Professional Documents

Culture Documents

Per Capita Disposable Income: Ibisworld Business Environment Report

Per Capita Disposable Income: Ibisworld Business Environment Report

Uploaded by

Tanzeel Ur RehmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Per Capita Disposable Income: Ibisworld Business Environment Report

Per Capita Disposable Income: Ibisworld Business Environment Report

Uploaded by

Tanzeel Ur RehmanCopyright:

Available Formats

CONTENTS Error! No text of specified style in document.

September 2012

IBISWorld Business Environment Report

Per capita disposable income

Per capita disposable income

September 2012

Estimated Value in 2012: $ 32,942 2007-2012 Compound Growth: 0.1% Forecast Value for 2017: $36,432 2012-2017 Compound Growth: 2.0% Per capita disposable income determines an individual's ability to purchase goods or services. It is calculated by taking income earned from all sources (wages, government transfers, rental income etc) minus taxes, savings and some non-tax payments (e.g. fines, forfeitures and donations) and dividing by the total US population. The data for this report is sourced from the Bureau of Economic Analysis and presented in chained 2005 dollars. Current Performance The financial meltdown and subsequent recession reversed a seventeen year streak of positive growth in disposable incomes. The primary drag on income was felt by millions of Americans who lost their jobs or were unable to join the workforce for the first time. Job losses started in the financial sector but quickly spread from Wall Street to Main Street as credit tightened and businesses saw demand wither in the face of uncertainty. The national unemployment rate climbed from 4.6% in 2007 to 10.6% in early 2010, crippling spending power across the United States and through all income brackets. Even Americans who retained their jobs were afflicted by stagnant wages, furloughs and diminished nest eggs. Given the possibility of an even bleaker future, individuals increased their savings rate from a low of 1.4% in 2005 to 5.9% in 2009, reducing the amount available for purchasing goods or services.

www.ibisworld.com | 1-800-330-3772 | info@ibisworld.com

WWW.IBISWORLD.COM

Per capita disposable income

September 2012

The impact of job losses and higher savings were partially offset by a larger safety net, with government assistance programs extended and expanded to unprecedented levels. However, these programs could only partially negate the impact of the economic collapse, with disposable income growth slipping by 3.6% in 2009. But conditions stabilized in 2010, allowing some of the storm clouds hanging over disposable income levels to retreat. Firstly, corporate profits surged, generating profits for owners and restoring battered stock portfolios. This eased pressure on businesses to keep wage costs down and boosted consumer sentiment, leading to both higher earned incomes and receding savings rate. Consequently, per capita disposable income edged up by an anemic but positive 1.0% in 2010. These initial signs of recovery were expected to make further gains in 2011 paving the way for a more robust rebound. However, the rebound was limited by unrelenting unemployment, a housing market trapped in the doldrums and by public debt domestically and abroad. Consequently, growth in disposable incomes weakened to in 2011. Rising prices in 2012 will continue to pressure growth in real disposable income, particularly for those in the lower income group. During the year, per capita disposable income is expected to increase 1.3% to $32,942. Outlook IBISWorld expects economic indicators that drive disposable income levels to steadily strengthen over the outlook period. A greater number of Americans returning to work will combine with improved housing and stock values to make consumers willing to spend on purchases delayed during the recession. However, future growth will be tempered relative to the boom leading up to the recent downturn. This is because the belief in ever rising house prices and unsound lending practices that created the bubble will not be present to inflate natural growth. Consequently, positive job growth and lower savings will lead positive growth, but at a slower annualized rate compared to the five years to 2006. Furthermore, growth in per capita disposable income will be hindered by the inevitably higher tax rates needed to balance the fiscal deficit and pay for the dual stimulus packages. The wealthiest individuals and households will generate the slowest real income growth from 2013 through 2017 as a consequence. Rising prices for high-end luxury goods and increasing mortgage costs as houses become less affordable will also contribute to slowing growth for the wealthier population. Data Volatility Per capita disposable income displays a low level of volatility. It is important to note that this measure looks only at income available for spending, after taxes and savings. This feature has allowed for American spending income to be extremely stable over the long term as individuals are able to tap into savings accounts and alternate income streams (e.g. unemployment payments from the government) to maintain their lifestyles in the short term. Additionally, due to the progressive income tax in the US, individuals with lowered incomes pay a smaller proportion in taxes and thus retain a greater share for potential expenditures. Meanwhile, in more prosperous times, these factors work in reverse and constrain disposable income from rising quickly.

WWW.IBISWORLD.COM

Per capita disposable income

September 2012

Per capita disposable income

8

% Change

-2

-4 1981

1986

1991

1996

2001

2006

2011

2016

Year

% Change

Year

% Change

1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

19,160 19,399 19,859 21,094 21,562 22,074 22,236 22,986 23,375 23,558 23,441 23,946 24,032 24,504 24,940 25,463 26,048 27,286 27,793

1.64 1.25 2.37 6.22 2.22 2.37 0.73 3.37 1.69 0.78 -0.50 2.15 0.36 1.96 1.78 2.10 2.30 4.75 1.86

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

28,885 29,285 29,964 30,429 31,184 31,318 32,303 32,749 33,229 32,020 32,335 32,529 32,942 33,515 34,218 35,142 35,782 36,432 37,124

3.93 1.38 2.32 1.55 2.48 0.43 3.15 1.38 1.47 -3.64 0.98 0.60 1.27 1.74 2.10 2.70 1.82 1.82 1.90

Per capita disposable income

www.ibisworld.com | 1-800-330-3772 | info@ibisworld.com

WWW.IBISWORLD.COM

Per capita disposable income

September 2012

IBISWorld's reports are more than just numbers. They combine data and analysis to answer to questions that successful businesses ask.

Who is IBISWorld? We are strategists, analysts, researchers and marketers. We provide answers to information-hungry, time-poor businesses. Our goal is to provide real-world answers that matter to your business. When tough strategic, budget, sales and marketing decisions need to be made, our suite of industry, economy and risk reports give you thoroughly researched answers quickly. IBISWorld Membership IBISWorld offers tailored membership packages to meet your needs.

Disclaimer This product has been supplied by IBISWorld Inc. (IBISWorld) solely for use by its authorized licenses strictly in accordance with their license agreements with IBISWorld. IBISWorld makes no representation to any other person with regard to the completeness or accuracy of the data or information contained herein, and it accepts no responsibility and disclaims all liability (save for liability which cannot be lawfully disclaimed) for loss or damage whatsoever suffered or incurred by any other person resulting from the use of, or reliance upon, the data or information contained herein. Copyright in this publication is owned by IBISWorld Inc. The publication is sold on the basis that the purchaser agrees not to copy the material contained within it for other than the purchasers own purposes. In the event that the purchaser uses or quotes from the material in this publication in papers, reports, or opinions prepared for any other person it is agreed that it will be sourced to: IBISWorld Inc.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Macroeconomics Theories and Policies 10th Edition Froyen 013283152X Solution ManualDocument6 pagesMacroeconomics Theories and Policies 10th Edition Froyen 013283152X Solution Manualkelly100% (27)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 703 - Finance For Managers - Azizul Hakem - Sub On 18 JulyDocument10 pages703 - Finance For Managers - Azizul Hakem - Sub On 18 JulyAzeezulNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quickfix Financial ManagementDocument7 pagesQuickfix Financial ManagementMiconNo ratings yet

- Small Business Profit and Loss StatementDocument6 pagesSmall Business Profit and Loss StatementDede KusumadiprajaNo ratings yet

- Business Enterprise Simulation q4 Module 9Document24 pagesBusiness Enterprise Simulation q4 Module 9cigfreudezekielmesa18No ratings yet

- BIR Ruling DA-058-08 (Reimbursement - Affiliates)Document4 pagesBIR Ruling DA-058-08 (Reimbursement - Affiliates)joefieNo ratings yet

- DFD PayrollDocument1 pageDFD PayrollJanine Taboga100% (2)

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

- TIME IN and OUT With Payslip 1 - ContinueDocument11 pagesTIME IN and OUT With Payslip 1 - Continuefeona llosalaNo ratings yet

- CAF 01 - FAR-1 All Tests by Sir Jawad Mehmood (S24)Document45 pagesCAF 01 - FAR-1 All Tests by Sir Jawad Mehmood (S24)manzoorabdullah585No ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Chapter 2: Engineering Costs and Cost EstimatingDocument16 pagesChapter 2: Engineering Costs and Cost EstimatingKamNo ratings yet

- Economics Chapter 2Document34 pagesEconomics Chapter 2cyndaleaNo ratings yet

- Applied Macroeconomics Test BankDocument23 pagesApplied Macroeconomics Test BankfelixsoNo ratings yet

- Chapter 9 National Income Accounting and The Balance of PaymentDocument26 pagesChapter 9 National Income Accounting and The Balance of PaymentNur AtikaNo ratings yet

- Cafe Monte BiancoDocument21 pagesCafe Monte BiancoWilliam Torrez OrozcoNo ratings yet

- Safari - 10 Nov 2018 at 22:02Document1 pageSafari - 10 Nov 2018 at 22:02berekettsegaye215No ratings yet

- Profit or Loss1 PDFDocument7 pagesProfit or Loss1 PDFdanishahmed2126No ratings yet

- Trial Balance Income Statement Balance SheetDocument3 pagesTrial Balance Income Statement Balance SheetKiabu ParindaliNo ratings yet

- EOS Disney FinancialsDocument12 pagesEOS Disney FinancialsMuskan ValbaniNo ratings yet

- Fin440 ApexFoods and GHAILDocument22 pagesFin440 ApexFoods and GHAILAbid KhanNo ratings yet

- TOA Quizzer 2 - Conceptual FrameworkDocument13 pagesTOA Quizzer 2 - Conceptual FrameworkmarkNo ratings yet

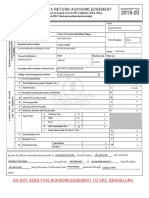

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- CHAPTER 1.an Introduction To Accounting TheoryDocument15 pagesCHAPTER 1.an Introduction To Accounting TheoryIsmi Fadhliati100% (2)

- Adhi PDFDocument3 pagesAdhi PDFSixth ScentsNo ratings yet

- YDS KPDS ÜDS ParagraflarDocument111 pagesYDS KPDS ÜDS Paragraflararamayapar100% (2)

- (A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Document5 pages(A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Sergio NicolasNo ratings yet

- Practice Questions 3-11 - 2020Document12 pagesPractice Questions 3-11 - 2020MUHAMMAD AZAMNo ratings yet

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- Automatic Salary Slip Generator Using ExcelDocument7 pagesAutomatic Salary Slip Generator Using ExcelkiuwmipNo ratings yet