Professional Documents

Culture Documents

Product Costing and Cost Accumulation in A Batch Production Environment

Uploaded by

Samuel SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Costing and Cost Accumulation in A Batch Production Environment

Uploaded by

Samuel SantosCopyright:

Available Formats

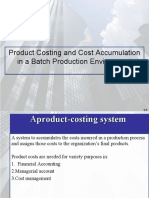

Chapter 3

Product Costing and Cost Accumulation in a Batch Production Environment

McGraw-Hill/Irwin

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objective 1

3-2

Product and Service Costing

Financial Accounting

Product costs are used to value inventory and to compute cost of goods sold.

Managerial Accounting and Cost Management

Product costs are used for planning, control, directing, and management decision making.

3-3

Learning Objective 2

3-4

Flow of Costs in Manufacturing Firm

Work-in-Process Inventory Direct material cost Direct labor cost Manufacturing overhead Product cost transferred when product is finished Finished Goods Inventory

Cost of Goods Sold Expense closed into Income Summary at end of accounting period

Income Summary

3-5

Learning Objective 3

3-6

Types of Product-Costing Systems

Process Costing Job-Order Costing

Used for production of large, unique, high-cost items.

Built to order rather than mass produced.

Many costs can be directly traced to each job.

TWO TYPES: Job-shop operations Products manufactured in very low volumes or at a time. one

Batch-production operations

Multiple products in batches of relatively small quantity.

3-7

Types of Product-Costing Systems

Process Costing Job-Order Costing

Typical job-order cost applications: Special-order printing Building construction Also used in service industry Hospitals Law firms

3-8

Types of Product-Costing Systems

Process Costing Job-Order Costing

Used for production of small, identical, low cost

items.

Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Typical process cost applications:

Petrochemical refinery Paint manufacturer Paper mill

3-9

Accumulating Costs in a Job-Order Costing System

The primary document for tracking the costs associated with a given job is the jobcost record.

Lets investigate using the AFB Company

3-10

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price Cost Date Direct Material Requisition Number Quantity

Date

Requisition Number

Direct Labor Quantity

Unit Price

Cost

Date

Manufacturing Overhead Requisition Number Quantity

Unit Price

Cost

Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount

Date

Shipping Summary Units Remaining Units Shipped in Inventory

Cost Balance

3-11

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price Cost Date Direct Material Requisition Number Quantity

Date

Requisition Number

Direct Labor Quantity

Unit Price

Cost

A materials requisition Date Unit Price form isCost used to Cost Summary authorize the use of Cost Item Amount Total direct material materials on a job. Total direct labor

Manufacturing Overhead Requisition Number Quantity Total manufacturing overhead Total cost Unit cost Shipping Summary Units Remaining Units Shipped in Inventory

Lets see one

Cost Balance

3-12

Date

Job-Order Cost Accounting

Requisition No. 352 Job Number to Be Charged F16 Department Supervisor Timothy Williams Item Aluminum Quantity 7,200 sq ft Unit Cost $ 2.50 Date 11/1/x1 Dept. Painting

Amount 18,000.00

Authorized Signature

Timothy Williams

3-13

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1/x1 Direct Material Requisition Number Quantity 352 7,200 sq ft Direct Labor Requisition Number Quantity

Date

Unit Price

Cost

Date

Manufacturing Overhead Requisition Number Quantity

Unit Price

Cost

Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000

Date

Shipping Summary Units Remaining Units Shipped in Inventory

Cost Balance

3-14

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Quantity

Date

Requisition Number

Unit Price

Cost

Date

Manufacturing Overhead Requisition Number Quantity

Unit Price

Cost

Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000

Accumulate direct labor costs by means of a work record, such as a time ticket, for each employee.

Lets see one

Date

Shipping Summary Units Remaining Units Shipped in Inventory

Cost Balance

3-15

Employee Time Ticket

Employee Ron Bradley Employee Number 12 Date 11/5/20x1 Department Painting Station

Time Started 8:00 11:30 1:00

Time Stopped 11:30 12:00 5:00

Job Number F16 Shop cleanup A26

3-16

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Quantity 600

Date Various dates

Time Cards Various time cards

Unit Price $20

Cost $12,000

Date

Manufacturing Overhead Requisition Number Quantity

Unit Price

Cost

Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000 12,000

Date

Shipping Summary Units Remaining Units Shipped in Inventory

Cost Balance

3-17

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Requisition Number Quantity Various time cards 600

Date Various dates

Unit Price $20

Cost $12,000

Date

Manufacturing Overhead Requisition Number Quantity

Unit Price

Cost

Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Apply manufacturing overhead to jobs using a predetermined overhead rate based on direct labor hours (DLH). Shipping Summary Lets do it Units Remaining

Date Units Shipped in Inventory Cost Balance

3-18

Amount $18,000 12,000

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Requisition Number Quantity Various time cards 600

Date Various dates

Unit Price $20

Cost $12,000

Date 11/30

Manufacturing Overhead Requisition Number Quantity Direct Labor Hours 600 Cost Summary Cost Item

Unit Price $30.00

Cost $18,000

Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000 12,000 18,000

Date

Shipping Summary Units Remaining Units Shipped in Inventory

Cost Balance

3-19

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Quantity 600

Date Various dates

Requisition Number Various time cards

Unit Price $20

Cost $12,000

Date 11/30

Manufacturing Overhead Requisition Number Quantity Direct Labor Hours 600 Cost Summary Cost Item

Unit Price $30.00

Cost $18,000

Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000 12,000 18,000 $48,000 $600

Date 11/30

Shipping Summary Units Remaining Units Shipped in Inventory 60 20

Cost Balance $12,000

3-20

Job-Order Cost Accounting

Job Number F16 Date Started Nov. 1, 20x1 JOB-COST RECORD Description 80 deluxe alum. fishing boats Date Completed Nov. 22, 20x1 Number of Units Completed 80 Unit Price $2.50 Cost $18,000 Date 11/1 Direct Material Requisition Number Quantity 803 7,200 sq ft Direct Labor Quantity 600

Date Various dates

Requisition Number Various time cards

Unit Price $20

Cost $12,000

Date 11/30

Manufacturing Overhead Requisition Number Quantity Direct Labor Hours 600 Cost Summary Cost Item

Unit Price $30.00

Cost $18,000

Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost

Amount $18,000 12,000 18,000 $48,000 $600

Date 11/30

Shipping Summary Units Remaining Units Shipped in Inventory 60 20

Cost Balance $12,000

3-21

Learning Objective 4

3-22

Manufacturing Overhead Costs

Overhead is applied to jobs using a predetermined overhead rate (POHR) based on estimates made at the beginning of the accounting period.

Budgeted manufacturing overhead cost POHR = 2 Budgeted amount of cost driver (or activity base)

1

Overhead applied = POHR Actual activity

Based on estimates, and determined before the period begins Actual amount of the allocation base, such as direct labor hours, incurred during the period

3-23

Manufacturing Overhead Costs

Overhead is applied to jobs using a predetermined overhead rate (POHR) based on estimates made at the beginning of the accounting period.

POHR =

Budgeted manufacturing overhead cost Budgeted amount of cost driver (or activity base)

Overhead applied = POHR Actual activity

Recall the Aluminum Boat example where:

Overhead applied = $30 per DLH 600 DLH = $18,000

3-24

Learning Objective 5

3-25

Job-Order Costing Document Flow Summary

Lets summarize the document flow we have been discussing in a job-order costing system.

3-26

Job-Order Costing Document Flow Summary

Production Order for Job Material Requisition Labor Time Records

The production order for the job authorizes the start of the production process. The materials requisition indicates the cost of direct material to charge to jobs and the cost of indirect material to charge to overhead. Employee time tickets indicate the cost of direct labor to charge to jobs and the cost of indirect labor to charge to overhead.

Actual Cost Driver (or Activity Base)

Apply Manufacturing Overhead

X Predetermined Overhead Rate

3-27

Job-Order System Cost Flows

Lets examine the cost flows in a job-order costing system. We will use T-accounts and start with materials.

3-28

Job-Order System Cost Flows

Raw Materials

Material Direct Purchases Material Indirect Material

Work in Process (Job-Cost Record)

Direct Material

Mfg. Overhead

Indirect Material

3-29

Job-Order System Cost Flows

Next lets add labor costs and applied manufacturing overhead to the job-order cost flows. Are you with me?

3-30

Job-Order System Cost Flows

Wages Payable

Direct Labor Indirect Labor

Work in Process (Job-Cost Record)

Direct Material Direct Labor

Mfg. Overhead

Indirect Material Indirect Labor

3-31

Job-Order System Cost Flows

Wages Payable

Direct Labor Indirect Labor

Work in Process (Job-Cost Record)

Direct Material Direct Labor Overhea d Applied If actual and applied

manufacturing overhead are not equal, a year-end adjustment is required. We will look at the procedure to accomplish this later.

3-32

Mfg. Overhead

Indirect Overhead Material Applied to Work in Indirect Process Labor

Job-Order System Cost Flows

Now lets complete the goods and sell them. Still with me?

3-33

Job-Order System Cost Flows

Work in Process (Job-Cost Record)

Direct Material Direct Labor Overhea d Applied Cost of Goods Mfd.

Finished Goods

Cost of Goods Mfd. Cost of Goods Sold

Cost of Goods Sold

Cost of Goods Sold

3-34

Job-Order System Cost Flows

Lets return to AFB Company and see what we will do if actual and applied overhead are not equal.

3-35

Overhead Application Example

Actual Overhead costs for the year: $5,050,000

Actual direct labor hours worked for the year: 170,000

Applied Overhead = POHR Actual Direct Labor Hours

Applied Overhead = $30.00 per DLH 170,000 DLH = $5,100,000

Applied overhead exceeds actual overhead by $50,000 This difference is called overapplied overhead.

3-36

Overapplied and Underapplied Manufacturing Overhead

$50,000 may be allocated to these accounts. $50,000 may be closed directly to cost of goods sold.

OR

Work in Process Finished Goods Cost of Goods Sold

Cost of Goods Sold

AFB Companys Method

3-37

Overapplied and Underapplied Manufacturing Overhead

AFBs Cost of Goods Sold for the year

Unadjusted Balance $50,000 Adjusted Balance

AFBs Mfg. Overhead for the year

Actual Overhead overhead Applied costs to jobs

$5,050,000 $5,100,000

$50,000

$50,000 overapplied

3-38

Overapplied and Underapplied Manufacturing Overhead Summary

Alternative 1 If Manufacturing Overhead is . . . UNDERAPPLIED (Applied OH is less than actual OH) OVERAPPLIED (Applied OH is greater than actual OH) Allocation INCREASE Work in Process Finished Goods Cost of Goods Sold DECREASE Work in Process Finished Goods Cost of Goods Sold Alternative 2 Close to Cost of Goods Sold INCREASE Cost of Goods Sold

DECREASE Cost of Goods Sold

3-39

Learning Objective 6

3-40

Schedule of Cost of Goods Manufactured

Schedule of Cost of Goods Manufactured Direct material: Raw material inventory, beginning Add: Raw material purchases Raw material available for use Deduct: Raw material, ending Raw material used Direct labor Manufacturing overhead Indirect material Indirect labor Other actual overhead charges Total actual manufacturing overhead Add: Overapplied overhead or Deduct: Underapplied overhead Overhead applied to work-in-process Total manufacturing costs Add: Work-in-process inventory, beginning Subtotal Deduct: Work-in-process inventory, ending Cost of goods manufactured $xxx xxx $xxx xxx $xxx xxx

$xxx xxx xxx $xxx xxx xxx $xxx xxx $xxx xxx $xxx

3-41

Schedule of Cost of Goods Sold

Schedule of Cost of Goods Sold Finished goods inventory, beginning Add: Cost of goods manufactured* Cost of goods available for sale Deduct: Finished goods inventory, ending Cost of goods sold Add: Underapplied overhead or Deduct: Overapplied overhead Cost of goods sold (adjusted) * From Cost of Goods Manufactured Schedule $xxx xxx $xxx xxx $xxx xxx $xxx

3-42

Actual and Normal Costing

Actual direct material and direct labor combined with actual overhead. Actual direct material and direct labor combined with predetermined overhead.

Using a predetermined rate makes it possible to estimate total job costs sooner.

Actual overhead for the period is not known until the end of the period.

3-43

Learning Objective 7

3-44

Two-Stage Cost Allocation

Stage One: Costs assigned to pools

Indirect Labor

Indirect Materials

Other Overhead

Cost pools

Department 1

Department 2

Department 3

3-45

Departmental Overhead Rates

Stage One: Costs assigned to pools

Indirect Labor

Indirect Materials

Other Overhead

Cost pools

Stage Two: Costs applied to products

Department 1

Direct Labor Hours

Department 2

Machine Hours

Department 3

Raw Materials Cost

Products

Departmental Allocation Bases

3-46

Learning Objective 8

3-47

Job-Order Costing in Nonmanufacturing Organizations

THE JOB

Cases Programs

Missions Contracts

3-48

Changing Technology in Manufacturing Operations

Computerized data interchange has eliminated much of the paperwork associated with job-order cost systems.

Scanning devices have simplified data entry to record material and labor use.

3-49

End of Chapter 3

3-50

You might also like

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Materials Handling Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMaterials Handling Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Manufacturing Costs ExplainedDocument30 pagesManufacturing Costs Explainedzahid_mahmood3811100% (1)

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument56 pagesProduct Costing and Cost Accumulation in A Batch Production Environmentsunanda mNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument44 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoberto De JesusNo ratings yet

- Sol ch03Document8 pagesSol ch03Wirachai PhongPhanNo ratings yet

- Matzusry9theditionsolutions 131114003908 Phpapp01 140411230630 Phpapp01Document101 pagesMatzusry9theditionsolutions 131114003908 Phpapp01 140411230630 Phpapp01Arslan AshfaqNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument55 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsBelajar MembacaNo ratings yet

- Product Costing1Document75 pagesProduct Costing1kukuh setiawanNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument50 pagesProduct Costing and Cost Accumulation in A Batch Production EnvironmentAbdelrahman El-shafaeeNo ratings yet

- HM-Ch05 Job OrderDocument45 pagesHM-Ch05 Job OrderMc KeteqmanNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument43 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsSoumik NagNo ratings yet

- Basic Cost Management ConceptsDocument15 pagesBasic Cost Management ConceptsKatCaldwell100% (1)

- Job Order CostingDocument42 pagesJob Order CostingPatreicia MariaNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument58 pagesProduct Costing and Cost Accumulation in A Batch Production EnvironmentWali NoorzadNo ratings yet

- Accounting for Manufacturing CostsDocument81 pagesAccounting for Manufacturing CostsAdrian Faminiano100% (1)

- No 3 Solution Work in Process Journal EntriesDocument10 pagesNo 3 Solution Work in Process Journal EntriesAsad ButtNo ratings yet

- Chapter Two Professor McdermottDocument31 pagesChapter Two Professor McdermottWasipfc100% (3)

- Process CostingDocument43 pagesProcess CostingbortycanNo ratings yet

- Cost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSDocument16 pagesCost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSRahila Rafiq0% (1)

- Supplier Cost Increase1Document3 pagesSupplier Cost Increase1prasad_kcpNo ratings yet

- Three manufacturing cost breakdownDocument30 pagesThree manufacturing cost breakdownkhldHANo ratings yet

- Cost Accounting 9 EditionDocument11 pagesCost Accounting 9 EditionRahila RafiqNo ratings yet

- Session 1: Basic Cost Management ConceptsDocument43 pagesSession 1: Basic Cost Management ConceptsCNo ratings yet

- ACCT-611 COGM and COGS ProblemsDocument4 pagesACCT-611 COGM and COGS ProblemsElvan Mae Rita ReyesNo ratings yet

- Chapter 4 Fa1Document6 pagesChapter 4 Fa1Zebib DestaNo ratings yet

- Manufacturing Accounts ExplainedDocument36 pagesManufacturing Accounts ExplainedEira JairaNo ratings yet

- Introduction To Managerial Accounting and Job Order Cost SystemsDocument57 pagesIntroduction To Managerial Accounting and Job Order Cost Systemsshailyrastogi100% (1)

- Bacostmx - HW3Document5 pagesBacostmx - HW3Airam Daisy MordenoNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- Ronald Hilton Chapter 3Document25 pagesRonald Hilton Chapter 3Swati67% (3)

- Accounting For Manufacturing BusinessDocument56 pagesAccounting For Manufacturing Businessrajahmati_2890% (20)

- ACCT 505 Quiz 1Document6 pagesACCT 505 Quiz 1Bella DavidovaNo ratings yet

- The Islamic University of Gaza Faculty of Commerce Department of AccountingDocument8 pagesThe Islamic University of Gaza Faculty of Commerce Department of AccountingAhmed RazaNo ratings yet

- Product Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinDocument73 pagesProduct Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinFarid MahdaviNo ratings yet

- Instructions For Completion of Piece Cost Breakdown WorksheetDocument9 pagesInstructions For Completion of Piece Cost Breakdown WorksheetfranciscoNo ratings yet

- Chap 4Document23 pagesChap 4Adrian ChrissanjayaNo ratings yet

- Chapter 2 Job Order CostingDocument72 pagesChapter 2 Job Order CostingLORENZE VIRNUEL UCAB IBA�EZ0% (1)

- Cost Sheet for Company BooksDocument16 pagesCost Sheet for Company BooksJayaKhemani82% (11)

- Comprehensive Exam A: Cost Accounting ProblemsDocument13 pagesComprehensive Exam A: Cost Accounting ProblemsKeith Joanne SantiagoNo ratings yet

- AnswersDocument28 pagesAnswersfmdeen100% (1)

- Job-Order Costing ExplainedDocument27 pagesJob-Order Costing ExplainedEmmanuel63% (8)

- Absorption Costing GuideDocument78 pagesAbsorption Costing GuideFariya MemonNo ratings yet

- Job Order Costing and Accounting CycleDocument7 pagesJob Order Costing and Accounting CycleLaibaNo ratings yet

- Chapter 3 Job Order CostingDocument33 pagesChapter 3 Job Order CostingFatimaIjazNo ratings yet

- HorngrenIMA14eSM ch14Document40 pagesHorngrenIMA14eSM ch14Piyal Hossain100% (1)

- Question On Production ProcessDocument14 pagesQuestion On Production Processaliimrankhan2009No ratings yet

- Job Order CostingDocument7 pagesJob Order CostingElla Mae VergaraNo ratings yet

- Principles of Accounting Chapter 17Document42 pagesPrinciples of Accounting Chapter 17myrentistoodamnhighNo ratings yet

- Managerial Accounting Problems on Product Costing and Cost FlowsDocument28 pagesManagerial Accounting Problems on Product Costing and Cost FlowsMaryAnnLasquiteNo ratings yet

- Case 3-61Document2 pagesCase 3-61T Yoges Thiru MoorthyNo ratings yet

- Managerial Accounting Basics: Garrisson cp3Document66 pagesManagerial Accounting Basics: Garrisson cp3GlenPalmerNo ratings yet

- Slide of Chapter 2Document19 pagesSlide of Chapter 2Uyen ThuNo ratings yet

- RFQ Cost Breakdown HUSQVARNA PartsDocument2 pagesRFQ Cost Breakdown HUSQVARNA PartsSusheel ShuklaNo ratings yet

- 2 Product Costing Systems Concepts and Design Issues Compatibility ModeDocument73 pages2 Product Costing Systems Concepts and Design Issues Compatibility ModeIamRuzehl VillaverNo ratings yet

- Methods & Formulas Lahore Commerce Academy: BY SIR IRFAN AHMED 03217601935Document29 pagesMethods & Formulas Lahore Commerce Academy: BY SIR IRFAN AHMED 03217601935Irfan AhmedNo ratings yet

- Assignment 1Document9 pagesAssignment 1Mariya FilimonovaNo ratings yet

- Pricing and Cost Accounting: A Handbook for Government ContractorsFrom EverandPricing and Cost Accounting: A Handbook for Government ContractorsNo ratings yet

- Solar ProjectDocument10 pagesSolar ProjectSamuel SantosNo ratings yet

- Test ProcedureDocument25 pagesTest ProcedureSamuel SantosNo ratings yet

- WBSDocument1 pageWBSSamuel SantosNo ratings yet

- MoM Craig 2nd ch031Document1 pageMoM Craig 2nd ch031Samuel SantosNo ratings yet