Professional Documents

Culture Documents

5 Yr

Uploaded by

api-25887578Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 Yr

Uploaded by

api-25887578Copyright:

Available Formats

For Immediate Release CONTACT: Office of Financing

June 24, 2009 202-504-3550

TREASURY AUCTION RESULTS

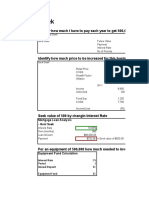

Term and Type of Security 5-Year Note

CUSIP Number 912828KY5

Series N-2014

Interest Rate 2-5/8%

High Yield1 2.700%

Allotted at High 23.37%

Price 99.651404

Accrued Interest per $1,000 None

Median Yield2 2.619%

Low Yield3 2.590%

Issue Date June 30, 2009

Maturity Date June 30, 2014

Original Issue Date June 30, 2009

Dated Date June 30, 2009

Tendered Accepted

Competitive $95,237,500,000 $36,893,034,700

Noncompetitive $107,079,600 $107,079,600

FIMA (Noncompetitive) $0 $0

Subtotal4 $95,344,579,600 $37,000,114,3005

SOMA $1,074,492,000 $1,074,492,000

Total $96,419,071,600 $38,074,606,300

Tendered Accepted

Primary Dealer6 $59,737,000,000 $12,646,590,000

Direct Bidder7 $6,284,000,000 $1,080,000,000

Indirect Bidder8 $29,216,500,000 $23,166,444,700

Total Competitive $95,237,500,000 $36,893,034,700

1 5

All tenders at lower yields were accepted in full. Awards to combined Treasury Direct systems = $62,372,600.

2 6

50% of the amount of accepted competitive tenders was tendered at or below Primary dealers as submitters bidding for their own house accounts.

that yield. 7

Non-Primary dealer submitters bidding for their own house accounts.

3 8

5% of the amount of accepted competitive tenders was tendered at or below Customers placing competitive bids through a direct submitter, including

that yield. Foreign and International Monetary Authorities placing bids through the

4 Federal Reserve Bank of New York.

Bid-to-Cover Ratio: $95,344,579,600/$37,000,114,300 = 2.58

You might also like

- Case Study PeregrineDocument4 pagesCase Study PeregrineCamille Fajardo67% (3)

- DCF Modeling Examplye Deal Gallagher MohanDocument16 pagesDCF Modeling Examplye Deal Gallagher Mohansuraj k33% (3)

- Input Area:: Keafer Manufacturing Working Capital ManagementDocument3 pagesInput Area:: Keafer Manufacturing Working Capital ManagementLina Oktaviani0% (1)

- SG 4 - Moms - Com Negotiation Result Form-Hasil DiskusiDocument23 pagesSG 4 - Moms - Com Negotiation Result Form-Hasil DiskusiFadhila Hanif100% (1)

- Bond and NoteDocument22 pagesBond and NoteEyuel SintayehuNo ratings yet

- For Immediate Release September 23, 2009Document1 pageFor Immediate Release September 23, 2009api-25887578No ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- For Immediate Release December 28, 2009Document1 pageFor Immediate Release December 28, 2009api-25887578No ratings yet

- For Immediate Release February 10, 2010Document1 pageFor Immediate Release February 10, 2010qtipxNo ratings yet

- 2 YrDocument1 page2 Yrapi-25887578100% (2)

- 2 YrDocument1 page2 Yrapi-25887578No ratings yet

- For Immediate Release October 08, 2009Document1 pageFor Immediate Release October 08, 2009api-25887578No ratings yet

- For Immediate Release September 22, 2009Document1 pageFor Immediate Release September 22, 2009api-25887578No ratings yet

- For Immediate Release November 12, 2009Document1 pageFor Immediate Release November 12, 2009api-25887578No ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- For Immediate Release January 14, 2010Document1 pageFor Immediate Release January 14, 2010api-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose Campos100% (1)

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose CamposNo ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered AcceptedJose CamposNo ratings yet

- Excel FinanceDocument28 pagesExcel FinanceabdullahNo ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Public Debt NewsDocument1 pagePublic Debt NewsTimNo ratings yet

- Yields and ReturnsDocument1 pageYields and ReturnsVISHAL PATILNo ratings yet

- FIN 4453 Project 3 Capital Budgeting Analysis TemplateDocument34 pagesFIN 4453 Project 3 Capital Budgeting Analysis TemplatevalNo ratings yet

- Customer Profitability AnalysisDocument1 pageCustomer Profitability AnalysisAdrianaNo ratings yet

- Latihan Soal Asis Akm Ii - Sekuritas DiplutifDocument6 pagesLatihan Soal Asis Akm Ii - Sekuritas DiplutifRADEN DIPONEGORONo ratings yet

- Final Exam SFM (Reppi, Michelle Gladys)Document7 pagesFinal Exam SFM (Reppi, Michelle Gladys)Bervie RondonuwuNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- AE 16 Effective Interest MethodDocument14 pagesAE 16 Effective Interest MethodMiles CastilloNo ratings yet

- Lease Option Offers - V1Document8 pagesLease Option Offers - V1John TurnerNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- What If ChecklistDocument11 pagesWhat If Checklistmohsanmajeed100% (1)

- Assignment 2 - SolutionsDocument6 pagesAssignment 2 - SolutionsSiying GuNo ratings yet

- Underwriting Report-Week Ending 03 September 2020Document12 pagesUnderwriting Report-Week Ending 03 September 2020Emmanuel MonzeNo ratings yet

- Important Uncertainties 2010Document25 pagesImportant Uncertainties 2010Charlie Qingling LuNo ratings yet

- Problemsets Whatifanalysis Aishu 15thmay 1Document11 pagesProblemsets Whatifanalysis Aishu 15thmay 1Deepak SharmaNo ratings yet

- StickkDocument4 pagesStickkNikesh PatelNo ratings yet

- VIII. Financial Plan: 1. 12-Month Profit and Loss ProjectionDocument4 pagesVIII. Financial Plan: 1. 12-Month Profit and Loss ProjectionAJ CalunsagNo ratings yet

- Jawaban Soal UAS 1Document5 pagesJawaban Soal UAS 1Muhammad SuryantoNo ratings yet

- PAID Network Token Metrics and Vesting Periods SummaryDocument1 pagePAID Network Token Metrics and Vesting Periods Summaryadi_doncaNo ratings yet

- Bonds PayableDocument7 pagesBonds PayableCarl Yry BitengNo ratings yet

- Quiz EiDocument3 pagesQuiz EiJOY LYN REFUGIONo ratings yet

- Gonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialDocument4 pagesGonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- Bonds Payable-Between Interest Dates and SerialDocument4 pagesBonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- Midterm Exam SolutionDocument3 pagesMidterm Exam SolutionRaj PatelNo ratings yet

- Rajesh Achutha WarrierDocument86 pagesRajesh Achutha Warrierkrishna PatelNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Rent vs. Buy Calculation: Inflation RateDocument3 pagesRent vs. Buy Calculation: Inflation RateOthman Alaoui Mdaghri BenNo ratings yet

- Customer Profitability Analysis by SegmentDocument1 pageCustomer Profitability Analysis by SegmentSurya GunawanNo ratings yet

- Secretary Chief Executive Officer: Head Office: 6985 Financial Drive Unit 400 Mississauga, Ontario L5N 0G3Document24 pagesSecretary Chief Executive Officer: Head Office: 6985 Financial Drive Unit 400 Mississauga, Ontario L5N 0G3Ufuoma ErhigbareNo ratings yet

- Streamline CompareDocument1 pageStreamline Comparejoe@josephhummel.comNo ratings yet

- Argent Research: Merger & Acquisition Modelling - Vertical Integration ModelDocument31 pagesArgent Research: Merger & Acquisition Modelling - Vertical Integration ModeltmendisNo ratings yet

- Hedging SampleDocument4 pagesHedging SampleJunior CelsiusNo ratings yet

- Financial Model for Revenue, Costs, Profits and Cash Flow Projections Over 5 YearsDocument5 pagesFinancial Model for Revenue, Costs, Profits and Cash Flow Projections Over 5 YearsARCHIT KUMARNo ratings yet

- UntitledDocument1 pageUntitledapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- December 2013 Construction at $930.5 Billion Annual RateDocument5 pagesDecember 2013 Construction at $930.5 Billion Annual Rateapi-25887578No ratings yet

- Roductivity and OstsDocument12 pagesRoductivity and Ostsapi-25887578No ratings yet

- UntitledDocument1 pageUntitledapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Full Report On Manufacturers' Shipments, Inventories and Orders September 2012Document9 pagesFull Report On Manufacturers' Shipments, Inventories and Orders September 2012api-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument1 pageJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument2 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- UntitledDocument50 pagesUntitledapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Talking Violence With ChildrenDocument2 pagesTalking Violence With ChildrenKING 5 NewsNo ratings yet

- UntitledDocument10 pagesUntitledapi-25887578No ratings yet

- January 2012 Construction at $827.0 Billion Annual RateDocument5 pagesJanuary 2012 Construction at $827.0 Billion Annual Rateapi-25887578No ratings yet

- UntitledDocument4 pagesUntitledapi-25887578No ratings yet

- UntitledDocument10 pagesUntitledapi-25887578No ratings yet

- Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, January 2012Document5 pagesEconomic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, January 2012api-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Treasury Auction Results: Tendered AcceptedDocument1 pageTreasury Auction Results: Tendered Acceptedapi-25887578No ratings yet

- Today's Treasury AuctionDocument1 pageToday's Treasury Auctionshawn2207No ratings yet

- 2 YrDocument1 page2 Yrapi-25887578No ratings yet

- Minutes of The Federal Open Market Committee August 9, 2011Document10 pagesMinutes of The Federal Open Market Committee August 9, 2011api-25887578No ratings yet

- UntitledDocument2 pagesUntitledapi-25887578No ratings yet

- Wednesday, August 24, 2011, at 8:30 A.M. EdtDocument4 pagesWednesday, August 24, 2011, at 8:30 A.M. Edtapi-25887578No ratings yet

- News Release: Personal Income and Outlays: January 2011Document13 pagesNews Release: Personal Income and Outlays: January 2011api-25887578No ratings yet