Professional Documents

Culture Documents

The Philippine Stock Exchange, Inc Daily Quotations Report May 27, 2013

Uploaded by

srichardequipOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report May 27, 2013

Uploaded by

srichardequipCopyright:

Available Formats

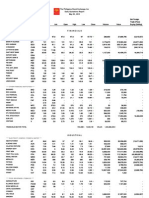

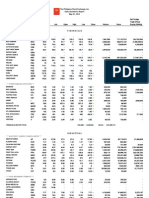

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIA UNITED

AUB

97.15

97.5

98.6

98.8

97

97.5

608,420

59,207,790.5

(13,655,199.5)

ASIATRUST

BANK PH ISLANDS

ASIA

BPI

100.9

101

101.7

102

100.6

101

5,913,800

597,562,006

(138,425,509)

BDO UNIBANK

BDO

91

91.5

93.85

93.85

90.2

91

4,628,960

423,655,109.5

(183,219,528)

CHINABANK

CHIB

74.5

74.65

76.5

76.5

74

74.5

84,120

6,281,238.5

686,560

CITYSTATE BANK

CSB

11.52

11.96

11.98

11.98

11.52

11.52

2,600

29,998

EAST WEST BANK

EW

35.5

35.65

35.55

35.7

35.05

35.65

1,574,900

55,902,445

31,015,455

EXPORT BANK

129.4

129.5

133.7

133.7

129.2

129.5

METROBANK

EIBA

EIBB

MBT

3,329,870

433,071,582

(135,199,178)

PB BANK

PBB

32.65

32.7

33.05

33.05

32.5

32.65

371,600

12,154,590

(2,694,910)

PBCOM

PBC

PNB

73

102.6

77.55

104

104.5

105

102.5

104

536,810

55,613,605

14,434,102

PTC

PSB

72

135

139

137

140.9

135

139

PSBANK

33,600

4,602,603

RCBC

RCB

67

68

70

70

66.7

67

1,322,170

89,203,777.5

(38,658,828.5)

SECURITY BANK

SECB

183.2

183.5

184.3

185

183

183.5

275,190

50,497,241

(2,980,220)

UNION BANK

UBP

144

144.2

147.5

147.5

144

144

49,570

7,154,248

522,246

BKD

BLFI

1.27

2.03

1.32

2.08

1.34

2.08

1.34

2.08

1.25

2.02

1.32

2.02

538,000

60,000

687,590

122,640

COL

FFI

20

21.1

20.35

22

20

21.6

20

21.6

19.9

21.1

20

21.1

515,700

8,800

10,313,990

187,980

FAF

I

0.79

2.7

0.86

2.85

0.8

2.75

0.8

2.85

0.8

2.75

0.8

2.76

115,000

32,000

92,000

88,300

MFC

MAKE

560

31.55

570

32

32.05

32.05

31.5

32

5,700

180,915

NTL REINSURANCE

MED

NRCP

0.415

-

0.42

-

0.42

1.86

0.42

1.86

0.415

1.83

0.42

1.83

1,030,000

7,000

430,950

12,840

(210,000)

-

PHIL STOCK EXCH

PSE

474

476

479

479

474

474

11,440

5,425,694

380,700

SUN LIFE

SLF

1,060

1,081

1,060

1,084

1,060

1,084

25

26,740

VANTAGE

2.73

2.74

2.76

2.79

2.74

2.74

18,000

49,540

VOLUME :

21,073,275

EXPORT BANK B

PHIL NATL BANK

PHILTRUST

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BDO LEASING

COL FINANCIAL

FILIPINO FUND

FIRST ABACUS

IREMIT

MANULIFE

MAYBANK ATR KE

MEDCO HLDG

FINANCIALS SECTOR TOTAL

VALUE :

1,812,555,413

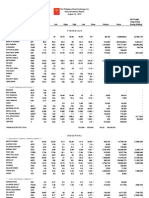

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

36.6

36.9

37.1

37.1

36.2

36.9

2,180,200

79,835,525

(16,854,970)

ALSONS CONS

ACR

1.38

1.41

1.4

1.41

1.37

1.41

1,481,000

2,046,810

CALAPAN VENTURE

H2O

7.26

7.9

7.8

8.18

7.26

7.9

11,100

84,406

ENERGY DEVT

EDC

5.89

5.9

6.06

6.07

5.82

5.89

25,262,300

148,699,956

(64,729,872)

FIRST GEN

FGEN

22.3

22.85

22.95

23.05

22.15

22.3

2,245,500

51,077,515

13,397,525

FIRST PHIL HLDG

MANILA WATER

FPH

MWC

101.9

40.45

102

40.6

102

40.9

103

40.9

101.2

40.1

102

40.6

546,740

873,800

55,635,627

35,361,055

3,334,588

13,711,780

MERALCO

MER

383

385

388

388

380.8

385

578,660

221,946,134

91,186,790

PETRON

PCOR

15.2

15.24

15.74

15.9

15.2

15.24

5,600,300

86,710,410

(48,440,228)

PHOENIX

PNX

7.25

7.27

7.48

7.48

7.25

7.27

311,000

2,279,942

(1,390,678)

SALCON POWER

SPC

5.15

5.31

5.15

5.15

5.15

5.15

9,200

47,380

(24,205)

TRANS ASIA

TA

2.49

2.5

2.56

2.58

2.45

2.5

23,820,000

59,336,570

(7,568,100)

VIVANT

VVT

10.02

10.98

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

6.56

6.68

6.56

6.6

6.56

6.6

4,300

28,332

ALLIANCE SELECT

FOOD

1.81

1.83

1.87

1.87

1.82

1.82

927,000

1,703,170

220,200

BOGO MEDELLIN

BMM

53.8

58

58

58

58

58

100

5,800

CNTRL AZUCARERA

CAT

CBC

DNL

8.1

8.11

8.22

8.22

8.1

6,483,500

52,408,779

7,678,030

GSMI

JFC

16.22

136

16.78

137

16.22

140

16.8

140

16.22

135.2

16.22

136

1,200

552,980

19,522

75,404,859

(24,681,113)

LFM

LTG

47.05

25.45

25.55

25.85

26.05

25.45

25.55

3,747,300

96,142,110

53,351,630

PCKH

PIP

12

6.08

12.3

6.09

6.15

6.15

6.06

6.08

2,494,000

15,164,201

249,409

PF

RFM

274

5.38

275

5.42

275

5.62

275

5.62

274

5.34

275

5.38

165,900

1,124,000

45,587,704

6,087,043

14,486,854

562,495

ROXAS HLDG

RCI

ROX

2.28

2.98

2.35

3.1

2.93

2.98

2.93

2.98

40,000

118,200

SAN MIGUEL CORP

SMC

108.4

108.9

113.6

113.6

107.9

108.9

2,618,550

285,873,353

(102,543,425)

SWIFT FOODS

SFI

0.137

0.14

0.14

0.14

0.138

0.138

3,300,000

457,920

138,000

COSMOS

DNL INDUS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

LT GROUP

PANCAKE

PEPSI COLA

PUREFOODS

RFM CORP

ROXAS AND CO

UNIV ROBINA

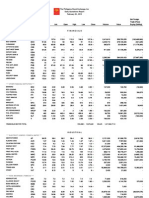

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

URC

118.5

118.6

122.4

122.4

118.1

118.5

2,344,960

279,359,040

(162,465,946)

VICTORIAS

VMC

2.02

2.05

2.09

2.09

1.99

2.02

6,450,000

13,071,000

VITARICH

VITA

0.91

0.92

0.92

0.92

0.91

0.91

2,472,000

2,261,120

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

19

19.58

19.6

19.66

18.1

19.58

33,600

620,968

CONCRETE A

CA

CAB

EEI

45.05

15

14.96

50

15

15.22

15.22

14.9

15

782,100

11,722,988

6,763,046

7

15.1

8.7

15.2

15.8

15.8

15.1

15.2

340,200

5,149,172

1,520,500

11.62

11.64

11.64

11.64

11.36

11.62

2,360,100

27,191,108

(8,456,400)

1.7

1.79

2.2

2.29

1.6

1.79

2,902,000

5,334,550

60,300

CONCRETE B

EEI CORP

FED CHEMICALS

HOLCIM

FED

HLCM

LAFARGE REP

LRI

MARIWASA

MMI

MEGAWIDE

MWIDE

20.5

20.6

20.5

20.5

20

20.5

1,074,600

21,737,550

12,768,595

PHINMA

PHN

14.2

14.9

14.4

14.4

14.2

14.2

5,100

72,500

PNCC

PNC

CMT

SEACEM

SUPERCITY

TKC STEEL

SRDC

T

1.2

2.69

2.74

2.8

2.8

2.69

2.74

275,000

746,260

VULCAN INDL

VUL

1.97

1.98

2.01

1.94

1.96

5,018,000

9,903,470

(9,750)

2.9

2.9

65,000

196,360

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

CIP

COAT

73.25

2.96

115

3

3.05

3.05

EUROMED

EURO

1.78

1.85

1.9

1.9

1.8

1.85

22,000

40,950

LMG CHEMICALS

LMG

MVC

MCP

2.26

1.63

11.68

2.27

2.3

11.7

2.3

12.28

2.4

12.28

2.27

11.3

2.27

11.68

82,000

5,748,000

186,880

67,456,016

3,000

4,644,724

15.46

0.016

3.57

16.9

0.017

3.62

16

0.017

3.6

16.9

0.017

3.6

16

0.016

3.55

16.9

0.017

3.57

32,200

34,800,000

47,000

534,014

590,000

168,520

32,300

-

0.61

0.62

0.64

0.64

0.61

0.61

1,255,000

779,110

5.5

5.99

5.99

5.99

5.99

5.99

100

599

15.02

17.48

15.5

15.5

15

15.02

6,200

93,714

(53,120)

1.92

1.97

1.97

1.97

1.89

1.96

280,000

546,550

(15,760)

MABUHAY VINYL

MELCO CROWN

METROALLIANCE A

METROALLIANCE B

PRYCE CORP

MAH

MAHB

PPC

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

INTEGRATED MICR

CHIPS

GREEN

IMI

IONICS

ION

PANASONIC

PMPC

GREENERGY

**** OTHER INDUSTRIALS ****

ALPHALAND

ALPHA

FILSYN A

SPLASH CORP

FYN

FYNB

PCP

SPH

STENIEL

STN

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

151,681,970

VALUE :

1,843,554,941.5

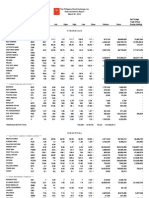

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS CONS

ABOITIZ EQUITY

ABA

AEV

0.64

53.9

0.65

54.3

0.66

56.45

0.66

56.45

0.64

53.8

0.64

54.3

807,000

1,968,510

516,520

107,104,663

(42,137,369.5)

ALLIANCE GLOBAL

AGI

25.45

25.5

26.55

26.55

25.45

25.5

30,904,600

790,314,750

231,911,390

ANGLO PHIL HLDG

APO

2.21

2.22

2.25

2.25

2.21

2.21

508,000

1,134,710

ANSCOR

ANS

6.9

6.95

6.92

7.04

6.9

6.9

47,200

325,920

ASIA AMLGMATED

AAA

4.22

4.5

4.25

4.28

4.22

4.22

39,000

165,300

ATN HLDG A

ATN

1.28

1.33

1.3

1.3

1.3

1.3

89,000

115,700

ATN HLDG B

ATNB

1.21

1.3

1.22

1.22

1.2

1.2

20,000

24,320

4,800

AYALA CORP

AC

650.5

651

664

664

649

651

706,910

460,195,005

(136,271,045)

BHI HLDG

COSCO CAPITAL

BH

COSCO

550

14.72

800

14.78

15.52

15.52

14.72

14.72

9,365,700

141,151,418

(6,889,388)

DMCI HLDG

DMC

56.8

56.9

57.2

57.2

56.5

56.9

747,150

42,512,541

9,164,759

FIL ESTATE CORP

FILINVEST DEV

FC

FDC

6.3

6.34

6.4

6.6

6.34

6.34

555,700

3,532,530

(208,740)

FJ PRINCE A

FJP

3.14

3.49

3.1

3.14

3.1

3.14

4,000

12,520

FJ PRINCE B

GT CAPITAL

FJPB

FPI

GTCAP

3.12

0.201

840

3.99

0.225

846

841.5

846

829

846

106,570

89,146,595

12,182,465

HOUSE OF INV

HI

8.53

8.59

8.7

8.7

8.6

8.6

1,054,300

9,128,434

4,372,750

JG SUMMIT

JGS

46.2

46.25

47

47

46

46.25

1,409,400

65,256,670

(28,478,255)

JOLLIVILLE HLDG

JOH

KPH

6.92

5.03

7.8

5.65

5.03

5.65

5.03

5.65

400

2,074

LODESTAR

KPHB

LIHC

5.2

0.75

5.6

0.8

0.8

0.8

0.8

0.8

1,000

800

LOPEZ HLDG

LPZ

6.19

6.2

6.45

6.45

6.12

6.19

3,068,400

19,111,189

1,021,555

MABUHAY HLDG

MHC

0.59

0.64

0.64

0.64

0.6

0.64

470,000

285,500

(242,700)

FORUM PACIFIC

KEPPEL HLDG A

KEPPEL HLDG B

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

MARCVENTURES

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MARC

MPI

1.84

6

1.85

6.01

1.86

6

1.88

6.06

1.82

5.89

1.84

6

1,052,000

44,270,300

1,942,730

265,255,163

63,409,034

MIC

MJIC

PA

PRIM

POPI

6.19

5.55

0.042

1.95

0.66

6.3

5.7

0.044

2.07

0.67

6.28

5.54

0.044

1.94

0.67

6.3

5.54

0.044

2.09

0.67

6.2

5.54

0.044

1.93

0.66

6.3

5.54

0.044

1.95

0.66

63,000

3,800

600,000

197,000

2,040,000

393,420

21,052

26,400

384,150

1,346,900

(66,500)

SINOPHIL

REG

SPM

SINO

2.5

2.04

0.355

2.8

2.18

0.365

0.37

0.37

0.36

0.36

2,690,000

976,550

96,200

SM INVESTMENTS

SM

1,155

1,160

1,192

1,192

1,148

1,155

352,085

406,892,615

(212,369,805)

SOLID GROUP

SGI

2.01

2.02

2.1

2.1

2.01

2.02

2,651,000

5,394,630

SOUTH CHINA

WELLEX INDUS

SOC

SGP

UNI

WIN

1.15

312

0.232

0.235

1.19

450

0.236

0.255

0.232

0.255

0.232

0.255

0.232

0.255

0.232

0.255

10,000

10,000

2,320

2,550

ZEUS HLDG

ZHI

0.375

0.39

0.39

0.39

0.375

0.375

310,000

117,650

VOLUME :

106,124,575

METRO PAC INV

MINERALES IND

MJC INVESTMENTS

PACIFICA

PRIME MEDIA

PRIME ORION

REPUBLIC GLASS

SEAFRONT RES

SYNERGY GRID

UNIOIL HLDG

HOLDING FIRMS SECTOR TOTAL

VALUE :

2,414,121,839

PROPERTY

**** PROPERTY ****

A BROWN

ANCHOR LAND

BRN

ALHI

2.31

23

2.39

24.15

2.39

23

2.4

23

2.38

23

2.4

23

207,000

200

494,300

4,600

ARANETA PROP

ARA

1.61

1.65

1.64

1.65

1.6

1.61

581,000

940,630

ARTHALAND CORP

AYALA LAND

ALCO

ALI

0.21

33.55

0.22

33.6

34

34.3

33.1

33.55

13,862,500

464,935,015

(235,988,745)

BELLE CORP

BEL

6.33

6.36

6.5

6.5

6.32

6.36

2,553,000

16,277,843

2,341,433

CEBU HLDG

CHI

6.25

6.29

6.05

6.3

6.05

6.25

264,600

1,642,236

1,243,771

CEBU PROP A

CENTURY PROP

CPV

CPVB

CPG

4.61

4.6

2.06

6

2.07

2.13

2.14

2.06

2.07

6,912,000

14,413,420

(2,306,910)

CITY AND LAND

LAND

2.36

2.48

2.48

2.48

2.48

2.48

1,000

2,480

CITYLAND DEVT

CDC

CEI

1.16

1.19

0.073

0.078

0.073

0.073

0.073

0.073

450,000

32,850

610,000

19,985,000

403,800

20,694,960

13,004,620

CEBU PROP B

CROWN EQUITIES

CYBER BAY

EMPIRE EAST

CYBR

ELI

0.66

1.03

0.68

1.04

0.67

1.06

0.68

1.06

0.66

1.02

0.68

1.03

EVER GOTESCO

EVER

0.31

0.32

0.315

0.315

0.29

0.31

9,230,000

2,824,450

(894,750)

FILINVEST LAND

FLI

1.96

1.97

2.07

2.09

1.96

1.96

34,974,000

69,867,230

(37,079,040)

GLOBAL ESTATE

GERI

2.1

2.11

2.24

2.24

2.08

2.1

7,099,000

14,937,870

2,413,420

GOTESCO LAND A

HIGHLANDS PRIME

GO

GOB

HP

2.3

2.49

2.49

2.49

2.49

2.49

1,000

2,490

IRC PROP

IRC

1.25

1.28

1.27

1.27

1.25

1.25

342,000

429,000

KEPPEL PROP

KEP

2.9

3.5

2.9

2.9

2.9

2.9

2,000

5,800

MARSTEEL A

MEGAWORLD

MC

MCB

MEG

3.89

3.9

4.04

4.04

3.88

3.9

80,587,000

315,956,280

11,855,930

MRC ALLIED

MRC

0.112

0.114

0.114

0.114

0.112

0.114

3,720,000

419,810

PHIL ESTATES

PHES

0.51

0.54

0.53

0.54

0.51

0.54

1,790,000

925,260

PHIL REALTY

RLT

0.51

0.52

0.52

0.52

0.52

0.52

670,000

348,400

PHIL TOBACCO

ROCKWELL

TFC

PMT

PRMX

RLC

ROCK

19

2.66

24.55

2.75

33.3

3.9

24.7

2.84

24.8

2.9

24.8

2.92

24.15

2.7

24.7

2.84

3,384,500

4,419,000

83,557,360

12,505,220

58,988,840

7,915,140

SHANG PROP

SHNG

3.75

3.76

3.77

3.78

3.75

3.75

60,000

225,840

131,750

SM DEVT

SMDC

7.98

7.99

8.22

8.22

7.96

7.99

2,847,700

22,849,344

(4,676,111)

SM PRIME HLDG

SMPH

20.15

20.35

21.25

21.3

20.1

20.15

13,526,500

275,624,795

(165,354,540)

STA LUCIA LAND

SLI

0.72

0.73

0.72

0.74

0.71

0.73

3,626,000

2,593,670

STARMALLS

STR

3.71

3.93

3.9

3.94

3.9

3.94

21,000

82,240

SUNTRUST HOME

SUN

0.61

0.62

0.62

0.63

0.61

0.62

831,000

512,590

(122,000)

UNIWIDE HLDG

UW

VLL

6.35

6.4

6.54

6.69

6.33

6.4

7,437,300

48,032,097

(27,515,509)

GOTESCO LAND B

MARSTEEL B

PRIMETOWN PROP

PRIMEX CORP

ROBINSONS LAND

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

220,301,300

VALUE :

1,372,408,680

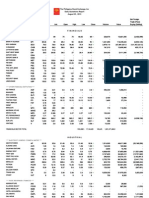

SERVICES

**** MEDIA ****

ABS CBN

ABS

GMA NETWORK

GMA7

MANILA BULLETIN

MB

MLA BRDCASTING

MBC

**** TELCOMMUNICATION ****

43.2

43.4

44.7

44.7

43.2

43.2

69,300

3,025,240

9.3

9.32

9.42

9.46

9.3

9.3

191,200

1,783,741

0.76

0.78

0.78

0.78

0.76

0.76

13,000

10,080

3.6

4.9

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

GLOBE TELECOM

LIBERTY TELECOM

Symbol

GLO

Bid

1,546

Ask

1,547

Open

High

1,550

1,552

Low

1,545

Close

1,547

Volume

68,385

Value

105,779,320

Net Foreign

Trade (Peso)

Buying (Selling)

14,933,030

PLDT

LIB

TEL

2.26

3,152

2.4

3,158

2.25

3,178

2.4

3,178

2.24

3,130

2.4

3,152

29,000

81,605

65,380

257,044,660

(86,157,890)

PTT CORP

PTT

4.15

4.6

22

8

4.2

5.99

50

8.14

5

8.38

5

8.38

5

7.8

5

8.14

15,000

62,800

75,000

501,647

IS

ISM

MG

0.051

2.26

0.52

0.053

2.38

0.53

0.051

0.52

0.051

0.53

0.051

0.52

0.051

0.52

500,000

611,000

25,500

317,730

PHILWEB

NXT

WEB

15.6

15.7

15.4

15.7

15.2

15.7

4,425,600

68,573,548

12,951,038

TOUCH SOLUTIONS

TSI

18.88

18.96

19.5

19.52

18.4

18.96

123,300

2,335,702

TRANSPACIFIC BR

TBGI

YEHEY

2.33

1.36

2.49

1.39

1.37

1.37

1.36

1.36

44,000

60,080

32,880

CEBU AIR

2GO

ATI

CEB

1.76

13

77.2

1.89

13.68

77.95

1.76

13

79.6

1.76

13

79.6

1.76

13

77.6

1.76

13

77.95

36,000

2,900

243,790

63,360

37,700

19,006,695.5

13,570,370.5

INTL CONTAINER

ICT

92.5

92.55

93.65

93.65

91.1

92.5

1,519,480

140,099,748

(4,556,261)

LORENZO SHIPPNG

MACROASIA

LSC

MAC

1.37

2.3

1.65

2.55

2.3

2.3

2.3

2.3

7,000

16,100

PAL HLDG

PAL

**** INFORMATION TECHNOLOGY ****

DFNN INC

IMPERIAL A

IMPERIAL B

IP CONVERGE

ISLAND INFO

ISM COMM

MG HLDG

NEXTSTAGE

YEHEY CORP

DFNN

IMP

IMPB

CLOUD

**** TRANSPORTATION SERVICES ****

2GO GROUP

ASIAN TERMINALS

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.22

1.27

1.24

1.29

1.22

1.28

306,000

380,200

BOULEVARD HLDG

BHI

0.161

0.162

0.173

0.174

0.162

0.162

67,110,000

11,129,110

GRAND PLAZA

GPH

WPI

33.1

0.38

45

0.4

0.4

0.4

0.385

0.395

580,000

226,400

CEU

FEU

IPO

10.98

1,155

11.5

11.7

1,280

11.9

BCOR

BLOOM

20.5

12.36

22

12.46

13.04

13.04

12.32

12.36

3,792,600

47,424,182

(12,930,848)

0.02

7.71

0.02

7.78

0.02

7.69

0.02

7.7

43,000,000

433,400

860,000

3,339,383

(88,000)

230,700

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

FAR EASTERN U

IPEOPLE

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

IP EGAME

LEISURE AND RES

EG

LR

0.02

7.69

0.021

7.7

MANILA JOCKEY

MJC

2.31

2.35

2.5

2.5

2.35

2.35

61,000

143,500

PACIFIC ONLINE

LOTO

14.8

15

14.9

14.9

14.8

14.8

5,500

81,500

PHIL RACING

PRC

9.5

9.96

9.3

9.96

9.3

9.51

14,200

135,139

PRMIERE HORIZON

PHA

0.33

0.34

0.33

0.34

0.33

0.335

1,180,000

392,800

CALATA CORP

CAL

3.95

4.1

4.1

3.95

297,000

1,190,540

PHIL SEVEN CORP

SEVN

91.1

94.95

90.05

94.95

90

94.95

1,340

120,764.5

1,800.5

PUREGOLD

PGOLD

39.5

39.6

39.85

39.9

38.95

39.5

2,459,000

97,034,600

38,548,200

APC GROUP

APC

0.82

0.83

0.82

0.84

0.81

0.82

4,276,000

3,501,040

(332,000)

EASYCALL

ICTV INC

ECP

PORT

ICTV

2.88

6.44

0.405

3

15.08

0.415

0.415

0.415

0.415

0.415

180,000

74,700

33,200

PAXYS

PAX

2.24

2.39

2.24

2.25

2.23

2.25

76,000

170,230

PHILCOMSAT

PHC

STI

0.95

0.96

0.97

0.98

0.95

0.95

12,730,000

12,153,060

2,519,140

**** RETAIL ****

**** OTHER SERVICES ****

GLOBALPORT

STI HLDG

SERVICES SECTOR TOTAL

VOLUME :

158,061,200

VALUE :

965,008,355

MINING & OIL

**** MINING ****

ABRA MINING

AR

APEX MINING A

APX

APEX MINING B

APXB

AT

ATLAS MINING

ATOK

BENGUET A

BENGUET B

AB

BC

BCB

0.0041

0.0043

0.0043

0.0043

0.0042

0.0042

31,000,000

130,700

3.75

3.85

3.89

3.89

3.8

3.8

28,000

107,250

3.7

18.06

4.2

18.1

18.5

18.54

18.1

18.1

718,200

13,141,316

(3,610,754)

17.5

13.8

14

20

14.24

14.38

20

14.1

20

14.1

20

14

20

14

200

5,000

4,000

70,440

(4,000)

-

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

CENTURY PEAK

CPM

0.97

0.99

0.97

0.97

584,000

576,740

COAL ASIA HLDG

COAL

1.01

1.02

1.02

1.04

1.01

2,600,000

2,632,160

DIZON MINES

DIZ

7.25

7.5

7.45

7.8

7.28

7.36

32,300

238,376

GEOGRACE

0.48

0.56

0.49

0.58

0.495

0.62

0.495

0.62

0.495

0.56

0.495

0.56

20,000

9,900

LEPANTO A

GEO

LC

29,168,000

17,085,060

LEPANTO B

LCB

0.58

0.59

0.67

0.67

0.57

0.58

120,031,000

68,977,230

59,550

MANILA MINING A

MA

0.04

0.041

0.046

0.046

0.04

0.041

180,300,000

7,572,500

MANILA MINING B

MAB

0.04

0.041

0.045

0.045

0.04

0.04

109,800,000

4,619,700

204,000

NICKEL ASIA

NIKL

20.1

20.2

20.8

20.8

20.1

20.1

1,029,100

21,113,850

344,305

NIHAO

NI

2.93

2.95

3.02

2.9

2.95

597,000

1,753,050

(11,780)

OMICO CORP

OM

0.55

0.58

0.55

0.55

0.55

0.55

510,000

280,500

43,450

ORNTL PENINSULA

ORE

2.28

2.35

2.4

2.4

2.29

2.3

2,494,000

5,840,940

PHILEX

PX

13.48

13.5

13.7

13.7

13.38

13.5

1,492,800

20,172,288

(136,710)

SEMIRARA MINING

SCC

279.8

280

283

283

276

280

264,330

73,976,250

(37,861,920)

UNITED PARAGON

UPM

0.014

0.015

0.015

0.015

0.015

0.015

58,000,000

870,000

ORIENTAL A

BSC

OPM

0.265

0.023

0.27

0.024

0.265

0.024

0.265

0.025

0.265

0.023

0.265

0.024

1,430,000

326,200,000

378,950

7,729,100

ORIENTAL B

OPMB

0.024

0.025

0.024

0.025

0.024

0.025

45,000,000

1,080,300

616,800

PETROENERGY

PERC

OV

PEC

PECB

PXP

6.7

0.043

19.02

6.75

0.044

19.6

6.7

0.043

19.6

6.7

0.044

20

6.7

0.042

18.9

6.7

0.043

19.02

1,100

232,500,000

-

7,370

9,990,000

-

2,446,200

-

54,500

1,039,972

(188,242)

**** OIL ****

BASIC PETROLEUM

PHILODRILL

PNOC A

PNOC B

PX PETROLEUM

MINING AND OIL SECTOR TOTAL

VOLUME :

1,143,859,530

VALUE :

259,397,942

PREFERRED

ABC PREF

ABC

ACPA

ACPR

DMCP

FGENF

FGENG

520

113.5

115

521

115.5

521

114.2

521

115.9

521

114.2

521

115.9

2,550

5,210

1,328,550

599,050

FPHP

PPREF

PFP

110.4

1,052

110.9

1,055

1,051

1,055

1,051

1,052

1,210

1,272,550

SMC PREF 2A

SFIP

SMCP1

SMC2A

1.26

79

1.45

79.8

79.95

79.95

79

79.8

898,790

71,611,797

(39,574,707)

SMC PREF 2B

SMC2B

80.1

81.95

80.05

80.05

80.05

80.05

500

40,025

SMC PREF 2C

SMC2C

83.5

83.7

83.75

83.75

83.5

83.7

2,470

206,757.5

(64,487.5)

BC PREF A

BCP

ABSP

15.82

45

45.05

45.8

45.8

44.5

45.05

ABS HLDG PDR

1,516,800

68,402,005

4,125,300

GMA HLDG PDR

GMAP

9.95

9.98

10

10

9.81

9.91

11,999,000

119,427,970

15,612,070

GLO PREF A

GLOPA

TLHH

7.5

-

746,400

120,400

AC PREF A

AC PREF B

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

PCOR PREF

PF PREF

SFI PREF

SMC PREF 1

TEL PREF HH

PREFERRED TOTAL

VOLUME :

14,426,530

VALUE :

262,888,704.5

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRC WARRANT

MEG WARRANT 2

IRW

MEGW1

MEGW2

PLDT USD

DTEL

MEG WARRANT

0.05

2.81

2.8

2.85

3.1

2.84

2.8

2.85

2.8

2.82

2.8

2.85

2.8

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

264,000

43,000

VOLUME :

307,000

VALUE :

866,800

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

RPL

8.14

8.18

8.35

8.35

8.18

8.18

3,500

29,001

MAKATI FINANCE

MFIN

3.02

4.5

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

3,500

1,801,105,350

VALUE :

VALUE :

29,001

8,667,076,171.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

NO. OF ADVANCES:

23

NO. OF DECLINES:

149

NO. OF UNCHANGED:

36

NO. OF TRADED ISSUES: 208

NO. OF TRADES:

35987

BLOCK SALES

SECURITY

PRICE

URC

122.2464

ALI

34.8021

ALI

34.7772

SM

1,191.8781

EDC

6.15

LTG

25.8104

MCP

12.75

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

188,470

4,398,700

2,033,600

25,705

3,456,700

2,443,500

2,295,700

VALUE

23,039,779.008

153,083,997.27

70,722,913.92

30,637,223.99

21,258,705

63,067,712.4

29,270,175

908,460

135,285.67

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

170,698,532

1,923,317,892.59

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

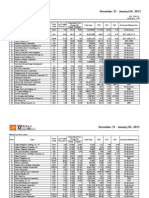

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,849.03

10,857.42

6,555.1

3,028.72

2,121.42

17,033.46

7,270.29

4,465.82

1,849.89

10,857.42

6,555.1

3,028.72

2,125.68

17,102.75

7,270.29

4,465.82

1,807.52

10,592.29

6,370.49

2,919.01

2,090.47

16,397.64

7,089.32

4,364.73

1,810.83

10,627.24

6,391.04

2,921.74

2,098.97

16,397.64

7,097.51

4,371.79

-2.07

-2.1

-2.46

-3.52

-1.05

-3.73

-2.36

-2.1

-38.2

-227.92

-161.25

-106.63

-22.23

-635.82

-171.4

-93.7

21,081,876

160,069,591

106,150,761

226,740,368

158,135,832

1,144,674,257

1,812,568,236.7

1,980,229,518.52

2,444,770,136.01

1,596,239,870.16

965,030,249.1

259,424,952.28

3,500

29,001

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

1,816,856,185 Php 9,058,291,963.768

Php 4,285,649,232.28

Php 5,526,565,119.09

Companies Under Suspension by the Exchange as of 05/27/2013

ACPR

- AC PREF B

ASIA

- ASIATRUST

CAT

- CNTRL AZUCARERA

CBC

- COSMOS

CMT

- SEACEM

EIBA

- EXPORT BANK

EIBB

- EXPORT BANK B

FC

- FIL ESTATE CORP

FPHP

- FPH PREF

FYN

- FILSYN A

FYNB

- FILSYN B

GO

- GOTESCO LAND A

GOB

- GOTESCO LAND B

MAH

- METROALLIANCE A

MAHB

- METROALLIANCE B

MC

- MARSTEEL A

MCB

- MARSTEEL B

NXT

- NEXTSTAGE

PAL

- PAL HLDG

PEC

- PNOC A

PECB

- PNOC B

PHC

- PHILCOMSAT

PNC

- PNCC

PCP

- PICOP RES

PMT

- PRIMETOWN PROP

PPC

- PRYCE CORP

PTT

- PTT CORP

STN

- STENIEL

UW

- UNIWIDE HLDG

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 27 , 2013

Name

Symbol

Bid

ABC

- ABC PREF

TLHH

- TEL PREF HH

SMCP1

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

The Philippine Stock Exchange, Inc.

Daily Quotations Report

May 27, 2013

CANCELLATION

Due to broker's request, the Daily Quotation Report (DQR) dated May 24, 2013 should be read as follows:

24-May-13

CANCELLATION DETAILS:

Philippine Long Distance Telephone Company

10,000 @ 3,190 = Php 31,900,000.

CURRENT

VOLUME

(in shares)

Philippine Long Distance Telephone Company (TEL)

Services Sector

Total Market

90,845

137,674,744

887,511,092

VALUE

(in Php)

288,211,050.00

897,093,363.75

7,130,048,555.52

LESS: ADJUSTMENTS

VOLUME

VALUE

(in shares)

(in Php)

10,000

10,000

10,000

31,900,000.00

31,900,000.00

31,900,000.00

ADJUSTED

VOLUME

(in shares)

80,845

137,664,744

887,501,092

VALUE

(in Php)

256,311,050.00

865,193,363.75

7,098,148,555.52

You might also like

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013srichardequipNo ratings yet

- Stockquotes 08012013Document7 pagesStockquotes 08012013srichardequipNo ratings yet

- Stockquotes 08122013Document7 pagesStockquotes 08122013srichardequipNo ratings yet

- Stockquotes 08132013Document7 pagesStockquotes 08132013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipNo ratings yet

- Stockquotes 08232013Document7 pagesStockquotes 08232013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipNo ratings yet

- Stockquotes 08222013Document7 pagesStockquotes 08222013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- Stockquotes 08162013Document7 pagesStockquotes 08162013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Selective Forex Trading: How to Achieve Over 100 Trades in a Row Without a LossFrom EverandSelective Forex Trading: How to Achieve Over 100 Trades in a Row Without a LossNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- Stockquotes 02062015Document8 pagesStockquotes 02062015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- October 2015: Sun Mon Tue Wed Thu Fri SatDocument1 pageOctober 2015: Sun Mon Tue Wed Thu Fri SatjNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNo ratings yet

- Stockquotes 04022013Document7 pagesStockquotes 04022013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- Table 1 Marriage 2011Document1 pageTable 1 Marriage 2011srichardequipNo ratings yet

- PRC AUD Prelim Wit Ans KeyDocument10 pagesPRC AUD Prelim Wit Ans KeyJeanette FormenteraNo ratings yet

- 2020 2021 Important JudgementsDocument6 pages2020 2021 Important JudgementsRidam Saini100% (1)

- The Hidden Opportunity in Container Shipping: Travel, Transport & LogisticsDocument8 pagesThe Hidden Opportunity in Container Shipping: Travel, Transport & LogisticseyaoNo ratings yet

- Blind DefenseDocument7 pagesBlind DefensehadrienNo ratings yet

- Denial of Right Warning of Arrest Intent To Lien Affidavit of Complaint Walmart GM Lee Store #2360 in Play Time Is Over The TruthDocument11 pagesDenial of Right Warning of Arrest Intent To Lien Affidavit of Complaint Walmart GM Lee Store #2360 in Play Time Is Over The Truthahmal coaxumNo ratings yet

- Wa0256.Document3 pagesWa0256.Daniela Daza HernándezNo ratings yet

- People vs. Patulot - Case DigestDocument5 pagesPeople vs. Patulot - Case DigestGendale Am-isNo ratings yet

- Comparative Analysis On Renaissance and 20th Century Modern ArchitectureDocument2 pagesComparative Analysis On Renaissance and 20th Century Modern ArchitectureJeriel CandidatoNo ratings yet

- Disbursement Register FY2010Document381 pagesDisbursement Register FY2010Stephenie TurnerNo ratings yet

- Toms River Fair Share Housing AgreementDocument120 pagesToms River Fair Share Housing AgreementRise Up Ocean CountyNo ratings yet

- Verbal Reasoning 8Document64 pagesVerbal Reasoning 8cyoung360% (1)

- Power Quality Improvement in Distribution Networks Containing DistributedDocument6 pagesPower Quality Improvement in Distribution Networks Containing DistributedsmruthiNo ratings yet

- Lesson Plan - ClimatechangeDocument7 pagesLesson Plan - ClimatechangeLikisha RaffyNo ratings yet

- Security Awareness TrainingDocument95 pagesSecurity Awareness TrainingChandra RaoNo ratings yet

- Exercise 4Document45 pagesExercise 4Neal PeterosNo ratings yet

- Tesco Vs Asda - EditedDocument15 pagesTesco Vs Asda - EditedAshley WoodNo ratings yet

- The A To Z Guide To Afghanistan Assistance 2012Document365 pagesThe A To Z Guide To Afghanistan Assistance 2012Khan MohammadNo ratings yet

- Term Paper General Principle in The Construction of StatutesDocument8 pagesTerm Paper General Principle in The Construction of StatutesRonald DalidaNo ratings yet

- Security System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Document61 pagesSecurity System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Carlos Enrique Huertas FigueroaNo ratings yet

- Business Forecasting: by ITH PhannyDocument2 pagesBusiness Forecasting: by ITH PhannysmsNo ratings yet

- South Valley: Transfer CertificateDocument2 pagesSouth Valley: Transfer CertificateNitin PatidarNo ratings yet

- Marudur,+6 +nikaDocument12 pagesMarudur,+6 +nikaResandi MuhamadNo ratings yet

- Machiavellian Thinking vs. Conventional Logic - Illimitable MenDocument16 pagesMachiavellian Thinking vs. Conventional Logic - Illimitable MenMaurice BathichNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2nskabra0% (1)

- Baby MangDocument8 pagesBaby MangffNo ratings yet

- Lesson Plan Curriculum IntegrationDocument12 pagesLesson Plan Curriculum Integrationapi-509185462No ratings yet

- 6 Habits of True Strategic ThinkersDocument64 pages6 Habits of True Strategic ThinkersPraveen Kumar JhaNo ratings yet

- Analysis of Chapter 8 of Positive Psychology By::-Alan CarrDocument3 pagesAnalysis of Chapter 8 of Positive Psychology By::-Alan CarrLaiba HaroonNo ratings yet

- ET Banking & FinanceDocument35 pagesET Banking & FinanceSunchit SethiNo ratings yet

- Marketing ManagementDocument228 pagesMarketing Managementarpit gargNo ratings yet