Professional Documents

Culture Documents

Birbform 2305 PDF

Birbform 2305 PDF

Uploaded by

Erwin BucasasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birbform 2305 PDF

Birbform 2305 PDF

Uploaded by

Erwin BucasasCopyright:

Available Formats

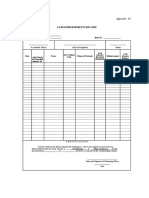

DLN:

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Certificate of Update of Exemption and of Employers and Employees Information

BIR Form No.

2305

July 1999 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 2 Type of Filer Effective Date ( MM / DD / YYYY ) Part I 3 Taxpayer Identification No. 5 Taxpayer's Name (Last Name, First Name, Middle Name) 5A Date of Birth 3 Taxpayer/Employee Information 4 RDO Code 4 1 2 Employee ( for update of "Exemption" and other employer's and employee's information) Self-employed ( for update of "Exemption")

Registered Address 6A Residence Address 6C

Zip Code 6B Zip Code 6D

Sex

Male

Female

I declare, under the penalties of perjury, that this certificate has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

8 Taxpayer/Authorized Agent Signature over Printed Name Part II 9 Taxpayer Identification No. 11 Employer's Name ( For Non-Individuals) 11 12 Employer's Name (For-Individuals) 12 Last Name 13 Registered Address 13 No. (Include Building Name) Street Subdivision Barangay First Name Middle Name 9 Employer Information 10

(If self-employed, please do not accomplish this part) 10 RDO Code

District/Municipality 14 Date of Certification ( MM / DD / YYYY ) 14

City/Province

Zip Code

Stamp of Receiving Office and Date of Receipt

I declare, under the penalties of perjury, that this certificate has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

15 Employer/Authorized Agent Signature

16 Title/Position of Signatory

BIR Form 2305 (ENCS) - Page 2 Part III Personal Exemptions 17 Civil Status 18 Employment Status of Spouse: Single/Widow/Widower/Legally Separated (No dependents) Unemployed Head of the Family Employed Single with qualified dependent Husband claims additional exemption Widow/Widower with qualified dependent Wife claims additional exemption Legally separated with qualified dependent (Attach court decision) (Attach waiver of husband) Benefactor of a qualified senior citizen (RA No. 7432) Engaged in Business Married Husband claims additional exemption Wife claims additional exemption (Attach waiver of husband) 19 Claims for Additional Exemptions / Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000.00 per annum. Husband claims additional exemption and premium deductions Wife claims additional exemption and premium deductions (Attach Waiver of the Husband) 20 Spouse Information Spouse Taxpayer Identification Number 20A Spouse Name ( if wife, indicate maiden name) 20B Last Name Spouse Employer's Taxpayer Identification Number 20C First Name Middle Name Spouse Employer's Name

Part IV Section A

Number and Names of Qualified Dependent Children 21 21 Number of Qualified Dependents Qualified Dependent Children Date of Birth ( MM / DD / YYYY ) 22D Mark if Mentally/ Physically Incapacitated 22E

Last Name 22A 22B

First Name 22C

Middle Name

23A

23B

23C

23D

23E

24A 25A

24B 25B

24C 25C

24D 25D

24E 25E

Section B Name of Qualified Dependent Other than Children Qualified Dependent Other than Children Date of Birth ( MM / DD / YYYY ) 26D Sister Qualified Senior Citizen Mark if Mentally/ Physically Incapacitated 26E

Last Name 26A 26F Relationship 26B Parent

First Name 26C Brother

Middle Name

Part V For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year 27 Type of multiple employments Successive employments Concurrent employments ( If successive, enter previous employer(s); if concurrent, enter main employer) Previous and Concurrent Employments During the Calendar Year TIN Name of Employer/s

You might also like

- Coa M2014-009Document34 pagesCoa M2014-009Aehruj Blet71% (7)

- Mock Trial Post Conference Discussion PointsDocument3 pagesMock Trial Post Conference Discussion PointsronjginaNo ratings yet

- Pagibig Calamity LoanDocument2 pagesPagibig Calamity LoanJenny Mauricio BassigNo ratings yet

- KOTC Official Basketball Rules Amended January 2019+ PDFDocument11 pagesKOTC Official Basketball Rules Amended January 2019+ PDFJessy James CardinalNo ratings yet

- Bir Form 1902Document4 pagesBir Form 1902fatmaaleah100% (1)

- Bir Form No. 2305 Certificate of Update of Exemption and Employers and Employees InformationDocument1 pageBir Form No. 2305 Certificate of Update of Exemption and Employers and Employees InformationRaymund Bonde100% (1)

- Bpi V TrinidadDocument1 pageBpi V TrinidadangelusirideNo ratings yet

- Azarraga V RodriguezDocument1 pageAzarraga V RodriguezJudy RiveraNo ratings yet

- Bravo-Guerrero Vs BravoDocument1 pageBravo-Guerrero Vs BravodmcfloresNo ratings yet

- Art. 1544 - 1564Document3 pagesArt. 1544 - 1564jayhandarwinNo ratings yet

- Appendix 12 - NORSA FormDocument1 pageAppendix 12 - NORSA FormRogie Apolo100% (1)

- Invitation Letter To Attend MeetingDocument1 pageInvitation Letter To Attend Meetingmark primo m. sisonNo ratings yet

- Special Leave Benefits For Women Employees Under The Magna Carta For WomenDocument1 pageSpecial Leave Benefits For Women Employees Under The Magna Carta For WomenDee Comon100% (2)

- Memorandum OrderDocument2 pagesMemorandum OrderppadojNo ratings yet

- 2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Document1 page2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Lyka Lim PascuaNo ratings yet

- Appendix 44 - (LR) Liquidation ReportDocument1 pageAppendix 44 - (LR) Liquidation ReportClaudine MagadiaNo ratings yet

- Mercado VS ManzanoDocument2 pagesMercado VS ManzanoGillian CalpitoNo ratings yet

- 26 PAC v. RevillaDocument2 pages26 PAC v. RevillaRem SerranoNo ratings yet

- Nyksm Disembarkation LetterDocument1 pageNyksm Disembarkation LetterGaurav Maithil100% (2)

- Nat Envi MT Reviewer MislangDocument7 pagesNat Envi MT Reviewer MislangAleezah Gertrude RaymundoNo ratings yet

- Amount of Net Taxable Income Rate Over But Not OverDocument11 pagesAmount of Net Taxable Income Rate Over But Not OverKayle MoralesNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptPhilip Anthony CastilloNo ratings yet

- Macalinao v. BPI (2009)Document2 pagesMacalinao v. BPI (2009)Patrick ManaloNo ratings yet

- 88 CIR v. Tours Specialists, IncDocument3 pages88 CIR v. Tours Specialists, IncGain DeeNo ratings yet

- Contract Template 02Document1 pageContract Template 02Patricia Anne NicoleNo ratings yet

- Loan AgreementDocument2 pagesLoan AgreementHoney Bee100% (1)

- New ApplicantsDocument3 pagesNew ApplicantsmgoldiieeeeNo ratings yet

- 38 Cruz vs. CatapangDocument9 pages38 Cruz vs. CatapangVianice BaroroNo ratings yet

- REPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Document5 pagesREPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Wilchie Dane OlayresNo ratings yet

- Madrid Vs MapoyDocument2 pagesMadrid Vs MapoyMishal OisinNo ratings yet

- People v. SandiganbayanDocument1 pagePeople v. SandiganbayananalynNo ratings yet

- Annex E Affidavit of Undertaking (PESFA)Document4 pagesAnnex E Affidavit of Undertaking (PESFA)Elonah Jean ConstantinoNo ratings yet

- Refunds Maceda Law and PD957Document2 pagesRefunds Maceda Law and PD957QUINTO CRISTINA MAENo ratings yet

- Cash Disbursements Record: Appendix 40Document1 pageCash Disbursements Record: Appendix 40Hike and Surf LivingNo ratings yet

- A Money Claim Against An Estate Is More Akin To A Motion For CreditorsDocument10 pagesA Money Claim Against An Estate Is More Akin To A Motion For CreditorsNonoy D VolosoNo ratings yet

- Obligations of The Vendor - Ownership, Delivery of The Thing SoldDocument24 pagesObligations of The Vendor - Ownership, Delivery of The Thing SoldKatharina CantaNo ratings yet

- Executive Order No 292 PDFDocument2 pagesExecutive Order No 292 PDFKelly50% (2)

- Appliance Loan FormDocument1 pageAppliance Loan FormDaniel DataNo ratings yet

- Application Form For The National Bureau of InvestigationDocument8 pagesApplication Form For The National Bureau of InvestigationlossesaboundNo ratings yet

- Know All: AssociationDocument2 pagesKnow All: AssociationLenz Meret CataquisNo ratings yet

- Course SyllabusDocument11 pagesCourse SyllabusLiwayNo ratings yet

- School Office Supply Requisition FormDocument2 pagesSchool Office Supply Requisition FormRoland CamposNo ratings yet

- Contract To Sell Vs Contract of SaleDocument4 pagesContract To Sell Vs Contract of SaleAnonymous Fx5VqHNo ratings yet

- Extinguishment of SaleDocument24 pagesExtinguishment of SaleGale RasNo ratings yet

- Chattel MortgageDocument2 pagesChattel MortgageAndrew BenitezNo ratings yet

- GPPB Resolution No. 01-2020Document12 pagesGPPB Resolution No. 01-2020Anthony SeptimoNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossKhrisAngelPeñamanteNo ratings yet

- Gsis Multi-Purpose Loan and Consolidation of Debts (MPL)Document2 pagesGsis Multi-Purpose Loan and Consolidation of Debts (MPL)vanessa hernandezNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseJasmin Sheryl Fortin-CastroNo ratings yet

- Affidavit of Disclosure of Other Related Business - Chairman of The BoardDocument1 pageAffidavit of Disclosure of Other Related Business - Chairman of The BoardJofer Joy MalolosNo ratings yet

- J. MBQuiambao - Rules For The Appreciation of BallotsDocument4 pagesJ. MBQuiambao - Rules For The Appreciation of BallotsacousticsynthNo ratings yet

- Liquidation ReportDocument4 pagesLiquidation ReportNoel Buenafe JrNo ratings yet

- Guidelines For Electronic Submission To Lower CourtsDocument3 pagesGuidelines For Electronic Submission To Lower CourtsBryce KingNo ratings yet

- Accountancy Days Program FlowDocument2 pagesAccountancy Days Program FlowMi AmorNo ratings yet

- Bir Form 2305 PDFDocument2 pagesBir Form 2305 PDFJosephine Redulla LogroñoNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesNo ratings yet

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Bir Form 2305Document1 pageBir Form 2305Analyn HernandezNo ratings yet

- BIR Form2305Document1 pageBIR Form2305menggay0513No ratings yet

- BIR Form 2305 ExcelDocument1 pageBIR Form 2305 ExcelFrancisco Galvez33% (3)

- Bir Form 2305Document4 pagesBir Form 2305fatmaaleahNo ratings yet

- Vicente de La Cruz VS para DigestDocument1 pageVicente de La Cruz VS para DigestAgatha GranadoNo ratings yet

- GR 95122-23 - DigestDocument3 pagesGR 95122-23 - DigestCha GalangNo ratings yet

- Project Deliverables ChecklistDocument2 pagesProject Deliverables ChecklistlelualluNo ratings yet

- Reissuance of Title SalasDocument4 pagesReissuance of Title SalasSarj LuzonNo ratings yet

- Part D - Focus CasesDocument22 pagesPart D - Focus CasesShalom MangalindanNo ratings yet

- Spouses Tan Vs Atty VallejoDocument2 pagesSpouses Tan Vs Atty VallejoBhenz Bryle TomilapNo ratings yet

- Iraq and The Democratic Peace - Who Says Democracies Don't FightDocument7 pagesIraq and The Democratic Peace - Who Says Democracies Don't FightAnonymous QvdxO5XTRNo ratings yet

- WTW Utusan Borneo Sabah FinalDocument34 pagesWTW Utusan Borneo Sabah FinalTessa J. HoughtonNo ratings yet

- Indian Lake Request For ProposalDocument6 pagesIndian Lake Request For Proposalmikes_npmNo ratings yet

- Sample Pages Title Fil9 Q1 M1 MamhotDocument22 pagesSample Pages Title Fil9 Q1 M1 MamhotDodong Romeo Lagayan0% (1)

- NegOr Q4 TNCT Module1 v2Document17 pagesNegOr Q4 TNCT Module1 v2Angel Mae IturiagaNo ratings yet

- Evan Mcmullin BioDocument2 pagesEvan Mcmullin Bioapi-292320446No ratings yet

- India Income Tax CalculatorDocument1 pageIndia Income Tax CalculatorPankaj Batra100% (24)

- Leca Realty V. RepublicDocument1 pageLeca Realty V. RepublicHarold Dominic MaranesNo ratings yet

- BLAW2401 Lesson 1Document29 pagesBLAW2401 Lesson 1Tamara Anderson-ShawNo ratings yet

- People vs. AmaroDocument10 pagesPeople vs. AmaroDaley CatugdaNo ratings yet

- The Due Process of Law PDFDocument8 pagesThe Due Process of Law PDFJignesh RathodNo ratings yet

- @2rey Vs CartagenaDocument3 pages@2rey Vs CartagenaSimeon SuanNo ratings yet

- Seoul Arbitration Lecture - John Beechey Nov. 2019Document29 pagesSeoul Arbitration Lecture - John Beechey Nov. 2019Zviagin & CoNo ratings yet

- The Supreme Court in US History, VOL 3 1856-1919 Charles Warren (1922)Document562 pagesThe Supreme Court in US History, VOL 3 1856-1919 Charles Warren (1922)WaterwindNo ratings yet

- Vicarious Liability in Criminal LawDocument4 pagesVicarious Liability in Criminal LawRiteshNo ratings yet

- Motor Insurance Claim FormDocument2 pagesMotor Insurance Claim FormMunish WadhwaNo ratings yet

- Introduction To Social Policy Essay 1Document6 pagesIntroduction To Social Policy Essay 1Dan HarringtonNo ratings yet

- Quiz PledgeDocument2 pagesQuiz PledgeEmilie DeanNo ratings yet

- CIR Vs RUEDA DIGESTDocument3 pagesCIR Vs RUEDA DIGESTMark Gabriel B. MarangaNo ratings yet

- Schengen Visa FormDocument4 pagesSchengen Visa FormlovemoreworrylessNo ratings yet

- Senate Hearing, 106TH Congress - Native American Graves Protection and Repatriations ActDocument236 pagesSenate Hearing, 106TH Congress - Native American Graves Protection and Repatriations ActScribd Government DocsNo ratings yet

- L. Norse Management Co. (PTE) vs. National Seamen BoardDocument2 pagesL. Norse Management Co. (PTE) vs. National Seamen BoardVloudy Mia Serrano PangilinanNo ratings yet