Professional Documents

Culture Documents

Gsis Multi-Purpose Loan and Consolidation of Debts (MPL)

Uploaded by

vanessa hernandezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gsis Multi-Purpose Loan and Consolidation of Debts (MPL)

Uploaded by

vanessa hernandezCopyright:

Available Formats

GSIS MULTI-PURPOSE LOAN AND CONSOLIDATION OF DEBTS (MPL)

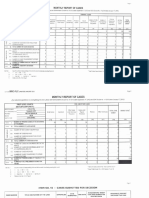

Form No. 11192019-MPL-REV 0

IMPORTANT: Before applying for the GSIS Multi-Purpose Loan, please secure tentative computation of your proceeds.

Name of Applicant

Last Name First Name Middle Name

Birthdate BP No.

eCard/UMID Card No.

eCard/UMID Bank Account No.

Mailing/Residential Address

Present Office

Telephone No. Cell Phone No. Email Address

For DepEd Personnel

Division No. Station No. Employee No.

LOAN AMOUNT(Please encircle your choice or indicate preferred loan amount) TYPE OF LOAN:

Basic Monthly Salary

1 2 3 4 5 6 7 8 9 10 11 12 13 14 New

mo. mos. mos. mos. mos. mos. mos. mos. mos. mos. mos. mos. mos. mos.

Renewal

Preferred Loan Amount(Any amount lower than the maximum loan) Php_________________________________

(Pease check choice)

I undertake to pay the loan within ______________________ years. (Please indicate applicable loan term.)

TERMS AND CONDITIONS

1. LOAN AMOUNT 2. CONSOLIDATION OF LOANS. The GSIS-MPL shall consolidate the

following loans, in this order:

a. Minimum Loanable Amount. The minimum loanable amount shall a. Salary Loan (SL)

be based on indebtedness of the borrower at the time of application: b. Restructured Salary Loan (RSL)

c. Enhanced Salary Loan (ESL)

d. Emergency Loan Assistance (ELA)

e. Summer One-Month Salary Loan (SOS)

f. Conso-Loan Plus / Enhanced Conso-Loan Plus

g. Member’s Cash Advance / eCard Cash Advance / eCard Plus

Cash Advance

h. Emergency Loan (EML)

i. Home Emergency Loan Program (HELP)

j. Educational Assistance Loan I and II (EAL I / II)

k. Fly PAL, Pay Later (FPPL)

l. Study Now, Pay Later (SNPL)

m. Stock Purchase Loan (SPL)

The consolidation of the loans shall result in the full liquidation of the

outstanding balances on the above loans. The outstanding balances of

such loans, including penalties (if any) to be waived, shall be computed

up to the date of granting of the MPL.

3. TERM

b. Maximum Loanable Amount a. For Regular Active Members. The loan term shall be as follows:

1) For Regular Active Members. The maximum loanable amount

shall depend on the members’ Period with Paid Premiums

(PPP) and computed Basic Monthly Salary (BMS) based on

actual premiums posted. Table 1 indicates the maximum

loanable amount for the MPL:

b. For Special Members with MOA with the GSIS. The loan term of the

MPL shall be set at 7 years.

c. If with existing Home Emergency Loan Program (HELP) account, the

loan term of the MPL shall be maximum of 10 years.

d. The borrower shall be given the option to choose a shorter term in

periods of: (i) For Permanent employees without Term/Tenure: 3 or

2) For Special Members. The loanable amount for Judges and 5 years; (ii) For Non-Permanent and Permanent with Term/Tenure: 2

Justices and Special Members with existing Memorandum of (iii) For Special Members with MOA with the GSIS: 3 or 5 years; (iv)

Agreement (MOA) with the GSIS shall be increased to 14 If with existing HELP account: 3, 5 or 7 years.

months of their BMS.

e. Failure to indicate payment term shall be interpreted as preference

3) The member can choose the amount of loan and the for the longest term to which the member is qualified.

corresponding loan term based on his or her PPP, but not to

exceed Php 3,000,000.00. 4. INTEREST. The interest rate shall be eight percent (8%) per annum

computed in advance for members with PPP of less than 3 years, and

4) The member, both regular and special, has the option to choose seven percent (7%) per annum computed in advance for members with

a lower loan amount provided that the proceeds of the loan will PPP of at least 3 years. The effective rate per annum that shall be used

be sufficient to cover aggregate balance for the existing loan will be as follows:

accounts including the fees charged.

a. Permanent without Term/Tenure

5) Failure to indicate the preferred loan amount shall mean that

the member is applying for the maximum loan amount for which

the member is qualified to avail.

9. PRE-TERMINATION. The MPL may be pre-terminated by paying the

outstanding balance of the loan before the end of the loan term.

10. COMPULSORY PRE-TERMINATION. The loan agreement shall be

deemed pre-terminated upon the death, resignation, permanent disability,

retirement or separation from service of the borrower, in which case, the

outstanding balance shall be due and demandable and shall be collected

by GSIS from the claims of the borrower, or of his or her heirs, or through

appropriate legal action. Retiring borrowers may opt to avail of the

Choice of Loan Amortization Schedule for Pensioners (CLASP), subject

to existing policies and procedures.

11. COLLECTION IN THE EVENT OF RESIGNATION, SEPARATION,

RETIREMENT, DEATH OR PERMANENT TOTAL DISABILITY. After

b. Non-Permanent and Permanent with Term/Tenure the date of execution of this loan application, the employer/agency shall

withhold the release of any or all benefits due to the borrower until after

the requisite clearance and/or statement of account, if any, shall have

been duly secured from the GSIS, pursuant to GSIS Memorandum

Circular No. 005, Series of 2018. The GSIS, upon receipt of the request,

shall issue the appropriate clearance and/or statement of account to the

duly authorized representative of the employer/agency. The

employer/agency, upon receipt of the statement of account from the

GSIS, shall deduct and/or withhold from any or all benefits that may

accrue to the borrower, the total amount corresponding to the

outstanding loan accounts and arrearages, if any, and remit the same to

the GSIS to liquidate the loan.

12. CANCELLATION. Borrowers shall be allowed to cancel the loan

agreement within a period of thirty (30) calendar days from the date of

c. For Special Members with MOA with GSIS loan granting. In cases of cancellation of the loan upon the behest of the

borrower, the principal amount (or the face value in the loan contract),

plus the pro-rata interest covering the days from loan granting up to the

actual cancellation of the loan, shall be paid in full. The cancellation of

the loan shall result in the reversal of all loans previously consolidated

under the MPL, including waived penalties, if any. These loans shall be

restored back to active status, and shall be computed corresponding

interests and surcharges that have accrued from the time they were

liquidated under the MPL.

13. DEFAULT. In the event of default, the outstanding balance of the loan

d. If with existing HELP account becomes due and demandable without need of demand or further notice,

all of which the member expressly waives. In case of failure to pay the

outstanding balance declared in default, the outstanding balance shall be

charged a penalty of 18% per annum compounded monthly (p.a.c.m.),

broken down as interest (on the outstanding balance) of 12% p.a.c.m.

and surcharge of 6% p.a.c.m., from the date of default until the date of

full payment. Accounts in default shall be endorsed for appropriate legal

action within thirty (30) working days from default.

14. APPLICATION OF PAYMENTS. The order of priority for the application

of payment shall be as follows: RI premium, surcharge (if any), interest

and principal.

15. RENEWAL. The MPL may be renewed anytime as long as there are net

proceeds on the loan renewal, after deducting the outstanding balances

of the previous MPL and other loans enumerated under Item 2 of this

The monthly interest on outstanding balance of the loan shall be application, with the penalties if any. The maximum loanable amount and

computed based on diminishing balance. Pro-rata interest covering the applicable interest rate and loan term shall be determined based on the

days from loan granting up to the end of the month prior to the first due PPP of the member-borrower at the time of application for loan renewal.

month shall be deducted in advance from the loan proceeds.

16. RECOVERY OF AMOUNT/S CREDITED IN THE eCARD. GSIS shall

5. DUE DATE OF FIRST MONTHLY AMORTIZATION. The remittance due have the right to recover any undue amount that it has credited in the

date of the monthly amortizations shall be on or before the 10th day of eCard due to fraud, misrepresentation or error.

each month following the due month until the loan is fully paid.

17. REFUND OF OVERPAYMENTS AFTER END OF LOAN TERM. At the

a. For loans granted on or before the 23rd of the month, the first due end of the loan term, any overpayment shall be treated in accordance

month shall be the calendar month following the granting of the loan. with the policy guidelines on the treatment of excess payment.

The loan amortization shall be remitted by the agency to GSIS on or

before the 10th of the month following such due month. 18. ATTORNEY’S FEES. Should the GSIS be compelled to refer the loan or

b. For loans granted after the 23rd of the month, the first due month any portion thereof to an Attorney-at-Law for collection or to enforce any

shall be the 2nd calendar month following the granting of the loan, right hereunder against the borrower or avail of any remedy under the

and shall be remitted by the agency to GSIS on or before the 10th law or this Agreement, the borrower shall pay an amount equivalent to

day of the month following such due month. 25% of all amounts outstanding and unpaid as and for attorney’s fees

and litigation expenses.

6. PAYMENT MECHANISM. The monthly amortization shall be paid

through payroll deduction. However, the borrower shall directly remit to 19. VENUE. Any legal action, suit or proceeding arising out or relating to this

the GSIS or to its external payment service provider/s the loan Agreement, shall be brought or instituted in the appropriate courts in the

installment as they fall due under any of the following instances: City of Pasay or such other venue at the exclusive option of GSIS. In the

event the borrower initiates any legal action arising from or under this

a. The name of a member/borrower is excluded from the monthly Agreement, for whatever causes, the borrower agrees to initiate such

collection list; action only in the City where the principal office of GSIS is located.

b. The member-borrower is on secondment, on study leave without

pay or extended leave without pay; 20. NOTICES. All notices required under this Agreement for its enforcement

c. The monthly amortization is not deducted and/or remitted by the shall be sent to the Office Address or the Residential Address indicated

agency for any other reason aside from item 6(b) above; in the Personal Data portion of this loan application. The notices sent to

d. The loan amortization deducted from the payroll is not sufficient to the said Office or Residential Address shall be valid and shall serve as

cover the full amount due. sufficient notice to the borrower for all legal intents and purposes.

7. REDEMPTION INSURANCE (RI). The MPL shall have RI to safeguard

the interests of both the member and the GSIS in case of the former’s I confirm that I have read and fully understood the GSIS MULTI-PURPOSE LOAN AND

untimely death during the term of the loan. The RI rate shall depend on CONSOLIDATION OF DEBTS WITH LOWER INTEREST RATE (MPL) Terms and Conditions

the term of loan, to wit: and undertake to comply with them. Furthermore, I hereby authorize the GSIS, through my

employer (government agency), to deduct from my terminal leave benefits any remaining

outstanding loan obligations I may have with the GSIS upon my separation or retirement. I

understand that the remittance thereof by my employer to the GSIS shall first be undertaken

before the issuance of a GSIS clearance for the release of my remaining terminal leave

benefits, if any.

I confirm my understanding of the Privacy Policy of the GSIS pursuant to the requirements of

Republic Act (R.A.) No. 10173, otherwise known as the Data Privacy Act, and consent to the

manner of collection, use, access, disclosure and processing of my personal and sensitive

To ensure that the member is covered with RI from the date of loan personal data by the GSIS.

granting, an advance RI premium shall be deducted from the loan

proceeds as follows: Finally, pursuant to R.A. No. 9510, otherwise known as the “Credit Information System Act”,

and its Implementing Rules and Regulations (IRR), I hereby acknowledge and consent to: 1)

Date of Loan Granting RI Premium to be the regular submission and disclosure of my basic credit data and updates thereon to the

Deducted Credit Information Corporation (CIC); and 2) the sharing of my basic credit data with lenders

authorized by the CIC, and credit reporting agencies and outsourced entities duly accredited by

On or before the 23rd of the mo. Equivalent to 1 month

the CIC, subject to the provisions of R.A. No. 9510, its IRR and other relevant laws and

After the 23rd of the mo. Equivalent to 2 months regulations.

8. COMPUTATION OF FEES. The following fees shall be charged upon ___________________________________________________________

loan granting: MEMBER/BORROWER (Signature over Printed Name)

a. Service Fee – 2% of the gross loan amount (for initial loan

availment) or incremental gross loan amount (for loan renewal). For

this purpose, the incremental gross loan amount refers to the ___________________________ ___________________

difference between the loan amount and the outstanding balances of DATE SIGNED BIR TIN

the existing loans to be consolidated. It is the amount that can be

borrowed before the imposition of insurance and other fees; and

b. eProcessing Fee – Php50.00.

You might also like

- Consoloan Application Form 4Document3 pagesConsoloan Application Form 4bhon20No ratings yet

- Home Reading ProjectDocument9 pagesHome Reading ProjectRica Avila100% (1)

- Villanueva Vs VelascoDocument2 pagesVillanueva Vs VelascoSopongco ColeenNo ratings yet

- SSS Disability BenefitsDocument5 pagesSSS Disability BenefitsJason TiongcoNo ratings yet

- Action Plan Patag ES SevenDocument3 pagesAction Plan Patag ES SevenSeven De Los ReyesNo ratings yet

- Understanding Section 78 of the Indigenous Peoples' Rights ActDocument14 pagesUnderstanding Section 78 of the Indigenous Peoples' Rights Actcharles d.No ratings yet

- 2 222 Tacher Vs....Document55 pages2 222 Tacher Vs....Menchie Maghirang CamataNo ratings yet

- Obligation and Contract Art 1159 CasesDocument6 pagesObligation and Contract Art 1159 CasesMaricar BautistaNo ratings yet

- Com - Res - 10460.gen - Instructions To EBsDocument10 pagesCom - Res - 10460.gen - Instructions To EBsellis_NWU_09No ratings yet

- Cruz Vs Court of Appeals: (Revocation and Reduction of Donation: Adopted Child)Document7 pagesCruz Vs Court of Appeals: (Revocation and Reduction of Donation: Adopted Child)AnsaiMendozaNo ratings yet

- Deped Order!Document2 pagesDeped Order!Maria Minda Cuyno RamirezNo ratings yet

- Bacao ES - Bank-Reconciliation-Statement - February 2021Document2 pagesBacao ES - Bank-Reconciliation-Statement - February 2021Mhalou Jocson EchanoNo ratings yet

- Palagiang Talaan Sa Mababang Paaralan: Deped Form 137-EDocument2 pagesPalagiang Talaan Sa Mababang Paaralan: Deped Form 137-ETripoli Deluta100% (1)

- Sinulog Festival Queen 2023 Application FormDocument2 pagesSinulog Festival Queen 2023 Application Formloverxia100% (1)

- Accountancy Days Program FlowDocument2 pagesAccountancy Days Program FlowMi AmorNo ratings yet

- Letter Intent For Salary RefundDocument2 pagesLetter Intent For Salary RefundKabacan Pilot Central School North CotabatoNo ratings yet

- Supreme Court Reviews Revocation of Teacher's License for BigamyDocument18 pagesSupreme Court Reviews Revocation of Teacher's License for BigamySamantha NicoleNo ratings yet

- Certificate of Enrolment CulturalDocument19 pagesCertificate of Enrolment CulturalManilyn Miranda RubioNo ratings yet

- Debate Scoring Sheet 2021Document4 pagesDebate Scoring Sheet 2021Hồng NguyễnNo ratings yet

- Cell Phone Use and Personality TraitsDocument8 pagesCell Phone Use and Personality Traitsgoldie mangotaraNo ratings yet

- Ombudsman Ruling on BSU OfficialsDocument20 pagesOmbudsman Ruling on BSU Officialsconcon006No ratings yet

- Transportation CASESDocument27 pagesTransportation CASESGhadahNo ratings yet

- Log Book On Daily Lesson Plan: Date DAY Time Learning Competency Code Result Principal' S Signature RemarksDocument2 pagesLog Book On Daily Lesson Plan: Date DAY Time Learning Competency Code Result Principal' S Signature RemarksApril Mae TurtogoNo ratings yet

- Domicile Requirement for CandidatesDocument11 pagesDomicile Requirement for CandidatesPaulo VillarinNo ratings yet

- Words of GratitudeDocument1 pageWords of Gratitudeル シリNo ratings yet

- Intent For PriesthoodDocument3 pagesIntent For PriesthoodFrederickVillaflorNo ratings yet

- Enhanced School Improvement Plan: Pulo Elementary School 105686 Pulo, San Isidro, Nueva EcijaDocument14 pagesEnhanced School Improvement Plan: Pulo Elementary School 105686 Pulo, San Isidro, Nueva EcijaJulius FloresNo ratings yet

- 2019 Southeast Asian Games Cauldron PDFDocument2 pages2019 Southeast Asian Games Cauldron PDFPatricia Camille Nepomuceno MateoNo ratings yet

- Zobel Vs ManilaDocument20 pagesZobel Vs Manilao6739No ratings yet

- Title Page Done MarvzDocument8 pagesTitle Page Done MarvzMark Anthony Nieva RafalloNo ratings yet

- Republic of The Philippines Position Description Form DBM-CSC Form No. 1Document4 pagesRepublic of The Philippines Position Description Form DBM-CSC Form No. 1NashaNo ratings yet

- Dipolog City Schools Division: Republic of The Philippines Department of Education Region IX, Zamboanga PeninsulaDocument3 pagesDipolog City Schools Division: Republic of The Philippines Department of Education Region IX, Zamboanga PeninsulaKhevin SumalpongNo ratings yet

- Acr Brigada Eskwela 22 CesDocument6 pagesAcr Brigada Eskwela 22 CesCecilyn L. RegoniosNo ratings yet

- 20th City Council Roll CallDocument4 pages20th City Council Roll CallJournal SP DabawNo ratings yet

- Advance Curriculuma and DevelopmentDocument4 pagesAdvance Curriculuma and DevelopmentAirma Ross HernandezNo ratings yet

- Blank Form SALN - 2017Document2 pagesBlank Form SALN - 2017Nic OleNo ratings yet

- Ui Vs BonifacioDocument4 pagesUi Vs BonifacioCistron ExonNo ratings yet

- 1st Division Mancom MinutesDocument18 pages1st Division Mancom MinutesseiNo ratings yet

- SSG Constitution and by Laws in Dona Rosario National High SchoolDocument9 pagesSSG Constitution and by Laws in Dona Rosario National High Schooldear2008100% (1)

- Teachers' Liability On Students' Injury in SchoolsDocument3 pagesTeachers' Liability On Students' Injury in SchoolsKristin Belgica100% (1)

- Cunanan V CA and BasaranDocument6 pagesCunanan V CA and BasaranMarielle ReynosoNo ratings yet

- Principle 4:: Management of ResourcesDocument28 pagesPrinciple 4:: Management of ResourcesAriel Roña RogonNo ratings yet

- New Katipunan ES Contingency Plan On Landlisde 2023Document23 pagesNew Katipunan ES Contingency Plan On Landlisde 2023Kyle Bersalote100% (1)

- Ong V AlegreDocument1 pageOng V AlegreglainarvacanNo ratings yet

- Republic of The Philippines: College of Arts & SciencesDocument1 pageRepublic of The Philippines: College of Arts & SciencesJaicaNo ratings yet

- 31 - Cruz v. GanganDocument1 page31 - Cruz v. GangandunscotusNo ratings yet

- Department of Education: Republic of The PhilippinesDocument18 pagesDepartment of Education: Republic of The PhilippinesJayson Dotimas VelascoNo ratings yet

- LBP vs. OmenganDocument1 pageLBP vs. OmenganHerrieGabicaNo ratings yet

- Department of Education: Intervention PlanDocument2 pagesDepartment of Education: Intervention PlanEmma Balbastro100% (1)

- Department of Education: Annual Gender and Development (Gad) Plan and Budget Accomplishment ReportDocument4 pagesDepartment of Education: Annual Gender and Development (Gad) Plan and Budget Accomplishment ReportReign Magadia BautistaNo ratings yet

- BIR Form 2316 Tax CertificateDocument1 pageBIR Form 2316 Tax CertificateAriel Grajera (Consultant)No ratings yet

- Disaster RIsk Management ProposalDocument7 pagesDisaster RIsk Management ProposalAsdfghjkl Lee100% (1)

- General Student Personal Information SheetDocument2 pagesGeneral Student Personal Information SheetKristal Joy Hermosa LindoNo ratings yet

- Inset ProgramDocument2 pagesInset ProgramSher-Anne Fernandez - BelmoroNo ratings yet

- Del Carmen Vs BacoyDocument14 pagesDel Carmen Vs BacoyKiks JampasNo ratings yet

- Correspondent bank liability under letters of creditDocument1 pageCorrespondent bank liability under letters of creditkathreenmonjeNo ratings yet

- Mangahas vs CA Ruling on Acquisitive PrescriptionDocument1 pageMangahas vs CA Ruling on Acquisitive PrescriptionChingkay Valente - JimenezNo ratings yet

- SUBJECT School Based Learning Action CelDocument9 pagesSUBJECT School Based Learning Action CelJuryCaramihanNo ratings yet

- FORM Application MPL PlusDocument2 pagesFORM Application MPL PlusCharles De Saint AmantNo ratings yet

- GSIS MPL Loan Consolidation FormDocument3 pagesGSIS MPL Loan Consolidation FormNgirp Alliv TreborNo ratings yet

- Basics of taxation law in the PhilippinesDocument10 pagesBasics of taxation law in the Philippinesnewa944No ratings yet

- Due 08232019 (14115232) - JadeDocument2 pagesDue 08232019 (14115232) - JadelrbbNo ratings yet

- Property Full Text 3 SeptemberDocument84 pagesProperty Full Text 3 Septembervanessa hernandezNo ratings yet

- Republic of The Philippines National Capital Judicial Region Branch 115, Taguig CityDocument2 pagesRepublic of The Philippines National Capital Judicial Region Branch 115, Taguig Cityvanessa hernandezNo ratings yet

- COP StoresDocument2 pagesCOP Storesvanessa hernandezNo ratings yet

- Public International Law Reviewer - CruzDocument48 pagesPublic International Law Reviewer - CruzMai Reamico100% (10)

- 1 MeralcoDocument2 pages1 Meralcovanessa hernandezNo ratings yet

- Chapter 1 - TAXDocument8 pagesChapter 1 - TAXTRXNo ratings yet

- Admin Case Doctrines MidtermsDocument27 pagesAdmin Case Doctrines Midtermsvanessa hernandezNo ratings yet

- Willingness To Pay For Renewable Energy: Evidence From Malaysian's HouseholdsDocument11 pagesWillingness To Pay For Renewable Energy: Evidence From Malaysian's Householdsvanessa hernandezNo ratings yet

- Philippines Bath & Body Works 2Document1 pagePhilippines Bath & Body Works 2vanessa hernandezNo ratings yet

- Original Registration I Ordinary Registration ProceedingsDocument2 pagesOriginal Registration I Ordinary Registration Proceedingsvanessa hernandezNo ratings yet

- PUBLIC CORPORATIONS EXPLAINEDDocument7 pagesPUBLIC CORPORATIONS EXPLAINEDMaya Angela TuldanesNo ratings yet

- Republic of The Philippines National Capital Judicial Region Branch 115, Taguig CityDocument2 pagesRepublic of The Philippines National Capital Judicial Region Branch 115, Taguig Cityvanessa hernandezNo ratings yet

- Labor Standards Azucena NotesDocument120 pagesLabor Standards Azucena NotesBoom Manuel75% (4)

- Cebu 2020Document1 pageCebu 2020vanessa hernandezNo ratings yet

- Letter Invite Cebu 2010Document1 pageLetter Invite Cebu 2010vanessa hernandezNo ratings yet

- Term Paper AvhicDocument5 pagesTerm Paper Avhicvanessa hernandezNo ratings yet

- ELEC 2I Compilation of Case DigestsDocument60 pagesELEC 2I Compilation of Case Digestsvanessa hernandezNo ratings yet

- ELEC 2I Compilation of Case DigestsDocument60 pagesELEC 2I Compilation of Case Digestsvanessa hernandezNo ratings yet

- Election Law Syllabus 2019Document6 pagesElection Law Syllabus 2019Hi Law SchoolNo ratings yet

- LoanDocument3 pagesLoanvanessa hernandezNo ratings yet

- How to Develop Students Through Teacher SupportDocument1 pageHow to Develop Students Through Teacher Supportvanessa hernandezNo ratings yet

- PubcorpDocument11 pagesPubcorpvanessa hernandezNo ratings yet

- AAA Succession PDFDocument157 pagesAAA Succession PDFBoy Omar Garangan DatudaculaNo ratings yet

- Election Law Reviewer SummaryDocument110 pagesElection Law Reviewer SummarylchieSNo ratings yet

- Lineups Scheds 1st HWs 1Document36 pagesLineups Scheds 1st HWs 1vanessa hernandezNo ratings yet

- MonthlyReport PDFDocument5 pagesMonthlyReport PDFvanessa hernandezNo ratings yet

- PUBLIC CORPORATIONS EXPLAINEDDocument7 pagesPUBLIC CORPORATIONS EXPLAINEDMaya Angela TuldanesNo ratings yet

- Motion For Extension of Time To Serve Complaint, U.S. Ex Rel. Schneider V JPMC 13-01223, D.E. 49Document2 pagesMotion For Extension of Time To Serve Complaint, U.S. Ex Rel. Schneider V JPMC 13-01223, D.E. 49larry-612445No ratings yet

- Bihar Municipal Amendment Act2009Document45 pagesBihar Municipal Amendment Act2009Latest Laws TeamNo ratings yet

- 151-MSM-Application Form Floating StaffDocument6 pages151-MSM-Application Form Floating StaffGourishankar Hiremath0% (1)

- An Allonge Is Not An AssignmentDocument3 pagesAn Allonge Is Not An Assignmentdbush2778No ratings yet

- Satinder BabejaDocument30 pagesSatinder BabejaduthindaraNo ratings yet

- Aznar v. GarciaDocument2 pagesAznar v. GarciaReigh Harvy CantaNo ratings yet

- Trade Union - Unit IIDocument9 pagesTrade Union - Unit IIPrerna KhannaNo ratings yet

- Movie Review Critiques Role of Corporations in SocietyDocument2 pagesMovie Review Critiques Role of Corporations in SocietyMau PeñaNo ratings yet

- WWF and WPPF by Syed Hassaan NaeemDocument34 pagesWWF and WPPF by Syed Hassaan Naeemikhan809No ratings yet

- Ansi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsDocument62 pagesAnsi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsLuis Carcamo Martinez100% (1)

- Essay Question Compare and Contrast The Domestic Policies of Hitler and Castro.Document2 pagesEssay Question Compare and Contrast The Domestic Policies of Hitler and Castro.chl23100% (1)

- Part-III Strikes and Lockouts PDFDocument69 pagesPart-III Strikes and Lockouts PDFLawrence BabuNo ratings yet

- Calimlim-Canullas V Fortun Sales CaseDocument1 pageCalimlim-Canullas V Fortun Sales Caseruth_pedro_2100% (1)

- 13 Am Crim LRev 235Document15 pages13 Am Crim LRev 235aristo01No ratings yet

- Multiple Choice - Theory: Part 2Document4 pagesMultiple Choice - Theory: Part 2Nicolle JungNo ratings yet

- Information Sheet On Importation of Pet FoodDocument3 pagesInformation Sheet On Importation of Pet FoodTamar MakhviladzeNo ratings yet

- One Wayos Employment ContractDocument6 pagesOne Wayos Employment ContractDavid Lemayian SalatonNo ratings yet

- Amercoat® 878: Product Data SheetDocument5 pagesAmercoat® 878: Product Data Sheetabdelkader benabdallahNo ratings yet

- Pilot Flying J Paid $4,250,000 To 382 Employees For Unpaid Overtime Oct. 27th 2009 39-PagesDocument39 pagesPilot Flying J Paid $4,250,000 To 382 Employees For Unpaid Overtime Oct. 27th 2009 39-PagesHarry the GreekNo ratings yet

- Digested SAULOG TRANSIT Vs LazaroDocument2 pagesDigested SAULOG TRANSIT Vs LazaroManz Edam C. JoverNo ratings yet

- (O&M ) Satish Kumar Vs Laxmi Narain On 22 December, 2015Document17 pages(O&M ) Satish Kumar Vs Laxmi Narain On 22 December, 2015Nishant hasijaNo ratings yet

- Judicial Appointments in PakistanDocument9 pagesJudicial Appointments in PakistanFURQAN AHMEDNo ratings yet

- Solution. Investment 1: Simple Interest, With Annual Rate RDocument11 pagesSolution. Investment 1: Simple Interest, With Annual Rate RLucky Gemina67% (3)

- FM 10 - Dr. Cedric Val Naranjo, CPADocument5 pagesFM 10 - Dr. Cedric Val Naranjo, CPARichielen Navarro RabayaNo ratings yet

- Parent Communication Log BookDocument100 pagesParent Communication Log BookPhinixiart Lahmama RachidNo ratings yet

- Application For Judicial ReviewDocument8 pagesApplication For Judicial ReviewWilliam SilwimbaNo ratings yet

- LETTERDocument4 pagesLETTERAbygail MorenoNo ratings yet

- Maths 2 Answer Sheet PDFDocument1 pageMaths 2 Answer Sheet PDFvinitha2675No ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- Business Finance Q4 Module 2Document16 pagesBusiness Finance Q4 Module 2randy magbudhi100% (14)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossFrom EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossRating: 3.5 out of 5 stars3.5/5 (6)

- Beyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceFrom EverandBeyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceRating: 4 out of 5 stars4/5 (107)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoFrom EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoRating: 4 out of 5 stars4/5 (97)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemFrom EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemRating: 4 out of 5 stars4/5 (25)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- Chokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackFrom EverandChokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackRating: 5 out of 5 stars5/5 (20)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- Perversion of Justice: The Jeffrey Epstein StoryFrom EverandPerversion of Justice: The Jeffrey Epstein StoryRating: 4.5 out of 5 stars4.5/5 (10)

- Summary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisFrom EverandSummary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisRating: 4 out of 5 stars4/5 (2)

- The Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterFrom EverandThe Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterRating: 4.5 out of 5 stars4.5/5 (456)

- The Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)From EverandThe Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)Rating: 4.5 out of 5 stars4.5/5 (10)

- The Dark Net: Inside the Digital UnderworldFrom EverandThe Dark Net: Inside the Digital UnderworldRating: 3.5 out of 5 stars3.5/5 (104)

- Learning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectFrom EverandLearning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectNo ratings yet

- The Death of Punishment: Searching for Justice among the Worst of the WorstFrom EverandThe Death of Punishment: Searching for Justice among the Worst of the WorstNo ratings yet

- The Internet Con: How to Seize the Means of ComputationFrom EverandThe Internet Con: How to Seize the Means of ComputationRating: 5 out of 5 stars5/5 (6)

- The Edge of Doubt: The Trial of Nancy Smith and Joseph AllenFrom EverandThe Edge of Doubt: The Trial of Nancy Smith and Joseph AllenRating: 4.5 out of 5 stars4.5/5 (10)

- Conviction: The Untold Story of Putting Jodi Arias Behind BarsFrom EverandConviction: The Untold Story of Putting Jodi Arias Behind BarsRating: 4.5 out of 5 stars4.5/5 (16)

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRFrom EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRNo ratings yet

- Lady Killers: Deadly Women Throughout HistoryFrom EverandLady Killers: Deadly Women Throughout HistoryRating: 4 out of 5 stars4/5 (154)