Professional Documents

Culture Documents

Jenkins Vs McCalla Raymer MERS

Jenkins Vs McCalla Raymer MERS

Uploaded by

Frank JeanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jenkins Vs McCalla Raymer MERS

Jenkins Vs McCalla Raymer MERS

Uploaded by

Frank JeanCopyright:

Available Formats

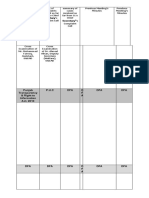

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 1 of 22

IN THE UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF GEORGIA ATLANTA DIVISION WENDY N. JENKINS, ELEANOR SPRATLIN CRAWFORD, each Plaintiff individually, and on behalf of all Georgia residents similarly situated. ) ) ) ) ) Plaintiffs, ) ) ) vs. ) ) ) McCALLA RAYMER, LLC, THOMAS A. ) SEARS, ESQ., INDIVIDUALLY, AS AN ) OFFICER OF MORTGAGE ELECTRONIC) REGISTRATION SYSTEMS, INC, AS AN ) OFFICER OF WELLS FARGO, AND AS ) AN EMPLOYEE OF McCALLA RAYMER) CHARLES TROY CROUSE, ESQ., aka C. ) TROY CROUSE ESQ., INDIVIDUALLY, ) AS AN OFFICER OF MORTGAGE ) ELECTRONIC REGISTRATION ) SYSTEMS, INC, AS AN OFFICER OF ) WELLS FARGO AND AS AN EMPLOYEE) OF McCALLA RAYMER, MERSCORP ) INC., BANK OF AMERICA, N.A., BAC ) HOME LOANS SERVICING, LP., fka ) COUNTRYWIDE HOME LOANS ) SERVICING, LP.,WELLS FARGO BANK, ) N.A., PROMMIS SOLUTIONS, LLC., ) PROMMIS SOLUTIONS HOLDING INC., ) GREAT HILL PARTNERS, INC., ) MORTGAGE ELECTRONIC ) REGISTRATION SYSYTEMS INC. ) AMERICAS SERVICING COMPANY, ) TAYLOR BEAN &WHITAKER, ) CRYSTAL WILDER, INDIVIDUALLY, ) AS NOTARY PUBLIC AND AS AN ) EMPLOYEE OF McCALLA RAYMER, ) ELIZABETH LOFARO, INDIVIDUALLY,) AS NOTARY PUBLIC AND AS AN ) EMPLOYEE OF McCALLA RAYMER, ) CHIQUITA RAGLIN, INDIVIDUALLY, )

CASE NO. 10-CV-3732-CAP-AJB

PLAINTIFFS DEMAND TRIAL BY JURY

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 2 of 22

AS NOTARY PUBLIC AND AS AN EMPLOYEE OF McCALLA RAYMER, VICTORIA MARIE ALLEN, INDIVIDUALLY, AS NOTARY PUBLIC AND AS AN EMPLOYEE OF McCALLA RAYMER, IRIS GISELLA BEY, INDIVIDUALLY, AS NOTARY PUBLIC AND AS AN EMPLOYEE OF McCALLA RAYMER, JAMELA REYNOLDS, INDIVIDUALLY, AS NOTARY PUBLIC AND AS AN EMPLOYEE OF McCALLA RAYMER AND LATASHA DANIEL, INDIVIDUALLY, AS NOTARY PUBLIC AND AS AN EMPLOYEE OF McCALLA RAYMER Defendants.

) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) )

PLAINTIFFS BRIEF IN RESPONSE TO DEFENDANTS MOTION TO DISMISS COMES NOW, Wendy Jenkins and Eleanor Spratlin Crawford, each Plaintiff individually, and on behalf of all Georgia residents similarly situated, and respectfully RESPOND to Defendants Motion to Dismiss and shows this Honorable Court as follows: Plaintiffs have plead enough facts to State a Claim to relief that is plausible on its face as required by law and required under the Federal Rules of Civil Procedure 12(b)(6).

FACTS OF THE CASE This action is a Class Action Complaint. Plaintiffs seek, inter alia, the

injunction of various foreclosure and eviction proceedings, as representatives for

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 3 of 22

themselves and of that Class of homeowners similarly situated, based upon the Defendants, each of them either Bankers, Lenders, Attorneys at Law, individuals, document preparers and their agents and employees acting in concert and their routine failure to comply with statutory prerequisites to foreclosure. Plaintiffs and the class they seek to represent also seek a determination of the validity of foreclosure sales held in violation of statutory requirements, together with damages and other relief. In recent years, many foreclosing entities, including Defendant attorneys, law firms, bankers, lenders, document preparers, their agents and employees have dispensed with the fundamental requirements prerequisite to foreclosure in Georgia Code O.C.G.A. 23-2-114. Such entities foreclose and advertise for foreclosure and take steps toward foreclosure, through their Attorneys, Counsels, document preparers, servicers, agents and employees, without having first obtained proper and legally valid assignments of the mortgages and the power of sale on property they purport to foreclose. Hundreds, if not thousands, of foreclosures are plainly void under statute and Georgia Case law and voidable under Federal Laws. Plaintiffs seek relief on their own behalf, and on behalf of all Georgia Property owners similarly situated, from the named Defendants jointly and severally, who routinely conduct and maintain wrongful foreclosure practices and

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 4 of 22

procedures, damages against entities who initiated wrongful foreclosure procedures and declaratory relief and injunctive relief conducted by entities who do not hold the Power of Sale nor the instrument upon which the proof of debt is based and injunction of eviction action pending procedures to verify the validity of underlying sales, injunction of upcoming sales where there is no proof of a valid assignment, and a cancellation of fees and costs related to invalid sales, assessments, processing and penalties, damages as required by law and a Jury Trial of 12 Jurors. FACTS OF PLAINTIFF WENDY JENKINS Plaintiff Wendy Jenkins is a married woman who owns a home and on or about July 3, 2008 she refinanced her property located at7372 Cedar Creek Loop, Columbus, GA. 31904. Plaintiff Jenkins executed a Note and Security Deed in favor of Taylor Bean and Whitaker who later abruptly closed its doors on August 5, 2009. Plaintiff Jenkins made payments to Taylor Bean and Whittaker, BAC Home Loan Servicing, Bank of America and Does, and their alleged predecessor(s). , who repeatedly and willfully acted fraudulently in that they improperly added fees to the balance of the loan, improperly credited and or misapplied payments to the principal balance of the note and refused to provide documentation or legal justification for the debt, the fees or the irregular amortization of the principal in

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 5 of 22

violation of the laws of the State of Georgia and Federal Laws. In addition, they refused payment and repeatedly returned Plaintiffs attempts to tender payment. Plaintiff Jenkins Note and Security Deed were bifurcated and the deed alone was separated from the note and her note has been pledged, hypothecated and /or assigned as collateral security to an unknown entity, foreign trust or to an agency of the United States government or the Federal Reserve. Plaintiff Jenkins was notified by Defendant McCalla Raymer with letters that Plaintiffs home was to be foreclosed upon by persons who they knew or should have known had no legal rights to plaintiffs home. Further, false and fraudulent representations were made by Defendant McCalla Raymer as to the ownership of plaintiffs note and Security Deed. Defendants McCalla Raymer LLC., and its attorneys violated Georgia Law; specifically O.C.G.A. 44-14-162.2, O.C.G.A. 44-14-162(b) and O.C.G.A. 26A-2 (6). Defendants McCalla Raymer LLC., Thomas A. Sears, Esq., Charles Troy Crouse, Esq. and other named Defendants, in an attempt to conceal and cover-up the deficiencies in their attempted foreclosure where defendants had not complied with the statutes as required by the Georgia Code, created documents and caused purported assignments (Plaintiffs Exhibit C), containing false and fraudulent information from MERS to BAC to be recorded upon the Public Records of

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 6 of 22

Muscogee County on April 14, 2010. When challenged in the Superior Court of Muscogee County, Defendants McCalla Raymer LLC., Thomas A. Sears, Esq., and Charles Troy Crouse, Esq , after entering default and then attempting to open default Defendants McCalla, Crouse and Sears submitted as part of their pleadings, a verified answer, inter alia, which presented documents which purport to be multiple Agreement for Signing Authority and Corporate Resolution contracts by and between McCalla Raymer, MERS, BAC, and Countrywide (which was bought and absorbed by Bank of America in 2008), these documents were dated April 21, 2010 and April 26, 2010. Nothing in these documents granted Defendants McCalla, Crouse and Sears the power or authority to execute an Assignment of the Deed, the Note and the attendant Power of Sale on February 2, 2010. There is no document, in evidence that grants any power or authority related to this property, to Defendants McCalla, Crouse and Sears on February 2, 2010. Defendants McCalla acting as an agent for, or representing Defendants BAC Home Loans Servicing and Defendants Bank of America, attempted to wrongfully foreclose upon Plaintiffs home using this purported assignment, and scheduled a Sale Under Power for May 5, 2010. FACTS OF PLAINTIFF ELANOR SPRATLIN CRAWFORD On or about August 11, 1997, Plaintiff Crawford executed a Note and

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 7 of 22

Security Deed, in favor of NationsBank due to a refinancing of the subject Property. At some time unbeknownst to Plaintiff Crawford, ASC acquired the servicing rights to the subject loan and began servicing the loan.

Plaintiff Crawford admits that she was in arrears in regards to four months of mortgage payments in May of 2009. This was due to having suffered four (4) deaths within four months within her immediate family. She fell behind because of contributing to funeral and burial costs for her deceased family members which included her husbands mother.

Plaintiff Crawford, being mindful of her obligations called ASC and obtained an amount to cure her default. She was told that she had to make a payment of Sixty Two Hundred dollars ($6200.00), which she was willing and able to pay immediately. When she attempted to make that payment to ASC, she was told that she had call McCalla Raymer and/ or Prommis Solutions. Plaintiff Crawford contacted McCalla Raymer in order to cure her default and was told to contact Prommis Solutions. Upon contacting

Prommis Solutions, Plaintiff Crawford was given an inflated amount of over double the previously quoted amount. When she questioned the amount, she was told that it was due to fees and costs associated with your foreclosure. These fees are inflated and improper under FDCPA 15 U.S.C. 1692K et seq..

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 8 of 22

On or about June 23, 2009, Defendants caused an alleged Assignment of the Security Deed and Note securing the subject property to be recorded upon the land records of Cobb County, Georgia. This alleged Assignment is

defective upon its face as the person who purported to have notarized it, Defendant Crystal Wilder, had not been given a commission as a Notary Public on the date the assignment purports to have been executed, February 2, 2009. Ms. Wilder was not given a Notary commission until May 15, 2009 according the Georgia Superior Court Clerks Cooperative Authoritys website, which is searchable under the tab Notary Index. (See Exhibit A attached hereunto)

This alleged Assignment violates various Georgia statutes, among them, specifically; O.C.G.A. 44-14-61, O.C.G.A. 44-14-33, O.C.G.A. 44-5-64, and O.C.G.A. 23-2-114. Additionally, this alleged assignment violates O.C.G.A. 45-17-5, which specifically states, in clear and unambiguous language: It is unlawful for any person to hold himself or herself out as a notary public or to exercise the powers of a notary public unless such person has an unexpired commission as a notary public. Defendants Crouse and Sears alleged signatures appear upon the face of this document.

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 9 of 22

Defendants McCalla acting as an agent for, or representing Defendant Wells Fargo, attempted to wrongfully foreclose upon Plaintiffs home using this purported assignment, and scheduled a Sale Under Power for July 7, 2009.

On or about July 1, 2009, Plaintiff Spratlin obtained a Temporary Restraining Order, after paying into the Courts registry the sum of $17, 485.84. On

September 24, 2010, Defendants Wells, and McCalla Raymer sought to have the Temporary Restraining Order dissolved. Defendants were successful at getting the Temporary Restraining Order dissolved, at some time subsequent to that date, the Court released the monies ($17,484.84) to the Defendants.

On or about October 19, 2010, Defendants Prommis Solutions caused to be recorded upon the land records of Cobb County, Georgia, in Deed Book 14806 Page 172 another alleged assignment of Plaintiff Crawfords Security Deed and Note, allegedly executed on October 15, 2010, which Defendants Sears and Crouse also allegedly signed. This document was labeled

Amended Assignment, but in fact amends nothing. The sole change, other than the dates involved, was that, this time, an actual notary, with a valid notary commission, stamped and signed the document. FACTS OF PLAINTIFFS COMPLAINT

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 10 of 22

Defendants assertions of a shotgun pleading notwithstanding, Plaintiffs have made their case in a manner which is clear as to which claims apply to Defendants McCalla, Defendant Sears and Defendant Crouse. Although

Defendants claim that Plaintiffs are being intentionally vague is entirely incorrect. Plaintiffs have clearly alleged that all named Defendants were joint venturers and sought merely to clarify that any action taken in furtherance of such joint venture was not necessarily committed by each and every defendant individually. For example, Defendants Sears and Crouses alleged signatures appear on each of the assignments for both plaintiffs but the fraudulent notarization of the assignment for Plaintiff Jenkins was executed by Defendant Victoria Marie Allen and the fraudulent and purported notarization for Plaintiff Crawfords assignment was Crystal Wilder. Clearly, Defendant Allen and

Defendant are each responsible for their own actions and Plaintiffs would not want to tar one with the others actions and wish to define such actions even though such actions are in furtherance of a unlawful or illegal joint fraudulent venture. Defendants insist that they have complied with all prerequisites to a nonjudicial foreclosure all the while ignoring that their own documents do not support their arguments that MERS, BAC Servicing and ASC followed all of the requirements set forth in O.C.G.A. 44-14-164 for the transferring of secured instruments. Specifically, Plaintiff Jenkins assignment contains a latent defect,

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 11 of 22

which is that Defendants McCalla, Defendant Sear and Defendant Crouse had no right or authority on February 2, 2010 to transfer anything from MERS to anyone. And, specifically, Plaintiff Crawfords assignment, dated April 4, 2009, contains a patent defect because it is easily determined that the notary stamp bearing the phrase my commission expires on May 14, 2013 clearly demonstrates that the notary was acting outside the four year term of a valid notary commission. Clearly this document does not comply with the requirements of O.C.G.A. 44-14-64 which clearly states:

(a) All transfers of deeds to secure debt shall be in writing; shall be signed by the grantee or, if the deed has been previously transferred, by the last transferee; and shall be witnessed as required for deeds. While defendants go to great pains to make a point that possession of the original note is not a prerequisite to non-judicial foreclosure in Georgia, they completely ignore the fact that without a valid assignment of the Security Deed, and the Note, neither the Deed nor the Note is transferred, standing is not conferred and ultimately, any attempt to foreclosure the subject properties is fraudulent. Defendants then claim that Plaintiffs claims for wrongful foreclosure are unsupportable under Georgia law, but they ignore Weiblen v. Leeds Building Products, Inc., 219 Ga. App. 349, 464 S.E.2d 907 (1995) which specifically states:

Furthermore, contrary to Leeds' arguments, it is not necessary that the foreclosure be completed to bring an action for wrongful foreclosure. The fact

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 12 of 22

that Leeds initiated foreclosure proceedings by advertising the properties for sale is sufficient to support a claim for wrongful foreclosure. In the instant case, both Plaintiff Jenkins and Plaintiff Crawfords properties have been advertised for sale. Plaintiff Jenkinss property was advertised in the

Muscogee County Columbus Ledger-Enquirer, which is a general circulation newspaper and the countys legal organ. Plaintiff Crawfords property was advertised in the Marietta Daily Journal, which is a general circulation newspaper and the countys legal organ. Defendants further contend that there have been no allegations of fraud within the complaint going so far as to claim the only allegations to support Plaintiffs claim of fraud are questions about the signatures of Defendants Sears and Crouse. Their erroneous contentions notwithstanding, Plaintiffs show that there have been allegations of fraud, specifically averring that Defendants McCalla deliberately manufactured documents which purport to give Defendants Sears and Crouse authority to sign as Officers of MERS and/or the banks named as Defendants thereby falsely representing themselves to have held the authority to assign Plaintiff Jenkins Security Deed and Note. Additionally, Plaintiffs have laid out, with particularity, the fraudulent conduct in regards to Plaintiff Crawfords assignment.

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 13 of 22

Each element of the of fraud have been addressed in the Original Complaint, as to the element of a false representation, the act of assigning Plaintiff Jenkins property without the authority to do so is a false and fraudulent misrepresentation of Defendant Sears and Defendant Crouses ability to act for MERS.

Defendants McCallas subsequent actions in pursuing a wrongful foreclosure are a continuation of that false misrepresentation. It is axiomatic that Defendant Sears, Defendant Crouse and Defendant McCalla would have to know or should have known when they entered into a contract with MERS, BAC Servicing, Bank of America or any other entity after examining the title that the documents they were executing in furtherance of foreclosure were without authority, false and fraudulent. Defendant Sears and Defendant Crouses fraudulent and false

misrepresentation were intended to deprive Plaintiff Jenkins of her property and induce her into relying upon their authority as agents of the holder of her note to assign her property as Defendant Sears and Defendant Crouse signed as either Vice President or Assistant Secretary of MERS. In regards to Plaintiff

Crawford, the presence of a notary stamp gives the appearance of legality of the assignment even though the alleged notary was not commissioned. Falsely representing that the document was properly executed, thereby depriving the Plaintiff Crawford, the court in a non-judicial foreclosure due process of law. Further, causing false and fraudulent and fictitious representation in the public

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 14 of 22

record of the Clerk of the Superior Court that the property had been properly conveyed. Outside of the artifice set up by MERS that certifying officers are indeed Vice Presidents or Assistant Secretaries, it is commonly accepted that anyone bearing those titles are indeed Officers of the corporation they represent and as such the General Public relies upon those titles to confer authority to exercise the correct authority to act on the behalf of the corporation they hold themselves out to represent. Such misrepresentation would lull the ordinary

public, and the plaintiffs, into believing that their property had indeed been properly conveyed and thus refrain from acting because of their reliance upon the fraudulent documents. Plaintiffs have been damaged due to having been subjected to wrongful foreclosure of their properties. Defendants are plainly wrong in that they have not collected any fees. Disbursement of $17,485.84 has been made from the Cobb Cou nty Courts registry. Defendants also claim that FDCPA does not apply to them in that they are a law firm seeking to foreclose a mortgage. Again, they ignore the fraudulent basis for their claims of standing. Even a non-judicial foreclosure state requires that the secured creditor be the one who forecloses upon property. In the case where an actual secured creditor is foreclosing upon its own loan, there can be no argument that mortgage foreclosure distinct and different from a collection of other sorts of

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 15 of 22

debt. Here, however, neither of the Banks are the actual secured creditor by virtue of not having been the original lender, and not having a valid assignment to rely upon to create such standing. Defendants argue that because they are a law firm seeking foreclosure of property they are exempt from FDCPA, but ignore Heintz, et. al. v. Jenkins, 514 U.S. 291, 115 S.Ct. 1489, 131 L.Ed.2d 395 (1995) which held that law firms were debt collectors and also ignore the recent ruling of the Supreme Court in Jerman v. Carlisle, McNellie, Rini, Kramer & Ulrich, L.P.A. 129 S. Ct. 2863 - Supreme Court (2010) which held that law firms are liable under FDCPA even for unintentional errors. In the instant case, there have been no unintentional errors but rather a violation of 15 U.S.C. 1692f 807et seq which states in pertinent part: A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. It is axiomatic that holding oneself out to have standing to foreclose without possessing such standing is a misleading representation. Since Defendant McCalla sent the notices of Sale under Power and placed the newspaper publications, they are just as culpable as Defendant Sears, and Defendant Crouse in engaging in these misleading representations.

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 16 of 22

Defendants allege that all remaining claims are predicate upon the claims addressed supra, Plaintiffs have shown that Defendants arguments are unavailing but will briefly address the remaining claims. RICO Claims- Section 1962(c) of the RICO Act makes it "unlawful for any person employed by or associated with any enterprise engaged in ... interstate ... commerce, to conduct or participate, directly or indirectly, in the conduct of such enterprise's affairs through a pattern of racketeering activity." Subsection (d) criminalizes a conspiracy to violate one of the other subsections of 1962. Section 1964(c) allows a private party, who has been injured in his property from a RICO violation, to sue for damages. To state a RICO claim, the Plaintiffs must show "(1) conduct (2) of an enterprise (3) through a pattern (4) of racketeering activity." Sedima, S.P.R.L. v. Imrex Co., Inc., 473 U.S. 479, 496, 105 S.Ct. 3275, 87 L.Ed.2d 346 (1985) (footnote omitted). In the instant case, Plaintiffs have shown in their Plaintiffs Response To Defendants Opposition To Motion For Extension Of Time And Motion To Dismiss that there is a pattern of racketeering activities due to the filing of at least 15 (fifteen) similar fraudulent assignments in Deed Book 14703 of the Cobb County Land Records, furthermore, in the case of those 15 (fifteen) fraudulent assignments, 7 (seven) of them have been foreclosed and have had Deeds of Foreclosure issued by Defendants McCalla and sometimes signed by Defendants Crouse and Sears.

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 17 of 22

Wire fraud - When pled as RICO predicate acts, mail and wire fraud require a showing of: (1) a plan or scheme to defraud, (2) intent to defraud, (3) reasonable foreseeability that the mail or wires will be used, and (4) actual use of the mail or wires to further the scheme. See Murr Plumbing, Inc. v. Scherer Bros. Fin. Servs. Co., 48 F.3d 1066, 1069 & n. 6 (8th Cir.1995) (noting that a RICO claim does not require proof of misrepresentation of fact). In the instant case, there is abundant

foreseeabilty that mail and wires are used in the furtherance of this fraud. Civil conspiracy - as discussed supra, there is abundant evidence that multiple actual tort violations have been committed upon the Plaintiffs and the class they seek to represent, which will be supported more fully during discovery. Punitive damages as the case is in its infancy, dismissal of these claims is premature. O.C.G.A. 51-12-5.1 (b) states in pertinent part: Punitive damages may be awarded only in such tort actions in which it is proven by clear and convincing evidence In the instant case, nothing has been proven as to the class, since there has been no certification of class status as of yet. In conclusion, Defendants seek dismissal of themselves due to a variety of unavailing reasons, among them that they are acting as agents for their lender clients. Although they are acting as agents of their lender clients O.C.G.A. 10-6-85 explicitly provides:

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 18 of 22

All agents, by an express undertaking to that effect, may render themselves individually liable. Every agent exceeding the scope of his authority shall be individually liable to the person with whom he deals; so, also, for his own tortious act, whether acting by command of his principal or not, he shall be responsible; for the negligence of his underservant, employed by him in behalf of his principal, he shall not be responsible. Additionally, in Miller & Miller v. Wilson, the Georgia Supreme Court held: Whoever meddles with another's property, whether as principal or agent, does so at his peril, and it makes no difference that in doing so he acts in good faith, nor, in the case of an agent, that he delivers the property to his principal before receiving notice of the claim of the owner. In the instant case, Defendants McCalla, Sears and Crouse are all responsible for their own actions, which include manufacturing documents which purport to transfer Security Deeds and Note on Real Property without having the authority to do so and without complying with the requirements that deed be properly attested. Defendants take the posture that these are mere technical defects when in fact, these technical defects have impacted hundreds, if not thousands, of Georgias most precious asset, its citizens.

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 19 of 22

Wherefore, Plaintiffs respectfully request that Defendants Motion to Dismiss be denied. Further, Plaintiff contends that the Defendants Motion to Dismiss is Premature before Discovery. This 10th day January, 2011.

/s/ Louise T. Hornsby Louise T. Hornsby Georgia Bar No. 367800 Attorney for Plaintiffs 2016 Sandtown Road, SW Atlanta, GA 30311 (404) 752-5082

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 20 of 22

CERTIFICATE OF SERVICE I hereby certify that I have electronically filed the Plaintiffs Response To Defendants Motion To Dismiss with the Clerk of Court using the CM/ECF system which will automatically send email notification of such filing to the following attorney of record: John H. Williamson, Esq. John P. MacNaughton, Esq. Counsel for Great Hill Partners, Inc., Prommis Solutions, LLC, Prommis Solutions Holding, Inc. Crystal Wilder, Elizabeth Lofaro, Chiquita raglan, Iris Gisella Bey and Latasha Daniel Linda S. Finley, Esq. Ed Novotny, Esq. Counsel for Wells Fargo Bank, N.A. Allen C. Myers, Esq. Counsel for Bank of American, NA, BAC Home Loan T. Ryan Mock, Jr., Esq. William M. Davis, Esq. Counsel for McCalla Raymer, LLC, Thomas A. Sears and Charles Troy Crouse Reese Willis, Esq. Lisa K. Rose, Esq. J. Thomas Howell, Esq. Steven Flynt, Esq. Counsel for McCalla Raymer, LLC, Thomas A. Sears and Charles Troy Crouse And the same by placing a copy in the U.S. Mail with the proper postage affixed to the following: Mortgage Electronic Registration Systems, Inc. c/o Legal Department 1818 Library St., Suite 300 Reston, VA 20190 MERSCORP, Inc. c/o Legal Department

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 21 of 22

1595 Spring Hill Road Suite 310 Vienna, VA 22182 This 10th day of January, 2011.

s/Louise T. Hornsby Louise T. Hornsby, Esq. Counsel for Plaintiffs Georgia Bar No. 367800 HORNSBY & ASSOCIATES 2016 Sandtown Road Atlanta, Georgia 30311 (404) 752-5082 (404) 758-5337 fax

Case 1:10-cv-03732-CAP -AJB Document 17-1

Filed 01/10/11 Page 22 of 22

CERTIFICATE OF COMPLIANCE This is to certify that this document was prepared in Times Roman, 14 point font that complies with this Courts Rules. s/Louise T. Hornsby Louise T. Hornsby, Esq. Counsel for Plaintiffs Georgia Bar No. 367800 HORNSBY & ASSOCIATES 2016 Sandtown Road Atlanta, Georgia 30311 (404) 752-5082 (404) 758-5337 fax

You might also like

- Class Action IL Amended Complaint FinalDocument75 pagesClass Action IL Amended Complaint FinalrodclassteamNo ratings yet

- Federal Class Action LawsuitDocument359 pagesFederal Class Action LawsuitWilliam100% (1)

- United States District Court Middle District of Florida - Ft. Myers DivisionDocument20 pagesUnited States District Court Middle District of Florida - Ft. Myers Divisiontwebster321No ratings yet

- Federal Lawsuit Against Open Doors KalamazooDocument51 pagesFederal Lawsuit Against Open Doors KalamazooMarie WeidmayerNo ratings yet

- (D.E.40) Motion Extend Seal To 12.10.2011-Coincide With Ace in N.D.N.C. U.S. (Szymoniak) V American - 10-01465Document7 pages(D.E.40) Motion Extend Seal To 12.10.2011-Coincide With Ace in N.D.N.C. U.S. (Szymoniak) V American - 10-01465larry-612445No ratings yet

- US (Szymoniak) V Ace Doc 56 Memo in Support of Transfer, January 14, 2013Document8 pagesUS (Szymoniak) V Ace Doc 56 Memo in Support of Transfer, January 14, 2013larry-612445No ratings yet

- Superior Court of The State of California County of San Francisco Unlimited JurisdictionDocument13 pagesSuperior Court of The State of California County of San Francisco Unlimited JurisdictionRalph KerstetterNo ratings yet

- Dancer V USA Complaint FiledDocument161 pagesDancer V USA Complaint FiledWXMINo ratings yet

- Stephen PerkinsDocument18 pagesStephen PerkinsKayode CrownNo ratings yet

- United States District Court Eastern District of Michigan Southern DivisionDocument60 pagesUnited States District Court Eastern District of Michigan Southern DivisionAllie GrossNo ratings yet

- Federal LawsuitDocument186 pagesFederal LawsuitErica Thomas100% (3)

- United States v. Joaquin Cambara, United States of America v. Jose Cambara, 902 F.2d 144, 1st Cir. (1990)Document7 pagesUnited States v. Joaquin Cambara, United States of America v. Jose Cambara, 902 F.2d 144, 1st Cir. (1990)Scribd Government DocsNo ratings yet

- PublishedDocument25 pagesPublishedScribd Government DocsNo ratings yet

- Class Action Maryland Oct 2010Document46 pagesClass Action Maryland Oct 2010dean6265No ratings yet

- Schneider's Entities Motion To Compel Deposition of Erika Lance of Nationwide Title Clearing,, MRS V JPMC 17-00044 D. E 1)Document21 pagesSchneider's Entities Motion To Compel Deposition of Erika Lance of Nationwide Title Clearing,, MRS V JPMC 17-00044 D. E 1)larry-612445No ratings yet

- C N - 12-17681 United States Court of Appeals For The Ninth CircuitDocument26 pagesC N - 12-17681 United States Court of Appeals For The Ninth CircuitEquality Case FilesNo ratings yet

- 1883 Civil Rights Case Overruling 1875 Civil Rights ActDocument90 pages1883 Civil Rights Case Overruling 1875 Civil Rights ActRaoul Mckinney100% (1)

- F - 04.24.23 Re FTCA Cover LTR To Chief Circuit JudgeDocument2 pagesF - 04.24.23 Re FTCA Cover LTR To Chief Circuit JudgeThomas WareNo ratings yet

- Ackerman McQueen MOTION Disqualify Plaintiff S Counsel BrewerDocument6 pagesAckerman McQueen MOTION Disqualify Plaintiff S Counsel Brewerwolf woodNo ratings yet

- Manson v. GMAC Mortgage, LLCDocument66 pagesManson v. GMAC Mortgage, LLCrichdebtNo ratings yet

- Alabama Attorney General's Office Response To Sherry Lewis Motion To DismissDocument29 pagesAlabama Attorney General's Office Response To Sherry Lewis Motion To DismissJenna AndertonNo ratings yet

- Supreme Court of The State of New York County of New York: Defendal TsDocument28 pagesSupreme Court of The State of New York County of New York: Defendal TscorruptioncurrentsNo ratings yet

- Quiet TitleDocument35 pagesQuiet Titleboathook67% (9)

- Supplemental Request For Judicial NoticeDocument35 pagesSupplemental Request For Judicial NoticeLee PerryNo ratings yet

- FAC Federal VADocument30 pagesFAC Federal VAnilessorrellNo ratings yet

- S TownDocument10 pagesS TowneriqgardnerNo ratings yet

- Reat Akes Ustice EnterDocument34 pagesReat Akes Ustice EnterRicca PrasadNo ratings yet

- 2014-05-12 US (Szymoniak) V Ace Doc 349, Order of Dismisal - First To File BarDocument12 pages2014-05-12 US (Szymoniak) V Ace Doc 349, Order of Dismisal - First To File Barlarry-612445No ratings yet

- OBLBoard LawsuitDocument114 pagesOBLBoard LawsuitNye Lavalle100% (1)

- All 3 Credit Bureaus Sued - 2011Document25 pagesAll 3 Credit Bureaus Sued - 201183jjmackNo ratings yet

- RICO Foreclosure ComplaintDocument35 pagesRICO Foreclosure ComplaintBleak NarrativesNo ratings yet

- CresCom Bank Wrongful Death LawsuitDocument18 pagesCresCom Bank Wrongful Death LawsuitWMBF NewsNo ratings yet

- GC LLC Civil ActionDocument24 pagesGC LLC Civil ActionJordanTurnerNo ratings yet

- 1-28-2017 V Relator ComplaintDocument50 pages1-28-2017 V Relator ComplaintJaniceWolkGrenadierNo ratings yet

- Watkins Superseding IndictmentDocument28 pagesWatkins Superseding IndictmentKyle WhitmireNo ratings yet

- In The United States District Court For The District of South Carolina Columbia Division CA No. 3:13-cv-1223-JFADocument7 pagesIn The United States District Court For The District of South Carolina Columbia Division CA No. 3:13-cv-1223-JFAlarry-612445No ratings yet

- (Doc 57) US (Szymoniak) V American U.S. Third Ex Parte Motion Extension Seal To 06/10/2012Document9 pages(Doc 57) US (Szymoniak) V American U.S. Third Ex Parte Motion Extension Seal To 06/10/2012larry-612445No ratings yet

- 2018.07.03 Sheldon Lockett ComplaintDocument22 pages2018.07.03 Sheldon Lockett ComplaintEthan Brown100% (1)

- Schwab Civil Rights Lawsuit 2018Document79 pagesSchwab Civil Rights Lawsuit 2018SeraphimAmelia Schwab100% (4)

- Georgia Foreclosure Fraud Class Action - Georgia Residents V Georgia Foreclosure FraudstersDocument84 pagesGeorgia Foreclosure Fraud Class Action - Georgia Residents V Georgia Foreclosure FraudstersForeclosure Fraud100% (7)

- In The United States District Court For The District of South Carolina Columbia Division CA No. 3:13-1223-JFADocument6 pagesIn The United States District Court For The District of South Carolina Columbia Division CA No. 3:13-1223-JFAlarry-612445No ratings yet

- Revised Fed Lawsuit 2Document77 pagesRevised Fed Lawsuit 2SeraphimAmelia Schwab100% (1)

- Excellent Quiet Title LawsuitDocument22 pagesExcellent Quiet Title LawsuitKaryl Hawes-Jones96% (24)

- Mico Rodriguez's CounterclaimDocument237 pagesMico Rodriguez's CounterclaimgoodmoineNo ratings yet

- Certified For Publication: Filed 8/24/11Document13 pagesCertified For Publication: Filed 8/24/11aorozcoirellNo ratings yet

- Collingsworth V Drummond Complaint 19-cv-1263Document91 pagesCollingsworth V Drummond Complaint 19-cv-1263PaulWolfNo ratings yet

- Mass Family Separation LawsuitDocument283 pagesMass Family Separation LawsuitMargo SchlangerNo ratings yet

- (Doc 50) Order Granting U.S. 6th Motion Extend Seal 30 Day Extension To 01.03.2013 US (Szymoniak) V AceDocument3 pages(Doc 50) Order Granting U.S. 6th Motion Extend Seal 30 Day Extension To 01.03.2013 US (Szymoniak) V Acelarry-612445No ratings yet

- Gatto Dismissal Request Denial OrderDocument26 pagesGatto Dismissal Request Denial OrderWHAS11No ratings yet

- Class ComplaintDocument13 pagesClass ComplaintForeclosure Fraud100% (3)

- Collapse of an Evil Empire: Florida's Most Prolific Insurance Litigator - Based on a True StoryFrom EverandCollapse of an Evil Empire: Florida's Most Prolific Insurance Litigator - Based on a True StoryNo ratings yet

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)From EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No ratings yet

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (22)

- The Law of Torts: A Concise Treatise on the Civil Liability at Common Law and Under Modern Statutes for Actionable Wrongs to PersonFrom EverandThe Law of Torts: A Concise Treatise on the Civil Liability at Common Law and Under Modern Statutes for Actionable Wrongs to PersonNo ratings yet

- Federal Tort Claims Act: Volume 1: Volume 1: Contemporary DecisionsFrom EverandFederal Tort Claims Act: Volume 1: Volume 1: Contemporary DecisionsRating: 5 out of 5 stars5/5 (1)

- Medical Malpractice Litigation in the 21St CenturyFrom EverandMedical Malpractice Litigation in the 21St CenturyRating: 5 out of 5 stars5/5 (1)

- Bond Info For Sumandeep College NEET PG 2019Document1 pageBond Info For Sumandeep College NEET PG 2019Hcuccjv UfucvkvvNo ratings yet

- U O P & E S S L: Niversity F Etroleum Nergy Tudies Chool of AWDocument18 pagesU O P & E S S L: Niversity F Etroleum Nergy Tudies Chool of AWDigvijay SinghNo ratings yet

- Rahul RaghuvanshiDocument3 pagesRahul RaghuvanshiMNB50% (2)

- Is Capital Punishment Morally RequiredDocument53 pagesIs Capital Punishment Morally RequiredOmar MohammedNo ratings yet

- Evidence CasesDocument176 pagesEvidence CasesAbigail AnziaNo ratings yet

- 10 Limitless Potentials, Inc. vs. QuilalaDocument2 pages10 Limitless Potentials, Inc. vs. QuilalaJemNo ratings yet

- WRITTEN SUBMISSIONS-lessons From Court Decisions-1Document5 pagesWRITTEN SUBMISSIONS-lessons From Court Decisions-1Flora100% (1)

- SAS#23-POS 056 - WatermarkDocument6 pagesSAS#23-POS 056 - Watermarkralphlaroza7No ratings yet

- History of Fiqh Stage 5Document18 pagesHistory of Fiqh Stage 5AzizSafianNo ratings yet

- G.R. No. 254282 (Case Digest)Document7 pagesG.R. No. 254282 (Case Digest)Nathalie Gyle GalvezNo ratings yet

- G.R. No. 126619Document3 pagesG.R. No. 126619Michelle MatubisNo ratings yet

- Wbcs Rules, 2011 - IndexDocument10 pagesWbcs Rules, 2011 - Indexnayan83No ratings yet

- 2 San Luis vs. San LuisDocument26 pages2 San Luis vs. San Luiscool_peachNo ratings yet

- Interim Report of Administrative Reforms Commission On Problems of Redress of Citizens' Grievances, 1966Document38 pagesInterim Report of Administrative Reforms Commission On Problems of Redress of Citizens' Grievances, 1966Piyush KulshreshthaNo ratings yet

- Erica Stewart Belhaven File July 7Document72 pagesErica Stewart Belhaven File July 7the kingfishNo ratings yet

- Effective Meetings 101Document19 pagesEffective Meetings 101syedahamanaNo ratings yet

- Chanrobles Internet Bar Review: Chanrobles Professional Review, IncDocument22 pagesChanrobles Internet Bar Review: Chanrobles Professional Review, IncERWINLAV2000No ratings yet

- Amicus Curiae Brief of Derek T. Muller in Support of Neither Party, Baca v. Colorado Department of State, 10th Circuit, 18-1173Document25 pagesAmicus Curiae Brief of Derek T. Muller in Support of Neither Party, Baca v. Colorado Department of State, 10th Circuit, 18-1173Derek MullerNo ratings yet

- Citizen's Informer May - August 2014Document36 pagesCitizen's Informer May - August 2014henrywolffNo ratings yet

- Combined Virtual Office AgreementDocument3 pagesCombined Virtual Office AgreementArthurLoefstokNo ratings yet

- PALE Canon 7-9 Case DigestsDocument12 pagesPALE Canon 7-9 Case DigestsFlorence Rosete100% (1)

- Norberto Cruz vs. People of The Philippines G.R. No. 166441 8 October 2014Document12 pagesNorberto Cruz vs. People of The Philippines G.R. No. 166441 8 October 2014Lemrose DuenasNo ratings yet

- Punjab Transparency & Right To Information Act, 2013 P.U.C DFA D F A DFA DFADocument36 pagesPunjab Transparency & Right To Information Act, 2013 P.U.C DFA D F A DFA DFADeputy SecretaryNo ratings yet

- Translation of Mannheim 2O387 Ruling Motorola V MicrosoftDocument61 pagesTranslation of Mannheim 2O387 Ruling Motorola V MicrosoftFlorian MuellerNo ratings yet

- Lederman V Giuliani RulingDocument14 pagesLederman V Giuliani RulingRobert LedermanNo ratings yet

- United States v. Terry Mitchell, 4th Cir. (2012)Document5 pagesUnited States v. Terry Mitchell, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- Exchanging A Kidney For Freedom: The Illegality of Conditioning Prison Releases On Organ DonationsDocument19 pagesExchanging A Kidney For Freedom: The Illegality of Conditioning Prison Releases On Organ DonationsNEJCCCNo ratings yet

- CASEDocument5 pagesCASEaman khanNo ratings yet

- Hon. Yedda Marie K. Romuladez: February 10, 2021 Starting at 1:30PMDocument6 pagesHon. Yedda Marie K. Romuladez: February 10, 2021 Starting at 1:30PMStruggling StudentNo ratings yet

- Emilio M. CaparosoDocument1 pageEmilio M. CaparosoRuiz Arenas AgacitaNo ratings yet