Professional Documents

Culture Documents

HUDCO's Objectives

Uploaded by

Avishek GhosalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HUDCO's Objectives

Uploaded by

Avishek GhosalCopyright:

Available Formats

HUDCO

Housing and Urban Development Corporation Ltd. (HUDCO) is a public sector enterprise fully owned by the Government of India, under the Companies Act 1956. HUDCO was incorporated on 25th April, 1970.

HUDCOs objectives. To provide long term finance for construction of houses for residential purposes or finance or undertake housing and urban development programmes in the country; To finance or undertake, wholly or partly, the setting up of new or satellite towns; To subscribe to the debentures and bonds to be issued by the State Housing (and/ or Urban Development) Boards, Improvement Trusts, Development Authorities etc.; specifically for the purpose of financing housing and urban development programmes; To finance or undertake the setting up of industrial enterprises of building material; To administer the moneys received, from time to time, from the Government of India and other sources as grants or otherwise for the purposes of financing or undertaking housing and urban development programmes in the country . To promote, establish, assist, collaborate and provide consultancy services for the projects of designing and planning of works relating to Housing and Urban Development programmes in India and abroad.

Mission To promote sustainable habitat development to enhance quality of life. Vision To be among the worlds leading knowledge hubs and financial facilitating organizations for habitat development.

Is HUDCO a Housing Finance Company (HFC) and if so who is the regulator of HUDCO? Yes, HUDCO is a Housing Finance Company registered with National Housing Bank (NHB), which was established under the Act of Parliament to operate as a principal agency to promote housing finance institutions both at local and regional levels and to act as the Regulator of Housing Finance Companies.

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

Page 1

What is the Resource Base of HUDCO? HUDCO was established with an equity base of Rs.2 crores. Over the years, the equity base has been expanded by the Government. The present authorised capital base of HUDCO is Rs.2500 crores and paid up capital is Rs. 2001.90 crores. Projects & Programmes of HUDCO HUDCO extends assistance benefiting the masses in urban and rural areas under a broad spectrum of programmes as listed below: Housing Urban Housing Rural Housing Staff Rental Housing Repairs and Renewals Shelter and Sanitation Facilities for Footpath dwellers in Urban Areas (Night Shelter and Pay & Use toilets) Working Women Ownership Condominium Housing Housing through Private Builders/Joint Sector Individual Housing Loans through HUDCO Niwas Land Acquisition Jawahar Lal Nehru National Urban Renewal Mission (JNNURM) Infrastructure Integrated Land Acquisition and Development Environmental Improvement of Slums Utility Infrastructure Social Infrastructure Economic and Commercial Infrastructure Building Technology Building Centres for Technology Transfer at the Grass-roots Building Material Industries Consultancy Services Consultancy in Housing, Urban Development and Infrastructure

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

Page 2

Research And Training Capacity Building and Technical Assistance to all Borrowing Agencies, Research Training and Networking in Human Settlement Planning and Management.

Eligible borrowers for HUDCO loan assistance

Eligible borrowers are: i) State level financing institutions / corporations ii) Water supply and sewerage boards iii) Development authorities iv) State functional borrowers for housing & urban development v) New town development borrowers vi) Regional planning boards vii) Improvement trusts viii) Municipal corporations / councils ix) Joint sector companies x) Cooperative societies / trusts xi) NGOs xii) Private companies/borrowers including BOT operators, concessionaires

Various categories of projects under Housing Finance

All types of Housing projects includes: i) Rural Housing ii) Urban Housing iii) Co-operative Housing iv) Community Toilets v) Slum Upgradation vi) Staff Housing including Police Housing vii) Repairs and Renewal viii) Housing by NGOs ix) Private Sector Housing x) Takeout finance xi) Land Acquisition cum Construction schemes xii) Individual Housing

Projects that are eligible for HUDCO finance in Infrastructure sector

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES Page 3

Construction, Augmentation and Improvement of the following: i) Water Supply Projects ii) Sewerage and Drainage iii) Solid Waste Management v) Integrated Area Development Schemes vi) Social Infrastructure vii) Transportation Roads, Bridges, Bus terminals, Ports, Airports etc. viii) Commercial / Economic Infrastructure ix) Power Generation, Transmission and Distribution x) Industrial and Business Infrastructure SEZ, Warehouses etc. xi) Information / Communication / Entertainment (ICE) xii) Telecom xiii) Ecologically Appropriate Infrastructure Projects

To what extent HUDCO can finance

i) Govt. Borrowers: The loan amount for a project may be upto 90% of the project cost subject to maximum of 15% of Net Owned Fund (NOF) of HUDCO. ii) Private Sector Borrower Loan amount may be upto 66% of project cost subject to maximum of 15% of NOF of HUDCO for a project/ SPV and upto 25% of NOF of HUDCO to group companies. Loan amount more than 100.00 crores will normally be sanctioned on consortium basis and a higher debt equity ratio may also be considered in line with the lead lender.

Types of rates offered by HUDCO

HUDCO provides the following rates of interest: i) Fixed rate of interest with 3 years reset option ii) Floating rate of interest

Repayment options available for HUDCO loan

1. Monthly 2. Quarterly 3. Half-yearly 4. Yearly. (For S.No. 3 & 4, the interest shall be calculated on quarterly basis) First point of contact when applying for a loan from HUDCO

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

Page 4

For acceptance and registering the Loan application, a Customer Relationship Officer (CRO) is available at all Regional Offices. The CRO is responsible for facilitating receipt of all project proposals (except HUDCO Niwas) within prescribed guidelines of HUDCO and ensuring availability of complete set of documents/ information required for determining eligibility and registration of schemes.

Securities that Borrowers can submit for availing loan from HUDCO

State government guarantees/ Bank Guarantees/ Equitable mortgage of land and buildings/ Hypothecation of movable and immovable assets/ assignment of rights/ corporate guarantee/ personal guarantee etc. However, the security would depend on the risk involved in the project.

Main security, if some infrastructure project is taken up on BOT concept.

Mortgage of project properties is the main security for any type of projects. However, in BOT projects, if mortgage of project properties is not possible/enforceable/permissible then loan can also be secured by assignment of project contracts, license, permits, insurance policies, approvals, consents, concessions etc., Assignment of contractual rights, security rights, actionable claims, charge on TRA/Escrow and Hypothecation of Moveable Properties.

Security Coverage Ratio

The minimum-security coverage during the currency of loan should not be less than 125% for Govt. Agencies and 150% for Private Sector Agencies of total outstanding loan amount at any point of time.

Consultancy Services provided by HUDCO

HUDCO has developed proficiency in design and consultancy services and have provided its services in the following areas: Architectural designs and detailed working drawings, Structural design, project estimates, Design of internal and external services, Landscape planning and design, Preparation of project reports and feasibility studies for housing, urban and

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES Page 5

regional planning issues. Waste management projects Preparation of City Development Plans (CDPs), Master Plans etc.

Efforts are being made by HUDCO in disaster hit areas

HUDCO had provided its technological support in the disaster-hit areas. Pamphlets and books on Dos & Donts on construction of houses and related matters had been distributed. Demonstration projects like Model Village & Model Basti were constructed as part of the Model Village & Model Basti schemes were executed by HUDCO.

HUDCOs role vis--vis JNNURM

HUDCO is one of the Appraising Agencies for BSUP projects and the only Appraising agency for all IHSDP projects under JNNURM.

HUDCO is doing for promoting cost effective building materials and technologies for Urban/Rural housing.

HUDCO contributes in promotion of appropriate, cost effective, building material and technologies for use in Housing and Infrastructure sector at grass root level through the National Network of Building Centres a scheme of MoH&UPA, Govt of India. The building centres promote innovative, cost effective, durable and aesthetic operations brought out by National level Research Development bodies such as CBRI. SERC, NEERI, RRLs, ASTRA, CSR, DA, INSWAREB, CSV and other state level institutions and work done by Laurie Baker. Does HUDCO accept Public Deposit? Yes, Public Deposit which means acceptance of deposits from various category of depositors excluding certain deposits like amount received from Central/State Governments/Banks/Public Financial Institutions and mutual Funds etc. are accepted by HUDCO.

Required norms to be disclosed by HUDCO in the Application Form soliciting public deposits

While accepting deposits HUDCO indicates the following in the Application Form: i) Particulars of eligible category of depositor. ii) Credit rating assigned for its deposits.

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES Page 6

iii) Particulars as required under non-banking financial companies and miscellaneous non-banking companies (Advertisement), Rules, 1977. iv) Rate of interest and period of deposit. v) KYC requirements vi) Principal terms and conditions of deposit scheme. vii) Summarize financial position of the company for the last two years balance sheet. viii) Name of the Registered Office and its branches accepting deposits.

HSMI

HSMI stands for Human Settlement Management Institute. It is the Research and Training Wing of HUDCO.HSMI conducts training, research and consultancy in areas related to urban development, housing, infrastructure, municipal finance, cost-effective building technologies and the like.

Training programme conducted by HSMI

Most training programmes at HSMI are sponsored by agencies for the identified target groups such as state and ULB level functionaries. HSMI also conducts feebased training programmes, which are open to all. In addition, HSMI undertakes to organise tailor made training programmes to address specific needs of organisations working in the field of urban development and poverty alleviation.

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

Page 7

AVISHEK GHOSAL, MBA-INFRASTRUCTURE, UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

Page 8

You might also like

- Nursing Care PlansDocument10 pagesNursing Care PlansGracie S. Vergara100% (1)

- Right To HealthDocument9 pagesRight To HealthPriya SharmaNo ratings yet

- Philippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsFrom EverandPhilippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsNo ratings yet

- 7 HOUSING FINANCE 1 MergedDocument192 pages7 HOUSING FINANCE 1 MergedKristien GuanzonNo ratings yet

- 006 National Agencies in HOUSING (3730)Document30 pages006 National Agencies in HOUSING (3730)Jonabel Osio100% (1)

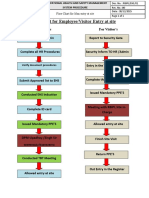

- fLOW CHART FOR WORKER'S ENTRYDocument2 pagesfLOW CHART FOR WORKER'S ENTRYshamshad ahamedNo ratings yet

- Role of Smart Metering in Distribution ReformsDocument32 pagesRole of Smart Metering in Distribution ReformsAvishek GhosalNo ratings yet

- Role of Smart Metering in Distribution ReformsDocument32 pagesRole of Smart Metering in Distribution ReformsAvishek GhosalNo ratings yet

- Sigma monitor relayDocument32 pagesSigma monitor relayEdwin Oria EspinozaNo ratings yet

- Alternate Mekton Zeta Weapon CreationDocument7 pagesAlternate Mekton Zeta Weapon CreationJavi BuenoNo ratings yet

- Refinery Economics-1Document16 pagesRefinery Economics-1Avishek GhosalNo ratings yet

- Role of Development Authorities in Urban DevelopmentDocument5 pagesRole of Development Authorities in Urban DevelopmentVikrant Chaudhary100% (1)

- HUDCO - All you need to know about Housing and Urban Development Corporation LtdDocument9 pagesHUDCO - All you need to know about Housing and Urban Development Corporation LtdSivakumar BakthavachalamNo ratings yet

- HudcoDocument3 pagesHudcoSriNo ratings yet

- HUDCO's role in housing developmentDocument9 pagesHUDCO's role in housing developmentkc831No ratings yet

- Robles Housing100Document4 pagesRobles Housing100Kyle Nathaniel RoblesNo ratings yet

- Housing and Urban Development Corporation LTD IPO NoteDocument15 pagesHousing and Urban Development Corporation LTD IPO NoteSrikant SuruNo ratings yet

- Housing & Urban Development Corporation Ltd. Citizen's CharterDocument7 pagesHousing & Urban Development Corporation Ltd. Citizen's CharterShivani SoniNo ratings yet

- DR A.P.J. Abdul Kalam Technical University Lucknow: TopicDocument30 pagesDR A.P.J. Abdul Kalam Technical University Lucknow: TopicMayank jainNo ratings yet

- Home Development Mutual Fund (Pag-IBIG Fund)Document5 pagesHome Development Mutual Fund (Pag-IBIG Fund)JORDAN T. ASTRERONo ratings yet

- Housing: As 503 Module 5Document25 pagesHousing: As 503 Module 5amlaNo ratings yet

- Housing Finance: Presented by Sulekha Beri I.D.NO .43847Document46 pagesHousing Finance: Presented by Sulekha Beri I.D.NO .43847mehakdadwalNo ratings yet

- Housing Finance: Roll #2812 & 2811Document18 pagesHousing Finance: Roll #2812 & 2811shalinganatraNo ratings yet

- HUDCO's Role in Affordable HousingDocument8 pagesHUDCO's Role in Affordable HousingadithyalakshmiNo ratings yet

- Sites and Services Scheme: The Basic PrinciplesDocument22 pagesSites and Services Scheme: The Basic PrinciplesMageshwarNo ratings yet

- NHB Project Lending Assistance for HousingDocument4 pagesNHB Project Lending Assistance for HousingbluebondNo ratings yet

- MA0044Document8 pagesMA0044Tushar AhujaNo ratings yet

- Singapore Housing StatsDocument15 pagesSingapore Housing StatsAmitMalhotraNo ratings yet

- HUDCO PresentationDocument6 pagesHUDCO PresentationAbhishek RaoNo ratings yet

- Housing FinanceDocument37 pagesHousing Finance22mba052No ratings yet

- Objectives: The Objectives of HUDCO IncludeDocument2 pagesObjectives: The Objectives of HUDCO IncludeAditya VermaNo ratings yet

- Hudco: Housing and Urban Development CorporationDocument3 pagesHudco: Housing and Urban Development Corporationkrvia 2019No ratings yet

- Community Smart Housing Initiative Business PlanDocument23 pagesCommunity Smart Housing Initiative Business PlanAyodeji AjideNo ratings yet

- Organizations Involved in Urban DevelopmentDocument6 pagesOrganizations Involved in Urban DevelopmentAnkita SharmaNo ratings yet

- Housing Development for Poor Urban CommunitiesDocument6 pagesHousing Development for Poor Urban CommunitiesethelmendiolaNo ratings yet

- SHFC High Density Housing ProgramDocument17 pagesSHFC High Density Housing ProgramraraNo ratings yet

- CIDCO and GRUH: Housing Authorities in Maharashtra/TITLEDocument15 pagesCIDCO and GRUH: Housing Authorities in Maharashtra/TITLEtanya mohantyNo ratings yet

- Urban DevelopmentDocument4 pagesUrban DevelopmentSujan BanerjeeNo ratings yet

- About DSC GroupDocument19 pagesAbout DSC GroupArun KediaNo ratings yet

- International Finance in Development of Integrated Township in IndiaDocument34 pagesInternational Finance in Development of Integrated Township in Indialazzyfn100% (1)

- Housing Finance and NHBDocument19 pagesHousing Finance and NHBiqbal_puneetNo ratings yet

- Project Report: Submitted by Namrata Makhija College Roll No.: 195 Shri Ram College of Commerce University of DelhiDocument30 pagesProject Report: Submitted by Namrata Makhija College Roll No.: 195 Shri Ram College of Commerce University of DelhiDhruv KapoorNo ratings yet

- Pf-2-Term 5-BKFSDocument41 pagesPf-2-Term 5-BKFSAasif KhanNo ratings yet

- Housing AgenciesDocument21 pagesHousing AgenciesAsin AntoNo ratings yet

- Yojana Summary September 2017 d81d78cb2dDocument16 pagesYojana Summary September 2017 d81d78cb2dnitesh011jhaNo ratings yet

- Housing FinanceDocument22 pagesHousing FinanceMitesh DhoriyaNo ratings yet

- Housing and Urban Development Corporation)Document6 pagesHousing and Urban Development Corporation)Pranav KaranNo ratings yet

- Delhi-Noida Bridge Pioneered India's First PPP ModelDocument12 pagesDelhi-Noida Bridge Pioneered India's First PPP ModelRaviNo ratings yet

- Taxation and Procurement ProcessDocument18 pagesTaxation and Procurement ProcessJaycil GaaNo ratings yet

- Comparative Customer Preference in Public and Private Sector Home LoansDocument86 pagesComparative Customer Preference in Public and Private Sector Home LoansDevangi PatelNo ratings yet

- Housing NotesDocument59 pagesHousing Notessaahasitha 14No ratings yet

- 00124568Document1 page00124568Utkarsh SinghNo ratings yet

- Housing Finance - Public and Private InstitutionsDocument3 pagesHousing Finance - Public and Private InstitutionsAnkita SrivastavaNo ratings yet

- Ate Rica TopicDocument9 pagesAte Rica TopicSharlot AsueroNo ratings yet

- Housing Agencies in India - 2010Document33 pagesHousing Agencies in India - 2010lavanya thangavelNo ratings yet

- Chapter-Viii 8.1. Housing & Urban Development Corporation (HUDCO) Limited Urban DevelopmentDocument13 pagesChapter-Viii 8.1. Housing & Urban Development Corporation (HUDCO) Limited Urban DevelopmentJayjeet BhattacharjeeNo ratings yet

- HousingDocument13 pagesHousing191142No ratings yet

- Sources of FundsDocument3 pagesSources of FundsakothariiitkgpNo ratings yet

- Housing Industry RoadmapDocument8 pagesHousing Industry RoadmapmjfprgcNo ratings yet

- Development Financial Institutions MBF 302 Indian Financial System Dr. Yamini Agarwal Indian Institute of FinanceDocument39 pagesDevelopment Financial Institutions MBF 302 Indian Financial System Dr. Yamini Agarwal Indian Institute of FinanceAnuj KumarNo ratings yet

- Project Finance: Funds Cashflow MoneyDocument5 pagesProject Finance: Funds Cashflow MoneySailesh PatnaikNo ratings yet

- Hfi MfisDocument5 pagesHfi MfisShubhendra SinghNo ratings yet

- Focus Area Aims of NUHHP 2007Document5 pagesFocus Area Aims of NUHHP 2007rajanNo ratings yet

- MTSIP (Medium-Term Strategic and Institutional Plan For UN-Habitat)Document7 pagesMTSIP (Medium-Term Strategic and Institutional Plan For UN-Habitat)mohitNo ratings yet

- T: F: S: D: B:: O ROM Ubject ATE AckgroundDocument17 pagesT: F: S: D: B:: O ROM Ubject ATE AckgroundNicoleNo ratings yet

- S9 Exam - 2017: HousingDocument30 pagesS9 Exam - 2017: HousingSandra BettyNo ratings yet

- National Urban Housing and Habitat Policy, 2007Document30 pagesNational Urban Housing and Habitat Policy, 2007saahasitha 14No ratings yet

- Lending Instr EngDocument28 pagesLending Instr EngAkash.s.p AchuNo ratings yet

- Telecom Regulatory Authority of IndiaDocument92 pagesTelecom Regulatory Authority of IndiaAvishek GhosalNo ratings yet

- Public Private Partnership (MBA)Document18 pagesPublic Private Partnership (MBA)Avishek GhosalNo ratings yet

- Environmental AspectsDocument30 pagesEnvironmental AspectsAvishek GhosalNo ratings yet

- Dissertation Yash HotaDocument37 pagesDissertation Yash HotaAvishek GhosalNo ratings yet

- Int. To Law of ContractDocument20 pagesInt. To Law of ContractAvishek GhosalNo ratings yet

- Study on feasibility of (Solar + Storage) project in IndiaDocument37 pagesStudy on feasibility of (Solar + Storage) project in IndiaAvishek GhosalNo ratings yet

- Competition Law: by T.K.Viswanathan Secretary, Ministry of Law & Justice Legislative DepartmentDocument68 pagesCompetition Law: by T.K.Viswanathan Secretary, Ministry of Law & Justice Legislative DepartmentAvishek GhosalNo ratings yet

- Rakesh Mohan PaperDocument64 pagesRakesh Mohan PaperAvishek GhosalNo ratings yet

- Int. To Law of ContractDocument20 pagesInt. To Law of ContractAvishek GhosalNo ratings yet

- An Introduction To The Law of ContractsDocument42 pagesAn Introduction To The Law of ContractsAvishek GhosalNo ratings yet

- An Introduction To The Law of ContractsDocument24 pagesAn Introduction To The Law of ContractsAvishek GhosalNo ratings yet

- Constitutional Principles: Exceptions To The Distribution of JurisdictionDocument27 pagesConstitutional Principles: Exceptions To The Distribution of JurisdictionAvishek GhosalNo ratings yet

- Dissertation Final P.S.anish 500077410Document88 pagesDissertation Final P.S.anish 500077410Avishek GhosalNo ratings yet

- Hari-Forecasting of Renewable Power For Solar & Wind DevelopersDocument39 pagesHari-Forecasting of Renewable Power For Solar & Wind DevelopersAvishek GhosalNo ratings yet

- Hari-Forecasting of Renewable Power For Solar & Wind DevelopersDocument39 pagesHari-Forecasting of Renewable Power For Solar & Wind DevelopersAvishek GhosalNo ratings yet

- Dissertation Yash HotaDocument37 pagesDissertation Yash HotaAvishek GhosalNo ratings yet

- Study on feasibility of (Solar + Storage) project in IndiaDocument37 pagesStudy on feasibility of (Solar + Storage) project in IndiaAvishek GhosalNo ratings yet

- Dissertation Final P.S.anish 500077410Document88 pagesDissertation Final P.S.anish 500077410Avishek GhosalNo ratings yet

- Urban Water ManagementDocument15 pagesUrban Water ManagementAvishek GhosalNo ratings yet

- Energy As A ResourceDocument61 pagesEnergy As A ResourceAvishek GhosalNo ratings yet

- Indonesian Coal Index Report Methodology GuideDocument2 pagesIndonesian Coal Index Report Methodology GuideAndria Lala NugrahaNo ratings yet

- Refinery Economics-2Document11 pagesRefinery Economics-2Avishek GhosalNo ratings yet

- 4B. Coal Types - IndiaDocument3 pages4B. Coal Types - IndiaAvishek GhosalNo ratings yet

- Decoupling EffectDocument18 pagesDecoupling EffectAvishek GhosalNo ratings yet

- Global Energy 2019 ReviewDocument14 pagesGlobal Energy 2019 ReviewAvishek GhosalNo ratings yet

- The Different Types of Crude OilDocument13 pagesThe Different Types of Crude OilAvishek GhosalNo ratings yet

- Analysis of CoalDocument14 pagesAnalysis of CoalAvishek GhosalNo ratings yet

- Proper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle JDocument15 pagesProper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle Jjoannamhay ceraldeNo ratings yet

- Ucg200 12Document3 pagesUcg200 12ArielNo ratings yet

- Myth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillDocument4 pagesMyth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillFaisal JahangeerNo ratings yet

- RA8485 Animal Welfare Act (Carabao Slaughter)Document2 pagesRA8485 Animal Welfare Act (Carabao Slaughter)Jazreth Gaile100% (1)

- Bs8161 - Chemistry Laboratory Syllabus: Course ObjectivesDocument47 pagesBs8161 - Chemistry Laboratory Syllabus: Course ObjectiveslevisNo ratings yet

- Chennai's 9 sewage treatment plants process 486 MLDDocument5 pagesChennai's 9 sewage treatment plants process 486 MLDmoni_john_1No ratings yet

- Consumer Behaviour: Group ProjectDocument5 pagesConsumer Behaviour: Group ProjectAanchal MahajanNo ratings yet

- Nursing Plan of Care Concept Map - Immobility - Hip FractureDocument2 pagesNursing Plan of Care Concept Map - Immobility - Hip Fracturedarhuynh67% (6)

- OilDocument8 pagesOilwuacbekirNo ratings yet

- Social Studies SbaDocument12 pagesSocial Studies SbaSupreme KingNo ratings yet

- Immune System Quiz ResultsDocument6 pagesImmune System Quiz ResultsShafeeq ZamanNo ratings yet

- Workplace Hazard Analysis ProcedureDocument12 pagesWorkplace Hazard Analysis ProcedureKent Nabz60% (5)

- Cellular Basis of HeredityDocument12 pagesCellular Basis of HeredityLadyvirdi CarbonellNo ratings yet

- Valvula de Leve MasterDocument20 pagesValvula de Leve Masterguillermo trejosNo ratings yet

- Impact of Energy Consumption On The EnvironmentDocument9 pagesImpact of Energy Consumption On The Environmentadawiyah sofiNo ratings yet

- Tumors of The Central Nervous System - VOL 12Document412 pagesTumors of The Central Nervous System - VOL 12vitoNo ratings yet

- Q1 Tle 4 (Ict)Document34 pagesQ1 Tle 4 (Ict)Jake Role GusiNo ratings yet

- Board Review Endocrinology A. ApiradeeDocument47 pagesBoard Review Endocrinology A. ApiradeePiyasak NaumnaNo ratings yet

- Rockwool 159: 2.2 Insulation ProductsDocument1 pageRockwool 159: 2.2 Insulation ProductsZouhair AIT-OMARNo ratings yet

- Abortion and UtilitarianismDocument4 pagesAbortion and UtilitarianismBrent Harvey Soriano JimenezNo ratings yet

- TDS Versimax HD4 15W40Document1 pageTDS Versimax HD4 15W40Amaraa DNo ratings yet

- Aging and Elderly IQDocument2 pagesAging and Elderly IQ317537891No ratings yet

- 2024 - Chung 2024 Flexible Working and Gender Equality R2 CleanDocument123 pages2024 - Chung 2024 Flexible Working and Gender Equality R2 CleanmariaNo ratings yet

- 2-D Motion Based Real Time Wireless Interaction System For Disabled PatientsDocument5 pages2-D Motion Based Real Time Wireless Interaction System For Disabled PatientsSantalum AlbumNo ratings yet

- C. Drug Action 1Document28 pagesC. Drug Action 1Jay Eamon Reyes MendrosNo ratings yet