Professional Documents

Culture Documents

SLF065 - Multi-Purpose Loan Application Form

SLF065 - Multi-Purpose Loan Application Form

Uploaded by

Rhoda PasardozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SLF065 - Multi-Purpose Loan Application Form

SLF065 - Multi-Purpose Loan Application Form

Uploaded by

Rhoda PasardozaCopyright:

Available Formats

MULTI-PURPOSE LOAN APPLICATION FORM (MPLAF)

For IISP

LAST NAME FIRST NAME

HQP-SLF-065

AGREEMENT ID

(TO BE FILLED OUT BY APPLICANT)

Type or print entries NAME EXTENSION (e.g., Jr., II) MIDDLE NAME MAIDEN NAME

(For married women)

PRESENT HOME ADDRESS Unit/Room No., Floor Subdivision BIRTHDATE mm Barangay Municipality/City BIRTHPLACE dd yyyy

Building Name

Lot No., Block No., Phase No. House

Street Name ZIP Code

DESIRED LOAN AMOUNT Max of 60% (24-59 mos.) Max of 80% (at least 120 mos.) Max of 70% (60-119 mos.) Other, please specify _______________ LOAN PURPOSE (Please refer to List of Loan Purpose at the Guidelines and

Instructions portion)

Province/State/Country (if abroad MOTHER'S MAIDEN NAME

TYPE OF LOAN

Pag-IBIG MID No./RTN

New Widow/er Legally Separated Annulled

SEX

Renewal

MOBILE PHONE No. (Required)

MARITAL STATUS Single/Unmarried Married EMPLOYER/BUSINESS NAME

SSS/GSIS ID No.

Male

Female

OFFICE TEL. NO. HOME TEL. No.

EMPLOYER/BUSINESS ADDRESS Unit/Room No., Floor

Building Name

Lot No., Block No., Phase No. House Street Name

Subdivision

Barangay

Municipality/City

Province/State/Country (if abroad

ZIP Code

FOR AFP EMP-SERIAL/ACCOUNT No. FOR DECS EMP - DIV. CODE/STATION CODE/ EMPLOYEE No. TIN EMPLOYEE No. DATE OF Pag-IBIG MEMBERSHIP

EMPLOYMENT HISTORY FROM DATE OF Pag-IBIG MEMBERSHIP

NAME OF EMPLOYER

(Use another sheet if necessary)

(Mo.Yr.) FROM (Mo./Yr.) TO (Mo./Yr.)

ADDRESS

SIGNATURE OF APPLICANT IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR MULTI-PURPOSE LOAN, I HEREBY AUTHORIZE Pag-IBIG FUND TO CREDIT MY LOAN PROCEEDS THROUGH MY PAYROLL ACCOUNT/DISBURSEMENT CARD THAT I HAVE INDICATED ON THE RIGHT PORTION.

MEMBER'S PAYROLL ACCOUNT/DISBURSEMENT CARD NUMBER

NAME OF BANK/BRANCH

BANK ADDRESS

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the Implementing Rules and Regulations of Pag-IBIG Fund, I hereby waive my rights under R.A. No. 1405 and authorize Pag-IBIG Fund to verify/validate my payroll account/disbursement card. Furthermore, I hereby authorize my present employer ______________________________________________________________________________ or any employer with whom I may get employed in the future, to deduct the monthly Pag-IBIG contribution and amortization due from my salary and remit the same to Pag-IBIG Fund. If the resulting monthly net take home pay after deducting the computed monthly amortization on MPL falls below the monthly net take home pay as required under the GAA/company policy, I authorize Pag-IBIG Fund to compute for a lower loanable amount. I understand that should I fail to pay the monthly amortization due, I shall be charged a penalty of 1/20 of 1% of any unpaid amount for every day of delay. If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I hereby authorize Pag-IBIG Fund to debit/deduct the excess amount from my account without need of further notice of demand. Should my account balance be insufficient, the Fund has the right to demand for the excess amount to be refunded. I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic. This office agrees to collect the corresponding monthly amortizations on this loan and the monthly contributions of herein applicant through payroll deduction, together with the employer counterpart contributions, and remit said amounts to Pag-IBIG Fund on or before the 15th day of every month, for the duration that the loan remains outstanding. However, should we deduct the monthly amortization due from the applicants salary but failed to remit it on due date, this office agrees to shoulder the corresponding penalty charged to applicant equivalent to 1/20 of 1% of any unpaid amount for every day of delay and penalty for non-remittance equivalent to 1/10 of 1% per day of delay of the amount payable from the date the loan amortizations or payments fall due until paid.

_________________________________________

HEAD OF OFFICE OR AUTHORIZED SIGNATORY (Signature over printed name) ________________________________________________ DESIGNATION _______________ ______________ AGENCY CODE BRANCH CODE

__________________________________

Signature of Applicant over Printed Name

______________ Pag-IBIG EMPLOYER ID NO.

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of Pag-IBIG Fund with principal office at Petron MegaPlaza, 358, Sen. Gil Puyat Avenue., City of Makati the sum of Pesos: (P_______________) Philippine Currency, with a nominal interest of 10.5% p.a. (effective rate of 17.50%), with interest during the grace period, capitalized and paid equally over the term of the loan. I hereby waive notice of demand for payment and agree that any legal action, which may arise in relation to this note, may be instituted in the proper court of Makati City. Finally, this note shall likewise be subject to the following terms and conditions: 1. The borrower shall pay the amount of Pesos: _______________________________ (P_______________) through salary deduction, whenever feasible, over a maximum period of 24 months, with a grace period of 2 months. In case of suspension from work, leave of absence without pay, or insufficiency of take home pay during the term of the loan, payments should be made directly to the Pag-IBIG Fund office where the loan was released. 2. Payments are due on or before the 15th day of the month starting on _________________________ and 23 succeeding months thereafter. 3. Payments shall be applied according to the following order of priorities: Penalties, Interest and Principal. 4. A penalty of 1/20 of 1% of any unpaid amount shall be charged to the borrower for every day of delay. Signed in the presence of: _________________________ Witness (Signature over Printed Name) _________________________ Witness (Signature over Printed Name) 5. The borrower shall be considered in default in any of the following cases: a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto; b. Failure of the borrower to pay any three (3) consecutive monthly amortizations; c. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly savings; d. Violation by the borrower of any policies, rules, regulations and guidelines of the Pag-IBIG Fund 6. In the event of default, the outstanding loan obligation shall become due and demandable. As a consequence thereof, the outstanding loan obligation, consisting of the principal, interest and penalties shall be subjected to offsetting against the borrowers Total Accumulated Value (TAV). However, immediate offsetting of the borrowers outstanding loan obligation may be effected immediately upon approval of the borrowers request, provided such request is based on the following justifiable reasons and upon validation by the Fund: Borrowers unemployment; illness of the member-borrower or any of his immediate family member as certified by a licensed physician, by reason thereof, resulted in his failure to pay the required amortizations when due; or death of any of his immediate family members, by reason thereof, resulted in his failure to pay the required amortizations when due. 7. In the event of membership termination prior to loan maturity, any outstanding loan balance, including the unpaid interest, penalti es and charges, shall be deducted from the borrowers TAV and/or any amount due him or his beneficiaries in the possession of the Fund. 8. In case of falsification, misrepresentation or any similar acts committed by the borrower, PagIBIG Fund shall automatically suspend his loan privileges indefinitely. The borrower shall abide with all the applicable rules and regulations governing this lending program that Pag-IBIG Fund may promulgate from time to time.

___________________________________ Signature of Applicant over Printed Name

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding MPL loan balance from my retirement or separation benefits to fully settle my loan obligation. In the event that my retirement/separation benefits is not sufficient to settle the outstanding balance of my MPL or my employer fails for whatever reason, to deduct the same from said retirement/separation benefits, I hereby authorize Pag-IBIG Fund to apply whatever benefits are due me from the Fund to settle the said obligation.

SIGNATURE OF APPLICANT

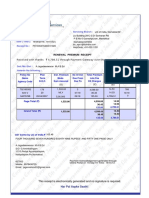

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

CLAIM/HOUSING LOAN/STL VERIFICATION

PARTICULARS CLAIMS HOUSING LOAN MPL/CL NONE WITH DV/CHECK NO. / APPLICATION NO. DATE FILED / DV NO. VERIFIED DATE

LOAN APPROVAL

LOAN AMOUNT GRANTED REVIEWED BY INTEREST DATE PREVIOUS LOAN BALANCE APPROVED BY LOAN PROCEEDS DATE MONTHLY AMORT DISAPPROVED BY DATE

NOTE: A notification on the approval/disapproval of the application shall be sent through SMS. For disapproved application, you may claim your submitted application form and supporting documents within five (5) working days upon receipt of the notification, otherwise such documents shall be disposed.

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

(11/2012)

GUIDELINES AND INSTRUCTIONS

A. Loan Purpose To provide financial assistance to Pag-IBIG I member for: 1. Minor home improvement/home renovation/upgrades; 2. Livelihood/additional capital in small business; 3. Tuition/educational expense; 4. Health and wellness; 5. Purchase of appliance and furniture/electronic gadgets; 6. Bills/credit card payment; 7. Vacation/travel; 8. Special events; 9. Car repair; 10. Balance transfer/debt consolidation; and 11. Other needs Who May File Any Pag-IBIG Fund member who satisfies the following requirements may apply for a Multi-Purpose Loan (MPL): 1. The member has made at least 24 monthly contributions. 2. Has five (5) MCs for the last six (6) months as of month prior to date of loan application. 3. If with existing housing loan, the account must not be in default as of the date of application. 4. If with existing MPL and/or Calamity Loan, the account/s is/are not in default as of date of application. How to File The applicant shall: 1. Secure the Multi-Purpose Loan Application Form (MPLAF) from any Pag-IBIG Fund NCR/ Regional branch. 2. Accomplish 1 copy of the application form. 3. Attach photocopy of payroll account/disbursement card/deposit slip (for newly-opened account). 4. Submit complete application, together with the required documents to any Pag-IBIG Fund NCR/ Regional Branch. Processing of loans shall commence only upon submission of complete documents. Loan Features 1. Loan Amount A qualified Pag-IBIG member shall be allowed to borrow an amount based on the lowest of the following: desired loan amount, loan entitlement, capacity-to-pay. 1.1 Loan Entitlement The loan entitlement shall depend on the number of contributions the borrower has made, based on the following schedule: Number of Contributions 24 to 59 months 60 to 119 months At least 120 months Loan Amount Up to 60% of the Total Accumulated Value (TAV) Up to 70% of the TAV Up to 80% of the TAV

CERTIFICATE OF NET PAY

NAME OF BORROWER For the month of: __________________

B.

Basic Salary

Add: Allowances

__________________

C.

________________________ ________________________

___________ ___________

D.

________________________ ________________________ ________________________

___________ ___________ ___________

Gross Monthly Income

___________

1.2 Capacity to Pay An eligible borrowers loan shall be limited to an amount for which statutory deductions, the monthly repayment of principal and interest, and other obligations will not render the borrowers net take home pay to fall below the minimum requirement as prescribed by the General Appropriation Act (GAA) or company policy, whichever is applicable. If borrower has an existing Calamity Loan, the loanable amount shall be the difference between 80% of the borrowers TAV and the outstanding balance of his Calamity Loan; provided, it does not exceed the borrowers loan entitlement. 2. Interest Rate and Loan Period 2.1 The loan shall be charged with a nominal interest of 10.5% p.a. (effective rate of 17.50%), with interest during the grace period, capitalized and paid equally over the term of the loan. 2.2 The loan shall be repaid over a maximum period of twenty-four (24) months, with a grace period of two (2) months. 3. Loan Release The loan proceeds shall be released through any of the following modes: a) Crediting to the borrowers cash card/disbursement card; b) Crediting to the borrowers bank account through LANDBANKs Payroll Credit Systems Validation (PACSVAL); c) Through check payable to the borrower; d) Other similar modes of payments. 4. Loan Payments 4.1 The loan shall be paid in equal monthly payments in such amounts as may fully cover the principal and interest over the loan period. Said amortization shall be made, whenever feasible, through salary deduction. 4.2 Payments shall be remitted to the Fund on or before the fifteenth (15 th) day of each month, starting on the third (3rd) month following the date on the DV/check. 4.3 The borrower may fully pay the outstanding balance prior to loan maturity. 4.4 The borrower shall pay directly to the Fund in case the borrower is unable to pay through salary deduction for any of the following circumstances such as but not limited to: a. Suspension from work b. Leave of absence without pay c. Insufficiency of take home pay at any time during the term of the loan 4.5 Payment shall be applied according to the following order of priorities: a. Penalties b. Interest c. Principal 4.6 Accelerated Payments any amount in excess of the required monthly amortization shall be applied to future amortizations when due. 5. Penalty The borrower shall be charged a penalty of 1/20 of 1% of any unpaid amount for every day of delay. However, for borrowers paying their loans through salary deduction, penalties shall be reversed only upon presentation of proof that non-payment was due to the fault of the employer. The said penalties including the penalty for non-remittance equivalent to 1/10 of 1% per day of delay of the amount payable from the date the loan amortizations or payments fall due until paid, shall then be charged against the employer. 6. Default The borrower shall be in default in any of the following cases: a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto. b. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly amortizations. c. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly savings. d. Violation by the borrower of any of the policies, rules, regulations and guidelines of Pag-IBIG Fund.

Less: Deductions

________________________

___________

________________________ ________________________ ________________________ ________________________ Total Deductions

___________ ___________ ___________ ___________ ___________

Net Monthly Income

___________

Issued this _______ day of ____________, 20__. I certify under pain of perjury that the abovementioned information is true and correct.

______________________________________________ HEAD OF OFFICE/AUTHORIZED SIGNATORY (Signature over printed name)

I hereby authorize ______________________________, our Fund Coordinator or Liaison Officer to file my MPL Application and receive the Pag-IBIG Fund Check in my behalf.

E. Other Provisions 1. The MPL and Calamity Loan shall be treated as separate and distinct from each other. Hence, the member shall be allowed to avail of an MPL while he still has an outstanding Calamity Loan, and vice versa. In no case, however, shall the aggregate short-term loan exceed eighty percent (80%) of the borrowers TAV. 2. For borrowers with existing Calamity Loan at the time of the availment of MPL, the outstanding loan balance of the Calamity Loan shall not be deducted from the proceeds of the MPL. F. Loan Renewal A borrower may renew his MPL upon payment of at least six (6) posted monthly amortizations and he meets the eligibility requirement. The proceeds of the new loan shall be applied to the borrowers outstanding MPL obligation and the net proceeds shall then be released to the borrower.

________________________________

Signature of Applicant over Printed Name

You might also like

- Pag-Ibig Multi Purpose Loan Application FormDocument2 pagesPag-Ibig Multi Purpose Loan Application Formhailglee192580% (5)

- Model Agreement Draft For Qard E HasnaDocument4 pagesModel Agreement Draft For Qard E HasnaSyed Zahid Ahmad100% (1)

- International Economics NotesDocument66 pagesInternational Economics NotesLukas Andriušis50% (2)

- Pagibig Calamity LoanDocument2 pagesPagibig Calamity LoanJenny Mauricio BassigNo ratings yet

- Policy Surrender Form PDFDocument2 pagesPolicy Surrender Form PDF1012804201No ratings yet

- Form CPFMCDocument4 pagesForm CPFMCJeyavikinesh SelvakkuganNo ratings yet

- 2016 SSS Loan Form PDFDocument4 pages2016 SSS Loan Form PDFAnonymous 1AXVu3Gh67% (6)

- Form CPFLMDocument4 pagesForm CPFLMKrishnan JayaramanNo ratings yet

- Pag IBIG FormDocument2 pagesPag IBIG FormJose Alberto100% (1)

- Six Sigma With A Case Study On WiproDocument13 pagesSix Sigma With A Case Study On WiproKavya Krishnan100% (1)

- This Document Is A Preview Generated by EVS: International StandardDocument10 pagesThis Document Is A Preview Generated by EVS: International StandardAndres Felipe Perez MarinNo ratings yet

- The Real North KoreaDocument5 pagesThe Real North KoreaJoseph LarrabasterNo ratings yet

- UiPath - Hand BookDocument23 pagesUiPath - Hand BookAvinash100% (1)

- FYREDocument107 pagesFYREMatthew WatanabeNo ratings yet

- SLF002 Calamity Loan Application FormDocument2 pagesSLF002 Calamity Loan Application FormRoy NarapNo ratings yet

- Calamity HMDFDocument3 pagesCalamity HMDFchennieNo ratings yet

- Calamity LoanDocument2 pagesCalamity LoanJu LanNo ratings yet

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Document2 pagesCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- SLF002 CalamityLoanApplication V05-2Document2 pagesSLF002 CalamityLoanApplication V05-2LouiseNo ratings yet

- Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03Document2 pagesPag-IBIG Fund Multi Purpose Loan Application SLF001 V03Jazz Adaza67% (3)

- FLS010 HDMF MPL Application Form Aug 09 - 092809Document2 pagesFLS010 HDMF MPL Application Form Aug 09 - 092809Amz Sau Bon100% (1)

- SLF001 MultiPurposeLoanApplicationForm (MPLAF) V01Document2 pagesSLF001 MultiPurposeLoanApplicationForm (MPLAF) V01mitzi_0350% (2)

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationDocument1 pageAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- HDMF Mplaf-Stl SampleDocument2 pagesHDMF Mplaf-Stl SampleHarold Quindica DaronNo ratings yet

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FDocument2 pagesFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FRochelle Esteban100% (2)

- Multi-Purpose Loan Application Form (MPLAF, HQP-SLF-001, V01) EDS2Document2 pagesMulti-Purpose Loan Application Form (MPLAF, HQP-SLF-001, V01) EDS2Edelyn Lindero Ambos100% (1)

- Emerson Rosaupan Calamity LoanDocument3 pagesEmerson Rosaupan Calamity LoanErere RosaupanNo ratings yet

- Pagibig Loan Fill in Form2Document2 pagesPagibig Loan Fill in Form2froilan1010100% (1)

- FLS011 Application For PenCon Special STLDocument2 pagesFLS011 Application For PenCon Special STLwillienorNo ratings yet

- Promissory Note OrigDocument2 pagesPromissory Note Origcarlo laguraNo ratings yet

- Application For Retirement Separation Life Insurance BenefitsDocument4 pagesApplication For Retirement Separation Life Insurance BenefitsKrizza Mae De Leon100% (1)

- BJMP-Coop Housing Loan FormDocument3 pagesBJMP-Coop Housing Loan FormAdah AbubacarNo ratings yet

- Salary and Medal New Form2Document3 pagesSalary and Medal New Form2diamajolu gaygons100% (1)

- Standard PN For Corporation - Aug2021Document2 pagesStandard PN For Corporation - Aug2021Jose Rico ColigadoNo ratings yet

- FD Form RevisedDocument2 pagesFD Form RevisedAshutosh TiwariNo ratings yet

- SSS Form Salary LoanDocument4 pagesSSS Form Salary LoanMikoy Lacson100% (4)

- Mandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDDocument1 pageMandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDSwarup GadeNo ratings yet

- Withdrawal Form Fixed and Eia Contracts: Monthly Quarterly Annually Specific Amount $Document1 pageWithdrawal Form Fixed and Eia Contracts: Monthly Quarterly Annually Specific Amount $Angie Perez BurgosNo ratings yet

- Application Form For Personal Loan To PensionersDocument7 pagesApplication Form For Personal Loan To PensionersPrudhuu PrudhviNo ratings yet

- Application For Provident BenefitDocument2 pagesApplication For Provident BenefitcaesarbaNo ratings yet

- SLF017 ShortTermLoanRemittanceForm V01Document2 pagesSLF017 ShortTermLoanRemittanceForm V01Ray Nan100% (8)

- Payout FormDocument3 pagesPayout FormavisekgNo ratings yet

- Partial Withdrawal FormDocument2 pagesPartial Withdrawal FormPinkys Venkat100% (1)

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- MetlifeDocument2 pagesMetlifeShantu ShirurmathNo ratings yet

- Credit Cash Line FormDocument2 pagesCredit Cash Line FormTommy Dela CruzNo ratings yet

- Panoril PN Set-2Document2 pagesPanoril PN Set-2Aileen PuerinNo ratings yet

- General Purpose Loan - FillableDocument2 pagesGeneral Purpose Loan - Fillablenemo_nadalNo ratings yet

- Application For Modified General Purpose Loan: Under Res. No. 21, Series of 2014Document3 pagesApplication For Modified General Purpose Loan: Under Res. No. 21, Series of 2014nemo_nadalNo ratings yet

- New Salary Apds Dep-Ed Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)Document6 pagesNew Salary Apds Dep-Ed Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)En-en FrioNo ratings yet

- Account Opening Form BOIDocument4 pagesAccount Opening Form BOIhrocking1No ratings yet

- Application FOR Unemployment Benefits Under RA 8291: DateDocument2 pagesApplication FOR Unemployment Benefits Under RA 8291: DateGianJyrellAlbertoCorletNo ratings yet

- Payout FormDocument5 pagesPayout FormMMayoor1984No ratings yet

- Maturity FormDocument3 pagesMaturity FormNashitNo ratings yet

- GSIS Retirement Form PDFDocument4 pagesGSIS Retirement Form PDFSam ReyesNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessFrom EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessRating: 1 out of 5 stars1/5 (1)

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!From EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Rating: 1 out of 5 stars1/5 (2)

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- How to Make Your Credit Card Rights Work for You: Save MoneyFrom EverandHow to Make Your Credit Card Rights Work for You: Save MoneyNo ratings yet

- Beneficial Traits of Moringa Oleifera Leaves in Healing WoundsDocument9 pagesBeneficial Traits of Moringa Oleifera Leaves in Healing Woundsgosmiley100% (1)

- Pandakaking-Puti: KampupotDocument10 pagesPandakaking-Puti: KampupotgosmileyNo ratings yet

- Application Software: Program Particular ProcessDocument2 pagesApplication Software: Program Particular ProcessgosmileyNo ratings yet

- Most Famouse Classical Composer-1.PsdDocument9 pagesMost Famouse Classical Composer-1.PsdgosmileyNo ratings yet

- Protagoras: Pre-Socratic Greek Philosopher Sophists PlatoDocument4 pagesProtagoras: Pre-Socratic Greek Philosopher Sophists PlatogosmileyNo ratings yet

- Gender and Human SexualityDocument1 pageGender and Human SexualitygosmileyNo ratings yet

- CARY NELSON Capsule BiographyDocument2 pagesCARY NELSON Capsule BiographygosmileyNo ratings yet

- Movies - Murder On The Orient ExpressDocument2 pagesMovies - Murder On The Orient ExpressgosmileyNo ratings yet

- Practical Research ContentDocument92 pagesPractical Research ContentgosmileyNo ratings yet

- Values EducationDocument7 pagesValues EducationgosmileyNo ratings yet

- 42 To 47 - History of CandoniDocument7 pages42 To 47 - History of Candonigosmiley100% (1)

- Explain Cultural ChangeDocument1 pageExplain Cultural ChangegosmileyNo ratings yet

- Religion in The PhilippinesDocument6 pagesReligion in The PhilippinesgosmileyNo ratings yet

- 10 Famous Fistival in The PhilippinesDocument5 pages10 Famous Fistival in The PhilippinesgosmileyNo ratings yet

- Zum Gali GaliDocument1 pageZum Gali Galigosmiley50% (2)

- The History of BaseballDocument2 pagesThe History of BaseballgosmileyNo ratings yet

- Origin of Sitio IgangDocument1 pageOrigin of Sitio IganggosmileyNo ratings yet

- 07 Competency AssessmentDocument17 pages07 Competency AssessmentgosmileyNo ratings yet

- The 10 Most Popular Festivals in The Philippines ScriptDocument4 pagesThe 10 Most Popular Festivals in The Philippines ScriptgosmileyNo ratings yet

- Tultugan FestivalDocument1 pageTultugan FestivalgosmileyNo ratings yet

- The World FolktalesDocument6 pagesThe World FolktalesgosmileyNo ratings yet

- (A) Pure Banking:: AdvantagesDocument4 pages(A) Pure Banking:: AdvantagesArihant JainNo ratings yet

- Presentation N - Du Pont - Stream 2Document19 pagesPresentation N - Du Pont - Stream 2Chuan LiuNo ratings yet

- Sample Town Hall SlidesDocument11 pagesSample Town Hall Slidesapi-280532286No ratings yet

- #3 Lab - Making DecisionsDocument2 pages#3 Lab - Making DecisionsСахиб РзаевNo ratings yet

- ID INSIGHTS Sustainable E-MobilityDocument115 pagesID INSIGHTS Sustainable E-MobilityFred Lamert100% (25)

- House of Strategy: VisionDocument4 pagesHouse of Strategy: VisionAnamika gudgeNo ratings yet

- Marketing Management of Asian PaintsDocument22 pagesMarketing Management of Asian PaintsManisha JainNo ratings yet

- The GOld COmpany ProfileDocument10 pagesThe GOld COmpany ProfilelancauNo ratings yet

- GeM Bidding Corr 3587945 61Document4 pagesGeM Bidding Corr 3587945 61MDL COMMNo ratings yet

- Cel2106 SCL Worksheet 7Document3 pagesCel2106 SCL Worksheet 7LI HELINNo ratings yet

- Received With Thanks ' 4,789.51 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 4,789.51 Through Payment Gateway Over The Internet FromJagadeeswaranNo ratings yet

- EXAMPLES - Notice, Agenda, Letters, ReportDocument24 pagesEXAMPLES - Notice, Agenda, Letters, Reportkimberlymurzello13No ratings yet

- Banquet Fact SheetDocument4 pagesBanquet Fact SheetRavinder NehraNo ratings yet

- Panel of Auditors of BSEC 18.06.2023Document7 pagesPanel of Auditors of BSEC 18.06.2023Sadia ParvinNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- India Case StudyDocument4 pagesIndia Case StudyMakame Mahmud DiptaNo ratings yet

- CHAPTER - 15-: Payments Under A Life Insurance PolicyDocument2 pagesCHAPTER - 15-: Payments Under A Life Insurance PolicyumeshNo ratings yet

- Illustrative Problems-Consolidation Date of Acquisition BDocument6 pagesIllustrative Problems-Consolidation Date of Acquisition BJanine TupasiNo ratings yet

- Alok KadamDocument5 pagesAlok KadamJohnathan RoweNo ratings yet

- MVP TemplateDocument24 pagesMVP Templatepriyanka jainNo ratings yet

- Sd6-The Economic Balance Sheet and An Overview of Cash Flow Based Valuation ModelsDocument7 pagesSd6-The Economic Balance Sheet and An Overview of Cash Flow Based Valuation Modelsanah ÜNo ratings yet

- AkuntansiDocument15 pagesAkuntansiMUHAMMAD RIZKYNo ratings yet

- Magna Carta For Women - Special Leave BenefitsDocument4 pagesMagna Carta For Women - Special Leave BenefitsLeigh VillegasNo ratings yet

- 9 0 9 PP028837 Ye Pro Stocker 2023 @Document11 pages9 0 9 PP028837 Ye Pro Stocker 2023 @lider aduana1No ratings yet