catalogue Yanmar 4TNV84T GGEDocument4 pagesCatalogue Yanmar 4TNV84T GGEAhmad Fahmi IrfandaNo ratings yet

- TI-700 - Eng-R1 - InookDocument6 pagesTI-700 - Eng-R1 - InookAnonymous DJrec2No ratings yet

- CHANGAN_Pre-reparación_LSCBBZ2T8NG602311_Informe de códigos de falla_20240304074228Document2 pagesCHANGAN_Pre-reparación_LSCBBZ2T8NG602311_Informe de códigos de falla_20240304074228Humberto Diaz UrbinaNo ratings yet

- Distillation - The Science of DistillationDocument3 pagesDistillation - The Science of DistillationFoo Cheok HwaNo ratings yet

- Frontal Advance CalculationDocument16 pagesFrontal Advance CalculationBinu KaaniNo ratings yet

- Appendix VIII: Determination of Chimney HeightsDocument12 pagesAppendix VIII: Determination of Chimney HeightsAshutosh PandeyNo ratings yet

- 1998 Volvo S70-V70Document52 pages1998 Volvo S70-V70cosminubNo ratings yet