Professional Documents

Culture Documents

Bullet Points For Loc

Uploaded by

api-24643888Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bullet Points For Loc

Uploaded by

api-24643888Copyright:

Available Formats

Bullet points for L.O.C.

sale

Customer needs to be in business for at least 6-12 months o Exception: If they use the merchant service account of the same client they only have to have ticket sales for 4 months and may be considered early. Customer needs to average a gross of $4000.00 a month or more for the last 4 months Require the last four months of Merchant statements (bank account statements) with application Must accept Credit cards (examples: Amex, Visa, MasterCard) Amount given can range from $2,000 to $200,000; anything above 200k will need a 10-20% proof of liquid cash to receive funds Underwriters are the only ones that can approve the amount and calculate the interest rate Maximum repayment time frame FOR L.O.C. is one year If customer gets a merchant account from us, they are automatically eligible for a L.O.C. within 3 months Underwriting takes approximately 2- 3 business days; once approved and all documents are submitted, funding make take place in as little as 5-10 business days Registration for being a member of all financial services is $295 only when customer is approved (see below)

Fees - Commercial Lending

There is a $295.00 one time registration fee for all new clients. This fee should go in with application, however, client can wait until after speaking with Funding Client directly to ensure program acceptance before submitting.

Fees - Church Loans

There is a $395.00 one time registration fee for all church loans. This fee should go in with application, however, client can wait until after speaking with Funding Client directly to ensure program acceptance before submitting.

You might also like

- 3 Phase CPN Credit Repair and Funding ProgramDocument7 pages3 Phase CPN Credit Repair and Funding ProgramAsberry Financial and 3G Technical Services73% (15)

- Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityFrom EverandStreetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityRating: 5 out of 5 stars5/5 (1)

- Credit Repair Retainer AgreementDocument3 pagesCredit Repair Retainer AgreementKNOWLEDGE SOURCE100% (2)

- Receivable and Collections Policy - SampleDocument10 pagesReceivable and Collections Policy - SampleMrLarry168No ratings yet

- 3 Phase CPN Credit Repair and Funding ProgramDocument7 pages3 Phase CPN Credit Repair and Funding ProgramAlex Morgan75% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Personal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouDocument12 pagesPersonal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouLingesh GobichettipalayamNo ratings yet

- Personal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouDocument12 pagesPersonal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouAmmabagavan 666No ratings yet

- Credit ControlDocument7 pagesCredit ControlFaina NaqviNo ratings yet

- Scribd NotesDocument14 pagesScribd NotesLeeAnn MarieNo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- Accounts Receivable Collection PolicyDocument9 pagesAccounts Receivable Collection PolicyEuneze Lucas100% (1)

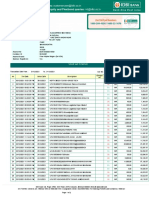

- 2014sep11 2014oct10Document3 pages2014sep11 2014oct10Karen JoyNo ratings yet

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- Credit and Collections PolicyDocument7 pagesCredit and Collections PolicySrinivasan Kadangot33% (3)

- Discover it® Cash Back Application SummaryDocument6 pagesDiscover it® Cash Back Application SummaryAnthony ANTONIO TONY LABRON ADAMSNo ratings yet

- 4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFDocument883 pages4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFElgun JafarovNo ratings yet

- When You Get Your BillDocument2 pagesWhen You Get Your BillFlaviub23No ratings yet

- 13 Prime Indexes Mobile Payments Industry Review 11102018Document20 pages13 Prime Indexes Mobile Payments Industry Review 11102018AmanNo ratings yet

- 4.02 Business Banking Check Parts (B) - 2Document7 pages4.02 Business Banking Check Parts (B) - 2TrinityNo ratings yet

- 8 Adjusted Trial BalanceDocument3 pages8 Adjusted Trial Balanceapi-299265916100% (1)

- E StatementDocument10 pagesE Statementsheheryar khanNo ratings yet

- Bank Audit Check List & Procedure (Concurrent Audit) : IndexDocument12 pagesBank Audit Check List & Procedure (Concurrent Audit) : IndexCA Jay ThakurNo ratings yet

- ISO8583 v93 Fields list for various financial MessagesDocument9 pagesISO8583 v93 Fields list for various financial MessagesnblroshanNo ratings yet

- ICICI Bank Car Loans Primary DetailsDocument11 pagesICICI Bank Car Loans Primary DetailsAastha PandeyNo ratings yet

- Appointment Setters ContractDocument2 pagesAppointment Setters Contractsherman60% (5)

- Heritage Funds Trade Program Hong KongDocument5 pagesHeritage Funds Trade Program Hong Kongmunkarobert100% (1)

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaNo ratings yet

- Personal loan details letterDocument4 pagesPersonal loan details letterchelladuraik25% (4)

- Tax Planning Guide for Employee RemunerationDocument34 pagesTax Planning Guide for Employee RemunerationRishabh Jain83% (6)

- Lingayen Gulf Electric Power Co. Franchise Tax RatesDocument1 pageLingayen Gulf Electric Power Co. Franchise Tax RatesRobertNo ratings yet

- Femme Pink Appform 2012 PDFDocument2 pagesFemme Pink Appform 2012 PDFEppNo ratings yet

- Policy Criteria Review May 2011Document5 pagesPolicy Criteria Review May 2011api-99058398No ratings yet

- Access Bank Creative Sector LoanDocument9 pagesAccess Bank Creative Sector LoanPelumi AdewoyinNo ratings yet

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasNo ratings yet

- FindingsDocument5 pagesFindingsafifNo ratings yet

- Security BankDocument2 pagesSecurity BankLiza SebastianNo ratings yet

- Security Bank SME Loan for Fast Equipment, Office or Cash FundingDocument2 pagesSecurity Bank SME Loan for Fast Equipment, Office or Cash FundingLiza SebastianNo ratings yet

- Paperwork Step by Step Process 090715Document3 pagesPaperwork Step by Step Process 090715api-293957681No ratings yet

- Chapter 1 IntroDocument10 pagesChapter 1 IntrosanyakathuriaNo ratings yet

- ApplicationDocument2 pagesApplicationvineet2342No ratings yet

- Bizmula-I Frequently Asked Questions - Website No. AnswerDocument1 pageBizmula-I Frequently Asked Questions - Website No. AnswerInet IntelliNo ratings yet

- What Is A.odtDocument4 pagesWhat Is A.odtAnonymous nZJiWLdC6No ratings yet

- HDB Loans StudyDocument34 pagesHDB Loans StudyMounicaNo ratings yet

- UntitledDocument23 pagesUntitledapi-281064364100% (1)

- Requirements For Offshore Banking License in BelizeDocument12 pagesRequirements For Offshore Banking License in BelizeBhagyanath MenonNo ratings yet

- 20208-SME FinancingDocument18 pages20208-SME FinancingAbdullah FazalNo ratings yet

- Cash Credit: Working Capital Facility ExplainedDocument1 pageCash Credit: Working Capital Facility ExplainedViswa KeerthiNo ratings yet

- Jennylyn Pascualjepascual@bpi.com.ph8845-6925Document2 pagesJennylyn Pascualjepascual@bpi.com.ph8845-6925Adrian FranciscoNo ratings yet

- Apply & Buy Process FlowDocument6 pagesApply & Buy Process FlowMark SwirskyNo ratings yet

- Supplier Deck (NEW-ENG) PDFDocument7 pagesSupplier Deck (NEW-ENG) PDFRiza Zausa CuarteroNo ratings yet

- EastWest Bank Credit Card Application Requirements and Benefits in Davao CityDocument8 pagesEastWest Bank Credit Card Application Requirements and Benefits in Davao CityAlfred LacandulaNo ratings yet

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- I. Learning ActivitiesDocument6 pagesI. Learning ActivitiesMaureen ColladoNo ratings yet

- Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModDocument4 pagesSpecialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModTim BryantNo ratings yet

- APARNote-1560149945966Document4 pagesAPARNote-1560149945966Rinesh ChandNo ratings yet

- Coaching Centre Liscensing & RegistrationsDocument3 pagesCoaching Centre Liscensing & RegistrationsshadabchistiNo ratings yet

- Hard Copy Loan Document (4213)Document6 pagesHard Copy Loan Document (4213)kevin.johnsonloanNo ratings yet

- HDFC Personal LoanDocument3 pagesHDFC Personal LoanmohammadtaufeequeNo ratings yet

- What Is Accounts Receivable Factoring?Document16 pagesWhat Is Accounts Receivable Factoring?Commonwealth CapitalNo ratings yet

- FAQ Main CategoriesDocument5 pagesFAQ Main CategoriesRoxy ThomasNo ratings yet

- Salary Dost Credit Policy: Loan Limit and TenureDocument11 pagesSalary Dost Credit Policy: Loan Limit and TenureAlpesh KuleNo ratings yet

- Chap-4 Departmentalization of NBPDocument25 pagesChap-4 Departmentalization of NBP✬ SHANZA MALIK ✬No ratings yet

- Declaration of Policy AMLSTATDocument3 pagesDeclaration of Policy AMLSTATGianfranco PieriniNo ratings yet

- Linkedin Ads Billing Overview: Credit Card PaymentDocument2 pagesLinkedin Ads Billing Overview: Credit Card PaymentGabrielly BalãoNo ratings yet

- CitiFinancial Consumer Finance India Limited-FPCDocument2 pagesCitiFinancial Consumer Finance India Limited-FPCRadhikarao ErrabelliNo ratings yet

- Inland TradeDocument32 pagesInland Tradepattabhi_reddy_1No ratings yet

- PricingDocument3 pagesPricingapi-285145795No ratings yet

- Understanding PG and Pay Updated 072213Document29 pagesUnderstanding PG and Pay Updated 072213api-24643888No ratings yet

- Security 9 95Document1 pageSecurity 9 95api-24643888No ratings yet

- NPR Independant Contractors Agreement Updated 052712Document4 pagesNPR Independant Contractors Agreement Updated 052712api-24643888No ratings yet

- Integrity Banc Solutions Product Sales Script 071911 ArtDocument5 pagesIntegrity Banc Solutions Product Sales Script 071911 Artapi-24643888No ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillAsif SohailNo ratings yet

- Differences Between Allowances and Perquisites ExplainedDocument6 pagesDifferences Between Allowances and Perquisites ExplainedXenqiyj XyenttukNo ratings yet

- Primary Account Holder Monthly StatementDocument3 pagesPrimary Account Holder Monthly Statementghanshyam makwanaNo ratings yet

- Gel Cash FlowDocument3 pagesGel Cash Flowravibhartia1978No ratings yet

- FormsDocument6 pagesFormsSHIELA MARIE L. DIMACULANGANNo ratings yet

- TaxDocument22 pagesTaxAashutosh RathodNo ratings yet

- Payslip 2190724 CIN Mar 2023Document1 pagePayslip 2190724 CIN Mar 2023sekhar nadimintiNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceKuldeep Krishan Trivedi Sr.No ratings yet

- 3MonthWaiver Poster 01Document1 page3MonthWaiver Poster 01Thanaraj SanmughamNo ratings yet

- Suman Debanth Proprietor Trading and Profit Loss StatementDocument4 pagesSuman Debanth Proprietor Trading and Profit Loss StatementABDUL KHALIKNo ratings yet

- Taxation Law BasicsDocument9 pagesTaxation Law BasicsABHIJEETNo ratings yet

- Api H2HDocument5 pagesApi H2HShree GuptaNo ratings yet

- OD329415113671088100Document1 pageOD329415113671088100maniksarkarmaniksarkar67No ratings yet

- MST 1295Document1 pageMST 1295digital lifeNo ratings yet

- Module 9 Ethical Principles in Business PDFDocument22 pagesModule 9 Ethical Principles in Business PDFRomulo MarquezNo ratings yet

- CertificateOfRegistration 2021 130369Document1 pageCertificateOfRegistration 2021 130369miguel soncuanNo ratings yet

- PH Tax 2024 Tax Calendar UpdatedDocument32 pagesPH Tax 2024 Tax Calendar Updatedmirandasonjairene.llevaNo ratings yet

- Payslip - Jenalyn MAY 1 - 15Document1 pagePayslip - Jenalyn MAY 1 - 15bktsuna0201No ratings yet

- Ias 12 Income TaxDocument36 pagesIas 12 Income Taxesulawyer2001No ratings yet

- Withholding Tax Guide for Philippines BusinessesDocument3 pagesWithholding Tax Guide for Philippines BusinessesJera Realyn SabayNo ratings yet

- Hotel Italy 3Document1 pageHotel Italy 3Riz MarcosNo ratings yet