Professional Documents

Culture Documents

My Investment Guide

Uploaded by

junelromeroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

My Investment Guide

Uploaded by

junelromeroCopyright:

Available Formats

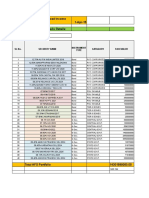

INVESTMENT GUIDE

Stock

Code

Security Name

since 1/16/2012

Cost / share

1/16/2013

Target Price

(FV)

340.000

522.00

568.00

46.00

8.10%

182.000

34.87%

Pts. To FV

% to FV

Pts. Up / Pts.

Down

% Gain /

(Loss) from

last year

Cost / share

1/16/2012

AC

AYALA CORPORATION

AGI

ALLIANCE GLOBAL GROUP, INC.

10.980

17.34

20.57

3.23

15.70%

6.360

36.68%

ALI

AYALA LAND, INC.

16.500

27.15

26.00

1.15

-4.42%

10.650

39.23%

AP

38.35

40.20

1.85

4.60%

8.100

21.12%

ABOITIZ POWER CORP.

30.250

BDO

BDO UNIBANK, INC.

58.100

75.40

95.00

19.60

20.63%

17.300

22.94%

BPI

BANK OF THE PHILIPPINE ISLANDS

57.800

100.00

100.00

0.00

0.00%

42.200

42.20%

CEB

CEBU AIR, INC

68.000

61.70

74.50

12.80

17.18%

(6.300)

-10.21%

DMC DMCI HOLDINGS, INC.

45.250

53.15

51.50

1.65

-3.20%

7.900

14.86%

6.190

7.05

7.90

0.85

10.76%

0.860

12.20%

EDC

ENERGY DEVELOPMENT CORP.

EEI

EEI CORPORATION

4.250

11.08

12.00

0.92

7.67%

6.830

61.64%

FGEN FIRST GEN CORPORATION

14.380

23.70

27.60

3.90

14.13%

9.320

39.32%

1.130

1.63

1.90

0.27

14.21%

0.500

30.67%

61.750

100.10

125.00

24.90

19.92%

38.350

38.31%

1,150.000

1,092.00

1,290.00

198.00

15.35%

(58.000)

-5.31%

FLI

FILINVEST LAND, INC.

FPH

FIRST PHILIPPINE HOLDINGS

GLO

GLOBE TELECOM INC

ICT

INT'L CONTAINER TERMINALS

56.500

75.30

69.80

5.50

-7.88%

18.800

24.97%

JFC

JOLLIBEE FOODS CORP.

89.200

108.50

123.00

14.50

11.79%

19.300

17.79%

MBT

METROPOLITAN BANK & TRUST

73.800

105.80

130.00

24.20

18.62%

32.000

30.25%

1.850

3.18

3.65

0.47

12.88%

1.330

41.82%

268.000

273.20

327.00

53.80

16.45%

5.200

1.90%

3.670

4.97

5.50

0.53

9.64%

1.300

26.16%

MWC MANILA WATER COMPANY, INC.

21.200

33.45

34.50

1.05

3.04%

12.250

36.62%

NIKL

22.550

19.70

16.70

3.00

-17.96%

(2.850)

-14.47%

18.000

32.50

39.50

7.00

17.72%

14.500

44.62%

MEG MEGAWORLD CORPORATION

MER

MANILA ELECTRIC COMPANY

MPI

METRO PACIFIC INVESTMENTS

NICKEL ASIA CORPORATION

PGOLD PUREGOLD PRICE CLUB, INC.

PNB

PHILIPPINE NATIONAL BANK

62.450

90.01

93.00

2.99

3.22%

27.560

30.62%

RLC

ROBINSONS LAND CORPORATION

13.200

21.30

23.60

2.30

9.75%

8.100

38.03%

SCC

SEMIRARA MINING CORPORATION

224.800

242.60

290.00

47.40

16.34%

17.800

7.34%

110.000

164.50

185.00

20.50

11.08%

54.500

33.13%

6.990

6.00

7.70

1.70

22.08%

(0.990)

-16.50%

14.420

16.66

21.00

4.34

20.67%

2.240

13.45%

PHIL. LONG DISTANCE TEL.

2,726.000

2,698.00

3,300.00

602.00

18.24%

(28.000)

-1.04%

URC UNIVERSAL ROBINA CORP.

51.700

86.20

73.00

13.20

-18.08%

34.500

40.02%

SECB SECURITY BANK CORPORATION

SMDC SM DEVELOPMENT CORPORATION

SMPH SM PRIME HOLDINGS, INC.

TEL

High

Buy

Hold

Sell

VLL

VISTA LAND & LIFESCAPES

3.070

5.15

5.30

0.15

2.83%

2.080

40.39%

TOP 16 GAINER'S FOR THE YEAR (JAN. 16, 2012 - JAN. 16, 2013)

Stock

Code

EEI

Security Name

EEI CORPORATION

PGOLD PUREGOLD PRICE CLUB, INC.

BPI

BANK OF THE PHILIPPINE ISLANDS

52 week

Cost / share

1/16/2012

Cost / share

1/16/2013

Target Price

(FV)

4.250

11.08

12.00

0.92

7.67%

6.830

61.64%

11.04

3.84

18.000

32.50

39.50

7.00

17.72%

14.500

44.62%

34.84

17.74

Pts. To FV

% to FV

Pts. Up / Pts.

Down

% Gain /

(Loss) from

last year

High

Low

57.800

100.00

100.00

0.00

0.00%

42.200

42.20%

103.30

57.12

MEG MEGAWORLD CORPORATION

1.850

3.18

3.65

0.47

12.88%

1.330

41.82%

3.33

1.58

VLL VISTA LAND & LIFESCAPES

URC UNIVERSAL ROBINA CORP.

3.070

5.15

5.30

0.15

2.83%

2.080

40.39%

5.21

2.97

51.700

86.20

73.00

13.20

-18.08%

34.500

40.02%

88.00

49.69

FGEN FIRST GEN CORPORATION

14.380

23.70

27.60

3.90

14.13%

9.320

39.32%

24.65

12.80

ALI

AYALA LAND, INC.

16.500

27.15

26.00

1.15

-4.42%

10.650

39.23%

27.65

16.50

FPH

FIRST PHILIPPINE HOLDINGS

61.750

100.10

125.00

24.90

19.92%

38.350

38.31%

101.20

58.50

RLC

ROBINSONS LAND CORPORATION

13.200

21.30

23.60

2.30

9.75%

8.100

38.03%

22.60

12.94

AGI

ALLIANCE GLOBAL GROUP, INC.

10.980

17.34

20.57

3.23

15.70%

6.360

36.68%

17.72

10.24

21.200

33.45

34.50

1.05

3.04%

12.250

36.62%

33.90

20.55

340.000

522.00

568.00

46.00

8.10%

182.000

34.87%

557.00

340.00

110.000

164.50

185.00

20.50

11.08%

54.500

33.13%

168.58

104.83

1.130

1.63

1.90

0.27

14.21%

0.500

30.67%

1.66

1.10

73.800

105.80

130.00

24.20

18.62%

32.000

30.25%

108.00

73.80

MWC MANILA WATER COMPANY, INC.

AC

AYALA CORPORATION

SECB SECURITY BANK CORPORATION

FLI

FILINVEST LAND, INC.

MBT

METROPOLITAN BANK & TRUST

MPI

METRO PACIFIC INVESTMENTS

3.670

4.97

5.50

0.53

9.64%

1.300

26.16%

5.17

3.48

ICT

INT'L CONTAINER TERMINALS

56.500

75.30

69.80

5.50

-7.88%

18.800

24.97%

78.00

54.00

BDO

BDO UNIBANK, INC.

58.100

75.40

95.00

19.60

20.63%

17.300

22.94%

77.70

51.69

JFC

JOLLIBEE FOODS CORP.

89.200

108.50

123.00

14.50

11.79%

19.300

17.79%

118.85

88.15

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Investment GuideDocument2 pagesInvestment Guidegundam busterNo ratings yet

- InvestmentGuide PDFDocument2 pagesInvestmentGuide PDFMon CuiNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideMichael MontinolaNo ratings yet

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeNo ratings yet

- Banks and Financials: As Of: 8/4/2017Document2 pagesBanks and Financials: As Of: 8/4/2017mitchNo ratings yet

- Banks and Financials: As Of: 04/24/2020Document2 pagesBanks and Financials: As Of: 04/24/2020Brylle AsuncionNo ratings yet

- Margin PDFDocument5 pagesMargin PDFSandeep OakNo ratings yet

- Daily Stock Watch: FridayDocument9 pagesDaily Stock Watch: FridayRandora LkNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideJustGentleNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Banks and Financials: As Of: 2/2/2018Document2 pagesBanks and Financials: As Of: 2/2/2018JanNo ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Share Prices 30 Sep 2011Document7 pagesShare Prices 30 Sep 2011Vincent RugutNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Trustee Securities LTD.: Investors Portfolio StatementDocument1 pageTrustee Securities LTD.: Investors Portfolio StatementMoin KhanNo ratings yet

- Bond Portfolio OptimizationAug.2019 For StudentsDocument60 pagesBond Portfolio OptimizationAug.2019 For StudentsMrunalNo ratings yet

- Atlas Honda LimitedDocument9 pagesAtlas Honda LimitedUnza TabassumNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Investment GuideDocument2 pagesInvestment GuidendNo ratings yet

- 1Document617 pages1Nelz CayabyabNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- An Inquiry: Company Stock Analysis and Recommendation: Analysis By: Dhenzel M. AntonioDocument18 pagesAn Inquiry: Company Stock Analysis and Recommendation: Analysis By: Dhenzel M. AntonioDhenzel AntonioNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Portfolio Report 2010Document13 pagesPortfolio Report 2010ASP420No ratings yet

- Stock Market: Presented By:-Dev Ranjan Diwakar 10DM112 PGDM Sec-BDocument28 pagesStock Market: Presented By:-Dev Ranjan Diwakar 10DM112 PGDM Sec-BDev R. DiwakarNo ratings yet

- Indianivesh Securities LTD.: F&O MarginDocument4 pagesIndianivesh Securities LTD.: F&O MarginsrirubanNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Dec 2011Document4 pagesDec 2011Abdur Rafe Al-AwlakiNo ratings yet

- Movement of Stock MarketDocument26 pagesMovement of Stock MarketAlok AgarwalNo ratings yet

- NSE DERV Contract Margin Applicable As On 26apr2012Document5 pagesNSE DERV Contract Margin Applicable As On 26apr2012Prakash N NallaNo ratings yet

- Shares at Discount With Good RoreDocument17 pagesShares at Discount With Good Roreapi-230818227No ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- BankersBall Compensation Report 2007 2008Document17 pagesBankersBall Compensation Report 2007 2008clmagnaye100% (2)

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- TT KPI Rate 1 2 3: I Ingame StatisticDocument5 pagesTT KPI Rate 1 2 3: I Ingame StatisticNguyễn Duy TùngNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- Duty Sheet October - 2020Document111 pagesDuty Sheet October - 2020jayed hasanNo ratings yet

- Duty Sheet September - 2020 - New PDFDocument111 pagesDuty Sheet September - 2020 - New PDFjayed hasanNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 28.03.2016Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 28.03.2016SriNo ratings yet

- Project Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav KaushalDocument19 pagesProject Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav Kaushalmanisha sonawaneNo ratings yet

- Ev-Ebitda Oil CompaniesDocument2 pagesEv-Ebitda Oil CompaniesArie Yetti NuramiNo ratings yet

- copy2-TAF 2016 AAB - SIMULASI UPDATED ADMIN 2016 1119 AmDocument14 pagescopy2-TAF 2016 AAB - SIMULASI UPDATED ADMIN 2016 1119 AmSendy IrawanNo ratings yet

- Daily Stock Watch 15 10 2014 PDFDocument9 pagesDaily Stock Watch 15 10 2014 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade - Update - 10 10 2014 PDFDocument4 pagesWeekly Foreign Holding & Block Trade - Update - 10 10 2014 PDFRandora LkNo ratings yet

- Portfolio Holdings: Investment SummaryDocument2 pagesPortfolio Holdings: Investment SummaryAshutosh GuptaNo ratings yet

- Sheltech Brokerage Limited: ActiveDocument1 pageSheltech Brokerage Limited: ActiveIstiak MahmudNo ratings yet

- Worldscope Full Company Report Acc LimitedDocument20 pagesWorldscope Full Company Report Acc LimitedAnkit LunawatNo ratings yet

- Case Ascend The Finnacle FinalRound 2ADocument3 pagesCase Ascend The Finnacle FinalRound 2ASAHIL BERDENo ratings yet

- Great Asian UniversityDocument15 pagesGreat Asian UniversityGhazi AnsarNo ratings yet

- BetterInvesting Weekly Stock Screen 4-20-15Document1 pageBetterInvesting Weekly Stock Screen 4-20-15BetterInvestingNo ratings yet

- Abb-2qcy2012ru 10th AugDocument12 pagesAbb-2qcy2012ru 10th AugAngel BrokingNo ratings yet

- Position of BFI Amoung Its Peers: Income Statement IDR MillDocument2 pagesPosition of BFI Amoung Its Peers: Income Statement IDR MillAhmad SaputraNo ratings yet

- Aci Mix DesignDocument9 pagesAci Mix DesignAlvaro Garnica TrujilloNo ratings yet

- VBA AutodeskDocument5 pagesVBA AutodeskjunelromeroNo ratings yet

- CASE 1: Monthly Contribution Payment of P2,000Document1 pageCASE 1: Monthly Contribution Payment of P2,000junelromeroNo ratings yet

- Nampap Membership FormDocument1 pageNampap Membership FormjunelromeroNo ratings yet

- Project TrackingDocument5 pagesProject TrackingVladimir AtanasiuNo ratings yet

- Nampap Membership FormDocument1 pageNampap Membership FormjunelromeroNo ratings yet

- Plantilla Seguimiento Projectos Earned Value ManagementDocument6 pagesPlantilla Seguimiento Projectos Earned Value ManagementEddie PalominoNo ratings yet

- List of Green CompaniesDocument21 pagesList of Green CompaniesjunelromeroNo ratings yet

- Rebar Arrangement in SlabDocument12 pagesRebar Arrangement in Slableovorig100% (2)

- VBA AutodeskDocument5 pagesVBA AutodeskjunelromeroNo ratings yet

- Basic Guide To VolleyballDocument28 pagesBasic Guide To Volleyballbasrie88No ratings yet

- VBA AutodeskDocument5 pagesVBA AutodeskjunelromeroNo ratings yet

- ChipotleDocument22 pagesChipotleChen JinghanNo ratings yet

- Godrej Industries LTD 270612Document82 pagesGodrej Industries LTD 270612Siddh001No ratings yet

- Mcdonalds EssayDocument17 pagesMcdonalds EssayUbaid KidcoNo ratings yet

- Strategic Themes in Food and Nutrition: Coronavirus Update: September 2020Document34 pagesStrategic Themes in Food and Nutrition: Coronavirus Update: September 2020Arima ChatterjeeNo ratings yet

- CoffeeDocument7 pagesCoffeeAndreea AndreeaNo ratings yet

- Introduction EntrepDocument42 pagesIntroduction Entrepisrael hapitaNo ratings yet

- Case Study Ent300Document10 pagesCase Study Ent300Ahmad Shah BullahNo ratings yet

- Whole Foods Market Case AnalysisDocument39 pagesWhole Foods Market Case AnalysisSadman Shariar BiswasNo ratings yet

- DominosDocument48 pagesDominosAaradhya Bhargava0% (1)

- Fashion GalaDocument44 pagesFashion GalaMarni MancenidoNo ratings yet

- Brochure - B2B - Trading - Globexia ProfileDocument42 pagesBrochure - B2B - Trading - Globexia ProfileGaurav GoyalNo ratings yet

- Consumer Satisfaction Towards Organic Food Products - A Study With Special Reference To Erode CityDocument7 pagesConsumer Satisfaction Towards Organic Food Products - A Study With Special Reference To Erode Cityarcherselevators100% (1)

- The Woodcutter and His Fortune (Mushkel Aasan) : Translated From GujaratiDocument8 pagesThe Woodcutter and His Fortune (Mushkel Aasan) : Translated From GujaratiGabriel Caicedo RussyNo ratings yet

- Agro Crops Peanut Crop ReportDocument3 pagesAgro Crops Peanut Crop ReportSrivatsan SeetharamanNo ratings yet

- Unit Test 6A: RefundDocument3 pagesUnit Test 6A: Refundjade16No ratings yet

- Ba 2 Final ExamDocument2 pagesBa 2 Final ExamYannie MalazarteNo ratings yet

- 104 Funny Knock Knock JokesDocument74 pages104 Funny Knock Knock Jokeskane_kane_kaneNo ratings yet

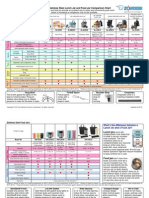

- Zojirushi Lunch Jar ChartDocument2 pagesZojirushi Lunch Jar Chartsir3liotNo ratings yet

- Strategic Marketing Plan For McDonald's 2016Document27 pagesStrategic Marketing Plan For McDonald's 2016Rizwan R. Ahmed92% (48)

- THE Foodservice IndustryDocument84 pagesTHE Foodservice IndustryMunch RoomNo ratings yet

- Commercial KitchenDocument34 pagesCommercial KitchenRohit Tangri0% (1)

- Tugas Bahasa Inggris (SOAL)Document17 pagesTugas Bahasa Inggris (SOAL)Ahmad Fauzi67% (3)

- JJ Menu No PricesDocument1 pageJJ Menu No PricesMax DrinkerNo ratings yet

- Autor - Michael Laiskonis - Recetas 2009-2010 (Inglés)Document159 pagesAutor - Michael Laiskonis - Recetas 2009-2010 (Inglés)gillliam100% (8)

- IntroductionDocument19 pagesIntroductionAnimo TonibeNo ratings yet

- Good Agriculture Practice (An Approach)Document28 pagesGood Agriculture Practice (An Approach)Robinson GultomNo ratings yet

- Obesity Concerns: Burger King'S Product RevampDocument25 pagesObesity Concerns: Burger King'S Product RevampShruti Desai100% (2)

- GK Consultant Profile PDFDocument7 pagesGK Consultant Profile PDFSatvinder Deep SinghNo ratings yet

- HR Dominos PizzaDocument27 pagesHR Dominos PizzaReece RodericNo ratings yet

- Full Project For LeoDocument50 pagesFull Project For LeoFavour Oluwafadejimi Leo-AdegunNo ratings yet