Professional Documents

Culture Documents

Interest Rate Hedging Tools Caps, Floors, Collars & FRA’s

Uploaded by

nivedita_h424040 ratings0% found this document useful (0 votes)

18 views11 pagesInterest Rate Derivatives Caps, Floors, Collars and FRA's hedging the Interest Rate. Hedging a raise in Interest Rate (for borrowing decisions) or short term hedging. Hedging a fall in Interest Rate (for investing decisions)

Original Description:

Original Title

IRD_Caps & Floors

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInterest Rate Derivatives Caps, Floors, Collars and FRA's hedging the Interest Rate. Hedging a raise in Interest Rate (for borrowing decisions) or short term hedging. Hedging a fall in Interest Rate (for investing decisions)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views11 pagesInterest Rate Hedging Tools Caps, Floors, Collars & FRA’s

Uploaded by

nivedita_h42404Interest Rate Derivatives Caps, Floors, Collars and FRA's hedging the Interest Rate. Hedging a raise in Interest Rate (for borrowing decisions) or short term hedging. Hedging a fall in Interest Rate (for investing decisions)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 11

Interest Rate Derivatives Caps, Floors, Collars & FRAs

Hedging the Interest Rate

Hedging a raise in Interest Rate (for borrowing decisions) or short term hedging.

Hedging a fall in Interest Rate ( for investing decisions) or long term hedging.

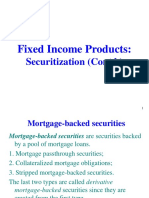

Interest rate Caps

Over-the-counter contract Considering a floating rate, Interest rate is reset periodically to LIBOR. The time between resets tenor An interest rate cap is designed to provide insurance against the rate of interest on the floating rate note rising above a certain level. The level is known as CAP RATE. An interest rate cap is a portfolio of Call options on interest rate.

Interest rate Caps-Example

Principal Amount - $10 Million Tenor 3 months Life of the cap 3 Years Cap rate - 4%(payments made quarterly) Cap provides hedge against the floating rate rising above 4%. The 3-m LIBOR is 5%, 0.25*0.05*$10,000,000= $1,25,000 Cap provides a pay-off of $25,000.

Interest rate Floors

An interest rate floor is designed to provide insurance against the rate of interest on the floating rate note falls below a certain rate. The level is known as FLOOR RATE. An interest rate Floor is a portfolio of PUT options on Interest rates.

Interest rate Collars

A Collar is a strategy designed to guarantee that the interest rate on the underlying floating rate always remain between two levels.

Combination of a Cap & Floor.

P10/Page 489 P G Apte.

PROBLEM

Forward Rate Agreement - FRAs

Notionally an agreement between two parties One of them(seller of FRA) contracts to lend the other( buyer of FRA) a certain amount of funds, in particular currency, for a specified period starting at a specified future rate, at an interest rate fixed at the time of agreement.

Notionally Underlying principal exchange doesnt happen, but only interest rate is locked in. USD 6/9 months: 7.20-7.30% p.a. The bank willing to accept 3-month US Dollar deposit, starting 6 months from now, maturing 9 months from now at an interest rate of 7.20%- Bid rate.

The End.

You might also like

- Swaps Session - Derivatives Risk ManagementDocument19 pagesSwaps Session - Derivatives Risk ManagementUtsav ThakkarNo ratings yet

- Fixed Income & Interest Rate DerivativesDocument64 pagesFixed Income & Interest Rate DerivativeskarthikNo ratings yet

- Unit Vi: Financial Risk ManagementDocument23 pagesUnit Vi: Financial Risk Managementmtechvlsitd labNo ratings yet

- SwapsDocument13 pagesSwapsNamrata KolteNo ratings yet

- International Financial Management PgapteDocument30 pagesInternational Financial Management Pgapterameshmba100% (1)

- Interest Rate Swaps (Final)Document35 pagesInterest Rate Swaps (Final)Harish SharmaNo ratings yet

- Definition of 'Amortizing Swap'Document4 pagesDefinition of 'Amortizing Swap'DishaNo ratings yet

- Part3D SwapDocument39 pagesPart3D SwapKaruna SethiNo ratings yet

- Session 6 - FDDocument26 pagesSession 6 - FDDaksh KhullarNo ratings yet

- Lec 10Document26 pagesLec 10danphamm226No ratings yet

- Fixed Income MarketsDocument15 pagesFixed Income MarketstoabhishekpalNo ratings yet

- 1.1 CallableDocument48 pages1.1 CallableEnnayojaravNo ratings yet

- Swaps-TSM 2020Document28 pagesSwaps-TSM 2020Rathina VelNo ratings yet

- Lecture 4 (Interest Rate and Bond Valuation)Document54 pagesLecture 4 (Interest Rate and Bond Valuation)Christy Ho100% (1)

- Chapter 10Document30 pagesChapter 10cedNo ratings yet

- TVM Seminar 3 NotesDocument34 pagesTVM Seminar 3 Notes朱艺璇No ratings yet

- Chapter 5: Interest Rate Risks: Lecturer: Amadeus GABRIEL La Rochelle Business SchoolDocument25 pagesChapter 5: Interest Rate Risks: Lecturer: Amadeus GABRIEL La Rochelle Business SchoolJuana BoresNo ratings yet

- Irswap 03Document6 pagesIrswap 03neha galaNo ratings yet

- UntitledDocument29 pagesUntitledDEEPIKA S R BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Financial MarketsDocument94 pagesFinancial MarketsEman AhmedNo ratings yet

- Interest Rate CollarDocument3 pagesInterest Rate Collarinaam mahmoodNo ratings yet

- FRM SwapsDocument64 pagesFRM Swapsakhilyerawar7013No ratings yet

- Swaps: Derivatives & Risk ManagementDocument17 pagesSwaps: Derivatives & Risk ManagementMayankSharmaNo ratings yet

- 4.0 Adjustable Rate & Variable Payment MortgagesDocument10 pages4.0 Adjustable Rate & Variable Payment MortgageserickekutuNo ratings yet

- CH12 13 14 - 2023Document34 pagesCH12 13 14 - 2023Siviwe DubeNo ratings yet

- Advanced Financial Accounting - Interest Rates QuestionDocument12 pagesAdvanced Financial Accounting - Interest Rates Questionailiwork worksNo ratings yet

- Financial Swaps EditedDocument19 pagesFinancial Swaps EditedMaria U DavidNo ratings yet

- BF330 FPD 8 2020 1Document49 pagesBF330 FPD 8 2020 1richard kapimpaNo ratings yet

- CCRA Session 6Document17 pagesCCRA Session 6Amit GuptaNo ratings yet

- Structured Products 2Document41 pagesStructured Products 2SCCEGNo ratings yet

- SwapsDocument16 pagesSwapsLuvnica VermaNo ratings yet

- Valuation of Securities-3Document54 pagesValuation of Securities-3anupan92No ratings yet

- Interest Rate Risk I (CH 8)Document13 pagesInterest Rate Risk I (CH 8)Mahbub TalukderNo ratings yet

- Derivatives PresentationDocument62 pagesDerivatives Presentationivyfinest100% (1)

- Manage Interest Rate Risk with Financial SwapsDocument27 pagesManage Interest Rate Risk with Financial Swapsraj kumarNo ratings yet

- Derivatives in ALMDocument53 pagesDerivatives in ALMSam SinhaNo ratings yet

- 2 Determinant of Int RateDocument23 pages2 Determinant of Int RateGovind DuragkarNo ratings yet

- Interest Rate SwapsDocument6 pagesInterest Rate SwapsKanchan ChawlaNo ratings yet

- Forward Rate Agreements 517Document10 pagesForward Rate Agreements 517stannis69420No ratings yet

- Swap Derivatives: Forward Swaps and SwaptionsDocument74 pagesSwap Derivatives: Forward Swaps and Swaptionsvineet_bmNo ratings yet

- Term Structure of Interest Rates Explained in 40 CharactersDocument12 pagesTerm Structure of Interest Rates Explained in 40 CharactersNikunj ShahNo ratings yet

- Ch5 Interest RatesDocument25 pagesCh5 Interest Rateszey9991No ratings yet

- VERY GOOD Ch7 Managing Bond Portfolios and Rate StrategiesDocument53 pagesVERY GOOD Ch7 Managing Bond Portfolios and Rate StrategiesKapil AgrawalNo ratings yet

- Intermediate Finance Session 9 Chapter 18 Key ConceptsDocument56 pagesIntermediate Finance Session 9 Chapter 18 Key ConceptsrizaunNo ratings yet

- Futures Options and Swaps PPT MBA FINANCEDocument11 pagesFutures Options and Swaps PPT MBA FINANCEBabasab Patil (Karrisatte)No ratings yet

- Lecture 5312312Document55 pagesLecture 5312312Tam Chun LamNo ratings yet

- Understanding the Yield CurveDocument14 pagesUnderstanding the Yield CurveAmirNo ratings yet

- Interest RatesDocument12 pagesInterest RatesRTushar BeeshmNo ratings yet

- F3 Chapter 10Document22 pagesF3 Chapter 10Ali ShahnawazNo ratings yet

- Understanding Yield SpreadDocument15 pagesUnderstanding Yield SpreadShubham KumarNo ratings yet

- The Term Structure and Interest Rate Dynamics: © 2016 CFA Institute. All Rights ReservedDocument35 pagesThe Term Structure and Interest Rate Dynamics: © 2016 CFA Institute. All Rights ReservedKapil AgrawalNo ratings yet

- Basics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsDocument39 pagesBasics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsVrinda GargNo ratings yet

- Interest Rate RiskDocument11 pagesInterest Rate Riskfrancis280No ratings yet

- Introduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıDocument27 pagesIntroduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıJean CastroNo ratings yet

- ACI Forward Rate Agreements (FRAs) CourseDocument12 pagesACI Forward Rate Agreements (FRAs) CourseJovan SsenkandwaNo ratings yet

- What is a Forward Rate Agreement (FRADocument2 pagesWhat is a Forward Rate Agreement (FRAmuzzamil123No ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Indian Economy-IDocument37 pagesIndian Economy-Inivedita_h42404No ratings yet

- KAS Notification 2015Document42 pagesKAS Notification 2015Bhaskar BabuNo ratings yet

- Kannada Science SampleQPaper QA1 PDFDocument25 pagesKannada Science SampleQPaper QA1 PDFnivedita_h42404No ratings yet

- Recruitment Temp Staff PDFDocument3 pagesRecruitment Temp Staff PDFnivedita_h42404No ratings yet

- Union Budget 2015 PDFDocument5 pagesUnion Budget 2015 PDFnivedita_h42404No ratings yet

- Kannada Langauge SampleQPaper Q2 PDFDocument20 pagesKannada Langauge SampleQPaper Q2 PDFnivedita_h42404No ratings yet

- Karnataka 2nd PUC Time Table 2015 PDFDocument5 pagesKarnataka 2nd PUC Time Table 2015 PDFnivedita_h42404No ratings yet

- KAS General Studies Prelims 2009 PDFDocument12 pagesKAS General Studies Prelims 2009 PDFnivedita_h42404No ratings yet

- Revalidation Test Paper Question-GR IDocument8 pagesRevalidation Test Paper Question-GR IVelayudham ThiyagarajanNo ratings yet

- Postal Test Papers_P8_Intermediate_Syllabus 2012Document23 pagesPostal Test Papers_P8_Intermediate_Syllabus 2012nivedita_h42404No ratings yet

- Managerial EconomicsDocument271 pagesManagerial EconomicsRaghu Sabbithi50% (2)

- Paper5 SolutionDocument25 pagesPaper5 Solutionnivedita_h42404No ratings yet

- Kannada MentalAbility SampleQPaper QA1 PDFDocument24 pagesKannada MentalAbility SampleQPaper QA1 PDFnivedita_h424040% (1)

- Kannada Science sampleQPaper Qa2Document23 pagesKannada Science sampleQPaper Qa2Vinay CkmNo ratings yet

- Probationary Officer COMPUTER KNOWLEDGE NOTES.............................................................................Document48 pagesProbationary Officer COMPUTER KNOWLEDGE NOTES.............................................................................Ghanesh SamalaNo ratings yet

- Bee PDFDocument430 pagesBee PDFNamita KumarNo ratings yet

- Neralknowledge SampleQPaper Q1 PDFDocument20 pagesNeralknowledge SampleQPaper Q1 PDFnivedita_h42404No ratings yet

- Tax Laws and Practice (Module I Paper 4)Document778 pagesTax Laws and Practice (Module I Paper 4)sonamkhanchandaniNo ratings yet

- Apeksha J Nayak (08VWCM6006)Document104 pagesApeksha J Nayak (08VWCM6006)nivedita_h42404No ratings yet

- NCERT Class 11 EconomicsDocument201 pagesNCERT Class 11 Economicsnivedita_h42404100% (1)

- Foundation Paper 4 FullDocument222 pagesFoundation Paper 4 FullVyasaraj KumarNo ratings yet

- NCFM Insurance ModuleDocument92 pagesNCFM Insurance ModuleBronil D'abreoNo ratings yet

- Tally ERP 9 - TutorialDocument1,192 pagesTally ERP 9 - TutorialChandan Mundhra85% (68)

- Business Research MethodologyDocument85 pagesBusiness Research Methodologynivedita_h42404No ratings yet

- Desertation SlidesDocument8 pagesDesertation Slidesnivedita_h42404No ratings yet

- Dept. of HindiDocument9 pagesDept. of Hindinivedita_h42404No ratings yet

- Securities Market (Basic) Module - RevDocument284 pagesSecurities Market (Basic) Module - RevnnjndjnNo ratings yet

- Technical Writing and Report WritingDocument15 pagesTechnical Writing and Report Writingnivedita_h42404No ratings yet

- Module 1Document28 pagesModule 1nivedita_h42404No ratings yet

- Module6 Lecture 2Document25 pagesModule6 Lecture 2nivedita_h42404No ratings yet