Professional Documents

Culture Documents

Margin Call Calculations

Margin Call Calculations

Uploaded by

Saqib Ansari0 ratings0% found this document useful (0 votes)

15 views1 pagebasic excel formula

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbasic excel formula

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageMargin Call Calculations

Margin Call Calculations

Uploaded by

Saqib Ansaribasic excel formula

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

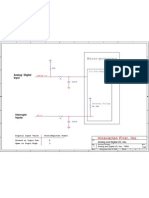

Initial Portfolio Value Your Initial Equity (Margin) Maintenance Margin Requirement Portfolio Value to Trigger Margin Call

Your Equity at Time of Margin Call Portfolio % Loss at Time of Margin Call

Margin Call Examples Example 1 Example 2 Example 3 Example 4 Example 5 20,000 50,000 100,000 75,000 12,000 10,000 30,000 50,000 40,000 10,000 25% 30% 30% 35% 30% 13,333.33 28,571.43 71,428.57 53,846.15 2,857.14 3,333.33 8,571.43 21,428.57 18,846.15 857.14 33.33% 42.86% 28.57% 28.21% 76.19%

To figure the portfolio value that will trigger a margin call:

V2 =

IM % - 1 V1 MM % - 1

Where: IM% = Initial Equity as a % of Portfolio Value MM% = Required Minimum Equity % V1 = Initial Value of Portfolio V2 = Portfolio Value To Trigger Margin Call

You might also like

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 1-150Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 1-150HILDA IDANo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Marathon S 2023 2024 Global Credit Whitepaper 1678838357Document23 pagesMarathon S 2023 2024 Global Credit Whitepaper 1678838357SwaggyVBros MNo ratings yet

- Brian Johnson Option Strategy Risk Return Ratios: A Revolutionary New Approach To Optimizing, Adjusting, and Trading Any Option Income StrategyDocument183 pagesBrian Johnson Option Strategy Risk Return Ratios: A Revolutionary New Approach To Optimizing, Adjusting, and Trading Any Option Income Strategypiwp0w100% (15)

- ABCP State StreetDocument28 pagesABCP State StreetAngshujit MajumderNo ratings yet

- Clo Manager Size RankingsDocument75 pagesClo Manager Size Rankingskiza66No ratings yet

- Derivatives - Option ValuationDocument73 pagesDerivatives - Option ValuationBala MuruganNo ratings yet

- Big Data Architectures For Investment Banking - Session IDocument56 pagesBig Data Architectures For Investment Banking - Session InelosanNo ratings yet

- Final CT8 Summary Notes PDFDocument110 pagesFinal CT8 Summary Notes PDFMihai MirceaNo ratings yet

- Ducati Case ExhibitsDocument10 pagesDucati Case Exhibitslucien_lu0% (1)

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- YTM at Time of Issuance (At Par)Document8 pagesYTM at Time of Issuance (At Par)tech& GamingNo ratings yet

- Asset Backed Commercial Paper Criteria ReportDocument33 pagesAsset Backed Commercial Paper Criteria Reported_nycNo ratings yet

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsDocument26 pagesCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraNo ratings yet

- Fabozzi CH 32 CDS HW AnswersDocument19 pagesFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- Taylor & Francis, Ltd. Financial Analysts JournalDocument16 pagesTaylor & Francis, Ltd. Financial Analysts JournalJean Pierre BetancourthNo ratings yet

- Corporate Banking Summer Internship ProgramDocument2 pagesCorporate Banking Summer Internship ProgramPrince JainNo ratings yet

- Apollo Global Asset Backed Finance White PaperDocument16 pagesApollo Global Asset Backed Finance White PaperstieberinspirujNo ratings yet

- Hedge Fund Risk Management: September 2009Document18 pagesHedge Fund Risk Management: September 2009Alan LaubschNo ratings yet

- A Primer On Whole Business SecuritizationDocument13 pagesA Primer On Whole Business SecuritizationSam TickerNo ratings yet

- Securitisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Document25 pagesSecuritisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Emmanuele Orospies SpadaroNo ratings yet

- Principal Protected Investments: Structured Investments Solution SeriesDocument8 pagesPrincipal Protected Investments: Structured Investments Solution SeriessonystdNo ratings yet

- Ion - Why Is It Necessary - How It WorksDocument7 pagesIon - Why Is It Necessary - How It WorksPankaj D. DaniNo ratings yet

- Minibond Series 35Document58 pagesMinibond Series 35Ben JoneNo ratings yet

- Third Point 2011 ADV Part 2a BrochureDocument23 pagesThird Point 2011 ADV Part 2a BrochureWho's in my FundNo ratings yet

- Deleveraging Investing Optimizing Capital StructurDocument42 pagesDeleveraging Investing Optimizing Capital StructurDanaero SethNo ratings yet

- CdosDocument53 pagesCdosapi-3742111No ratings yet

- Mortgage Backed SecuritiesDocument3 pagesMortgage Backed SecuritiesLalit SapkaleNo ratings yet

- Credit Derivatives: An Overview: David MengleDocument24 pagesCredit Derivatives: An Overview: David MengleMonica HoffmanNo ratings yet

- Callable BrochureDocument37 pagesCallable BrochurePratik MhatreNo ratings yet

- 7.2 The Build and Break Approach 7.3 Financial EngineeringDocument24 pages7.2 The Build and Break Approach 7.3 Financial EngineeringmahrukhNo ratings yet

- Kevin Buyn - Denali Investors Columbia Business School 2009Document36 pagesKevin Buyn - Denali Investors Columbia Business School 2009g4nz0No ratings yet

- ABCs of ABCP, 2009Document42 pagesABCs of ABCP, 2009ed_nycNo ratings yet

- Introduction To Credit DerivativesDocument23 pagesIntroduction To Credit DerivativesSumeet MhamunkarNo ratings yet

- Leverage Capital Group - ProfileDocument23 pagesLeverage Capital Group - Profileanon_601430920No ratings yet

- Valuation and Hedging of Inv Floaters PDFDocument4 pagesValuation and Hedging of Inv Floaters PDFtiwariaradNo ratings yet

- Askin CapitalDocument1 pageAskin CapitalPoorvaNo ratings yet

- The Benefits of Convertible Bonds: - UBS Asset ManagementDocument21 pagesThe Benefits of Convertible Bonds: - UBS Asset ManagementHans HermannNo ratings yet

- The Pension Risk Transfer Market at $260 BillionDocument16 pagesThe Pension Risk Transfer Market at $260 BillionImranullah KhanNo ratings yet

- Alternatives in Todays Capital MarketsDocument16 pagesAlternatives in Todays Capital MarketsjoanNo ratings yet

- European Bond Futures 2006Document10 pagesEuropean Bond Futures 2006deepdish7No ratings yet

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- DCM For LSEDocument14 pagesDCM For LSEAlbert TsouNo ratings yet

- Credit-Linked NotesDocument16 pagesCredit-Linked NotestonyslamNo ratings yet

- Dual Range AccrualsDocument1 pageDual Range AccrualszdfgbsfdzcgbvdfcNo ratings yet

- 26 Structured RepoDocument4 pages26 Structured RepoJasvinder JosenNo ratings yet

- Floating Rate Note Pricing V3Document9 pagesFloating Rate Note Pricing V3QuantmetrixNo ratings yet

- Bosphorus CLO II Designated Activity CompanyDocument18 pagesBosphorus CLO II Designated Activity Companyeimg20041333No ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Investment TheoryDocument29 pagesInvestment Theorypgdm23samamalNo ratings yet

- Survey of Microstructure of Fixed Income Market PDFDocument46 pagesSurvey of Microstructure of Fixed Income Market PDF11: 11100% (1)

- DerivativesDocument19 pagesDerivativesSangram BhoiteNo ratings yet

- Orange CountryDocument4 pagesOrange CountrylilisliliNo ratings yet

- VelocityShares Etn Final Pricing Supplement VixlongDocument196 pagesVelocityShares Etn Final Pricing Supplement VixlongtgokoneNo ratings yet

- (Bank of America) Guide To Credit Default SwaptionsDocument16 pages(Bank of America) Guide To Credit Default SwaptionsAmit SrivastavaNo ratings yet

- Note On Credit Credit Analysis ProcessDocument26 pagesNote On Credit Credit Analysis Processaankur aaggarwalNo ratings yet

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- BNP April 2012 PDFDocument28 pagesBNP April 2012 PDFcaxapNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Alternative Investment Strategies A Complete Guide - 2020 EditionFrom EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Interest Rate ModelsDocument109 pagesInterest Rate ModelsJessica HendersonNo ratings yet

- Fixed Income SecuritiesDocument103 pagesFixed Income Securitiesaru1977No ratings yet

- Index ofDocument1 pageIndex ofapi-27174321No ratings yet

- Eco No Metrics Forecasting 1999 - NonLinear DynamicsDocument43 pagesEco No Metrics Forecasting 1999 - NonLinear Dynamicsapi-27174321No ratings yet

- Fixed Income Bond Trading 1999 - Rich-Cheap & Relative ValueDocument38 pagesFixed Income Bond Trading 1999 - Rich-Cheap & Relative Valueapi-27174321100% (1)

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- Fixed Income Bond Trading 1999 - Bonds With Embedded OptionsDocument26 pagesFixed Income Bond Trading 1999 - Bonds With Embedded Optionsapi-27174321No ratings yet

- Advanced Option Risk ManagementDocument97 pagesAdvanced Option Risk Managementvenkraj_iitm100% (2)

- Derivatives Equity Linked DebtDocument28 pagesDerivatives Equity Linked Debtapi-27174321No ratings yet

- Option Risk ManagementDocument44 pagesOption Risk ManagementThanh Tam LuuNo ratings yet

- Socialism and International Economic OrderDocument316 pagesSocialism and International Economic OrderchovsonousNo ratings yet

- Derivatives Equity DerivativesDocument31 pagesDerivatives Equity Derivativesapi-27174321100% (1)

- Socialism and Religion: PREFACE To The Second Edition (1911)Document19 pagesSocialism and Religion: PREFACE To The Second Edition (1911)api-27174321No ratings yet

- Vex Analog Digital InputDocument1 pageVex Analog Digital Inputapi-27174321No ratings yet

- Lego Story TellingDocument6 pagesLego Story Tellingapi-27174321100% (1)

- NCFM Capital Market Module (CMDM) Study Notes. NCFM Mock Test at WWW - Modelexam.inDocument19 pagesNCFM Capital Market Module (CMDM) Study Notes. NCFM Mock Test at WWW - Modelexam.inThiagarajan Srinivasan75% (4)

- Fin333 Secondmt04w Sample QuestionsDocument10 pagesFin333 Secondmt04w Sample QuestionsSara NasNo ratings yet

- Manajemen Keuangan - SulisytandariDocument115 pagesManajemen Keuangan - SulisytandariTrianto SatriaNo ratings yet

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomNo ratings yet

- Project Feasibility StudyDocument3 pagesProject Feasibility StudyAli Gramme BinadayNo ratings yet

- Competitive Strategies Followed by FMCG Sector in IndiaDocument4 pagesCompetitive Strategies Followed by FMCG Sector in IndiaPrashant Gurjar100% (1)

- M 206Document3 pagesM 206Rafael Capunpon VallejosNo ratings yet

- Brian Vinci Presentation of An Economic Model Comparing Open Net and Land Based Aquaculture1Document24 pagesBrian Vinci Presentation of An Economic Model Comparing Open Net and Land Based Aquaculture1MARIO GUERRERO GARCIANo ratings yet

- From To: RealityDocument96 pagesFrom To: RealityAw Yuong TuckNo ratings yet

- AirtelDocument3 pagesAirtelAkhil JayathilakanNo ratings yet

- Analysis of Mutual FundsDocument88 pagesAnalysis of Mutual FundsMano Bernard100% (2)

- Article PMDocument9 pagesArticle PMferoz khanNo ratings yet

- Swot Analysis For Pearson PLC LatestDocument6 pagesSwot Analysis For Pearson PLC LatestAnonymous F7KAqUPNo ratings yet

- US Historical RoEDocument17 pagesUS Historical RoEdiffsoft100% (2)

- DELL LBO Model Part 1 CompletedDocument45 pagesDELL LBO Model Part 1 CompletedascentcommerceNo ratings yet

- Ratio Analysis of Bajaj Auto LTDDocument4 pagesRatio Analysis of Bajaj Auto LTDRadhika KadamNo ratings yet

- Project On Mutual Fund Akhilesh MishraDocument77 pagesProject On Mutual Fund Akhilesh MishraMAAHIMANOJNo ratings yet

- CPL StructureDocument42 pagesCPL StructureUma NNo ratings yet

- Cost of CapitalDocument114 pagesCost of CapitalNamra ImranNo ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- 50 Rules of Futures TradingDocument29 pages50 Rules of Futures TradingWong100% (5)

- Welcome To Bollinger Band SqueezeDocument12 pagesWelcome To Bollinger Band SqueezeRenatoNo ratings yet

- Financial Management MCQs 35Document6 pagesFinancial Management MCQs 35khan50% (2)

- Horizontal Analysis (Grate)Document6 pagesHorizontal Analysis (Grate)Leonelson CorralNo ratings yet

- HFSF Annual Report 2012 enDocument57 pagesHFSF Annual Report 2012 enVaggelarasBNo ratings yet

- 5 Ways Post BTFD 2018Document17 pages5 Ways Post BTFD 2018emirav2No ratings yet