Professional Documents

Culture Documents

ACC 225 Week 3 DQ 2

Uploaded by

Praveen SudarsanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 225 Week 3 DQ 2

Uploaded by

Praveen SudarsanCopyright:

Available Formats

ACC 225 Week 3 DQ 2 Based on the information, the type of adjusting entries the Ritz Manor must have

is unearned revenue. The Ritz Manor receives a one night pay in advance for a reservation. The term unearned revenue refers to cash received in advance of providing products and services (Larson, Wild & Chiapetta, 2005, pg. 101). Also, the Vendalite Companys stocking of the vending machines is a unearned revenue. In turn, it can also be an earned revenue. As products or services are provided, the unearned revenue becomes earned revenues (Larson, Wild & Chiapetta, 2005, pg. 101).

The amounts of these adjustments are determined by how much the Ritz Manor charges for one night in advance and what they earn for the vending machines. The process of adjusting accounts involves analyzing each account balance and the transactions and events that affect to determine any needed adjustments (Larson, Wild & Chiapetta, 2005, pg. 97).

The balance sheet accounts are affected by the adjustments. Each adjusting entry affects one or more income statement accounts and one or more balance sheets accounts (but not cash) (Larson, Wild & Chiapetta, 2005, pg. 105).

Reference Larson, K.D., Wild, J.J., Chiapetta, B. (2005). Fundamental Accounting Principles. Chapter 3, pgs. 93-133. New York: McGraw-Hill Irwin.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

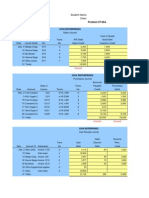

- ACC 225 Week 9 Final Project Comprehensive Problem-PerpetualDocument9 pagesACC 225 Week 9 Final Project Comprehensive Problem-PerpetualPraveen SudarsanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- ACC 225 Week 8 Assignment Internal Control and Bank ReconciliationsDocument2 pagesACC 225 Week 8 Assignment Internal Control and Bank ReconciliationsPraveen SudarsanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ACC 225 Week 8 Assignment Internal Control and Bank ReconciliationsDocument4 pagesACC 225 Week 8 Assignment Internal Control and Bank ReconciliationsPraveen SudarsanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ACC 225 Week 8 CheckPoint Internal Control and Bank ReconciliationsDocument2 pagesACC 225 Week 8 CheckPoint Internal Control and Bank ReconciliationsPraveen SudarsanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ACC 225 Week 7 CheckPoint Accounting Information Systems and Special JournalsDocument3 pagesACC 225 Week 7 CheckPoint Accounting Information Systems and Special JournalsPraveen SudarsanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- ACC 225 Week 7 Quick Study Questions QS 7-1 and QS 7-3Document1 pageACC 225 Week 7 Quick Study Questions QS 7-1 and QS 7-3Praveen SudarsanNo ratings yet

- ACC 225 Week 6 Problem 6-6B Problem 6-7BDocument3 pagesACC 225 Week 6 Problem 6-6B Problem 6-7BPraveen SudarsanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ACC 225 Week 5 DQ 2Document1 pageACC 225 Week 5 DQ 2Praveen SudarsanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ACC 225 Week 6 Problem 6-1ADocument6 pagesACC 225 Week 6 Problem 6-1APraveen SudarsanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- ACC 225 Week 6 Problem 5-4ADocument2 pagesACC 225 Week 6 Problem 5-4APraveen SudarsanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- ACC 225 Week 5 CheckPoint Inventory Systems and Calculating Revenues, Expenses, and IncomeDocument3 pagesACC 225 Week 5 CheckPoint Inventory Systems and Calculating Revenues, Expenses, and IncomePraveen SudarsanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- ACC 225 Week 6 CheckPoint Computing Inventory Balances and Lower of Cost or MarketDocument6 pagesACC 225 Week 6 CheckPoint Computing Inventory Balances and Lower of Cost or MarketPraveen SudarsanNo ratings yet

- ACC 225 Week 4 CheckPoint Preparing Balance Sheets and StatementsDocument4 pagesACC 225 Week 4 CheckPoint Preparing Balance Sheets and StatementsPraveen SudarsanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- ACC 225 Week 3 DQ 1Document1 pageACC 225 Week 3 DQ 1Praveen SudarsanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ACC 225 Week 2 CheckPoint Debits and CreditsDocument2 pagesACC 225 Week 2 CheckPoint Debits and CreditsPraveen SudarsanNo ratings yet

- BUS 475 Integrated Business Topics Strategic Plan, Part II SWOTT AnalysisDocument10 pagesBUS 475 Integrated Business Topics Strategic Plan, Part II SWOTT AnalysisPraveen Sudarsan100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ACC 225 Week 1 Exercises Accounting and Business OrganizationsDocument1 pageACC 225 Week 1 Exercises Accounting and Business OrganizationsPraveen SudarsanNo ratings yet

- BUS 475 Final Exam PostDocument19 pagesBUS 475 Final Exam PostPraveen Sudarsan100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- ACC 225 Week 2 Assignment Preparing Journal Entries and Trial BalancesDocument6 pagesACC 225 Week 2 Assignment Preparing Journal Entries and Trial BalancesPraveen SudarsanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingDocument2 pagesACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingPraveen SudarsanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- BUS 475 Week 5 Final Strategic Plan and PresentationDocument5 pagesBUS 475 Week 5 Final Strategic Plan and PresentationPraveen SudarsanNo ratings yet

- Rjet Task 5 Cfo-Ceo ReportsDocument11 pagesRjet Task 5 Cfo-Ceo ReportsPraveen Sudarsan100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)