Professional Documents

Culture Documents

Oct 2006

Uploaded by

André Le RouxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oct 2006

Uploaded by

André Le RouxCopyright:

Available Formats

LEGAL PRACTITIONER'S EXAMINATION OCTOBER 2006

MARKS 100 PAPER 2. TIME 90 MINUTES.

===================================================================

Candidates should use their own facts where necessary.

QUESTION 1 (65)

Your client who died on 15 June 2006 left a will reading as follows:

"I bequeath my fixed property to my wife.

The residue of my estate I bequeath to my wife and my three children in equal shares."

The executor nominated in the will declined the appointment so you were appointed as executor

He left the following family:

a/ His wife to whom he was married out of community of property,

b/ A daughter married in community of property,

c/ A daughter married out of community of property,

d/ A minor grandson, child of predeceased son

The following are the assets and liabilities in his estate:

Assets:

a/ Fixed property situated in Windhoek valued at $800 000

b/ Furniture valued at $50 000,

c/ Motor vehicle valued at $50 000,

d/ Cash and investments in the bank of $500 000.

e/ Rental from fixed property after death $5 000,

f/ Interest from investments in respect of period after death $20 000

Liabilities totalling $200 000 include:

a/ Funeral expenses $8 000,

b/ Bond on fixed property of which $1 000 is in respect of interest after death,

c/ Normal administration expenses.

As the movables cannot be readily divided the heirs entered into a redistribution agreement.

1.1 Draft the redistribution agreement that must be attached to the account. [15]

1.2 Draw up the Following sections of the liquidation and distribution account.

1.2.1 Liability section [15]

1.2.2 Distribution account [20]

1.2.3 Income and expenditure account [15]

QUESTION 2 (14 )

You were appointed on 10th March 2006 as executor in the estate of the late Tomas Brown.

As you are unable to lodge the account, draft a letter to the Master applying for an extension of 2 months

QUESTION 3 (21)

John van Wyk a member of the Rehoboth Baster Community died intestate leaving a net estate of $120 000.00.

He left the following family:

a/ Sarah, his wife married in community of property

b/ Peter his father

c/ Mary his sister

3.1 Draw up the distribution account [13]

3.2 Discuss what will happen if the deceased did not leave a surviving spouse or a parent, or child or

brother or sister. [8]

You might also like

- Nov 03Document1 pageNov 03André Le RouxNo ratings yet

- Mar-01 QueDocument2 pagesMar-01 QueAndré Le RouxNo ratings yet

- Mar-03 QueDocument2 pagesMar-03 QueAndré Le RouxNo ratings yet

- Mar 06Document1 pageMar 06André Le RouxNo ratings yet

- Nov 98 QueDocument5 pagesNov 98 QueAndré Le RouxNo ratings yet

- Mar-98 QueDocument3 pagesMar-98 QueAndré Le RouxNo ratings yet

- Nov-03, AnsDocument3 pagesNov-03, AnsAndré Le RouxNo ratings yet

- Aug 03Document1 pageAug 03André Le RouxNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Lpe March 1998 AnswersDocument5 pagesLpe March 1998 AnswersAndré Le RouxNo ratings yet

- Midterm - Business Tax - ProblemsDocument7 pagesMidterm - Business Tax - Problemsargene.malubayNo ratings yet

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- Solved From The General Journal in Figure 9 15 Record To TheDocument1 pageSolved From The General Journal in Figure 9 15 Record To TheAnbu jaromiaNo ratings yet

- ReSA B42 TAX First PB Exam - Questions, Answers - SolutionsDocument18 pagesReSA B42 TAX First PB Exam - Questions, Answers - SolutionsPearl Mae De VeasNo ratings yet

- Session 6 Exercise DrillDocument3 pagesSession 6 Exercise DrillAbigail Ann PasiliaoNo ratings yet

- Task 2 04 QueDocument2 pagesTask 2 04 QueAndré Le RouxNo ratings yet

- Estate TaxDocument8 pagesEstate TaxIELTSNo ratings yet

- LB301 2017 08Document4 pagesLB301 2017 08Clayton MutsenekiNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Executors AccountsDocument5 pagesExecutors AccountskennedyNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- February 96 Answers To QuestionsDocument4 pagesFebruary 96 Answers To QuestionsAndré Le RouxNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- 89 05 Estate and Trust Taxation PDF FreeDocument3 pages89 05 Estate and Trust Taxation PDF Freefrostysimbamagi meowNo ratings yet

- Intermediate Accounting 1 Quiz 1Document4 pagesIntermediate Accounting 1 Quiz 1Manuel MagadatuNo ratings yet

- Bush A Sole Trader Commenced Trading On 1 January 20x2 ADocument1 pageBush A Sole Trader Commenced Trading On 1 January 20x2 AMiroslav GegoskiNo ratings yet

- Macn-R000130743 - Affidavit of Universal Commerical Code 1 Financing Statement (H. LYNN JONES II)Document6 pagesMacn-R000130743 - Affidavit of Universal Commerical Code 1 Financing Statement (H. LYNN JONES II)theodore moses antoine beyNo ratings yet

- Jun-97 QueDocument2 pagesJun-97 QueAndré Le RouxNo ratings yet

- Succession Assignment 21 October 2019 1Document3 pagesSuccession Assignment 21 October 2019 1Rossette AnaNo ratings yet

- Module A: Foundation ExaminationDocument5 pagesModule A: Foundation ExaminationHar San LeeNo ratings yet

- 2019 Assg Wet 3 Succ Self-Assessment Ga JM F 8 JulyDocument2 pages2019 Assg Wet 3 Succ Self-Assessment Ga JM F 8 JulyphichunuNo ratings yet

- Taxn03b DrillDocument1 pageTaxn03b Drillsmosaldana.cvtNo ratings yet

- Deductions From The Gross EstateDocument14 pagesDeductions From The Gross Estatejungoos100% (1)

- Mayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageDocument3 pagesMayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageCalifornia CourtsNo ratings yet

- Chapter 3 - Deductions From The Gross EstateDocument22 pagesChapter 3 - Deductions From The Gross EstateAngelika BalmeoNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- 2024.02.02 HWF To OC Outlining Settlement Agreement W ChartDocument23 pages2024.02.02 HWF To OC Outlining Settlement Agreement W ChartrealtorrobbinsmithNo ratings yet

- St. Vincent'S College Incorporated College of Accounting EducationDocument8 pagesSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNo ratings yet

- Jack Stanley Thornicroft V Murray Evans and Ivan McKillop (1985) ZRDocument6 pagesJack Stanley Thornicroft V Murray Evans and Ivan McKillop (1985) ZRDebbie PhiriNo ratings yet

- Complaint For Declaration of Nullity of Foreclosure Proceedings October 1 2012 FinalDocument19 pagesComplaint For Declaration of Nullity of Foreclosure Proceedings October 1 2012 FinalAmado Vallejo III100% (1)

- August 2005 QueDocument2 pagesAugust 2005 QueAndré Le RouxNo ratings yet

- Source Documents and Books of Original Entry QDocument6 pagesSource Documents and Books of Original Entry QMoses IngudiaNo ratings yet

- Accounts Paper 1 June 2001Document11 pagesAccounts Paper 1 June 2001BRANDON TINASHENo ratings yet

- SolutionDocument23 pagesSolutionKavita WadhwaNo ratings yet

- Poa May 2001 Paper 2Document10 pagesPoa May 2001 Paper 2TiARA SerrantNo ratings yet

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- AEC 215 Complete Online Activities MidtermFinalsDocument4 pagesAEC 215 Complete Online Activities MidtermFinalsHazel Seguerra BicadaNo ratings yet

- Chapter 15 TaxDocument11 pagesChapter 15 TaxEmmanuel PenullarNo ratings yet

- Module 1 - Deductions From Gross EstateDocument68 pagesModule 1 - Deductions From Gross EstateKat Miranda100% (1)

- Cash Cash Equivalents Ia 1 2020 EditionDocument3 pagesCash Cash Equivalents Ia 1 2020 EditionmarielleNo ratings yet

- 12 Com....Document5 pages12 Com....Advanced AcademyNo ratings yet

- MidtermDocument13 pagesMidtermAlexandra Nicole IsaacNo ratings yet

- Paper - 2 - Answer - E - NormalDocument191 pagesPaper - 2 - Answer - E - NormalJhianne Mae AlbagNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Illustrations ExecutorshipDocument2 pagesIllustrations ExecutorshipTAHENUNo ratings yet

- Accounts Paper 1 November 2007Document7 pagesAccounts Paper 1 November 2007WayneNo ratings yet

- Zimbabwe School Examinations Council: Accounts 7112/1Document7 pagesZimbabwe School Examinations Council: Accounts 7112/1WayneNo ratings yet

- P.O.A Paper 02. 27 May 2003Document11 pagesP.O.A Paper 02. 27 May 2003Jerilee SoCute Watts0% (2)

- Tax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreFrom EverandTax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreNo ratings yet

- Namibia: Prevention and Combating of Terrorist and Proliferation Activities ActDocument55 pagesNamibia: Prevention and Combating of Terrorist and Proliferation Activities ActAndré Le RouxNo ratings yet

- Status of Air Namibia Flights SW 285 & SW 286Document1 pageStatus of Air Namibia Flights SW 285 & SW 286André Le RouxNo ratings yet

- Air Namibia's New Operational Turnaround TeamDocument1 pageAir Namibia's New Operational Turnaround TeamAndré Le RouxNo ratings yet

- Labour Judgment Index Namibia 2013Document15 pagesLabour Judgment Index Namibia 2013André Le Roux0% (1)

- Statement Marlene Manave, CEO LAM - Media Briefing - Official StatementDocument2 pagesStatement Marlene Manave, CEO LAM - Media Briefing - Official StatementAndré Le RouxNo ratings yet

- Bank of Namibia Issues Banking License To Ebank LimitedDocument2 pagesBank of Namibia Issues Banking License To Ebank LimitedAndré Le RouxNo ratings yet

- Civil Judgment Index Namibia 2013Document79 pagesCivil Judgment Index Namibia 2013André Le Roux100% (1)

- The State V Ashipala (CR 262012) (2012) NAHCNLD 08 (15 November 2012)Document4 pagesThe State V Ashipala (CR 262012) (2012) NAHCNLD 08 (15 November 2012)André Le RouxNo ratings yet

- Criminal Judgments Index NamibiaDocument53 pagesCriminal Judgments Index NamibiaAndré Le RouxNo ratings yet

- KPMG Zuma Report The State Versus Jacob G Zuma Andothers Forensic Investigation Draft Report On Factual Findings For Review OnlyDocument490 pagesKPMG Zuma Report The State Versus Jacob G Zuma Andothers Forensic Investigation Draft Report On Factual Findings For Review OnlyAndré Le RouxNo ratings yet

- Chief Executive Officer of Namibia Financial Institutions Supervisory Authority V Fis Life Assurance Company LTD & Others.Document33 pagesChief Executive Officer of Namibia Financial Institutions Supervisory Authority V Fis Life Assurance Company LTD & Others.André Le RouxNo ratings yet

- Extractive Mining in NamibiaDocument20 pagesExtractive Mining in NamibiaAndré Le RouxNo ratings yet

- The State Versus C Van WykDocument18 pagesThe State Versus C Van WykAndré Le RouxNo ratings yet

- 1.mining Industry Performance During 2011 & Role of Mining in The Namibian Economy - Robin Sherbourne PDFDocument18 pages1.mining Industry Performance During 2011 & Role of Mining in The Namibian Economy - Robin Sherbourne PDFAndré Le RouxNo ratings yet

- VOIGTS H G V S E INTERLOCUTORY APPLICATION - DAMASEB JP.8 AUG 2012.I105-09 PDFDocument14 pagesVOIGTS H G V S E INTERLOCUTORY APPLICATION - DAMASEB JP.8 AUG 2012.I105-09 PDFAndré Le RouxNo ratings yet

- The State VS Hangula Simson Mwanyangapo - Cc21-10.judg - Shivute, J.17oct12 PDFDocument24 pagesThe State VS Hangula Simson Mwanyangapo - Cc21-10.judg - Shivute, J.17oct12 PDFAndré Le RouxNo ratings yet

- Session4 Automotive Front End DesignDocument76 pagesSession4 Automotive Front End DesignShivprasad SavadattiNo ratings yet

- Adverbs of Manner and DegreeDocument1 pageAdverbs of Manner and Degreeslavica_volkan100% (1)

- Centrifuge ThickeningDocument8 pagesCentrifuge ThickeningenviroashNo ratings yet

- Nestlé CASEDocument3 pagesNestlé CASEAli Iqbal CheemaNo ratings yet

- Kidney Stone Diet 508Document8 pagesKidney Stone Diet 508aprilNo ratings yet

- Nutrition Great Foods For Getting Vitamins A To K in Your DietDocument1 pageNutrition Great Foods For Getting Vitamins A To K in Your DietDhruv DuaNo ratings yet

- NHM Thane Recruitment 2022 For 280 PostsDocument9 pagesNHM Thane Recruitment 2022 For 280 PostsDr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- Monitor Stryker 26 PLGDocument28 pagesMonitor Stryker 26 PLGBrandon MendozaNo ratings yet

- Historical Exchange Rates - OANDA AUD-MYRDocument1 pageHistorical Exchange Rates - OANDA AUD-MYRML MLNo ratings yet

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDocument170 pages21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89No ratings yet

- HAYAT - CLINIC BrandbookDocument32 pagesHAYAT - CLINIC BrandbookBlankPointNo ratings yet

- Mixing and Agitation 93851 - 10 ADocument19 pagesMixing and Agitation 93851 - 10 Aakarcz6731No ratings yet

- Linear Dynamic Analysis of Free-Piston Stirling Engines OnDocument21 pagesLinear Dynamic Analysis of Free-Piston Stirling Engines OnCh Sameer AhmedNo ratings yet

- Research On Export Trade in BangladeshDocument7 pagesResearch On Export Trade in BangladeshFarjana AnwarNo ratings yet

- En 50124 1 2001Document62 pagesEn 50124 1 2001Vivek Kumar BhandariNo ratings yet

- LKG Math Question Paper: 1. Count and Write The Number in The BoxDocument6 pagesLKG Math Question Paper: 1. Count and Write The Number in The BoxKunal Naidu60% (5)

- 200150, 200155 & 200157 Accelerometers: DescriptionDocument16 pages200150, 200155 & 200157 Accelerometers: DescriptionJOSE MARIA DANIEL CANALESNo ratings yet

- Pest of Field Crops and Management PracticalDocument44 pagesPest of Field Crops and Management PracticalNirmala RameshNo ratings yet

- Ebops PDFDocument2 pagesEbops PDFtuan nguyen duyNo ratings yet

- Unit 1 - Lecture 3Document16 pagesUnit 1 - Lecture 3Abhay kushwahaNo ratings yet

- ATADU2002 DatasheetDocument3 pagesATADU2002 DatasheethindNo ratings yet

- Corvina PRIMEDocument28 pagesCorvina PRIMEMillerIndigoNo ratings yet

- Understanding The Marshall AttackDocument6 pagesUnderstanding The Marshall Attacks.for.saad8176No ratings yet

- UntitledDocument13 pagesUntitledTestNo ratings yet

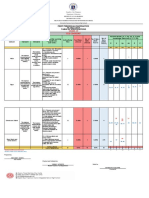

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- QuinnmcfeetersresumeDocument1 pageQuinnmcfeetersresumeapi-510833585No ratings yet

- Engine Controls (Powertrain Management) - ALLDATA RepairDocument3 pagesEngine Controls (Powertrain Management) - ALLDATA RepairRonald FerminNo ratings yet

- Properties of LiquidsDocument26 pagesProperties of LiquidsRhodora Carias LabaneroNo ratings yet

- Answer Key To World English 3 Workbook Reading and Crossword Puzzle ExercisesDocument3 pagesAnswer Key To World English 3 Workbook Reading and Crossword Puzzle Exercisesjuanma2014375% (12)