Professional Documents

Culture Documents

Finance Function (Accountants Today)

Finance Function (Accountants Today)

Uploaded by

Issac KCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Function (Accountants Today)

Finance Function (Accountants Today)

Uploaded by

Issac KCopyright:

Available Formats

FINANCE & ACCOUNTING

PROVING THE VALUE OF THE

Finance Function

by Sir Andrew Likierman

The finance function can no longer rest on its laurels and assume that everyone in the business knows its indispensable. How can financial managers go about proving their value?

nce upon a time, finance did not have to discuss its own performance. The function was seen as essential, although the reasons why it was essential were understood only hazily by outsiders. But thats no longer the case. Inexorable cost pressures have exposed finance to increasing scrutiny and it is as much a potential target for cost-cutting as any other activity. Technology and outsourcing are often the most obvious way to achieve such savings. Even without cost pressures, if finance fails to explain how it adds value, it will lose out in the competition for scarce resources. The whole business will suffer as a result, so good performance measures are essential weapons for those fighting for the right resources to do the job. But first there must be a health warning. The finance core assumed here is private sector (overall lessons may also be relevant to the public sector), including external reporting, risk and compliance, treasury and tax, investor relations, transaction processing, costing, planning and control. But there are huge variations in

April 2005 ACCOUNTANTS TODAY

35

Proving the Value of the Finance Function

the way departments are organised. It is a question not only of size, whether you have one part-time unqualified bookkeeper or hundreds of trained professionals but also of the degree of centralisation and integration. The boundaries vary greatly too, with IT, strategy, performance and other functions sometimes inside the finance department and sometimes outside it. This article therefore highlights ways to test existing practice and does not attempt to give one answer, regardless of the circumstances.

Inexorable cost pressures have exposed finance to increasing scrutiny and it is as much a potential target for cost-cutting as any other activity.

organisation has not gone bankrupt is hardly a knockout argument. Good relations with the bank and the external auditors may be a sign of strength, but they could also mean that the organisation is the

cess or failure directly to finance. This measurement problem becomes worse the more the function embeds itself into line management.

Choosing measures

The implication of these problems is that it may be impossible to give an unambiguous answer to the question how well is finance doing? The good news is that there are many ways to use performance measures to provide solid evidence. Connect the performance of the function to objectives and constraints for the

Getting there

When first asked to measure per formance, the understandable temptation for financial managers is to use their numerical skills to crack the problem. Popular measures include cost over the past five years, numbers employed compared with last year and the proportion of invoices paid on time. The advantage of these measures is that they are precise. The problem is that the bare numbers give only a partial picture. What about quality? So next there are measures to plug gaps, including customer satisfaction questionnaires, the number of days it takes to provide financial information and, perhaps, a balanced scorecard. This gives better information, yet rarely provides an answer to the question how well is finance doing? At this stage it is tempting to give up and simply say that everything is not only essential, but, because of IT and outsourcing, it is getting cheaper. Resist this temptation. Its vital to continue asking questions and helping the function to define its performance. What should finance functions do? Before even thinking about measurement, they need to recognise the problems. These usually start with poor links to organisational objectives. There is no easy answer here and those outside the function rarely know enough to distinguish between whats optional and whats required. This applies as much to traditional activities such as budgeting as to newer ones such as risk. Then theres the thorny issue of measuring the results outcomes rather than inputs. Its all very well to chant the mantra of the need to add value, but how would we know? The fact that the

loser in these key relationships. How would we measure this issue anyway? Life isnt made easier by poor feedback. Unless they have recently worked elsewhere, most customers will not possess enough information to make judgements. Many long-serving managers lack wider experience to be clear about trade-offs, opportunity costs and risks. Is it better to have monthly management information mostly right after one week or much more accurately after two? Its often assumed that current practice is the only way to do things. It is only after you add non-financial measures, forward-looking information, charts, a really useful commentary and perhaps some colour that the board realises the good old system was in fact pretty terrible. Lastly, because boundaries are so fluid, and responsibility for parts of the work is shared, its often difficult to ascribe suc-

organisation as a whole, and to the expectations of its management. This needs to be done at least once a year at budget time, when the expectations including trade-offs in cost and time of line and senior management are formed. Two examples are understanding the disadvantages of an aggressive tax strategy and agreeing with the marketing and purchasing department the implications of managing working capital to its limits. These expectations should also be part of the targets that are set, perhaps in formal service agreements. Increase the sophistication of the measures and the way they are used. This should start by shifting the focus away from measuring cost and activity towards outcomes, signalling that performance is about delivery, not effort. Rather than using cost (or even no measure) for

ACCOUNTANTS TODAY April 2005

36

Proving the Value of the Finance Function

As finance becomes more integrated into the rest of the organisation, as outsourcing becomes recognised as a permanent option, as the focus moves towards added value, so it becomes increasingly hard to define its success.

reporting, why not use a combination of financial and non-financial measures and commentary for external reporting, and customer feedback and comparisons for internal reporting and control? The message should be reinforced by setting targets at levels defined by the organisations objectives and customers, not by finance. Indeed, people outside the department should be used wherever possible. They could be from another function (such as HR), from another organisation (Ill appraise yours if youll appraise mine), the auditors or an external consultant. All of these have disadvantages in terms of knowledge, independence and cost, but the most important benefit is that they have a fresh view on, for example, the extent to which the function initiates action. Use comparisons wherever possible. Best practice should involve a constant search, even by those who reckon they are among the leaders. The ideal, obviously, is to compare best practice in functions that are as similar as possible, but this may prove difficult. Where do you begin? Large organisations with decentralised finance functions should start with intrafirm comparisons. Smaller organisations can look at other finance functions, perhaps through a benchmarking club. Also consider using other service functions in your organisation. When was the last time

April 2005 ACCOUNTANTS TODAY

you talked about performance to HR or IT? When making comparisons, the correct unit of analysis will be relevant individual activities. For example, response times will vary for different activities, but you could discuss the approach with the IT department. Similarly, it may be worth discussing approaches for quantifying costs and benefits with research and development. Improve the quality of feedback provided to, and given by, finance. Customer satisfaction is a crucial indicator of successful outcomes, but this is tricky to measure because customer perceptions are dominated by current practice they dont know what they dont know. You must not only determine whether customers are satisfied with what finance decides to provide; you must also help them to understand what is possible. For example, ever yone may be used to a budgeting routine, but they may not see possible improvements from sharpening some processes and cutting others. You should construct questionnaires with great care. Comparing what customers think with what finance thinks is more useful than simply asking: Were you happy with the service (yes, no or quite)? Indeed, questionnaires may not even be appropriate. Face-to-face feedback on questions sent out earlier, probably at budget time, give a better idea about what people really think. Such dis-

cussions allow you to try out new ideas as well as to find out whether other people think finance supports them. You could also tr y using the head of finances annual performance appraisal to discuss progress against objectives, changes to requirements and quality standards and trade-offs. How well was that unexpected hedging package put together? Overall, how did the treasury function cope with the unforeseen during the year?

Conclusion

As finance becomes more integrated into the rest of the organisation, as outsourcing becomes recognised as a permanent option, as the focus moves towards added value, so it becomes increasingly hard to define its success. Financial managers need to deal with these complexities by moving away from cost and activity measurement and towards closer links to objectives, more sophisticated measurement, better comparisons and improved feedback. Doing so will improve the ability of those in finance to identify their contribution, benefiting all who work in it and the organisation as a whole. AT

Sir Andrew Likierman is a professor of management practice at the London Business School. This article is contributed by CIMA and it first appeared in Financial Management, CIMAs monthly magazine for accountants in business.

37

You might also like

- Finance TransformationDocument16 pagesFinance Transformationzavalase100% (1)

- Hedge Fund Start-Up Guide - Bloomberg, AIMADocument43 pagesHedge Fund Start-Up Guide - Bloomberg, AIMAgchagas6019100% (1)

- Accounting Policies & Procedures ManualDocument335 pagesAccounting Policies & Procedures ManualPlatonic100% (23)

- Project Profitability: Ensuring Improvement Projects Achieve Maximum Cash ROIFrom EverandProject Profitability: Ensuring Improvement Projects Achieve Maximum Cash ROINo ratings yet

- Hedge Fund AdministrationDocument3 pagesHedge Fund AdministrationRDNo ratings yet

- This Study Resource Was: Philippine Christian UniversityDocument3 pagesThis Study Resource Was: Philippine Christian UniversityFred Nazareno Cerezo100% (2)

- Lu Uk Value Creation Through MaDocument24 pagesLu Uk Value Creation Through MaVijayavelu AdiyapathamNo ratings yet

- Third-party-Risk-Management Joa Eng 0317Document6 pagesThird-party-Risk-Management Joa Eng 0317jmonsa11No ratings yet

- DR Responsibilities Databarracks.01Document1 pageDR Responsibilities Databarracks.01CarlosNo ratings yet

- Sample Business Development PlanDocument6 pagesSample Business Development PlanlaylaNo ratings yet

- SSRN-id256754 What Is Behavioral FinanceDocument9 pagesSSRN-id256754 What Is Behavioral FinancegreyistariNo ratings yet

- BAIN BRIEF When The Front Line Should Lead A Major TransformationDocument8 pagesBAIN BRIEF When The Front Line Should Lead A Major TransformationsilmoonverNo ratings yet

- Ownership and Governance of State Owned Enterprises A Compendium of National Practices 2021Document104 pagesOwnership and Governance of State Owned Enterprises A Compendium of National Practices 2021Ary Surya PurnamaNo ratings yet

- 10 Principles of ManufacturingDocument4 pages10 Principles of Manufacturingsarwan85806167% (3)

- Gestion de AlmacenDocument11 pagesGestion de Almacenjuan carlosNo ratings yet

- Project Assessment at Railways FinalDocument5 pagesProject Assessment at Railways FinaldebojyotiNo ratings yet

- Good Practice Note: Managing Retrenchment (August 2005)Document28 pagesGood Practice Note: Managing Retrenchment (August 2005)IFC Sustainability100% (1)

- Introduction To Managerial Accounting: Discussion QuestionsDocument5 pagesIntroduction To Managerial Accounting: Discussion QuestionsParth GandhiNo ratings yet

- The Perform SystemDocument18 pagesThe Perform Systemapi-20008007No ratings yet

- Deloitte Uk Finance Business PartneringDocument16 pagesDeloitte Uk Finance Business PartneringrubenrealperezNo ratings yet

- The Central IssueDocument3 pagesThe Central IssueJosé RodríguezNo ratings yet

- The Power of Procurement A Global Survey of Procurement Functions PDFDocument68 pagesThe Power of Procurement A Global Survey of Procurement Functions PDFTetiana SchipperNo ratings yet

- Best Practices in Financial Planning and Analysis: White PaperDocument8 pagesBest Practices in Financial Planning and Analysis: White PaperManikantan NatarajanNo ratings yet

- FM Realising The ValueDocument16 pagesFM Realising The ValueEduardo VianaNo ratings yet

- Outsourcing Fund Administration 1Document5 pagesOutsourcing Fund Administration 1aashinerrNo ratings yet

- CMMS Manwinwin Article - Importance of Maintenance FunctionDocument2 pagesCMMS Manwinwin Article - Importance of Maintenance FunctionFawaaz KhurwolahNo ratings yet

- A Balanced Approach: by Ketan VariaDocument4 pagesA Balanced Approach: by Ketan VariaAmber PreetNo ratings yet

- 1002 Reducing RiskDocument12 pages1002 Reducing Riskatomicslash3No ratings yet

- Making It StickDocument12 pagesMaking It Sticktoya.incorporatedNo ratings yet

- Monitor Getting Off RollercoasterDocument24 pagesMonitor Getting Off Rollercoasterquizzy226No ratings yet

- $study On The Imapct of Change in Organisational Behaviour in Marriott HotelDocument9 pages$study On The Imapct of Change in Organisational Behaviour in Marriott HotelRomiNo ratings yet

- A CEO Guide For Avoiding Ten TrapsDocument9 pagesA CEO Guide For Avoiding Ten TrapsLuis BarretoNo ratings yet

- Maq Winter 2009 Kren PDFDocument12 pagesMaq Winter 2009 Kren PDFarmagedeonNo ratings yet

- WP Corporate Actions ProcessingDocument20 pagesWP Corporate Actions ProcessingAzim BawaNo ratings yet

- Interim Executives Achieve Goals 20 Times Faster: Cutting Perks?Document4 pagesInterim Executives Achieve Goals 20 Times Faster: Cutting Perks?Tim DixonNo ratings yet

- Midterm ENGF 1x2Document3 pagesMidterm ENGF 1x2ZeusNo ratings yet

- McKinsey - A Better Way To Cut CostsDocument4 pagesMcKinsey - A Better Way To Cut Costsgweberpe@gmailcomNo ratings yet

- Toward A Leaner Finance DepartmentDocument6 pagesToward A Leaner Finance DepartmentRafnunNo ratings yet

- IFAC Future Fit Accountant ROLES V5 SinglesDocument16 pagesIFAC Future Fit Accountant ROLES V5 SinglesssasfNo ratings yet

- Alignment GapDocument2 pagesAlignment GapLeor FranksNo ratings yet

- 5 Essential Principles For A Better Strategy Review (Palladium 2015)Document8 pages5 Essential Principles For A Better Strategy Review (Palladium 2015)Grant MillinNo ratings yet

- Future Finance Report FinanceDocument46 pagesFuture Finance Report Financesteve.tranNo ratings yet

- Why BSCs FailDocument6 pagesWhy BSCs Failshepherd junior masasiNo ratings yet

- G, Z:,%GR,: Bringing Quality Management Into FocusDocument5 pagesG, Z:,%GR,: Bringing Quality Management Into Focusabdullah aashif aliNo ratings yet

- What Are The Pitfalls of Outsourcing Your Facilities Management?Document12 pagesWhat Are The Pitfalls of Outsourcing Your Facilities Management?Sahana GowdaNo ratings yet

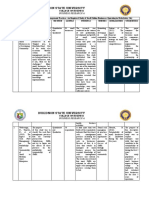

- Bukidnon State University: Business Research ADocument9 pagesBukidnon State University: Business Research AkwyncleNo ratings yet

- Todays-Interdisciplinary-Auditors Joa Eng 0919Document5 pagesTodays-Interdisciplinary-Auditors Joa Eng 0919Koyel BanerjeeNo ratings yet

- LO27 Epstein & Wisner 2011 Using A BSC To Implement SustainabilityDocument11 pagesLO27 Epstein & Wisner 2011 Using A BSC To Implement SustainabilitymiguelNo ratings yet

- The Role of Performance Appraisal System in Hindustan Unilever LimitedDocument5 pagesThe Role of Performance Appraisal System in Hindustan Unilever LimitedSaahi Seenivasan100% (1)

- 1 OneTelDocument7 pages1 OneTelLordson Ramos100% (1)

- Ensuring Erp Implementation SuccessDocument3 pagesEnsuring Erp Implementation SuccessAkshat Kapoor SthapakNo ratings yet

- CAREERS 10 Qualities of Successful Financial ExecutivesDocument2 pagesCAREERS 10 Qualities of Successful Financial ExecutivesmariaNo ratings yet

- A New Blueprint For SuccessDocument7 pagesA New Blueprint For Successgelir30719No ratings yet

- F1 and F2 Fmarticleseptember 09Document2 pagesF1 and F2 Fmarticleseptember 09Md. Mostafizur RahmanNo ratings yet

- Next Generation Internal Audit ProtivitiDocument20 pagesNext Generation Internal Audit ProtivitiFandi Arya PratamaNo ratings yet

- Narrative Reporting: Give Yourself A Head StartDocument22 pagesNarrative Reporting: Give Yourself A Head StartBaiq AuliaNo ratings yet

- CIMA - P2 - Performance Management - Useful Articles - Ian Herbert - EmpowermentDocument3 pagesCIMA - P2 - Performance Management - Useful Articles - Ian Herbert - Empowermente_NomadNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- Seminar 4 - Zoe RadnorDocument22 pagesSeminar 4 - Zoe RadnortpapadopNo ratings yet

- Ch1 - Managerial Accounting and The Business EnvironmentDocument29 pagesCh1 - Managerial Accounting and The Business EnvironmentehtikNo ratings yet

- Disruption To BusinessDocument4 pagesDisruption To Businessregina.phalangeNo ratings yet

- Makalah Business FinanceDocument18 pagesMakalah Business FinanceDaniel SihotangNo ratings yet

- 5minutes of PowerDocument6 pages5minutes of PowerHassan AskaryNo ratings yet

- Resource Pro Ebook Getting Started About Employee BenefitsDocument10 pagesResource Pro Ebook Getting Started About Employee BenefitsSushma VNo ratings yet

- RUXX - Russian Industrial Leaders Index - Home - Analysis: Uralchem, A Minority Shareholder in TogliattiAzot, Seeks To Reduce Social Spending To Maximize Its Profits Badly Needed To Pay Down DebtDocument4 pagesRUXX - Russian Industrial Leaders Index - Home - Analysis: Uralchem, A Minority Shareholder in TogliattiAzot, Seeks To Reduce Social Spending To Maximize Its Profits Badly Needed To Pay Down DebtoligarchwatchNo ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Mission ProjectDocument33 pagesMission ProjectSupriya GautamNo ratings yet

- Corporate Income Tax and Incentives Reform: Dispelling The MythsDocument47 pagesCorporate Income Tax and Incentives Reform: Dispelling The Mythsmiron68No ratings yet

- APPS Rating and ReviewsDocument83 pagesAPPS Rating and ReviewsApurbh Singh KashyapNo ratings yet

- AFT 04101 Correction of Errors Dip 1Document55 pagesAFT 04101 Correction of Errors Dip 1charichamakoriNo ratings yet

- Slides - Accounting For Mudharabah FinancingDocument25 pagesSlides - Accounting For Mudharabah FinancingMasni Najib Kaaybee100% (1)

- A Critique of Creative Shari'Ah Compliance in The Islamic Finance Industry-Brill (2017)Document301 pagesA Critique of Creative Shari'Ah Compliance in The Islamic Finance Industry-Brill (2017)roytanladiasanNo ratings yet

- Post Reform PeriodDocument26 pagesPost Reform PeriodIshu ChopraNo ratings yet

- Trial Balance FinalDocument2 pagesTrial Balance FinalsenbrosNo ratings yet

- Philippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Document7 pagesPhilippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Biboy GSNo ratings yet

- Mathematics Module 2 With AnswerDocument4 pagesMathematics Module 2 With Answerbelle maraNo ratings yet

- Fee Structure Year 2 Semester 1Document4 pagesFee Structure Year 2 Semester 1petermutua1759No ratings yet

- Mid Monthly December 2015 Exampunditfinalversionpdfofmidmonthlydecember2015Document24 pagesMid Monthly December 2015 Exampunditfinalversionpdfofmidmonthlydecember2015Sahil GuptaNo ratings yet

- CA Part B 2019Document135 pagesCA Part B 2019Amit KumarNo ratings yet

- Finals Syllabus (Tax 02 - Atty. Acas)Document19 pagesFinals Syllabus (Tax 02 - Atty. Acas)AprilNo ratings yet

- ProjectDocument42 pagesProjectNikhil BirajNo ratings yet

- Summit Bank Internship ReportDocument72 pagesSummit Bank Internship ReportAbdul Qadir50% (2)

- Integration of Business Functions Assessment Term 1 3.1 Joshua Jackson.J Banner Id B00408102Document3 pagesIntegration of Business Functions Assessment Term 1 3.1 Joshua Jackson.J Banner Id B00408102Joshua JacksonNo ratings yet

- Risk and Return: All Rights ReservedDocument28 pagesRisk and Return: All Rights ReservedWasif KhanNo ratings yet

- Blaw 1000 ReviewerDocument10 pagesBlaw 1000 ReviewerKyla FacunlaNo ratings yet

- Intership Report On General Banking of Standard BankDocument44 pagesIntership Report On General Banking of Standard Bankporosh100100% (1)

- Spd-Ncs WB - PDF - Lamp 5-4Document126 pagesSpd-Ncs WB - PDF - Lamp 5-4dutsarah364No ratings yet

- NBP ReportDocument131 pagesNBP ReportimrankmlNo ratings yet

- DLP GenMathDocument4 pagesDLP GenMathMa. Consuelo Melanie Cortes IIINo ratings yet

- Chapter 10-Stocks - Valuation PDFDocument21 pagesChapter 10-Stocks - Valuation PDFzoom Tanjung karangNo ratings yet