Professional Documents

Culture Documents

Stock Market

Stock Market

Uploaded by

Keval PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Market

Stock Market

Uploaded by

Keval PatelCopyright:

Available Formats

The market in which shares are issued and traded either through exchanges or over-thecounter markets.

Also known as the equity market. This market can be split into two main sections: the primary and secondary market. The primary market is where new issues are first offered, with any subsequent trading going on in the secondary market.

The primary market is where securities are created. It's in this market that firms sell (float) new stocks and bonds to the public for the first time. It is that market in which shares, debentures and other securities are sold for the first time for collecting long-term capital. This market is concerned with new issues. Therefore, the primary market is also called NEW ISSUE MARKET.

In this market, the flow of funds is from savers to borrowers (industries), hence, it helps directly in the capital formation of the country. The money collected from this market is generally used by the companies to modernize the plant, machinery and buildings, for extending business, and for setting up new business unit.

It Is Related With New Issues It Has No Particular Place It Has Various Methods Of Float Capital: Following are the methods of raising capital in the primary market: i) Public Issue ii) Offer For Sale iii) Private Placement iv) Right Issue v) Electronic-Initial Public Offer It comes before Secondary Market

Public issue involves sale of securities to the members of the public. The first public offering of equity shares of a company, which is followed by a listing of its shares on the stock market, is called the initial public offering (IPO). Subsequent are called seasonal offerings.

Initial Public Offering: The decision to go public or more precisely the decisions to make an IPO so that that the securities of the company are listed on the stock market and publicly traded is a very important decision which calls for carefully within the benefits against costs.

The sale of securities to a relatively small number of select investors as a way of raising capital. Investors involved in private placements are usually large banks, mutual funds, insurance companies and pension funds. Private placement is the opposite of a public issue, in which securities are made available for sale on the open market.

It is when a listed company which proposes to issue fresh securities to its existing shareholders as on a record date. The rights are normally offered in a particular ratio to the number of securities held prior to the issue. This route is best suited for companies who would like to raise capital without diluting stake of its existing shareholders.

An issuing of shares to investors by a public company that is already listed on an exchange. An FPO is essentially a stock issue of supplementary shares made by a company that is already publicly listed and has gone through the IPO process.

The secondary market is that market in which the buying and selling of the previously issued securities is done. The transactions of the secondary market are generally done through the medium of stock exchange. The chief purpose of the secondary market is to create liquidity in securities.

If an individual has bought some security and he now wants to sell it, he can do so through the medium of stock exchange to sell or purchase through the medium of stock exchange requires the services of the broker presently, their are 24 stock exchange in India.

A company can make 100% retail issues provided it satisfies all the following conditions 1.It has a net tangible asset of at least Rs 3 crore in each of the preceding three years. 2.It has a track record of distributable profit for at least three out of immediately proceeding 5 years. 3.It has a net worth of at least Rs1 crore in each of the preceding 3 financial years. 4.The issue size (offer through offer document + firm allotment + promoters contribution through offer document) does not exceed five times the pre-issue net worth

If an individual has bought some security and he now wants to sell it, he can do so through the medium of stock exchange to sell or purchase through the medium of stock exchange requires the services of the broker presently, their are 24 stock exchange in India.

SEBI guidelines, 1995 defines book building as a process undertaken by which a demand for the securities proposed to be issued by a body corporate is elicited and built up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by means of a notice, circular, advertisement, document or information memoranda or offer document .

Book Building is basically a process used in IPOs for efficient price discovery. During the process the IPO is open ,bids are collected from investors at various prices, which are above or equal to the Floor price . Floor price is the minimum price at which bids can be made. The spread between the floor price and the cap of the price band shall not be more than 20%. The actual discovered issue price can be any price in the price band or any price above the floor price. This issue price is called Cut-Off Price.

Underwriter accepts a series of bids that include number of shares and price per share The price that everyone pays is the highest price that will result in all shares being sold There is an incentive to bid high to make sure you get in on the auction but knowing that you will probably pay a lower price than you bid Google was the first large Dutch auction IPO

Underwriter must make their best effort to sell the securities at an agreed-upon offering price The company bears the risk of the issue not being sold The offer may be pulled if there is not enough interest at the offer price and the company does not get the capital and they have still incurred substantial flotation costs

The minimum shares the company needs to get from the public out of the total issue by the date of closure. (Presently every company need to raise 90% of the issued amount). Else, the company shall refund the whole amount received. This 90 % has to be exclusive of the cheques that are not cleared.

Greenshoe options typically allow underwriters to sell up to 15% more shares than the original number set by the issuer, if demand conditions warrant such action. A provision contained in an underwriting agreement that gives the underwriter the right to sell investors more shares than originally planned by the issuer. This would normally be done if the demand for a security issue proves higher than expected. Legally referred to as an over-allotment option. The term is derived from the fact that the Green Shoe Company was the first to issue this type of option.

A preliminary registration statement that must be filed with the SEC describing a new issue of stock and the prospects of the issuing company. There is no price or issue size stated in the red herring, and it is sometimes updated several times before being called the final prospectus. It is known as a red herring because it contains a passage in red that states the company is not attempting to sell its shares before the registration is approved by the SEC.

That disclaimer contains information similar to the following: "A Registration Statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. Information contained herein is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective."

IPO grading is the grade assigned by a Credit Rating Agency registered with SEBI, to the initial public offering (IPO) of equity shares or any other security which may be converted into or exchanged with equity shares at a later date. The grade represents a relative assessment of the fundamentals of that issue in relation to the other listed equity securities in India. Such grading is generally assigned on a five-point point scale with a higher score indicating stronger fundamentals and vice versa as below.

IPO grading has been introduced as an endeavor to make additional information available for the investors in order to facilitate their assessment of equity issues offered through an IPO IPO grading covers both internal and external aspects of the issuing company.

Internal factors include the competence of the management, promoters profile, marketing strategies, growth prospects, competitive edge, technology, operating efficiency, liquidity and financial flexibility, asset quality, accounting quality, profitability and hedged risks. External factors would be the industry and economic, or, business environment for the company.

The minimum amount of equity that must be maintained in a margin account. In the context of the NYSE and FINRA, after an investor has bought securities on margin, the minimum required level of margin is 25% of the total market value of the securities in the margin account. Keep in mind that this level is a minimum, and many brokerages have higher maintenance requirements of 30-40%.

current liquidating margin is the value of a securities position if the position were liquidated now. In other words, if the holder has a short position, this is the money needed to buy back; if they are long, it is the money they can raise by selling it. The variation margin or maintenance margin is not collateral, but a daily payment of profits and losses.

Additional margin is intended to cover a potential fall in the value of the position on the following trading day. This is calculated as the potential loss in a worst-case scenario. premium margin is equal to the premium that they would need to pay to buy back the option and close out their position.

Escrow a/c refers to an arrangement where assets or revenue streams are held in the safe custody of a Bank as safety against a situation when a contract isnt fulfilled. The escrow arrangement ensures that obligations between parties are met with and transactions are operated in terms of the underlying agreement.

The S&P CNX Nifty, also called the Nifty 50 or simply the Nifty, is a stock market index and benchmark index for Indian equity market. Nifty is owned and managed by India Index Services and Products Ltd. (IISL), which is a joint venture between NSE and CRISIL (Credit Rating and Information Services of India Ltd). From June 26, 2009, the computation is done on the basis of free float methodology. The base period for the S&P CNX Nifty index is November 3, 1995, which marked the completion of one year of operations of NSE's Capital Market Segment. The base value of the index has been set at 1000, and a base capital of Rs 2.06 trillion.

The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also called the BSE 30 (BOMBAY STOCK EXCHANGE)or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange (BSE). The base value of the SENSEX is taken as 100 on April 1, 1979, and its base year as 1978-79. the market capitalization of SENSEX was about 29,733 billion (US$541 billion)

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Game PDFDocument10 pagesGame PDFKichi UeharaNo ratings yet

- Project Management - PPT FINAL REPORTDocument46 pagesProject Management - PPT FINAL REPORTSai RillNo ratings yet

- Determination of Social Impact and Public PurposeDocument14 pagesDetermination of Social Impact and Public PurposeDr. Jaspreet Kaur MajithiaNo ratings yet

- Administrative Support UNITSDocument74 pagesAdministrative Support UNITSReina Allyza Pineda100% (1)

- Cpa A1.3 - Advanced Financial Reporting - Study ManualDocument452 pagesCpa A1.3 - Advanced Financial Reporting - Study ManualDamascene100% (1)

- Blue ScreenDocument9 pagesBlue ScreenRafik DjoucampNo ratings yet

- K2000 Admin Guide v33Document170 pagesK2000 Admin Guide v33amlesh80100% (1)

- 08 VESDA Pipe Network Design Guide A4 IE LoresDocument56 pages08 VESDA Pipe Network Design Guide A4 IE Loresvlaya1984No ratings yet

- Mode of Entry Used by Netflix in IndiaDocument1 pageMode of Entry Used by Netflix in IndiaErika BNo ratings yet

- Lecture 07 Erd PDFDocument57 pagesLecture 07 Erd PDFFaz LynndaNo ratings yet

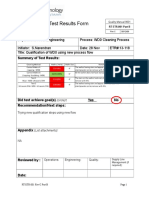

- Engineering Test Results FormDocument1 pageEngineering Test Results FormVijay RajaindranNo ratings yet

- Application For Permit To Operate: A. General InformationDocument2 pagesApplication For Permit To Operate: A. General InformationCivie Jomel QuidayNo ratings yet

- Compressed Air Systems CatalogDocument12 pagesCompressed Air Systems CatalogMichael FabianNo ratings yet

- How Can We Prevent Collision at Sea?Document5 pagesHow Can We Prevent Collision at Sea?Haeisy SimsuangcoNo ratings yet

- Python RecordDocument101 pagesPython Record321126510L03 kurmapu dharaneeswarNo ratings yet

- MicroeconomicsDocument265 pagesMicroeconomicsSaule BaurzhanNo ratings yet

- Forcipol: Grinding & PolishingDocument4 pagesForcipol: Grinding & PolishingArifDarmawanNo ratings yet

- Bar Charts in ResearchDocument5 pagesBar Charts in ResearchPraise NehumambiNo ratings yet

- Pre Tensioning SystemsDocument19 pagesPre Tensioning SystemsDiego H FernandezNo ratings yet

- APA Refresher - ReferencesDocument46 pagesAPA Refresher - ReferencesNewton YusufNo ratings yet

- Facility Commander End-UserDocument48 pagesFacility Commander End-UseradriansitNo ratings yet

- CHM 101 Exams 20182019 Type B-1Document4 pagesCHM 101 Exams 20182019 Type B-1balikisolayemi2005No ratings yet

- Taylor's Motivation TheoryDocument5 pagesTaylor's Motivation TheoryAinunNo ratings yet

- Cdma-Basic PrincipleDocument35 pagesCdma-Basic Principlemohamed ameeNo ratings yet

- NESTLEDocument4 pagesNESTLEReza MuhammadNo ratings yet

- Business Environment-HA 1Document2 pagesBusiness Environment-HA 1SrinivasNo ratings yet

- Full Text 01Document76 pagesFull Text 01Franshellie T. DagdagNo ratings yet

- Key Success Factors of SME Entrepreneurs: Empirical Study in VietnamDocument8 pagesKey Success Factors of SME Entrepreneurs: Empirical Study in VietnamRekhsa AngkasawanNo ratings yet

- Highway Weigh-In-Motion (WIM) Systems With User Requirements and Test MethodsDocument18 pagesHighway Weigh-In-Motion (WIM) Systems With User Requirements and Test MethodsFayyaz Ahmad KhanNo ratings yet

- Before Completing This Form, Please Read The Explanatory Notes BelowDocument2 pagesBefore Completing This Form, Please Read The Explanatory Notes Belowalisonbelton4575No ratings yet