Professional Documents

Culture Documents

tpz-1029 8 F A-V (2012-10)

tpz-1029 8 F A-V (2012-10)

Uploaded by

Mennatallah M.Salah El DinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

tpz-1029 8 F A-V (2012-10)

tpz-1029 8 F A-V (2012-10)

Uploaded by

Mennatallah M.Salah El DinCopyright:

Available Formats

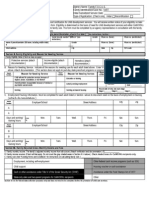

Childcare Expenses Qualifying for the Tax Credit

Fees and Number of Days of Care for 2013

If you wish to apply for advance payments of the tax credit for childcare expenses, have the person who provides the childcare services (or the persons representative) complete this form. Return the form to Revenu Qubec, along with your application for advance payments. Social insurance number of the person u who pays the childcare expenses Last name and first name of the person who pays the childcare expenses

Number of days of care in 2013

TP Z-1029.8.F.A-V 2012-10

Identification number or social insurance number of the person who provides the childcare services Name and address of the person who provides the childcare services

Last name and first name of each eligible child

Childcare fee per day*

X

* Do not enter the reduced contribution set by the government ($7 per child per day).

Signature of the person who provides the childcare services (or of the persons representative)

116W

Childcare Expenses Qualifying for the Tax Credit

Fees and Number of Days of Care for 2013

If you wish to apply for advance payments of the tax credit for childcare expenses, have the person who provides the childcare services (or the persons representative) complete this form. Return the form to Revenu Qubec, along with your application for advance payments. Social insurance number of the person u who pays the childcare expenses Last name and first name of the person who pays the childcare expenses

Number of days of care in 2013

TP Z-1029.8.F.A-V 2012-10

Identification number or social insurance number of the person who provides the childcare services Name and address of the person who provides the childcare services

Last name and first name of each eligible child

Childcare fee per day*

X

* Do not enter the reduced contribution set by the government ($7 per child per day).

Signature of the person who provides the childcare services (or of the persons representative)

116W

Childcare Expenses Qualifying for the Tax Credit

Fees and Number of Days of Care for 2013

If you wish to apply for advance payments of the tax credit for childcare expenses, have the person who provides the childcare services (or the persons representative) complete this form. Return the form to Revenu Qubec, along with your application for advance payments. Social insurance number of the person u who pays the childcare expenses Last name and first name of the person who pays the childcare expenses

Number of days of care in 2013

TP Z-1029.8.F.A-V 2012-10

Identification number or social insurance number of the person who provides the childcare services Name and address of the person who provides the childcare services

Last name and first name of each eligible child

Childcare fee per day*

X

* Do not enter the reduced contribution set by the government ($7 per child per day).

Signature of the person who provides the childcare services (or of the persons representative)

116W

You might also like

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Loan Rein Ex InfoDocument5 pagesLoan Rein Ex InfoGomezLiliNo ratings yet

- 2012 Ontario Tax FormDocument2 pages2012 Ontario Tax FormHassan MhNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 9 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 9 PDFMennatallah M.Salah El DinNo ratings yet

- tpz-1029 8 F A-V (2012-10) DXDocument1 pagetpz-1029 8 F A-V (2012-10) DXMennatallah M.Salah El DinNo ratings yet

- FIS Statement Website Packet Rev. 6 6 5 19 2Document10 pagesFIS Statement Website Packet Rev. 6 6 5 19 2Rob WrightNo ratings yet

- Description: Tags: GEN0511Attach2Document3 pagesDescription: Tags: GEN0511Attach2anon-315755No ratings yet

- Help With School ExpensesDocument4 pagesHelp With School Expensesapi-140120973No ratings yet

- td1 13eDocument2 pagestd1 13eMel McSweeneyNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearDocument5 pagesUniversity of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearAisha KannehNo ratings yet

- FSM Application 2020.202648652 3Document3 pagesFSM Application 2020.202648652 3imanomarbayoumiNo ratings yet

- 2014-15 Verification Worksheet - Dependent Student Institutional Documentation Service (IDOC)Document4 pages2014-15 Verification Worksheet - Dependent Student Institutional Documentation Service (IDOC)Brenn WhitingNo ratings yet

- TDON1Document2 pagesTDON1Fevzi OzdemirNo ratings yet

- Child Support Paid: Verification WorksheetDocument1 pageChild Support Paid: Verification Worksheetspikerulez95No ratings yet

- 2014-2015 Verification Worksheet-Dependent Student IDOCDocument4 pages2014-2015 Verification Worksheet-Dependent Student IDOCJoshChukwubudikeBarnesNo ratings yet

- TD1Document2 pagesTD1AmandaNo ratings yet

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Child Tax Credit and ACTCDocument1 pageChild Tax Credit and ACTCNelwin ThomasNo ratings yet

- 2011 Quebec Tax FormsDocument4 pages2011 Quebec Tax FormsManideep GuptaNo ratings yet

- CD 9600Document6 pagesCD 9600api-2812926660% (1)

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- NABA Financial Aid FormDocument6 pagesNABA Financial Aid FormHien Giang Vu NgocNo ratings yet

- New Scholarship Application 111609Document2 pagesNew Scholarship Application 111609rob_crowell_1No ratings yet

- 2009 Personal Tax Credits Return: Disability Tax Credit Certificate, Enter $7,196Document2 pages2009 Personal Tax Credits Return: Disability Tax Credit Certificate, Enter $7,196Muneeb ArshadNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- td1 Fill 04 16eDocument2 pagestd1 Fill 04 16eAlec RichardsonNo ratings yet

- 1112 Dependent Verification Worksheet-1Document2 pages1112 Dependent Verification Worksheet-1Mikey NguyenNo ratings yet

- 2011-2012 Dependent Verification FormDocument4 pages2011-2012 Dependent Verification FormCoachRich3No ratings yet

- Form 11sDocument12 pagesForm 11sgilbert.belciugNo ratings yet

- Claim Health Care Benefits 19132ADocument2 pagesClaim Health Care Benefits 19132ACharles MoncyNo ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- Additional Financial Information: Funds Were ReceivedDocument1 pageAdditional Financial Information: Funds Were ReceivedaushishinhamoriNo ratings yet

- Form 11: Tax Return and Self-Assessment For The Year 2014Document32 pagesForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82No ratings yet

- Instructions For Schedule 2 (Form 1040A)Document3 pagesInstructions For Schedule 2 (Form 1040A)IRSNo ratings yet

- TEP Application Form 2Document3 pagesTEP Application Form 2adam adamNo ratings yet

- Students FormDocument4 pagesStudents Formrico saundersNo ratings yet

- Disabled Student Allowances 2013/14 Application Form: SFE/DSASL/1314/BDocument11 pagesDisabled Student Allowances 2013/14 Application Form: SFE/DSASL/1314/BVampireDiaries01No ratings yet

- LHS ExemptionForm Final-1Document6 pagesLHS ExemptionForm Final-1rayghanaachmatNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- Florida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentDocument4 pagesFlorida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentdraykidNo ratings yet

- In-School Deferment RequestDocument3 pagesIn-School Deferment RequestSirLockInBottomNo ratings yet

- Bachelor of AccountingDocument4 pagesBachelor of AccountingThai NguyenNo ratings yet

- English Free School MealsDocument2 pagesEnglish Free School MealsarktindalNo ratings yet

- Nwe Zealand Visa ApplicationDocument16 pagesNwe Zealand Visa ApplicationUdesh De ZoysaNo ratings yet

- Medical Card GP Visit Card Application FormDocument12 pagesMedical Card GP Visit Card Application FormGeorgiana GattinaNo ratings yet

- Sfe Dsa Slim 1314 DDocument11 pagesSfe Dsa Slim 1314 DMauro Ibarra MolasNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentDaniel FetherzNo ratings yet

- A Guide To Australian Government Payments 2014Document44 pagesA Guide To Australian Government Payments 2014Wing ChuNo ratings yet

- Co029 2022Document110 pagesCo029 2022Audrey TaylorNo ratings yet

- Childcare Grant Application Form Ccg1: Your Estimated Weekly Childcare Costs 2018/19Document10 pagesChildcare Grant Application Form Ccg1: Your Estimated Weekly Childcare Costs 2018/19Ahmed91No ratings yet

- Faculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlineDocument5 pagesFaculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlinekarenNo ratings yet

- Description: Tags: GEN0503AttachDocument2 pagesDescription: Tags: GEN0503Attachanon-302580No ratings yet

- Flexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)Document9 pagesFlexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)ErmintrudeNo ratings yet

- Parents FormDocument11 pagesParents Formrico saundersNo ratings yet

- Installment Agreement RequestDocument1 pageInstallment Agreement Requestkyiwayphy03681No ratings yet

- Sponsorship: Who's Eligible & How to ApplyFrom EverandSponsorship: Who's Eligible & How to ApplyNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 18 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 18 PDFMennatallah M.Salah El DinNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 11 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 11 PDFMennatallah M.Salah El DinNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 17 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 17 PDFMennatallah M.Salah El DinNo ratings yet

- On The Art of Building in Ten Books: LineamentsDocument5 pagesOn The Art of Building in Ten Books: LineamentsMennatallah M.Salah El Din0% (1)

- Ricoeur, Paul - 1965 - Fallible Man 15 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 15 PDFMennatallah M.Salah El DinNo ratings yet

- The Gospel of Mary of Magdala PDFDocument5 pagesThe Gospel of Mary of Magdala PDFMennatallah M.Salah El DinNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 16 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 16 PDFMennatallah M.Salah El DinNo ratings yet

- Ricoeur, Paul - 1965 - Fallible Man 16 PDFDocument1 pageRicoeur, Paul - 1965 - Fallible Man 16 PDFMennatallah M.Salah El DinNo ratings yet

- Como Construir Un Astrolabio CaseroDocument5 pagesComo Construir Un Astrolabio CaseroMaximiliano AbiusoNo ratings yet

- Unit 1: (M) Qul Qoolee (F)Document1 pageUnit 1: (M) Qul Qoolee (F)Mennatallah M.Salah El DinNo ratings yet

- Astrolabe Jbaa PDFDocument9 pagesAstrolabe Jbaa PDFMennatallah M.Salah El DinNo ratings yet

- Unit 1 : Al-Kitaabah KitaabahDocument1 pageUnit 1 : Al-Kitaabah KitaabahMennatallah M.Salah El DinNo ratings yet

- Unit 1 : PhoneticsDocument1 pageUnit 1 : PhoneticsMennatallah M.Salah El DinNo ratings yet

- Unit 1 : Al-Kitaabah KitaabahDocument1 pageUnit 1 : Al-Kitaabah KitaabahMennatallah M.Salah El DinNo ratings yet

- Unit 1: TadreebaatDocument1 pageUnit 1: TadreebaatMennatallah M.Salah El DinNo ratings yet

- ﺙ ﺕ ﺏ Unit 1: Where is ٣Document1 pageﺙ ﺕ ﺏ Unit 1: Where is ٣Mennatallah M.Salah El DinNo ratings yet

- Unit 1: 3-DammahDocument1 pageUnit 1: 3-DammahMennatallah M.Salah El DinNo ratings yet

- Choosing Life and The Possibilfe and Thought of Jaques Ellul 10Document1 pageChoosing Life and The Possibilfe and Thought of Jaques Ellul 10Mennatallah M.Salah El DinNo ratings yet

- Unit 1: My Name IsDocument1 pageUnit 1: My Name IsMennatallah M.Salah El DinNo ratings yet

- Unit 1Document1 pageUnit 1Mennatallah M.Salah El DinNo ratings yet

- Choosing Life and The Possibilfe and Thought of Jaques Ellul 11Document1 pageChoosing Life and The Possibilfe and Thought of Jaques Ellul 11Mennatallah M.Salah El DinNo ratings yet

- History of Logic 3Document1 pageHistory of Logic 3Mennatallah M.Salah El DinNo ratings yet