Professional Documents

Culture Documents

Banking Financial Services WP

Banking Financial Services WP

Uploaded by

chamila2345Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Financial Services WP

Banking Financial Services WP

Uploaded by

chamila2345Copyright:

Available Formats

imaging

White paper

Banking and Financial Services

Market Description (The Prospect):

The Banking and Financial Service sectors provide significant opportunities for Document Imaging software and hardware including document scanners as this market is currently paper driven and prospects are looking for ways to improve their existing manual processes. This sectors includes numerous prospects including the following: Large banks, Community banks, Credit unions, Brokerage firms, Accounting firms, Financial investment firms, and Check cashing facilities.

White paper

Business Drivers:

The banking and financial service sectors have relied heavily on microfilm technology to image business documents and checks. Today these organizations are seeking technological advancements to replace out of date and inefficient microfilm. Service contracts for microfilm are almost cost prohibitive today so alternative technology, such as document imaging, is in high demand. The worldwide web is the dominant means of information access and delivery. The internet is a dominant and viable means of business communication. Banking and financial service organizations are looking for ways to leverage the internet to accelerate their business processes. Banking and financial service is an extremely competitive business. In recent years there have been numerous acquisitions in an effort to eliminate competition and expand customer base. In this competitive industry the bank or financial service organization that is first in service will often get the business. For example, the bank that processes your loan application the fastest will likely be the bank that wins your business. Banks and financial service organizations are looking to apply technology to process documents faster, to improve internal operations, to improve customer service and to expand their competitive advantage. Many banks and financial service organizations have branch offices in major metropolitan areas such as Shanghai, Tokyo, New York and Los Angeles. The cost for office space in these areas is extremely expensive. These organizations are looking for ways to reduce physical storage costs by eliminating storing paperbased documents. In a time when there is a worldwide economic slowdown, all organizations today are looking for ways to cut costs, to do more with less resources and in general to streamline their business operations. Due to recent corporate improprieties, the banking and financial service sectors are subject to numerous guidelines established by regulatory bodies such as the Security and Exchange Commission, the Ministry of Finance, and the International

White paper

Accounting Standards Committee. These guidelines define how banking and financial service organization must manage their business information. An example of this can be found in a U.S. regulatory guideline referred to as Gram-Leach-Bliley. In section 12 CFR Part 30 it states each bank shall identify reasonably foreseeable internal and external threats that could result in unauthorized disclosure, misuse, alteration, or destruction of customer information or customer information systems. The highly visible Sarbanes-Oxley Act requires banks and financial service organizations to have an audit committee to validate the accuracy of their financial reports. The Chief Executive Office of these organizations is held personally responsible for the accuracy of their data. Stiff fines and prison terms have been imposed for fraudulent entries and the intentional disposition of business documents. Central to these guidelines are three things: Data accessibility, Ensuring the privacy of customer information, and The physical protection of data. As a result these organizations are looking for technology that can help them manage data more efficiently, that can track access to data, and to ensure the physical protection of data should they need to recover from any type of data storage disaster. These organizations are looking not only for a return on the investment but they are also concerned with the total cost of failure.

The Financial Document Imaging Solutions:

The solution to help banks and financial service organizations to address these business drivers is Enterprise Content Management (ECM), including the critical document imaging component, as it enables them to capture, manage, store, preserve and deliver information and documents related to business and organizational processes.

White paper

Selected ECM technologies that are particularly beneficial for the banking and financial service sectors include the following: Forms processing for processing documents associated with loans for new cars or mortgages. Forms processing can be used to scan and extract data from either typed or handwritten text. Advances in this technology allow organizations to process forms with either structured or unstructured data. Implementing this technology for transaction processing can reduce cycle time from weeks to literally hours. Archive and retrieval can assist by converting paper-based document such as customer records, human resource records, signature verification cards, safe deposit contracts, and wire transfer documents into electronic documents that can be archived. These electronic documents can be searched and retrieved for viewing or printing. Accessing electronic documents is much faster enabling bank and financial service organizations to be more forthcoming with their business information to assist with regulatory compliance. Document distribution can be used to electronically distribute documents using the internet eliminating the time and resources required to fax documents. Additionally, this can be used for redundant off-site storage to ensure the physical protection of data. Enterprise Report Management, formerly called Computer Output to Laser Disk (COLD), can be used to move data off of expensive host computers into Local and Wide Area Networks where supporting paper documents can be scanned and managed with this data. Business Process Management, formerly call Workflow, can be applied to automate business processes by routing electronic documents to appropriate departments or individuals to expedite the approval processes. Image Enable Software, gives banking and financial service organizations the ability to add scanning and document management functionality to existing line of business applications and business processes such as teller and mortgage lending processes. This gives them the ability to implement document imaging without having to change the way employees are use to doing their jobs. The recent Check 21 initiative, making an Image Replace Document the legal equivalent has escalated Check/Remittance Processing for banks, financial service organizations and retail stores. These organizations are looking for scanning technology in order to image the check at the earliest stage of the process. This may include at tellers station or even at check out facilities in retail and grocery stores.

White paper

The Benefits:

Implementing document imaging technology in the banking and financial service sectors can yield many benefits such as: Faster access and retrieval of documents associated with customers, employees, and transactions to improve customer service and expand their competitive advantage. Track access and manage information more efficiently to assist with regulatory compliance guidelines for protecting and ensure the privacy of information. Leverage the internet to enable better business to business communication and better business to consumer communication.

Return on the Investment:

In addition to the business improvement benefits there are many tangible returns on the investment banking and financial service organizations will achieve from implementing document imaging. These include the following: Cut costs associated with the labor required to manage paper-based transactions. In many cases organizations have increased productivity with the equivalent or less staff members. Another major cost savings is associated with the reduction of physical office space by eliminating storing paper documents. Many investment firms have been able to facilitate additional brokers by using the space previously occupied by filing cabinets. By reducing processing time organizations can increase the volume of transactions and revenue. This also facilitates improved customer service and overall customer satisfaction. As a result of managing their business information more efficiently, these organizations can be more forthcoming with their business documents to assist with regulatory compliance. This reduces their risk of potential fines and penalties. The ultimate ROI is the result of redundant off-site storage ensuring business continuity should they experience any type of data storage disaster.

White paper

Strategic Software Partners:

Our document scanners are a critical component in addressing the myriad of application needs in the banking and financial service sectors. Complimenting our hardware to make a complete solution are a number of strategic software partners including some of the following (list is not all inclusive): Kofax (Dicom): Kofax is the worlds leading provider of information capture solutions. No other company has the same global reach, depth of experience or breadth of technology devoted to capturing vital business information from VRS (VirtualReScan) and Adrenaline for maximizing scanning productivity and quality, to the powerful Ascent platform for automatically transforming document and forms into retrievable information. Captiva: Captiva has a broad range of products targeted at optimizing the delivery of information across the enterprise and into todays sophisticated information systems. Ranging from low volume, destop products to high-volume, enterpriselevel products, Captivas offerings have a common mission: relieve the burden organizations face feeding the information-intensive systems faster, more cost effectively and with greater accuracy. Hyland: OnBase, developed by Hyland Software, is enterprise content management software that combines integrated document management, business process management and records management in a single application. Whether deployed as a hosted or premises-base solution, OnBase allows organizations to automate business processes, reduce the time and cost of performing important business functions, improve organizational efficiency, and address the need for governance, risk and compliance through the management and control of content from virtually any source. OnBase also facilitates the sharing of digital content with employees, business partners, customers and other audiences. FileNet: FileNet, the leading provider of Enterprise Content and Business Process Management solutions, enables the worlds leading companies and government agencies to streamline and automate their business processes, access and manage all forms of content and automate records management to help meet compliance needs.

White paper

AnyDoc Software: AnyDoc Software provides the full spectrum of automated solutions for all document and data capture needs. AnyDoc Softwares suite of products eliminates the need to manually enter the valuable data off the millions of paper documents forms, invoices, etc., received daily at organizations worldwide. AnyDoc Software offers: Scanning software local and remote Forms processing structured and unstructured Document imaging storage and retrieval Tokair: Tokairo is a United Kingdom based company that is a specialist within the document management and workflow market who have developed the TokOpen document management software suite. TokOpen is a powerful portfolio of document capture and management products that tightly integrate with your existing systems and business processes. TokOpen is a scalable solution that can be implemented into a department or rolled out throughout the enterprise.

Market Potential

Market data for the overall potential of Enterprise Content Management is very diversified. There are several studies indicating the market is healthy but there is tremendous discrepancies in the size of the market. A recent study by the Gartner Group (used by AIIM) indicates the market is 3 billion. AMR Research predicts the overall information technology opportunity created by the need for compliance will reach 80 billion over the next five years. The banking and financial service sectors are most impacted by the need for regulatory compliance. A study by AIIM International indicates the Compound Annual Growth Rate for the combined Banking and Financial Service Sectors is 51% of the overall market.

White paper

Supporting Case Study American Savings Bank of NJ:

As reported by Champion Workflow Systems, Inc. What started out as a microfilm replacement project has blossomed into a bank-wide opportunity to increase customer service and improve internal operations. American Savings Bank of NJ is a $350 million community bank with offices in Bloomfield and Cedar Grove, NJ. While the bank has experienced substantial growth in recent years, it has maintained its hallmark personal customer service. The search for a microfilm replacement originally was a minor technology initiative. Where that initiative has led and where it continues to lead is a testament to the imaginative use of information technology. Champion Workflow Systems, a system integrator, based in Bloomfield, New Jersey was broadly experienced in imaging and electronic document management systems. They proposed a solution tailored to American Savings objectives. The central technology selected was the TokOpen Electronic Document Management System from Takairo, Inc. According to Champions president, Gary Loew, TokOpen offers all of the functionality that a bank needs to stay competitive. We can integrate TokOpen with any Windows application in the bank, thus image enabling all of the tools used by tellers, customer service representatives and mortgage lending representatives. TokOpen uses the familiar file cabinet metaphor for document storages. Users can access file drawers containing PendaFlex folders, nested manila folders , and documents from any of their existing line of business applications. Paper-based documents are captured with Fujitsu ScanPartner and fi-4120 series scanners. Applications to date that American Savings has applied the combined Takairo and Fujitsu solution to address include: Signature Cards for Transaction Verification, Redundant Off-Site Storage for Disaster Recovers, and Transaction processing for Mortgages.

White paper

Future applications the solution will be applied to address include: Safe Deposit Contracts and Wire Transfers. American Savings Bank has reported numerous returns on their investment including: A reduction in the time to access documents from hours to seconds, Access to images that are always legible, Improved customer service, Data protected for business continuity, and Access to information more quickly to assist with regulatory compliance.

Other Resources of Information:

The following web sites have been beneficial in the research of this report and may proved beneficial for further research on this subject: The Banking Administration Institute: www.bai.org The Association of Information and Image Management: www.aiim.org The Association of Records Management Professionals: www.arma.org Periodicals referenced include: Business Solutions Magazine eDoc Magazine Document Imaging Report Bank Technology News Faulkner and Gray Report

About Fujitsu Computer Products of America, Inc. Fujitsu Computer Products of America, Inc. is a subsidiary of Fujitsu Limited, a leading provider of customer-focused IT and communications solutions for the global marketplace. FCPA provides innovative solutions for the U.S. marketplace. Current product and service offerings include high performance hard-disk drives, magneto-optical drives, scanners, and scanner maintenance.

Fujitsu Computer Products of America, Inc. www.fcpa.fujitsu.com 1255 East Arques Avenue, Sunnyvale, CA 94085-4701. (800) 626-4686 (408) 746-7000 info@fcpa.fujitsu.com

2006 Fujitsu Computer Products of America, Inc. All rights reserved. Fujitsu and the Fujitsu logo are registered trademarks and The Possibilities are Infinite is a trademark of Fujitsu Ltd. All other trademarks are the property of their respective owners. Statements herein are based on normal operating conditions and are not intended to create any implied warranty of merchantability or fitness for a particular purpose. Fujitsu Computer Products of America, Inc. reserves the right to modify at any time without notice these statements.

Printed in the U.S.A. Qty. 3M WP10600306

You might also like

- Operations Management in BankingDocument12 pagesOperations Management in Bankinggmurali_17956883% (12)

- Karen Leon Bicycle RentalDocument6 pagesKaren Leon Bicycle RentalYanaiza Irisari Alvarez50% (2)

- IT Infrastructure ManagementDocument6 pagesIT Infrastructure ManagementSoroosh SanadiNo ratings yet

- Why I Invested in BitcoinDocument3 pagesWhy I Invested in BitcoinJuan Manuel Lopez Leon50% (2)

- Assignment-2: Submitted by Anjanna Matta MA08M001Document9 pagesAssignment-2: Submitted by Anjanna Matta MA08M001Rafiqul Islam TalukderNo ratings yet

- Core Banking Is A: Banking Bank Branches Bank AccountDocument16 pagesCore Banking Is A: Banking Bank Branches Bank AccountJoseph VelasquezNo ratings yet

- Banking SectorDocument8 pagesBanking Sectorvishal thomkeNo ratings yet

- Way To Manage KYCDocument11 pagesWay To Manage KYCVipul JainNo ratings yet

- Is Your Business at Risk? Document Management Facts & Aspects - Whitepaper by BancTecDocument8 pagesIs Your Business at Risk? Document Management Facts & Aspects - Whitepaper by BancTecJone SmithNo ratings yet

- MIS AsynchDocument4 pagesMIS AsynchManal JhaNo ratings yet

- Data Mining: A Competitive Tool in The Banking and Retail IndustriesDocument7 pagesData Mining: A Competitive Tool in The Banking and Retail Industriesrk7570No ratings yet

- Accenture Banking Technology VisionDocument7 pagesAccenture Banking Technology VisionJustinNo ratings yet

- Technologies Shaping The Future of BankingDocument27 pagesTechnologies Shaping The Future of BankingAryanSainiNo ratings yet

- Case 3 - Group 1Document2 pagesCase 3 - Group 1truongvutramyNo ratings yet

- Literature Review Sneha ProjectDocument3 pagesLiterature Review Sneha ProjectKaran BhatiaNo ratings yet

- Case Study: Managing Storage, Retrieval and Archival of Customer BillsDocument2 pagesCase Study: Managing Storage, Retrieval and Archival of Customer BillsmrbubosNo ratings yet

- Information Technology in The Accounting CurriculumDocument4 pagesInformation Technology in The Accounting CurriculumRufest TaningNo ratings yet

- Future of Trade Finance - Yalin Alakoc Apr23Document11 pagesFuture of Trade Finance - Yalin Alakoc Apr23ministry.o.reconciliationNo ratings yet

- Financial ServicesDocument30 pagesFinancial Servicesmanojkumartanwar05No ratings yet

- IT Risks in BankingDocument7 pagesIT Risks in BankingDinesh KashyapNo ratings yet

- Evolve Business Model Modern Core Platform WPDocument23 pagesEvolve Business Model Modern Core Platform WPMutaz BakriNo ratings yet

- 2020-06 - IDC - US45837220e - OracleDocument9 pages2020-06 - IDC - US45837220e - OracleRenzo VigilNo ratings yet

- Book MGTDocument5 pagesBook MGTRashi ShuklaNo ratings yet

- Benefits of A CAAT Audit Are:: 1) What Is Computer-Assisted Audit Technique?Document24 pagesBenefits of A CAAT Audit Are:: 1) What Is Computer-Assisted Audit Technique?Chaitali KambleNo ratings yet

- Impact of IT On Banking: Management Information SystemsDocument12 pagesImpact of IT On Banking: Management Information SystemssairamskNo ratings yet

- Digital Banking FrameworkDocument20 pagesDigital Banking FrameworkTanaka Mboto100% (1)

- Process-Centric Banking: by Group 7 Needhi Nagwekar - PGPM-021-029 Priyank Yadav - PGPM-021-038Document21 pagesProcess-Centric Banking: by Group 7 Needhi Nagwekar - PGPM-021-029 Priyank Yadav - PGPM-021-038xyzNo ratings yet

- Untitled 2Document5 pagesUntitled 2Sultan_Alali_9279No ratings yet

- Digital Banking & Alternate Delivery ChannelsDocument102 pagesDigital Banking & Alternate Delivery ChannelsPriya Raj100% (1)

- Backfile Conversion White PaperDocument6 pagesBackfile Conversion White PaperVidya Sagar TamminaNo ratings yet

- Cognitive BankingDocument15 pagesCognitive Bankingrajitha revannaNo ratings yet

- Design of Study: ObjectiveDocument48 pagesDesign of Study: ObjectiveHitesh MoreNo ratings yet

- Auditing in The E-Commerce EraDocument12 pagesAuditing in The E-Commerce EratalentaNo ratings yet

- Documents Used in BanksDocument4 pagesDocuments Used in BanksSrinivas Laishetty50% (6)

- Syed Waleed 23k 5033Document4 pagesSyed Waleed 23k 5033M. Amir AliNo ratings yet

- Aurum Documentcare: Enterprise Content ManagementDocument8 pagesAurum Documentcare: Enterprise Content ManagementgvozdokNo ratings yet

- The Impact of Information Technology On Accounting and Finance 1Document12 pagesThe Impact of Information Technology On Accounting and Finance 1Samsung IphoneNo ratings yet

- Assignment-01: Q1) - Why E Banking Is Being Popular? Describe Their Advantages and DisadvantagesDocument11 pagesAssignment-01: Q1) - Why E Banking Is Being Popular? Describe Their Advantages and DisadvantagesNanya SinghNo ratings yet

- Management Information Systems IDocument7 pagesManagement Information Systems IFabrizio MarrazzaNo ratings yet

- Customer/Accounts Management Systems - Standard Chartered BankDocument5 pagesCustomer/Accounts Management Systems - Standard Chartered BankPatrick TiekuNo ratings yet

- Saas Cloud ComputingDocument3 pagesSaas Cloud ComputingAnonymous ul5cehNo ratings yet

- IT Infrastructure ManagementDocument8 pagesIT Infrastructure ManagementSomak Ray100% (1)

- THE ROLE OF DIGITAL TECHNOLOGIES IN STREAMLINING LOAN SERVICING AND COLLECTION".docx Jyotika BagDocument29 pagesTHE ROLE OF DIGITAL TECHNOLOGIES IN STREAMLINING LOAN SERVICING AND COLLECTION".docx Jyotika BagJyotika BagNo ratings yet

- Big Data in Financial ServicesDocument20 pagesBig Data in Financial ServicesPALLAVI KAMBLENo ratings yet

- Information Technology in The Banking Sector - Opportunities, Threats and StrategiesDocument7 pagesInformation Technology in The Banking Sector - Opportunities, Threats and StrategiesMahadi HasanNo ratings yet

- Mortgage Industry - How The Next Five Years Are Looking For US Mortgage Industry and What Can Businesses Do To Prepare For ItDocument4 pagesMortgage Industry - How The Next Five Years Are Looking For US Mortgage Industry and What Can Businesses Do To Prepare For ItRajesh SomshekharNo ratings yet

- Bank StatemntDocument19 pagesBank Statemntkiruthikakiruthika637No ratings yet

- Mis in BankingDocument12 pagesMis in BankingKanishk MehrotraNo ratings yet

- Information Systems For ManagersDocument16 pagesInformation Systems For ManagersMeow WeddingNo ratings yet

- Financial Services AssignmentDocument18 pagesFinancial Services Assignmentshiv mehraNo ratings yet

- Ijreiss 3610 88395Document5 pagesIjreiss 3610 88395somenbiswas2kNo ratings yet

- Itc Lesson 1 Cde Au May 2024Document15 pagesItc Lesson 1 Cde Au May 2024jaya69.69.69.69No ratings yet

- The Implication of MIS in A Banking SystemDocument9 pagesThe Implication of MIS in A Banking SystemSAMUEL KIMANINo ratings yet

- Group 13 - MIS Group Project Phase 2Document7 pagesGroup 13 - MIS Group Project Phase 2SRIJAN SINGHNo ratings yet

- DGGFDocument11 pagesDGGFRamiEssoNo ratings yet

- Importance of Management Information System in Banking SectorDocument12 pagesImportance of Management Information System in Banking SectorMulatu TekleNo ratings yet

- Acumen - Insurance Data Warehouse PDFDocument6 pagesAcumen - Insurance Data Warehouse PDFnitinakkNo ratings yet

- FOUR 03 09 COL BPM in India Jyoti Fernandez FinalDocument3 pagesFOUR 03 09 COL BPM in India Jyoti Fernandez FinalLee KallyNo ratings yet

- Managing Finance in a Digital World: CIMA CGMA Operational LevelFrom EverandManaging Finance in a Digital World: CIMA CGMA Operational LevelNo ratings yet

- Straight from the Client: Consulting Experiences and Observed TrendsFrom EverandStraight from the Client: Consulting Experiences and Observed TrendsNo ratings yet

- Tyco International Ltd. Case Study - The Implications of Unethical PDFDocument7 pagesTyco International Ltd. Case Study - The Implications of Unethical PDFDiane EstradaNo ratings yet

- Flexible Budget Examples (Chapter 18)Document9 pagesFlexible Budget Examples (Chapter 18)Muhammad azeemNo ratings yet

- Bureau of Internal RevenueDocument11 pagesBureau of Internal RevenueJerwhyne J. SaycoNo ratings yet

- Bidding and Auction ProceduresDocument16 pagesBidding and Auction ProceduresjNo ratings yet

- Notes For The Teacher: Chapter 3: Money and CreditDocument16 pagesNotes For The Teacher: Chapter 3: Money and CreditEmil AbrahamNo ratings yet

- 12a Isc 858 AccountsDocument18 pages12a Isc 858 AccountsA.c. GuptaNo ratings yet

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- Alison Krauss CompanyDocument3 pagesAlison Krauss Companymagdy kamelNo ratings yet

- Chapter 3.12 - Winding UpDocument21 pagesChapter 3.12 - Winding UpDashania GregoryNo ratings yet

- Dewan Cement: Internal ComparisonDocument24 pagesDewan Cement: Internal ComparisonOsama JavedNo ratings yet

- Contrato de Donacion en InglesDocument1 pageContrato de Donacion en InglesAnonymous KDxGih2No ratings yet

- Presentation On MiningDocument15 pagesPresentation On Miningdj_semaj074461No ratings yet

- MR - MD Samiullah: Page 1 of 1 M-2263937Document1 pageMR - MD Samiullah: Page 1 of 1 M-2263937Notty AmreshNo ratings yet

- The Nature of Construction ContractsDocument14 pagesThe Nature of Construction ContractsEhya' Zaki0% (1)

- PremiumPaidStatement 2022-2023 LicDocument1 pagePremiumPaidStatement 2022-2023 LicHemant BhoriaNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- Kelly Services Salary Sacrificing MaxxiaDocument1 pageKelly Services Salary Sacrificing MaxxiaSa RaNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Al Madina - en PDFDocument236 pagesAl Madina - en PDFAkmal MazlanNo ratings yet

- Lehman Aug 07 IndustryDocument145 pagesLehman Aug 07 IndustryYoujin ChoiNo ratings yet

- CREDAI Pre-Revenue Checklist v1.0 220714Document92 pagesCREDAI Pre-Revenue Checklist v1.0 220714Srinath NalluriNo ratings yet

- Forward RatesDocument2 pagesForward RatesTiso Blackstar GroupNo ratings yet

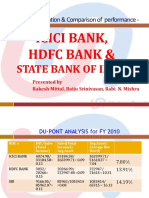

- Icici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceDocument7 pagesIcici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceNabarun MajumderNo ratings yet

- Boat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Document3 pagesBoat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Ram RahimNo ratings yet

- Portfolio Theory Lecture NotesDocument2 pagesPortfolio Theory Lecture NotesCha-am Jamal100% (1)

- Financial Sector Development and Economic Growth in EthiopiaDocument11 pagesFinancial Sector Development and Economic Growth in EthiopiaAbdi ÀgeNo ratings yet

- Analysis For Financial Management 10th Edition Higgins Test BankDocument23 pagesAnalysis For Financial Management 10th Edition Higgins Test BankEdwinMyersnayzsNo ratings yet

- Adoc - Pub Analisis Kelayakan Finansial Dan Sensitivitas UsahDocument8 pagesAdoc - Pub Analisis Kelayakan Finansial Dan Sensitivitas UsahYOSAFAT GOBAINo ratings yet