Professional Documents

Culture Documents

B S Plot

B S Plot

Uploaded by

Gallo SolarisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B S Plot

B S Plot

Uploaded by

Gallo SolarisCopyright:

Available Formats

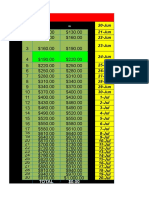

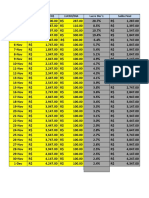

S

Rf

Expiry

B-S

Actual

S = current Stock price

$35.00

$20.00

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$15.40

$35.00

$22.50

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$12.90

$35.00

$25.00

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$10.40

$35.00

$27.50

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$7.90

$35.00

$30.00

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$5.50

$35.00

$35.00

$32.50

$35.00

5.0%

5.0%

20.0%

20.0%

18-Mar-05

18-Mar-05

-8.35

-8.35

#NUM!

#NUM!

$3.20

$1.43

K = strike price

Rf = Risk-free rate

V = Volatility

Expiry = Expiry date

T = Time to expiry (in years)

B-S = Black-Scholes Call option premium

$35.00

$35.00

$37.50

$40.00

5.0%

5.0%

20.0%

20.0%

18-Mar-05

18-Mar-05

-8.35

-8.35

#NUM!

#NUM!

$0.45

$0.13

Actual = Actual premium (You stick these into column H)

$35.00

$42.50

5.0%

20.0%

18-Mar-05

-8.35

#NUM!

$0.10

Stick a bunch of numbers in for S, K, Rf, V and Expiry

= S*NORMSDIST((LN(S/K)+(Rf+V^2/2)*T)/(V*SQRT(T))) - K*EXP(-Rf*T)*NORMS

Change them to see the effect on Black-Scholes

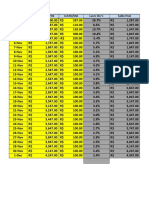

S=$35.00 Rf=5% V=20% T=-3046 days

Black-Scholes versus Strike Price

$18.00

$16.00

Compare to Actual premiums obtained here:

http://finance.yahoo.com/q/op?s=G

Actual premium

S=$35.00 Rf=5% V=20% T=-3046 days

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$42.50

$40.00

$37.50

$35.00

$32.50

$30.00

$27.50

$25.00

$22.50

$20.00

$0.00

ack-Scholes Call option premium

DIST((LN(S/K)+(Rf+V^2/2)*T)/(V*SQRT(T))) - K*EXP(-Rf*T)*NORMSDIST((LN(S/K)+(Rf+V^2/2)*T)/(V*SQRT(T))-V*SQRT(T))

Actual premium (You stick these into column H)

unch of numbers in for S, K, Rf, V and Expiry

them to see the effect on Black-Scholes

e to Actual premiums obtained here:

http://finance.yahoo.com/q/op?s=GE

You might also like

- Hechuras 1Document3 pagesHechuras 1fabian alvarezNo ratings yet

- Praça CampesinaDocument3 pagesPraça CampesinaBrunoNo ratings yet

- Examen Virtual: Alumno: Grupo: Docente: FechaDocument16 pagesExamen Virtual: Alumno: Grupo: Docente: FechaLucas BillNo ratings yet

- Examen Virtual: Alumno: Grupo: Docente: FechaDocument16 pagesExamen Virtual: Alumno: Grupo: Docente: FechaLucas BillNo ratings yet

- Tabla de AmortizacionesDocument1 pageTabla de AmortizacionesOscar IsidoroNo ratings yet

- 1001 Rate CardDocument1 page1001 Rate Cardjdickey333No ratings yet

- Gerenciamento de Risco 2Document10 pagesGerenciamento de Risco 2rodrigoguerreiroNo ratings yet

- Controle de Pagamento Dos ContratosDocument13 pagesControle de Pagamento Dos Contratosgeo construçoesNo ratings yet

- Gerenciamento TrainderDocument5 pagesGerenciamento Traindertoureti daviesNo ratings yet

- DIRECT and TOTAL JOB COSTS - AMBROL PROJECT (Not Incl. Land Comp. / Taxes / Royalties / Fees / VAT and Shipping Costs)Document1 pageDIRECT and TOTAL JOB COSTS - AMBROL PROJECT (Not Incl. Land Comp. / Taxes / Royalties / Fees / VAT and Shipping Costs)Steve MedhurstNo ratings yet

- Spreadsheet Home GameDocument7 pagesSpreadsheet Home GameJorge Augusto de Moura LimaNo ratings yet

- Gerenciamento TrainderDocument5 pagesGerenciamento Traindertoureti daviesNo ratings yet

- 4 AN Price 2017-2022Document4 pages4 AN Price 2017-2022nsrkprasad61No ratings yet

- Elizeu - Gerenciamento de BancaDocument4 pagesElizeu - Gerenciamento de BancaLucas AnjosNo ratings yet

- Disha P&LDocument160 pagesDisha P&LShruti ShrutiNo ratings yet

- Gestão Infinity XDocument6 pagesGestão Infinity XAnderson DutraNo ratings yet

- SR - No. Scrip Action B Trade Date BPR S Trade Date Sell PR P&L PsDocument33 pagesSR - No. Scrip Action B Trade Date BPR S Trade Date Sell PR P&L PsShruti ShrutiNo ratings yet

- Payment Scheme 3.21.2fDocument1 pagePayment Scheme 3.21.2fFara Dinaa SusiloNo ratings yet

- Ob GerenciamentoDocument12 pagesOb GerenciamentoBruno SantosNo ratings yet

- Total High Low Avg Med: Listing Count: 73 Days On Market: 1394 1 184 131Document4 pagesTotal High Low Avg Med: Listing Count: 73 Days On Market: 1394 1 184 131tillmezNo ratings yet

- Formato de SimulacionDocument3 pagesFormato de SimulacionPiedadAlvarezNo ratings yet

- Untitled SpreadsheetDocument13 pagesUntitled Spreadsheetprabhjot kaurNo ratings yet

- 2019 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2019 TSP Catch-Up Contributions and Effective Date ChartRayNo ratings yet

- Neelsindhu Industry Send MaterailDocument12 pagesNeelsindhu Industry Send MaterailSunil Deshmukh.No ratings yet

- Libros - OriginalDocument3 pagesLibros - OriginalNelida Berru SalvadorNo ratings yet

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Document9 pagesEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Isaac Andres Pech SanchezNo ratings yet

- International Primary Price List 2020Document133 pagesInternational Primary Price List 2020Pam SeagalNo ratings yet

- Tabela - PriceDocument4 pagesTabela - PricejetttttNo ratings yet

- I White HatDocument4 pagesI White HatSamuel SantosNo ratings yet

- Mercuro Tag Sale PricesDocument1 pageMercuro Tag Sale PricesHolstein PlazaNo ratings yet

- Kalender Maret - 2020 MHDDocument3 pagesKalender Maret - 2020 MHDMuhammad NaufalNo ratings yet

- Data Saldo Dia Inicial R$ Lucro/Dia Lucro Dia % Saldo FinalDocument7 pagesData Saldo Dia Inicial R$ Lucro/Dia Lucro Dia % Saldo FinalmarcdsfNo ratings yet

- Mayke Naves Gerenciamento de RiscoDocument7 pagesMayke Naves Gerenciamento de Riscojoao moutinhoNo ratings yet

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4Document28 pagesEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4AnetteNo ratings yet

- Planilha Moral Do Gelo - STNDocument20 pagesPlanilha Moral Do Gelo - STNPivetim ManeiroNo ratings yet

- SIP - Aashish Wataveods - OdsDocument5 pagesSIP - Aashish Wataveods - OdsHimanshu RunwalNo ratings yet

- Planilha MercadoDocument47 pagesPlanilha MercadoMattNo ratings yet

- Daftar Harga Pulsa Elektronik: No Jenis Voucher Nominal Kode Harga No Jenis Voucher Nominal Kode HargaDocument3 pagesDaftar Harga Pulsa Elektronik: No Jenis Voucher Nominal Kode Harga No Jenis Voucher Nominal Kode HargatamsartNo ratings yet

- Roleta GerenciamentoDocument2 pagesRoleta GerenciamentonicolasluizcostaserafimNo ratings yet

- Hobbizine: Buffalo Nickel ValuesDocument7 pagesHobbizine: Buffalo Nickel ValuesCarlo AndreNo ratings yet

- Gestão PriceDocument5 pagesGestão PriceAlisson Gomes LuzNo ratings yet

- Latihan Pajak AbsolutDocument7 pagesLatihan Pajak AbsolutLeonardus PietajendraNo ratings yet

- Transaksi Duit Rek Bca G.RDocument2 pagesTransaksi Duit Rek Bca G.Rkiki varelNo ratings yet

- Tabla MoratoriosDocument1 pageTabla Moratoriosmariano morelosNo ratings yet

- GERENCIAMENTO Planilha Cad Capital.Document6 pagesGERENCIAMENTO Planilha Cad Capital.welligtonsantos0No ratings yet

- Disha P&LDocument146 pagesDisha P&LShruti ShrutiNo ratings yet

- Parches Jet - Diagonales: # Tipo Parche Unid X Caja Precio Caja Ant Precio Caja Precio UnitarioDocument3 pagesParches Jet - Diagonales: # Tipo Parche Unid X Caja Precio Caja Ant Precio Caja Precio UnitarioMMM ORURO 2No ratings yet

- Total Result 1,260,000.00Document25 pagesTotal Result 1,260,000.00Sameep Kaur GillNo ratings yet

- Pow - Installation of CHB Retaining Wall at Public MarketDocument25 pagesPow - Installation of CHB Retaining Wall at Public MarketJudy Anne BautistaNo ratings yet

- Pow - Water TankDocument14 pagesPow - Water TankJudy Anne BautistaNo ratings yet

- Grupo 1.0 Grupo 2.0 Grupo 3.0 Grupo 4.0 Grupo 5.0 Grupo 6.0 Grupo 7.0 Grupo 8.0Document9 pagesGrupo 1.0 Grupo 2.0 Grupo 3.0 Grupo 4.0 Grupo 5.0 Grupo 6.0 Grupo 7.0 Grupo 8.0Bolao SuperNo ratings yet

- Menu KeizakiDocument28 pagesMenu KeizakiEstefania Rodrigue TamayoNo ratings yet

- Resumen Ventas DiarisDocument32 pagesResumen Ventas DiarisMio Y Mia Romeo De La CruzNo ratings yet

- 2019 TSP Contributions and Effective Date ChartDocument1 page2019 TSP Contributions and Effective Date ChartRayNo ratings yet

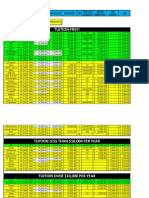

- 2014-15 Law School GI Bill + Yellow Ribbon InfoDocument5 pages2014-15 Law School GI Bill + Yellow Ribbon InfoCraig SandersNo ratings yet

- Input The Proper Arguments For The Required Functions.: InstructionsDocument2 pagesInput The Proper Arguments For The Required Functions.: InstructionsChristiana JadeNo ratings yet

- Gerenciamento MensalDocument18 pagesGerenciamento MensalclailtonNo ratings yet

- Summer RRP 2024Document4 pagesSummer RRP 2024gwydirindustriesNo ratings yet

- 1 ST RiskDocument1 page1 ST Riskfrank.james312079No ratings yet

- R-QuantLib Integration Spanderen 2013 SlidesDocument20 pagesR-QuantLib Integration Spanderen 2013 SlidesGallo SolarisNo ratings yet

- 4 Stock RegressionsDocument16 pages4 Stock RegressionsGallo SolarisNo ratings yet

- OneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesDocument8 pagesOneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesGallo SolarisNo ratings yet

- 3 Stock Correlations2Document162 pages3 Stock Correlations2Gallo SolarisNo ratings yet

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDocument78 pagesUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- Ito PredictDocument79 pagesIto PredictGallo SolarisNo ratings yet

- 5 Year AnalysisDocument100 pages5 Year AnalysisGallo SolarisNo ratings yet

- Download: Fill in The Then Click The ButtonDocument101 pagesDownload: Fill in The Then Click The ButtonGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument101 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Distribution LaplaceDocument199 pagesDistribution LaplaceGallo SolarisNo ratings yet

- Asset Volatility2Document126 pagesAsset Volatility2Gallo SolarisNo ratings yet

- D Stock Symbol: MSFT MSFT MSFTDocument76 pagesD Stock Symbol: MSFT MSFT MSFTGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument23 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument18 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button MDocument13 pagesDownload: Fill in The Then Click The Button MGallo SolarisNo ratings yet