Professional Documents

Culture Documents

Minimum Alternate Tax (MAT) (Chapter-XIIB (Section 115J/ JAA/ JB) )

Minimum Alternate Tax (MAT) (Chapter-XIIB (Section 115J/ JAA/ JB) )

Uploaded by

Sanjiv KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Minimum Alternate Tax (MAT) (Chapter-XIIB (Section 115J/ JAA/ JB) )

Minimum Alternate Tax (MAT) (Chapter-XIIB (Section 115J/ JAA/ JB) )

Uploaded by

Sanjiv KumarCopyright:

Available Formats

Articles

MINIMUM ALTERNATE TAX ( MAT )

Minimum Alternate Tax (MAT) (Chapter-XIIB {Section 115J/ JAA/ JB})

Objective behind the introduction of MAT:

Normally, a coma pny is liable to p ay tax on the inc ome computed in accordance with the provisions of the income tax Act, but the profit and loss account of the company is prepared as per provisions of the Companies Act. There were large number of companies who had book profits as per their profit and loss ac count but were not paying any ta x because income computed as per pr ovisions of the inc ome ta x act was either nil or negative or insignificant. I n such case, although the companies were showing book profi ts and declaring dividends to the shareholders, the y were not paying a ny income tax. The se companies are popularly known as Zero Tax companies . I norder to bring such companies under the income tax act net, MAT wa s introduced .

Background:

The levy of a minimum tax on compani es was first introduced throug h section 80VVA b y the Finance Act, 1983 w.e .f. A.Y. 1984- 85. The me thod adopted b y this section was to place a ceiling on the ag gregate quantum of incenti ves available under various provisions of the Ac t. However, the unab sorbed incentives were allowed to be carried forward and set off against taxable income in future years. The concept of tax on book profits wa s introduced originally under section 115J b y the Finance Act, 1987 with effect fr om A. Y. 1988-89 a nd it was withdrawn with effect from A.Y. 1990-91. Here, the tax was levied on 30% of Book Profits . Subsequently the c oncept was reintr oduced with a few c hanges, imposing Minimum Alterna te Tax (M AT) under section 115JA with effect from A.Y. 1997-98 a nd had effect up to A.Y.2000-01. Here , if the taxable income of a comp any computed under this Ac t, in respect of any previous year relevant to the assessment year commencing on or after 1.4.97 but before 1.4.2001 is less than 30 % of its book profits, the total income of such company, chargeable to tax for the relevant previous year shall be deemed to an amount e qual to 30 % of suc h book profits . Section 115JB was i ntroduced in Finance Act, 2000 w.e .f. 1.4.2001, whereby, a compa ny s hall be liable to pay higher of ta x computed under I ncome Tax Ac t provisions and tax computed under Sec 115JB . Ghalla & Bhansali Chartered Accountants Page 1

Articles

MINIMUM ALTERNATE TAX ( MAT )

Applicability:

The provisions of this chapter are ap plicable only to C ompanies and not to a ny other assess ee like I ndividual, HUF, Partnership Firm, etc.

Statutory Provision of Section 115JB as mentioned under Income Tax Act,1961

115JB. (1) Notwithstanding anything c ontained in any other provision of this Act, where in the case of an assessee, being a company, the income-tax, payable on the total income as computed under this Ac t in respect of any previous year relevant to the a ssessment year commencing on or after the 1st day of April, 2010, is less than fifteen per cent of its book profit, such book profit shall be dee med to be the total income of the assessee and the tax payable by the assessee on such total income shall be the amount of i ncome-tax at the r ate of fiftee n per cent. * For calculation of Books Prof its ref er Anne xure I

Rate of tax u/s 115JB Tax ra te applicable u/s 115JB for various assessment year s are as follows : Period A.Y.2001-02 to A.Y.2006-07 A.Y.2007-08 to A.Y. 2009-10 A.Y.2010-11 A.Y.2011-12 onwards MAT Rate 7.5% 10% 15% 18%

Exclusion from applicability of Sec 115JB

w.e .f. 1.4.2005, the provisions of Sec 115JB s hall not appl y to the income from a ny business c arried on, or services rendered, by an entrepreneur or a Developer, in a Unit or Special Economic Zone.

Ghalla & Bhansali Chartered Accountants

Page 2

Articles

MINIMUM ALTERNATE TAX ( MAT )

Report to be furnished u/s 115JB:

Under Sec 115JB (4), every c ompany to which this section applies, shall furnish a report in F orm 29B, as prescribed under rule 40B , from an accountant, certifying tha t the Book Profits has been computed in accordance with the provisions of Se c 115JB . This report has to be accompanied with the return of income filed under Sec 139(1) or 142(1)(i ). MAT Credit Sec 115JAA: Sec 115JAA provides for calculation a nd carry for ward of MAT Credit in respect of MAT pai d u/s 115JB (1) for the assessment year comme ncing on 1.4.2006 and any s ubsequent assessment year. The a mount of tax paid under section 115JB is allowed to be carried forward to the e xte nt of the M AT paid in excess of the reg ular tax and can be set off agai nst tax payable upto the tenth assess ment year (w.e .f. 1.4.2010) imme diately succeeding the assessment year in which tax credit becomes allowable under the provisions of section 115JAA.

MAT credit sha ll be allowed to be carried forward as fo llo ws : Finance Act Finance Act, 2005 Finance Act, 2006 Finance Act, 2010 Period of carry fo rward 5 years 7 years 10 years

The a mount of MAT Credit to be carried for ward s hall be exclusive of Cess and Surcharg e.

Ghalla & Bhansali Chartered Accountants

Page 3

Articles

MINIMUM ALTERNATE TAX ( MAT )

Working for cla iming MAT credit and carry forward of balance unutilized MAT credit : Year 1:

I f TP < M AT I f TP > M AT T a x L i a b i l i t y = M AT M AT (C r ) c / f = M AT T P T a x L i a b i l i t y = T P a s p e r I . T . Ac t M AT (C r ) c / f = N I L

Year 2 and thereaft er:

I f TP < M AT Th e r e i s a n B o u g h t F o r w a r d M AT (C r ) T a x L i a b i l i t y = M AT M AT (C r ) c / f = M AT (C r ) b / f + C u r r e n t Ye a r [ M AT T P ]

Th e r e i s N O B o u g h t F o r w a r d M AT (C r ) I f TP > M AT T a x L i a b i l i t y = M AT M AT (C r ) c / f = C u r r e n t y e a r [ M AT T P ] Th e r e i s a n B o u g h t F o r w a r d M AT (C r ) I f N T P < M AT Ad j u s t a b l e M AT (C r ) = C u r r e n t Y e a r [ T P M AT ] T a x L i a b i l i t y = T P Ad j u s t e d M AT (C r ) = C u r r e n t Y e a r M AT M AT (C r ) c / f = M AT (C r ) b / f Ad j u s t e d M AT (C r )

I f N T P > M AT Tax Liability = NTP M AT (C r ) c / f = M AT (C r ) b / f

Th e r e i s N O B o u g h t F o r w a r d M AT (C r ) T a x L i a b i l i t y = T P a s p e r I . T . Ac t M AT (C r ) c / f = N I L

W h er e ,

M AT = M i n i m um Al t e rn a t e Ta x TP = Ta x Pa ya b l e a s p er I n c o me T a x Ac t , 1 96 1

NT P = TP [B /f M AT c re di t ]

Ghalla & Bhansali Chartered Accountants

Page 4

Articles

MINIMUM ALTERNATE TAX ( MAT )

Annexure I: Calculation of Book Profit under Sec 115JB(2) Particulars Profit as per P&L A/c (computed as per companies act) As Increased by : Income tax paid (including Tax on distributed profit u/s 115O, Distribution Tax u/s 115R, education cess, surcharge and interest on income tax ) Income tax Payable or Income tax provisions Any transfer to reserve Provisions for unascertained liability Provisions for loss of subsidiary company Dividend Paid/Proposed Expenses relating to exempt income u/s 10 (other than clause 38 of Sec 10) Expenses relating to exempt income u/s 11 Expenses relating to exempt income u/s 12 Depreciation (As per Companies Act) Amount of Deffered Tax & Provision Thereof Amount or amounts set aside as provision for dimunation in value of asset (to the extent any of above is debited to P & L A/c) As Reduced by : Withdrawal from the reserve or provisions Exempt income u/s 10 (other than clause 38 of Sec 10) Exempt income u/s 11 Exempt income u/s 12 The amount of loss b/f or unabsorbed depreciation , whichever is less as per books of accounts Profit eligible for deduction u/s 80HHC Profit eligible for deduction u/s 80HHE Profit eligible for deduction u/s 80HHF Profit of sick industrial company Profit of tonnage Tax Company (section-115VO) Depreciation (as per Companies Act) (however excluding depreciation on revaluation of assets) Amount withdrawn from the revaluation reserve to the extent it does not exceed the amount of depreciation on account of revaluation of assets Amount of Deffered Tax , if credited to P & L A/c Book Profits on which MAT is to be calculated Amount (Rs.) Amount (Rs.) xxx

Xx Xx Xx Xx Xx Xx Xx Xx Xx Xx Xx Xx xx xxx Xx Xx Xx Xx

Xx Xx Xx Xx Xx Xx Xx Xx Xx (xx) xxx

Ghalla & Bhansali Chartered Accountants

Page 5

Articles

MINIMUM ALTERNATE TAX ( MAT )

Disclaimer : The information contained in this write up is to provide a general guidance to the intended user. The information should not be used as a substitute for specific consultations. We recommend that professional advice is sought before taking any action on specific issues.

Ghalla & Bhansali Chartered Accountants

Page 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Your PRIMARY SAVINGS JUNIOR Account Summary Your PRIMARY SAVINGS JUNIOR Account SummaryDocument3 pagesYour PRIMARY SAVINGS JUNIOR Account Summary Your PRIMARY SAVINGS JUNIOR Account SummaryDj262022/ /DaviePlaysNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Invoice No.: 380500045: Payment ReferenceDocument1 pageInvoice No.: 380500045: Payment ReferencePablo Barrio CarvajalNo ratings yet

- Chapter 01 - Introduction To Federal Taxation in CanadaDocument40 pagesChapter 01 - Introduction To Federal Taxation in CanadaDonna So100% (2)

- BIR Ruling 033-00Document3 pagesBIR Ruling 033-00RB Balanay0% (1)

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Income Tax On Individual TaxpayersDocument7 pagesIncome Tax On Individual TaxpayersYoite MiharuNo ratings yet

- Tax-2Document118 pagesTax-2ethel hyugaNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- Law of TaxationDocument13 pagesLaw of TaxationRameshNadarNo ratings yet

- Priyanka Salt 1Document46 pagesPriyanka Salt 1Raj GuptaNo ratings yet

- Contoh Report TextDocument1 pageContoh Report TextRandi naufNo ratings yet

- Federal Tax Research 11th Edition Sawyers Test BankDocument35 pagesFederal Tax Research 11th Edition Sawyers Test Bankfactivesiennesewwz2jj100% (24)

- PT Kino Indonesia Tbk. Pay Slip Juli - 2020Document4 pagesPT Kino Indonesia Tbk. Pay Slip Juli - 2020Ananta SaoryNo ratings yet

- Lewis Printing Has Projected Its Sales For The First 8Document1 pageLewis Printing Has Projected Its Sales For The First 8Amit PandeyNo ratings yet

- Invoice Template 5 WordDocument2 pagesInvoice Template 5 WordGuardian Network BangladeshNo ratings yet

- AUSL LMT TaxDocument16 pagesAUSL LMT TaxMaria GarciaNo ratings yet

- 6 Pro InvoiceDocument1 page6 Pro InvoicesanthulohithaNo ratings yet

- Principles of Economics 12Th Edition Case Solutions Manual Full Chapter PDFDocument35 pagesPrinciples of Economics 12Th Edition Case Solutions Manual Full Chapter PDFmirabeltuyenwzp6f100% (9)

- The Purpose of An Interperiod Income Tax Allocation Is ToDocument2 pagesThe Purpose of An Interperiod Income Tax Allocation Is ToAllen Kate100% (1)

- TAX05 - First Preboard ExaminationDocument13 pagesTAX05 - First Preboard ExaminationMIMI LANo ratings yet

- 1st Semester Transfer Taxation Module 3 Estate Taxation - DeductionsDocument13 pages1st Semester Transfer Taxation Module 3 Estate Taxation - DeductionsNah HamzaNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- CMR Payroll On VBA 8.1 - Design by Mr. MBEDocument7 pagesCMR Payroll On VBA 8.1 - Design by Mr. MBEMbecha BenedictNo ratings yet

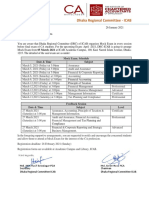

- Dhaka Regional Committee - ICAB: Mock Exam. Schedule Date & Time Subject LevelDocument1 pageDhaka Regional Committee - ICAB: Mock Exam. Schedule Date & Time Subject LevelMd MirazNo ratings yet

- Coursebook Chapter 8 AnswersDocument4 pagesCoursebook Chapter 8 AnswersAhmed Zeeshan100% (9)

- ManojDocument1 pageManojAjit pratap singh BhadauriyaNo ratings yet

- Tax Residence TutorialDocument11 pagesTax Residence TutorialHazlina HusseinNo ratings yet

- 2006 RMO 18-2006 LOA CriteriaDocument3 pages2006 RMO 18-2006 LOA Criteriaedong the greatNo ratings yet

- SOCIAL ArithmeticDocument5 pagesSOCIAL ArithmeticAdek Teguh Rachmawan Anar-qNo ratings yet

- Diskusi 7 Bahasa Inggris NiagaDocument2 pagesDiskusi 7 Bahasa Inggris NiagaRamdhaniNo ratings yet