Professional Documents

Culture Documents

IRT Withholding Rates August 2009

Uploaded by

Nuno L. S. Cabral0 ratings0% found this document useful (0 votes)

3 views1 pagePersonal Income Tax (Imposto sobre os Rendimentos do Trabalho ("IRT")) rates are currently as follows: Monthly Income (Kz.) a) up to 25,000.00 EXEMPT 5% on the balance in excess of Kz. 25,000.00.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPersonal Income Tax (Imposto sobre os Rendimentos do Trabalho ("IRT")) rates are currently as follows: Monthly Income (Kz.) a) up to 25,000.00 EXEMPT 5% on the balance in excess of Kz. 25,000.00.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageIRT Withholding Rates August 2009

Uploaded by

Nuno L. S. CabralPersonal Income Tax (Imposto sobre os Rendimentos do Trabalho ("IRT")) rates are currently as follows: Monthly Income (Kz.) a) up to 25,000.00 EXEMPT 5% on the balance in excess of Kz. 25,000.00.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

IN ASSOCIATION WITH

ANGOLA

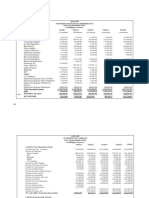

PERSONAL INCOME TAX

As per Executive Decree No. 80/09, of 7 August 2009, Personal Income Tax (Imposto sobre os

Rendimentos do Trabalho ("IRT")) rates are currently as follows:

Monthly Income (Kz.)

a)

up to 25,000.00

EXEMPT

b)

25,001.00 up to 30,000.00

5% on the balance in excess of Kz.

25,000.00

c)

30,001.00 up to 35,000.00

Kz. 250.00 + 6% on the balance in excess

of Kz. 30,000.00

d)

35,001.00 up to 40,000.00

Kz. 550.00 + 7% on the balance in

excess of Kz. 35,000.00

e)

40,001.00 up to 45,000.00

Kz. 900.00 + 8% on the balance in excess

of Kz. 40,000.00

f)

45,001.00 up to 50,000.00

Kz. 1,300.00 + 9% on the balance in

excess of Kz. 45,000.00

g)

50,001.00 up to 70,000.00

Kz. 1,750.00 + 10% on the balance in

excess of Kz. 50,000.00

h)

70,001.00 up to 90,000.00

Kz. 3,750.00 + 11% on the balance in

excess of Kz. 70,000.00

i)

90,001.00 up to 110,000.00

Kz. 5,950.00 + 12% on the balance in

excess of Kz. 90,000.00

j)

110,001.00 up to 140,000.00

Kz. 8,350.00 + 13% on the balance in

excess of Kz. 110,000.00

k)

140,001.00 up to 170,000.00

Kz. 12,250.00 + 14% on the balance in

excess of Kz. 140,000.00

l)

170,001.00 up to 200,000.00

Kz. 16,450.00 + 15% on the balance in

excess of Kz. 170,000.00

m)

200,001.00 up to 230,000.00

Kz. 20,950.00 + 16% on the balance in

excess of Kz. 200,000.00

n)

more than 230,001.00

Kz. 25,750.00 + 17% on the balance in

excess of Kz. 230,000.00

14 August 2009

You might also like

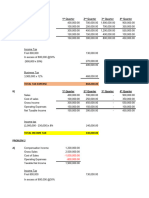

- Net Income 2,030,000 2,324,000 2,667,000 2,798,950 Changes 330,000Document5 pagesNet Income 2,030,000 2,324,000 2,667,000 2,798,950 Changes 330,000April SolimanNo ratings yet

- Withholding Tax For 2020-21Document2 pagesWithholding Tax For 2020-21Rana InamNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Simulasi Corporate TaxDocument9 pagesSimulasi Corporate TaxANDIYANA ANSARNo ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- 2014 Volume 2 CH 5 AnswersDocument6 pages2014 Volume 2 CH 5 AnswersGirlie SisonNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Chap15 Tax PbmsDocument10 pagesChap15 Tax PbmskkNo ratings yet

- Advanced ExcelDocument3 pagesAdvanced ExcelEsani DeNo ratings yet

- Advanced ExcelDocument3 pagesAdvanced ExcelEsani DeNo ratings yet

- Kitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesDocument7 pagesKitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesGalina FateevaNo ratings yet

- RetoSA - EmirDocument21 pagesRetoSA - EmirEdward Marcell BasiaNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Taxation 2 (Maika Notes)Document30 pagesTaxation 2 (Maika Notes)Maria Acepcion DelfinNo ratings yet

- Ethiopian Tax SystemDocument26 pagesEthiopian Tax SystemAsfaw WossenNo ratings yet

- Tax SimulatorDocument10 pagesTax SimulatorAnil KesarkarNo ratings yet

- H. Other Percentage TaxesDocument32 pagesH. Other Percentage TaxesMaha CastroNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsGhulam AwaisNo ratings yet

- Debit Eliminasi POS PT. Borang PT. Granita: CreditDocument6 pagesDebit Eliminasi POS PT. Borang PT. Granita: CreditMeliana ChaiNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- CH 8 Answers 2008Document5 pagesCH 8 Answers 2008ergiesonaNo ratings yet

- Excel PractiseDocument4 pagesExcel PractiseJackNo ratings yet

- FIN515 W5 ProjectDocument10 pagesFIN515 W5 ProjectCharlson020No ratings yet

- Assignment 9 - Replacement Project Case - EmptyDocument4 pagesAssignment 9 - Replacement Project Case - EmptyAudi Imam LazuardiNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Adj. Present Value 657.88 75.15Document8 pagesAdj. Present Value 657.88 75.15Naresh VemisettiNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- Book 3Document6 pagesBook 3Titania ErzaNo ratings yet

- ACCTAX2 Business Case RecentDocument5 pagesACCTAX2 Business Case RecentHazel Joy DemaganteNo ratings yet

- BEP Template: Process ADocument8 pagesBEP Template: Process AKaye CollinsonNo ratings yet

- Sales Operating Expense: LessDocument10 pagesSales Operating Expense: LessShiela Mae Azarcon TuvillaNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- Perhitungan Cash FlowDocument10 pagesPerhitungan Cash FlowhafizhNo ratings yet

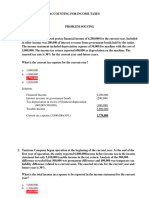

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- V!s!t!l!ty Statement of Financial Performance Table 1Document15 pagesV!s!t!l!ty Statement of Financial Performance Table 1Carl Toks Bien InocetoNo ratings yet

- BV SV N $ 20,000 $ 0: Depreciation Method: Straight LineDocument4 pagesBV SV N $ 20,000 $ 0: Depreciation Method: Straight LineWindi Rodi MassangNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Single EntryDocument2 pagesSingle EntryAnswer KeyNo ratings yet

- Case 1 - TaylorDocument5 pagesCase 1 - TaylorEdwin EspirituNo ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Sales 3,000,000.00: Invoice Price 112,000.00Document11 pagesSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Law PetroleumActivities PTDocument20 pagesLaw PetroleumActivities PTNuno L. S. CabralNo ratings yet

- Guidelines Absence For Examination July 2007Document1 pageGuidelines Absence For Examination July 2007Nuno L. S. CabralNo ratings yet

- Partial Lease Termination AgreementDocument8 pagesPartial Lease Termination AgreementNuno L. S. CabralNo ratings yet

- Executive Decree No. 80-09 of 7 August 2009Document1 pageExecutive Decree No. 80-09 of 7 August 2009Nuno L. S. CabralNo ratings yet

- Digital Transformation A Road-Map For Billion-Dollar OrganizationsDocument68 pagesDigital Transformation A Road-Map For Billion-Dollar OrganizationsApurv YadavNo ratings yet

- Chap 013Document141 pagesChap 013theluckless77750% (2)

- Ethics DigestDocument29 pagesEthics DigestTal Migallon100% (1)

- Berkshire Blueprint 2.0Document82 pagesBerkshire Blueprint 2.0iBerkshires.com100% (1)

- EcoTourism Unit 8Document20 pagesEcoTourism Unit 8Mark Angelo PanisNo ratings yet

- Guide To Buying A Wooden SunglassesDocument2 pagesGuide To Buying A Wooden SunglassesBrendan LuoNo ratings yet

- 16 PDFDocument11 pages16 PDFVijay KumarNo ratings yet

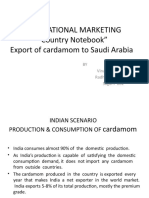

- International Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaDocument28 pagesInternational Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaPurohit SagarNo ratings yet

- The Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinDocument33 pagesThe Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinRanyDAmandaNo ratings yet

- Critique On The Design and PlanningDocument2 pagesCritique On The Design and PlanningAngelica Dela CruzNo ratings yet

- Population GrowthDocument3 pagesPopulation GrowthJennybabe PetaNo ratings yet

- Presentation - Sacli 2018Document10 pagesPresentation - Sacli 2018Marius OosthuizenNo ratings yet

- Cover Letter For Mayors MeetingDocument6 pagesCover Letter For Mayors MeetingDallasObserverNo ratings yet

- Gmail - Your Booking Confirmation PDFDocument8 pagesGmail - Your Booking Confirmation PDFvillanuevamarkdNo ratings yet

- Chapter 6 - Product and Service StrategiesDocument32 pagesChapter 6 - Product and Service StrategiesralphalonzoNo ratings yet

- Manual AdeptDocument196 pagesManual AdeptGonzalo MontanoNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Jurnal Metana TPADocument8 pagesJurnal Metana TPARiska Fauziah AsyariNo ratings yet

- Ecosystem Services of The Congo Basin ForestsDocument33 pagesEcosystem Services of The Congo Basin ForestsGlobal Canopy Programme100% (3)

- International Economic (Group Assignment)Document12 pagesInternational Economic (Group Assignment)Ahmad FauzanNo ratings yet

- Exam 20210209Document2 pagesExam 20210209Luca CastellaniNo ratings yet

- CET Analysis of SamsungDocument9 pagesCET Analysis of SamsungMj PayalNo ratings yet

- Pune MetroDocument11 pagesPune MetroGanesh NichalNo ratings yet

- Liebherr Annual-Report 2017 en Klein PDFDocument82 pagesLiebherr Annual-Report 2017 en Klein PDFPradeep AdsareNo ratings yet

- Adobe Scan Apr 18, 2023Document6 pagesAdobe Scan Apr 18, 2023Yan PaingNo ratings yet

- Synopsis Self-Sustainable CommunityDocument3 pagesSynopsis Self-Sustainable Communityankitankit yadavNo ratings yet

- Macro Unit 2 WorksheetDocument5 pagesMacro Unit 2 WorksheetSeth KillianNo ratings yet

- John Deere 6405 and 6605 Tractor Repair Technical ManualDocument16 pagesJohn Deere 6405 and 6605 Tractor Repair Technical ManualJefferson Carvajal67% (6)

- Ceramic Tiles - Official Gazette 27 (10234)Document16 pagesCeramic Tiles - Official Gazette 27 (10234)NajeebNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet