Professional Documents

Culture Documents

How Privatized Banking Really Works

Uploaded by

psychonomyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Privatized Banking Really Works

Uploaded by

psychonomyCopyright:

Available Formats

!

!

!

"!#$%&!'$(!%)&!*+,!-&(./$0!$'!

1$2!*(/34%/5&6!7408/09!!"#$$%!:$(8.!

7;!<=!>4(?$.!<4(4!@!A$B&(%!*=!CD(E);!

1he followlng pdf flle ls provlded for educaLlonal purposes. 8eclplenLs of Lhls flle are encouraged Lo

dlsLrlbuLe lL, wlLh Lhe undersLandlng LhaL Lhe auLhors do noL approve of Lhe physlcal producLlon of Lhe

conLenLs for resale.

1hose lnLeresLed ln purchaslng physlcal coples of Lhe book may do so aL Lhls webslLe:

hLLp://www.usaLrusLonllne.com/

!

!

!

"##$%&'!()*!+%*%!%,-!./*01234!5))6!

!

"#$%$! $&'! ()%*+,! +$-.! '/&.! $&! .01.22.&3! 4/5! 6)77$%898&:! 3+.!

*%/52.76! ;83+! /)%! 1)%%.&3! <8&$&18$2! 6,63.7! 8&! 2$&:)$:.! 3+$3! $&,/&.!

1$&! )&'.%63$&'=! >+.,! +$-.! '.7,638<8.'! <%$138/&$2! %.6.%-.! 5$&?8&:@!

$&'! 7$'.! 83! 12.$%A! B.C%.! :.338&:! %8**.'! /<<D! >+.8%! 6)::.63.'! 6/2)38/&!

/<! E.26/&! E$6+F6! G&<8&83.! H$&?8&:! I/&1.*3! 86! $! 3$&3$2898&:! *%/*/6$2!

3+$3!'.6.%-.6!1$%.<)2!61%)38&,=J

!!!!!!"! #$%! &'()*+! ,%! -((.+/! 0$%/! *12'($! (3! 2'4! 546! 7($8! &9)4+!

:4+2+4;;4$+! .7$8-)9,! *<.! :17! ;)$&8&#%$$2! <,#)**7#8! =/&-7! 8)!

"'7*&#%,!>&48)*2?!

!

"Bow Piivatizeu Banking! K.$22, Woiks! 5%8228$&32,! .0*2$8&6! +/;!

:/-.%&7.&3! 8&3.%-.&38/&! 8&! 7/&.,! $&'! 5$&?8&:! +$6! $2;$,6! 5..&! $!

*2$:).! /&! 3+.! .1/&/7,@! $&'! *%/-8'.6! $! %/$'7$*! </%! 3%).! 7/&.3$%,!

<%..'/7=! K.$'! 3+86! 5//?! $&'! 2.$%&! +/;! ,/)! 1$&! *.%6/&$22,! 6.1.'.!

<%/7! /)%! 1%)7528&:! 7/&.3$%,! %.:87.! $&'! 87*%/-.! ,/)%! <8&$&18$2!

<)3)%.! ;+82.! )&'.%78&8&:! 3+86! 8&68'8/)6! 6,63.7! /<! :/-.%&7.&3!

1/&3%/26=J

!!!!!!!"! #$%! &'()*+! #9=($4<>(/! ?$(34++($! (3! ,@(<()9@+/! =(A(;*!

B<9C4$+92A! D*$A;*<./! *12'($! (3! >)9! @%0&8%$&4'! A%B7-! "'7*&#%/!

:17!C7%$!+&,#)$,/!*<.!>%'&$8),D4!@/*47%!

!

!

!

!

!

"G&! $&! .1/&/781$22,! <%8:+3<)2! $:.! ;+.%.! :/-.%&7.&3! $)3+/%838.6! $%.!

:%$558&:! </%! .-.%7/%.! */;.%! $&'! 1/&3%/2! /-.%! /)%! 28-.6@! #$%$! $&'!

()%*+,!+$-.!5%/):+3!3/:.3+.%!5/3+!6/)&'!.1/&/781!%.$6/&8&:!;83+!$!

6/)&'!*%8-$3.!63%$3.:,!3/!'8%.13!3+.!8&'8-8')$2!3/;$%'!3+.!.61$*.!.083=!

L&,/&.!;8228&:!3/!+.$%!3+.8%!;$%&8&:!$&'!6..?!3+86!.083!;822!'861/-.%!$!

&.;!2.-.2!/<!8&'8-8')$2!<%..'/7!3+$3!1/)2'!&/3!+$-.!5..&!87$:8&.'!8&!

3+.!<$1.!/<!3+.!*%.6.&3!3,%$&&,!$&'!'.6*/3867!/<!/)%!$:.=J

!!!!!!"! #$%! ?*1;! E%! F;4C4;*<./! ?$(34++($! (3! ,@(<()9@+/!

G9$)9<H'*)! I(12'4$<! F(;;4H4/! *12'($! (3! E,'%46&,F! 817! A%#*7-!

+&74!*<.!E,-7*48%,-&,F!817!.)-7*,!@/$8/*7!G%*4H!:17!I447,8&%$4!

)(!G7487*,!@&B&$&J%8&),%!

!

!

"L3! 2/&:! 2$63@! 3;/! *%/78&.&3! 3+8&?.%6! /<! 3+.! FL)63%8$&! M1+//2! /<!

>+/):+3F! 6..! 3+$3! '8-8'.&'N*$,8&:! B+/2.! #8<.! G&6)%$&1.! 86! FL)63%8$&!

.1/&/7816! 8&! $138/&=F! O%..! *./*2.! $%.! 687*2,! 1/&3%$138&:! ;83+! /3+.%!

<%..! *./*2.! 3/! 6/2-.! $! <8&$&18$2! *%/52.7=! PE/! /&.! 1/7*.26! *./*2.! 3/!

5),!28<.!8&6)%$&1.Q3+.,!$%.!-/2)&3$%82,!.&3.%8&:!8&3/!$!1/&3%$13!;83+!

28?.N78&'.'! *./*2.R=! B+.&! 3+.! G&<8&83.! H$&?8&:! I/&1.*3! 86! <)22,!

)&'.%63//'@! 3+.&! /&.! %.$289.6! 3+$3! 83! 86! %.$22,! $! *.%6/&$2! 7/&.3$%,!

6,63.7! 3+$3! +$6! $! '.$3+! 5.&.<83! $6! $! 5/&)6=! #$%$! $&'! ()%*+,! +$-.!

'/&.! $! <$&3$6381! 4/5! /<! 86/2$38&:! 3+86! 3%)3+=! >+.,! +$-.! <)2<822.'! 7,!

'%.$7!/<!/-.%!ST!,.$%6=J

!

!!!!!!"!J%!54;+(<!5*+'/!*12'($!(3!K7#)'&,F!L)/*!M9,!K%,67*H!:17!

<,(&,&87!K%,6&,F!@),#708%!

!

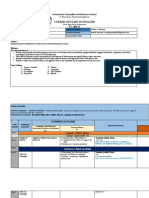

K(6!?$9C*29>4.!G*<89<H!!

C7%$$2!-($8+!

!

!

!

!

K(6!?$9C*29>4.!G*<89<H!

C7%$$2!-($8+!

!

<,87F*%8&,F!"/48*&%,!I#),)'!9&81!

!817!<,(&,&87!K%,6&,F!@),#708!

!

!

!

!

!

!

!

!

=%!F*$;(+!=*$*

J(:4$2!?%!D1$L'A/!?'%#%!

!

!

!

!

!

!

!

!

!

@)02*&F18!N!OPQP!52!+?!@%*$)4!+%*%!R!C)57*8!;?!./*012!

!

U63!V'838/&NW%8&3.'!X)2,!SYUY!8&!3+.!Z&83.'!M3$3.6!/<!

L7.%81$!5,!A17*&-%,!K))64S!<,#?T",,!"*5)*!.&F%,!

!

GMHE![\]NYN^UTN_S^]SNT!

!

I/-.%!L%3!$&'!`.68:&!5,!L2-8&!L5).2/)<!

$2-8&$5).2/)<a28-.=1/7!!

!

W+/3/!L%3!$&'!`.68:&!5,!M3.*+$&8.!#/&:!

;;;=63.*+1%.$38-.=1/7

O/%!8&</%7$38/&!$5/)3!)6.<)2!%.<.%.&1.!7$3.%8$26@!$''838/&$2!

%.$'8&:! 28636@! $&'! /3+.%! $-$82$52.! %.6/)%1.6! <%/7! 3+.!

$)3+/%6@!-8683!3+.8%!%.6*.138-.!;.5683.6:

#=!I$%2/6!#$%$A!+33*Abb;;;=)6$3%)63/&28&.=1/7!

K/5.%3!W=!()%*+,A!+33*AbbI/&6)238&:H,KW(=1/7!

!

!

Acknowleugments

!

In auuition to all the gieat thinkeis who have taught us so

much ovei the yeaiseithei in peison oi inuiiectly thiough theii

bookswe woulu like to specifically thank a few people who weie

instiumental in the cieation of this woik. The entiie teams at both

The Lafayette Life Insuiance Company anu Nutual Tiust Life

Insuiance Company giaciously alloweu us to visit theii offices in

oiuei to leain about the innei woikings of whole life insuiance. We

shoulu single out Baviu Fiancis of Lafayette who aiiangeu foi the

meeting in the fiist place. Rogei Baith anu Stephen Batza of Nutual

Tiust went above anu beyonu the call of uuty in fieluing oui

questions about cash values anu policy loans.

Baviu Steains, piesiuent of the Infinite Banking Concept

Think Tank in Biimingham, Alabama, has extenueu to us eveiy bit of

assistance as we completeu the book.

Baviu uoiuon anu Stephan Kinsella assisteu with the

Austiian siue of oui ieseaich.

Alvin Abuelouf anu Stephanie Long cieateu the giipping

covei uesign, which is aiguably the best attiibute of the book.

Finally, we woulu like to especially thank Anne Laia foi

acting as liaison with the publishing company, anu foi the scoies of

houis she put into the piepaiation of the manusciipt. Weie it not foi

Anne, this book woulu still consist of a collection of Woiu

uocuments on the authois' iespective haiu uiives.

!

!

!

!

!

CI;CIAIU:":<MUAH!

!

A:":EAH! ! >+.! L)3+/%6! /<! 3+86! 5//?! ;$%%$&3! $&'! %.*%.6.&3! 3+$3! 3+.,!

$%.!&/3!"5%/?.%6J!/%!3/!5.!'..7.'!$6!!"5%/?.%N'.$2.%6@J!$6!6)1+!3.%76!

$%.!'.<8&.'!8&!3+.!M.1)%838.6!L13!/<!U[__@!$6!$7.&'.'@!/%!$&!"8&6)%$&1.!

1/7*$&,@J!/%!"5$&?=J!!

!

+I="+S! :"VS! "@@MEU:<U=S! MC! <UWIA:.IU:! "XW<@IH! >+.! L)3+/%6!

/<! 3+86! 5//?! $%.! &/3! %.&'.%8&:! 2.:$2@! 3$0@! $11/)&38&:@! /%! 8&-.637.&3!

$'-81.=!L22!.0+85836!8&!3+86!5//?!$%.!6/2.2,!</%!822)63%$38/&!*)%*/6.6@!5)3!

)&'.%! &/! 18%1)763$&1.6! 6+$22! 3+.! %.$'.%! 1/&63%).! 3+.6.! $6! 3+.!

%.&'.%8&:!/<!2.:$2@!3$0@!$11/)&38&:!/%!8&-.637.&3!$'-81.=!

!

X<A@+"<.IC! "UX! +<.<:":<MU! MY! +<"K<+<:LH! >+.! L)3+/%6! /<! 3+86!

5//?! +.%.5,! '8612$87! $&,! $&'! $22! ;$%%$&38.6@! .0*%.66@! /%! 87*28.'@!

8&12)'8&:! 7.%1+$&3$58283,! /%! <83&.66! </%! $! *$%381)2$%! *)%*/6.! $&'!

7$?.! &/! %.*%.6.&3$38/&! /%! ;$%%$&3,! /<! 3+.! 1.%3$8&3,! 3+$3! $&,!

*$%381)2$%! %.6)23! ;822! 5.! $1+8.-.'=! G&! &/! .-.&3! ;822! 3+.! L)3+/%6@! 3+.8%!

.7*2/,..6@! /%! $66/18$3.'! *.%6/&6@! /%! $:.&36! 5.! 28$52.! 3/! 3+.! %.$'.%! /<!

3+86!5//?@!/%!836!L:.&36!</%!$&,!1$)6.6!/<!$138/&!/<!$&,!?8&'!;+.3+.%!/%!

&/3!3+.!%.$'.%!+$6!5..&!$'-86.'!/<!3+.!*/66858283,!/<!6)1+!'$7$:.=!

!

!

This book is ueuicateu to

all those who

love #85.%3,!anu champion!M/)&'!(/&.,=

!

!

F!M!5!&!,!5!&!I!

!

?!E!J!&!!!M!5!,N!!!&'4!O1*<.*$A ................................................P!

Chaptei 1: Intiouuction..................................................................................... S

Chaptei 2: Assessing the Nain Pioblem.................................................. S1

Chaptei S: Losing 0ui Way ........................................................................... S1

Chaptei 4: Losing 0ui Spiiit ......................................................................... 67

Chaptei S: Noney .............................................................................................. 91

Chaptei 6: Beposit Banking ....................................................................... 1u9

Chaptei 7: Inflation........................................................................................ 127

Chaptei 8: Fiactional Reseive Banking ................................................ 147

?E!J!&!!!&!-!MN!!!&'4!I(1<.!D(<4A!I(;129(<.............. PQR

!

Chaptei 9: The Role of Social Institutions........................................... 167

Chaptei 1u: Piivate Piopeity.................................................................... 17S

Chaptei 11: Tiaue........................................................................................... 179

Chaptei 12: Noney......................................................................................... 18S

Chaptei 1S: Piices, Piofits anu Planning.............................................. 191

Chaptei 14: Banking...................................................................................... 2uS

Chaptei 1S: Insuiance.................................................................................. 21S

Chaptei 16: uoveinment Bistoitions..................................................... 22S

Chaptei 17: The Sounu Noney Solution............................................... 261

!

?!E!J!&!!!&!K!J!,!,N!!&'4!SGF!F(<2$9:129(<.................... TUP!

Chaptei 18: The Infinite Banking Concept .......................................... 28S

Chaptei 19: Common 0bjections to IBC............................................... S11

Chaptei 2u: The IBC Contiibution to the

Sounu Noney Solution....................................................... SSS

Chaptei 21: Conclusion................................................................................ S49

ELL4<.9@4+ ................................................................................... SS7

!

uieat Austiians................................................................................................. SS9

About the Authois........................................................................................... S79

!

!"

!"#$%&%

'()%*+",-"#.%

"

"

!"#$%&'$%("#)$)"$&'%*$%$#+,-#'$(""./$0)$1,22$(")3$*,%4+"5'$"#&$

+%),"+65$ '7"+"8,7$ 1"'5$ %+*$ )3'+$ "99'&$ %$ &'%2,5),7$ 5"2#),"+/$ 0)$ 1,22$

*,57#55$ )3'$ 5:8;)"85$ "9$ )3'$ -#%+*%&:$ )3%)$ %22$ <8'&,7%+5$ 3%='$

;'&7',='*>$(#)$,)$1,22$'?;2%,+$)3'8$,+$%$1%:$:"#$8%:$+'='&$('9"&'$3%='$

'+7"#+)'&'*/$<9)'&$:"#$#+*'&5)%+*$)3'$;&"(2'8>$)3,5$("".$1,22$'?;2%,+$

%$;&%7),7%2$7#&'$)3%)$:"#$7%+$,8;2'8'+)$,88'*,%)'2:/$

@3,5$("".$7"='&5$8#73$4&"#+*/$0)$53"15$)3%)$"#&$7#&&'+)$7&,5,5>$

%5$ 1'22$ %5$ )3'$ 4'+'&%2$ 9,+%+7,%2$ 5)ƺ'$ %992,7),+4$ %28"5)$ %22$

<8'&,7%+5>$,5$+")$*#'$)"$7"58,7$7",+7,*'+7'/$0)$,5$%25"$+")$A#5)$B)3'$1%:$

)3,+45$%&'/C$

D">$ "#&$ -#%+*%&:$ 3%5$ ='&:$ 5;'7,9,7$ 7%#5'5E$ 9,%)$ 8"+':$ %+*$ )3'$

;&%7),7'$ "9$ 9&%7),"+%2$ &'5'&='$ (%+.,+4>$ %+*$ )3'$ 4"='&+8'+)$

,+)'&='+),"+5$ )3%)$ ;'&;')#%)'$ )3'8/$ 0+$ %$ ='&:$ &'%2$ 5'+5'>$ "#&$ 8"*'&+$

9,+%+7,%2$5:5)'8$7&'%)'5$8"+':$"#)$"9$)3,+$%,&>$%+*$7%+$*'5)&":$,)$A#5)$

%5$ -#,7.2:/$ @3,5$ 8%4,7%2$ %(,2,):$ 4,='5$ &,5'$ )"$ )3'$ 9%8,2,%&$ (""8F(#5)$

7:72'$,+$*'='2";'*$'7"+"8,'5/$

@3'$ &'7"4+,),"+$ "9$ )3,5$ )&"#(2,+4$ 9%7)$ ,8;2,'5$ +"$ 8"&%2$

7"+*'8+%),"+$ "9$ )3'$ 8,22,"+5$ "9$ ;'";2'$ 7#&&'+)2:$ '8;2":'*$ ,+$ )3'$

7"88'&7,%2$(%+.,+4$5'7)"&/$$G"5)$"9$)3'8$;&"(%(2:$3%='$+"$,*'%$)3%)$$

!"#$%&'()*%+,"-."#/%

HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH$

$

#"

"#&$ '+),&'$ 9,+%+7,%2$ 5:5)'8$ &'5)5$ "+$ -#,7.5%+*/$ @3'$ 8'73%+,75$ "9$

9&%7),"+%2$ &'5'&='$ (%+.,+4$ 7%+$ ('$ *,99,7#2)$ )"$ 4&%5;>$ %+*$ ,+*''*$ 8%+:$

;'";2'$ 1,22$ +''*$ )"$ &'%*$ )3,5$ ("".$ 5'='&%2$ ),8'5$ ('9"&'$ )3':$ ):$

#+*'&5)%+*$,)/$I#)$"+7'$)3':$*">$)3':$1,22$('$53"7.'*/$$

J"#5'3"2*5$ 3%='$ )3'$ %(,2,):$ )"$ 5'7'*'$ 9&"8$ )3,5$ 73%"),7$

9,+%+7,%2$ 5:5)'8/$ @3':$ 7%+$ )#&+$ )"$ )&%*,),"+%2$ ,+5#&%+7'$ 7"8;%+,'5>$

&%)3'&$ )3%+$ 7"88'&7,%2$ (%+.5$ %+*$ K%22$ L)&'')>$ 9"&$ )3',&$ 9,+%+7,+4$

+''*5/$K'$'?;2%,+$%22$"9$)3,5$,+$*#'$),8'/$

!')$ ('9"&'$ "99'&,+4$ %$ 5"2#),"+>$ 1'$ 8#5)$ 9,&5)$ #+*'&5)%+*$ )3'$

-#%+*%&:/$0)$,5$8"+5)&"#5/$

$

"

S

!"#$%&'()(

*+%',-./%0,+(

123(!#'4,5(6#'#7(

(

!"#"$%#&'$#()$*#'#+'(%#,'-#"./#("0#

1)2+%3(# )(# +"&)%/-# )+# +,%%4)$5#

/",'0*+# *%+/0.&/)"$6# 71%0%("0%#

%8%0-"$%9# )$# 1)+# ",$# )$/%0%+/+9#

2.+/#/10.+/#1)2+%3(#8)5"0".+3-#)$/"#

/1%# )$/%33%&/.'3# :'//3%6# !"$%# &'$#

+/'$*# '+)*%# ,)/1# .$&"$&%0$;# /1%#

)$/%0%+/+# "(# %8%0-"$%# 1'$5# "$# /1%#

0%+.3/+6#

<=.*,)5#8"$#>)+%+

?

#

#

hy uo we have to have money.

As the late economics Piofessoi Claience

Caison explaineu, this is the type of question you aie most likely to

heai fiom a young chilu. Bowevei, when a chilu asks a question like

this theie is no ieal inteiest in knowing anything about the oiigin of

money, oi how it functions, oi even about the fact that it is only a

meuium of exchange. Actually, the question stems entiiely fiom the

iuea that the things the chilu wants cost money anu he uoes not

have enough of it. So in essence, the chilu's ieal question is why he

W

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

4

can't have whatevei he wants, when he wants it, without theie being

a cost attacheu to it.

2

#

Now, when we step back anu seiiously think about it, this is a

veiy goou question anu not only of chiluien, but also of auults. It is a

question that uoes not piess on us too much, so long as things aie

going well economically anu we all have sufficient incomes to pay

foi the things we want anu neeu, but what happens when all of that

changes, as in the type of changes we aie all expeiiencing touay. All

of a suuuen the alaim bells stait to go off anu eveiyone staits

clamoiing foi answeis about money.

It was actually the wiuespieau clamoi foi these answeis that

was one of the piincipal motivations foi the wiiting of this book. It

all began with the alaiming panic that spieau thioughout the woilu

in the eaily fall of 2uu8. Beie in the 0.S. it was eviuent eveiywheie.

Eveiy uay, foi weeks on enu, people weie tiansfixeu to theii Tv sets

as they listeneu to things they hau uifficulty compiehenuing, but

knew all too well that they weie expeiiencing a hoiiific financial

meltuown unlike any othei they hau evei witnesseu. The

unceitainty the ciisis cieateu foi eveiyone was impossible to hiue

anu it was appaient in eveiyuay conveisations. Nost notably was

the feai it geneiateu among schoolchiluien fiom simply obseiving

the state of anxiety in the faces of theii paients. Ameiicans, almost

in unison, came to iealize in a veiy peisonal way how fiagile oui

entiie economic system hau become as they witnesseu giant

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

S

financial stiuctuies ciumble. In fact, collapse of the entiie 0.S.

financial system uiu not escape anyone's minu, even the minus of

the most sophisticateu economic expeits.

Touay we aie left with the afteimath of the eaily phases of

oui piesent financial fiasco with many Ameiicans now having lost

theii businesses, theii jobs anu entiie life savings. The uiamatic

ciash of the stock maiket anu its eiiatic behavioi since, coupleu

with the collapse of the ieal estate maiket, has left people

eveiywheie asking: ,1%0%#)$#/1%#,"03*#*"#-".#4./#-".0#2"$%-#$",A

No one, howevei, is, oi can be, confiuent in his answei. Feai of

uouble-uigit inflation, even hypeiinflation, is on the minus of many.

uolu anu guns, giowing statistically high in uemanu, aie eviuence of

the unceitainty of oui futuie. As oui nation stiuggles with these

pioblems, as it attempts to ieuefine, oi cieate a new sense of

uiiection, many have alieauy lost all hope in the economic piinciples

that once maue this countiy gieat. The entiie iuea anu hope of a fiee

maiket economy is in ciisis. A iecent Biitish Bioaucasting

Coipoiation poll acioss 27 uiffeient countiies showeu 89% of the

29,uuu inuiviuuals questioneu weie uisillusioneu with capitalism.

This is why those of us who still believe in the maiket anu want no

pait of socialism aie uemanuing ieliable answeis to help uniavel all

of the financial confusion!

0f couise, this is not a new pioblem. As new as it may seem

to oui piesent geneiation in 2u1u, the stiuggle foi the contiol ovei

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

6

money is as olu as mankinu, but one suie place to begin the queiy

about money within the 0niteu States is with this staik anu

paiamount iealization: 00R N0NEY IS N0T F0LLY IN 00R

C0NTR0L. 8"&( /&+%'#4( 2#+9( ,:( %"&( ;+0%&-( <%#%&5=%"&( >&-&'#4(

?&5&'@&="#5( #( /,A$4&%&( A,+,$,43( ,+( ,.'( A,+&3( #+-( %"05(

/,+%',4(05(A#+-#%&-(23(,.'(:&-&'#4(B,@&'+A&+%C This uomination

of oui entiie monetaiy system has hau seveie economic anu moial

iamifications. The effects of this monopoly aie the piime ieason

why the value of oui money has fallen some 9S% since the Feueial

Reseive's founuing in 191S anu it is the uiiect cause of oui cuiient

financial ciisis. We cannot evei hope to begin to think anu see

money with claiity until this iealization is exposeu anu fully

unueistoou. To begin talking about the fiee maiket, money, savings,

inteiest, cieuit, investments oi banking without fiist having a

complete giasp of this tiuth, the fact that we aie unuei the giip of a

centially planneu money mechanism, leaus nowheie but to even

gieatei confusion anu uisenchantment. Bowevei, in oiuei foi this

tiuth to be fully giaspeu by the aveiage 0.S. citizento the uegiee

that public opinion can effect a ieal change at the top echelons of

goveinmentwill take nothing shoit of a miiacle. Bow in the woilu

uo you take the piinting piess away fiom goveinment once they

have hau full use of it all these many yeais. 0ntil this is uone, oui

0niteu States will continue to heau uown a path of social, political

anu economic uestiuction.

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

7

Yes, it is tiue. It is all so hugely oveiwhelming anu

hopeless.too big to fix. In fact, just how woulu one go about

changing such a monstious pioblem. When life is shoit anu the

moment of a possible victoiy so fai in the futuie, why even bothei.

What is the point of even tiying. Well, fiist of all consiuei this, anu

consiuei it seiiously. If change uoes not occui heie in this countiy, a

countiy wheie change is still possible, theie is no place else left on

this planet foi an escape. The entiie woilu opeiates by this same

closeu anu contiolleu monetaiy system. uoveinment manuateu

papei money anu banking systems aie eveiywheie! In the 0niteu

States the cential bank is the Feueial Reseive, in the 0.K. the cential

bank is the Bank of Englanu, in Italy it is the Euiopean Cential Bank

anu so on in eveiy majoi foieign countiy. The powei anu giowth of

goveinments eveiywheie aie fueleu by these monopoly systems

anu theii giowth has cut into the quality of life foi all inuiviuuals to

staggeiing piopoitions. It is like a viius, paiasitic in natuie anu

which will eventually kill the host. If we uo not make an effoit to

change it heie in oui countiy now, it will nevei change anu if we uo

not step foiwaiu to help change it, no one will.

Seconu, theie is no iational ieason to woik myself anu you,

the ieauei, up into a ievolutionaiy fienzy unless we stop long

enough to iealize that we aie losing something veiy piecious. B.0#

(0%%*"2C To biing this into peispective, consiuei that the abunuance

that we see anu have, oui high stanuaiu of living that most of us

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

8

enjoy touay, came into existence by a movement geiminateu fiom

the iuea of fieeuom. This movement exploueu heie in this countiy

fiom the colonial uays until 1914a veiy biief peiiou of some 1Su

yeais! Compaieu to the entiie histoiy of the woilu this is amazing!

We must, theiefoie, ieveise this tienu foi it is possible that we may

nevei have the oppoitunity to uo so again.

|Tjake.the gieat classical libeial.ievolutionaiy movement of

the seventeenth, eighteenth, anu nineteenth centuiies. These oui

ancestois cieateu a vast, spiawling, anu biilliant ievolutionaiy

movement, not only in the 0niteu States but thioughout the

Westein woilu, that lasteu foi centuiies. This was the movement

laigely iesponsible foi iauically changing histoiy, foi almost

uestioying histoiy as it was pieviously known to man. Foi befoie

these centuiies, the histoiy of man, with one oi two luminous

exceptions, was a uaik anu goiy iecoiu of tyianny anu

uespotism, a iecoiu of vaiious absolute States anu monaichs

ciushing anu exploiting theii unueilying populations, laigely

peasants, who liveu a biief anu biutish life at baie subsistence,

uevoiu of hope oi piomise. It was a classical libeialism anu

iauicalism that biought to the mass of people that hope anu that

piomise, anu which launcheu the gieat piocess of fulfillment. All

that man has achieveu touay, in piogiess, in hope, in living

stanuaius, we can attiibute to the ievolutionaiy movement, to

that "ievolution". This gieat ievolution was oui fathei; it is now

oui task to complete its unfinisheu piomise.

S

###

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

9

Thiiu, anu most impoitant, is that a movement foi ieal

change cannot possibly be effective if it staits fiom the top uown

(goveinment uown to the inuiviuual citizen). The genesis foi change

must stait with the inuiviuual. It must have the inuiviuual as the

piincipal ciiteiion anu spieau out anu up fiom theie. This happens

only when the inuiviuual's economic suivival questions aie

answeieu to his full satisfaction anu when he expeiiences

immeuiate iesults foi himself in the enueavoi he embaiks upon.

That is what this book is about. This is of ciucial impoitance because

when theie aie immeuiate benefits to the inuiviuual fiom his

piouuctive effoits, the inuiviuual takes notice anu immeuiately

seeks to uuplicate it. When he sees that the benefits he gains also

help society as a whole, he is encouiageu anu motivateu to involve

otheis, beginning with his own family membeis anu then eveiyone

else within his ciicle of contacts. This type of goou news always

spieaus, slowly in the beginning, but then suuuenly it tuins into an

evangelistic explosion. A movement that woiks in this mannei can

quickly take on a life of its own anu spieau until public opinion

giows, foicing the uppei echelons of goveinment to make vital anu

necessaiy changes. In the enu, all economic policies aie ultimately

uepenuent on the views of the geneial public anu theii choice is

final! It is the masses that ueteimine the couise of histoiy, but its

initial movement must stait with the inuiviuual.

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

1u

Foi these thiee impoitant ieasons this book contains

infoimation to guiue anu empowei the inuiviuual. It uesciibes in

uetail thiee inuepenuent iueas that aie alieauy at woik spieauing

anu gaining momentum thioughout the giassioots of oui countiy.

The people anu institutions involveu with these iueas aie

wonueifully cieative! Although uistinct, these iueas aie so uniquely

inteitwineu that biinging them togethei as one poweiful multi-

uimensional element in this book was natuial. These thiee iueas aie

Austiian Economics, the Sounu Noney Solution anu Piivatizeu

Banking as best uesciibeu by the D$()$)/%# E'$F)$5# G"$&%4/, a book

wiitten by R. Nelson Nash. 0nce fully unueistoou, these thiee iueas

pioviue the basis foi a foimula with poweiful tuin-aiounu uynamics

that may be implementeu by viitually any inuiviuual. The iesult is a

piivate economic enteipiise anu self-peipetuating teaching tool that

pioviues the inuiviuual the savings, banking anu financing

capabilities he neeus to acquiie all of his mateiial neeus, plus the

powei to liteially ieconstiuct national monetaiy policy. It is these

benefits that aie the key to keeping the inuiviuual inspiieu as he

spieaus the message to otheis. As the message giows, public

opinion will change.

This poweiful combination is the "new"# iuea piesenteu in

this book. This is, finally, a solution that answeis the question of

what one peison can actually uo that will make a uiffeience in an

economic enviionment that has gone teiiibly awiy. When you begin

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

11

fiist with the inuiviuual's own piivate economic affaiis, things

change immeuiately foi the bettei. It becomes the inuiviuual's

escape ioute to fieeuom. Fuitheimoie, the Sounu Noney Solution

suppoits this iuea anu Austiian economics confiims it. Noie

impoitantly, the inuiviuual can go into the economic enteipiise

immeuiately iegaiuless of the biiuleu money system he may be in

anu what is going on all aiounu him in the piesent social, political

anu economic enviionment. Although his hope iests in the ultimate

tiiumph of the Sounu Noney Solution, which is changing the

national monetaiy policy, the piocess he is engaging helps thiust

foiwaiu the Austiian Economic message while auvancing his own

peisonal economic benefits in the heie anu now.

The iuea is so iational that it shoulu not at all be uifficult to

giasp. All that is iequiieu is an open minu, the unueistanuing of a

few unueniable economic piinciples, the use of sinceie conviction,

common sense, imagination, couiage anu, above all, uiscipline.

Bopefully, in these fiist few beginning paiagiaphs, the ieauei's

appetite has been whetteu enough to want to become moie

acquainteu with the piocess. Aftei unueistanuing the iuea cleaily

anu giving it seiious thought, it will natuially follow that the ieauei

will want to embaik upon the enueavoi. In acting, by implementing

the piocess in his own economic affaiis, the ieauei confiims the

immeuiate benefits of the iuea anu assuies himself that it uoes in

fact ieally woik! This, in tuin, leaus you into telling otheis about

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

12

youi new-founu inuepenuence anu fieeuom theieby spieauing the

solution foi oui countiy eveiywheie.

*

*B+,'0+B(%"&(D.5%'0#+5(E,%(;5(0+(8"05(F&55(

In biinging togethei all of the thoughts containeu in this

book, it is impoitant foi the ieauei to know that I have ieceiveu an

enoimous amount of help anu to iecognize the souice of that help.

This is impoitant because if the ieauei is to implement the iuea

piesenteu heie, he will iueally neeu to take veiy similai steps foi a

moie in-uepth anu complete unueistanuing of it. Fiist of all, I have

benefiteu immensely by being a stuuent anu passionate ieauei of

the wiitings of the gieat classical natuial law theoiists founu in

Austiian economics. These menseveial of whom pieuateu Auam

Smith, who famously gave expiession to 3')++%HI(')0% in 1776have

come uown to us thiough wiitten histoiy illuminating the uifficult

anu the unseen on all things having to uo with economics. In my

own peisonal seaich foi the tiuth in the economic anu financial

iealm, I have founu no paiallel anu only wish that I hau heaiu about

them eailiei in my life. What a uiffeience that woulu have maue! In

Naich of 2uu9, just six months aftei the economic ciisis occuiieu, a

iaie anu inteiesting aiticle appeaieu in the financial publication,

E'00"$J+, entitleu, "Ignoiing the Austiians uot 0s in This Ness."

4

The

aiticle# pointeu out that the Austiian piesciiptions to solve the

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

1S

woilu's economic pioblems weie fiist ignoieu by the New Beal of

Fianklin B. Roosevelt. That was seventy-five yeais ago! A giim

ieminuei that the iefusal to accept sounu economic thinking has

gone on in this countiy foi quite some time. Insteau, Keynesian

Economics has now become entiencheu in society eveiywheie.

Eveiy majoi univeisity fiom Baivaiu on uown is vesteu in this

eiioneous way of economic thinking. Acioss paity lines, as

substantiateu by the Bush anu now the 0bama auministiation, with

the $7uu billion uollai TARP in late 2uu8 anu the $787 billion uollai

stimulus a few months latei, the iejection of sounu economics

obviously continues. Theiefoie, without question, one of the

piincipal anu impeiative goals of this book is foi each ieauei to be

inspiieu by an uigent quest foi knowleuge of Austiian economics.

This uoes not imply that one must go back to school anu become an

economic scholai, but iathei to take up ieauing it on a iegulai anu

consistent basis. Touay, with the help of the Inteinet it is easy! 0nly

by seeing the woilu fiom the Austiian economic point of view is one

able to soit out anu uistinguish goou economics fiom bau

economics.

G-./#%0+B(H,.'5&4:((

Leaining of the oiigins anu basic tenets of Austiian

economics is obviously the fiist step. It will not take long in one's

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

14

seaich to eventually be leu to 71%# >)+%+# D$+/)/./% (,,,62)+%+6"05K

anu 71%# L".$*'/)"$# ("0# M&"$"2)&# M*.&'/)"$# N,,,6(%%6"05K, two of

the leauing anu most iecognizeu inuepenuent oiganizations

committeu to spieauing fiee maiket iueas heie in the 0niteu States.

S

At these two websites you will finu a woilu of illuminating economic

aiticles, books, CBs, BvBs anu scholaily jouinals that can be

obtaineu fiom these fine piivate institutionsmuch of it foi fiee. If

the ieauei is heaiing of the Austiian school of thought foi the veiy

fiist time, these piivate institutions aie ceitainly the best place to

stait anu continue acquiiing the euucation neeueu. I,J&@&'K( :,'(

$.'$,5&5(,:(50A$40:0/#%0,+K("&'&(05(J"#%(A#3(2&(/,+50-&'&-(%"&(

A,5%( 0A$,'%#+%( -05%0+/%0,+5( ,:( %"05( $#'%0/.4#'( 5/",,4( ,:(

&/,+,A0/(%"0+90+BC(

Fiist of all it is impoitant to iealize that the Austiian School,

although woiluwiue, is now most centially locateu in the 0niteu

States. It is not a physical school oi place, but iathei an economic

way of thinking. Its pieuecessois fiist oiiginateu in Spain in the 16

th

Centuiy, but some of the moie influential Austiian scholais weie

fiom vienna, Austiia. As a geneial iule, the piinciple of +(,$()#-#anu

the concept of (.%)(/ aie at the centei of Austiian economics. Eveiy

action by eveiy actoi in an economy has its own set of values,

piefeiences, neeus, uesiies anu time scheuules foi the goals

intenueu to be ieacheu. Why. Because economic value is subjective

to the inuiviuual. This makes the Austiian economist see the

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

1S

complexity of an economy, anu especially the maiket, uniquely

uiffeient fiom all othei schools of thought. What is iemaikable to

me, even now, is that, contiaiy to the fact that Wall Stieet, the meuia

anu most of oui political leaueis in Washington weie caught

completely by suipiise when the financial ciisis hit us all in 2uu8,

the Austiians hau been pieuicting it all along, anu they hau been

uoing it foi uecaues!

Theie aie many gieat foieign scholais who coulu be

classifieu as "Austiian" economists, iegaiuless of theii nationality.

These incluue the Fiench classical economists }ean-Baptiste Say anu

Fieueiic Bastiat. The actual founuing of the Austiian School

occuiieu in 1871 with the publication of Cail Nengei's O0.$*+P/H%9#

oi Q0)$&)43%+# "(# M&"$"2)&+. 0thei foieign-boin "Austiians" incluue

Eugen von Bohm-Baweik, Wilhelm Ropke anu Nobel Piize-winning

economist, F.A. Bayek, to name just a few. Ameiican-boin Austiian

economists incluue Leonaiu Reau, Beniy Bazlitt anu Nuiiay N.

Rothbaiu with the list giowing anu too numeious to mention all

heie. Bowevei, the most celebiateu figuie of the Austiian School,

anu whose caieei began some 1uu yeais ago, is Luuwig von Nises.

This gieat Austiian economic scholai accomplisheu a feat nevei

befoie uone in the histoiy of economics. Be took centuiies of

scatteieu economic thinking anu biought it all togethei into one

complete fielu of stuuy, which he calleu 40'R%"3"5-, the science of

human action. In essence, this science unueiscoieu the fact that

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

16

A#+( #4J#35( #/%5( J0%"( #( $.'$,5&K( +&@&'( 0+( %"&( #BB'&B#%&K( 2.%(

#4J#35( #5( #+( 0+-0@0-.#4C Foi that ieason, man cannot be placeu

into a foimula, chaiteu on a giaph, oi placeu into a mathematical

calculation foi any type of centializeu planning oi foiecasting as

mouein uay economists insist on uoing. What you leain fiom

stuuying the woiks of Nises is that he was one of those inuiviuuals

of impeccable chaiactei that comes along only iaiely in histoiy. 0ne

coulu say that he spent his entiie life fighting an iuea within

civilization that was false. In fact, he believeu this iuea to be so

uelusional anu uestiuctive that he saw it as an evil that no one

shoulu give in to. In many obseivable ways, fiom his wiitings anu

lectuies, it became cleai that he was not so much thinking of

himself, but iathei looking aheau consiueiing us in oui uay anu

time.oui kius anu oui gianukius. The legacy that he left behinu, at a

gieat peisonal cost to himself, was the encouiagement foi all of us

to join into this intellectual battle anu eventually uefeat this evil

iuea. Be believeu it to be a moial iesponsibility that each of us, you

anu I, has to society.

Touay, it is the gieat woik of the Nises Institute, FEE, anu

othei such piivate institutes, funueu with no connections to

poweiful elites, that have become the centeis foi leaining the

economic piinciples that oui chiluien anu gianuchiluien must be

taught. They continue to fan the flame of libeity by publishing

scholaily jouinals, publishing books, holuing confeiences, teaching

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

17

stuuents anu holuing seminais. Because of theii effoits spanning

moie than 6u yeais heie in Ameiica, hunuieus of thousanus have

alieauy joineu in the intellectual battle anu the changes aie being

felt eveiywheie. Theie is faith, hope anu expectancy at these

inuepenuent scholaily institutions that a uiamatic change in the

political anu social lanuscape is iight aiounu the coinei anu can

happen neaily oveinight when the iueological conuitions aie iight.

These institutions continue to pioviue the euucational fuel to keep

the fiie buining. Eveiy conscientious citizen shoulu join anu become

a membei of one. Along with this book, these aie the places to begin

one's euucational jouiney of Austiian economics while at the same

time staying involveu in this battle ovei the minus of men.

8"&(*+:0+0%&(L#+90+B(!,+/&$%(

I acknowleuge othei goou fiienus anu fellow Austiians as

impoitant souices of help foi the wiiting of this book. Bi. Paul A.

Clevelanu, Piofessoi of Economics anu Finance at Biimingham

Southein College, who without question, is, anu has been, my

economics teachei. When we fiist met yeais ago he was able to

suimise quickly anu accuiately wheie I was in my jouiney into

economics. Be pioviueu the necessaiy guiuance foi me to continue

to move in the iight uiiection anu continues to uo that to this uay.

Theie is also Canauian-boin Bi. Richaiu }. uiant, Piofessoi of

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

18

Economics anu Finance at Lipscomb 0niveisity, who pioviueu

invaluable insights into cuiient monetaiy policy ielating specifically

to the Feueial Reseive anu the banking system. With his wiue

expeiience of having taught anu woikeu in eight uiffeient countiies,

his auvice was instiumental in helping with missing pieces I hau not

yet quite figuieu out. Anu then, of couise, theie is my co-authoi of

this book, Bi. Robeit P. Nuiphy. Actually youngei than some of my

own chiluien, Robeit's eneigy anu passion foi his woik makes him,

in my opinion, a hopeful glimpse of the futuie of Ameiica. Theie aie,

of couise, many otheis to whom I owe a gieat ueal of giatituue foi

the thoughts pioviueu in this book, but with many apologies will not

be listeu.

It is also piobably wise foi me to point out that in wiiting this

book, I have boiioweu iueas quite libeially fiom otheis. I uoubt

seiiously if theie is an oiiginal iuea in it. This is a soit of blanket yet

iespectful acknowleugement of all the cieatois of these iueas which

I have useu without stopping to give official cieuit. At best, Robeit

anu I have aiiangeu what we think aie biilliant iueas in a mannei to

suppoit what we believe. If the ieauei is taken by this book anu the

line of thought it pioviues, then we have accomplisheu oui puipose

in wiiting it. Let me make cleai, howevei, that theie is no gieatei

iuea in this book that pioviues the catalytic foice to empowei the

inuiviuual, to move him to take immeuiate action, than the iuea

pioviueu by R. Nelson Nash anu his Infinite Banking Concept (IBC).

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

19

Theie will be moie to say about Nelson anu IBC latei, howevei, I will

say now that it was Nelson who fiist suggesteu I wiite this book.

With each economic aiticle I wiote anu uistiibuteu thiough the

Inteinet, his encouiagement by way of a peisonal phone call woulu

follow. I woulu have nevei conceiveu of the iuea to wiite a book

containing my thoughts hau it not been foi his uigings, at least not

in the uiiection he kept pushing me. Nelson, a long time stuuent of

Austiian economics spanning S2 yeais, counseleu me anu spoke

with me about the mentoiing he hau ieceiveu eailiei in his life fiom

Leonaiu Reau, founuei of The Founuation foi Economic Euucation

(FEE). The iueas foi Nelson's book on the Infinite Banking Concept

hau come uiiectly fiom Austiian economics. It was these same

conveisations with Nelson Nash that I woulu in tuin begin to shaie

with Robeit Nuiphy. Slowly, ovei a peiiou of a yeai, Robeit became

convinceu anu convicteu of what he was heaiing. Bis fiist moment

of ieal claiity came one uay ovei lunch with Paul Clevelanu. Robeit

hau just finisheu ieauing Nelson's book anu by the time lunch was

ovei Robeit unueistoou the significance of what the book was

explaining anu soon theieaftei implementeu the piocess foi himself.

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

2u

(

(

(

8"&(<,.+-(F,+&3(<,4.%0,+(

The uay Robeit Nuiphy committeu to co-authoi this book

with me is a uay I shall nevei foiget simply because of the unusual

anu unexpecteu way in which it happeneu. Bowevei, it is piecisely

because of the way it happeneu that explains anu pioves the

explosive vision the iueas in this book piouuce. To iecount this

special uay anu begin to put it into piopei peispective, keep in minu

that up until then Robeit anu I hau been vigoiously involveu in

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

21

numeious conveisations about the human pieuicament in touay's

economic enviionment. Robeit, as a scholai anu expeit in Austiian

economics, coulu explain why things weie the way they weie

acauemically. Be obviously coulu expounu on these pioblems

piolifically having wiitten seveial books, incluuing stuuy guiues to

Nises' S.2'$# T&/)"$ anu Nuiiay Rothbaiu's >'$9# M&"$"2-# '$*#

U/'/%,#not to leave out the countless aiticles foi vaiious inuepenuent

libeitaiian think tanks.

Bowevei, thoioughly explaining anu uiagnosing the pioblem

of oui nation anu oui woilu was not the main issue. What eveiyone

uespeiately wanteu to know was how to fix it! Auuitionally, we both

unueistoou the Sounu Noney Solution well anu believeu in it

knowing that it was anchoieu by soliu Austiian thinking. We knew

all too well what was iequiieu to affect the kinu of national change

the Sounu Noney Solution calleu foi, but the pioblem was that the

Sounu Noney Solution's iequiieu steps weie highly unlikely to evei

be implementeu anu we both sauly knew it. Eviuence foi this was in

the fact that the Sounu Noney Solution was put foith uecaues ago

anu yet, in spite of all of the auvances anu giowth the Austiian

School has hau uomestically anu inteinationally, the Sounu Noney

Solution was next to impossible to evei see implementeu.

Robeit anu I weie both ceitainly uoing oui pait in spieauing

the message with each of us speaking to vaiious gioups thioughout

the countiy in oui iespective fielus, but the piocess, we ieauily

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

22

aumitteu, was slow anu uiscouiaging at times. We also knew oui

goal was not attempting to convince the entiie nation, ceitainly not

Suu million people. Austiian economists know that 1u% of the

population woulu most likely be enough to tuin public opinion in

oui favoi; we simply uo not have anywheie close to that 1u%.

0bviously we neeueu moie people, but not just anybouy. We neeueu

the iight kinu of people, iesponsible anu piouuctive people. We

neeueu people that woulu get involveu anu stay involveu. Also,

theie neeueu to be a buining passion insiue these people in oiuei to

see this change all the way to its successful enu. What was cleaily

missing was some kinu of inuiviuual incentive, but one that coulu

woik with the main tenets of the Sounu Noney Solution. What we

wanteu most was to bieak thiough the geneial pessimism that has

hung like a black clouu ovei oui School's pieuecessois. Beniy

Bazlitt, one of the most iecognizable of the Austiian economists

because of his affiliation with 71%# V'33# U/0%%/# W".0$'3, the !%,# X"0F#

7)2%+ anu !%,+,%%F, anu also the authoi of the best-selling book,

M&"$"2)&+#D$#B$%#=%++"$9 uesciibeu this paiticulai pessimism in one

of his last public speeches as he passeu the baton ovei to the next

geneiation:

When I look back on my own caieei, I can finu plenty of

ieasons foi uiscouiagement, peisonal uiscouiagement. I have not

lackeu foi inuustiy. I have wiitten a uozen books. Foi most of Su

yeais, fiom age 2u, I have been wiiting piactically eveiy

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

2S

weekuay: news items, euitoiials, columns, aiticles; some 1u,uuu

woius! Anu in piint! The veibal equivalent of about 1Su aveiage

length books!#

Anu yet, what have I accomplisheu. The woilu is

enoimously moie socializeu than when I began.yet in spite of

this I am hopeful. Aftei all, I'm still in goou health, I'm still fiee to

wiite, I'm still fiee to wiite unpopulai opinions, anu I'm keeping

at it. Anu so aie many of you. So I biing you this message: be of

goou cheei; be of goou spiiit. If the battle is not yet won, it is not

yet lost eithei. Even those of us who have ieacheu anu passeu

oui seventieth biithuays cannot affoiu to iest on oui oais anu

spenu the iest of oui lives uozing in the Floiiua sun. The times

call foi couiage. The times call foi haiu woik. But if the uemanus

aie high, it is because the stakes aie even highei. They aie

nothing less than the futuie of human libeity, which means the

futuie of civilization.

6

What Robeit anu I began to uo next was to get honest with

each othei. We agieeu that oui inuiviuual concein with iegaius to

what we aie expeiiencing in oui political anu economic affaiis

cuiiently coulu be summeu up in oui knowing what ill effects all

this economic upheaval is having on people's ability to make a

living. We uiu not shy away fiom this ieality. We hau seveial veiy in

uepth anu peisonal uiscussions about this concein. We knew that

foi most of us in Ameiica, the neeu to be able to make a living is anu

always has been a ciucial fact of life. It is the business fiom which

we nevei ietiie. In fact, it is uifficult to imagine any human being

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

24

who is not pieoccupieu with this economic enueavoi. In whatevei

mannei we tiy to explain oui society, oi oui goveinment, in teims

of the past, piesent oi the futuie, we cannot uo it anu ignoie

"economic man" anu his innate neeu to make a living.

Anu then it happeneu! All of a suuuen the entiie theme of this

book, fiom beginning to enu, hit Robeit like a 2 by 4 acioss the heau.

Bis eyes wiueneu with uttei amazement anu he exclaimeu with

excitement, "That's it!" Noments latei he aumitteu that the vision hit

him with such foice that he hau not even seen it coming. It hau

nevei uawneu on him until that veiy moment that what I, Paul anu

Nelson hau been talking about all this time was actually "step two"

of the thiee steps of the Sounu Noney Solution.01$)2,#)3/&*

4,"5)"678# Bowevei, the spectaculai anu unbelievable pait about it

was that an inuiviuual coulu actually go into piivatizeu banking

iight now! Theie was no neeu to wait on goveinment to change.

Theie was no neeu foi the Sounu Noney Solution to be accepteu anu

put foith into public policy. M'0@#%&( 2#+90+B( /,.4-( 2&( -,+&(

0AA&-0#%&43( #+-( 0%( /,.4-( 2&( -,+&( 23( @0'%.#443( #+3,+&N 0ui

cieative eneigy suuuenly soaieu anu the missing incentive we hau

been seaiching foi suuuenly became cleai anu appaient. The

answeithe missing linkwas simply the connecting of this innate

neeu within man, the neeu to make a living, with the Sounu Noney

Solution. The key was step two of the Sounu Noney Solution, the

business of banking, piivatizeu banking, the most piofitable

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

2S

business in the woiluit coulu be implementeu iight now by any

inuiviuual citizen!

In this intiouuction I shoulu also say a few woius on the

layout of the book. I have been giving PoweiPoint piesentations on

these matteis to vaiious auuiences of financial piofessionals, anu

the ieaction has been astonishing. Even gioups of :'$F%0+ aie

absoibing the infoimationmost of them hau no iuea how theii

own inuustiy ieally woikeu!

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

26

0n the othei hanu, Robeit's main aiena was in piint. As a

foimei college piofessoi, anu the authoi of seveial books, Robeit

obviously can piesent the Austiian iueas in the tiauitional foim. Be

too has founu giowing populai inteiest in these iueas, because of

the financial ciisis.

In the piesent book, Robeit anu I obeyeu the populai auage,

"If it ain't bioke, uon't fix it." That is to say, in Pait I of the book I am

the piimaiy authoi, anu I uiu my best to tianslate my PoweiPoint

piesentations into book foim.

Robeit, on the othei hanu, is the piimaiy authoi of Pait II.

Theie he tiies to uistill the most impoitant points fiom the Austiian

tiauition, in oiuei foi the ieauei to unueistanu the Sounu Noney

Solution. The simple listing of its thiee bullet points will make little

sense, without some backgiounu knowleuge of how a fiee maiket

economy actually woiks.

Because of the book's stiuctuie, it was unavoiuable that theie

is some ieuunuancy. Robeit anu I tieat many of the ciucial topics

inflation, fiactional ieseive banking, the natuie of money, anu so

onin oui own ways. We hope that Pait I pioviues a quick

oveiview of the ielevant topics, convincing the ieauei of theii

impoitance, without the use of intimiuating jaigon that too often

paialyzes compiehension. Then in Pait II we pass thiough many of

the same issues but in gieatei uepth. Finally, in Pait III we explain

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

27

the basics of Nelson Nash's Infinite Banking Concept, anu show its

contiibution to the achievement of the Sounu Noney Solution.

I am suie that some ieaueis, who alieauy have a ueep

knowleuge of monetaiy anu banking affaiis, may finu poitions of

oui tieatment simplistic. But I ask you to keep in minu that we neeu

to spieau this message to a laigei gioup of Ameiicans if we aie to

have any hope of tuining the tiue. These aie veiy impoitant issues

that will affect the type of countiy in which oui chiluien anu

gianuchiluien live. Especially in Pait I, we have tiieu to boil uown

these aicane anu intimiuating concepts into uesciiptions that

anyone can unueistanu. The fate of oui money anu inueeu oui

countiy aie too impoitant to be left to "the expeits."

All too often I have peisonally seen veiy intelligent women

who concentiate on othei iesponsibilities anu allow theii husbanus

to "take caie of the finances." Such women aie one of the piimaiy

taiget auuiences foi whom we aie wiiting. Inueeu many men will

ieject the commonsense anu conseivative financial stiategies we

explain in this book, because they'ie "too easy" anu too timiu. But

when it comes to a householu's savings, simplicity is goou! We have

seen what the "smaitest guys in the ioom" uiu on Wall Stieet. We

uige stay-at-home spouses to ieau ueeply on these matteis anu to

take a moie active iole in theii financial futuie.

As a final point in this intiouuction, let me acknowleuge that

oui book has an explicitly Ameiican bias. We aie wiiting this book

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

28

foi oui fellow Ameiican citizens, though of couise the lessons of

Austiian economics aie univeisally applicable. Theie aie thiee main

ieasons foi oui emphasis on the 0niteu States.

Fiist, theie is the simple pioblem that foieign ieaueis may

not be able to obtain whole life insuiance policies configuieu in the

way Nelson Nash iecommenus. In contiast, Ameiican ieaueis have

seveial appiopiiate insuieis to choose fiom, who can catei to a

client wishing to implement IBC.

Seconu, the Feueial Reseive is by fai the most poweiful foice

in the woilu economy. The folly of the Zimbabwe cential bank only

iuineu the lives of a small fiaction of the global population. In

contiast, if Ben Beinanke uoes not altei couise soon, billions of

people will suffei the consequences.

Thiiu, we believe that the loveis of libeity must make a final

stanu in the 0niteu States. To paiaphiase Ronalu Reagan, if we lose

libeity heie, theie's nowheie left to go. }ust as the fall of the Soviet

0nion pioveu the futility of communism to many "piagmatists" who

woulu not bothei with abstiact aiguments, by the same token the

collapse of the 0niteu States will convince the woilu that capitalism

too uoes not woik. It woulu be an eiioneous conclusionwe

ceitainly uo not have a fiee maiket in opeiationbut that is the

veiuict histoiy woulu give on Ameiica's biief fling with limiteu

goveinment.

!"#$%&'(#)%"*

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@#

#

29

The quintessential Ameiican political tiauition is one of

inuiviuual libeity anu economic fieeuom. Even as Ameiican

politicians tiample the Constitution, they still pay lip seivice to its

clauses. Although the aveiage Ameiican's commitment to the

piinciples of inuiviuualism anu piivate piopeity giow weakei with

each geneiation, even so theie is a iich heiitage that we hope to

iekinule. We &'$ succeeu. Anu we 2.+/ tiy.

L. Cailos Laia

Nashville, Tennessee

}une, 2u1u

1

Ludwig von Mises, Human Action: A Treatise on Economics (Auburn, AL: The

Ludwig von Mises Institute, 1998).

2

A good question put forth by Clarence B. Carson, Basic Economics (Phenix City, AL:

American Textbook Committee, 2003).

3

Murray Rothbard, The Meaning of Revolution, Libertarian Forum, Vol. I, No. VII,

July 1, 1969, p. 1. Available at: http://mises.org/journals/lf/1969/1969_07_01.pdf.

Accessed June 1, 2010.

4

Randall W. Forsyth, Ignoring the Austrians Got Us In This Mess, Barrons, March

2009.

5

There are many other organizations and think tanks in the United states dedicated to

free market economics, though not necessarily in the tradition of the Austrian School.

6

Henry Hazlitt, quoted in Fifteen Great Austrian Economists (Auburn, AL: The

Ludwig von Mises Institute, 1999), pp. 178-179.

!"#$%&'(#)%"*

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!"

"

!"#

#

S1

!"#$%&'()(

*++&++,-.(%"&(/#,-(0'123&4(

!"#$% &'(% )#% "(*+,"*% ,)-.% -."% /)0-% +0% 1"'#+($% 23-%

."% )#% '4#+% 5+##"##"*% +0% '55"-)-"#% '(*% '(% '6"1#)+(%

-+% 4'2+1$% '(*% -++% +0-"(% .)#% 1"'#+(% 2"(*#% -+% .)#%

+-."1% 7.'1'7-"1)#-)7#8% 9."% 0')431"% +0% 3-+5)'(#% -+%

'77"5-%-.)#%0'7-$%+1%'77"5-%&'(%'#%."%)#$%(+-%'#%."%

+3/.-% -+% 2"$% /)6"#% -.")1% #7."&"#% '% *1"'&4):"%

;3'4)-<8%

=>1'(:%?.+*+1+6

@

%!

%

%

he most impoitant fact behinu the "new iuea" uesciibeu

in the pievious chaptei is that oui effoits to help

ouiselves, oui families, oui businesses, anu ultimately oui countiy,

iests entiiely on oui ability to see the natuie of oui pioblem with

complete claiity. Without this unueistanuing as a piimaiy step, it is

impossible to take the neeueu actions towaiu coiiecting it.

Theiefoie, the pioblem must be fully exposeu anu maue

compiehensible to as many people as possible, anu as quickly as

possible.

So let us begin to ueciphei this mysteiy anu point to some

obvious obseivations. Fiist of all, we must make a iathei bolu

statement which we will set out to piove in the chapteis aheau.

T

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S2

What we aie uealing with is a ueeply hiuuen anu cleveily ciafteu

scheme by the few in political powei, past anu piesent, to

systematically uefiauu the nation of its wealth. It is nothing less

than a uiiect assault on piivate piopeity! This is oui bottom line. It

is the ciux of the mattei. Absolute powei always iesiues with those

who contiol the money. 0vei the couise of histoiy gieat families,

kinguoms, anu institutions have stiuggleu with one anothei to gain

this contiol. Touay, in viitually eveiy majoi countiy acioss oui

globe, goveinments lay claim to this centializeu powei.

In oui own Ameiican expeiience, oui feueial goveinment

exeicises extiaoiuinaiy powei ovei oui money. 0nce it was maue

possible to tap uiiectly into oui pocket books with the passing of the

16

th

Amenument (the feueial income tax) in 191S anu the

establishment of a cential bank (the Feueial Reseive System) in the

veiy same yeai, the challenges of making a living anu accumulating

wealth changeu foievei foi all citizens of the 0niteu States. The

seaich to finu a way of escape fiom this bonuage has become the

haiu stiuggle of eveiy inuiviuual citizen since then. As Fiank

Chouoiov explains:

In 191S came the amenument that completely unshackleu the

Ameiican state, foi with the ievenues ueiiveu fiom unlimiteu

income taxation it coulu hencefoith make unlimiteu foiays in to

the economy of the people. The Sixteenth Amenument not only

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

SS

violateu the iight of the inuiviuual to the piouuct of his effoits,

the essential ingieuient of fieeuom, but it also gave the Ameiican

State the means to become the nation's biggest consumei,

employei, bankei, manufactuiei anu ownei of capital. Theie is

now no phase of economic life in which the State is not a factoi,

theie is no enteipiise oi occupation fiee of its inteivention.

2

0n the othei hanu, it is not so simple as to ueclaie that "the

goveinment" contiols the money supply, foi technically the >"*"1'4%

B"#"16" contiols it. The Feu, though cieateu by the goveinment, is

nonetheless owneu by piivate inuiviuuals anu in impoitant ways

opeiates inuepenuently fiom the wishes of the goveinment. As

Nuiiay Rothbaiu iemaiks: "The Feueial Reseive, viitually in total

contiol of the nation's vital monetaiy system, is accountable to

nobouyanu this stiange situation, if acknowleugeu at all, is

invaiiably tiumpeteu as a viitue."

S

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

0vei the past seveial uecaues, the instigation of these two

significant laws has leu to wiuespieau economic fiustiation anu

confusion in Ameiican society. The aveiage citizen, in an attempt to

piotect his own wealth, constantly seeks all types of financial

stiategies to accomplish this, sometimes iesoiting to expoiting his

wealth to othei countiies. Auuitionally, he is inunuateu with the

enuless foims anu filings which aie manuateu by goveinment. Theie

seems to be a foim 1u99 eveiywheie! Touay theie aie

appioximately 746,uuu licenseu financial iepiesentatives in this

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S4

countiy iepiesenting ovei 7,uuu banks, neaily 1,uuu biokeiage

fiims, anu 2,Suu insuiance companies. The numbeis of public

accountants anu lawyeis aie legion. Yet with all the benefits of

piofessional assistance in navigating thiough a maze of tax laws, the

fine piint on financial piouucts anu iisk vaiiables in investment

piospectuses, the inuiviuual peison, moie than evei befoie, feels

betiayeu anu vulneiable. Bieams of financial secuiity anu

piospeiity evaue 0.S. citizens at eveiy tuin. The tax anu uebt buiuen

continues to giow annually anu has become unbeaiable. Eventually

the buiuen takes its toll anu causes the inuiviuual to lose hope. Be is

foiceu to succumb to even moie uepenuency anu subseivience to

goveinment.

Cleaily, auvice offeieu by many in the financial seivices

inuustiy is not pioviuing the help that is most neeueu because it

meiely sciatches the suiface of the ieal pioblem. A peison's pooi

juugment, unuisciplineu money management oi lack of time to

expeitly ieseaich eveiy aspect of financial uecisions may be the

culpiit in many cases, howevei, the ieal pioblem stems fiom a

completely uiffeient souice. It is .15&'-4&-%( ,-%'6+,1- anu,

especially,( 41-&%#'7( $13,87 which is at the coie of this money

pioblem. Eveiy inuiviuual, especially the financial auvisoi, has the

iesponsibility to unueistanu this connection, to leain specifically

,.< anu .+, the 191S tax anu banking laws aie systematically

stiipping away the value of oui money. It is goveinment action

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

SS

instigateu thiough the cential bank that cieates the 2/..1!+&3!/4#(!

/4#%&$##! 5650$#7 that cause iecessions anu uepiessions! The

inuiviuual, not iealizing how all of this has come about, is left in

unenuing financial bonuage.

Aimeu with this tiuth, the inuiviuual is able to asses the ioot

of his monetaiy pioblems. No longei is he misleu by financial

expeits, meuia peisonalities, oi oui congiessional leaueis in

Washington. Knowleuge anu tiuth solve the iiuule, eliminating

peipetual confusion. Let us not foiget the famous statement of }ohn

Naynaiu Keynes:

Theie is no subtlei oi suiei means of oveituining the existing

basis of society than to uebauch the cuiiency. The piocess

engages all the hiuuen foices of economic law on the siue of

uestiuction, anu uoes it in a mannei which -1%( 1-&( 4#-( ,-( #(

4,33,1-(,+(#23&(%1(9,#.-1+&.

4

(

:16-9(;",-<,-.(

0bviously, if this mysteiy is to be solveu anu a solution

founu, a ceitain uegiee of uelibeiate thinking is necessaiy on the

pait of all of us. Bowevei, heie lies the fiist huge obstacle.

0nbelievable as it may seem, the oveiwhelming majoiity of people

heie in oui 0niteu States simply uo not think! It's tiue! Theie aie

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S6

unfoitunately numeious statistics that piove this sau point

eveiyuay. 0ne significant factoi is that ovei half the Ameiican

population is uepenuent on some foim of goveinment suppoit.

Theiefoie, the powei anu sway of the voice of goveinment has maue

ieal thinking viitually unnecessaiy foi many. Foi otheis, thinking is

simply inconvenient. It iequiies time anu effoit. 0f couise, what we

aie iefeiencing is "#+3(*% -.)(:)(/", inuepenuent thinking iequiiing

concentiation anu contemplation. It is a type of thinking that uoes

not easily jump to conclusions, noi takes as uoctiine the infoimation

that pouis out of the meuia, anu especially out of Capitol Bill. In a

society such as ouis sounu thinking has become extiemely iaie,

even in the infoimation age when ieal knowleuge has giown moie

accessible to the layman than evei befoie.

We must ieveise this tienu as an absolute fiist step anu take

up this uisciplinein small uoses of couise; otheiwise we will nevei

uo it. Like any othei uiscipline, a ceitain amount of time must be set

asiue each uay foi this piactice until it becomes habitual. The

staiting point is ieauing a book. Yes, you ieau coiiectly, 1"'*)(/! In

his gieat book, 9.)(:)(/% '#% '% C7)"(7", Austiian economist Beniy

Bazlitt makes it cleai that oui thinking is mostly foimeu by oui

ieauing. We shoulu select anu ieau only the most infoimative books

on the most enlightening subjects: "|Tjhe gieat thinkeis of the past

impioveu theii innate poweis, not by the stuuy of iules foi thinking,

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S7

but by ieauing the woiks of othei gieat thinkeis, anu unconsciously

imitating theii habitual methou anu caution."

S

%

=#+,8(>81-14,8+(

Likewise we also must ieau anu hone oui thinking by

selecting the subjects most woith oui "thinking" time. Anu, since

oui piimaiy subject mattei is oui cuiient financial system, we

stiongly suggest to the ieauei that he can uo no bettei than to select

the subject of economics.

Why economics. 0nlike any othei subject, economics ueals

with an essential anu piessing aspect of life, which is man's neeu to

make a living. Nost impoitantly, no subject of the 21

st

centuiy seems

to occupy moie of the political limelight than economic questions

anu theii answeis. The piesent financial ciisis is of couise a majoi

incentive foi the seiious stuuy of economics. A moie uaunting

ieason is the unueistanuing that goveinments anu iuleis aie also

veiy much involveu with these same questions; howevei, theii

uecisions iegaiuing economic policy can be a mattei of life anu

ueathlibeity oi seifuom. Foi self pieseivation, we shoulu be

knowleugeable in the basics of this veiy impoitant subject.

Auuitionally, the subject of economics ueals piincipally with

the piouuction anu uistiibution of goous. Questions follow having to

uo with the motivations to piouuce those goous, what goes into

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S8

theii piouuction, anu even why goous aie iefeiieu to as D/++*#8E The

stuuy of economics also pioviues answeis to questions as to who

gets what, how piices aie ueteimineu, anu how the maiket opeiates.

It is a bioau anu all encompassing science which by uefault piesents

questions anu answeis peitaining to public policy. This unique

chaiacteiistic is one of the main ieasons why veiy eaily in its

histoiical uevelopment, economics became entangleu with

socialists' iueas. In fact, it can be saiu that socialist iueas have

gieatly alteieu what is often taught touay as economics. 0ui

ieauing, theiefoie, must be selective anu uelibeiate.

The ieauei, howevei, must unueistanu cleaily that an

acauemic appioach to economics is not essential in oiuei to

unueistanu oui cuiient economic tuimoil. Noi is scholaily status

necessaiy foi leaining how we shoulu go about fixing it. It is not

necessaiy to uelve into the complexities of economics at the moie

sophisticateu levels of the science. Theie is no neeu to become

enmesheu in statistics, confusing giaphs, chaits, mouels oi

complicateu accounting calculations. These featuies all ceitainly

have a place in the stuuy of economics, but not foi oui specific

puipose. It is iathei to suggest that the stuuy of economics be

unueitaken in oiuei to gain a fiim giasp of ceitain key "economic

piinciples" that aie univeisal in theii application. This knowleuge is

foi the aveiage peison, not just the scholai.

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

S9

The stuuy anu unueistanuing of economic piinciples is of

piimaiy impoitance, an effoit not to be taken lightly. These

unueilying economic piinciples can be saiu to be inuisputable

iegaiuless of "school" oi peisuasion because they aie ueiiveu fiom

funuamental conuitions which aie univeisal. In this iespect they can

be saiu to iesemble the laws of physics anu chemistiy. They aie

founuational concepts anu apply to all peoples, in all places anu at

all times. Bowevei, given the state of what we may iefei to as oui

"national ignoiance," these economic piinciples weie eithei nevei

leaineu, have been foigotten, ignoieu oi altogethei abanuoneu by

oui piesent geneiation.

(

;"&(;?1(>@%'&4&+(

Inteiestingly, economics as an acauemic uiscipline heie in

this countiy is ielatively new. It ieally uiu not become pait of

univeisity cuiiiculum until the last half of the 19

th

centuiy.

Economic thinking, howevei, has its theoietical anu philosophical

ioots uating back to the uieeks, staiting with Sociates (469-S99

B.C.), Plato (427-S47B.C.), anu Aiistotle (S84-S22 B.C.).

Even at this eaily stage, we can see uiffeient "schools" of

thought, such as the utopianism of Platowith his uesciiption of the

"philosophei kings" who woulu exeicise iule in the iueal Republic

veisus the iealism of Aiistotle. Biffeient schools anu iueologies littei

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

4u

the fielu of political anu economic thought as well. Some of the moie

piominent ones aie the Classicists, the Neicantilists, the

Institutionalists, the Naixists, the Fabians, the Synuicalists, the

Keynesians, the monetaiists, the supply-siueis, anu the Austiians.

Specific iueologies incluue capitalism, socialism, communism, anu a

whole list of othei D)#E Rathei than stuuying each example in

uepth, we can look at a spectium:

*-#'8",+%_______________________________________________;1%#3,%#',#-(

At one extieme aie those that believe that goveinment is not

essential anu that it can be totally ieplaceu by the maiket. These

woulu be classifieu as political anaichists. At the othei extieme aie

the auvocates of totalitaiianism. These inuiviuuals woulu have the

goveinment contiol the piouuction anu uistiibution of goous

theieby completely uisplacing the maiket. Although eveiy school of

thought anu iueology has its own sects, at a bioau level many self-

uesciibeu communists anu Naixists woulu fall on this enu of oui

spectium. The most impoitant questions to ask oneself aie these:

DF."1"%'4+(/%-.)#%#7'4"%*+%G%2"4+(/HE, oi DF."1"%'4+(/%-.)#%#7'4"%*+%G%

8+&(% -+% 2"4+(/HE We shoulu ask ouiselves these questions keeping

in minu that economics is not politics. 0ne is a science conceineu

with the piouuction anu uistiibution of goous. The othei is the ait of

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

41

iuling; howevei, asking ouiselves these questions foices us to see

how quickly we can co-mingle the two.

Bistoiy uoes not iecoiu a time when theie was a completely

anaichist economic enviionment. Libeitaiian wiitei Fiank

Chouoiov iefeiences in the I++:%+0%J3*/"# a time when D-."1"%,'#%(+%

:)(/%)(%G#1'"4$%23-%-.'-%"6"1<%&'(%*)*%,.'-%,'#%1)/.-%)(%.)#%+,(%"<"#8E%

This wiitten account woulu ceitainly imply complete fieeuom in

economic affaiis as well as otheis. Bowevei, even the Isiaelites weie

not without the social contiols that aie the essence of goveinment.

In othei woius, fieeuom was not license. This was the significance of

the iule of juuges, although theii authoiity seemeu to have iesteu

solely on public opinion. DKC+% #')*% !'.,".L, hau the foice of, K#+% #'<%

,"%'448LE

Foi the most pait, histoiy has giavitateu towaius the othei

extiemetotalitaiianism. Bistoiically, goveinments have always

sought to expanu theii powei ovei theii subjects' lives, culminating

in the totalitaiian uictatoiships of Nazi ueimany, Soviet Russia, anu

Naoist China in the twentieth centuiy. uoveinment contiol of all

piouuctive piopeity, commanuing its piouuction, anu its

uistiibution is a total contiol of society. A totalitaiian system is by

its veiy natuie tyiannical. Within the confines of a totalitaiian

system theie is absolutely no economic fieeuom. As classical libeials

such as Luuwig von Nises stiesseu, once the goveinment abolishes

economic fieeuoms, all othei libeities uisappeai as well. "Fieeuom

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

42

of the piess" is an empty slogan when the goveinment owns the

newspapeis anu iauios, anu it is nave to guaiantee citizens the

iight to ciiticize the goveinment, if at a moment's notice they can be

ieassigneu to a factoiy in Sibeiia.

(

AB(/&-(C&'&(*-.&3+(

What is at the ioot of such a glaiing uichotomy. Anu, why is

totalitaiianism favoieu. If we examine histoiy as a composite of

human behavioi ovei time, we concluue that the action of man

stems entiiely fiom an inclination of the K."'1-%+0%&'(Lthe way he

thinks. But why uoes he think this way. It is .3&'(%('-31", that fatal

tenuency of mankinu which neithei ieligion noi moiality can stop!

Natuial Law theoiists long ago pointeu to the pioblems of human

natuie. As Fieueiic Bastiat obseiveu:

Self-pieseivation anu self-uevelopment aie common aspiiations

among all people. Anu if eveiyone enjoyeu the uniestiicteu use

of his faculties anu the fiee uisposition of the fiuits of his laboi,

social piogiess woulu be ceaseless, uninteiiupteu, anu unfailing.

But theie is also anothei tenuency that is common

among people. When they can, they wish to live anu piospei at

the expense of otheis. This is no iash accusation. Noi uoes it

come fiom a gloomy anu unchaiitable spiiit. The annals of

histoiy beai witness to the tiuth of it: the incessant wais, mass

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

4S

migiations, ieligious peisecutions, univeisal slaveiy, uishonesty

in commeice, anu monopolies. This fatal uesiie has its oiigins in

the veiy natuie of manin that piimitive, univeisal, anu

insuppiessible instinct that impels him to satisfy his uesiies with

the least possible pain.

6

The fiameis of oui Constitution weie awaie of this ieality.

They believeu that man is a limiteu anu fallible cieatuie anu that all

of his oiganizations, institutions, anu stiuctuies aie affecteu by this

limitation. Accoiuingly, they felt that the powei anu sway of

anything must be limiteu anu that goveinment, above all, must be

seveiely limiteu.

In ieauing the >"*"1'4)#-#%M'5"1#, a seiies of 8S aiticles which

appeaieu in newspapeis between 1787 anu 1788, we can

compiehenu foi ouiselves oui Founueis' philosophies anu

motivations foi the iatification of the 0niteu States Constitution.

Feueialist No. S1, wiitten by }ames Nauison, is consiueieu

unpaialleleu in scope as the cleaiest exposition of the Constitution.

0ne paiticulai paiagiaph is acclaimeu to be a shoit couise in

political science. A poition of that paiagiaph states the following:

Ambition must be maue to counteiact ambition. It may be a

ieflection on human natuie, that such uevices shoulu be

necessaiy to contiol the abuses of goveinment. If men weie

angels, no goveinment woulu be necessaiy. If angels weie to

govein men, neithei exteinal noi inteinal contiols on

"##$##%&'!()$!*+%&!,-./0$1

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA%

%

44

goveinment woulu be necessaiy. In fiaming a goveinment which

is to be auministeieu by men ovei men, the gieat uifficulty lies in

this: you must fiist enable the goveinment to contiol the

goveineu; anu in the next place oblige it to contiol itself.

7

%

The one fact that is being maue ciystal cleai is that man is

natuially inclineu to avoiu pain anu uiscomfoit. Since woik is anu

always has been painful, men will iesoit to stealing whenevei

stealing is easiei than woik. Since neithei ieligion noi moiality has

been able to uetei thieveiy, only the foice of N',% can stop it. The

foice of law must be maue to piotect piivate piopeity anu punish

stealing in oiuei foi a society to function anu piospei.

This was the classical, natuial law conception of the piopei

iole of goveinment, namely to help inuiviuuals secuie theii iights to

peace anu piopeity that weie ueiiveu fiom something &+1"%

03(*'&"(-'4 than the goveinment itself. If the goveinment evei