Professional Documents

Culture Documents

Moody's Downgrades Five Egyptian Banks On High Credit Risk

Moody's Downgrades Five Egyptian Banks On High Credit Risk

Uploaded by

AlexisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moody's Downgrades Five Egyptian Banks On High Credit Risk

Moody's Downgrades Five Egyptian Banks On High Credit Risk

Uploaded by

AlexisCopyright:

Available Formats

Moodys Downgrades Five Egyptian Banks On High Credit Risk

The credit agency, Moodys, downgraded 5 Egyptian banks from B3 to Caa1 on April 1, 2013.

VENTURES AFRICA Rating agency, Moodys Investors Services, downgraded the local currency deposit ratings of five Egyptian banks citing very high credit risk in the troubled country, it was reported at the weekend.

Ahram Online reported that the National Bank of Egypt was downgraded to Caa1 from B3, Banque du Caire to Caa1 from B3, Banque Misr to Caa1 from B3, Commercial International Bank to Caa1 from B3, and Bank of Alexandria to B2 from B3. This comes shortly after Moodys had relegated Egypts sovereign rating to Caa1, demonstrating reduced quality and very high credit risk.

According to Moodys, Egypt could fail to pay foreign debts within five years, saying the chance was 40 percent. Investors are anticipating official approval of a $4.8 billion loan from the International Monetary Fund (IMF), with observers attributing the setback in the granting of the loan to Egypts continuing political uncertainty.

According to Ahram Online, Egypts $13 billion in foreign reserves is not sufficient to cover the cost of three months of imports. Moodys said progress in Egypts sovereign credit risk profile and operating setting could promote its bank ratings.

Article from ventures

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Structuralism Vs ReconstructionismDocument3 pagesStructuralism Vs ReconstructionismRupashi GoyalNo ratings yet

- Assignment For Tally PrimeDocument12 pagesAssignment For Tally PrimeSagarNo ratings yet

- Ranking Mutually Exclusive InvestmentsDocument22 pagesRanking Mutually Exclusive InvestmentsSimran JainNo ratings yet

- School of Accounting and Finance: Sample ExaminationDocument4 pagesSchool of Accounting and Finance: Sample ExaminationChenyu HuangNo ratings yet

- 08-CRIDP Proposal-2021-22Document56 pages08-CRIDP Proposal-2021-22Highways DepartmentNo ratings yet

- The Circular Flow of Economics ActivitiesDocument7 pagesThe Circular Flow of Economics ActivitiesLuna AdrianneNo ratings yet

- Japanese Invasion MoneyDocument1 pageJapanese Invasion MoneySimi KiranNo ratings yet

- Simple and General Annuities TrueDocument50 pagesSimple and General Annuities TrueRhomel Phillipe' de GuzmanNo ratings yet

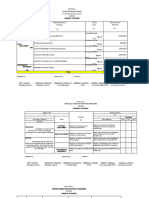

- Revision of GST - Orders IssuedDocument4 pagesRevision of GST - Orders IssuedSE PR MedakNo ratings yet

- NBFC CompaniesDocument705 pagesNBFC CompaniesGauravs100% (1)

- E-Book DemoDocument12 pagesE-Book Demokejolij439No ratings yet

- Platts Global Petrochemical Trends h1 2020Document32 pagesPlatts Global Petrochemical Trends h1 2020SunitNo ratings yet

- FS Form 5446Document12 pagesFS Form 54462Plus100% (1)

- LESSON 2 - Globalisation Internalisation of Diff. Industries MarketsDocument22 pagesLESSON 2 - Globalisation Internalisation of Diff. Industries MarketsRumeysha rujubNo ratings yet

- Report Timber 1c (Table Project)Document2 pagesReport Timber 1c (Table Project)Nailea DevoraNo ratings yet

- Reforms of BhuttoDocument6 pagesReforms of BhuttoHamza Naseer0% (1)

- Lesco 5-0-20 10feDocument1 pageLesco 5-0-20 10feCory HansonNo ratings yet

- Test Bank For Public Finance in Canada 5th EditionDocument36 pagesTest Bank For Public Finance in Canada 5th Editionperulaalienatorrbw36100% (46)

- Financial Accounting (Assignment)Document7 pagesFinancial Accounting (Assignment)Bella SeahNo ratings yet

- Background of The StudyDocument2 pagesBackground of The StudyAdonis GaoiranNo ratings yet

- Melakuu AbebeDocument26 pagesMelakuu AbebemelemengistNo ratings yet

- Shuttle ScheduleDocument2 pagesShuttle Schedulerawg12No ratings yet

- 8938 InstructionsDocument13 pages8938 Instructionssrinivas NNo ratings yet

- Agus Didik SetiyonoDocument152 pagesAgus Didik Setiyonobakhtiar2014No ratings yet

- Lesson 2 RegionalizationDocument50 pagesLesson 2 Regionalizationave sambranaNo ratings yet

- Aip 2023 2 3Document29 pagesAip 2023 2 3menchiemanaloNo ratings yet

- Bac Info End-Term Test 2Document5 pagesBac Info End-Term Test 2asmakadraouiNo ratings yet

- Problem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsDocument6 pagesProblem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsMd. Shahriar Kabir RishatNo ratings yet

- 01 Cash and Cash EquivalentDocument3 pages01 Cash and Cash EquivalentJetro JuantaNo ratings yet

- PDFDocument4 pagesPDFAce MereriaNo ratings yet