Professional Documents

Culture Documents

Untitled Document

Uploaded by

Daniel FetherzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled Document

Uploaded by

Daniel FetherzCopyright:

Available Formats

1300 133 697

accesspay.com.au

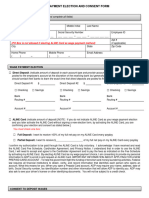

Claim form – expense reimbursement

Please complete all sections of this form to claim a reimbursement for an expense you have already paid.

Send your completed form to customerservice@accesspay.com.au or post to PO Box 1238, Adelaide,

SA 5001.

Section 1: Your details

Subscriber ID: ______

Employer name: Fighting chance

First name: Daniel

Last name: Fethers

Date of birth: 11/11/2003

Phone: 0409929855

Email address: danielfethers22@gmail.com

Section 2: Your bank account details

Please transfer funds to the account below

[_] Please pay to my default bank account

OR

[_] Please pay to the bank details below

BSB number: 012349

Account number: 221964145

Account name: FETHERS D J

Reference: ______

Section 3: Reimbursement details

Please confirm the total amount claimed per benefit payment

Expense dates Expense Over how many Total claim GST (if

(DD/MM/YY) description pays? amount applicable)

__/__/__ to __/__/__ $ $

__/__/__ to __/__/__ $ $

__/__/__ to __/__/__ $ $

__/__/__ to __/__/__ $ $

__/__/__ to __/__/__ $ $

See Section 6 – Supporting Documentation on page 2 for details of the documents required to support

your claim. Where no supporting documentation is provided, payment will not be made.

Section 4: Declarations

I declare that:

● Neither I nor an associate are claiming the amounts on this form through any other salary

packaging facility, nor are the amounts being paid or reimbursed by my employer (or associate’s

employer), and are not being(and will not be) used for any other tax deductible purpose.

● The total amount being claimed on this form is for previously unclaimed purchases only and not

for cash advances, purchases where funds have been returned or an outstanding balance of

previously claimed transactions.

● I understand I may be subject to an Australian Taxation Office (ATO) audit at any time and may

incur a future tax liability on any funds received without legitimate documentation and/or proof of

occurrence.

● I have read the current AccessPay Terms & conditions – available at accesspay.com.au/terms-

and-conditions/ and agree to be bound by them in relation to my salary packaging activities.

Substantiation and Compliance Declaration and Warranty

● I have attached copies of documentation to substantiate this claim and warrant that the total

amount claimed on this form is substantiated by the attached documentation.

● I declare and warrant that I hold (and will continue to hold) original documentation to substantiate

any expenses that are or become included in the salary package provided to me by my employer

from time to time. I understand that I am required to retain these records for a period of seven

years.

● I agree to indemnify my employer from and against any Fringe Benefits Tax liability incurred as a

result of the parties entering into this salary packaging arrangement, including, without limitation,

where I am not able to produce original documentation to support any expense when requested

to do so by you or my employer.

Signature* ______

Date ______

[* By signing above, you agree to the Section 4 – Declarations and have provided all supporting

documentation and payment information. You may sign your name physically or by using a certified

electronic signature that verifies the date and time that you applied your electronic signature. By doing so

you consent to the terms and conditions applicable to this form.]

Section 5: Checklist

[_] I have completed my claim details above.

[_] I have signed this form above.

[_] I have read and agreed to the Section 4: Declarations.

[_] I have included all pages of my supporting documentation with this claim form.

Section 6: Supporting documentation

Where no supporting documentation is provided, payments will not be made.

Expense type Documentation required

Mortgage repayment

Current statement showing the BSB, account number, amount

(excluding investment

owing and proof of payment.

properties)

Current statement showing the BSB, account number, amount

Personal loan repayment

owing and proof of payment.

Current lease or rental declaration showing your name, address,

Rent

rent amount, length of lease and proof of payment.

Education payments (school Invoice showing amount owing and proof of up to 12 months’ worth

fees, child care, HELP) of payments.

Health insurance Policy document showing the amount owing and proof of payment.

Income Protection insurance Policy document showing the amount owing and proof of payment.

Invoice showing payment details, amount owing and proof of

Household bills (rates, power,

payment. If this payment includes GST, the tax invoice must show

groceries etc.)

the GST amount.

Meal and Entertainment Invoice showing payment details, amount owing and proof of

benefits (holiday payment. If this payment includes GST, the tax invoice must show

accommodation) the GST amount.

Credit card statement showing amount(s) paid to the credit card

and up to 12 monthly statements.

Credit card Please ensure that you blank out the credit card number from your

statement before submitting it to us, as per this example:

You might also like

- Entire Packet 10Document7 pagesEntire Packet 10JohnnyLarsonNo ratings yet

- Credit Limit Increase Application: D D / M M / Y YDocument2 pagesCredit Limit Increase Application: D D / M M / Y YAmrinder SetiaNo ratings yet

- Financial Assistance Scheme For Uncontracted Assessors: Application Form - IndividualsDocument4 pagesFinancial Assistance Scheme For Uncontracted Assessors: Application Form - Individualsn_san5No ratings yet

- Application For Waiver or Deferral of FeesDocument5 pagesApplication For Waiver or Deferral of Feessbf20112011No ratings yet

- Offer in Compromise ApplicationDocument4 pagesOffer in Compromise ApplicationRoy CraytonNo ratings yet

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Payout RequestDocument2 pagesPayout RequestInfopedia OnlinehereNo ratings yet

- OM UnitTrust DO AmendmentForm (FINAL) ElectronicDocument6 pagesOM UnitTrust DO AmendmentForm (FINAL) ElectronicMonika ShanikaNo ratings yet

- E VisaDocument3 pagesE Visazahoorunisa20No ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- Care Credit AppDocument7 pagesCare Credit AppwvhvetNo ratings yet

- 656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateDocument4 pages656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateRonell D. MooreNo ratings yet

- 15 Wage Payment Election PDFDocument2 pages15 Wage Payment Election PDFHenry MorenoNo ratings yet

- Forms Payout Others Web 23 AprilDocument2 pagesForms Payout Others Web 23 AprilYo PaisaNo ratings yet

- Adp Wage Payment Election and Consent FormDocument2 pagesAdp Wage Payment Election and Consent FormjermarionNo ratings yet

- Date: - Application #Document4 pagesDate: - Application #988965No ratings yet

- Income Withholding For SupportDocument3 pagesIncome Withholding For SupportballNo ratings yet

- Printapplication GE SSDocument8 pagesPrintapplication GE SSmgworkNo ratings yet

- Form OrganPaymentReimbursementDocument1 pageForm OrganPaymentReimbursementWondemagenAliNo ratings yet

- Rental ApplicationDocument4 pagesRental ApplicationMus MNo ratings yet

- Commercial - Loan - Application PDFDocument4 pagesCommercial - Loan - Application PDFKent WhiteNo ratings yet

- Monthly Business Expense ReportDocument3 pagesMonthly Business Expense ReportXYZNo ratings yet

- H Homeowner's Information Packet: For Chase CustomersDocument8 pagesH Homeowner's Information Packet: For Chase CustomersEric WardNo ratings yet

- Discharge Voucher ULIP End V6.1 RevisedDocument3 pagesDischarge Voucher ULIP End V6.1 Revisedsunny0908No ratings yet

- Application and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About YourselfDocument8 pagesApplication and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About Yourselfsaxmachine1411No ratings yet

- Direct Deposit FormDocument3 pagesDirect Deposit FormSreenivas RaoNo ratings yet

- Georgia DOL Application For Overpayment WaiverDocument6 pagesGeorgia DOL Application For Overpayment WaiverLindsey BasyeNo ratings yet

- Fannie Mae Hardship AffidavitDocument2 pagesFannie Mae Hardship AffidavitkwillsonNo ratings yet

- 2022-10-05T11 - 11 - 20 - LoanAgreement - 1123603 3Document9 pages2022-10-05T11 - 11 - 20 - LoanAgreement - 1123603 3Liliana MendozaNo ratings yet

- Subscriber Dispute FormDocument3 pagesSubscriber Dispute FormApril RNo ratings yet

- Account Opening Form BOIDocument4 pagesAccount Opening Form BOIhrocking1No ratings yet

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocument4 pagesCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNo ratings yet

- GCash Dispute FormDocument3 pagesGCash Dispute FormJoemar YubokmeeNo ratings yet

- F 9465Document3 pagesF 9465Pat PlanteNo ratings yet

- Orchard Bank 288451024 - AgreementNPI2701ADocument15 pagesOrchard Bank 288451024 - AgreementNPI2701AKestrel1940No ratings yet

- Health Total Claim FormDocument2 pagesHealth Total Claim Formpavan reddyNo ratings yet

- JDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Document2 pagesJDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Antoinette MoederNo ratings yet

- Consumer Account AgreementDocument20 pagesConsumer Account AgreementjeevankombanNo ratings yet

- Payout FormDocument3 pagesPayout FormavisekgNo ratings yet

- Standing Instruction Form Through IndusInd Bank Account-2Document1 pageStanding Instruction Form Through IndusInd Bank Account-2SonuNo ratings yet

- Creditcare - Ca Agreement: O/B Finance West IncDocument2 pagesCreditcare - Ca Agreement: O/B Finance West IncRitu Aryan0% (1)

- Chase Loan Modification PacketDocument11 pagesChase Loan Modification PacketSince 1990 BK AND MOTIONS AT YAHOO COM100% (1)

- 2015 Client Checklist - IndividualDocument9 pages2015 Client Checklist - IndividualMichael JordanNo ratings yet

- Direct Deposit FormDocument3 pagesDirect Deposit FormRabindra ShakyaNo ratings yet

- Cigna Global Claim FormDocument3 pagesCigna Global Claim Formrsiabs marketingNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- Instructions For Florida Family Law Rule of Procedure Form 12.902 (C), Family Law Financial Affidavit (Long Form) (09/12)Document13 pagesInstructions For Florida Family Law Rule of Procedure Form 12.902 (C), Family Law Financial Affidavit (Long Form) (09/12)vskywokervsNo ratings yet

- Avanse Part Pre Payment Foreclosure Form ELDocument1 pageAvanse Part Pre Payment Foreclosure Form ELArun KatareNo ratings yet

- Adjustment of Status I-130/485 Checklist of Supporting DocumentsDocument7 pagesAdjustment of Status I-130/485 Checklist of Supporting DocumentsSteve MacarioNo ratings yet

- Personal Financial StatementDocument3 pagesPersonal Financial StatementChristopher MacLeodNo ratings yet

- MHF Loan FormDocument9 pagesMHF Loan Formshayaltanisha198No ratings yet

- Redirection of Benefit PaymentDocument4 pagesRedirection of Benefit PaymentStephanie PrangnellNo ratings yet

- Six Month Self-Attestation of Eligibility Changes: Staff Name: Agency/Program: Phone #: Fax #Document1 pageSix Month Self-Attestation of Eligibility Changes: Staff Name: Agency/Program: Phone #: Fax #benNo ratings yet

- Request RestitutionDocument2 pagesRequest Restitutionjlori82No ratings yet

- FD Form RevisedDocument2 pagesFD Form RevisedAshutosh TiwariNo ratings yet

- Financial Information Sheet: Bal 1 Bal 2 TTLDocument4 pagesFinancial Information Sheet: Bal 1 Bal 2 TTLSteve MontroseNo ratings yet

- GUIDE TO COMPLETING FORM E & OVER 200 QUESTIONS ANSWERED ON FINANCES IN DIVORCE: Helping You To Complete the Form E, With Hints and Tips and Answering Questions on the Financial Aspects of DivorceFrom EverandGUIDE TO COMPLETING FORM E & OVER 200 QUESTIONS ANSWERED ON FINANCES IN DIVORCE: Helping You To Complete the Form E, With Hints and Tips and Answering Questions on the Financial Aspects of DivorceNo ratings yet

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- Branded Dropshipping TemplateDocument1 pageBranded Dropshipping TemplateDaniel FetherzNo ratings yet

- Ana Moroz EmailDocument2 pagesAna Moroz EmailDaniel FetherzNo ratings yet

- Tom RipleyDocument1 pageTom RipleyDaniel FetherzNo ratings yet

- English Assessment - Term 2Document25 pagesEnglish Assessment - Term 2Daniel FetherzNo ratings yet

- RespirationDocument1 pageRespirationDaniel FetherzNo ratings yet

- Ana Moroz EmailDocument2 pagesAna Moroz EmailDaniel FetherzNo ratings yet

- Capítulo 05 - OM Solutions (8 Edición) - Barry Render y Jay HeizerDocument11 pagesCapítulo 05 - OM Solutions (8 Edición) - Barry Render y Jay HeizerAntonio LMNo ratings yet

- 26208-Article Text-30589-1-10-20181210Document10 pages26208-Article Text-30589-1-10-20181210mrizzqi22No ratings yet

- 2014 Qatar QoS Policy and QoS REgulatory FrameworkDocument7 pages2014 Qatar QoS Policy and QoS REgulatory FrameworkHộp Thư Điện TửNo ratings yet

- Synopsis: Comparative Analysis of MARKETING STRATEGIES OF Vodafone & AIRTELDocument7 pagesSynopsis: Comparative Analysis of MARKETING STRATEGIES OF Vodafone & AIRTELme_akashmbaNo ratings yet

- HQ27 - Gurugram - Snapshot - Aug 2022Document16 pagesHQ27 - Gurugram - Snapshot - Aug 2022Manoj KumarNo ratings yet

- Chapter 35 Business Law PowerpointDocument18 pagesChapter 35 Business Law PowerpointJohn JonesNo ratings yet

- Comprehensive Problem On Intercompany TransactionsDocument9 pagesComprehensive Problem On Intercompany TransactionsasdasdaNo ratings yet

- Axis Bluechip Fund Attribution Analysis PDFDocument7 pagesAxis Bluechip Fund Attribution Analysis PDFYasahNo ratings yet

- Christopher Morrison Analysis Project-4Document12 pagesChristopher Morrison Analysis Project-4api-624308446No ratings yet

- Taxation of Business Entities 2017 8th Edition Spilker Solutions ManualDocument11 pagesTaxation of Business Entities 2017 8th Edition Spilker Solutions Manualotisviviany9zoNo ratings yet

- Nota Kuliah (2) MAINTAIN QUALITY CONTROL (QC) SERVICED PRODUCTDocument14 pagesNota Kuliah (2) MAINTAIN QUALITY CONTROL (QC) SERVICED PRODUCTMohd HakimNo ratings yet

- Eric Tsui - Technology in Knowledge ManagementDocument148 pagesEric Tsui - Technology in Knowledge ManagementDhimitri BibolliNo ratings yet

- l4m7 Questions 1Document19 pagesl4m7 Questions 1Dejanira ScottNo ratings yet

- National Oil Corporation: Rev Date Description Checked ApprovedDocument27 pagesNational Oil Corporation: Rev Date Description Checked ApprovedALI BEN AMORNo ratings yet

- Duration Gap ModelDocument29 pagesDuration Gap ModelSachit KCNo ratings yet

- Data Skills Report 2020Document41 pagesData Skills Report 2020Wee WeeNo ratings yet

- MOD 1 - Introduction On Cost AccountingDocument10 pagesMOD 1 - Introduction On Cost Accountingzach thomasNo ratings yet

- UPP TyingDocument14 pagesUPP TyingRajeshKumarJainNo ratings yet

- BYOD Case StudyDocument2 pagesBYOD Case StudyNaman JainNo ratings yet

- Capital Budgeting Case 4Document4 pagesCapital Budgeting Case 4Expert AnswersNo ratings yet

- Go Boldly Explore Augmented Reality Ar Virtual RealityDocument8 pagesGo Boldly Explore Augmented Reality Ar Virtual RealityNiveditha PNo ratings yet

- Airtel NavratnaDocument29 pagesAirtel Navratnariteshgoyal0380% (5)

- 08.LAMPIRAN 3 - BDD Lampiran 27 Senarai Semak Audit Dalaman ABMS ABMS Internal Audit Checklist30 Dan 31 Jan2024Document53 pages08.LAMPIRAN 3 - BDD Lampiran 27 Senarai Semak Audit Dalaman ABMS ABMS Internal Audit Checklist30 Dan 31 Jan2024Yusoff Sya JajaNo ratings yet

- Incident Handling Response Plan-ExampleDocument3 pagesIncident Handling Response Plan-ExampleCharag E ZindgiNo ratings yet

- Case Study Mango - QuestionDocument7 pagesCase Study Mango - QuestionVi Phạm Thị HàNo ratings yet

- Assignment 2 Buisness LawDocument8 pagesAssignment 2 Buisness LawMuhammad IrfanNo ratings yet

- Fast Food Nation by Eric Schlosser - Discussion QuestionsDocument8 pagesFast Food Nation by Eric Schlosser - Discussion QuestionsHoughton Mifflin HarcourtNo ratings yet

- SCR 2011 053Document131 pagesSCR 2011 053divya kathareNo ratings yet

- Dwi Julianti: Work Experience ProfileDocument1 pageDwi Julianti: Work Experience ProfileDwi JuliantiNo ratings yet

- 001 Principles of Real Estate BrokerageDocument13 pages001 Principles of Real Estate BrokerageRHOEL ARIES PEÑAMANTE PINTONo ratings yet