Professional Documents

Culture Documents

3 CH 15 Uang Pasar Uang

Uploaded by

Bella NovitasariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 CH 15 Uang Pasar Uang

Uploaded by

Bella NovitasariCopyright:

Available Formats

Money, Interest Rates, and the Exchange Rate Chapter 15

1. Money

2. Money market equilibrium

3. Money supply and the exchange rate in the short run

4. Money supply and the exchange rate in the long run

Money

1.1

What is money?

Medium of exchange

Unit of account

Store of value

M1 is determined by monetary authority

1.2

Money demand

Money is one way to hold wealth Transactions demand (liquidity) Opportunity cost of money (nominal interest rate) Purchasing power of money matters M P Aggregate money demand (add over all households and rms)

Md = L (R; Y ) P

Money Market Equilibrium

2.1

Graph of money market

Graph real money demand against R Graph real money supply against R Determines equilibrium R What if R were higher than equilibrium? excess supply money so agents try to sell money for bonds driving price of bonds up and interest rate down.

2.2

Eect of shocks on equilibrium R

M increases

Y increases

A change in nancial technology reduces money demand at each R and Y

Monetary policy - Fed cuts the interest rate

Money Supply and the Exchange Rate in the Short Run

3.1

Assumptions

P is xed

E = E$=e

e Et +1 is xed and exogenous

3.2

Graph of equilibrium

US money market equilibrium determines R$ European money market equilibrium determines Re

Interest rate parity determines Et

R$ = Re +

e Et +1

Et

Et

3.3

Eect of shocks on the exchange rate

Increase in US money supply

Decrease in European money supply

Money Supply and the Exchange Rate in the Long Run

4.1

Assumptions

e P and Et +1 are endogenous

Determined by monetary neutrality

4.2

Monetary Neutrality

Money aects nominal prices proportionately and has no eect on real variables Real money supply M P unchanged when M increases

$ unchanged when M increases Relative price of domestic goods EP e

4.3

Shocks

Reduction in M

e Et +1 falls

Short - run P is xed, but falls in the long run

You might also like

- The Foreign Exchange Matrix: A new framework for understanding currency movementsFrom EverandThe Foreign Exchange Matrix: A new framework for understanding currency movementsRating: 3.5 out of 5 stars3.5/5 (3)

- Currency BasicsDocument18 pagesCurrency BasicsChandan AgarwalNo ratings yet

- Money, Interest Rates, and The Exchange RateDocument12 pagesMoney, Interest Rates, and The Exchange RatemissariwatiNo ratings yet

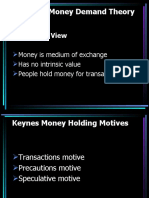

- Keynesian Money Demand Theory: Traditional ViewDocument52 pagesKeynesian Money Demand Theory: Traditional ViewALINo ratings yet

- Price Level and InflationDocument15 pagesPrice Level and InflationAr RainNo ratings yet

- Foreign Exchange MarketsDocument19 pagesForeign Exchange MarketsniggerNo ratings yet

- Group 6 Money Growth & InflationDocument27 pagesGroup 6 Money Growth & Inflationlarasetiari123No ratings yet

- EC2102 - The Asset MarketDocument41 pagesEC2102 - The Asset MarketsanjeeNo ratings yet

- NotesDocument2 pagesNotesbousry.meryemNo ratings yet

- Book - IFM - Lecture NotesDocument261 pagesBook - IFM - Lecture NotesasadNo ratings yet

- Lecture 7 - Money Growth and InflationDocument35 pagesLecture 7 - Money Growth and InflationY Nguyen Ngoc Nhu QTKD-1TC-18No ratings yet

- ln1 PDFDocument20 pagesln1 PDFM.n KNo ratings yet

- Money and Monetary Policy: Md. Shawkat Ali Professor Department of EconomicsDocument23 pagesMoney and Monetary Policy: Md. Shawkat Ali Professor Department of EconomicsEverything What U WantNo ratings yet

- Foreign Exchange Management: Tools of International ExchangeDocument42 pagesForeign Exchange Management: Tools of International ExchangeSarvajeet BiswasNo ratings yet

- Academic Script - Pom - 32200228060602021111Document8 pagesAcademic Script - Pom - 32200228060602021111Justin AryanNo ratings yet

- Money Growth and Inflation LessonDocument27 pagesMoney Growth and Inflation Lessonlarasetiari123No ratings yet

- Theoretical Framework of IMPACTS OF INFLATION AMONG MICRO BUSINESSES IN MASINLOC ACADEMIC YEAR 2022Document4 pagesTheoretical Framework of IMPACTS OF INFLATION AMONG MICRO BUSINESSES IN MASINLOC ACADEMIC YEAR 2022John Brad Angelo LacuataNo ratings yet

- (Determination of Exchange Rates) PDFDocument24 pages(Determination of Exchange Rates) PDFEdward Joseph A. RamosNo ratings yet

- Chapter 3Document49 pagesChapter 3Trang ĐoànNo ratings yet

- Liquidity Preference TheoryDocument10 pagesLiquidity Preference TheoryRajshree MundraNo ratings yet

- International Economics: Foreign Exchange Markets and Exchange RatesDocument50 pagesInternational Economics: Foreign Exchange Markets and Exchange RatesMa Shareen Joy SaleNo ratings yet

- MIT14 02F09 Lec10Document27 pagesMIT14 02F09 Lec10mkmusaNo ratings yet

- Session 9 Reading 1. This Set of Slides 2. From The Text Material Chapter - 5Document33 pagesSession 9 Reading 1. This Set of Slides 2. From The Text Material Chapter - 5AkshitSoniNo ratings yet

- The Asset Market Money and PriceDocument12 pagesThe Asset Market Money and PriceRaja Sikanadar - 92023/TCHR/BSBNo ratings yet

- IFM - Lecture NotesDocument256 pagesIFM - Lecture NotesGAJALNo ratings yet

- IFM - Lecture NotesDocument249 pagesIFM - Lecture NotesSharath S100% (1)

- Exchange RatesDocument81 pagesExchange Ratesankit1070No ratings yet

- Purchase Power ParityDocument7 pagesPurchase Power ParityFALCO1234No ratings yet

- Macro Lecture07Document52 pagesMacro Lecture07Lê Văn KhánhNo ratings yet

- Chapter 3Document47 pagesChapter 3vanhuyennguyen2003No ratings yet

- Currency Risk and Pricing Kernel VolatilityDocument35 pagesCurrency Risk and Pricing Kernel Volatilitygunjananand070No ratings yet

- Lecture 21 ME Ch.15 Foreign Exchange MarketDocument50 pagesLecture 21 ME Ch.15 Foreign Exchange MarketAlif SultanliNo ratings yet

- Ifm - Lecture NotesDocument272 pagesIfm - Lecture NotesJeremy MaihuaNo ratings yet

- Principles of MacroeconomicsDocument52 pagesPrinciples of Macroeconomicsmoaz21100% (1)

- ICERDocument11 pagesICEROussama ChaoukiNo ratings yet

- Lecture 1 - Is-lM & AD-As AnalysisDocument25 pagesLecture 1 - Is-lM & AD-As AnalysisLuis Aragonés FerriNo ratings yet

- International Business: Foreign Exchange MarketsDocument34 pagesInternational Business: Foreign Exchange MarketsRahul DewakarNo ratings yet

- Chapter+3+ +blaauw+ +class+2023Document103 pagesChapter+3+ +blaauw+ +class+2023Msa MsaNo ratings yet

- 1 Foreign Exchange Markets and Exchange RatesDocument7 pages1 Foreign Exchange Markets and Exchange RatessheetalNo ratings yet

- Quantity Theory of MoneyDocument12 pagesQuantity Theory of MoneyNuurNo ratings yet

- Chapter Eight: 8. Foriegn Exchange MarketsDocument26 pagesChapter Eight: 8. Foriegn Exchange MarketsNhatty WeroNo ratings yet

- Foreign Exchange MarketsDocument17 pagesForeign Exchange MarketsDiana BercuNo ratings yet

- Foreignexchangemarket 190712100000Document79 pagesForeignexchangemarket 190712100000Prasanjit BiswasNo ratings yet

- Exchange RatesDocument32 pagesExchange RatesStuti BansalNo ratings yet

- Mid Term 2 Đi inDocument5 pagesMid Term 2 Đi insodfNo ratings yet

- Quantity Theories of Money - From Fisher To FriedmanDocument4 pagesQuantity Theories of Money - From Fisher To FriedmansahadudheenNo ratings yet

- Financial Markets and Institution: The Foreign Exchange MarketDocument33 pagesFinancial Markets and Institution: The Foreign Exchange MarketDavid LeowNo ratings yet

- Money Growth and Inflation: Week 7Document22 pagesMoney Growth and Inflation: Week 7Dewi Ushriyah UlyaNo ratings yet

- Lecture Notes 3Document15 pagesLecture Notes 3Eris HotiNo ratings yet

- (TCQT) Slide - Group 1Document53 pages(TCQT) Slide - Group 1hoangminh01122019No ratings yet

- Money, Interest Rates, and Exchange Rates (Lecture 7)Document8 pagesMoney, Interest Rates, and Exchange Rates (Lecture 7)nihadsamir2002No ratings yet

- Econjn 0060 Study Guide, Exam 3 Fall17Document18 pagesEconjn 0060 Study Guide, Exam 3 Fall17Lauren SerafiniNo ratings yet

- Ch30 Money Growth and InflationDocument16 pagesCh30 Money Growth and InflationMộc TràNo ratings yet

- Lecture 03 Notes - Spring 2009 PDFDocument8 pagesLecture 03 Notes - Spring 2009 PDF6doitNo ratings yet

- GRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM CurveDocument3 pagesGRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM Curveprasadpatankar9No ratings yet

- Mishkin 19 28essaywithansDocument21 pagesMishkin 19 28essaywithanssmsm93No ratings yet

- Quantity Theory of MoneyDocument25 pagesQuantity Theory of MoneyNuurNo ratings yet

- International Parity ConditionsDocument62 pagesInternational Parity ConditionsHaimanot tessemaNo ratings yet

- Chapter 4Document19 pagesChapter 4Proveedor Iptv EspañaNo ratings yet

- Analisis Faktor-Faktor Yang Mempengaruhi Produksi Padi Sawah Pada Daerah Tengah Dan Hilir Aliran Sungai AyungDocument10 pagesAnalisis Faktor-Faktor Yang Mempengaruhi Produksi Padi Sawah Pada Daerah Tengah Dan Hilir Aliran Sungai AyungBella NovitasariNo ratings yet

- Lembaran Soal PostestDocument4 pagesLembaran Soal PostestBella NovitasariNo ratings yet

- Ps 3 ADocument9 pagesPs 3 ABella NovitasariNo ratings yet

- Solowmodel (BAGUS NIH)Document19 pagesSolowmodel (BAGUS NIH)Bella NovitasariNo ratings yet

- The Solow Growth ModelDocument2 pagesThe Solow Growth ModelBella NovitasariNo ratings yet

- ch05 Mark HirscheyDocument11 pagesch05 Mark HirscheyBella NovitasariNo ratings yet

- Managerial Economics & Business Strategy: Market Forces: Demand and SupplyDocument41 pagesManagerial Economics & Business Strategy: Market Forces: Demand and SupplyBella NovitasariNo ratings yet

- ARTIKEL - Hubungan Faktor Sosial Ekonomi Dan Ketahanan Pangan Terhadap KEJADIAN STUNTINGDocument9 pagesARTIKEL - Hubungan Faktor Sosial Ekonomi Dan Ketahanan Pangan Terhadap KEJADIAN STUNTINGBella NovitasariNo ratings yet